Overview

In this article, we explore ten fantastic benefits of bringing in external CFO services for small business owners. First off, let’s talk about cost efficiency. These services can save you a pretty penny compared to hiring a full-time CFO. But that’s just the tip of the iceberg! You also gain access to a wealth of expertise, scalability, and enhanced financial planning tailored just for your business.

Imagine having financial strategies that not only help you navigate growth but also manage risks effectively. Sounds great, right? Plus, these strategies align your financial decisions with your overall business goals. It’s all about improving your operational performance and ensuring sustainability in the long run.

So, if you’re looking to make smarter financial moves without breaking the bank, consider how external CFO services could be the game-changer you need. After all, who wouldn’t want to blend expertise with cost savings? Let’s dive in and see how these services can elevate your business!

Introduction

Navigating the financial landscape can feel pretty overwhelming for small business owners, right? Especially when resources are tight and finding expertise seems like searching for a needle in a haystack. As the world of financial management gets more complex, many entrepreneurs are realizing just how beneficial external CFO services can be. These services not only give you access to top-notch financial know-how but also offer customized strategies that can really boost your decision-making and operational efficiency. But with so many options out there, how do you figure out the real value of bringing in financial leadership from outside?

Steinke and Company: Tailored Financial Strategies for Small Businesses

Since 1974, Steinke and Company has been all about empowering micro and small businesses with financial strategies tailored just for them, especially in service-oriented sectors. Their wide array of services—think proactive tax planning, startup consultations, and strategic advisory—ensures that clients get the personalized support they need to hit their unique goals. By meeting one to three times a year to go over tax returns and current financials, Steinke and Company spots missed opportunities and lays out clear strategies to reduce tax burdens and boost growth. This thorough approach not only makes managing resources easier but also significantly enhances overall organizational performance.

Did you know that 90% of independent business owners say their accounting expert is key to their success? That really highlights how important Steinke and Company’s services are! Plus, with 71% of small business owners still relying on pen and paper or spreadsheets for managing their finances, the need for professional advice is more crucial than ever. By focusing on the unique needs of independent business owners, Steinke and Company has become a trusted partner, helping clients navigate the complexities of financial operations, avoid costly underpayment penalties, and achieve sustainable growth.

And let’s not forget about the recent cuts in COVID-19 tax benefits that have impacted tax refunds. Steinke and Company is ready to offer essential planning strategies to help clients adjust and improve their financial outcomes. So, if you're feeling overwhelmed by your financials, why not reach out? You’re not alone in this!

Cost Efficiency: Save on Full-Time CFO Salaries with External Services

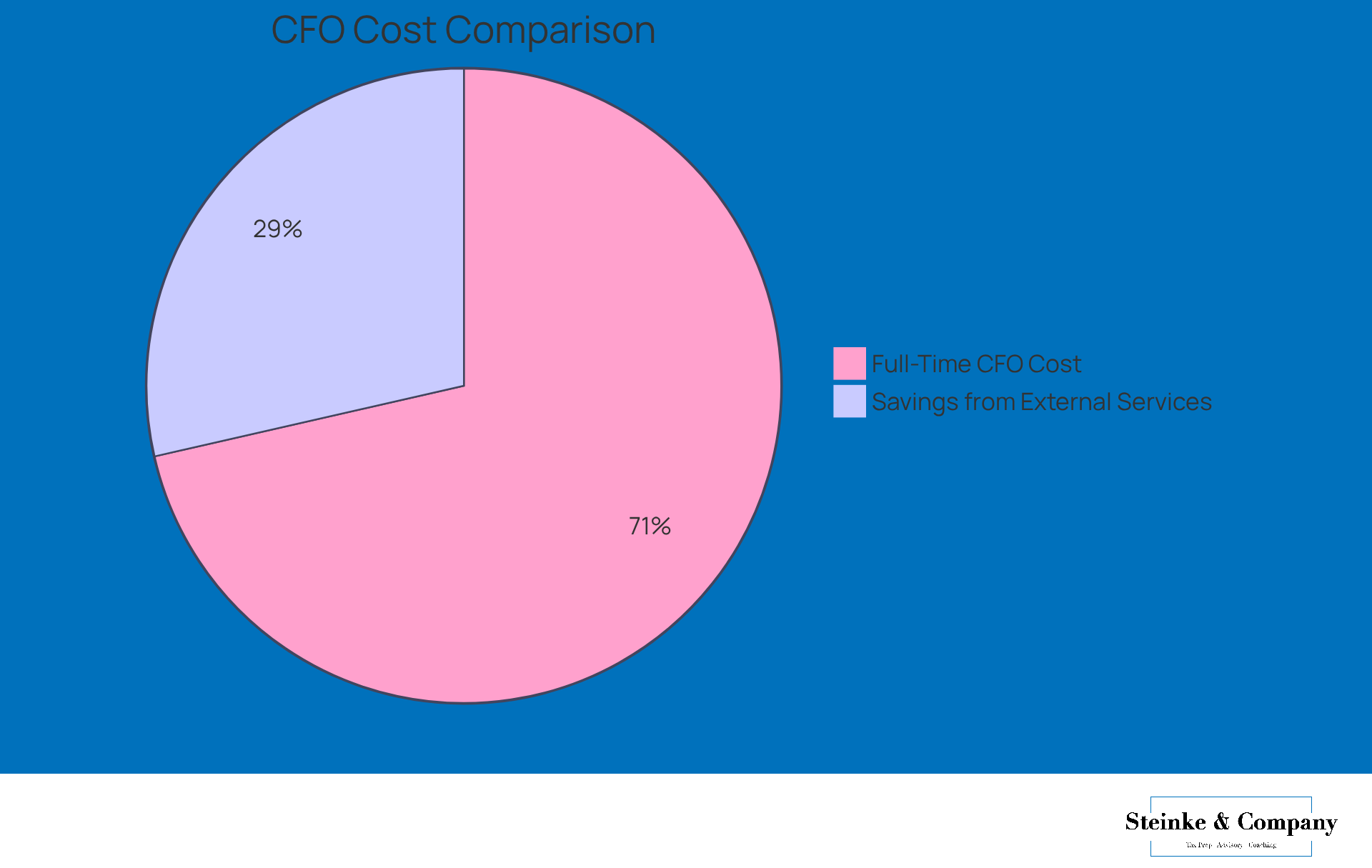

Hiring a full-time CFO can really stretch the budget for small businesses, right? With total compensation often surpassing $200,000 a year—when you factor in salary, benefits, and overhead—it’s a hefty investment. But here’s some good news: opting for external CFO services can be a much more wallet-friendly option, usually costing 30-50% less than hiring someone full-time. This cost-saving approach lets entrepreneurs tap into top-notch financial expertise without the long-term commitment, freeing up cash to focus on other important parts of their business.

Fractional CFOs are a fantastic solution, offering tailored financial services that fit the unique needs of small to mid-sized businesses. They bring expertise in fiscal strategies, KPI tracking, and cash flow management, all on a flexible schedule. Many small businesses have reported significant savings by opting for external CFO services, which provide customized financial guidance while keeping staffing options open. This strategy not only enhances resource management but also helps businesses thrive in competitive markets. So, why not consider this approach and see how it could benefit your operation?

Access to Expertise: Leverage High-Level Financial Knowledge

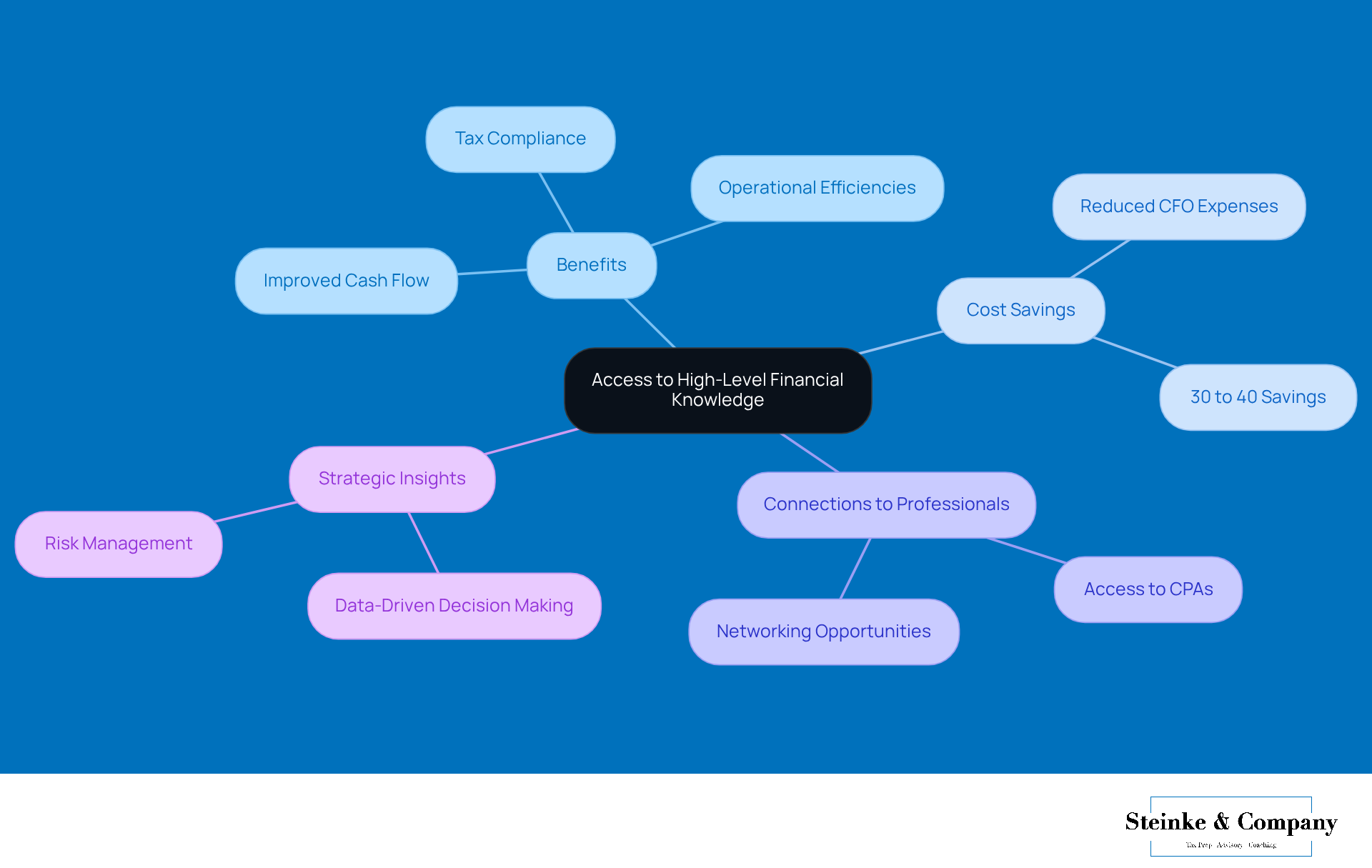

For modest enterprises, external CFO services are a game-changer, providing access to seasoned financial experts who understand the ins and outs of industry best practices and regulatory compliance. This kind of expertise is crucial for making informed strategic decisions, optimizing economic performance, and staying on top of tax regulations. With this high-level financial insight, small business owners can fine-tune their monetary strategies, boost operational efficiencies, and drive sustainable growth.

Have you noticed the rising demand for fractional chief financial officers? This trend shows that companies are recognizing the value of expert financial oversight without the hefty price tag of a full-time CFO. In fact, businesses that bring on external financial officers often report double-digit improvements in cash flow visibility and operational efficiency within just six months. That’s some serious ROI! This trend particularly benefits small enterprises pulling in over $1-2 million in revenue, as they can tap into specialized knowledge to navigate complex financial landscapes and make quick decisions.

But wait, there’s more! External financial officers don’t just provide strategic insights; they also connect you with other professionals, like top-notch tax CPAs and marketing specialists. This not only saves you time but also boosts your organization’s growth potential. They help entrepreneurs shift their mindset towards growth, encouraging them to evaluate their risk tolerance and marketing strategies effectively. Plus, external CFOs can guide modest enterprise owners in preparing for IRS audits, ensuring they understand their rights and easing any anxiety during the process.

As the world of financial management evolves, small businesses looking to thrive in a competitive landscape are finding that integrating external CFO services is becoming a vital strategy. And here’s a fun fact: companies can save 30% to 40% on CFO expenses by hiring a fractional CFO instead of a full-time one. Talk about a smart and economical choice! To dodge budgeting pitfalls and achieve success, it’s essential for owners to implement effective planning strategies and regularly check in on their performance.

Scalability: Adjust Financial Support as Your Business Grows

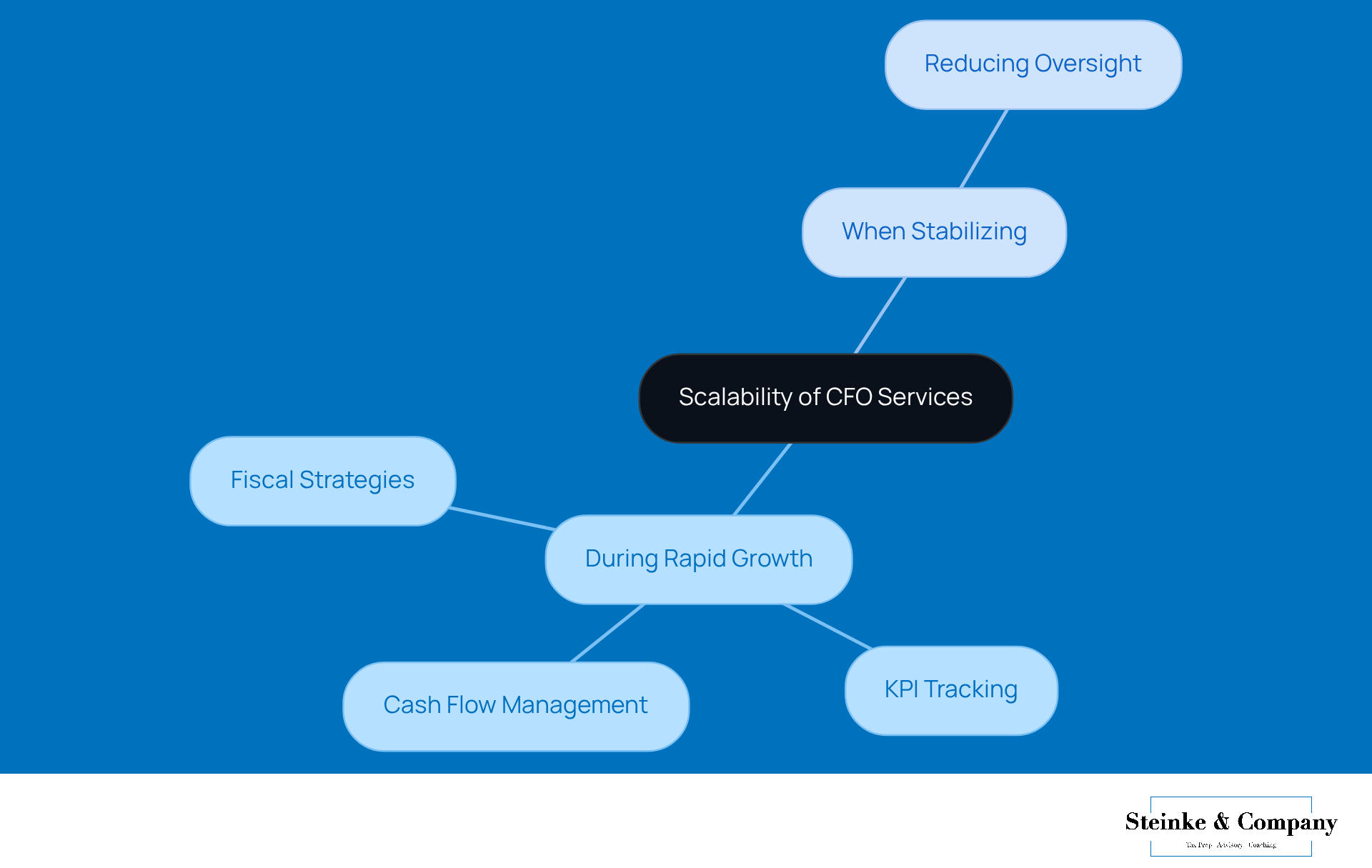

One of the best perks of utilizing external CFO services is their remarkable scalability. As companies grow, their financial needs can change quite a bit. That’s where fractional financial officers come in—they can tweak their services to match these shifts. They provide extra support during those growth spurts and can dial it back when things slow down. This flexibility means businesses get the precise level of financial guidance they need while keeping costs in check.

For example, if a company is experiencing rapid growth, they can really benefit from external CFO services to help them navigate the tricky financial waters. These CFOs can offer services like:

- Fiscal strategies

- KPI tracking

- Cash flow management

On the flip side, companies that are stabilizing can cut back on resource oversight without losing quality. This model helps smaller businesses stay financially nimble, ensuring they only spend on the services that matter most for their current growth stage.

As industry experts point out, the adaptability of fractional CFOs allows organizations to align their financial strategies with their growth paths, paving the way for a sustainable future. Moreover, the cost-effectiveness of external CFO services allows smaller enterprises to access top-notch financial expertise without the burden of hiring a full-time employee. With real-time financial insights and projections from fractional financial leaders, companies can make informed decisions, especially when navigating those crucial growth phases.

Strategic Planning: Enhance Decision-Making with Expert Guidance

External CFO services are key players in strategic planning, providing expert advice that helps small business owners make informed choices. They dive into financial data, spot trends, and provide practical insights that align with the company’s goals. This kind of strategic support not only sharpens decision-making but also positions organizations to seize opportunities and manage risks effectively.

For many business owners, hitting that $1 million revenue milestone can feel like climbing a mountain. Factors like market competition, resource limitations, and the need for savvy money management can make it particularly tough. To leap from $1 million to $10 million, owners need to embrace a mindset focused on gradual growth and smart risk management. Here’s where external CFO services come in handy, offering tailored financial strategies that help pinpoint genuine growth opportunities while steering clear of common pitfalls.

Take, for example, a small retail business that struggled with cash flow management. After bringing on a fractional CFO, they saw significant improvements thanks to better budgeting practices and fiscal forecasting. Plus, these experts can guide effective marketing strategies, ensuring businesses not only retain their current customers but also attract new ones through informed decision-making.

By tapping into the expertise of a fractional CFO, small enterprises can navigate the complexities of financial planning, ultimately leading to sustainable growth and success. And let’s not forget the cost-effectiveness of external CFO services; they allow businesses to access high-level financial expertise without the hefty price tag of a full-time hire. It’s a smart choice for agency owners looking to thrive!

Improved Cash Flow Management: Ensure Financial Stability

Outsourced CFOs are really important when it comes to managing cash flow, helping small businesses not just survive but thrive economically. They use smart strategies for forecasting cash flow, juggling receivables and payables, and making the most of working capital. By keeping cash flow healthy, companies can dodge those pesky liquidity issues and instead focus on seizing growth opportunities, which definitely takes a load off during tough economic times.

For example, many companies that have utilized external CFO services often see a noticeable boost in their cash flow stability. This newfound stability allows them to invest in growth initiatives and tackle economic uncertainties with a lot more confidence. A virtual CFO doesn’t just whip up personalized financial strategies and forecasts that enhance operational performance; they also offer flexible scheduling tailored to each company’s unique needs.

They create detailed monthly reports that shine a light on both growth factors and challenges, plus they keep an eye on key performance indicators (KPIs) to make sure everything’s on track. As one expert put it, positive cash flow is essential for covering expenses, investing in growth, and dealing with economic hurdles. This really underscores why it’s crucial for businesses to make effective cash flow management a key part of their operational strategy.

So, how’s your cash flow looking these days?

Risk Mitigation: Navigate Compliance and Financial Regulations

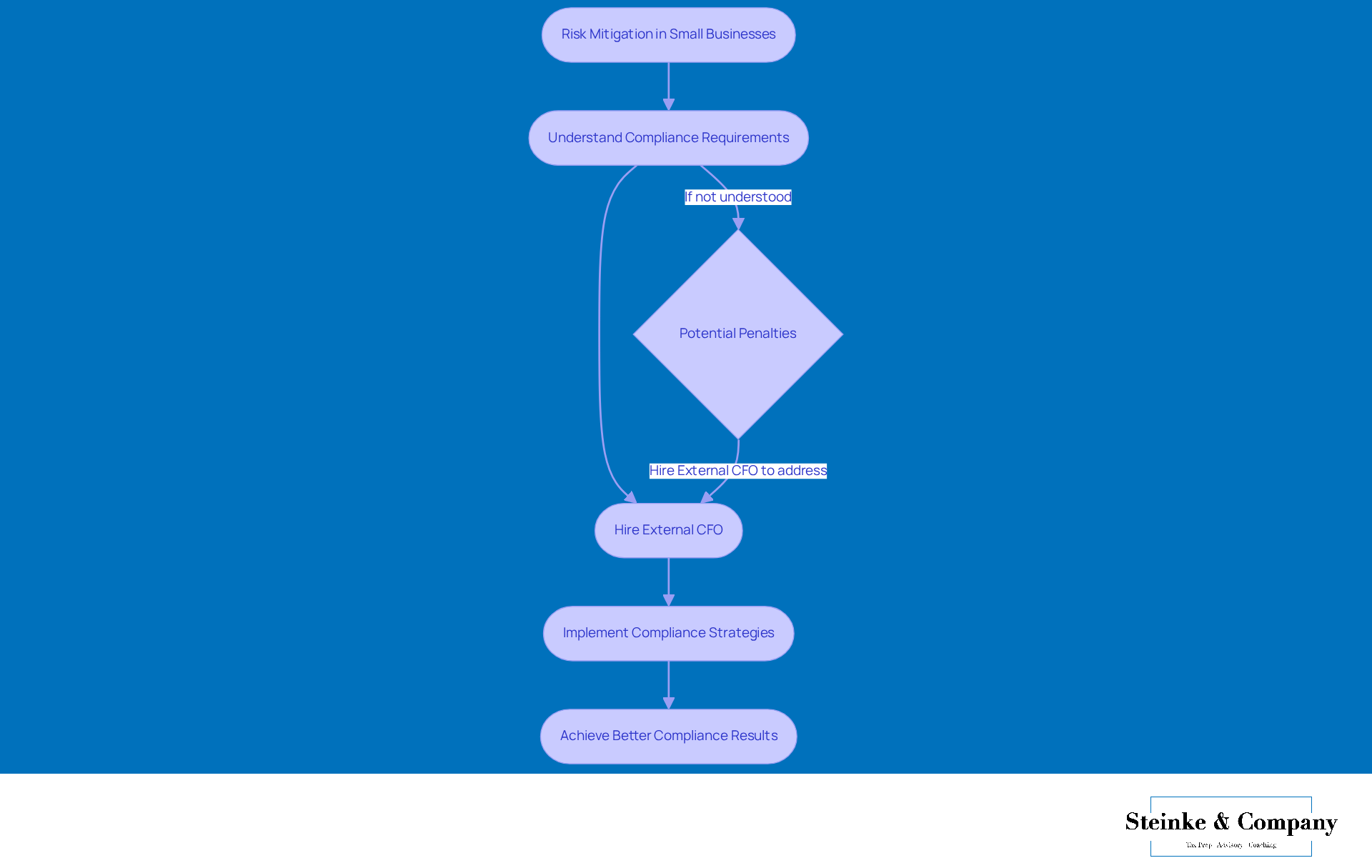

Risk reduction is super important for effective economic management, especially for small businesses that have to deal with complex compliance and regulatory requirements. That’s where external CFO services come into play! They keep up with the latest laws and regulations, which is crucial for making sure everything is in line, including avoiding those pesky underpayment penalties. You know, those penalties the IRS slaps on taxpayers who don’t pay enough of their tax obligations through withholding or estimated payments? They can really hit a company’s finances hard. And with the interest rate for underpayments recently climbing to 8% annually, compounded daily, it’s vital for small business owners to understand their responsibilities.

Fractional CFOs offer tailored support to help businesses navigate these tricky waters, ensuring they meet IRS requirements and dodge penalties. They assist clients in making estimated tax payments and adjusting withholdings to hit those safe harbor thresholds, which helps avoid costly fees. Their expertise in compliance—especially understanding the de minimis exception and safe harbor payments—is key to maintaining solid internal controls over financial reporting. This proactive approach not only reduces the risk of expensive penalties but also boosts the overall financial health of the organization.

For example, companies that utilize external CFO services have seen better compliance results. In fact, 67% of organizations have chosen a centralized approach to compliance investigations, thanks to the strategic guidance provided by external CFO services. By spotting potential compliance risks early on, outsourced CFOs help businesses steer clear of penalties and protect their reputations. Plus, they set up standardized reporting procedures that ensure accurate and clear financial reporting, which is essential for meeting regulatory deadlines and passing audits. This way, small businesses can focus on growth and strategic initiatives while staying compliant with industry standards, avoiding serious consequences like monetary penalties and damage to their reputation.

Flexibility: Adapt Financial Strategies to Market Changes

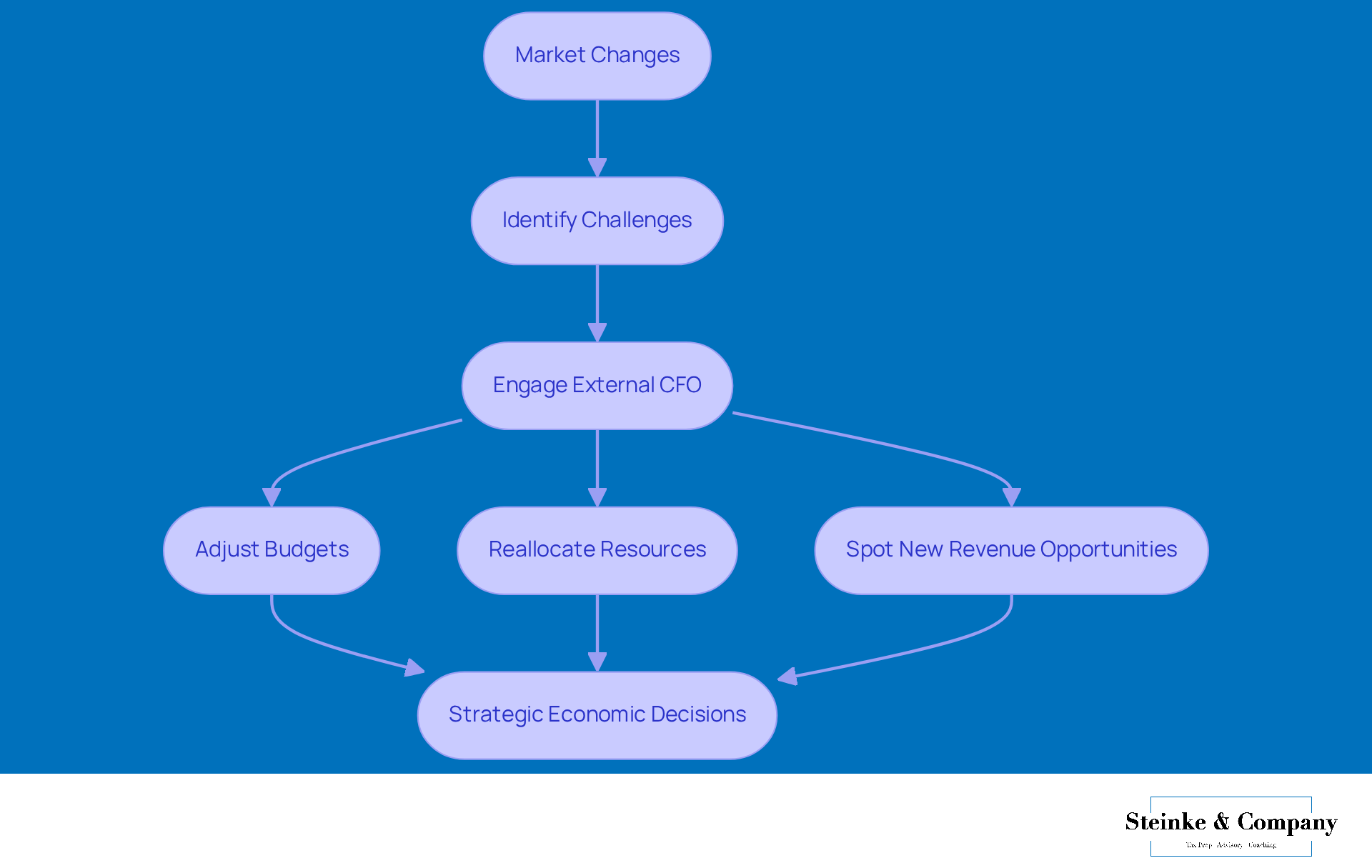

In today's fast-paced business world, flexibility is key! External financial officers bring the agility needed to tweak financial strategies as market conditions change. They’re crucial for adjusting budgets, reallocating resources, and spotting new ways to earn revenue, which helps organizations stay nimble and responsive. For instance, when 72% of business leaders pointed to worsening economic conditions as their biggest challenge in early 2025, outsourced CFOs stepped up to guide companies through these tricky times.

By tapping into centralized data and fostering cross-functional communication, they ensure that economic decisions are not just informed but also strategic. A fractional CFO offers customized support, from tracking KPIs to developing financial strategies and conducting regular reviews of key metrics. This way, they can keep an eye on efficiency and make timely tweaks.

This kind of adaptability not only helps organizations seize new opportunities but also prepares them for unexpected hurdles, highlighting just how essential external CFO services are in today’s dynamic landscape. As Alex Auchter puts it, "Chief Financial Officers enjoy an unusually strategic vantage point within their organizations." This really emphasizes their crucial role in navigating both opportunities and challenges while delivering high-level expertise without the hefty price tag of a full-time salary.

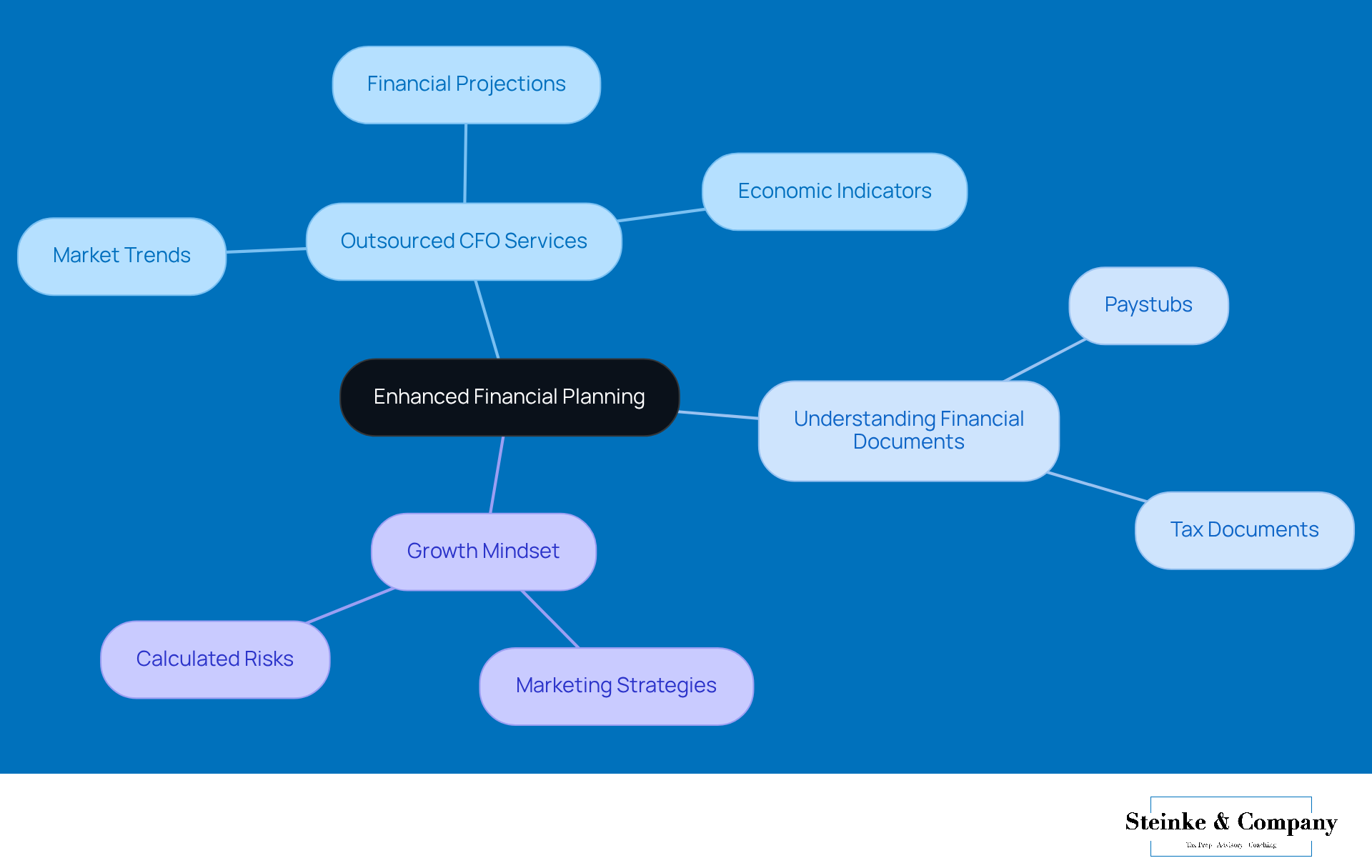

Enhanced Financial Planning: Anticipate Future Needs and Opportunities

Outsourced CFOs, or external CFO services, can really boost your fiscal planning by providing insights that help companies predict their future needs and opportunities. They dive deep into market trends, economic indicators, and internal performance metrics to create solid financial projections. This proactive approach is a game changer for small businesses, allowing them to plan for growth, manage risks, and leverage external CFO services effectively—all key ingredients for long-term success.

And let’s not forget about the importance of understanding financial documents like paystubs. It’s crucial for maximizing tax efficiency and ensuring compliance. By educating clients on the significance of reviewing their paystubs and keeping their tax documents organized, CFOs can help them avoid budgeting headaches and achieve financial stability.

Now, if you’re a small business aiming to grow from $1 million to $10 million in revenue, embracing a growth mindset is essential. This isn’t just about having effective marketing strategies; it’s also about being open to taking calculated risks and grabbing opportunities as they come your way. So, are you ready to take your business to the next level?

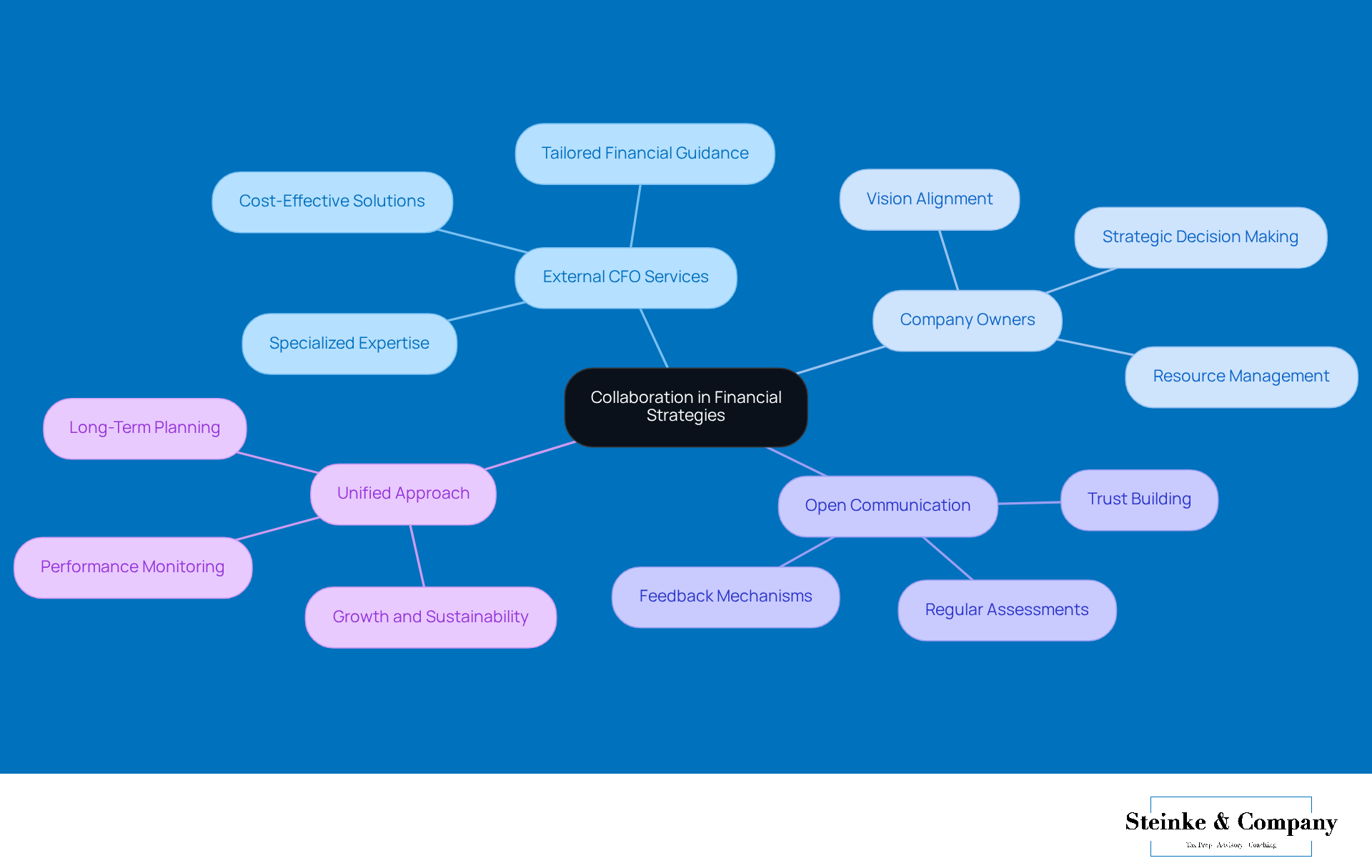

Collaboration: Align Financial Strategies with Business Goals

Cooperation is key when it comes to managing resources effectively. Think about it: external CFO services work hand-in-hand with company owners to ensure that financial strategies truly align with the big picture goals of the organization. This teamwork encourages open communication, which means that financial decisions can directly support the company’s vision and objectives.

By creating this collaborative atmosphere, businesses can craft a unified approach to growth and sustainability. And let’s be honest, in today’s competitive landscape, that’s what can really boost their chances of success. So, how does your organization foster collaboration? It’s a vital piece of the puzzle!

Conclusion

Outsourcing CFO services can be a game changer for small business owners looking to level up their financial management and strategic planning. By bringing in an external expert, businesses gain access to high-level insights, customized financial strategies, and cost-effective solutions that can fuel growth and stability—all without the hefty price tag of a full-time CFO.

Let’s talk about the perks! You’ll find significant cost savings, better cash flow management, and enhanced decision-making capabilities among the many benefits. External CFOs offer invaluable insights into compliance and risk management, helping businesses navigate the tricky waters of financial regulations while staying nimble in a fast-paced market. Plus, their ability to scale means that companies can adjust their financial support as they grow, aligning resources with changing business needs.

In today’s rapidly shifting economic landscape, the value of tapping into external CFO services is huge. By embracing this approach, small business owners can protect their financial health and set their organizations up for lasting success. Engaging a fractional CFO isn’t just a smart financial decision; it’s a strategic investment in your business’s future. So, why not explore this option and see how it can work for you?

Frequently Asked Questions

What services does Steinke and Company offer to small businesses?

Steinke and Company provides a range of services including proactive tax planning, startup consultations, and strategic advisory tailored specifically for micro and small businesses, particularly in service-oriented sectors.

How does Steinke and Company help clients manage their finances?

They meet with clients one to three times a year to review tax returns and current financials, identifying missed opportunities and developing strategies to reduce tax burdens and promote growth.

Why is having an accounting expert important for small business owners?

According to surveys, 90% of independent business owners believe their accounting expert is key to their success, highlighting the critical role of professional financial guidance.

What is the cost benefit of using external CFO services instead of hiring a full-time CFO?

External CFO services can cost 30-50% less than hiring a full-time CFO, making them a more budget-friendly option for small businesses while still providing high-level financial expertise.

What advantages do fractional CFOs provide to small businesses?

Fractional CFOs offer tailored financial services, expertise in fiscal strategies, KPI tracking, and cash flow management on a flexible schedule, helping businesses save costs and manage resources effectively.

How can external CFO services improve a business's financial performance?

Businesses that utilize external CFO services often see double-digit improvements in cash flow visibility and operational efficiency within six months, leading to better decision-making and growth.

What additional support do external CFOs provide beyond financial oversight?

External CFOs connect clients with other professionals, such as tax CPAs and marketing specialists, saving time and enhancing growth potential while guiding business owners through financial audits and compliance.

How can small businesses benefit from integrating external CFO services?

By leveraging expert financial knowledge, small businesses can navigate complex financial landscapes, improve strategic decision-making, and achieve significant savings on CFO expenses, ultimately supporting their growth and success.