Introduction

Navigating the world of short-term rentals can be a real adventure, right? It’s rewarding, but let’s be honest - it can also get pretty complex, especially when it comes to understanding tax obligations. For Airbnb hosts, following IRS rules isn’t just about checking a box; it’s crucial for protecting your hard-earned money and ensuring a hassle-free hosting experience.

In this article, we’re diving into ten essential Airbnb IRS rules that every host should be aware of. We’ll shed some light on the perks of keeping your taxpayer information accurate and the potential pitfalls you might face if you don’t. So, what happens if hosts overlook these regulations? And how can you stay ahead of the game and manage your tax responsibilities to dodge those costly mistakes? Let’s find out!

Provide Accurate Taxpayer Information to Airbnb

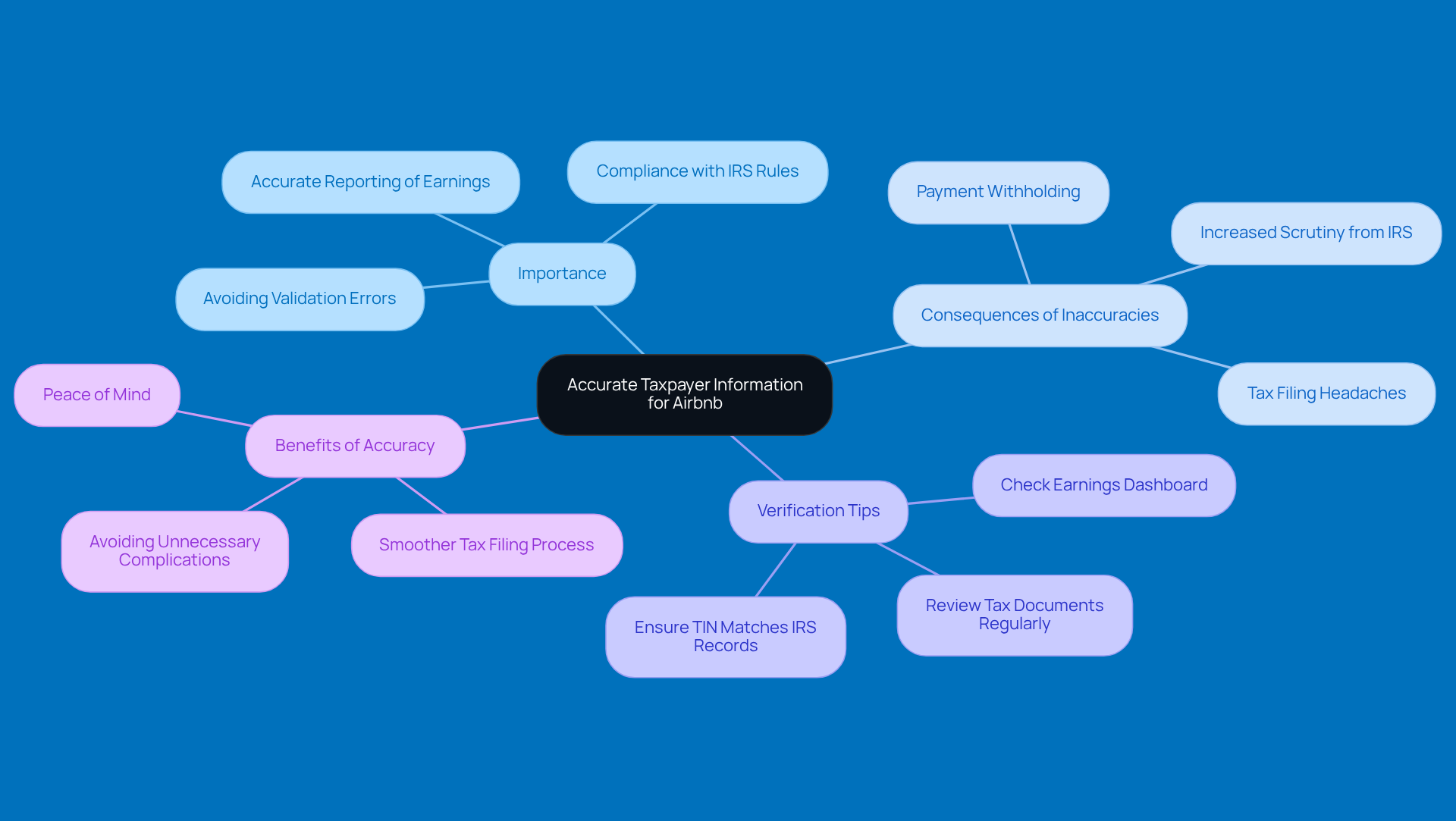

Hey there! If you’re a property owner, it’s super important to provide accurate taxpayer details, like your Taxpayer Identification Number (TIN) or Social Security Number (SSN), in accordance with Airbnb IRS rules. Why? Well, this info is crucial for the platform to report your earnings correctly in compliance with the Airbnb IRS rules. If there are any inaccuracies, you might face payment withholding and some headaches during tax filing. So, make sure your name and TIN match what the IRS has on file to avoid any validation errors.

Did you know that a good chunk of Airbnb property owners have run into issues because of discrepancies in their taxpayer info? It really highlights how important it is to be diligent in this area. A handy tip: you can check out your earnings dashboard to verify and filter your reported income. This way, you can ensure you’re in line with the Airbnb IRS rules.

By keeping your records accurate, you can dodge unnecessary tax complications and make your tax filing process a whole lot smoother. So, take a moment to double-check your details - it’ll save you time and stress down the road!

Understand Consequences of Not Providing Taxpayer Information

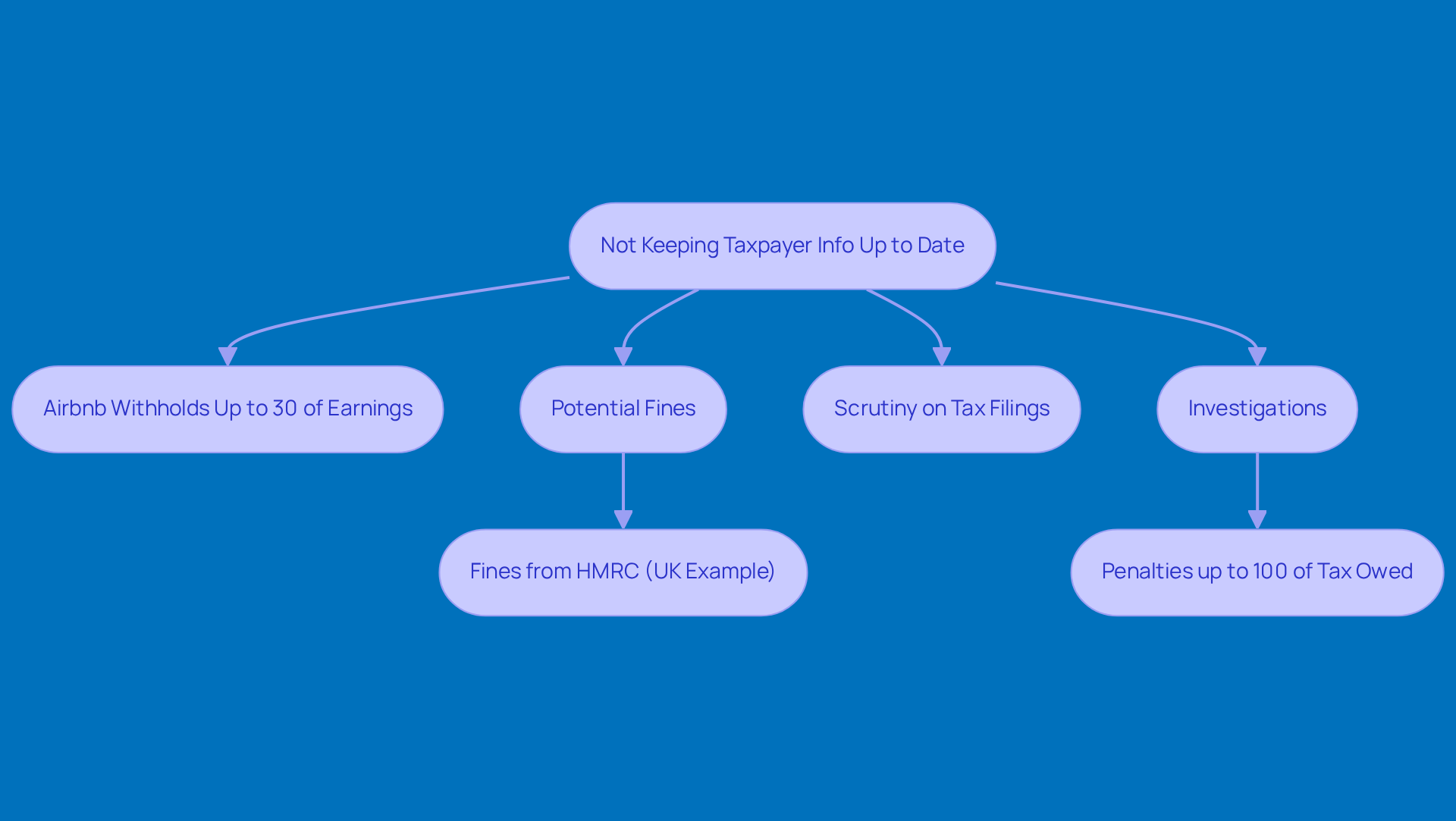

Hey there, hosts! If you’re not keeping your taxpayer info up to date, you might be surprised, as the Airbnb IRS rules allow Airbnb to withhold up to 30% of your earnings for tax purposes. Yikes, right? This isn’t just a precaution; it’s a serious reminder of what happens when you don’t comply with Airbnb IRS rules. The penalties can pile up fast, leading to fines and a whole lot of scrutiny on your tax filings.

For example, if you’re in the UK, you need to declare any income over £7,500. Otherwise, you could face some hefty fines from HMRC. It really shows how important it is to report accurately! Plus, there are stories out there of folks who didn’t comply and ended up facing investigations that could look back over 20 years. Imagine the stress of penalties reaching up to 100% of the tax owed!

So, understanding these potential outcomes is key. It’s all about encouraging you to keep your information precise and current. After all, managing the ins and outs of tax compliance doesn’t have to be a headache!

Know the Required Tax Forms for Reporting Income

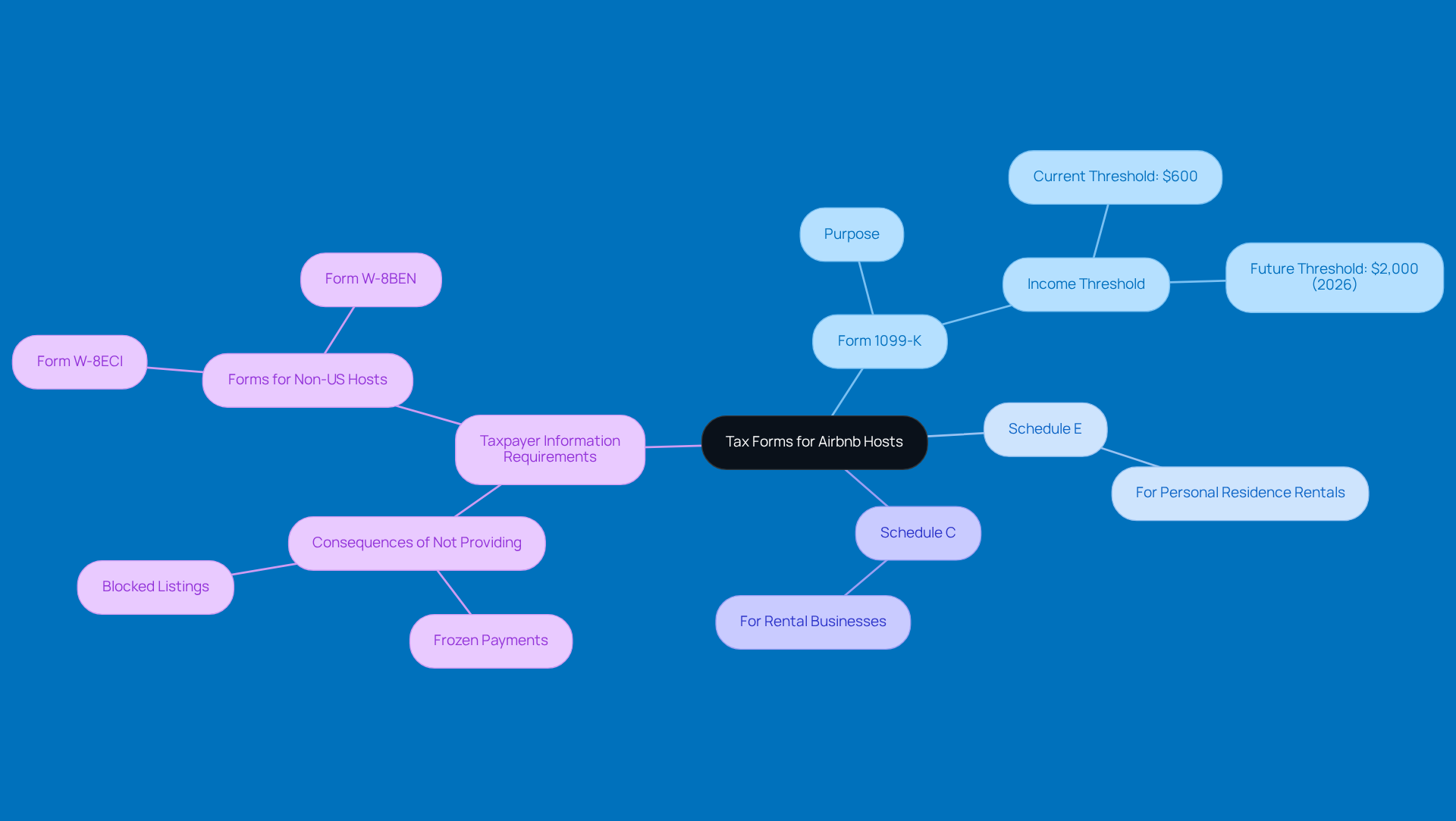

If you're an Airbnb host, you have to navigate the Airbnb IRS rules to tackle the necessary tax forms and report your income accurately. Usually, you’ll receive a Form 1099-K when your gross earnings hit over $600 in a calendar year. This form lays out the total income you’ve made through the platform, and it’s super important for staying compliant with Airbnb IRS rules. Remember, as the IRS puts it, "All income, no matter the amount, is taxable unless it's excluded by law, whether a Form 1099-K is sent or not."

Depending on how you’re renting out your property, you might also need to file either Schedule E or Schedule C. Schedule E is for reporting income from renting out your personal residence, while Schedule C is for those running a rental business. It’s crucial to provide your taxpayer information, too - otherwise, you could face some serious consequences like frozen payments or blocked listings. Understanding the Airbnb IRS rules is essential for ensuring you report your taxes accurately and avoid any headaches with the IRS.

Oh, and here’s something to keep in mind: starting in 2026, the reporting threshold for Form 1099-MISC and Form 1099-NEC is going up to $2,000. So, as you gear up for your upcoming tax responsibilities, make sure you’re aware of this change!

Learn About Tax Withholding for Foreign Hosts

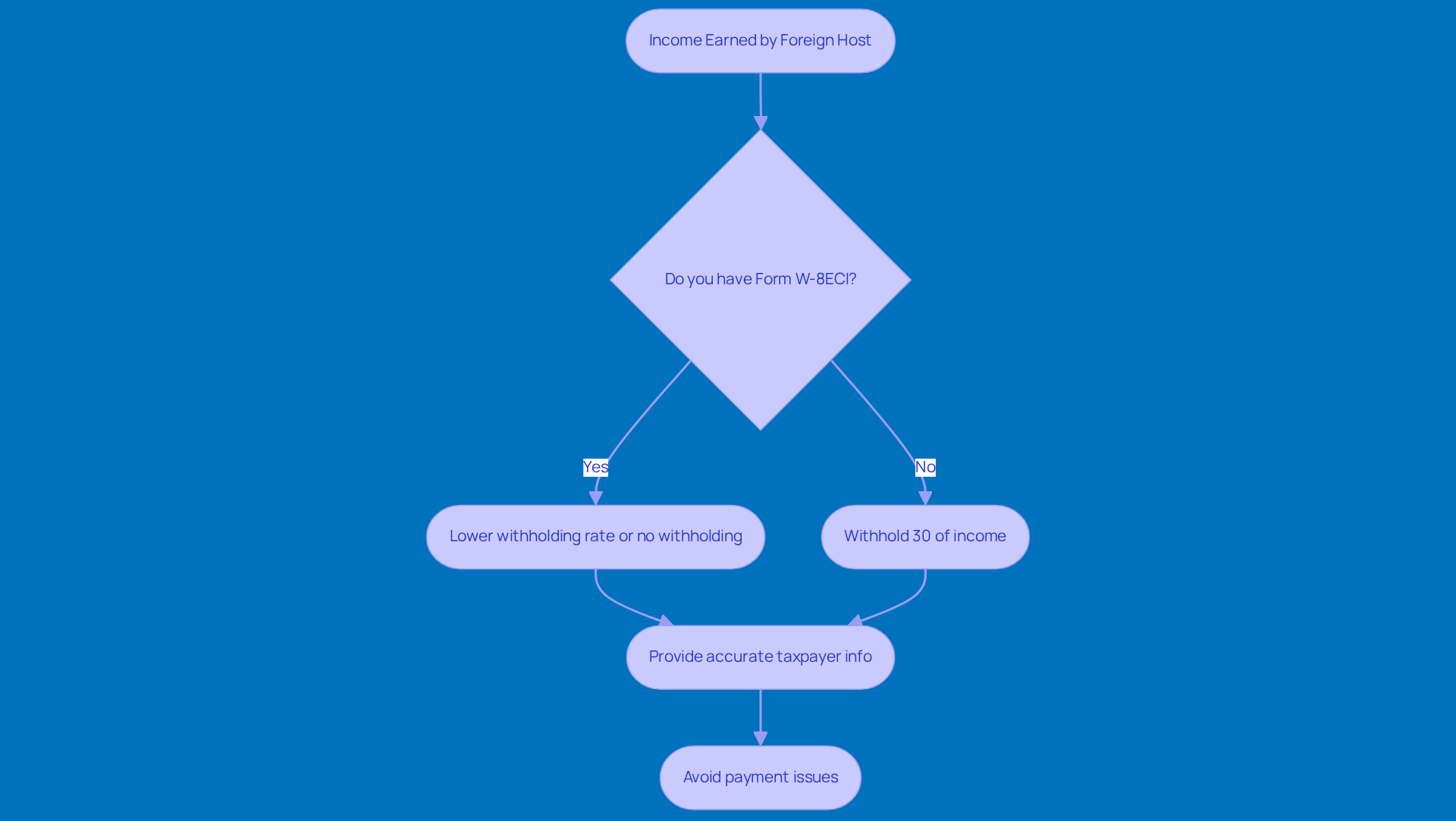

Hey there! If you’re a foreign provider, it’s super important to know that you need to keep 30% of your income for U.S. tax purposes - unless you’ve got a valid Form W-8ECI handy. This form is your ticket to proving you’re a non-resident alien, which means you could snag a lower withholding rate or even skip withholding altogether.

Understanding these requirements can really help you manage your tax obligations and keep more of your hard-earned money. Did you know that many international property owners use this form to improve their tax situations? It’s a big deal in the rental world! Airbnb even suggests, "You should include your taxpayer details, even just to confirm that you should not receive year-end US tax reporting."

By adhering to the Airbnb IRS rules, you can tackle the complexities of U.S. tax obligations while maximizing your rental income. But watch out - if you don’t comply, you might face some serious hiccups, like frozen payments or blocked listings. So, make sure you provide accurate taxpayer info to keep everything running smoothly!

Familiarize Yourself with 1099 and 1042-S Tax Forms

Hey there! If you're hosting, it's super important to know the Airbnb IRS rules and the difference between Form 1099-K and Form 1042-S for your tax reporting. So, here’s the scoop:

- Form 1099-K is what U.S. providers get when they earn over $5,000 from reservations. It shows your gross income before any deductions for those pesky Airbnb fees.

- On the flip side, Form 1042-S is meant for foreign entities. It reports U.S. source income and helps ensure you’re on the right side of U.S. tax obligations.

Now, misreading these forms can lead to some serious tax headaches under the Airbnb IRS rules. A lot of providers don’t realize there’s a gap between what they see as earnings and what they actually take home.

For example, many organizers receive a 1099-K that shows higher amounts than what they pocket after service fees, which can range from 3% to 15%. Yikes, right? That’s why it’s crucial for organizers to get familiar with these forms and perhaps even consult with a tax pro to help navigate the complexities of their tax responsibilities under the Airbnb IRS rules. Trust me, it’s worth it!

Recertify Your Tax Information Regularly

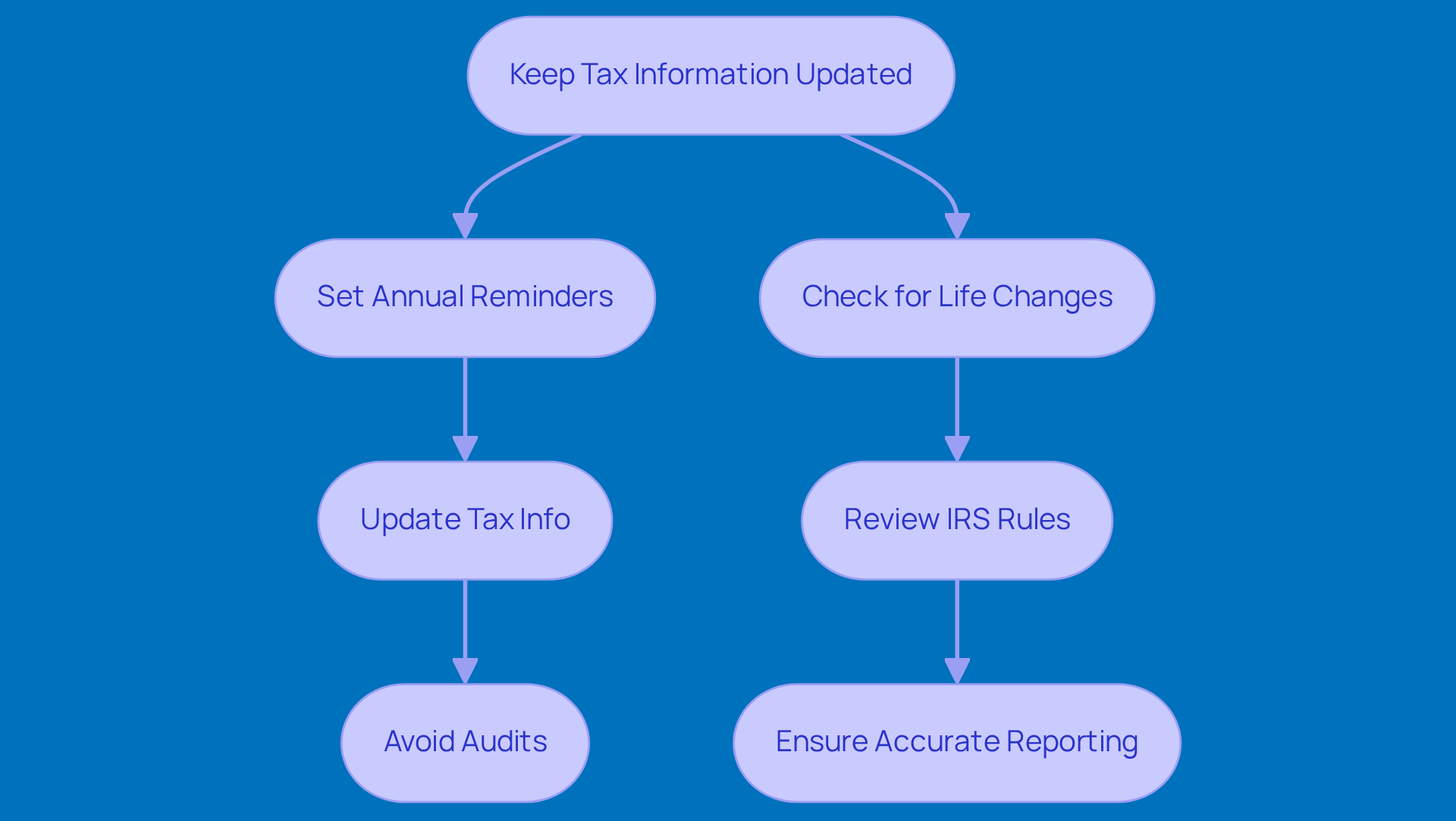

Keeping your tax details up to date is super important for property owners, especially when life throws some changes your way. Airbnb really encourages hosts to refresh their info regularly to stay in line with Airbnb IRS rules. This proactive step not only helps avoid payment hiccups but also makes sure your tax reporting is spot on. Did you know the IRS processed over 266.6 million tax returns in FY 2024? That really shows how crucial it is to submit your info on time and accurately.

Now, if you don’t keep your tax details current, you might run into some trouble come tax season. We’re talking potential audits or mismatches in your reported income - yikes! A good tip from the pros is to set reminders to check and update your tax info every year. This way, you can stay compliant and dodge any unnecessary stress.

Many successful short-term rental hosts have shared how updating their taxpayer info has given them peace of mind. They love knowing their records are accurate and up to date. By making this a priority, you can focus on giving your guests an amazing experience while confidently managing your tax responsibilities according to the Airbnb IRS rules.

Resolve TIN Validation Errors Promptly

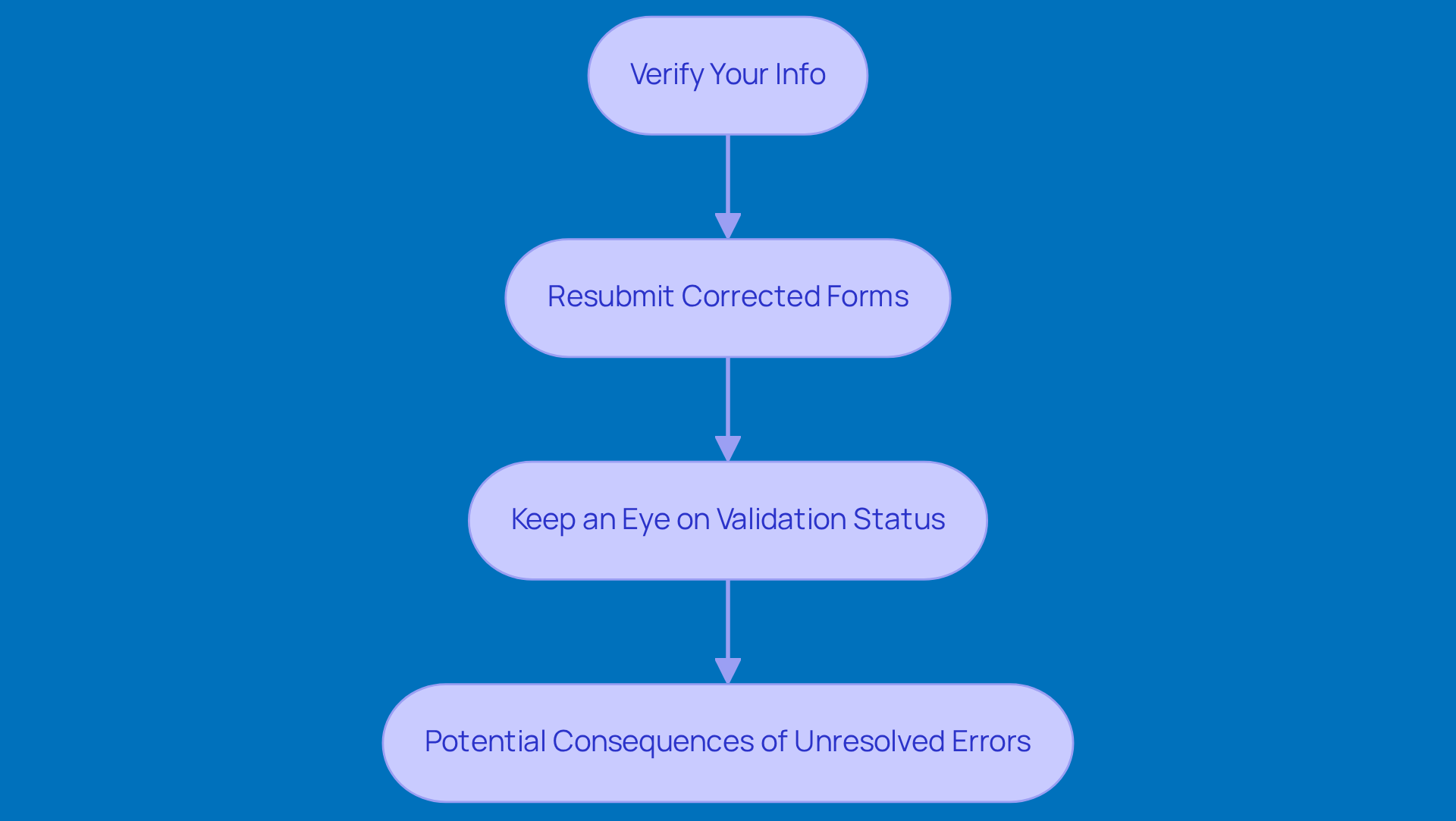

If you're a host facing a TIN validation error from Airbnb, it’s time to jump into action! This usually means you need to double-check that your name and Tax Identification Number (TIN) match what the IRS has on file. If things don’t line up, you could risk having your payments held up and run into some headaches come tax season. So, how do you fix those pesky TIN discrepancies? Here’s a quick guide:

- Verify Your Info: First things first, make sure the name and TIN on your Form W-9 or W-8ECI match exactly with IRS records. Common slip-ups include name changes or just plain typos.

- Resubmit Corrected Forms: If you spot any errors, don’t wait-submit those corrected forms ASAP! Remember, if you filed electronically, the IRS only needs the corrected forms, not the whole batch again.

- Keep an Eye on Validation Status: After you’ve resubmitted, check back on the validation status. Just a heads up, Airbnb’s validation can take up to 14 days, so be ready for a bit of a wait.

Experts say that leaving TIN errors unresolved can really mess with your tax filings, possibly leading to audits or penalties. One provider shared their experience of submitting their taxpayer details for three years straight without a fix-talk about frustrating! It really shows how important it is to tackle these issues head-on.

Real-life stories highlight the hurdles hosts face. One user had a long validation process due to a simple data entry mistake but got it sorted out quickly once they corrected it. Another provider felt let down by conflicting info from Airbnb support about the validation timeline, which made them think about switching up their payout methods to dodge delays.

Looking ahead to 2026, it’s clear that TIN discrepancies can still have serious consequences for payments. Hosts need to make sure their details are spot on to ensure timely payouts and keep their hosting activities running smoothly. By taking proactive steps to fix TIN validation errors, you can protect your earnings and ensure compliance with Airbnb IRS rules. So, don’t wait-get those details sorted!

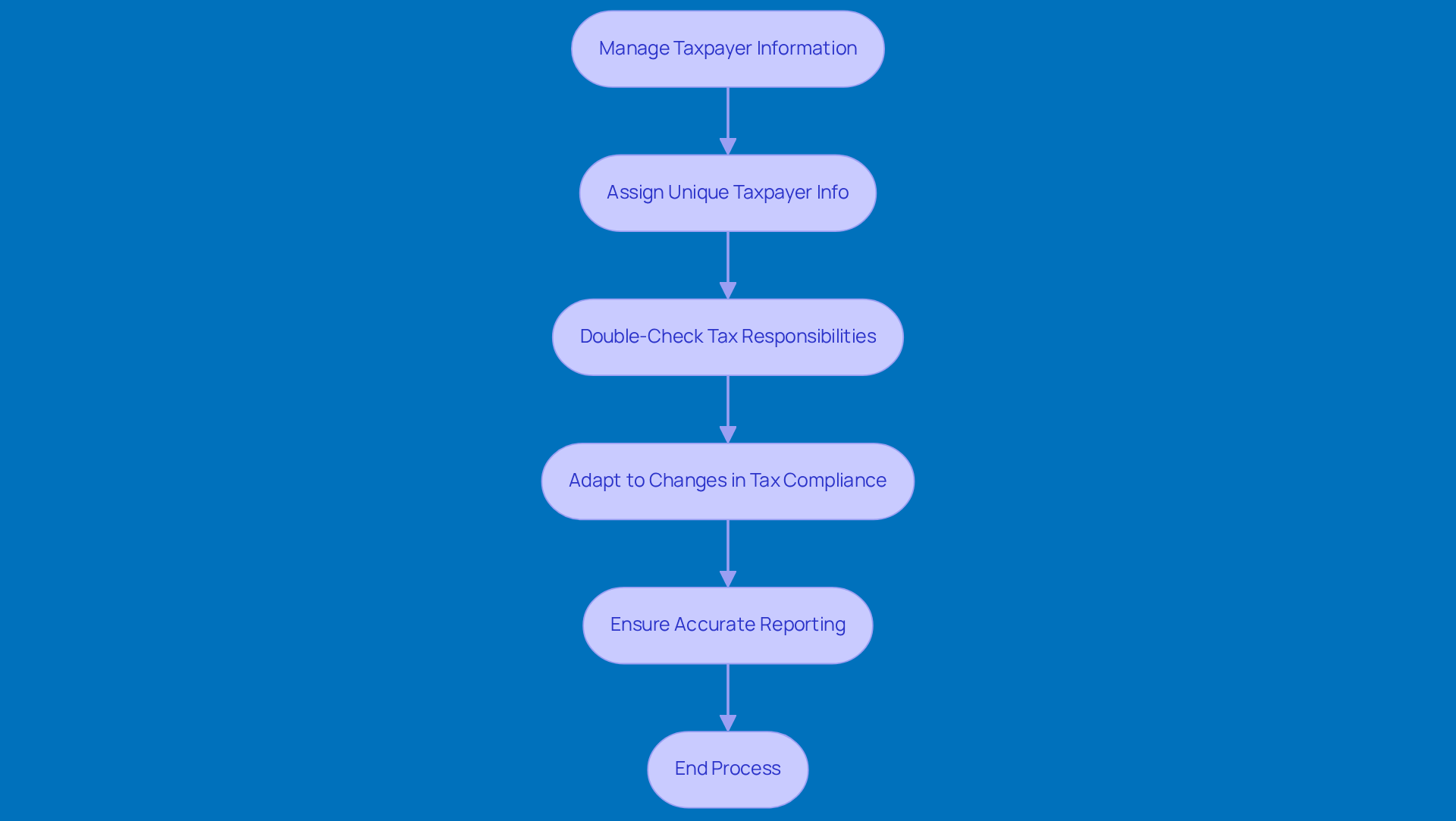

Manage Multiple Taxpayer Information for Listings

Handling taxpayer data for rental listings is super important for staying compliant with Airbnb IRS rules and ensuring accurate reporting. Airbnb lets property owners assign unique taxpayer info to each listing, which is key for making sure every property’s income is reported correctly. This not only makes tax compliance easier according to Airbnb IRS rules but also helps avoid the headaches that come from misreporting.

For instance, property managers juggling multiple sites need to double-check the tax responsibilities for each area since tax rates can vary a lot by jurisdiction. Recent changes in tax compliance really highlight how crucial the Airbnb IRS rules are for compliance. In places like British Columbia and Quebec, centralized tax collection laws have made reporting simpler for property owners, ensuring that all short-term rental platforms are on the same page with local tax regulations. As the platform points out, 'What began with Voluntary Collection Agreements has evolved into close collaboration with lawmakers to pass centralized tax collection laws such as those now in place in British Columbia and Quebec.'

By managing taxpayer details efficiently, property owners can navigate the complexities of tax compliance under Airbnb IRS rules and focus on boosting their rental income. Since 2014, the platform has collected and submitted over $13 billion in taxes for property owners worldwide, which really underscores the importance of accurate reporting.

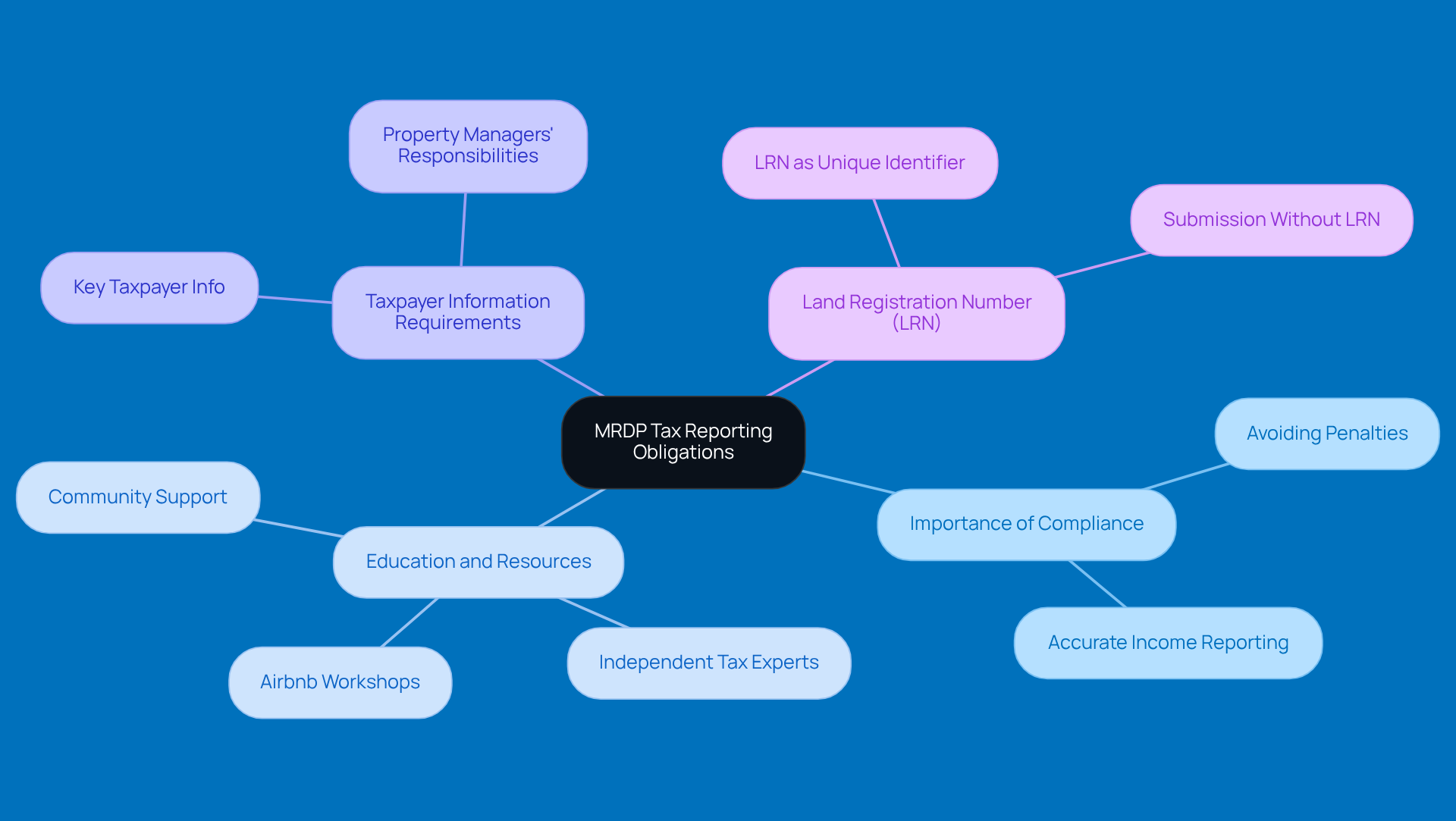

Comprehend MRDP Tax Reporting Obligations

If you're hosting in a country that follows the Model Rules for Reporting by Digital Platforms (MRDP), it's super important to know your tax reporting responsibilities. This means you need to share key taxpayer info with Airbnb, which is essential for sticking to local tax laws. Understanding these requirements is crucial to avoid any penalties and ensure you're reporting your income accurately.

You might be surprised to learn that many hosts are still in the dark about their MRDP obligations. This really highlights the need for more education and resources out there. For example, Airbnb has been proactive by organizing tax workshops in different areas, teaming up with independent tax experts to help property owners get the knowledge they need to stay compliant.

And let’s not forget about property managers! They also need to provide their own taxpayer information to meet legal requirements. By getting familiar with these obligations, you can navigate the sometimes tricky world of tax reporting. Don’t forget, you’ll need to provide your Land Registration Number (LRN) when it’s available. This way, you can contribute positively to your local economy while keeping everything above board!

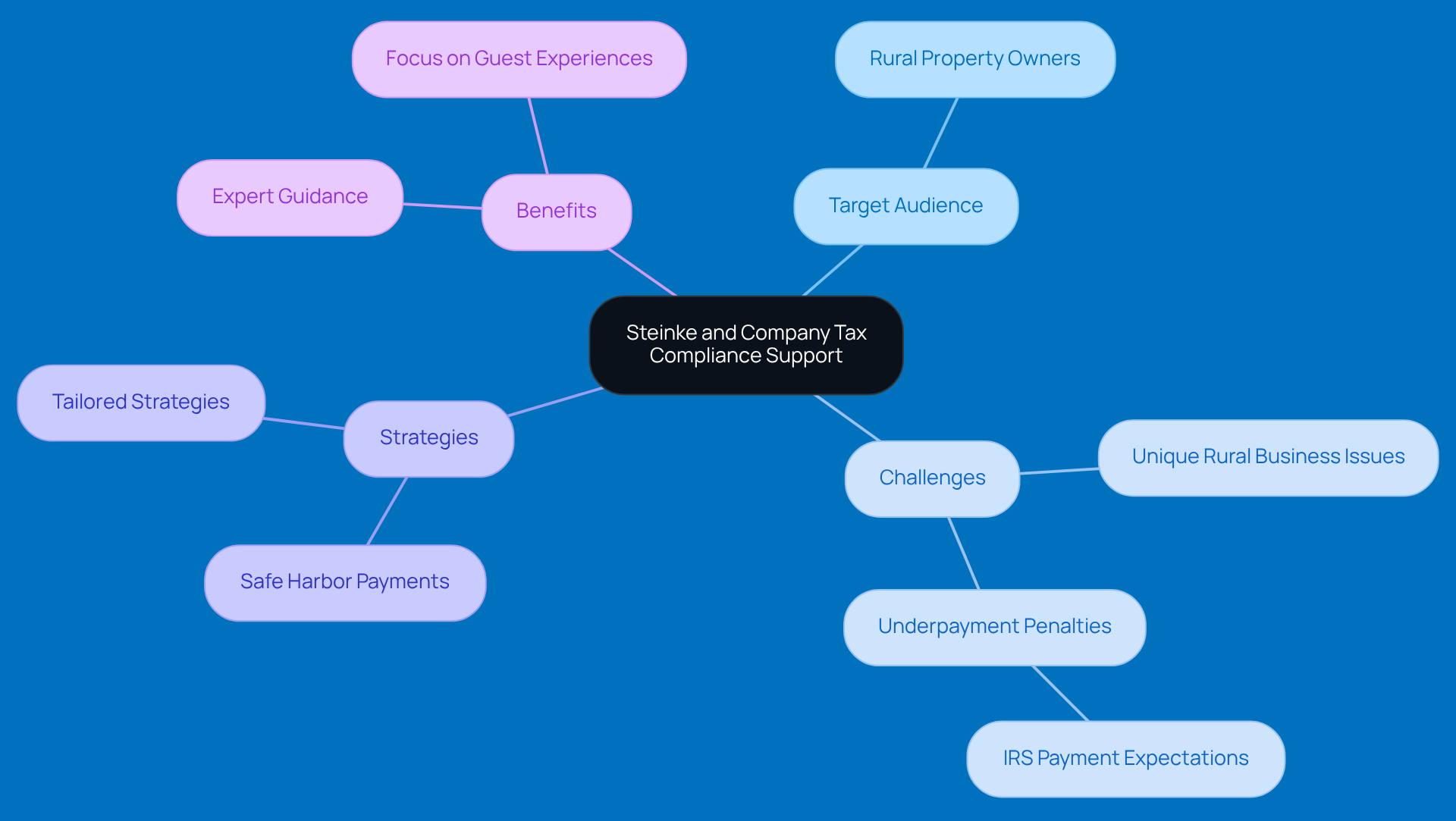

Leverage Steinke and Company for Tax Compliance Support

If you own rural property, you might want to check out what Steinke and Company has to offer. They specialize in tax compliance strategies that are just right for small business owners like you. They really get the unique challenges that come with running a business in rural areas, and they provide practical insights to help you stay on the right side of tax regulations. Plus, they can help you dodge those pesky underpayment penalties that can hit hard.

You know, engaging with professionals can really lighten the load when it comes to tax reporting. Underpayment penalties can be a real bummer - did you know the IRS expects you to pay at least 90% of your current year's tax liability or 100% of what you owed last year to avoid those fees? Steinke and Company has got your back with tailored strategies, like safe harbor payments, to help you meet those requirements without breaking a sweat.

And here’s something interesting: a lot of rental property owners are turning to professional services for tax compliance. They see the value in expert guidance, especially with how quickly tax laws can change. Steinke and Company has helped many rural Airbnb operators fine-tune their tax strategies while adhering to Airbnb IRS rules, and the results speak for themselves. Their case studies show how they’ve made a real difference in compliance and profitability.

This means you can focus on what you do best - providing amazing guest experiences - while ensuring compliance with Airbnb IRS rules. So, why not reach out and see how they can help you too?

Conclusion

Navigating the ins and outs of Airbnb IRS rules is super important for hosts. It’s not just about ticking boxes; getting your taxpayer info right is key to protecting your earnings and making tax time a breeze. By grasping the various requirements - from providing accurate taxpayer details to knowing which tax forms to use - hosts can tackle their tax obligations head-on and steer clear of any compliance headaches.

Let’s break it down: accurate taxpayer info is crucial, and failing to provide it can lead to some serious consequences. Plus, there are specific tax forms you’ll need for reporting your income. If you’re a foreign host, don’t forget about those withholding rules! And for everyone, regularly recertifying your tax info can help you avoid pesky issues like TIN validation errors. Engaging with tax compliance experts can really boost your confidence in handling these challenges, making your rental business run smoother.

At the end of the day, staying informed and proactive about your tax obligations is vital for Airbnb hosts. By tapping into resources and seeking professional advice, property owners can not only safeguard their income but also make a positive impact on their local communities. Embracing these practices is a step toward successful hosting and financial stability, highlighting just how important compliance is in the ever-changing world of short-term rentals.

Frequently Asked Questions

Why is it important to provide accurate taxpayer information to Airbnb?

Providing accurate taxpayer information, such as your Taxpayer Identification Number (TIN) or Social Security Number (SSN), is crucial for Airbnb to report your earnings correctly in compliance with IRS rules. Inaccuracies can lead to payment withholding and complications during tax filing.

What issues have Airbnb property owners faced regarding taxpayer information?

Many Airbnb property owners have encountered issues due to discrepancies in their taxpayer information, which can result in validation errors and complications with tax filings.

How can I verify my reported income on Airbnb?

You can check your earnings dashboard on Airbnb to verify and filter your reported income, ensuring that you are in line with Airbnb IRS rules.

What are the consequences of not providing updated taxpayer information to Airbnb?

If you do not keep your taxpayer information up to date, Airbnb may withhold up to 30% of your earnings for tax purposes. This can lead to fines, scrutiny on your tax filings, and potential investigations.

What are the penalties for not complying with tax reporting in the UK?

In the UK, if you do not declare any income over £7,500, you could face hefty fines from HMRC and potentially be subjected to investigations that can look back over 20 years.

What tax forms do Airbnb hosts need to report their income?

Airbnb hosts typically receive a Form 1099-K when their gross earnings exceed $600 in a calendar year. Depending on the rental situation, hosts may also need to file Schedule E for personal residence rentals or Schedule C for rental businesses.

What happens if I do not provide my taxpayer information when reporting taxes?

Failing to provide your taxpayer information can lead to serious consequences, such as frozen payments or blocked listings on Airbnb.

What is the upcoming change in the reporting threshold for tax forms?

Starting in 2026, the reporting threshold for Form 1099-MISC and Form 1099-NEC will increase to $2,000.