Introduction

In the fast-paced world of small business, getting a handle on bookkeeping isn’t just a nice-to-have-it’s a must! When you have the right practices in place, you can simplify your financial management, stay compliant, and set the stage for lasting growth. But let’s be real: many small business owners find themselves tangled up in the complexities of keeping financial records and planning strategically.

So, what are the key steps that can turn bookkeeping from a chore into a powerful ally for your success?

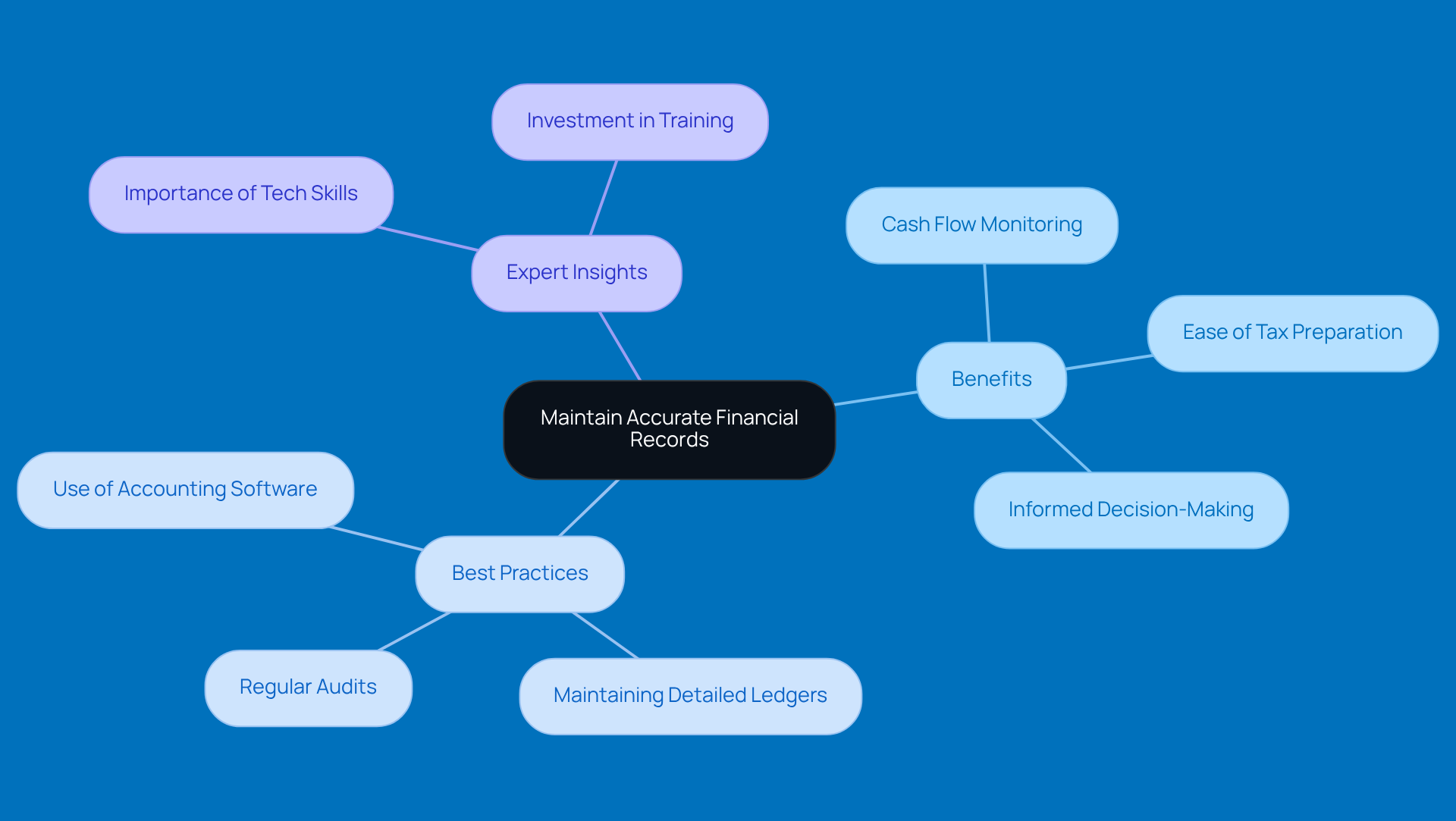

Maintain Accurate Financial Records

Keeping precise financial records is key for any business, especially for small rural enterprises. They help you keep an eye on cash flow, make tax time a breeze, and support smart money decisions. To get it right, having a solid system for record-keeping is a must. Using accounting software can really simplify things, and maintaining a detailed ledger ensures you’re on top of all your financial activities.

Don’t forget about regularly reconciling your accounts with bank statements! This step is super important because it helps catch any discrepancies early on, saving you from headaches later. Did you know that businesses that focus on accurate financial reporting are 70% more likely to make effective strategic choices? Plus, sticking to best practices like consistent data entry, timely updates, and regular audits can really boost the reliability of your financial records.

Experts agree that investing in technology and training can pay off big time. In fact, 57% of firms highlight the importance of tech skills for accountants. By embracing these practices, rural entrepreneurs can not only improve their resource management but also set themselves up for long-term success in a competitive landscape. So, why not take a step today towards better financial management?

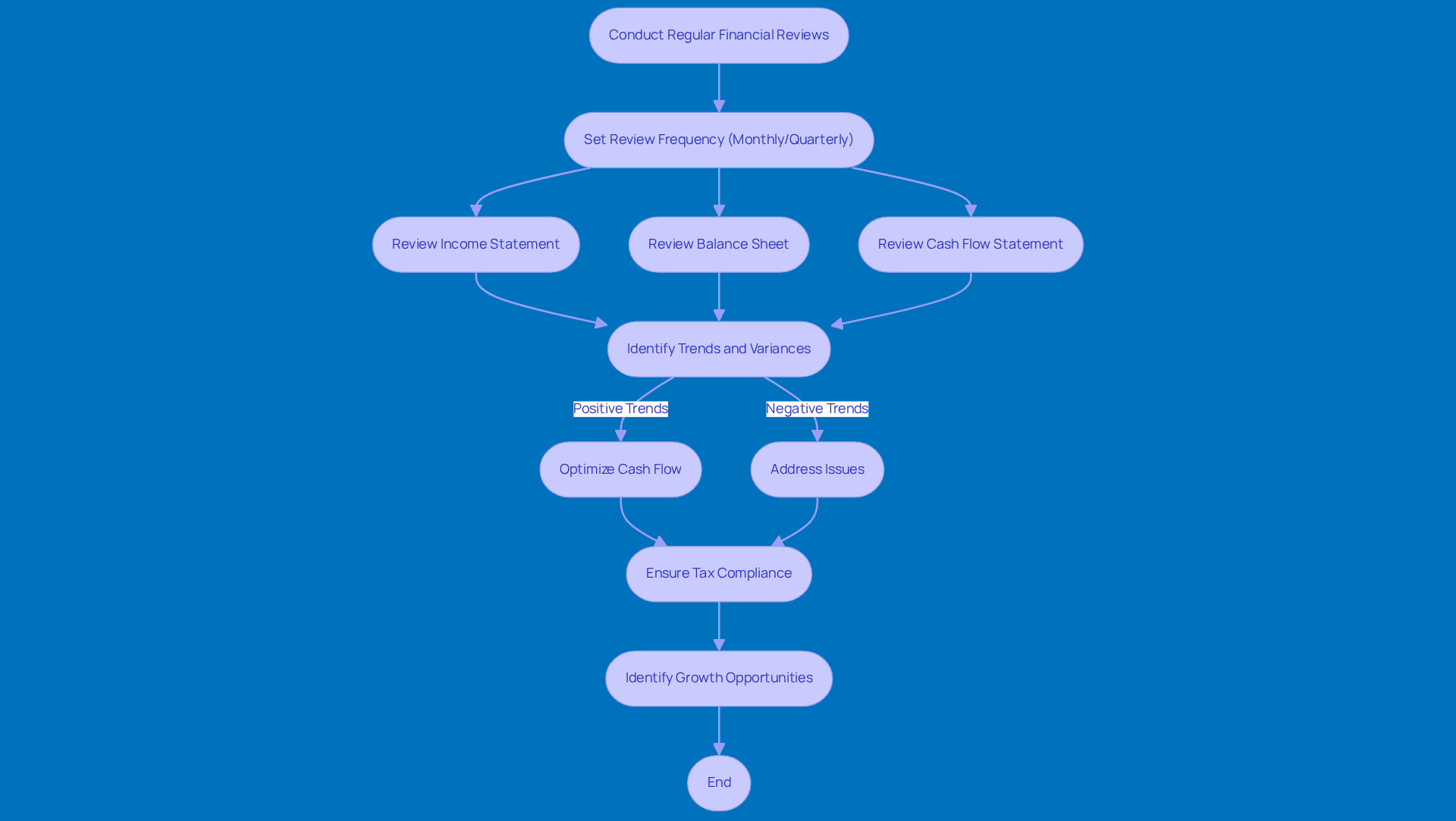

Conduct Regular Financial Reviews

Creating a routine for reviewing your financial statements is a smart move - aim for monthly or quarterly check-ins. During these reviews, take a good look at your income statement, balance sheet, and cash flow statement. This way, you can spot trends, variances, and areas that might need a little TLC. Regular financial evaluations aren’t just a nice-to-have; they’re crucial for keeping your small business thriving. Did you know that a whopping 82% of small businesses fail because of cash flow problems? That’s why these assessments are so important - they help you steer clear of potential pitfalls.

But it’s not just about avoiding failure; these reviews also help you stay compliant and plan strategically. By keeping an eye on your finances, you can uncover growth opportunities, optimize your cash flow, and tackle any issues before they snowball. Plus, understanding underpayment penalties is key. The IRS wants you to pay at least 90% of your current year’s tax liability or 100% of last year’s to dodge those pesky penalties. Regularly checking your financials ensures you’re on track with your estimated tax payments, helping you avoid costly fines and keep your tax compliance in check.

And let’s not forget about choosing the right accounting method - whether it’s cash, accrual, or hybrid. This choice can really shape how you manage your resources and tax responsibilities. By taking a strategic approach, you’ll not only stay compliant but also boost your overall financial health. So, why not start that review routine today? Your future self will thank you!

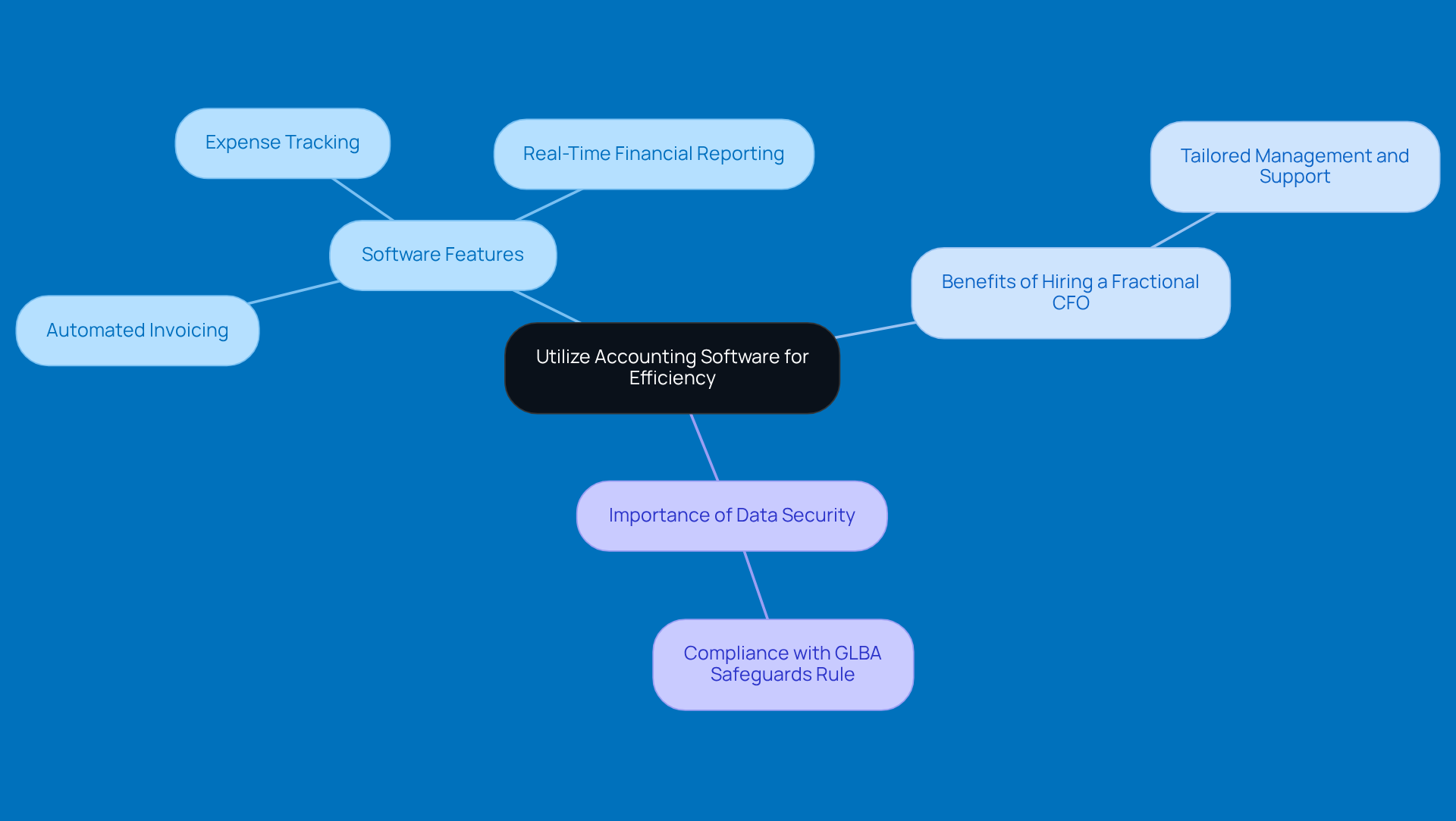

Utilize Accounting Software for Efficiency

Investing in reliable accounting software can really boost your bookkeeping efficiency and help you adhere to bookkeeping best practices for essential data security. Look for software that offers features like:

- Automated invoicing

- Expense tracking

- Real-time financial reporting

These tools not only make your bookkeeping easier but also give you valuable insights into your financial health.

Now, have you ever thought about the benefits of hiring a fractional CFO? It’s a smart, cost-effective way to get tailored management and support, especially when you’re navigating tricky compliance requirements like the GLBA Safeguards Rule. This rule is super important for keeping customer information safe, and having the right help can make all the difference.

By incorporating bookkeeping best practices, you can significantly strengthen your organization’s financial stability and build trust with your clients. Just remember, ignoring data security practices can lead to serious consequences, like hefty fines and a loss of customer trust. So, prioritizing secure accounting solutions isn’t just a good idea - it’s a must for protecting your business!

Separate Personal and Business Finances

If you want to keep your money matters in check, setting up a dedicated bank account for your business is a must. Trust me, using this account just for your commercial transactions makes bookkeeping a breeze and helps you keep a close eye on your expenses. Plus, getting a credit card for your company can really help clarify your finances. It makes tracking expenses smoother and gives you a clearer picture of your business's financial health.

By keeping your personal and business finances separate, you’ll find it much easier to manage your cash flow, which aligns with bookkeeping best practices. This way, you can make smarter money decisions and create a more organized financial environment. So, why not take that step today? Your future self will thank you!

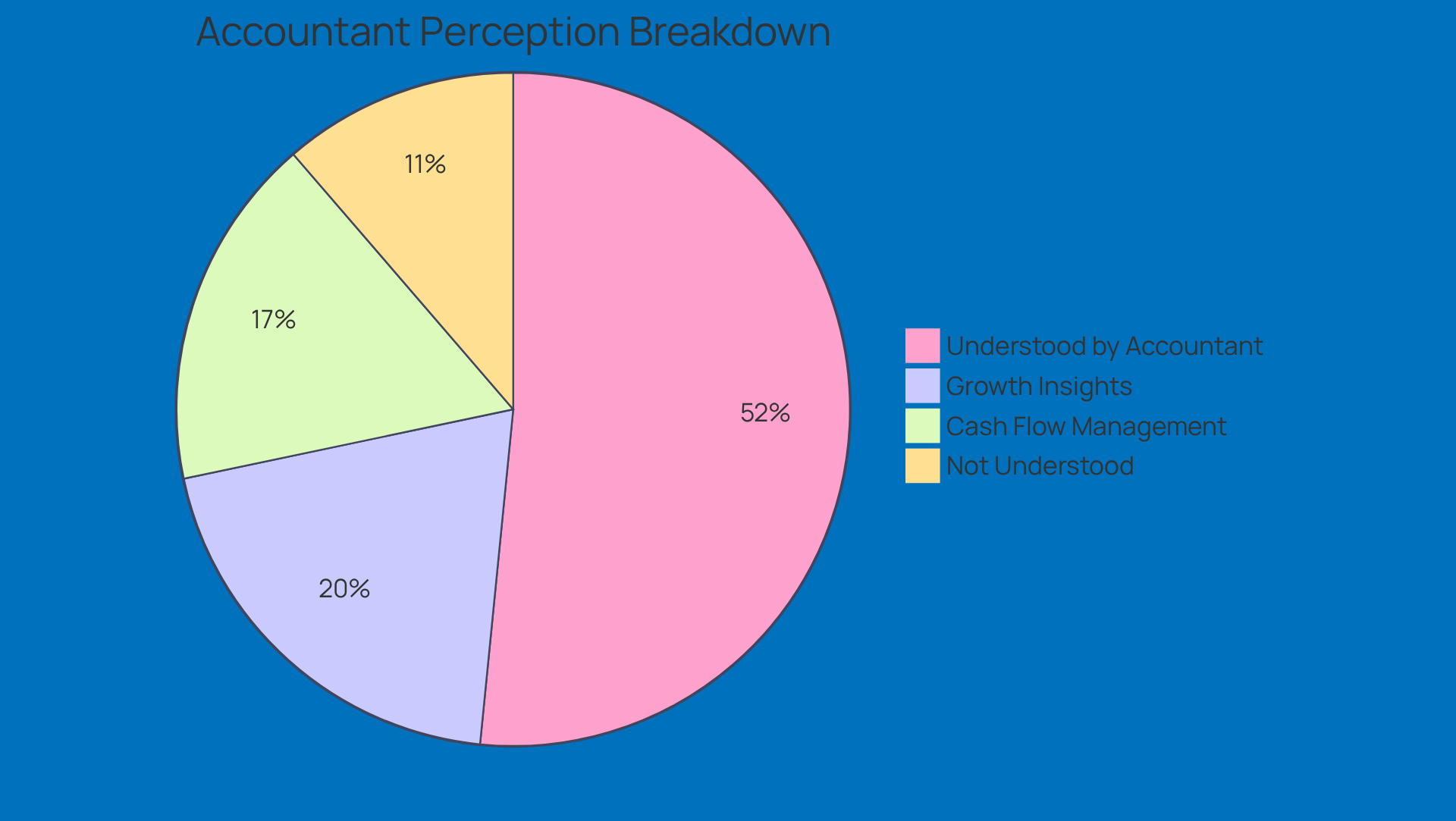

Consider Hiring a Professional Accountant

Hiring a professional accountant can really shake things up for your organization. With their know-how in tax planning, compliance, and financial reporting, you can finally focus on what you do best - running your business. When you're on the hunt for an accountant, look for someone who gets the ins and outs of local businesses and understands the unique challenges you face. This kind of expertise can save you from costly blunders and help you tap into your financial potential.

Did you know that 82% of independent business owners feel their accountant truly understands their operations? That’s a big deal! Finding the right partner can lead to better cash flow management and smart growth strategies. Plus, professional accountants don’t just keep you compliant; they also provide insights that can boost your overall financial health. So, think of them as essential allies in your journey toward success.

Keep Receipts and Documentation Organized

Hey there, entrepreneurs! Let’s discuss something super important: bookkeeping best practices, which include keeping your receipts and financial documents organized. Using digital tools to scan and store your receipts can really make life easier. You can categorize them by type or date, which not only simplifies tax prep but also means you’ll have everything you need if an audit comes knocking.

Now, it’s a good idea to regularly review and clear out any documents you don’t need. This helps ensure that your bookkeeping best practices remain manageable. Did you know that small businesses using digital tools for receipt management often see better efficiency and compliance? It’s definitely worth considering! Remember, proper documentation is essential for maintaining your credibility and operational integrity, as it aligns with bookkeeping best practices.

And let’s not forget about your paystub! Understanding it is key to making sure you’re getting paid correctly and that the right amount is withheld for taxes. Keeping an eye on your paystub details can save you from any surprises come tax time.

Oh, and here’s a tip: hold onto your tax records for at least three years. This way, you can back up your income and deductions if the IRS has any questions. So, how do you keep your financial documents in check? Share your tips!

Establish Consistent Bookkeeping Practices

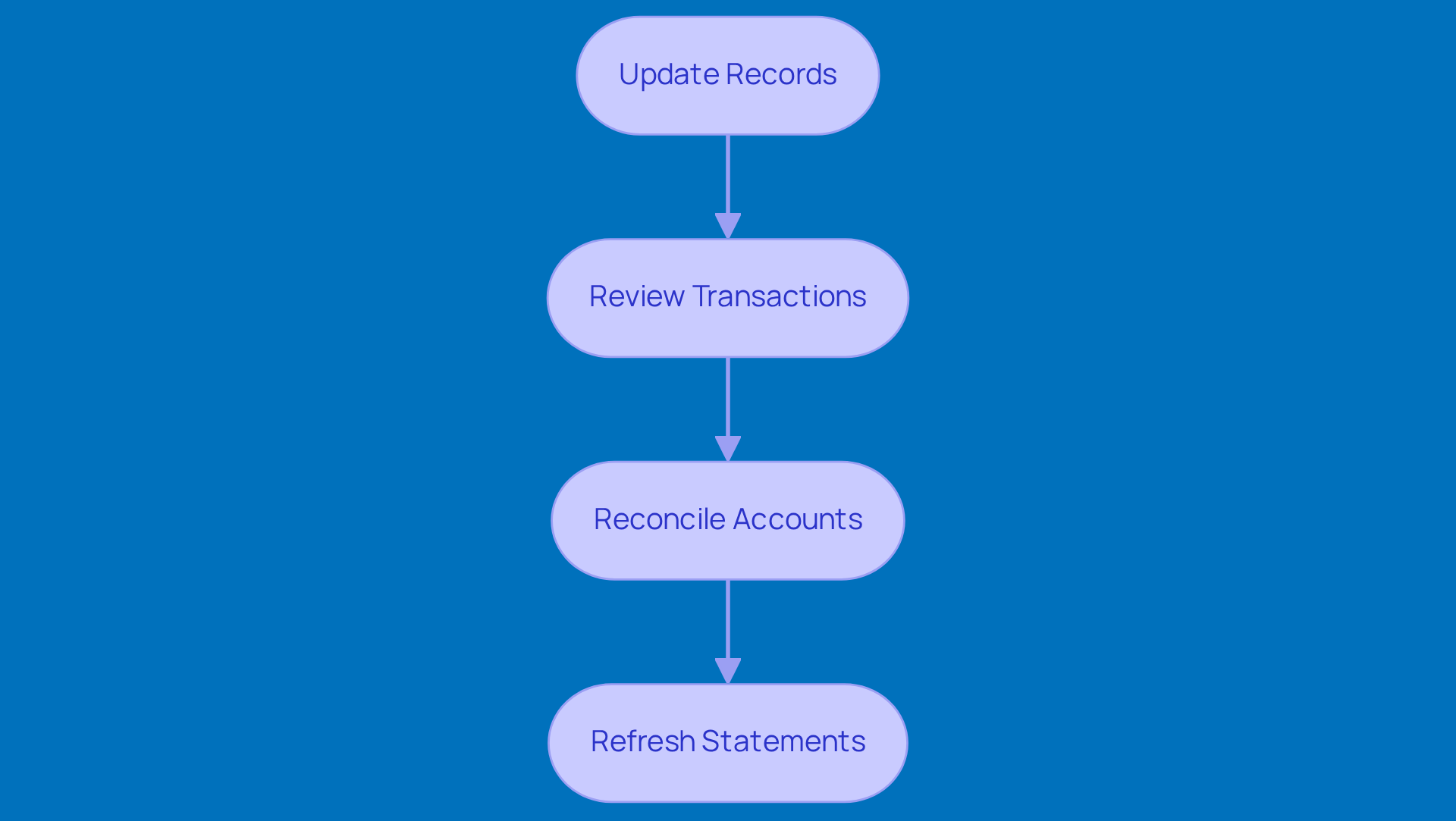

Creating a routine for your bookkeeping activities is crucial for maintaining organized finances and following bookkeeping best practices, especially if you run a small business. Try setting aside specific times each day or week to:

- Update your records

- Review transactions

- Reconcile accounts

- Refresh your statements

This kind of consistency not only keeps your data fresh but also cuts down on the chances of making mistakes. You know, businesses that adhere to bookkeeping best practices often find they can manage things better, leading to improved cash flow and smoother operations.

As Benjamin Franklin wisely said, 'Your net worth to the world is usually determined by what remains after your bad habits are subtracted from your good ones.' By making regular bookkeeping best practices a priority, you’re not just keeping track of numbers; you’re building good financial habits that can really help your business thrive in the long run. So, why not start today? What’s one small step you can take to get your bookkeeping routine going?

Understand Financial Statements Thoroughly

If you want to keep your business running smoothly, you’ve got to get familiar with the three big financial statements:

- The income statement

- Balance sheet

- Cash flow statement

Each one gives you a different look at your company’s financial health. The income statement shows your revenue and expenses, which helps you figure out how profitable you are over a certain period. The balance sheet gives you a snapshot of your assets, liabilities, and equity, letting you see where you stand financially at any given moment. And then there’s the cash flow statement, which tracks the money coming in and going out, shining a light on your liquidity and how efficiently you’re operating.

Regularly checking these statements is key to understanding your business’s financial dynamics. This habit not only helps you make smarter decisions but also boosts your strategic planning for future growth. Being financially literate can really pay off; studies show that small business owners who grasp financial concepts are better at securing funding and managing their resources. In fact, a staggering 50% of small businesses face financial troubles due to a lack of financial literacy, and only about 27% of U.S. adults can pass a basic financial knowledge quiz.

As you get a better handle on these financial statements, think about the perks of bringing in a fractional CFO. They can provide tailored fund management, including tracking key performance indicators (KPIs) and strategies that fit your business’s unique needs. This cost-effective approach lets you tap into professional expertise without the hefty price tag of a full-time hire, guiding your business toward sustainable growth. As Joe Henderson, Senior Vice President at Advantage Capital, points out, successful entrepreneurs make financial management a priority from the get-go to attract growth capital.

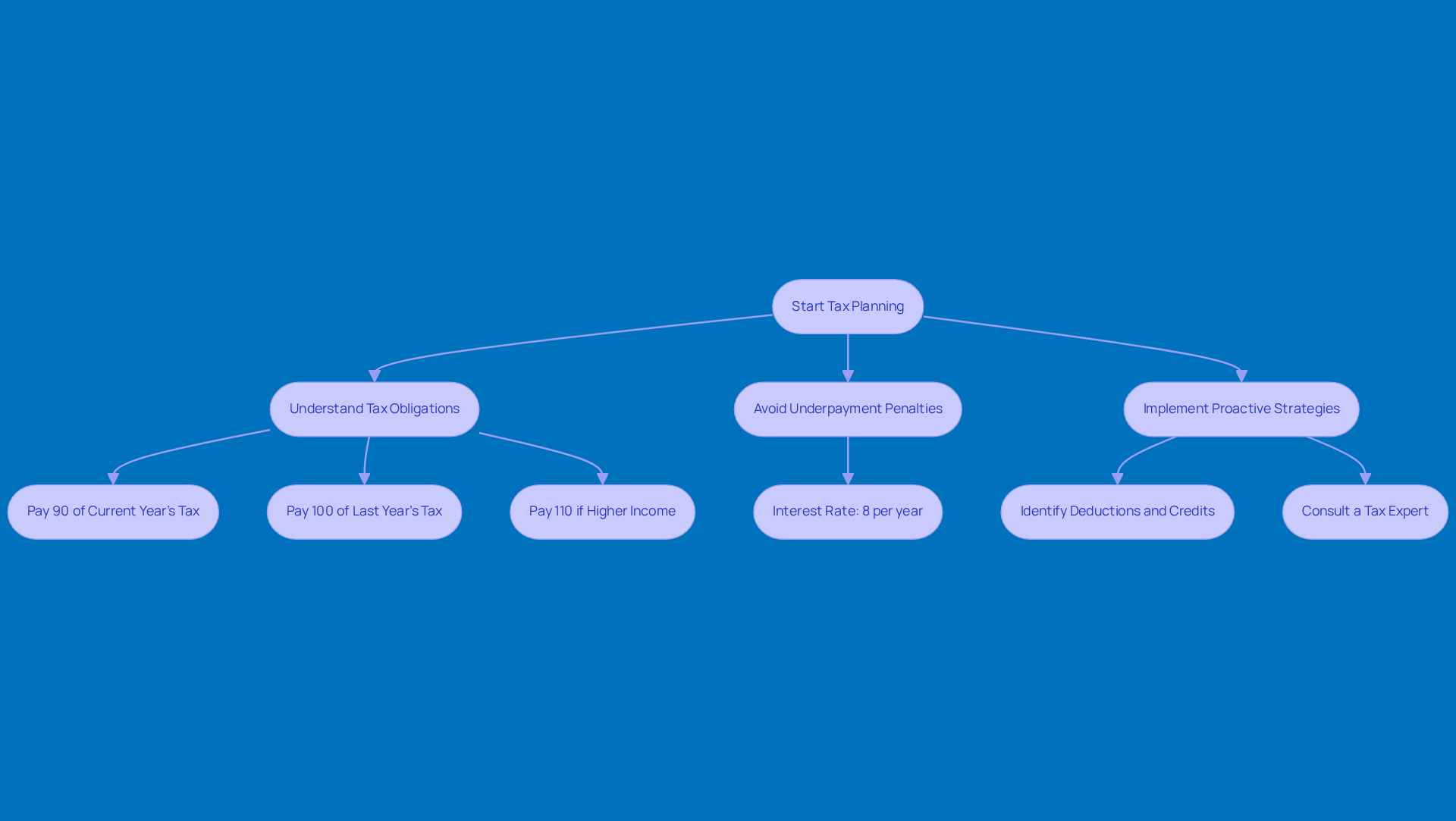

Prioritize Tax Planning and Compliance

Getting into proactive tax planning is a must for entrepreneurs who want to cut down on tax obligations and steer clear of hefty fines. It’s super important to grasp underpayment penalties since the IRS hits you with these when you don’t pay enough of your tax bill through withholding or estimated payments during the year. To dodge these penalties, small business owners should aim to pay at least:

- 90% of their current year’s tax obligation

- 100% of what they owed last year

- 110% if you’re in the higher-income bracket

And just a heads up - the interest rate for underpayments has been sitting at 8% per year, compounded daily, since October 1, 2023. That really highlights how costly underpayment penalties can be! By spotting potential deductions and credits, like the Qualified Business Income (QBI) deduction, businesses can seriously lighten their tax load, possibly saving thousands in federal taxes.

Now, teaming up with a tax expert is a smart move to ensure you’re following all the rules and deadlines. This is especially crucial since about 70% of small businesses skip hiring outside accountants, which often leads to missed opportunities and compliance slip-ups. Regularly checking in on your financial situation is key as your business grows. This way, you can make timely tweaks to your tax strategy, especially with all the changes coming from the One Big Beautiful Bill Act (OBBBA), which brought back 100% bonus depreciation for qualifying businesses. These proactive steps not only boost compliance but also set businesses up for long-term success by fine-tuning their tax strategies and avoiding those pesky penalties. In the end, making tax compliance and planning a priority can really enhance the economic health and sustainability of local businesses.

Leverage Steinke and Company for Tailored Financial Guidance

Working with Steinke and Company opens up a world of tailored financial advice for small businesses in rural America, addressing the unique challenges they face. Our team knows the ins and outs of rural enterprises, crafting personalized strategies that not only boost growth but also keep you compliant and simplify your financial management. Whether it’s detailed tax planning or implementing bookkeeping best practices, we’ve got the tools you need to build a strong and profitable business.

And let’s not forget the success stories! We’ve seen our clients transform their operations with our dedicated support, leading to sustainable growth and stability in their communities. So, if you’re ready to take your business to the next level, why not reach out? We’re here to help you thrive!

Conclusion

Implementing effective bookkeeping practices is key for small business owners who want to achieve financial stability and long-term success. By focusing on accurate financial records, doing regular financial check-ups, and using technology, entrepreneurs can manage their resources better and tackle the complexities of business finances with confidence.

In this article, we’ve highlighted some important strategies like:

- Keeping precise financial records

- Using accounting software

- Separating personal and business finances

- Understanding financial statements

Each of these practices is crucial for building a solid financial foundation, helping business owners dodge common pitfalls and grab growth opportunities. Plus, hiring professional accountants and engaging in proactive tax planning really shows how valuable expert guidance can be in navigating the financial landscape.

So, adopting these bookkeeping practices isn’t just about ticking boxes; it’s a proactive way to ensure your small business stays healthy and sustainable. I encourage you to take immediate steps to enhance your financial management-whether that’s investing in technology, setting up a consistent bookkeeping routine, or seeking tailored financial advice. By doing this, you’re setting yourself up for success and creating a thriving business that can stand the test of time!

Frequently Asked Questions

Why is maintaining accurate financial records important for small businesses?

Maintaining accurate financial records is crucial for small businesses as it helps monitor cash flow, simplifies tax preparation, and supports informed financial decisions.

What are some best practices for keeping financial records?

Best practices include using accounting software, maintaining a detailed ledger, regularly reconciling accounts with bank statements, ensuring consistent data entry, timely updates, and conducting regular audits.

How can technology and training benefit financial record-keeping?

Investing in technology and training can enhance financial management, with 57% of firms emphasizing the importance of tech skills for accountants, leading to improved resource management and long-term success.

How often should businesses conduct financial reviews?

Businesses should aim for monthly or quarterly financial reviews to assess their income statement, balance sheet, and cash flow statement.

Why are regular financial evaluations important?

Regular financial evaluations help businesses identify trends, avoid cash flow problems, ensure compliance, uncover growth opportunities, and manage tax responsibilities effectively.

What tax compliance tips should businesses keep in mind?

Businesses should pay at least 90% of their current year’s tax liability or 100% of last year’s to avoid penalties, and regularly checking financials ensures they stay on track with estimated tax payments.

What features should reliable accounting software offer?

Reliable accounting software should include automated invoicing, expense tracking, and real-time financial reporting to enhance bookkeeping efficiency and provide insights into financial health.

What is the benefit of hiring a fractional CFO?

Hiring a fractional CFO is a cost-effective way to receive tailored management and support, especially for navigating compliance requirements like the GLBA Safeguards Rule.

Why is data security important in accounting practices?

Prioritizing data security in accounting practices is essential to protect customer information and avoid serious consequences such as fines and loss of customer trust.