Introduction

Navigating the ins and outs of tax obligations can feel pretty overwhelming for small business owners with a green card. As U.S. tax residents, these folks have some unique requirements that go beyond just meeting filing deadlines. They need to accurately report their worldwide income, keep up with different state laws, and really understand what could happen if they don’t comply.

In this article, we’ll dive into ten essential tax return requirements that green card holders need to keep in mind, sharing some handy insights and strategies to help steer clear of costly mistakes.

So, how can small business owners juggle their tax responsibilities while also maximizing their financial outcomes?

Understand Tax Filing Obligations as a Green Card Holder

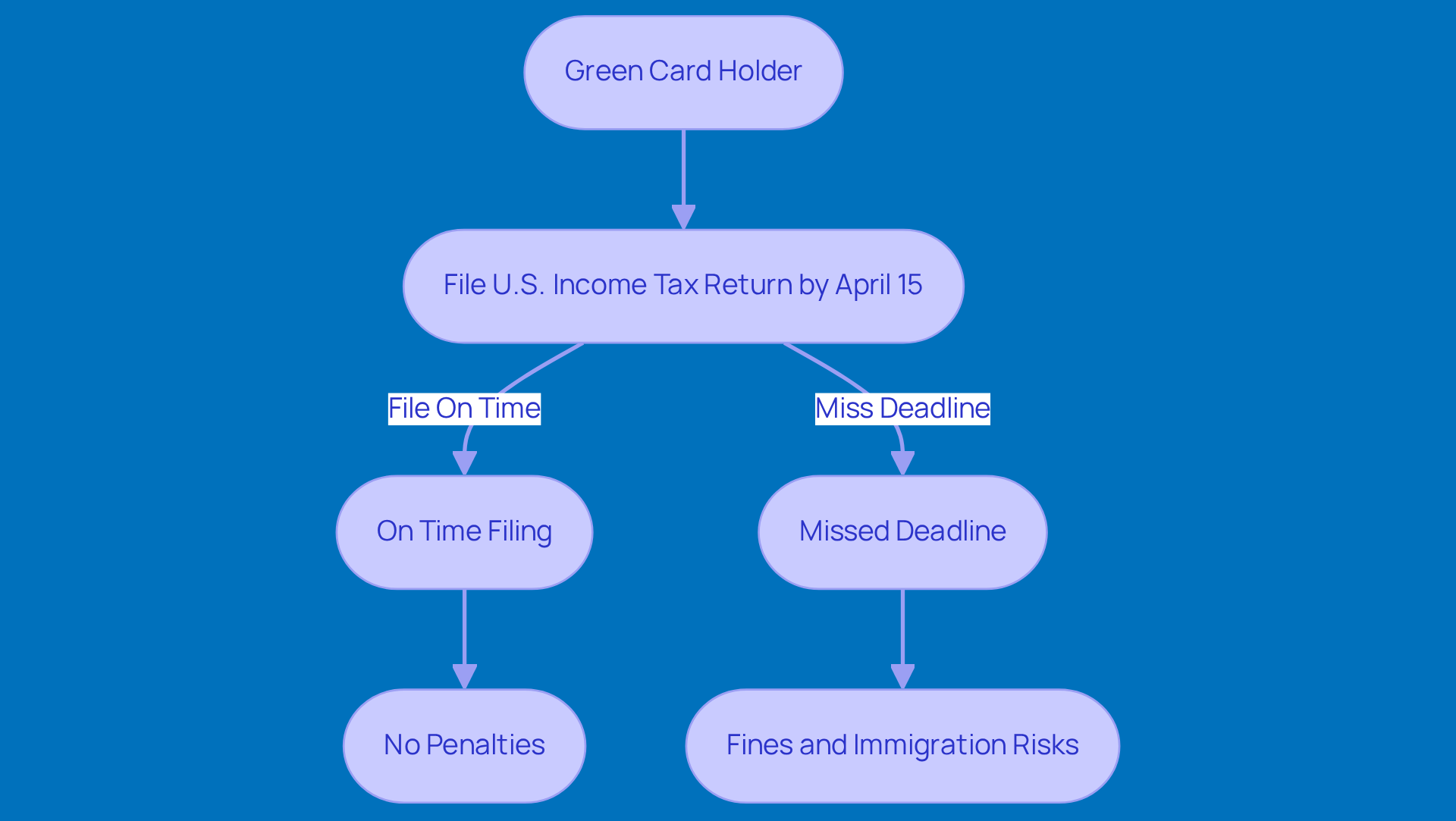

If you're a permanent resident, guess what? You're considered a U.S. tax resident! That means you need to file a U.S. income tax return every year, no matter where you are or where your income comes from, due to the green card tax return requirements. The deadline? It's April 15 of the following year, just like it is for U.S. citizens.

Now, here's the thing: if you miss these deadlines, you could face some serious penalties. We're talking fines and even issues with your immigration status. For instance, not filing could put your residency at risk since the IRS keeps a close eye on permanent residents to ensure they're following the rules.

So, it’s super important to stay on top of the green card tax return requirements. You definitely don’t want any surprises that could affect your immigration status. Keep informed, and you'll be in a much better position to avoid any hiccups!

Identify Required Tax Forms for Green Card Holders

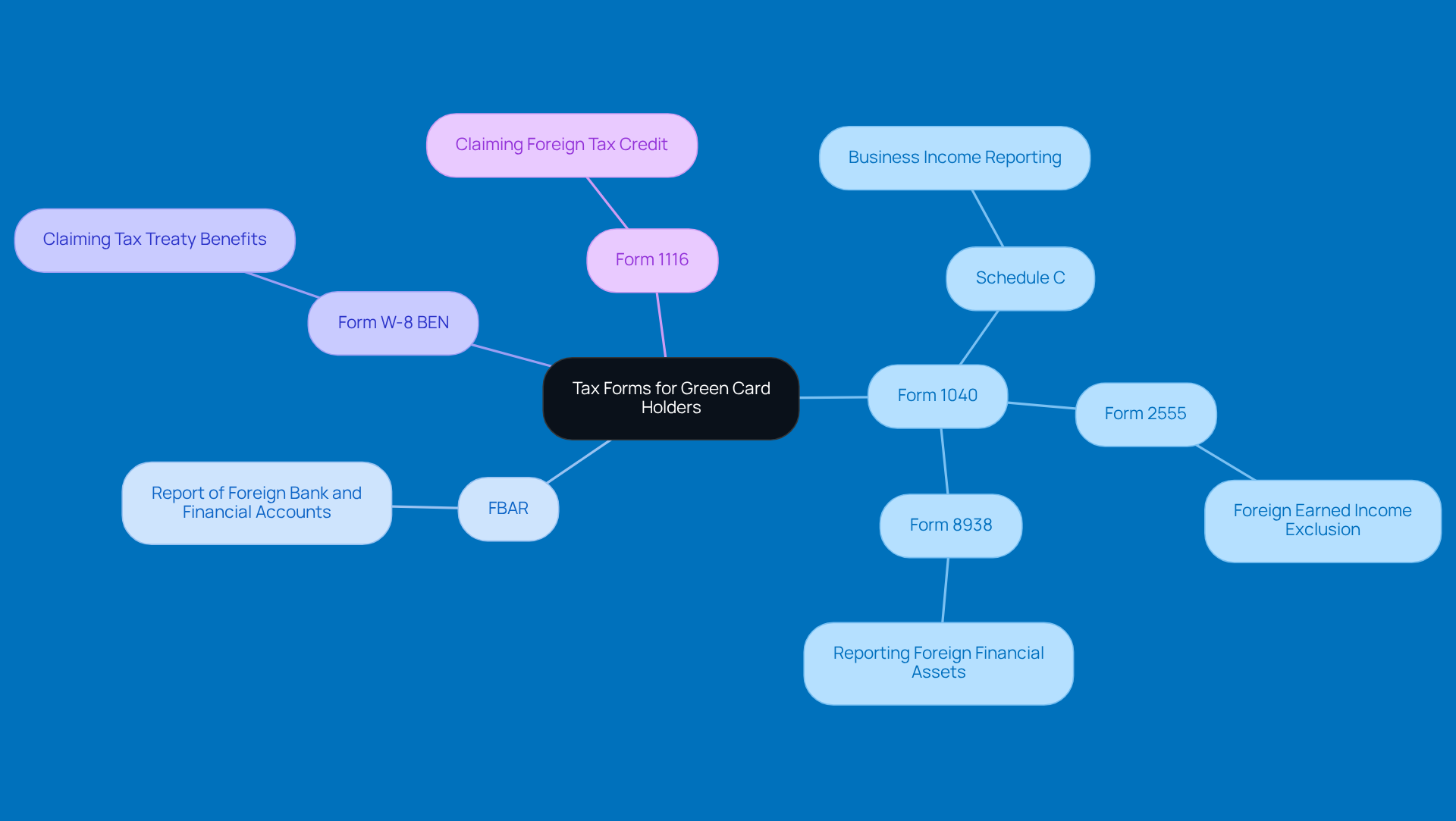

If you’ve got a green visa, you’ll need to file Form 1040 to comply with the green card tax return requirements in the U.S. Individual Income Tax Return. This means you have to report your worldwide income, no matter where you’re living. Depending on your situation, you might also have to fill out some extra forms. For example, if you’re running a business, you’ll want to use Schedule C to report that income. And if you’re eligible, Form 2555 can help you claim the Foreign Earned Income Exclusion, letting you exclude some of your foreign income from U.S. taxes.

Understanding these forms is super important for complying with the green card tax return requirements and keeping everything above board with U.S. tax laws. Take small business owners, for instance. They often file Form 1040 along with Schedule C to detail their business earnings. This way, they can make sure they’re meeting all their tax obligations while also maximizing their deductions. So, if you’re in this boat, make sure you’re on top of these forms!

Report Worldwide Income Accurately

Hey there! As a green card holder, you should be aware of the green card tax return requirements, which necessitate reporting all your income from around the globe. This includes everything from wages and dividends to rental income. Why is this so crucial? Well, it gives the IRS a complete picture of your financial situation. Ignoring this responsibility can lead to some hefty penalties, like fines and interest on what you owe. For example, if you don’t report foreign accounts, you could face penalties starting at $10,000 a year, and that can really add up if it’s deemed willful.

Tax experts really stress the importance of adhering to green card tax return requirements. One expert pointed out that 'Citizenship-based taxation subjects US expats to an array of onerous filing and reporting obligations whose annual cost can quickly escalate into the thousands.' As we look ahead to 2026, the IRS is keeping a close eye on reporting obligations, and any slip-up could mean overdue payments, interest, and civil penalties. So, it’s super important to keep your records straight and make sure you report all your income. Trust me, avoiding these severe consequences is worth the effort!

Consider State Tax Filing Requirements

If you're a permanent resident, you've got to juggle not just federal taxes but also state income taxes, which can really vary based on where you live. Each state has its own set of tax rules and filing requirements, so it’s super important to check in with your state’s tax authority to stay on the right side of the law. For example, state tax rates can swing from 0% in places like Florida and Texas to a hefty 12.3% in California, which can really change your overall tax bill.

Tax pros stress how crucial it is to get a handle on these responsibilities. One expert puts it simply: "Once you receive your green card, the IRS treats you the same as a U.S. citizen for tax purposes." This means green card holders need to report their worldwide income, just like citizens do.

Now, if you're a small business owner, you might run into some unique hurdles when it comes to state tax compliance. Take Arizona, for instance: nonresidents have to file a return after just one day of work, but employers don’t have to start withholding taxes until after 60 days. This can create a bit of a mess and lead to confusion, especially if you’re working across state lines. Plus, there are fourteen states that impose local income taxes that could affect nonresidents, making things even trickier.

Understanding the green card tax return requirements is crucial for permanent residents to dodge penalties and keep their businesses running smoothly. So, why not chat with a tax professional? They can help clear up the confusion and guide you through the maze of state tax obligations.

Recognize Consequences of Non-Filing

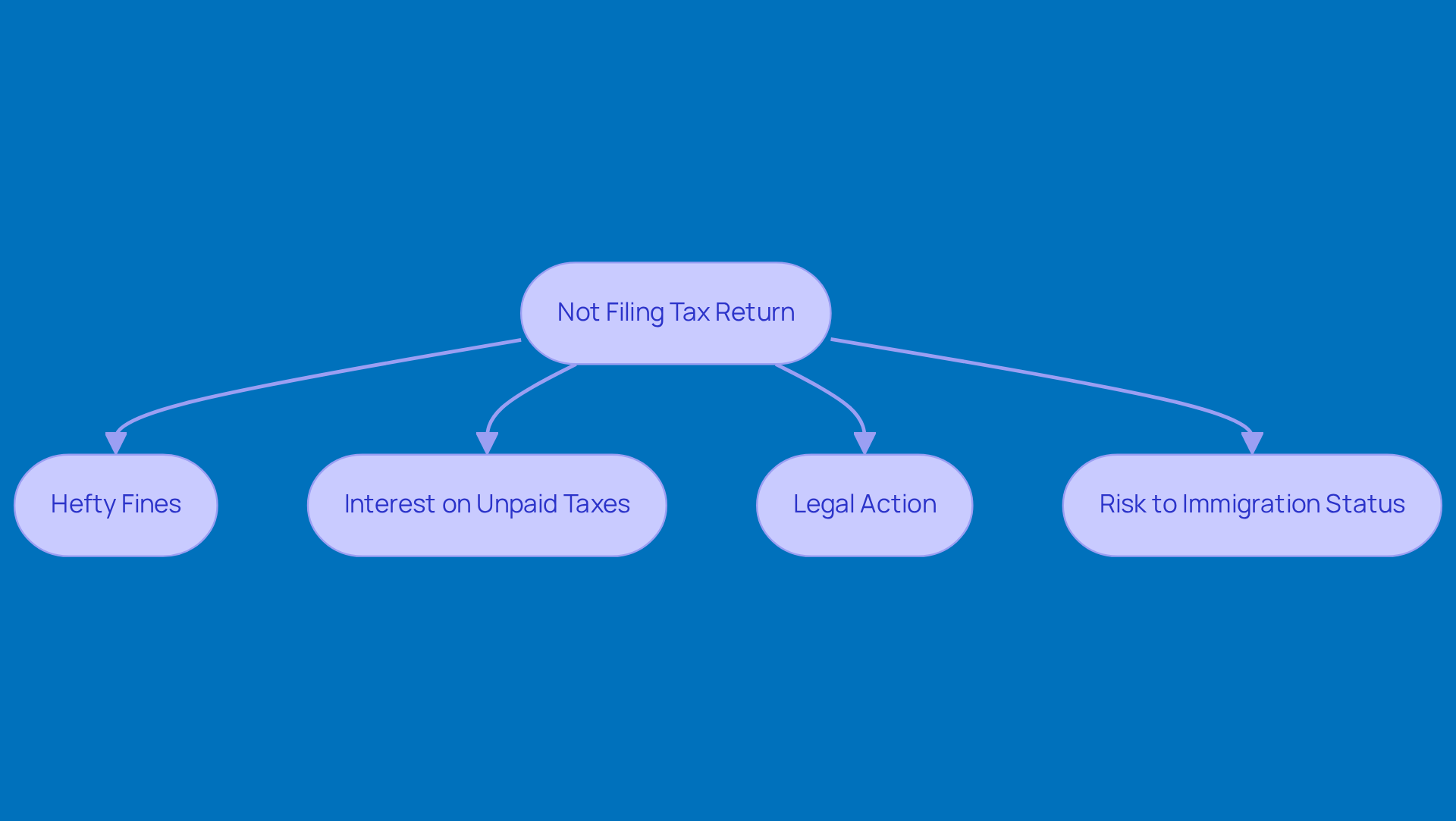

Not filing your tax return? That could lead to some serious trouble! We're talking hefty fines, interest piling up on unpaid taxes, and even the possibility of legal action. If you're a residency permit holder, understanding the green card tax return requirements makes the stakes even higher. Ignoring the green card tax return requirements can put your immigration status at risk, as the IRS might notify immigration authorities about your non-compliance. This could make it tough to renew your residency permit or even apply for citizenship.

Did you know that the failure-to-file penalty is usually 5% of the unpaid taxes for each month your return is late? It caps out at 25% of the total amount you owe. Yikes! Legal experts also warn that failing to meet green card tax return requirements might be seen as abandoning your permanent residence, which can complicate your immigration situation even further. There are plenty of case studies showing that many permanent residents have faced legal issues because they didn’t keep up with their taxes. It really highlights how important it is to stay on top of your tax obligations.

So, here’s the deal: if you’ve got a residency permit, the green card tax return requirements begin right after you receive it, no matter where you are. It’s crucial to keep that in mind!

Understand Tax Implications of Dual Citizenship

Navigating tax obligations as a dual citizen can feel pretty complex, right? You often find yourself filing tax returns in both countries, each with its own set of rules. This dual filing can lead to some real head-scratchers, especially when it comes to understanding tax treaties and the credits that help ease the burden of double taxation.

Take the Foreign Earned Income Exclusion (FEIE), for example. It lets qualifying folks exclude a chunk of their foreign-earned income from U.S. taxes. Sounds great, but it doesn’t cover everything - like retirement funds, for instance. That’s why tax advisors stress the importance of having a solid plan in place to manage these obligations effectively.

They often suggest chatting with experts who can offer personalized advice based on your unique situation. This way, you can stay compliant while also making the most of your tax outcomes. If you’re a small business owner, you really need to keep a close eye on your income and expenses across borders. Ignoring this could lead to some nasty surprises come tax time.

But don’t worry! By leveraging tax treaties and credits, dual citizens can navigate their obligations more smoothly, turning potential pitfalls into manageable tasks. So, how are you planning to tackle your tax situation? Let’s make it a little easier together!

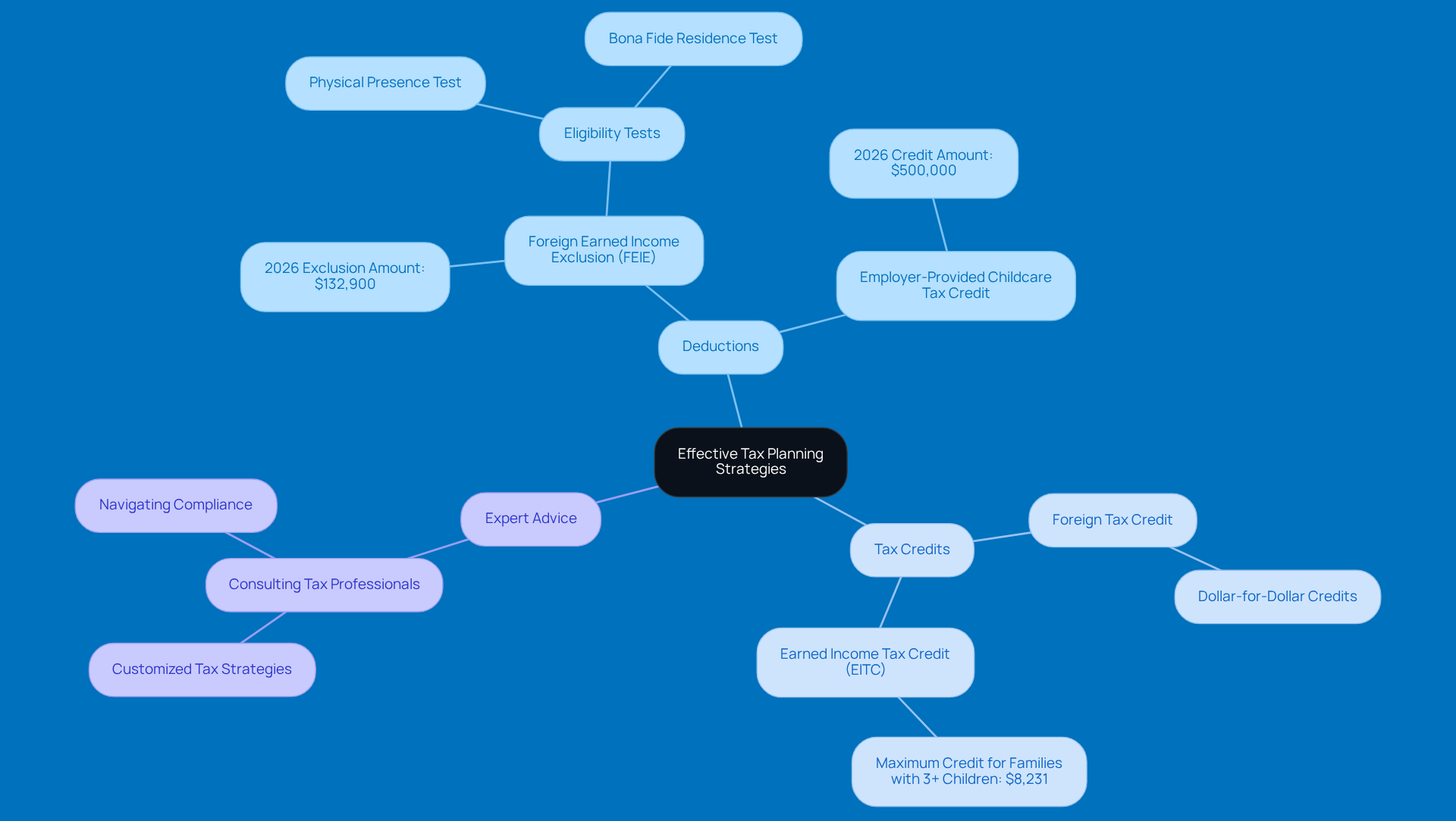

Implement Effective Tax Planning Strategies

Effective tax planning is super important for permanent residents, especially when considering green card tax return requirements, particularly if you’re a small business owner. By maximizing deductions and taking advantage of tax credits, you can really lower your taxable income. For instance, did you know that the Foreign Earned Income Exclusion (FEIE) lets qualified residents exclude up to $132,900 of foreign earned income from U.S. taxes for the 2026 tax year? This is a game-changer for those living in low-tax countries, where combining the FEIE with local tax credits can lead to some serious savings.

And there’s more! The Employer-Provided Childcare Tax Credit has jumped to $500,000, giving small business owners even more chances to cut down on their tax bills. Working with a tax pro, like the folks at Steinke and Company, can help you customize these strategies to fit your unique situation, making sure you’re using all the deductions and credits available to you. Statistics show that most expats find the green card tax return requirements manageable with a bit of planning, which really highlights the importance of mapping out a proactive tax strategy.

Tax experts often emphasize how crucial these strategies are: "The Foreign Tax Credit offers dollar-for-dollar credits for foreign taxes paid." This demonstrates how permanent residents can leverage their international tax responsibilities to comply with green card tax return requirements and reduce their U.S. tax burden. By getting a handle on these strategies, permanent residents can navigate their tax responsibilities more smoothly and boost their financial outcomes. So, why not take a closer look at your tax situation? You might be surprised at what you can save!

Seek Professional Help for Tax Compliance

Navigating the ins and outs of U.S. tax laws, particularly the green card tax return requirements, can feel like a maze, especially for permanent residents running small businesses. That’s why teaming up with a tax advisor or CPA who knows the ropes of expatriate tax issues is so important. Did you know that folks who seek professional help often see much higher compliance rates? This means fewer headaches from costly mistakes and penalties. As one savvy CPA puts it, 'Having a knowledgeable tax advisor can make all the difference in understanding your obligations and maximizing your benefits.'

For small business owners, expert guidance doesn’t just make filing easier; it can also reveal potential savings through available credits and exclusions. Imagine finding money you didn’t even know you could claim! By investing in professional tax assistance, permanent residents can tackle their green card tax return requirements with confidence and clarity. So, why not take that step? It could save you time, stress, and maybe even some cash!

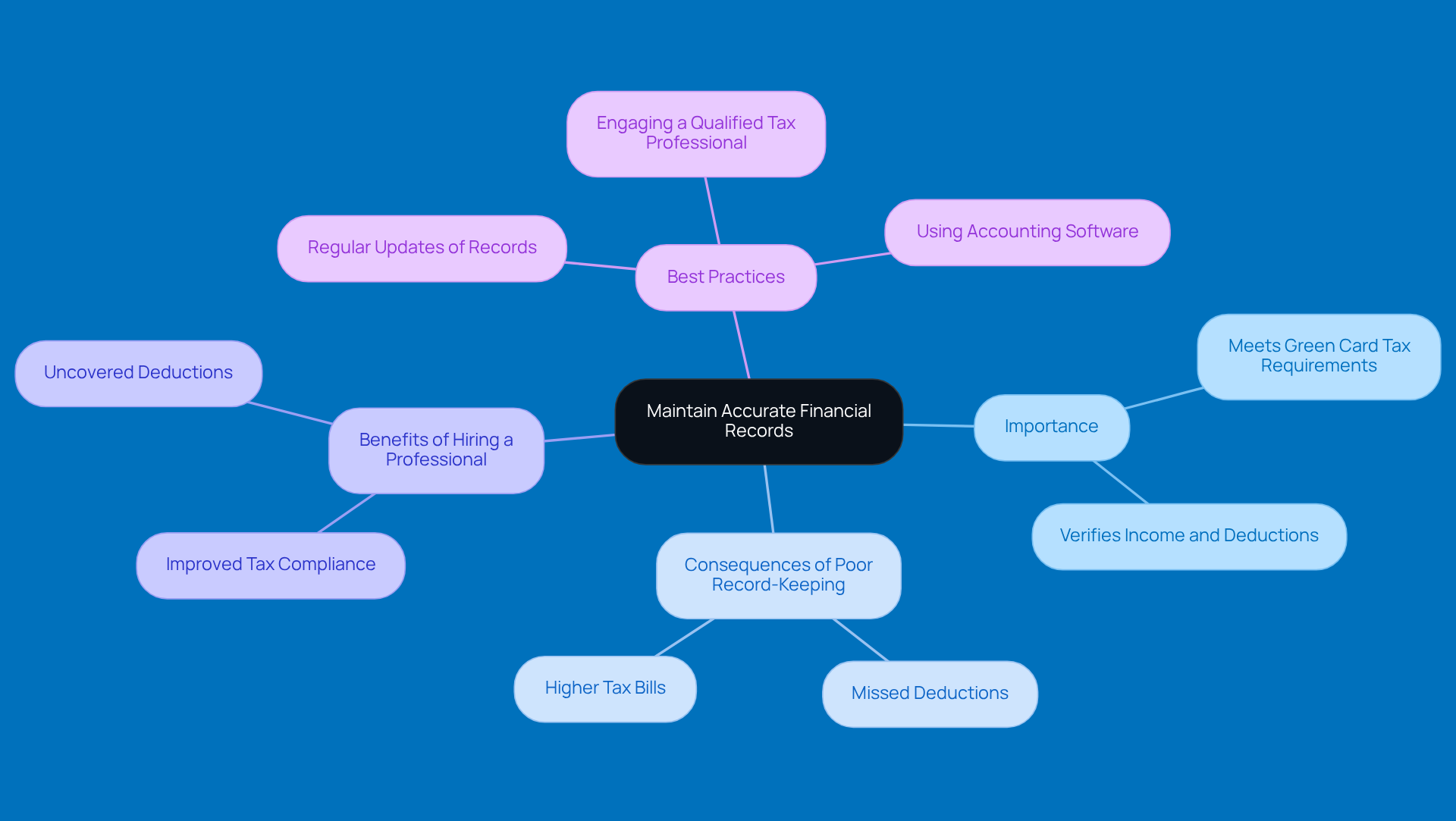

Maintain Accurate Financial Records

For permanent residents, keeping your financial records in check is super important to meet the green card tax return requirements. It helps verify the income and deductions you declare on your tax returns. So, what does that mean? Well, it means you should keep detailed documentation - think receipts, bank statements, and records of all your income sources. Not only does effective record-keeping make tax filing a breeze, but it also keeps you in line with IRS regulations, which means fewer worries about audits and penalties.

Did you know that about 30% of residency permit holders don’t keep comprehensive records? That can lead to missed deductions and higher tax bills. Engaging a qualified tax professional can really make a difference. Many small business owners have found this out the hard way. For example, a freelance graphic designer saw a huge improvement in their tax compliance after hiring a professional bookkeeper, uncovering a whopping $8,000 in deductible expenses they had overlooked!

Financial advisors often say that organized documentation is key to successful tax management. One expert even mentioned, "Diligently documenting every income and expense is crucial during tax season." By adopting some solid record-keeping practices, permanent residents can more effectively tackle the complexities of green card tax return requirements. So, why not take a step towards better financial outcomes today?

Utilize Steinke and Company for Tailored Tax Services

At Steinke and Company, we specialize in tax services tailored to meet the green card tax return requirements for green card holders and small business owners. Our focus? Making sure you stay compliant while planning strategically. Our experienced team knows the ins and outs of U.S. tax laws, helping you maximize your savings and keep stress at bay.

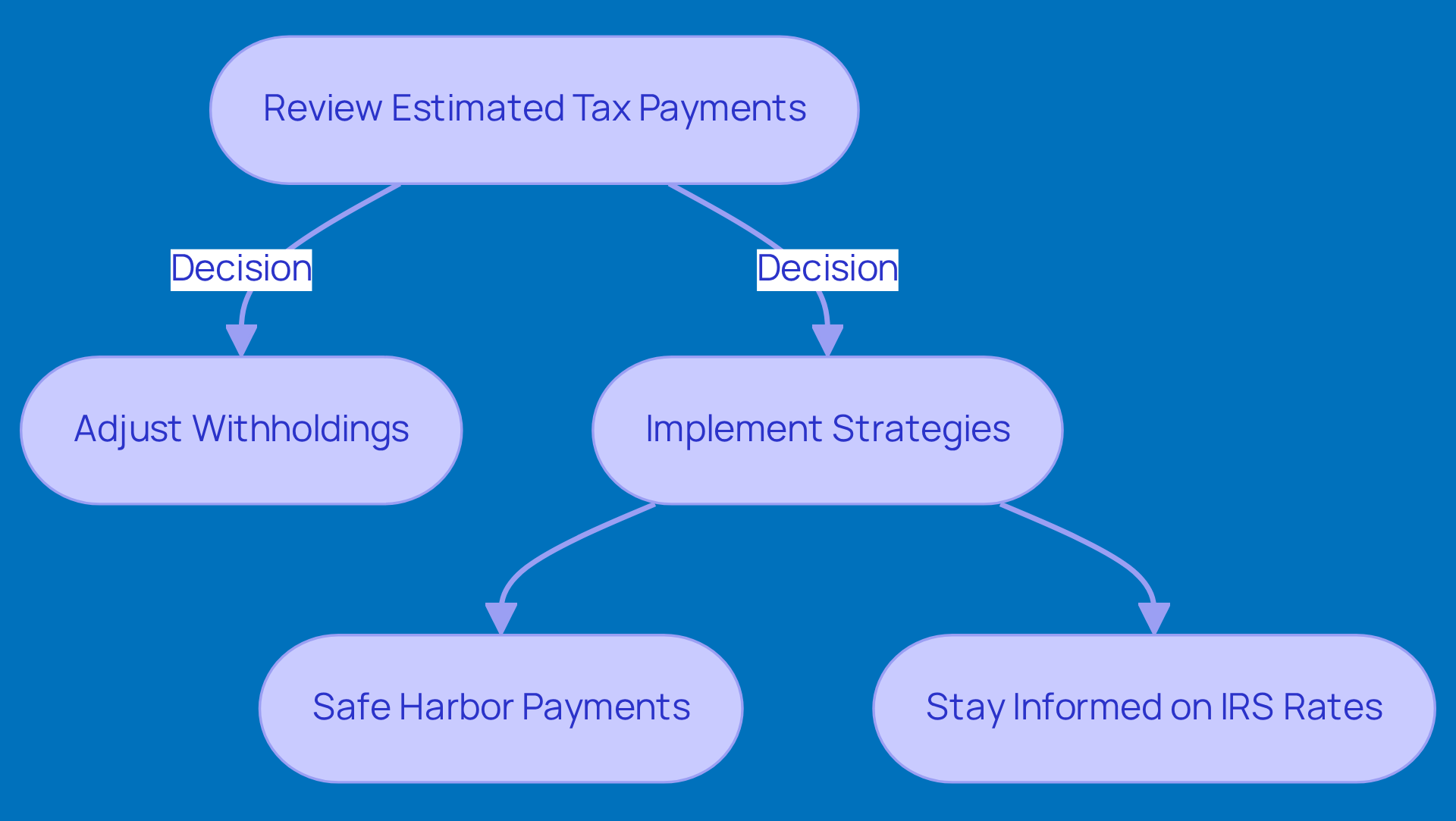

Now, let’s talk about underpayment penalties. These can sneak up on you if you don’t pay enough of your tax liability through withholding or estimated payments during the year. But don’t worry! When you partner with us, you can focus on growing your business, knowing your tax obligations are in expert hands.

We believe in proactive planning - it’s key to minimizing liabilities and avoiding those pesky surprises come tax season. For instance, strategies like safe harbor payments can shield you from underpayment penalties, making sure you meet your tax responsibilities without a hitch. And with the IRS recently bumping up the interest rate for underpayments to 8% per year, staying ahead of your tax game is more important than ever.

With our support, you’re not just getting a service; you’re gaining a trusted partner committed to your long-term success. So, why not take a moment to review your estimated tax payments and adjust your withholdings as needed? It’s a simple step that can make a big difference!

Conclusion

Understanding the green card tax return requirements is super important for small business owners and permanent residents. If you don’t meet these obligations, you could face some serious penalties - think fines, interest on unpaid taxes, and even risks to your immigration status. But don’t worry! By staying informed and proactive about your tax responsibilities, you can tackle the complexities of U.S. tax laws with confidence and peace of mind.

Throughout this article, we’ve highlighted some key points that really matter:

- Timely tax filing

- Accurately reporting your worldwide income

- Grasping those pesky state-specific tax obligations

It’s crucial to use the right tax forms, keep your financial records organized, and don’t hesitate to seek professional help. Each of these elements is vital for staying compliant and maximizing your potential tax savings.

So, what’s the takeaway? Effective tax planning and diligent record-keeping aren’t just best practices - they’re essential strategies for your success. If you’re a small business owner, consider teaming up with tax professionals like Steinke and Company to customize your approach to tax compliance. By doing this, you can secure your financial future while minimizing the risks tied to tax obligations. Taking action today can lead to a more manageable and profitable tomorrow!

Frequently Asked Questions

What are the tax filing obligations for green card holders in the U.S.?

Green card holders are considered U.S. tax residents and must file a U.S. income tax return every year by April 15, regardless of where they live or where their income comes from.

What could happen if a green card holder misses the tax filing deadline?

Missing the tax filing deadline can result in fines and potential issues with immigration status, including risking residency, as the IRS monitors compliance closely among permanent residents.

What tax form do green card holders need to file?

Green card holders need to file Form 1040, the Individual Income Tax Return, to report their worldwide income. Additional forms may be required based on individual circumstances.

What additional forms might green card holders need to file?

Depending on their situation, green card holders may need to file Schedule C for business income or Form 2555 to claim the Foreign Earned Income Exclusion, which allows them to exclude some foreign income from U.S. taxes.

Why is it important for green card holders to report their worldwide income?

Reporting worldwide income provides the IRS with a complete picture of a green card holder's financial situation. Failure to do so can lead to significant penalties, including fines and interest on unpaid taxes.

What are the potential penalties for not reporting foreign accounts?

Not reporting foreign accounts can result in penalties starting at $10,000 per year, which can increase if the non-reporting is deemed willful.

What should green card holders do to avoid tax-related issues?

Green card holders should stay informed about their tax obligations, keep accurate records, and ensure they report all sources of income to avoid penalties and maintain compliance with U.S. tax laws.