Introduction

Navigating the ins and outs of federal LLC tax rates can feel like a real headache for small business owners, especially with all the recent changes in legislation that might shake up their financial game plans. But here’s the thing: understanding these tax obligations isn’t just about staying compliant; it can actually lead to some serious savings that help your business thrive.

So, with all the different tax classifications and deductions out there, how can entrepreneurs like you make sure you’re making the smartest choices to lighten your tax load while still reaping the benefits? This article dives into ten key insights that will arm LLC owners with the know-how they need to navigate the ever-changing tax landscape. Let’s get started!

Steinke and Company: Expert Guidance on Federal LLC Tax Rates for Small Businesses

At Steinke and Company, we’re all about helping small businesses in rural America tackle their tax compliance needs. Our expert insights into the federal LLC tax rate help entrepreneurs understand their responsibilities and identify potential savings. We provide practical strategies that break down the complexities of tax regulations, so our clients can focus on what really matters to them.

You know, staying updated on tax compliance is crucial, especially with recent changes that impact LLCs. Take the Qualified Business Income (QBI) deduction, for instance. It allows eligible LLC owners to deduct up to 20% of their qualified earnings, which can really lower taxable income. But here’s the catch: this deduction starts to phase out for individual filers making over $191,950 and married couples earning more than $383,900 in 2025. So, it’s super important for entrepreneurs to plan ahead.

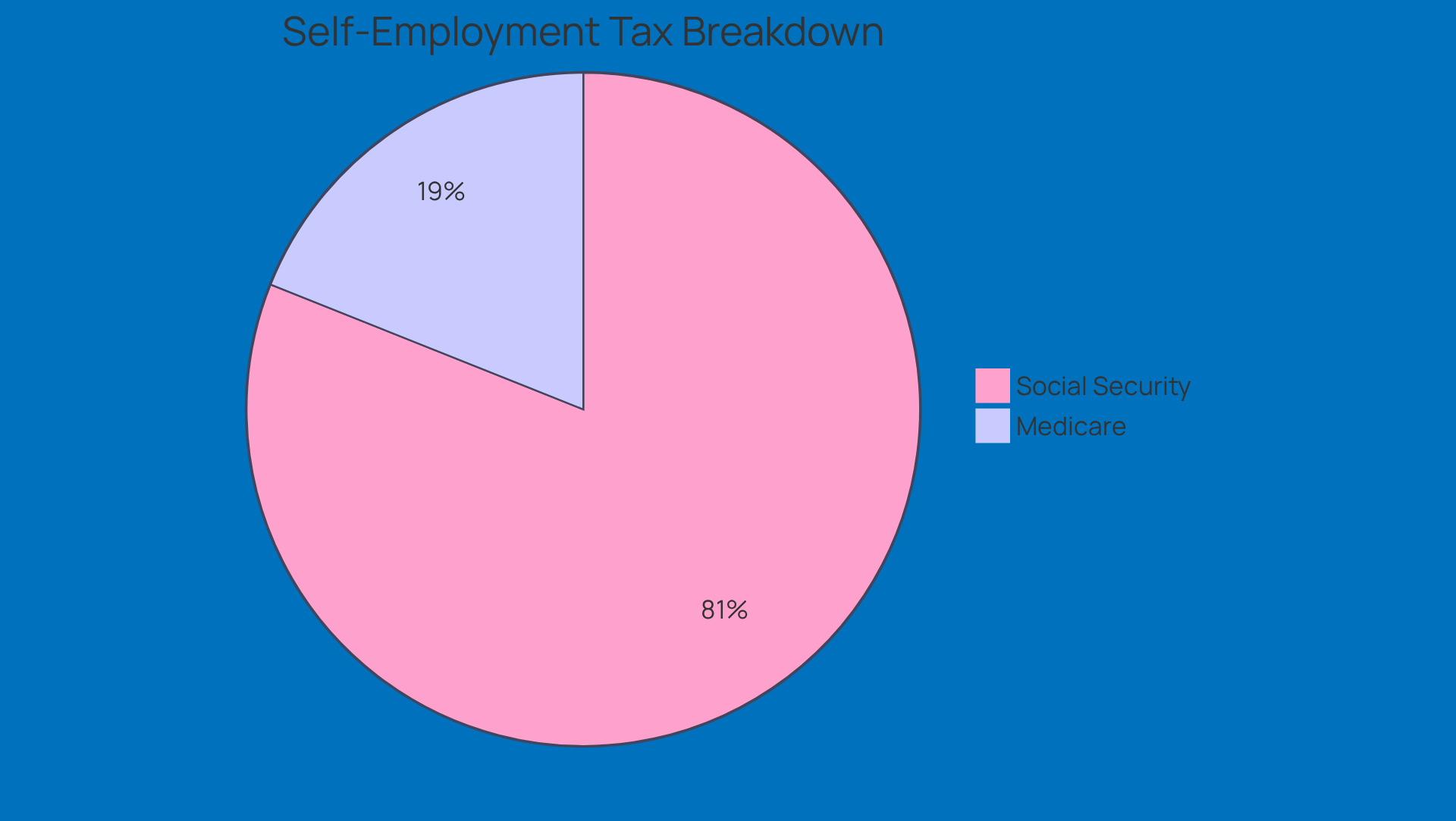

And let’s not forget about self-employment tax! LLC members are responsible for both the employee and employer portions of Social Security and Medicare contributions, which adds up to 15.3% on their earnings. For example, if an LLC pulls in $150,000 in profits, the self-employment tax could be around $21,194. That really highlights the need for careful record-keeping and proactive tax planning.

To tackle these challenges, we suggest that rural entrepreneurs make quarterly estimated payments a priority. This helps avoid penalties and keeps cash flow in check. By setting aside 25-35% of profits for taxes, they can dodge those nasty surprises come tax season. Plus, taking advantage of deductions like the Section 179 deduction, which lets businesses write off up to $2.5 million of qualifying property in 2025, can really boost financial outcomes.

At Steinke and Company, we’re dedicated to helping our clients thrive in the midst of the federal LLC tax rate maze. Our personalized approach ensures that rural small businesses not only meet tax regulations but also seize opportunities for growth and sustainability.

Understanding Federal LLC Taxation: Key Principles Every Owner Should Know

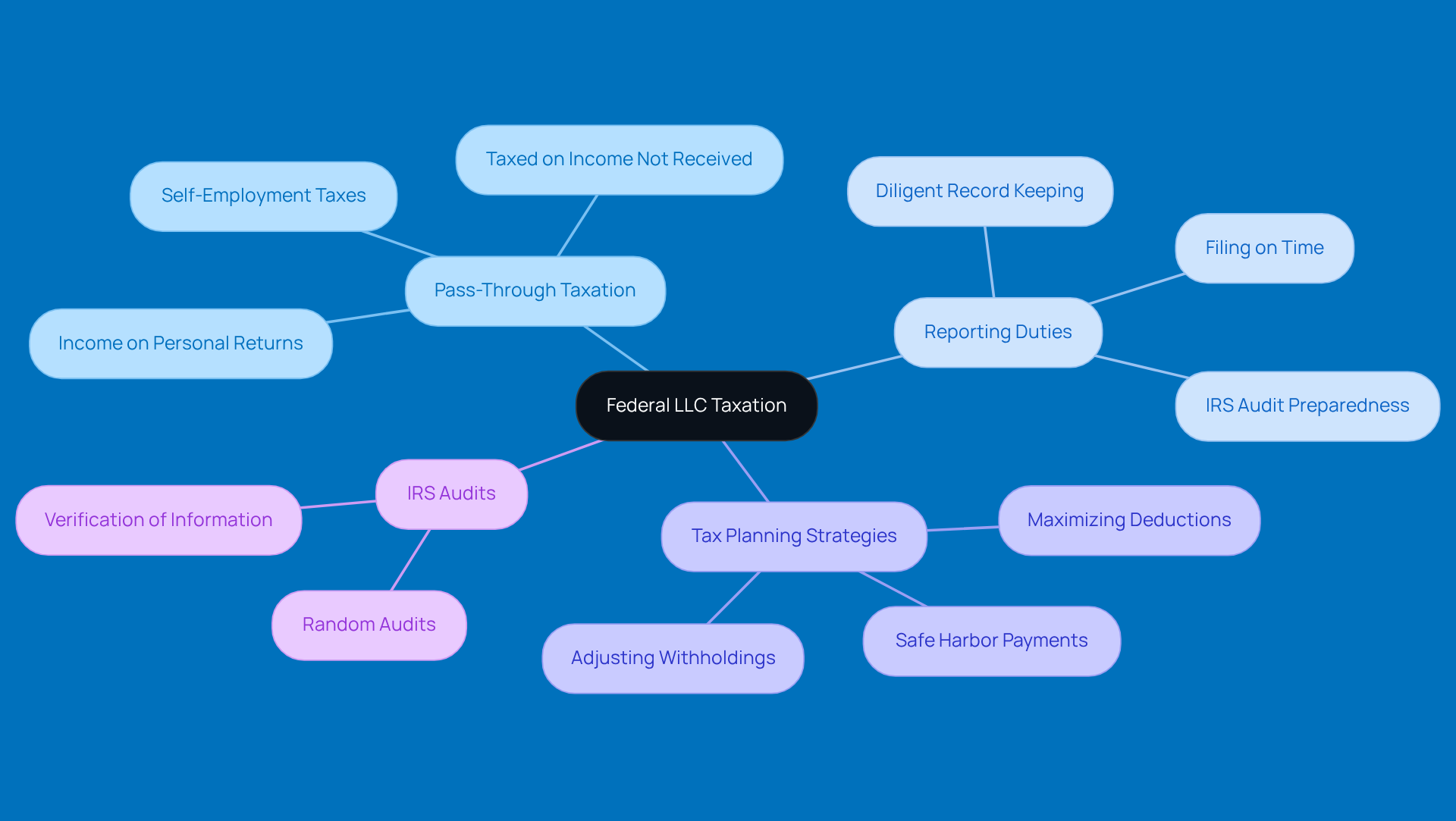

When discussing the federal LLC tax rate, it’s all about pass-through taxation. What does that mean? Well, the LLC itself doesn’t pay taxes, as it is not subject to the federal LLC tax rate. Instead, the profits and losses show up on your personal tax returns. This setup can be a real boon for your tax situation, but it also means you’ve got to stay on top of your reporting and compliance duties. It’s crucial to grasp how your income gets taxed individually and what self-employment taxes entail. One downside? You might find yourself taxed on income you didn’t even receive, which can throw a wrench in your overall tax strategy.

So, how can small business owners tackle these challenges? Keeping diligent records and filing on time is key. For example, if your modified adjusted gross income is over $150,000, you might miss out on certain deductions. That’s why strategic tax planning is so important! And let’s not forget about the potential for IRS audits. Not every audit means you’ve done something wrong; sometimes, they just happen randomly or to verify information. Having organized records can really ease the stress if you ever face an audit.

You can see successful navigation of the federal LLC tax rate in action with many small businesses that have effectively utilized this structure. By leveraging the benefits of pass-through taxation, these businesses have optimized their tax situations, allowing them to reinvest in growth and development. Plus, small business owners need to be aware of underpayment penalties, which can hit if they don’t meet IRS payment thresholds throughout the year. Strategies like safe harbor payments and adjusting withholdings can help dodge those penalties.

Tax experts really stress the importance of understanding these principles. Diana Walker from Baker Tilly points out that the pass-through taxation model can provide significant relief for small business leaders, letting them reinvest those savings back into their operations. This smart approach not only boosts immediate financial health but also supports long-term sustainability and growth. And hey, if you’re running a small business, it’s a great idea to chat with tax advisors about the best ways to maximize your tax benefits and stay compliant with the ever-changing regulations, especially with recent changes that could impact your refunds.

LLC Tax Classifications: Choosing Between Sole Proprietorship, Partnership, S Corp, and C Corp

When it comes to LLCs, one of the coolest things is their flexibility in choosing how they want to be taxed. They can go for a sole proprietorship, partnership, S Corporation, or C Corporation - each option comes with its own set of tax implications. For instance, S Corporations are great because they offer pass-through taxation. This means that income gets reported on the individuals' personal tax returns, which can help lower those pesky self-employment taxes. If you're an LLC stakeholder looking to keep your tax liabilities in check, this could be a game-changer!

On the flip side, C Corporations face double taxation. What does that mean? Well, profits are taxed at the corporate level first, and then again when those profits are handed out as dividends to shareholders. Yikes! By getting a grip on these different classifications, LLC members can make smart choices that fit their goals and financial plans. So, which tax structure do you think would work best for you?

Self-Employment Tax Obligations: What LLC Owners Need to Consider

If you're self-employed and running an LLC, you need to keep in mind that self-employment taxes are part of the deal. This includes contributions to Social Security and Medicare. For 2025, the self-employment tax rate is set at 15.3% on your net earnings, which breaks down to 12.4% for Social Security and 2.9% for Medicare. Getting this calculation right is super important because it can really affect your cash flow and overall financial health.

Now, don’t forget about those quarterly estimated tax payments! Missing them can lead to some hefty penalties, and nobody wants that. Staying on top of your tax obligations is crucial, especially with the IRS keeping a closer eye on things these days. Did you know that self-employed folks usually pay self-employment tax on 92.35% of their net earnings after deductions? That’s why keeping meticulous records and planning ahead is key.

By understanding your tax responsibilities, you can manage your finances better and set your business up for long-term success. So, take a moment to reflect on your own situation - are you ready to tackle your tax obligations head-on? Let's make sure you're prepared!

State-Level Tax Considerations: Navigating LLC Taxes Across Different Jurisdictions

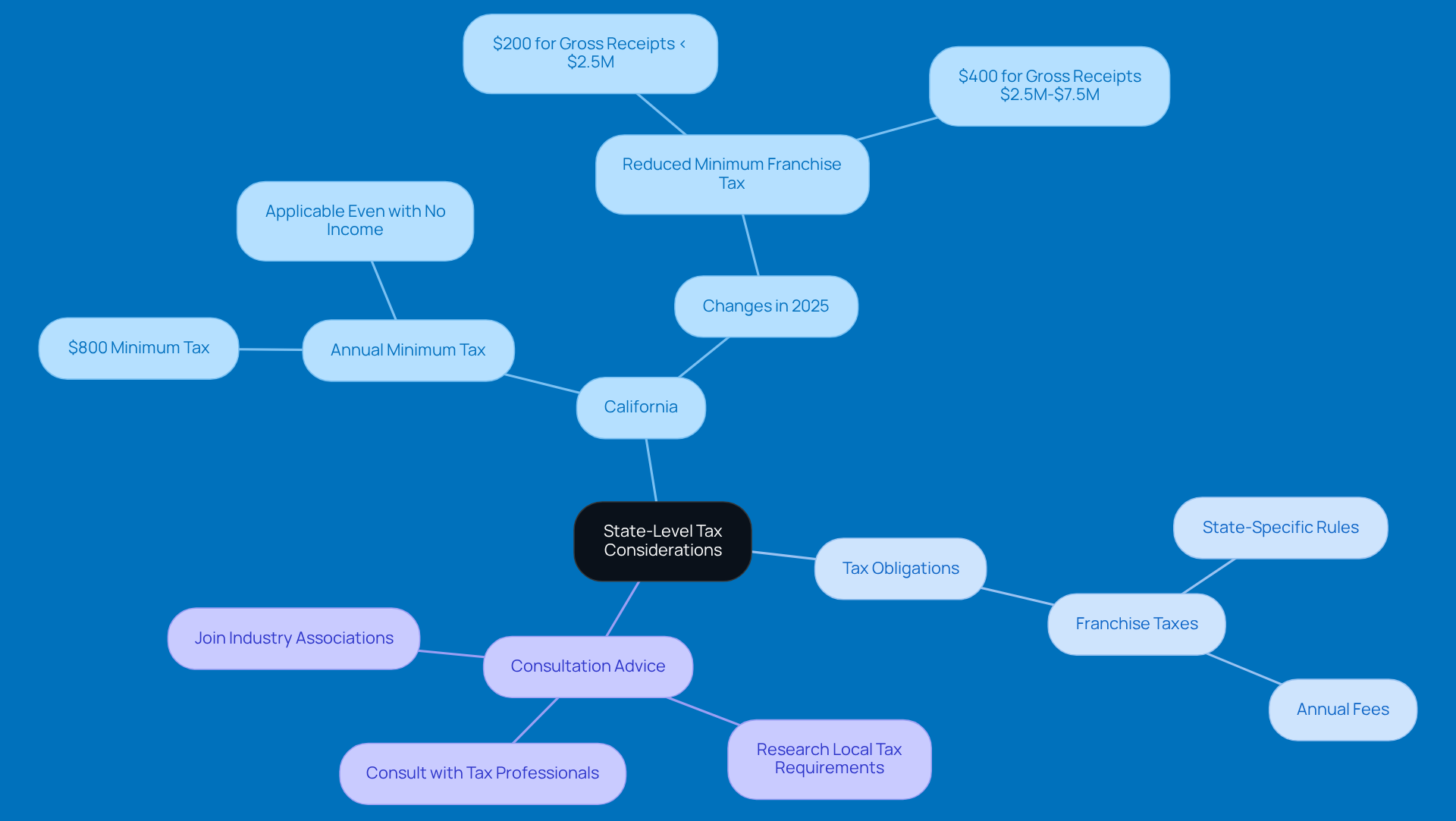

When it comes to state-level tax obligations for LLCs, things can get a bit tricky. Each state has its own rules, and many impose franchise taxes or annual fees. Take California, for example. LLCs there have to cough up an annual minimum tax of $800, no matter how much money they make - or even if they make none at all! This really highlights why it's crucial for business owners to keep an eye on their tax responsibilities.

Now, here’s something to note: starting January 1, 2025, corporations with gross receipts under $2.5 million will see a break with a reduced minimum franchise tax of just $200. And if your gross receipts fall between $2.5 million and $7.5 million? You’ll owe $400. These changes really drive home the need to understand your state-specific tax obligations to dodge any penalties and stay compliant.

Feeling overwhelmed? Don’t worry! Consulting with a tax professional can be a game-changer in navigating these complexities, especially with new regulations rolling out. Small businesses across the country should definitely take the time to research their local tax requirements. And hey, joining industry associations can also provide some great support and resources tailored just for you!

Maximizing Deductions: Strategies for Reducing Your LLC's Tax Liability

Hey there, LLC owners! Did you know that keeping track of your operational expenses can really boost your tax savings? It’s true! You can deduct things like operating expenses, home office costs, and even health insurance premiums - yep, those are fully deductible for self-employed folks and their dependents. Plus, if you’re contributing to retirement plans, you’re not just getting immediate tax benefits; you’re also setting yourself up for a secure financial future.

Looking ahead to 2025, small business owners can deduct up to $5,000 in startup expenses. This can cover essential costs like marketing and training, which is pretty handy. And here’s a little nugget of info: the maximum amount you can expense right away under Section 179 is going up to $2.5 million starting in 2025. How awesome is that?

Now, it’s a good idea to regularly review your expenses and chat with a tax advisor. They can help you uncover even more savings opportunities, making sure you’re taking advantage of all eligible deductions. Just a heads up - keeping your personal and business expenses separate is super important. Mixing them up can lead to disallowed deductions, and nobody wants that!

Also, understanding your paystub is key. It ensures you’re getting paid correctly and that the right taxes are being withheld. Keeping accurate records of your paystubs and tax documents is vital for compliance and can save you a lot of headaches during an IRS audit.

So, by adopting these strategies, you can really optimize your tax position and lower your overall tax liability. Sounds good, right? Let’s make the most of those deductions!

Leveraging the Qualified Business Income Deduction: A Key Tax Benefit for LLCs

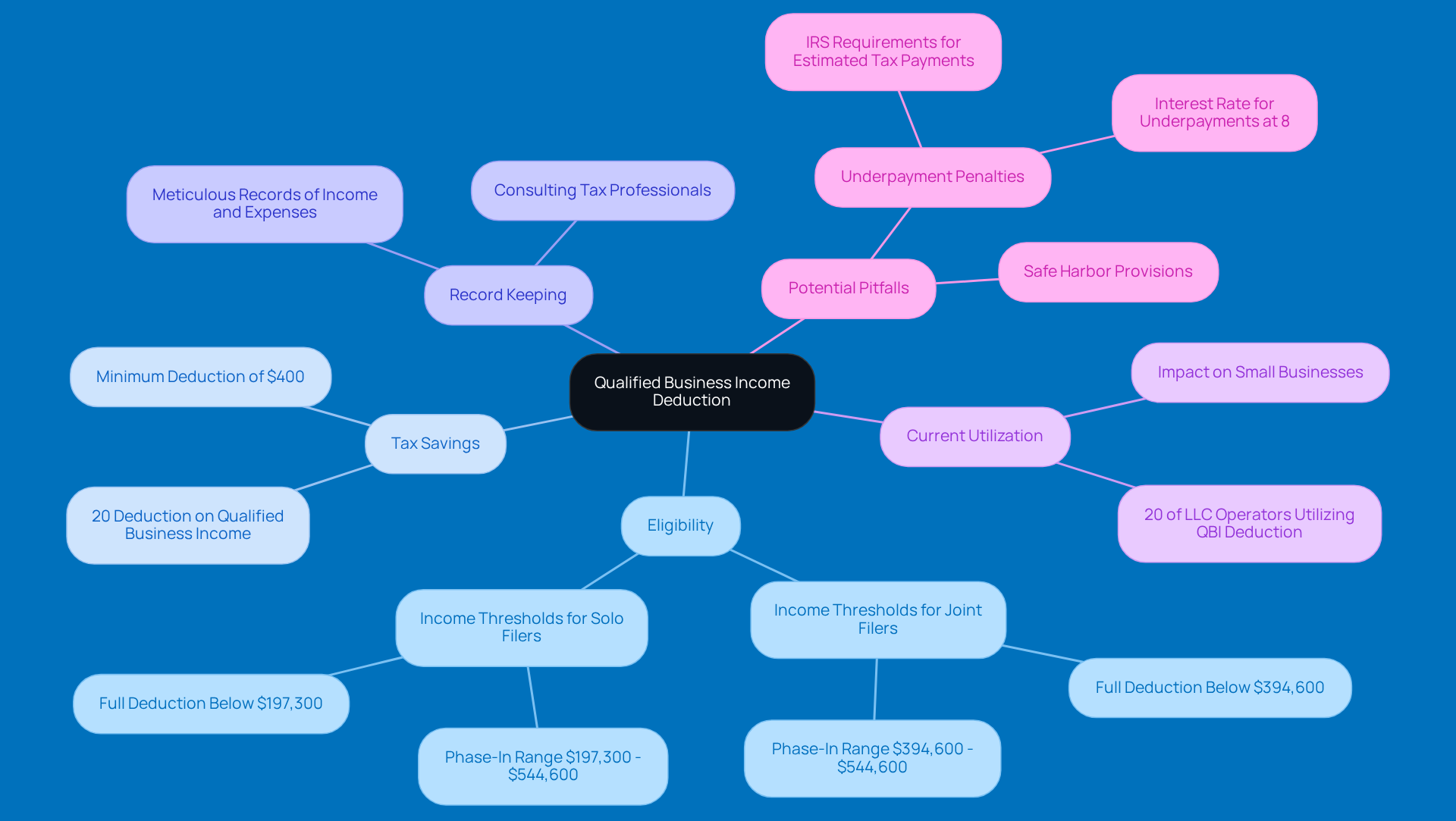

Hey there! Let’s talk about the Qualified Business Income (QBI) deduction. If you’re an eligible LLC operator, you could deduct up to 20% of your qualified business income from your taxable income. That’s some serious tax savings! For 2025, this deduction is especially great for folks with taxable income below $394,600 if you’re filing jointly, or $197,300 if you’re flying solo.

To really make the most of this benefit, it’s super important for LLC members to keep everything in check. That means keeping meticulous records of your income and expenses. And hey, if you’re feeling a bit lost, don’t hesitate to reach out to a tax professional. They can help you navigate the sometimes tricky waters of the QBI deduction, especially since recent legislation has expanded the phase-in ranges, letting more taxpayers qualify.

Did you know that about 20% of LLC operators are currently taking advantage of the QBI deduction? That just goes to show how significant it can be in your tax planning strategies. Small businesses, like local contractors and service providers, have really hit the nail on the head by optimizing their income structures to stay within those thresholds.

But here’s a heads-up: LLC owners need to be careful about underpayment penalties. If you don’t meet the IRS requirements for estimated tax payments, you could be in hot water. The interest rate for underpayments has jumped to 8% per year, compounded daily, since October 1, 2023. So, it’s crucial to understand the safe harbor provisions and the de minimis exception.

By getting a grip on these strategies, LLC operators can really boost their tax advantages and help secure their business’s long-term financial health. So, what are you waiting for? Dive in and start maximizing those benefits!

Proactive Tax Planning: Essential Strategies for LLC Owners to Minimize Tax Burden

Proactive tax planning is super important for LLC members. It’s all about regularly checking your financial statements, estimating your tax liabilities accurately, and making smart adjustments to how you run your business. By making estimated tax payments throughout the year, you can dodge those pesky penalties and keep your cash flow in check.

Have you ever chatted with a tax advisor? It’s a game changer! Ongoing discussions can help you spot potential deductions and credits, plus they’ll get you ready for the wild ride that is tax season. For instance, companies that stick to year-round tax strategies often see some serious savings. In fact, over 65% of clients who tweaked their tax structures reported savings of more than $10,000. That’s a nice chunk of change!

And let’s not forget about those timely estimated payments. They can really boost your cash flow management, allowing you to allocate resources more efficiently. Industry experts agree: proactive tax planning isn’t just a nice-to-have; it’s essential for keeping your financial health in check and minimizing those tax burdens.

So, how can you stay ahead of the game? By staying informed and organized, LLC operators can navigate the ever-changing tax landscape and seize available opportunities. This approach not only leads to a more resilient enterprise but also makes tax season a whole lot less stressful!

Avoiding Common Tax Mistakes: Tips for LLC Owners to Keep Their Tax Bills Low

Frequent tax errors for LLC owners often pop up due to a few common culprits:

- Poor record-keeping

- Mixing personal and business finances

- Forgetting about estimated tax payments

When records aren’t kept straight, it can lead to hefty tax bills, including penalties and missed deductions. For instance, if you don’t keep accurate financial records, the IRS might deny your deductions, which can really hurt your business’s bottom line.

To steer clear of these pitfalls, LLC operators should set up separate bank accounts for business transactions. This way, personal and business expenses don’t get tangled up. Not only does this practice help maintain the LLC's liability protection, but it also makes bookkeeping and tax prep a whole lot easier.

Keeping your financial records updated is super important for staying compliant and can help you spot potential deductions that you might miss otherwise. Did you know that many small businesses overlook significant deductions related to home office expenses, startup costs, and equipment purchases just because of poor documentation? Consulting with a tax expert can provide tailored insights on effective tax strategies, helping you navigate the tricky world of tax regulations and optimize your tax situation.

By adopting these practices, LLC operators can really lighten their tax load and dodge common mistakes that could lead to costly errors. So, why not take a moment to review your record-keeping habits? It could save you a lot of headaches down the road!

The Value of Professional Tax Assistance: How Experts Can Help LLC Owners Navigate Tax Challenges

If you’re running an LLC, getting a professional tax advisor on your team is a game changer. These experts can help you craft strategies that fit your unique business needs. They’re key in spotting deductions, keeping you compliant with federal and state regulations, and offering smart tax planning advice. For instance, small businesses that regularly consult with tax advisors can save over $5,000 a year by opting for S Corporation taxation. This allows owners to pay themselves a salary while distributing the rest of the profits without facing self-employment tax.

Did you know that nearly 70% of small business owners who work with tax advisors feel more confident about their tax strategies? This partnership lets LLC operators focus on growing their business while trimming down tax liabilities. Plus, tax advisors are always in the know about the latest changes in tax laws, which is super important in today’s ever-evolving landscape. By tapping into their expertise, LLC owners can tackle tricky tax challenges and make sure they’re taking advantage of deductions and credits, like the 20% Qualified Business Income deduction, which is a big perk for pass-through entities.

In the end, finding the right tax advisor isn’t just about compliance; it’s about empowering you to make smart financial choices that lead to long-term success. So, why not take that step today?

Conclusion

Staying informed about federal LLC tax rates is super important for small business owners who want to make the most of their financial strategies. When you get the hang of tax obligations - like the perks of pass-through taxation and what self-employment taxes mean - you can make smart choices that really boost your bottom line. This knowledge helps LLC owners tackle the tricky world of tax compliance while maximizing potential savings.

Throughout this article, we’ve highlighted some key insights. For instance:

- Proactive tax planning is a game changer.

- The Qualified Business Income deduction can really work in your favor.

- Keeping accurate financial records is a must!

The flexibility of LLC tax classifications means you can pick the structure that fits your goals best, whether that’s a sole proprietorship, partnership, or corporation. Each of these elements is crucial in shaping a successful tax strategy for small businesses.

Ultimately, teaming up with tax professionals can give your LLC’s financial health a serious boost. They provide tailored advice and help you stay compliant with all those ever-changing regulations. By prioritizing tax planning and taking advantage of available deductions, small business owners can not only cut down on their tax bills but also set themselves up for sustainable growth. So, why not take these steps today? It could lead to a more secure and prosperous future in the competitive world of small business!

Frequently Asked Questions

What is the federal LLC tax rate and how does it work?

The federal LLC tax rate is not directly applied to the LLC itself, as LLCs utilize pass-through taxation. This means profits and losses are reported on the owners' personal tax returns, avoiding double taxation.

What is the Qualified Business Income (QBI) deduction?

The QBI deduction allows eligible LLC owners to deduct up to 20% of their qualified earnings, which can significantly reduce taxable income. However, it begins to phase out for individual filers making over $191,950 and married couples earning more than $383,900 in 2025.

What are the self-employment tax responsibilities for LLC members?

LLC members are responsible for both the employee and employer portions of Social Security and Medicare taxes, totaling 15.3% on their earnings. For example, on $150,000 in profits, the self-employment tax could be around $21,194.

How can LLC owners manage their tax payments effectively?

LLC owners should prioritize making quarterly estimated payments to avoid penalties and maintain cash flow. It's recommended to set aside 25-35% of profits for taxes.

What is the Section 179 deduction?

The Section 179 deduction allows businesses to write off up to $2.5 million of qualifying property in 2025, which can enhance financial outcomes for small businesses.

What are the key principles of federal LLC taxation that every owner should know?

Owners should understand that LLCs benefit from pass-through taxation, meaning they must stay diligent with reporting and compliance. They may also face taxes on income not yet received, emphasizing the importance of strategic tax planning.

What should small business owners do to avoid underpayment penalties?

To avoid underpayment penalties, small business owners need to meet IRS payment thresholds throughout the year. Strategies like safe harbor payments and adjusting withholdings can help.

What tax classifications can LLCs choose from?

LLCs can choose to be taxed as a sole proprietorship, partnership, S Corporation, or C Corporation. Each classification has different tax implications, with S Corporations offering pass-through taxation and C Corporations facing double taxation.

Why is it important for small business owners to consult tax advisors?

Consulting tax advisors is crucial for small business owners to maximize tax benefits, ensure compliance with changing regulations, and effectively navigate their tax situations for better financial health and growth.