Introduction

In the world of non-profit organizations, effective bookkeeping isn’t just a necessity; it’s a lifeline. With financial pressures piling up and compliance requirements constantly changing, small agencies often find themselves in a tough spot, trying to keep things transparent and accountable. So, let’s dive into ten essential bookkeeping services designed just for non-profits. These services can really help organizations focus on their mission while navigating the tricky waters of financial management.

What challenges do these agencies face when trying to implement such services? And how can they make sure they’re maximizing their impact in a competitive landscape? Let’s explore!

Steinke and Company: Tailored Bookkeeping Services for Non-Profits

Steinke and Company specializes in personalized non-profit bookkeeping services tailored for non-profits, especially those in rural America. They really get the unique challenges these organizations face, like tight budgets and the need to stick to regulations. That’s why their services include meticulous record-keeping, compliance checks, and detailed reporting. This way, charitable organizations can zero in on their main missions without the stress of financial hurdles weighing them down.

Fast forward to 2025, and you’ll find that organizations in small towns are still navigating a tricky landscape filled with economic challenges and changing donor expectations. Customized bookkeeping is a game-changer for these groups that require non-profit bookkeeping services. It not only ensures financial accuracy but also boosts transparency and accountability - key ingredients for building trust with stakeholders. As Helen Keller wisely said, "Alone, we can do so little; together we can do so much." This really highlights how important collaboration is for making a real impact.

The firm’s integrated approach blends accounting precision with strategic insights, making them a vital partner for organizations looking to thrive in their communities. Their commitment to understanding the unique dynamics of rural charities allows them to provide services that foster resilience and growth, ultimately empowering these organizations to make a lasting difference. Plus, with the shift to a fully remote support model, they offer 24/7 access through their client portal, email, and text. This means charitable organizations can get timely help whenever they need it. How cool is that? This innovative approach not only improves service delivery but also shows their dedication to adapting to the ever-changing needs of small enterprises.

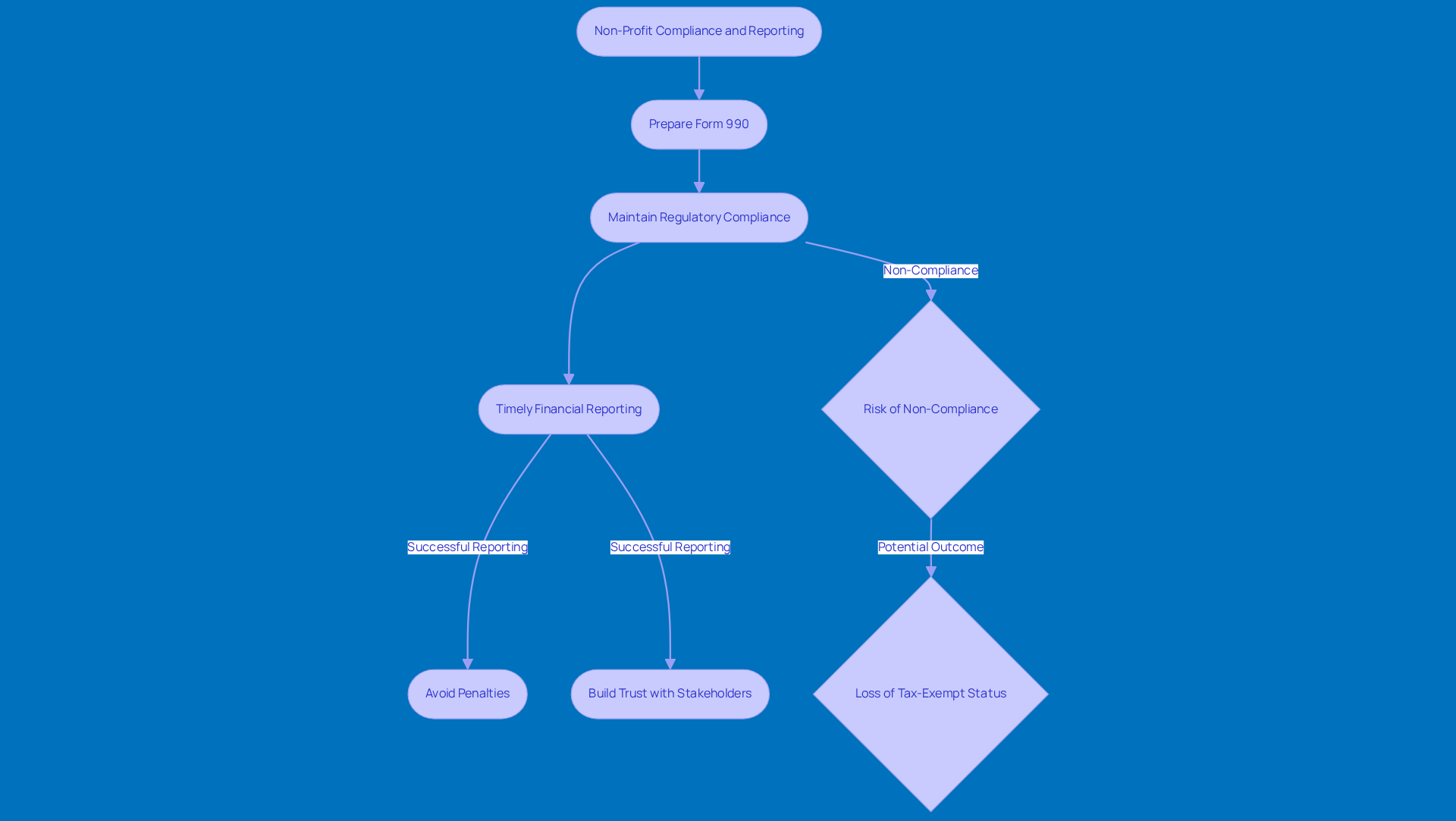

Compliance and Reporting: Essential Services for Non-Profit Accountability

When it comes to non-profit organizations, non profit bookkeeping services are absolutely crucial for compliance and reporting success. That’s where Steinke and Company steps in, offering essential services that help charitable organizations meet all their regulatory requirements. One of the key tasks? Preparing Form 990 and other necessary filings. This form isn’t just a box to check; it plays a vital role in ensuring compliance while boosting transparency and accountability. It helps organizations share their mission and impact with stakeholders effectively.

Did you know that a large number of charitable organizations struggle to keep up with regulatory requirements? This can put their tax-exempt status at risk and shake public trust. But don’t worry! Steinke and Company helps these organizations dodge penalties and maintain their credibility with donors by offering non profit bookkeeping services that provide timely and accurate financial reporting. This proactive approach is all about building trust and transparency, which are essential for nurturing lasting relationships with stakeholders and ensuring long-term sustainability in the non-profit world.

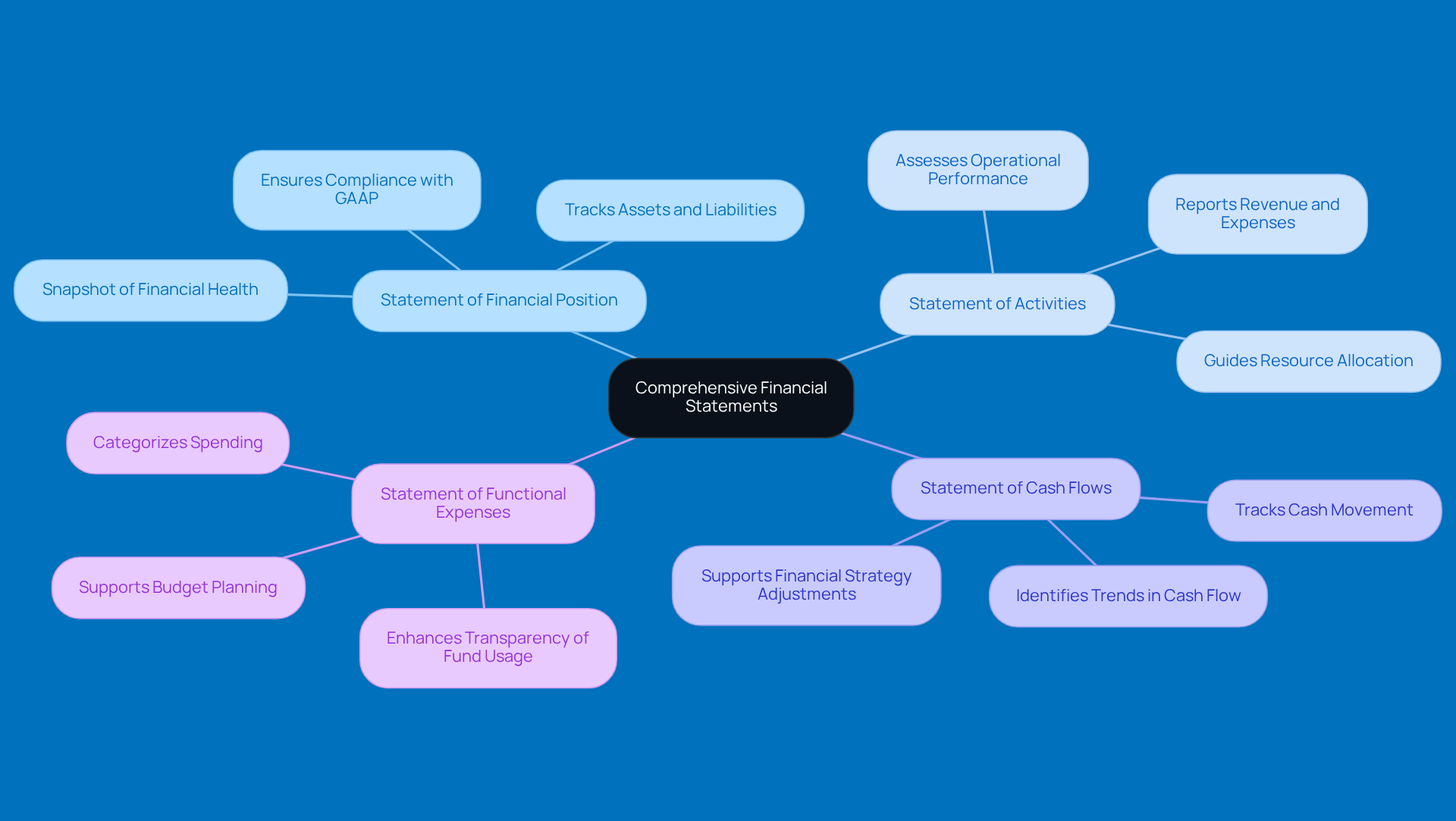

Comprehensive Financial Statements: Key to Non-Profit Transparency

Thorough economic reports are super important for organizations that want to keep things transparent and build trust with their stakeholders. At Steinke and Company, we focus on crafting detailed financial documents like the:

- Statement of Financial Position

- Statement of Activities

- Statement of Cash Flows

These statements provide a clear snapshot of an organization’s financial health, which is essential for charities using non profit bookkeeping services to communicate effectively with donors, grantors, and the community.

By ensuring accuracy and clarity in financial reporting, organizations can make informed decisions. This not only boosts their credibility but also strengthens relationships with stakeholders. Plus, this commitment to transparency meets compliance requirements and aligns with GAAP for nonprofits, which is a big win for non profit bookkeeping services when it comes to impressing potential supporters.

And let’s not forget about the Statement of Functional Expenses! This handy document helps organizations categorize their spending, offering even more transparency about how funds are used. This is crucial for attracting and keeping donor support.

So, how does your organization approach financial reporting? It’s all about building trust and showing your commitment to transparency!

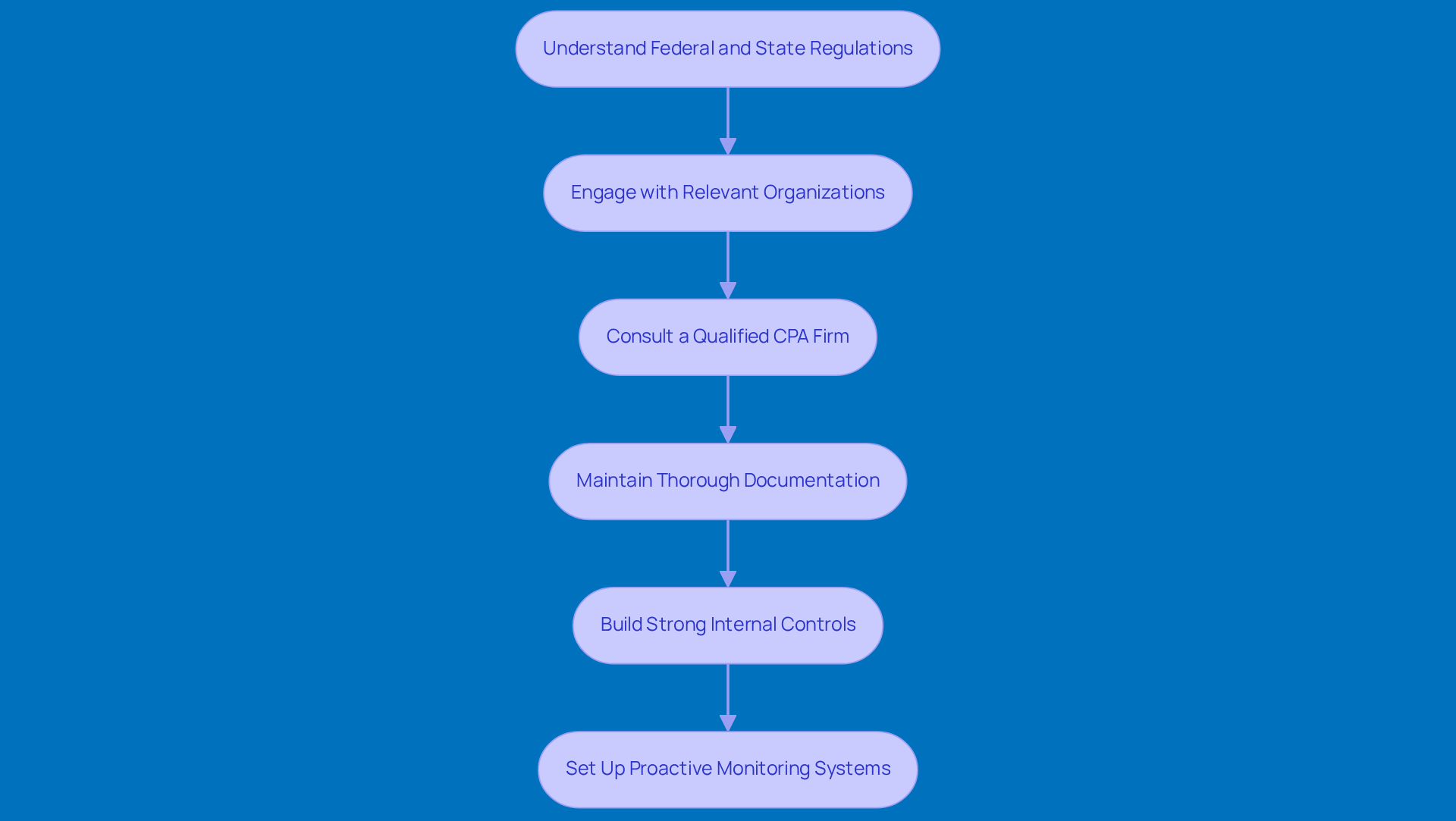

Audit Support Services: Navigating Financial Scrutiny for Non-Profits

Navigating monetary audits can feel like a maze for non-profits, right? But don’t worry - Steinke and Company is here to help with essential audit support services designed just for you. Our team makes sure that all your monetary records are kept in tip-top shape and up-to-date. This is super important for staying compliant with federal and state regulations.

Now, with the new $1 million threshold for the federal 'Single Audit' kicking in for fiscal years starting on or after October 1, 2024, it’s crucial to get a handle on these requirements. We’re here to guide you through the audit process, helping you prepare the necessary documentation and tackle any concerns that pop up along the way. This proactive approach not only leads to successful audit results but also strengthens your monetary practices and enhances your organization’s reputation.

By building strong internal controls and keeping thorough documentation, non-profits can show they’re accountable and transparent - key ingredients for earning trust from stakeholders. Have you thought about chatting with seasoned auditors early on? It’s a great way to spot compliance gaps and implement effective strategies, which can really boost your economic health and sustainability.

As industry experts say, "Nonprofits can ensure overall audit compliance by understanding federal and state regulations, engaging with relevant organizations, consulting a qualified CPA firm, and maintaining thorough documentation." Plus, setting up proactive monitoring systems to track federal expenditures throughout the fiscal year is vital for navigating compliance smoothly. Ignoring state-specific rules? That could lead to hefty penalties and damage your reputation, so comprehensive audit support is a must!

Specialized Knowledge of Non-Profit Accounting Methods: A Necessity

Non-profit accounting is a bit of a unique beast, right? It really requires a specialized understanding of certain accounting methods, especially fund accounting and managing restricted funds. That’s where our team comes in! We’ve got specialists who know these areas inside and out, assisting charitable organizations in monitoring their financial activities through non profit bookkeeping services. This expertise is super important for staying compliant with IRS regulations and giving stakeholders a clear view of how funds are allocated and spent.

By leveraging this knowledge, Steinke and Company offers non profit bookkeeping services to help charities navigate the often tricky waters of their financial landscape. And here’s a fun fact: organizations that embrace solid fund accounting practices often find they can keep 6-12 months' worth of operating costs in reserve. That’s a great strategy for boosting stability during those unpredictable economic times.

As the world of charitable giving continues to change, grasping and applying these accounting principles is becoming more crucial than ever for organizations that want to make a real impact. So, how are you ensuring your organization is ready to tackle these challenges? Let's chat about it!

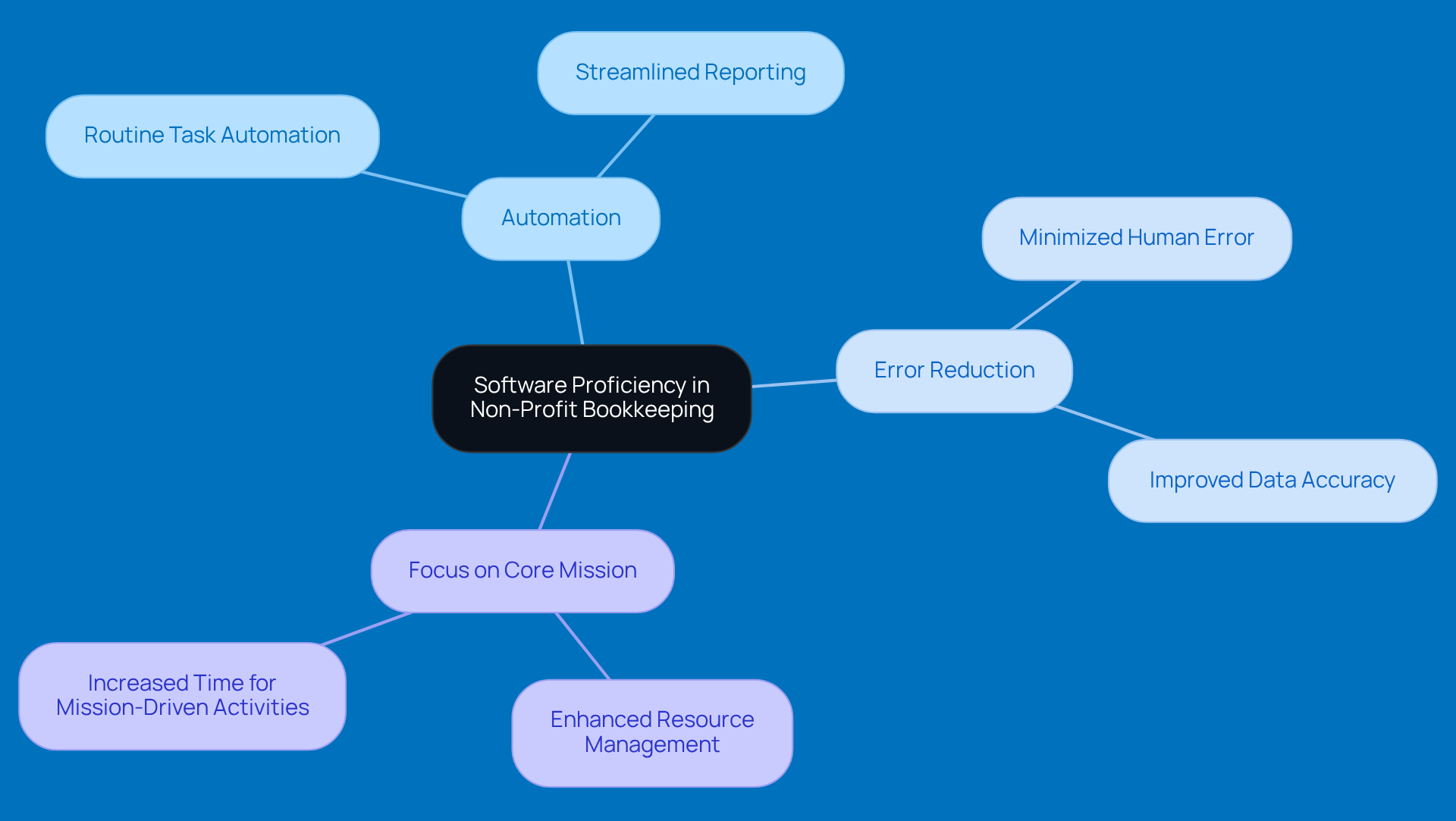

Software Proficiency: Enhancing Efficiency in Non-Profit Bookkeeping

Getting the hang of accounting software is super important for making non-profit bookkeeping a breeze. Our firm utilizes advanced accounting tools that are specifically designed for non-profit bookkeeping services for charitable organizations. This means we can automate those routine tasks, keep an eye on contributions, and whip up reports without breaking a sweat.

Not only does this tech-savvy approach save us a ton of time, but it also cuts down on mistakes. That way, non-profits can really zero in on what matters most: their core mission. By weaving technology into their accounting processes, we help these organizations streamline their operations and manage their resources more effectively.

So, have you thought about how tech could make your bookkeeping easier? It's all about working smarter, not harder!

Cost-Effective Solutions: Maximizing Value for Non-Profit Organizations

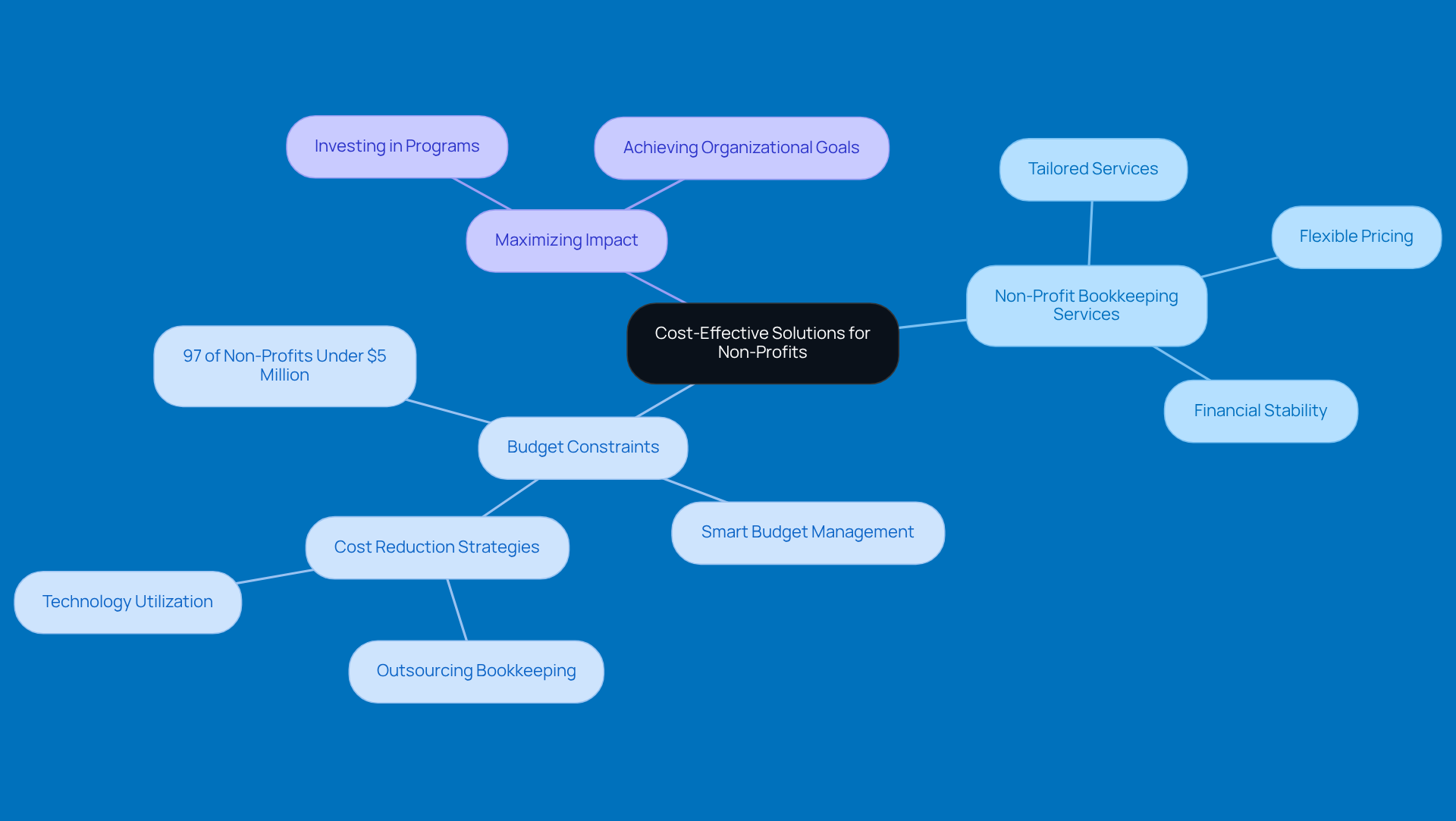

Cost-effective solutions, such as non profit bookkeeping services, are a must for non-profits looking to make the most of their resources. That’s where Steinke and Company comes in! They offer tailored non profit bookkeeping services designed to fit the budget constraints that many charitable organizations face. This means you can get top-notch assistance without breaking the bank.

With flexible pricing models and services that can grow with you, organizations can spend their funds more wisely. This way, they can invest in the programs and initiatives that really matter. It’s all about helping charitable organizations reach their goals while keeping their finances stable.

Did you know that 97 percent of charitable organizations operate with budgets under $5 million each year? That really highlights the need for smart budget management! By tapping into non profit bookkeeping services, successful non-profits can navigate those budget constraints and truly maximize their impact. So, why not consider how these services could help your organization thrive?

Common Challenges in Non-Profit Bookkeeping: Identifying and Overcoming Obstacles

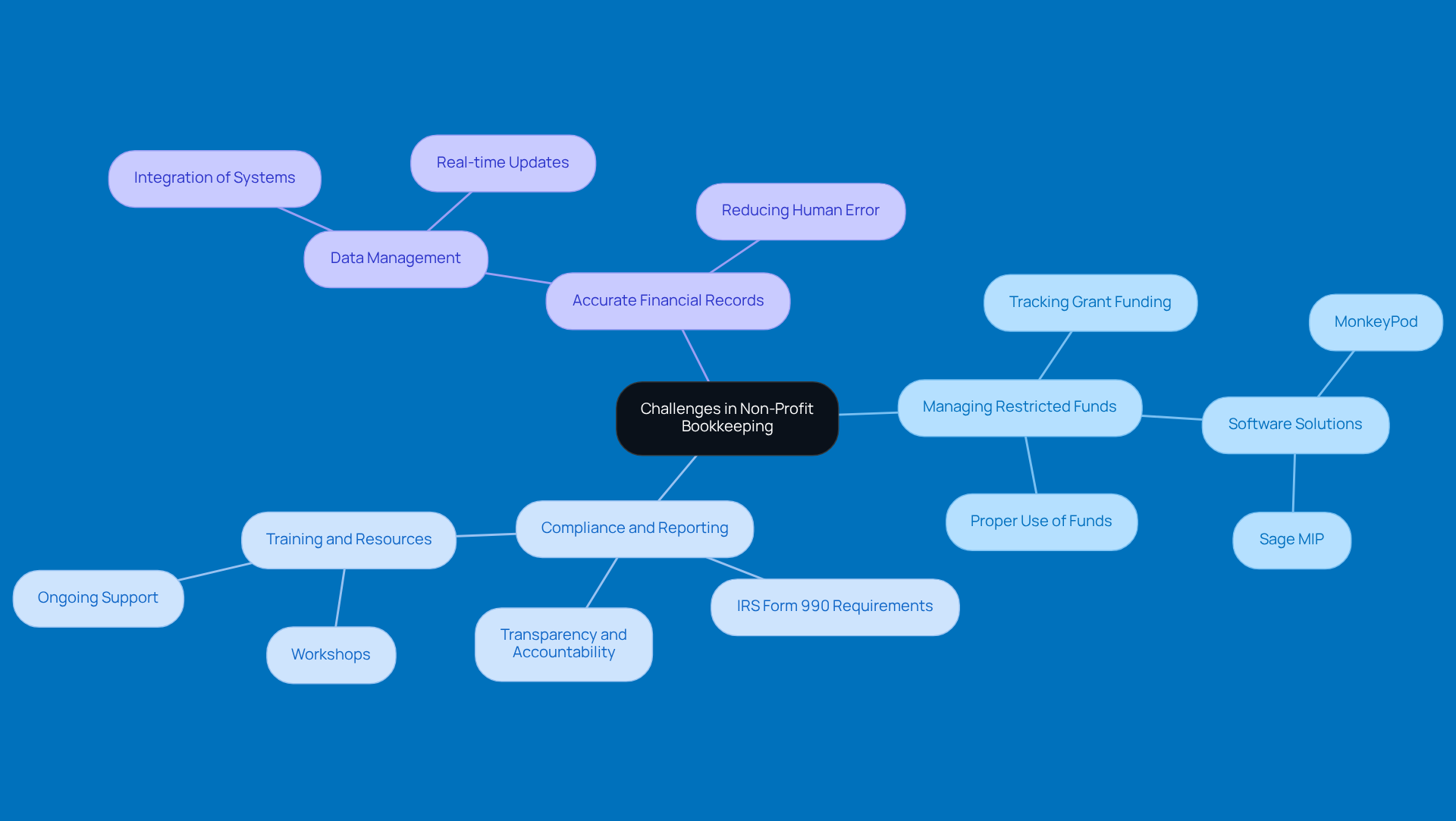

Non-profit organizations often encounter unique challenges that require specialized non profit bookkeeping services. Think about it: managing restricted funds, keeping up with compliance and reporting requirements, and ensuring accurate financial records can be quite the juggling act! Did you know that according to the IRS Exempt Entities Business Master File Extract, there are over 1.7 million exempt entities registered? That really shows how vast the non-profit sector is and just how important effective bookkeeping practices are.

To tackle these challenges, Steinke and Company teams up with charitable organizations to pinpoint specific hurdles and craft tailored strategies to overcome them. They offer extensive training, helpful resources, and ongoing support, all aimed at helping organizations boost their bookkeeping practices and manage their funds more effectively. This proactive approach not only reduces the risks associated with financial mismanagement but also bolsters the economic stability of organizations dedicated to serving the public. It allows them to focus on what they do best - fulfilling their mission.

Successful charitable organizations have demonstrated that with the right training and systems in place, they can navigate these challenges smoothly. This ensures transparency and accountability in their operations. As Scott A. Brown points out, non-profits are under increasing pressure for clearer, comparable reporting. So, it’s crucial for these entities to adopt solid non profit bookkeeping services to ensure accurate financial management.

Have you ever thought about how your organization manages its funds? It might be time to take a closer look!

Supportive Partnership: Enhancing Non-Profit Operations Through Collaboration

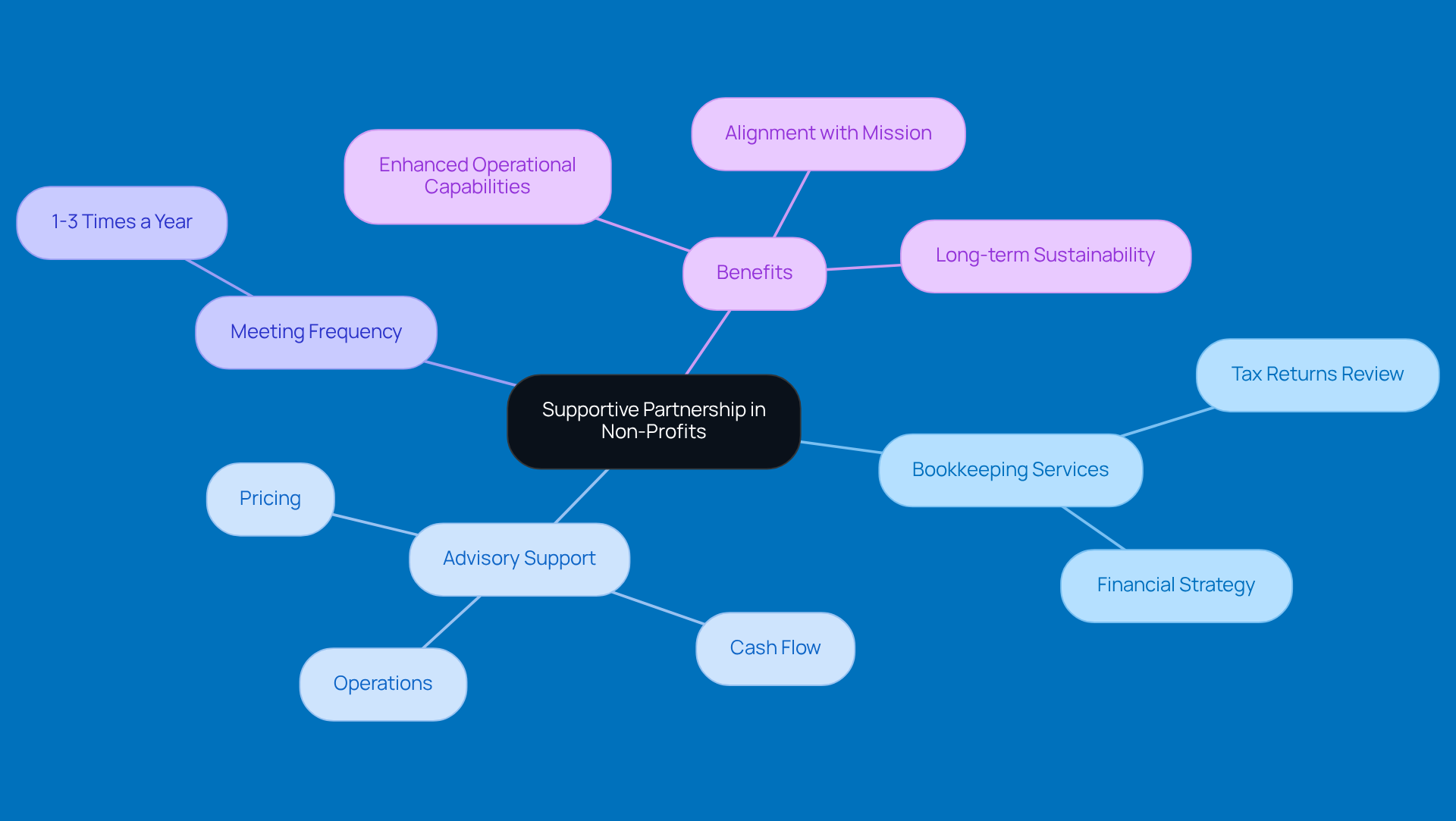

A supportive partnership is key to boosting operations through non profit bookkeeping services. Steinke and Company steps in as a strategic partner for charitable organizations by providing non profit bookkeeping services along with tailored advice and support that directly addresses their unique challenges. They meet with clients 1-3 times a year to review tax returns and current financials, helping to spot missed opportunities and lay out clear strategies to lighten tax burdens while promoting business growth.

Their advisory services cover essential areas like pricing, cash flow, and operations. This ensures that organizations have a solid game plan to tackle financial hurdles and grab growth opportunities. By working together, they not only enhance the operational capabilities of charitable organizations but also align their financial strategies with their mission, paving the way for long-term sustainability.

Through these partnerships, non-profits can enhance their financial health with non profit bookkeeping services and better serve their communities. So, if you’re part of a charitable organization, consider how a supportive partnership could make a difference for you!

Simple Onboarding: Ensuring a Smooth Transition to Non-Profit Bookkeeping Services

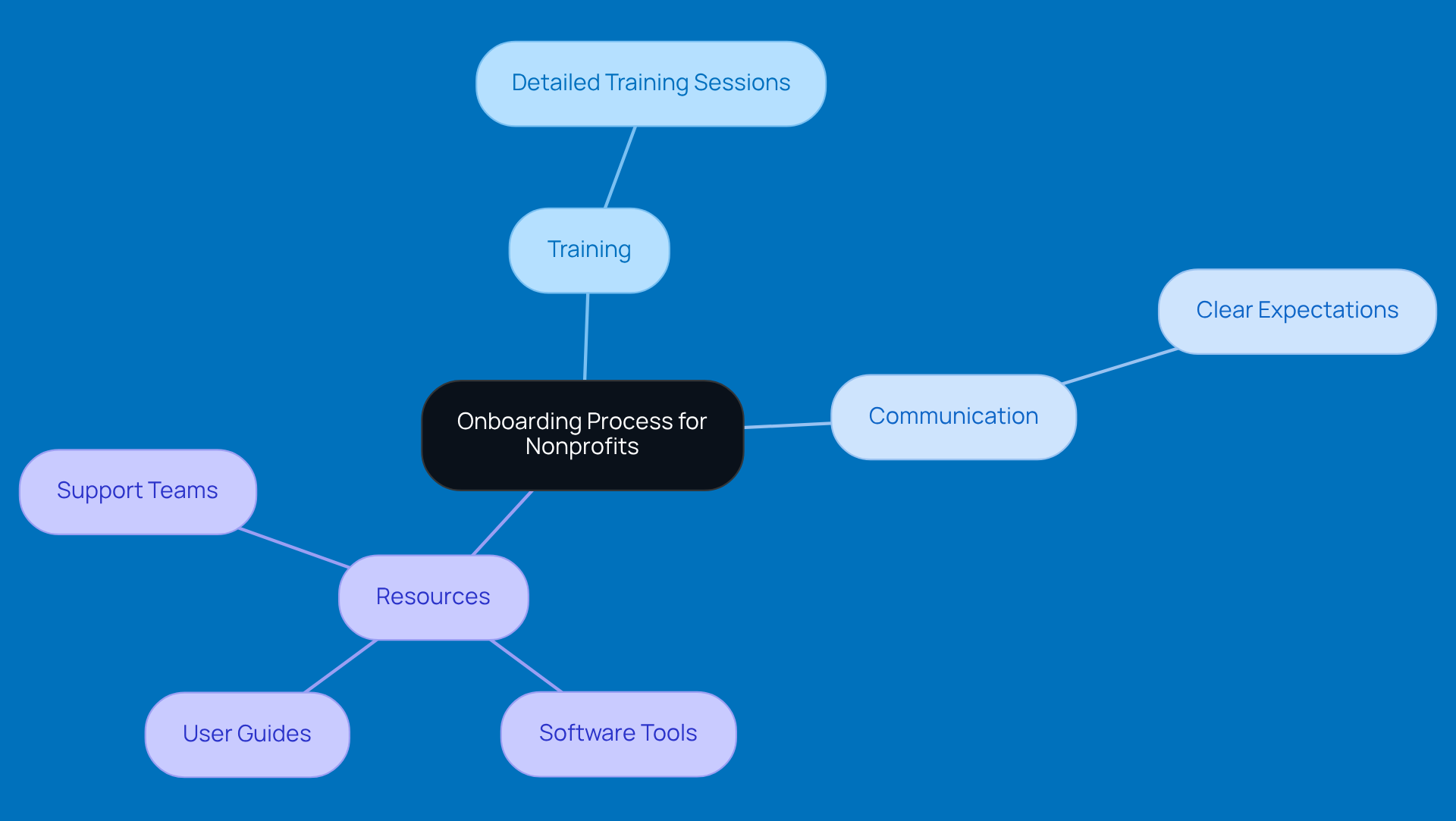

When nonprofits switch to new non profit bookkeeping services, having a solid onboarding process is key. Steinke and Company has put together a thorough onboarding procedure that makes this transition as smooth as possible for clients. This includes:

- Detailed training

- Clear communication about what to expect

- Essential resources like software tools, user guides, and access to support teams

By focusing on a seamless onboarding experience, nonprofits can quickly get used to their new non profit bookkeeping services. This not only cuts down on disruptions but also lets them focus on their mission right from the start. Plus, effective onboarding doesn’t just help with adopting services; it also builds a culture of efficiency and clarity, which is crucial for thriving in financial management.

Did you know that organizations with strong onboarding processes can see a whopping 60% increase in productivity and a 52% boost in retention? That really highlights why investing in a solid onboarding strategy is so important. As one expert put it, 'A strong nonprofit onboarding experience sets the tone for employee success and engagement.' So, it’s clear that nonprofits should make this critical phase a top priority!

Conclusion

Steinke and Company is here to help non-profit organizations with essential bookkeeping services that tackle their unique financial challenges. They offer tailored solutions that boost compliance, transparency, and operational efficiency, allowing these organizations to concentrate on what they do best - fulfilling their core missions - without getting tangled up in financial details.

Throughout this article, we’ve highlighted some key points about the importance of specialized knowledge in non-profit accounting. We’ve talked about the need for comprehensive financial statements and the benefits of cost-effective solutions. Plus, the proactive support for audits and smooth onboarding processes are crucial for helping non-profits navigate their financial landscapes with ease. These services not only promote accountability but also build trust among stakeholders, which is essential for long-term sustainability.

In a world where every dollar counts, choosing the right bookkeeping services can make a real difference in an organization’s ability to achieve its mission. So, why not explore how partnering with experts like Steinke and Company can boost your financial health and operational capabilities? By investing in tailored bookkeeping solutions, you can tackle common challenges and maximize your potential to create meaningful change in your community. Let's make a difference together!

Frequently Asked Questions

What services does Steinke and Company provide for non-profits?

Steinke and Company offers tailored bookkeeping services specifically designed for non-profits, including meticulous record-keeping, compliance checks, and detailed reporting to help organizations focus on their missions without financial stress.

Why are customized bookkeeping services important for non-profits?

Customized bookkeeping services ensure financial accuracy, boost transparency and accountability, and help non-profits navigate economic challenges and changing donor expectations, which are crucial for building trust with stakeholders.

How does Steinke and Company support rural non-profits?

Steinke and Company understands the unique challenges faced by rural non-profits and provides services that foster resilience and growth, allowing these organizations to thrive in their communities.

What is the significance of Form 990 for non-profit organizations?

Form 990 is essential for ensuring compliance and boosting transparency and accountability, as it allows organizations to effectively share their mission and impact with stakeholders.

How does Steinke and Company help non-profits with compliance and reporting?

Steinke and Company assists non-profits by providing timely and accurate financial reporting, helping them meet regulatory requirements, maintain tax-exempt status, and build trust with donors.

What types of financial statements does Steinke and Company prepare for non-profits?

Steinke and Company prepares comprehensive financial statements, including the Statement of Financial Position, Statement of Activities, Statement of Cash Flows, and Statement of Functional Expenses, to ensure transparency and informed decision-making.

How does accurate financial reporting benefit non-profits?

Accurate financial reporting boosts credibility, strengthens relationships with stakeholders, meets compliance requirements, and aligns with GAAP for nonprofits, which helps attract and retain donor support.

What innovative approach does Steinke and Company use to provide support?

Steinke and Company has shifted to a fully remote support model, offering 24/7 access through a client portal, email, and text, allowing non-profits to receive timely assistance whenever needed.