Overview

The article "10 Essential Questions for Hiring a Tax Associate" dives into what really matters when you're on the lookout for a tax associate. It highlights the need for solid experience in tax compliance, staying updated on tax laws, and having the chops to tackle complex financial situations. These elements are super important for making sure your clients get the best tax planning and compliance possible.

So, what should you keep in mind? First off, think about their experience. Have they navigated tricky tax scenarios before? It’s crucial! And don’t forget about continuous education—tax laws change all the time, and you want someone who’s on top of it. Lastly, consider their ability to manage complex financial situations; after all, taxes can get pretty intricate!

In short, finding the right tax associate means looking for someone who not only knows their stuff but also keeps learning and can handle the tough stuff. Happy hiring!

Introduction

Navigating the complexities of tax compliance can feel like a maze, right? For small business owners, the challenge is often compounded by ever-changing regulations and the lurking potential for pitfalls. In this article, we’ll explore ten essential questions that can help you find a qualified tax associate who can guide you through this intricate tax landscape. You’ll discover what to look for in a candidate—from their experience in tax reporting to their strategies for ensuring accuracy and handling tight deadlines. So, how do you tell the difference between a savvy tax associate and someone just pretending to know their stuff in a field where expertise really counts?

Describe Your Experience with Tax Compliance and Reporting

If you're looking for a qualified tax associate, it's important that they provide a comprehensive overview of their experience. You want to know about the types of service-oriented businesses they've supported and the specific tax compliance challenges they've tackled. Did you know that around 60% of small businesses report facing tax compliance issues? That's why it's crucial to find examples that showcase their expertise in managing complex tax situations, like underpayment penalties.

Understanding the IRS's requirements for estimated tax payments, safe harbor payments, and the de minimis exception is key for small business owners to dodge those costly penalties. Additionally, your tax associate needs to be well-versed in the recent changes to tax benefits resulting from the COVID-19 pandemic, which have significantly affected tax refunds and compliance strategies. Look for instances where they've successfully guided clients through tricky tax scenarios, such as navigating reduced tax credits and implementing tailored solutions that fit the unique needs of service-oriented individuals.

Their knack for ensuring accurate reporting and keeping up with evolving tax regulations will be vital in optimizing tax compliance for small businesses. So, when you're searching for a tax associate, think about how they can assist you in navigating these complexities and maintaining your business on the right track!

How Do You Stay Updated on Changes in Tax Laws and Regulations?

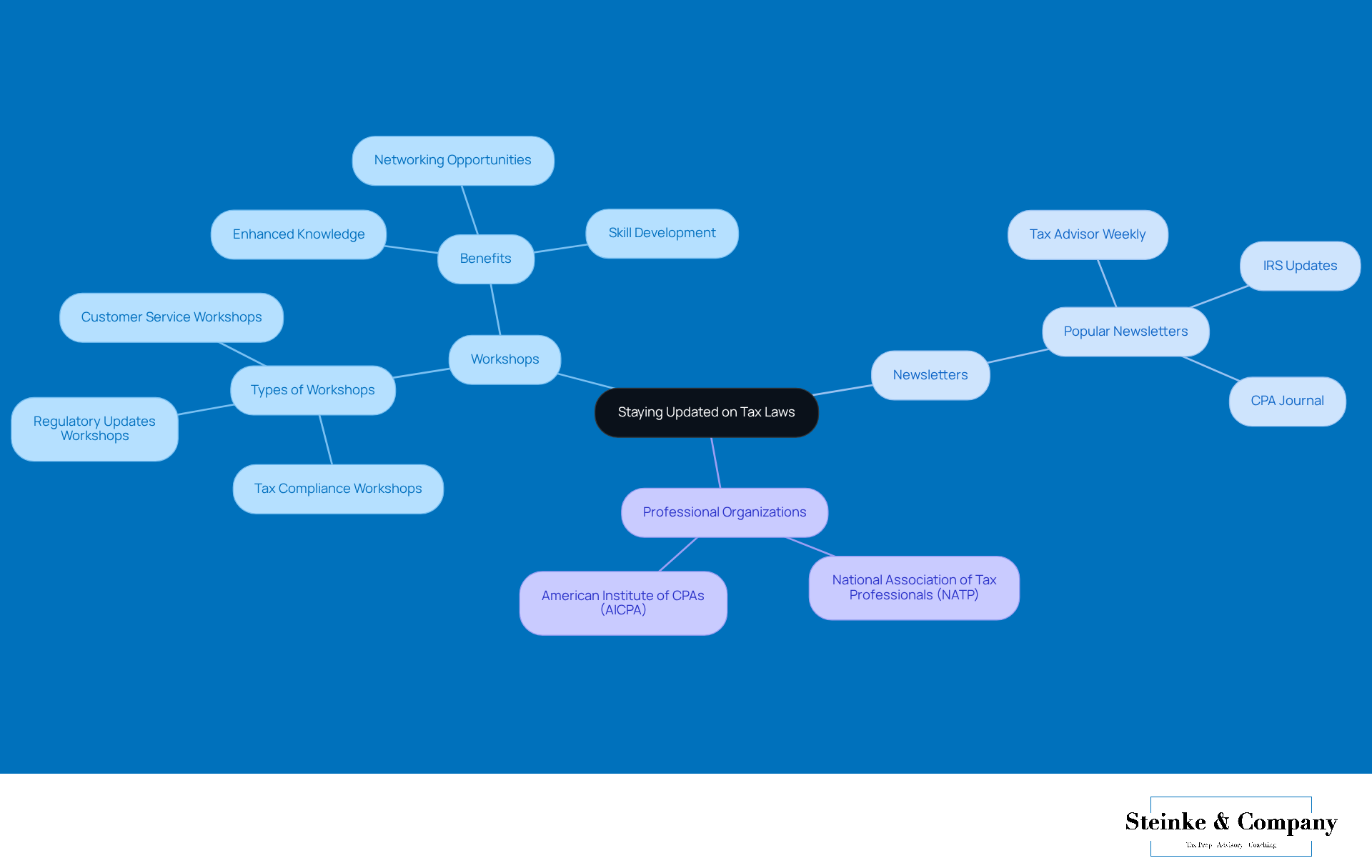

A strong candidate should really show their commitment to continuous education by sharing how they keep up with changes in tax laws and regulations. This could mean:

- Attending workshops

- Subscribing to industry newsletters

- Getting involved with organizations like the National Association of Tax Professionals (NATP) or the American Institute of CPAs (AICPA)

Did you know that around 70% of professionals in the field, specifically tax associates, participate in workshops or join professional groups to boost their knowledge and skills? This kind of proactive learning not only helps them adapt to new tax regulations but also ensures that they excel as a tax associate in providing top-notch customer service.

Tax associates are committed to ongoing education, especially when it comes to navigating the tricky world of tax compliance. With recent changes like increased underpayment penalties and the reduction of COVID-19 tax benefits affecting small business owners’ tax strategies, it’s more important than ever. Erin M. Collins, the National Taxpayer Advocate, says it best: "Continuous education is vital for tax experts to effectively serve their clients and stay ahead of regulatory changes." By showcasing their dedication to professional development, candidates can really highlight their readiness to tackle the challenges of the ever-evolving tax landscape.

Explain the Difference Between Tax Avoidance and Tax Evasion

Tax avoidance is all about working the system legally to keep your tax bills as low as possible. On the flip side, tax evasion is a big no-no—it's illegal and involves sneaky moves like underreporting income or cooking the books on deductions. It’s super important to understand ethical tax practices because tax avoidance is totally recognized as a smart way to manage tax burdens. It helps businesses boost their financial performance while staying on the right side of the law.

Take small businesses, for example. They often use legal tax strategies like:

- Claiming deductions for business expenses

- Snagging tax credits

- Putting money into retirement accounts

These practices keep them compliant, but they also help create financial stability and pave the way for long-term success.

Now, let’s talk about tax evasion. This can land you in hot water with serious legal repercussions, including hefty fines and even jail time. That’s why sticking to ethical tax practices is so crucial. Knowing the difference between tax avoidance and tax evasion is key to running a reputable business and steering clear of the trouble that comes with illegal tax practices.

Describe a Challenging Tax Issue You Encountered and How You Resolved It

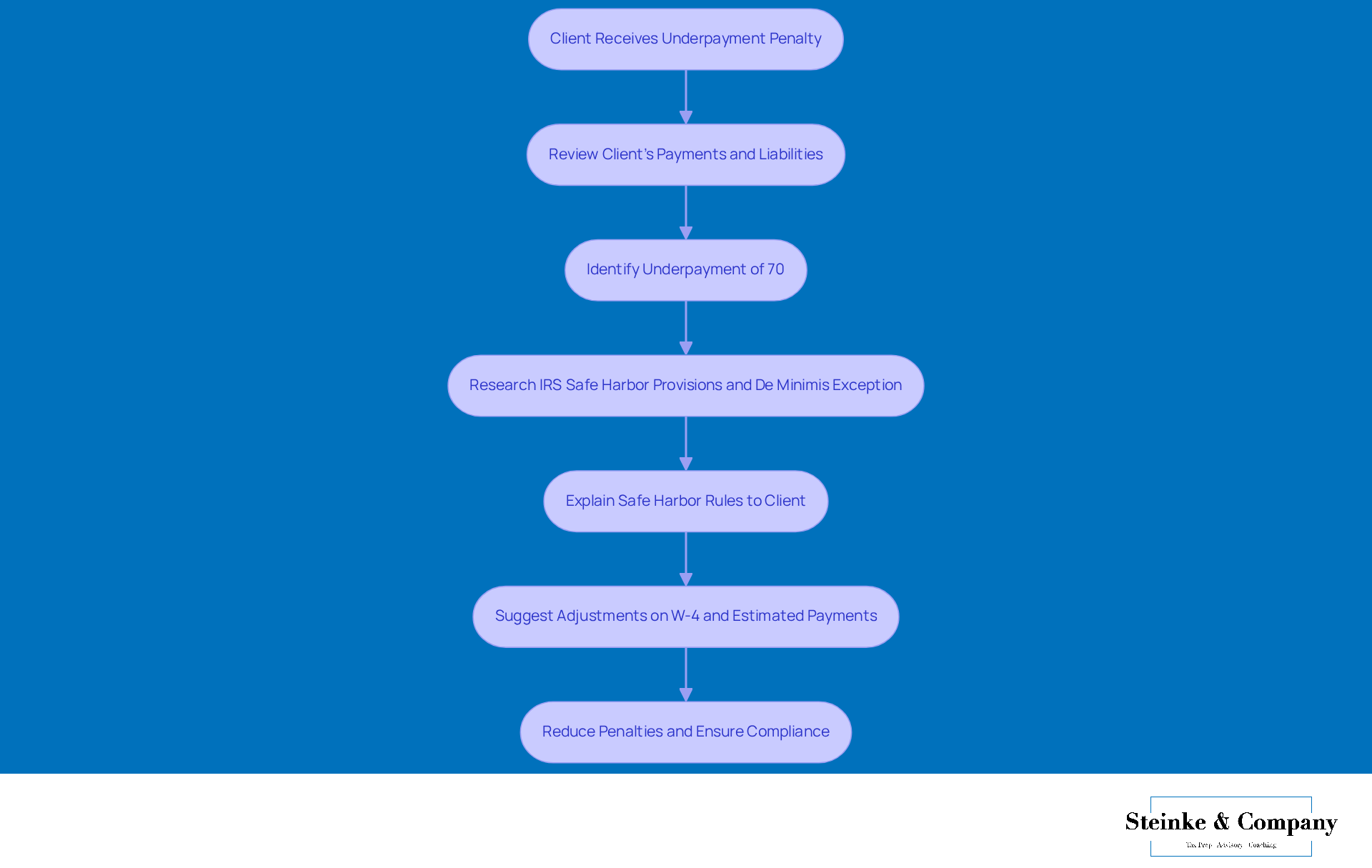

In my previous role as a tax associate, I faced a challenging situation with a client who received substantial underpayment penalties from the IRS. They hadn’t made enough estimated tax payments throughout the year, which led to a pretty substantial penalty notice. To tackle this, I first took a close look at the tax associate’s payments and liabilities for the client. Turns out, they had only paid 70% of what they owed instead of the required 90%.

So, what’s the game plan? I dove into researching potential solutions, focusing on the IRS's safe harbor provisions and the de minimis exception. I explained to my client that if their total tax obligation, minus withholdings and credits, was less than $1,000, they could actually dodge those penalties entirely. Plus, I laid out the safe harbor rule, which lets taxpayers avoid penalties by prepaying either 90% of the current year’s tax or 100% of the previous year’s tax (110% for those higher-income folks).

After gathering all the necessary info, I crafted a plan that included tweaking the individual’s withholding for the rest of the year. I suggested they submit a revised W-4 form to their employer to boost their withholding, making sure they’d hit those safe harbor requirements by year-end. I also guided them on making those extra estimated tax payments before the upcoming deadlines.

In the end, by taking these proactive steps as a tax associate, we managed to significantly cut down the penalties for the client and ensure they were in compliance with IRS regulations. It was a win-win, giving them some much-needed peace of mind moving forward!

How Do You Prioritize Tasks When Managing Multiple Clients or Projects?

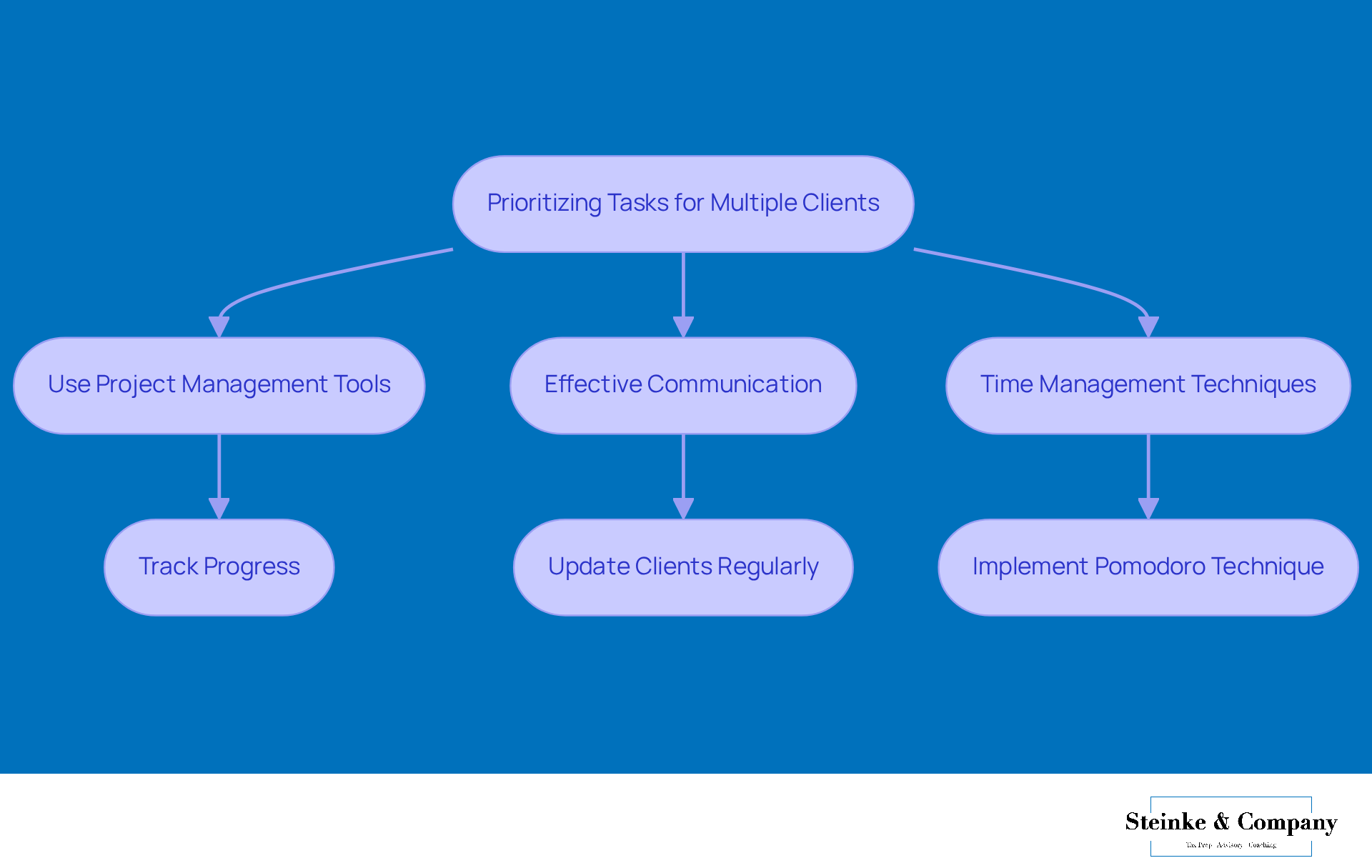

When it comes to being a strong candidate, having a clear strategy for prioritizing tasks is key. You might want to think about using project management tools like Trello or Asana to keep everything organized and track your progress on different projects. And let’s not forget about deadlines! They’re super important for staying focused and making sure services are delivered on time.

Effective communication with customers is another must-have. It’s essential to show how you keep them updated on project statuses and any bumps in the road. This kind of systematic approach not only boosts efficiency but also builds trust and transparency in client relationships.

Plus, insights from a tax associate highlight the value of time management techniques, like the Pomodoro Technique. This can really help associates maintain productivity while juggling various responsibilities. Ultimately, being able to showcase these project management skills will demonstrate your readiness as a tax associate to tackle the complexities of tax-related tasks with confidence.

So, how do you manage your time and projects? Let’s chat about it!

What Strategies Do You Use to Ensure Accuracy in Tax Calculations and Filings?

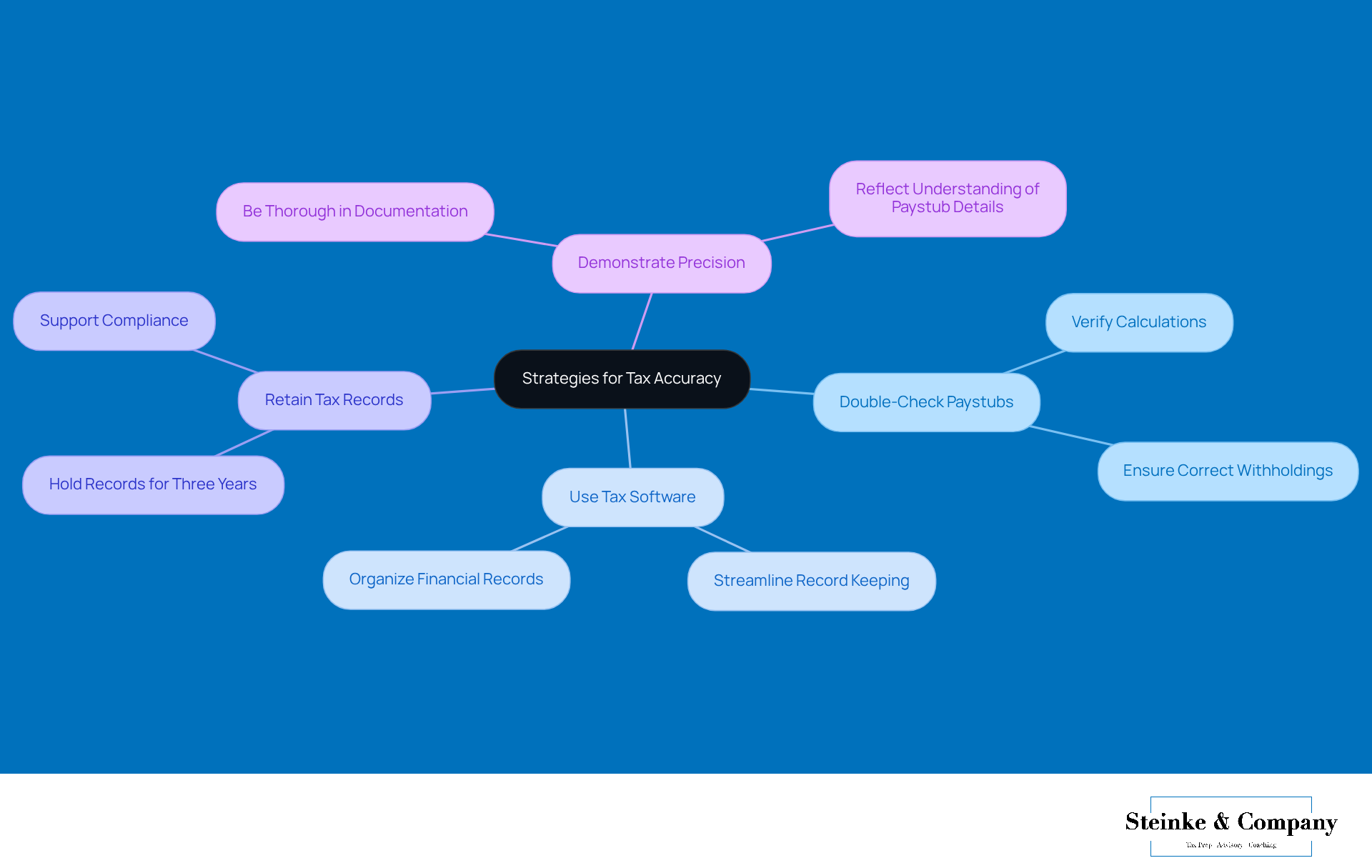

Hey there! Let’s chat about some smart strategies to keep an eye on your paycheck. One great tip is to double-check your calculations on your paystubs. This way, you can make sure you’re getting paid correctly and that the right amounts are being withheld. Understanding what’s on your paystub—like your wages, taxes, and deductions—is super important for a tax associate to ensure your financial records are accurate.

Have you ever thought about using tax software? It can really help streamline the process and keep your records organized, which is key for following tax record retention guidelines. And don’t forget, it’s a good idea to hold onto your tax records for at least three years! This little habit can really support your compliance and financial stability.

When you’re answering questions about this, show that you care about being precise and thorough. It reflects not just your understanding of paystub details, but also highlights how crucial it is for a tax associate to maintain accurate tax documentation.

So, what strategies do you use to stay on top of your finances?

Discuss Your Experience with Tax Software and Tools

Hey there! If you're looking to stand out in the tax world, it’s super important to detail your experience with different tax software programs. Don’t forget to highlight any relevant certifications or training you've completed. You know, being familiar with tools that boost efficiency and accuracy in tax prep is key. Tax experts are increasingly recognizing that advanced software can really elevate the quality of their work. Did you know that a recent report found 77% of tax experts use software for tax research? And 63% rely on it for tax preparation! That just shows how crucial it is in today’s tax practices.

Now, let’s talk about certifications. Having specific certifications in tax software can really set you apart from the crowd. Many professionals in the field of tax associate dive into training programs that not only sharpen their technical skills but also keep them in the loop with the latest features and compliance requirements. For example, folks who are certified in tools like ProFile or Intuit often feel a boost in confidence when it comes to delivering accurate and timely tax returns. Eswar Dasari, an Accountant Technician, even mentioned that ProFile is "very cost efficient compared to a lot of other software," which just goes to show the financial perks of using the right tax tools.

And let’s not overlook the impact of tax software on efficiency! Firms that embrace these technologies can automate those routine tasks, allowing tax associates to focus on more valuable advisory work. It’s pretty exciting to see that 55% of tax experts are enthusiastic about how generative AI tools could enhance their capabilities. So, be ready to chat about how your software experience aligns with the ever-evolving demands of the tax industry!

How Do You Approach Tax Planning for Clients with Complex Financial Situations?

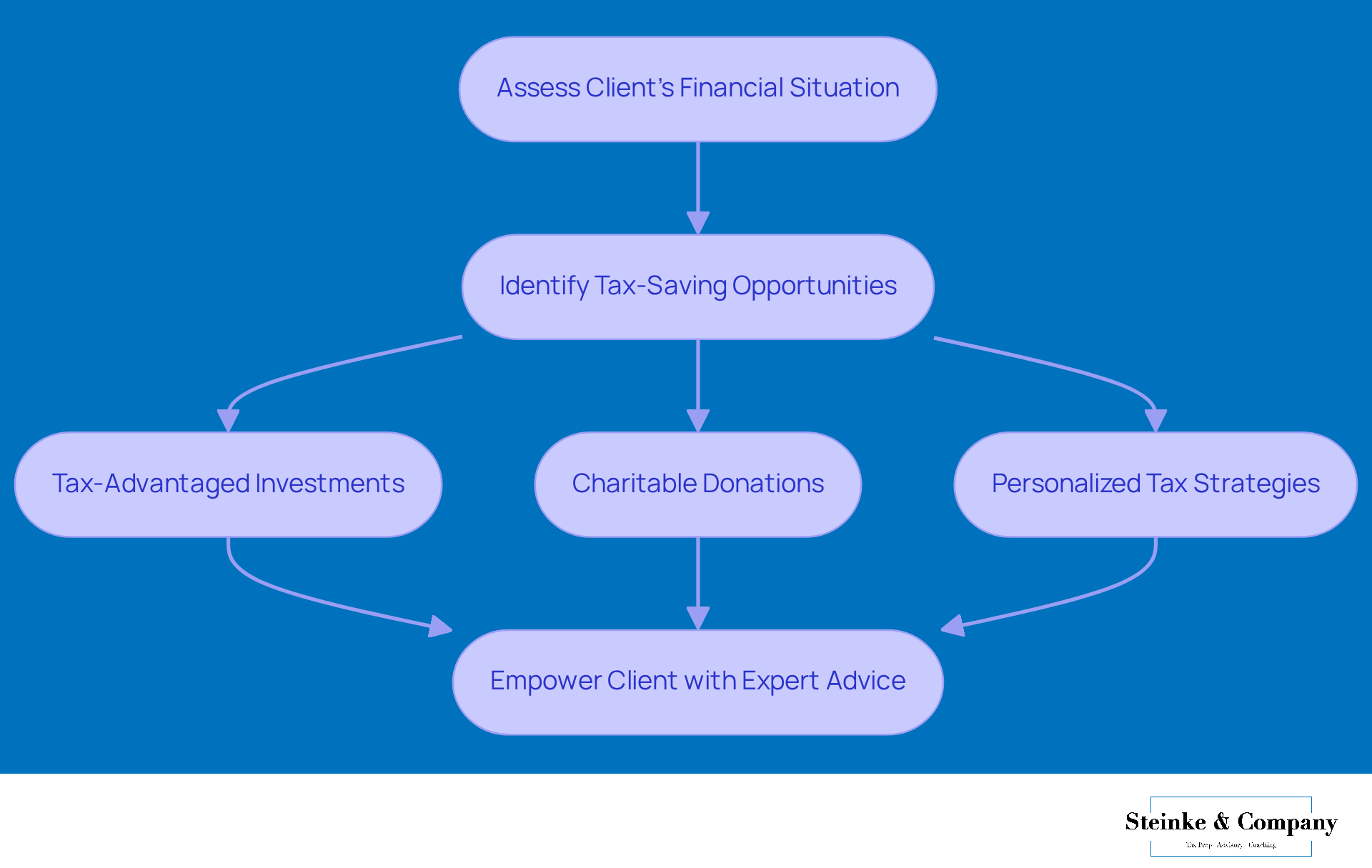

Tax experts are like your friendly guides in the maze of tax planning, especially when it comes to folks with a lot going on financially. They kick things off by diving deep into a customer’s financial situation, taking a good look at income, expenses, investments, and potential deductions. This thorough check-up helps them spot all sorts of tax-saving gems, like eligible deductions, credits, and smart investment choices.

For instance, a tax associate might discover ways for individuals to access tax-advantaged investments, such as retirement accounts or education savings plans. These can really help lower taxable income while also supporting long-term financial goals. Plus, they might explore opportunities for charitable donations, using donation tax credits to lighten tax burdens while backing causes that matter to the individual.

Once they’ve identified these potential savings, tax pros whip up personalized tax strategies that cater to each person’s unique needs and goals. These plans often include tips for maximizing deductions, timing income and expenses just right, and making savvy investment choices. Imagine a tax associate developing a strategy that aligns perfectly with a customer’s retirement dreams, ensuring that tax implications are always included in the financial conversation.

In the end, it’s all about empowering individuals to take charge of their financial futures with expert advice and proactive strategies. By building a collaborative relationship, tax professionals help people navigate the ever-changing tax landscape, ensuring they stay compliant while unlocking their financial potential. So, are you ready to take control of your tax situation?

Describe a Time When You Had to Explain a Complex Tax Concept to a Non-Financial Audience

In my previous job, I had the opportunity to break down the complexities of retirement income taxation for a group that wasn’t too familiar with financial concepts. I started by explaining the different sources of retirement income, like Social Security benefits, traditional and Roth IRAs, and Health Savings Accounts (HSAs). It’s super important to understand the tax implications of each source because it can really help maximize your after-tax income during retirement. For example, while Social Security benefits might not be taxable for folks with lower incomes, distributions from traditional IRAs are fully taxable, which can have a big impact on retirement planning. I also pointed out that state taxation varies, with some states not taxing retirement income at all, which can influence where you choose to retire.

To make things more relatable, I shared real-life examples, like how a couple could take advantage of a back-door Roth IRA if they exceeded the income limits for direct contributions. I also talked about the Saver’s Credit, which is especially helpful for low- and moderate-income workers since it offers a tax credit for contributions to retirement accounts.

Throughout our chat, I welcomed questions and used analogies to simplify complex terms, making sure everyone felt comfortable engaging with the material. By the end of the session, the clients expressed that they had a clearer understanding of how to manage their retirement income and the associated tax strategies, which ultimately empowered them to make informed financial choices.

How Do You Handle Tight Deadlines During Tax Season?

Candidates should share their strategies for managing stress and ensuring timely tax associate filings during those hectic peak periods. Effective time management techniques are key here; for example, prioritizing tasks based on deadlines can really boost productivity. Tools like digital calendars and task management software can help streamline workflows and keep an eye on those all-important deadlines. As Benjamin Franklin famously said, 'In this world, nothing can be said to be certain, except death and taxes,' which really drives home the need for a tax associate to be prepared during tax season.

Proactive workload management is super important too. Tax experts often break larger projects into smaller, manageable tasks, which can help ease that overwhelming feeling. Plus, having regular check-ins with team members can encourage collaboration and make sure everyone is on the same page with priorities. A case study titled 'Lightening the Mood' shows that firms that promote open communication and sprinkle in some humor tend to see better morale and productivity during tax season.

Let’s not forget about stress management techniques! Many experts suggest that taking short breaks throughout the day can really enhance focus and reduce burnout. Mindfulness practices, like deep breathing exercises or quick meditation sessions, can also be great for keeping your cool during high-pressure moments. Data shows that tax associates who stick to structured time management practices are 30% more likely to hit their deadlines during those busy periods.

By creating an environment that values both time management and stress reduction, tax associates can tackle the challenges of peak periods with more ease. Why not consider setting up a daily check-in with your team to chat about priorities and share stress management techniques? It’s a great way to ensure everyone feels supported and aligned!

Conclusion

Finding the right tax associate is super important for navigating the tricky waters of tax compliance and keeping your finances stable. This article laid out some essential questions that can help you spot candidates who have the right skills, experience, and a commitment to staying updated on the ever-changing tax laws. By zeroing in on their qualifications—like their ability to tell the difference between tax avoidance and evasion, as well as their experience with tax software—you can make smart hiring decisions that fit your financial goals.

We also touched on key areas like the need for continuous education for tax pros, tips for juggling multiple clients, and the proactive strategies tax associates can use to tackle tough tax problems. By highlighting the importance of accuracy in tax calculations and effective communication with clients, we really emphasized how these qualities lead to successful tax practices.

So, to wrap things up, taking the time to ask the right questions during the hiring process not only helps ensure compliance with tax regulations but also builds a partnership that can pave the way for long-term financial success. As tax laws keep evolving, having a knowledgeable and proactive tax associate by your side will be invaluable in helping your business navigate its tax obligations while making the most of financial opportunities. Keep these insights in mind as a roadmap to making the best hiring choices for your financial future!

Frequently Asked Questions

What should I look for in a qualified tax associate regarding their experience?

You should seek a comprehensive overview of their experience, including the types of service-oriented businesses they've supported and the specific tax compliance challenges they've tackled, such as managing underpayment penalties.

Why is tax compliance important for small businesses?

Around 60% of small businesses report facing tax compliance issues, making it crucial to find a tax associate who can help manage complex tax situations and ensure adherence to IRS requirements.

What recent changes should a tax associate be familiar with?

A tax associate should be well-versed in recent changes to tax benefits resulting from the COVID-19 pandemic, which have significantly affected tax refunds and compliance strategies.

How can a tax associate help small businesses with tax compliance?

A tax associate can assist in navigating tricky tax scenarios, ensuring accurate reporting, and keeping up with evolving tax regulations to optimize tax compliance for small businesses.

How do tax associates stay updated on changes in tax laws and regulations?

They stay updated by attending workshops, subscribing to industry newsletters, and getting involved with organizations like the National Association of Tax Professionals (NATP) or the American Institute of CPAs (AICPA).

What percentage of tax professionals participate in workshops or professional groups?

Around 70% of tax professionals, specifically tax associates, engage in workshops or join professional groups to enhance their knowledge and skills.

What is the difference between tax avoidance and tax evasion?

Tax avoidance is the legal practice of minimizing tax bills through legitimate strategies, while tax evasion is illegal and involves dishonest actions like underreporting income or falsifying deductions.

Why is understanding ethical tax practices important for businesses?

Understanding ethical tax practices allows businesses to manage tax burdens legally, which helps boost financial performance and ensures compliance, avoiding serious legal repercussions associated with tax evasion.