Introduction

Navigating the world of SaaS tax compliance can feel like a real maze for small agency owners, right? With regulations changing from state to state, it’s no wonder many feel overwhelmed. But here’s the thing: understanding these tax implications isn’t just about dodging penalties. It’s a vital step toward boosting your financial performance and paving the way for sustainable growth.

As we look ahead to 2025, big changes are on the horizon for SaaS businesses. So, how can agency owners gear up for these challenges while also seizing opportunities to sharpen their financial strategies? In this article, we’re diving into ten essential insights that will help small agency owners tackle the complexities of SaaS taxation. Let’s make sure you stay compliant and competitive in this ever-evolving digital economy!

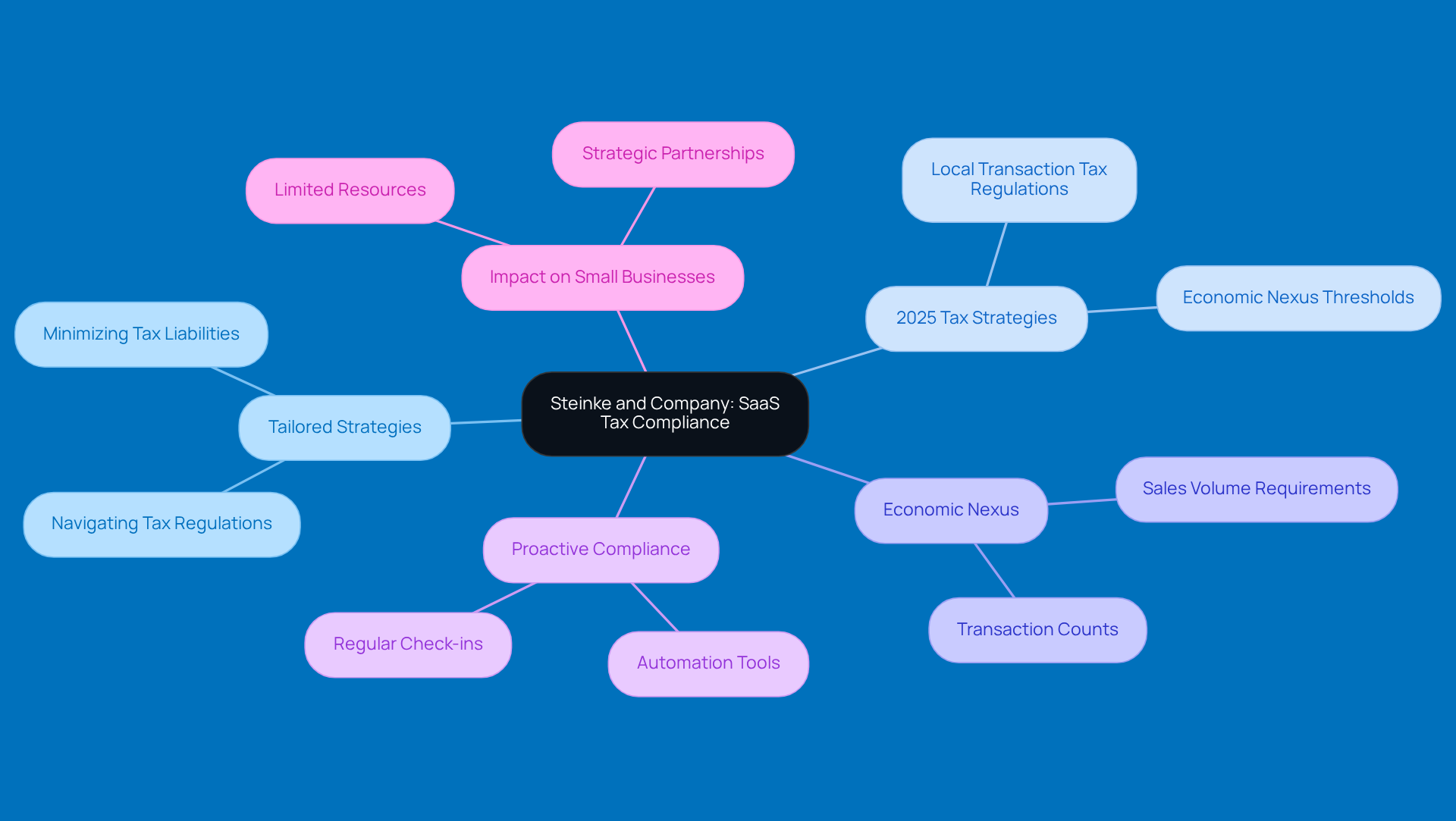

Steinke and Company: Expert Tax Compliance for SaaS Businesses

Steinke and Company is shaking things up in the world of SaaS tax compliance for software-as-a-service (SaaS) businesses. They’re all about crafting tailored strategies that help clients navigate the sometimes tricky waters of tax regulations. Focusing on small and micro businesses, they provide insights aimed at minimizing tax liabilities while keeping everything above board legally. Their unique approach blends precise accounting with strategic coaching, making them a go-to partner for SaaS entrepreneurs.

Now, let’s talk about the recent tax strategies for 2025. It’s crucial to get a grip on local transaction tax regulations, especially with the new economic nexus thresholds from the South Dakota vs. Wayfair ruling. This ruling means that many states now expect SaaS companies to collect SaaS tax based on their sales volume or transaction counts—even if they don’t have a physical presence there. Can you believe that?

Tax experts are all about proactive compliance strategies. They recommend that SaaS companies regularly check in on their SaaS tax responsibilities and consider using automation tools to streamline their processes. By teaming up with Steinke and Company, clients can tackle these complexities head-on, ensuring they stay compliant while keeping their eyes on growth.

And let’s not forget about the impact of tax regulations on small businesses in rural America. These enterprises often operate with limited resources, so having a strategic partner like Steinke and Company can really make a difference in overcoming tax challenges and grabbing opportunities for financial success. So, if you’re in that boat, why not reach out and see how they can help you thrive?

State Tax Trends: Why States Are Eyeing SaaS Now

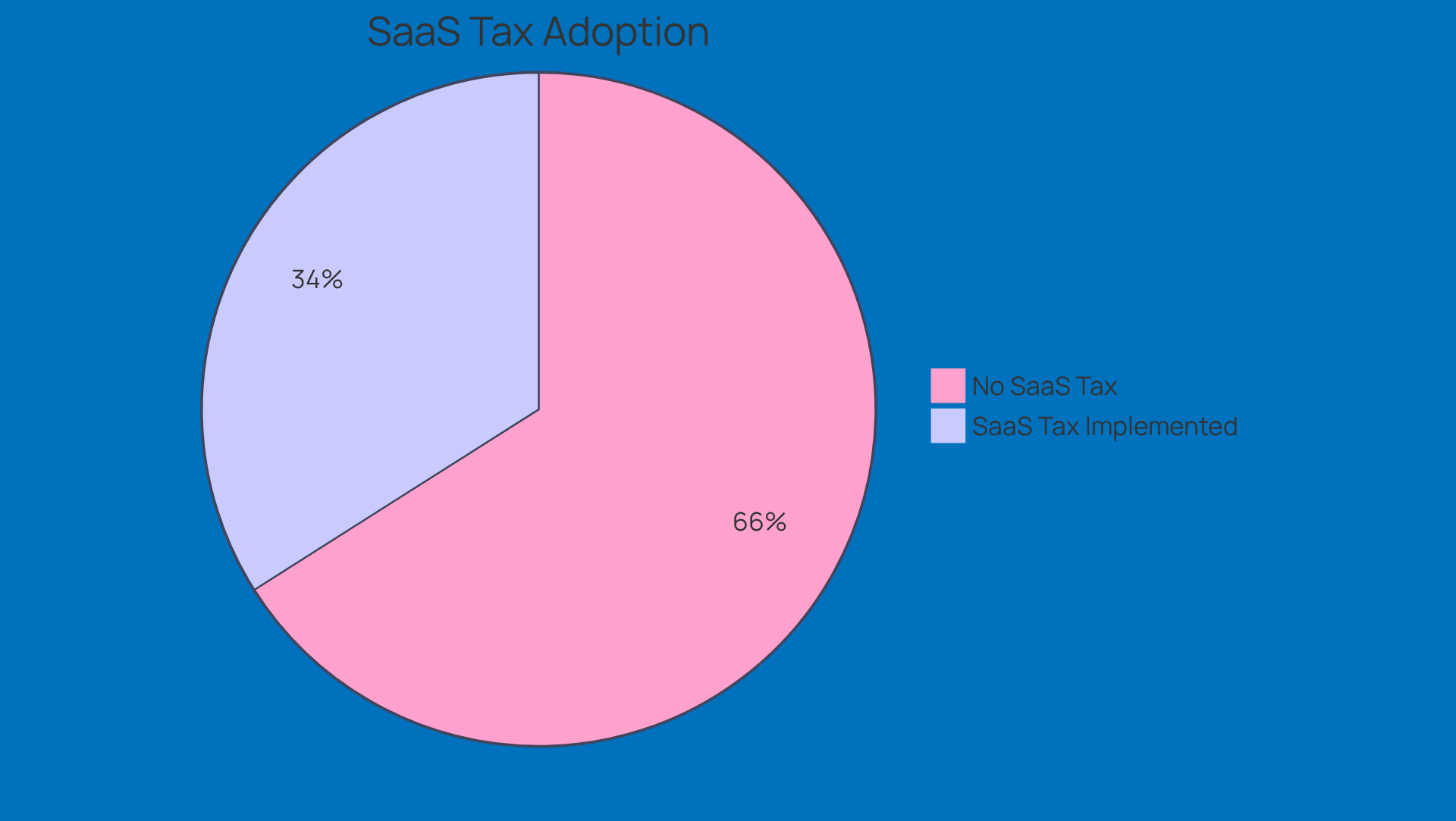

In recent years, states have really started to see the potential for revenue in SaaS tax from Software as a Service (SaaS) companies. As digital services become more popular, many states are updating their tax codes to classify software as a taxable service. This shift is mainly driven by the need for extra revenue, especially given the economic challenges many states are facing. Take Louisiana, for example. They’ve recently added SaaS to their taxable base and bumped up their tax rate to 5% to make up for cuts in personal and corporate income taxes. This is part of a broader trend across the U.S., where 25 jurisdictions now have implemented some form of SaaS tax on services.

Tax analysts are pointing out that states are smartly tapping into the digital economy, leveraging SaaS tax to boost their budgets. Remember the 2018 Supreme Court decision in South Dakota v. Wayfair? It allows states to require remote vendors to collect tax, and since then, there’s been a stronger push to tax digital products. So, if you’re running a company in this space, it’s crucial to stay on top of these changing regulations. You want to ensure you’re compliant and avoid any unexpected tax bills. Regular compliance reviews and investing in automated tax solutions are key strategies to help you navigate this tricky landscape.

So, how are you preparing for these changes? It’s a good idea to keep your ear to the ground and be proactive about compliance!

SaaS Sales Tax Treatment: Key States to Watch

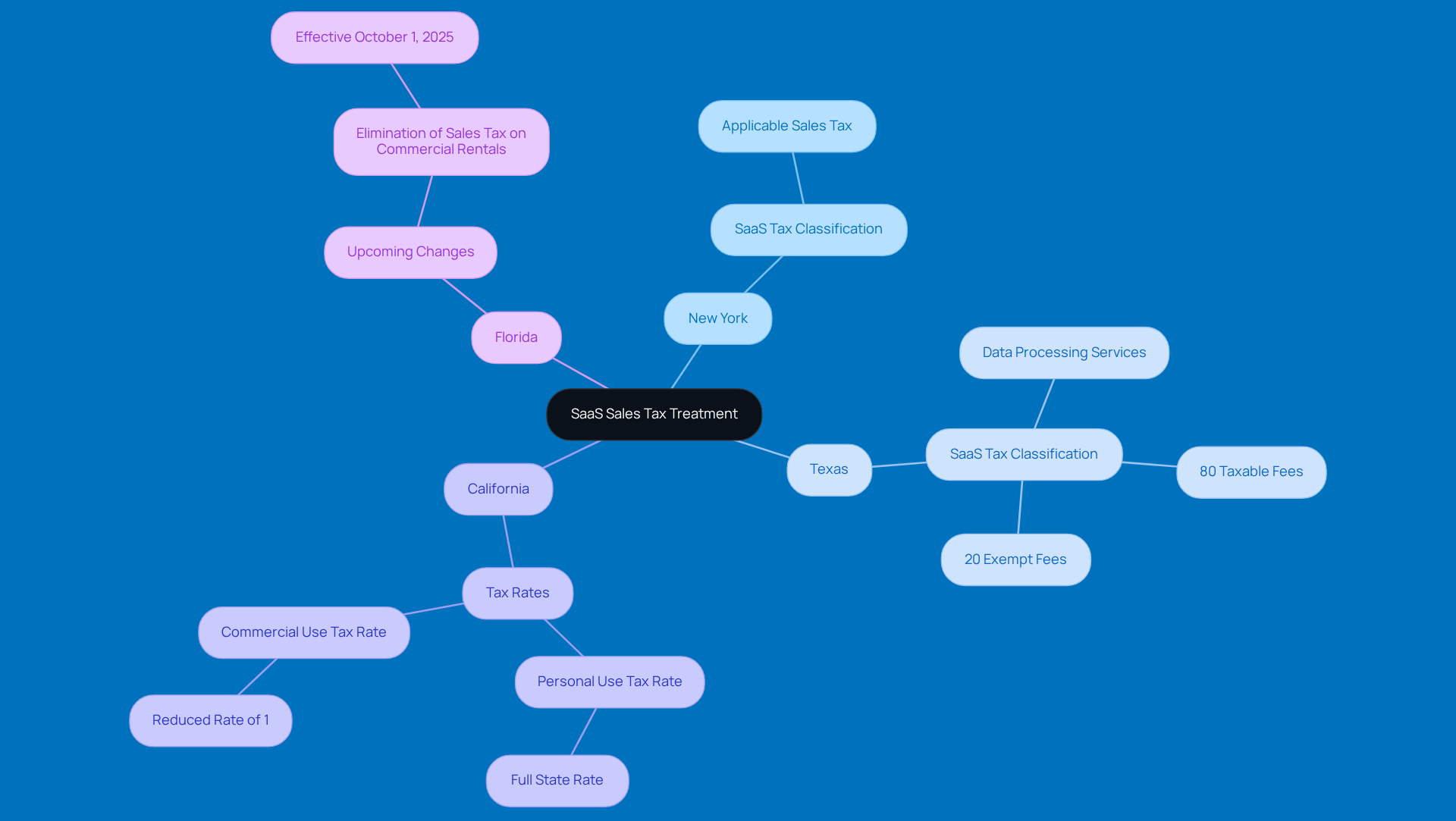

In 2025, the SaaS tax responsibilities for software-as-a-service (SaaS) providers are becoming clearer across various states. For instance, New York, Texas, and Washington have classified SaaS tax as applicable to their offerings, meaning companies in these states need to carefully collect and submit the appropriate sales tax. Take Texas, for example: here, the SaaS tax applies because SaaS falls under data processing services, with 80% of the fees subject to tax.

Meanwhile, California and Florida are in the process of updating their tax regulations, which could significantly impact the SaaS tax for firms. In California, personal use of SaaS is taxed at the full state rate, while commercial use gets a break with a reduced rate of just 1%. And in Florida, there’s a big change on the horizon—starting October 1, 2025, they plan to eliminate sales tax on commercial rentals. This could really shake up pricing strategies for software services, potentially lowering operational costs for companies that also lease commercial space.

As these states tweak their tax rules, it’s crucial for SaaS companies to stay on their toes and keep up with SaaS tax changes. After all, in 2025, the SaaS tax will be imposed in some form across 25 US jurisdictions, which shows just how complex compliance can be. As Gail Cole wisely pointed out, "transaction tax rates, rules, and regulations change frequently," highlighting the need to stay informed. Plus, companies need to figure out where they have nexus, as that’s key to understanding their sales tax responsibilities. So, how are you planning to navigate these changes?

Navigating Gray Areas: Common Gotchas in SaaS Taxation

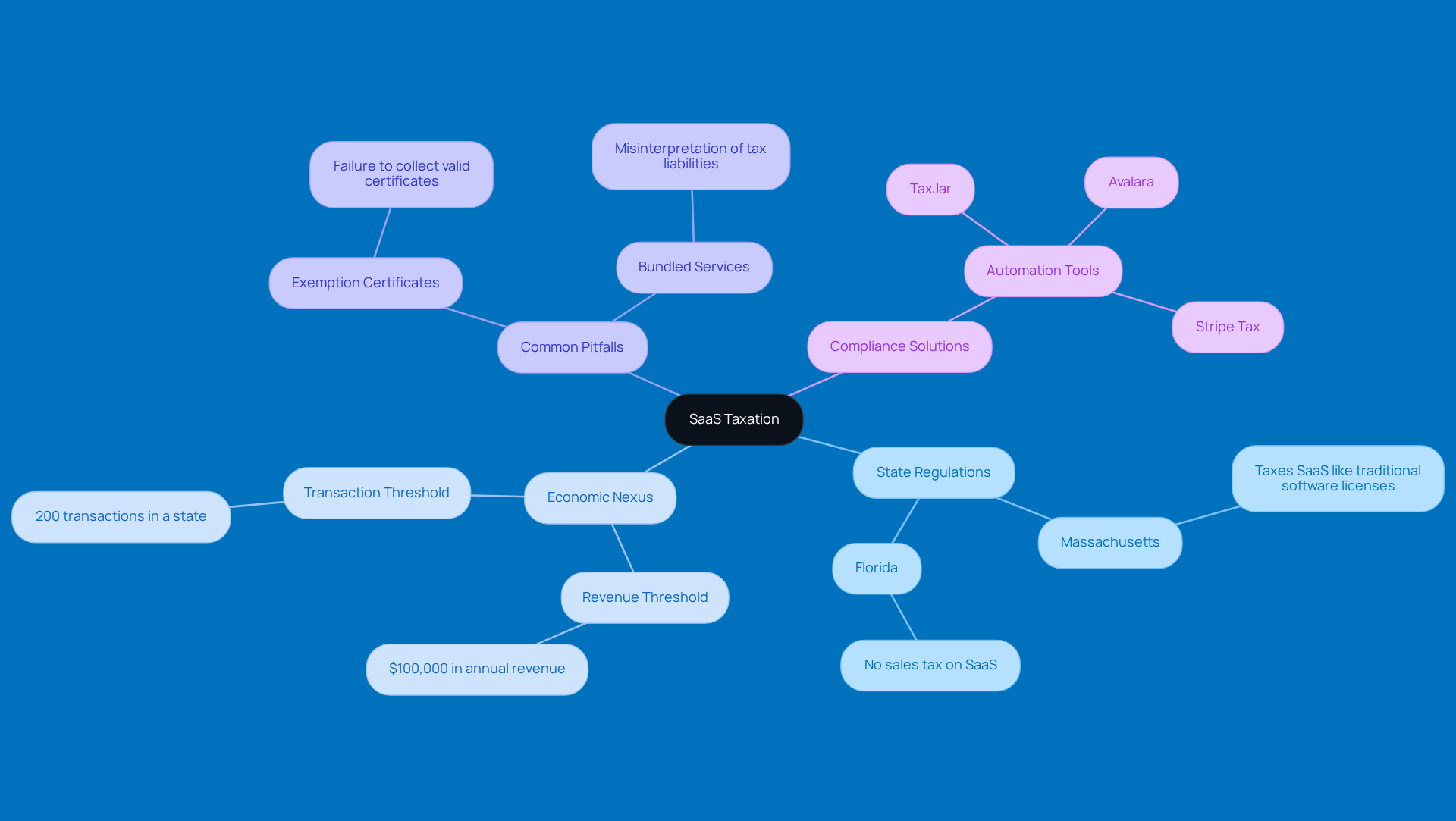

Navigating saas tax can feel like wandering through a maze, right? Business owners often find themselves scratching their heads over the gray areas that pop up. The distinction between taxable services and non-taxable software can vary quite a bit from state to state. For example, in Massachusetts, they treat software-as-a-service under saas tax similarly to traditional software licenses, which means you’ll need to pay tax on those subscription fees. On the flip side, states like Florida currently don’t impose a saas tax, viewing it as a non-taxable service.

Now, here’s where it gets a bit tricky: if a software company rakes in $100,000 in annual revenue or completes 200 transactions in a state, they might trigger economic nexus. This makes it super important for businesses to get a handle on these regulations. To avoid misclassifying services and facing penalties, SaaS companies should regularly review their offerings to identify any digital items or services that could be affected by saas tax. Plus, consulting with tax experts is always a smart move.

Common pitfalls? Oh, they’re out there! Many companies forget to collect valid exemption certificates or misinterpret the complexities of bundled services, which can lead to some unexpected tax bills. Staying updated on changing regulations is key. For instance, Texas is set to require marketplaces to start taxing commission fees from October 1, 2025. Utilizing automation tools like TaxJar, Avalara, and Stripe Tax can really help streamline compliance efforts and minimize risks.

As Sam Ross puts it, using a sales tax tool can bring a sense of relief, allowing companies to focus on growth while keeping everything above board. So, why not take a moment to assess your own situation? It could save you a lot of headaches down the road!

Tax Planning Strategies: Optimize Cash Flow for SaaS Success

If you want to boost your cash flow, software-as-a-service companies really need to embrace saas tax planning strategies proactively. Think about it: leveraging industry-specific deductions, credits, and incentives can make a huge difference. Why is this planning so important? Well, it helps you dodge the big headache of improper budgeting, which can lead to financial stress and overspending.

Given the complexity of revenue models and the global tax compliance challenges that software companies face, regular financial assessments are key. They help you spot potential tax-saving opportunities and ensure you’re not overpaying. For instance, a mid-sized software company managed to claim a whopping $500,000 in R&D tax credits just by documenting 40% of its engineering costs that went back into product development.

Working with a tax advisor who knows the ins and outs of software taxation can really pay off. They can craft tailored strategies that align with your growth goals, turning tax optimization from just a compliance necessity into a real strategic advantage. But, let’s not forget about the potential risks that come with tax optimization strategies, like non-compliance and audits. Staying educated and keeping up with changing tax laws is crucial for maintaining effective tax strategies.

By focusing on accessible deductions and credits—like those for startup costs and organizational expenses—SaaS firms can significantly enhance their cash flow and financial stability, while effectively managing their saas tax obligations. As Sager CPA points out, a proactive approach to tax planning is essential for navigating these complexities. So, small agency owners, make it a habit to regularly assess your current tax position and consult a saas tax advisor to maximize your financial potential!

Compliance Essentials: Key Requirements for SaaS Businesses

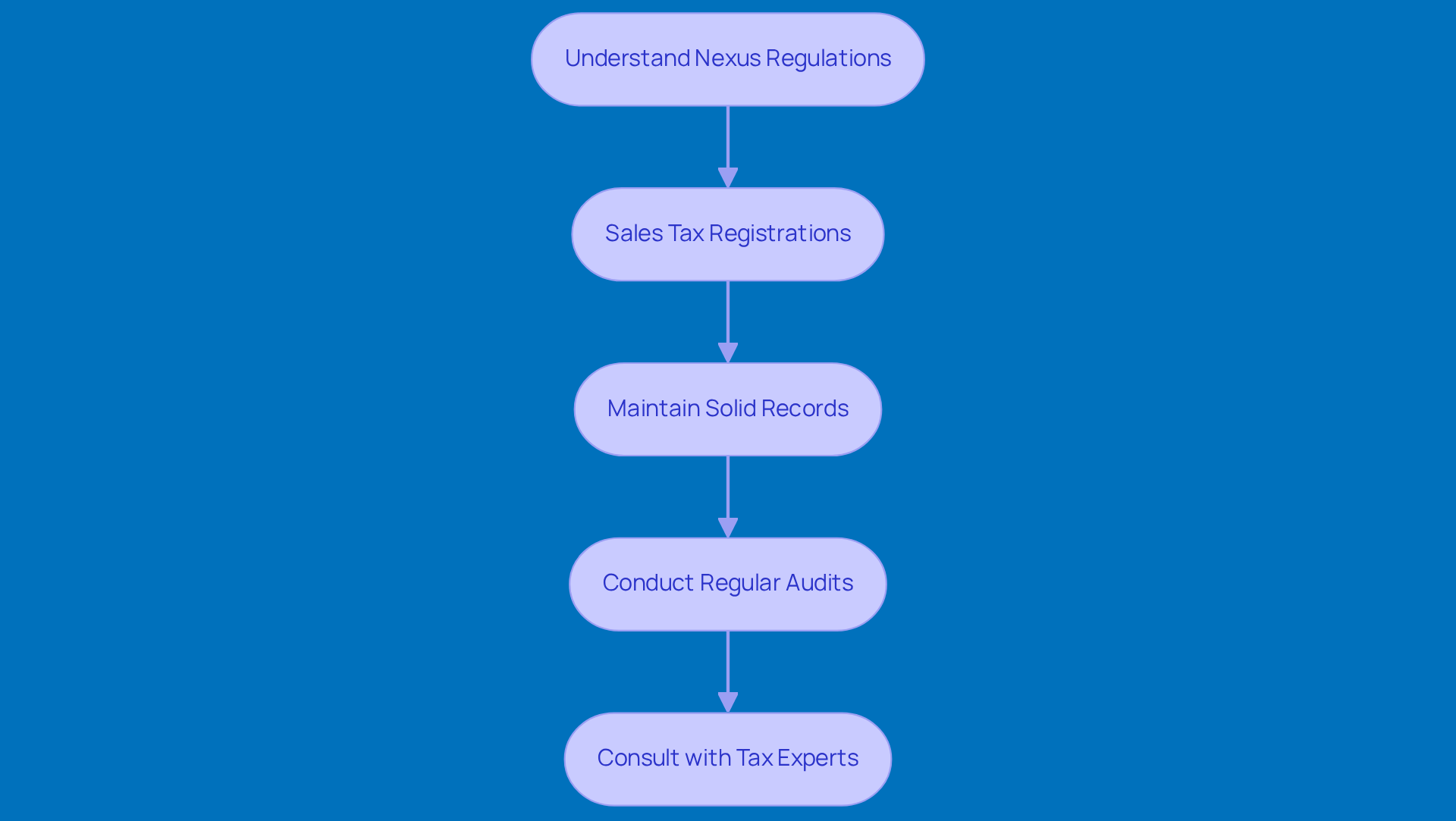

Navigating the world of Software as a Service (SaaS) can feel like a maze, especially regarding SaaS tax compliance. You've got to keep track of sales tax registrations in the right states, maintain solid records, and make sure tax returns are filed on time. Understanding nexus regulations is key here. You might find yourself needing to collect sales tax in states where you have a significant presence—think revenue volume or the number of transactions.

As of 2025, there are 25 jurisdictions that implement a SaaS tax, each with its own definition of nexus. This can really complicate things! Regular audits of your financial practices are a must to stay on top of these regulations and spot areas that could use a little improvement. Plus, effective record-keeping—like keeping detailed logs of transactions and sales patterns—can really help you stay compliant and reduce the risks of non-compliance. After all, penalties can average around 4.3% of your revenue, and nobody wants that!

So, what can you do? Consulting with tax experts can be a game-changer. They can provide insights into state-specific requirements and help you keep up with the ever-changing tax landscape. It’s all about staying informed and proactive. Have you thought about how your business handles these compliance challenges? It might be time to take a closer look!

Leveraging Technology: Tools for Managing SaaS Tax Obligations

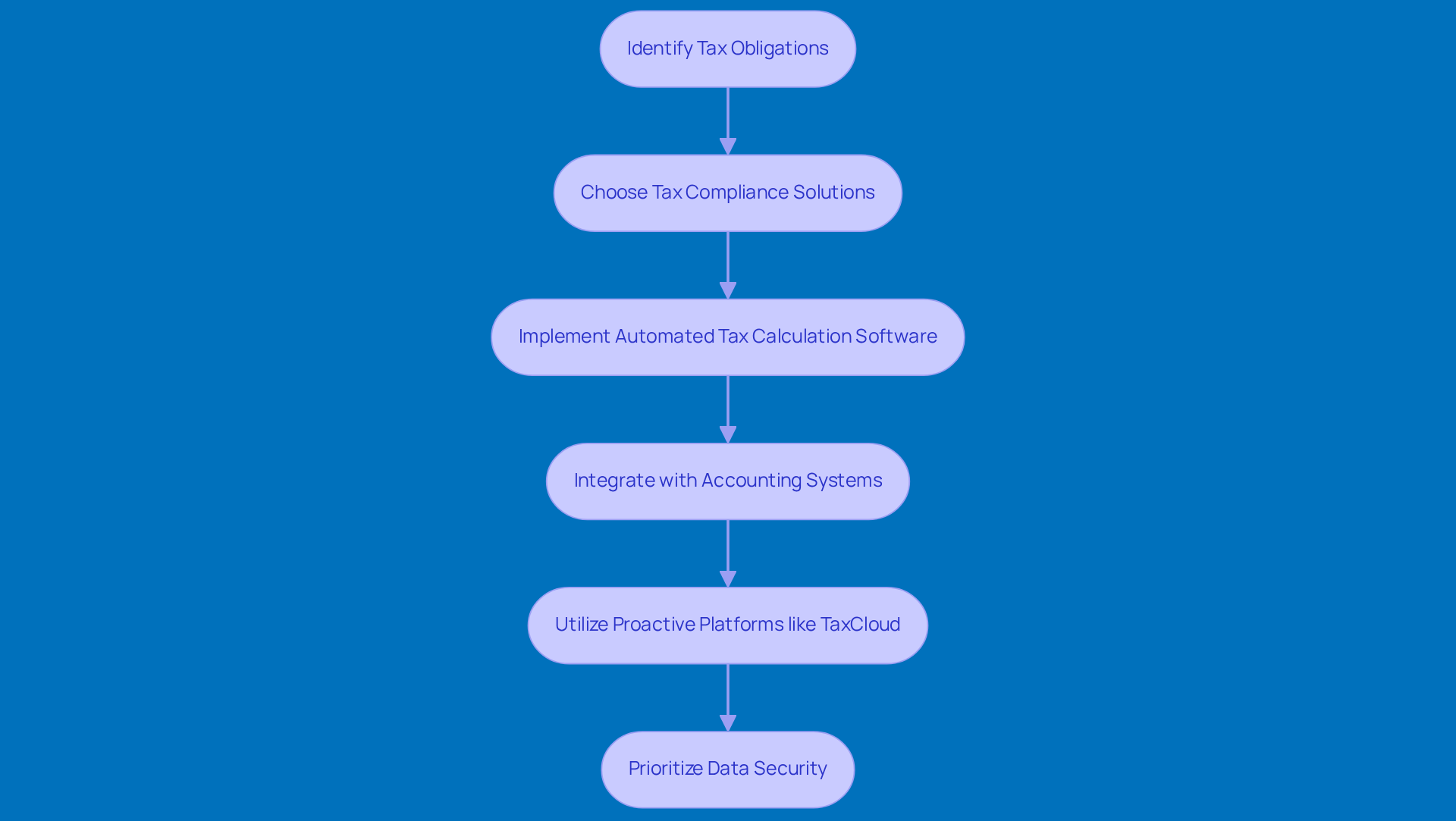

If you’re running a SaaS company, managing your SaaS tax obligations can seem like a daunting task. But here’s the good news: technology is here to help! By using SaaS tax compliance solutions designed just for you, you can simplify the whole process. Automated tax calculation software, for instance, helps you figure out the right sales tax rates based on where your customers are. This means you can apply the correct rates consistently, without the headache of manual calculations. Plus, these platforms often work seamlessly with your accounting systems, making reporting and filing a breeze while cutting down on errors.

Investing in these technologies isn’t just about saving time; it’s also about boosting accuracy in tax compliance, especially with regards to SaaS tax, which is super important in today’s tricky regulatory landscape. Take Zillow, for example. They’ve successfully rolled out user-friendly tax solutions that fit right into their existing systems, making compliance much more efficient. And here’s a bonus: automated solutions can adapt to changing tax regulations, giving you the flexibility to stay compliant without needing constant oversight.

Let’s not forget about platforms like TaxCloud in the context of SaaS tax. They offer integrated notifications and proactive advice, helping software companies stay ahead of their SaaS tax responsibilities and avoid those pesky penalties. By tapping into these advanced tools, you can focus on growing your business while keeping your tax compliance accurate and efficient. And remember, proactive planning is key! Regularly reviewing your tax strategies can help you dodge surprises when tax season rolls around.

As small businesses tackle these tax obligations, it’s crucial to prioritize data security too. Complying with regulations like the GLBA isn’t just about avoiding fines; it’s about building trust and ensuring long-term success. Implementing secure portals for document sharing and using encryption tools can protect sensitive data, which only strengthens your overall compliance strategy. By weaving these essential practices into your operations, you can create a solid framework for managing both tax obligations and customer data security.

Multi-State Operations: Tax Implications for SaaS Providers

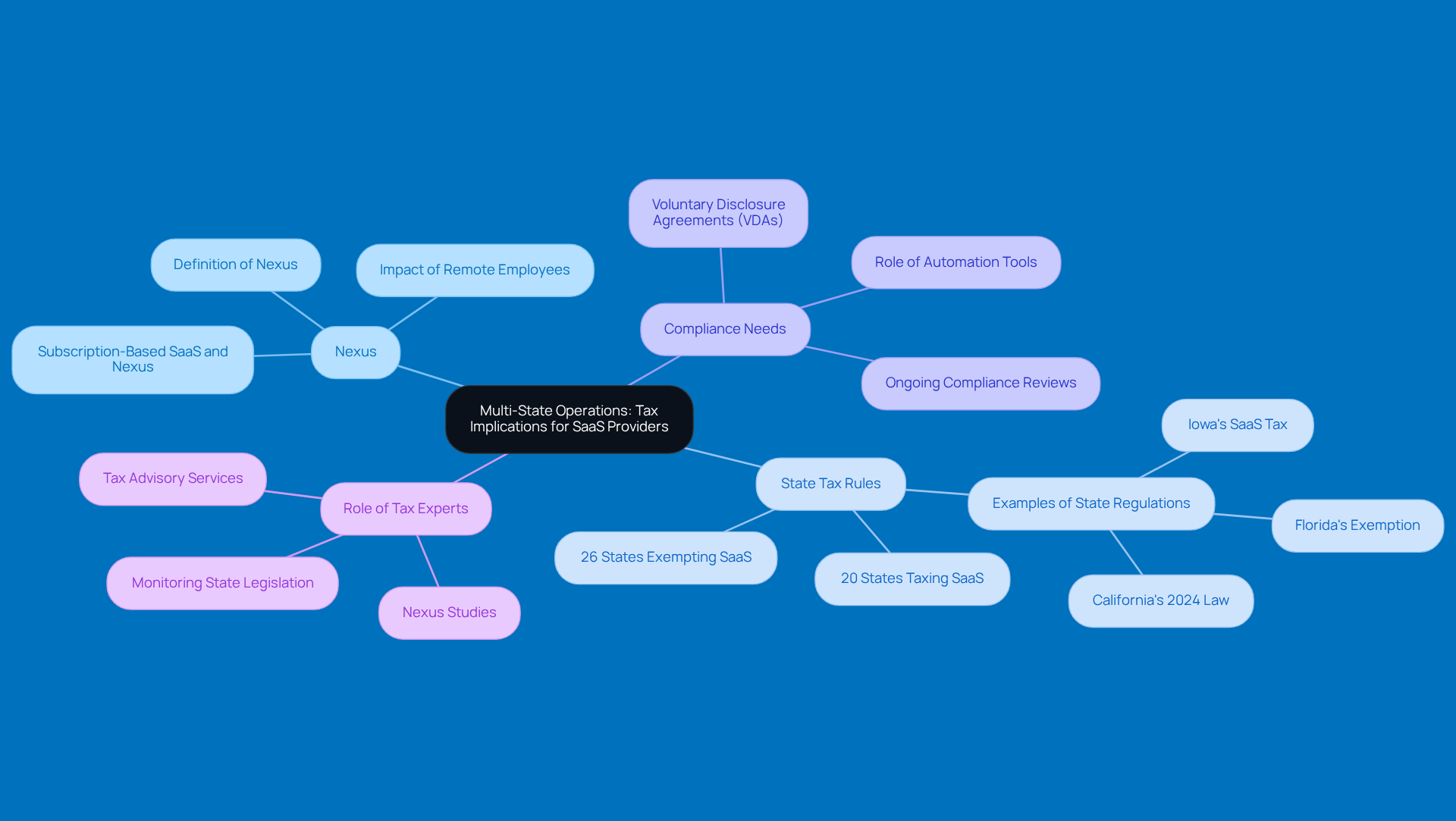

For software-as-a-service providers operating in different states, getting a grip on tax implications is super important. With about 15,000 SaaS companies in the U.S., each state has its own tax rules, so it’s essential to know where nexus exists. Nexus is basically a company’s connection to a state that triggers tax obligations, and it can be influenced by things like remote employees and where customers are located. For instance, if you have remote employees, they might create connections in their home states, which could lead to extra sales tax, payroll tax, or registration requirements.

To stay on the right side of local tax laws, SaaS companies might need to register in multiple states and collect tax based on where their customers are. As of 2022, 20 states impose a SaaS tax on software as a service in some way, while 26 states exempt it. This highlights the need for a thorough look at each state’s regulations. Regularly reviewing state tax rules is key, especially since legislation can change often. Take California, for example; they passed a law in June 2024 that expands tax to certain digital services, showing just how dynamic software as a service tax responsibilities can be. Tax experts emphasize that keeping up with compliance should be an ongoing effort, not just a one-time project—especially when businesses grow or employees move around.

Companies like AAFCPAs help SaaS providers navigate these tricky waters by conducting nexus studies to pinpoint where tax obligations pop up. Brian O'Hearn, a CPA and Tax Manager at AAFCPAs, puts it simply: "Tax obligations should be reviewed regularly—especially when sales expand, offerings change, or employees relocate." These studies help companies make smart decisions about registration and tax collection. Plus, using automation tools can really simplify managing software tax compliance, letting companies focus on growth while ensuring they meet their tax obligations.

Staying Informed: Essential Updates on SaaS Tax Laws

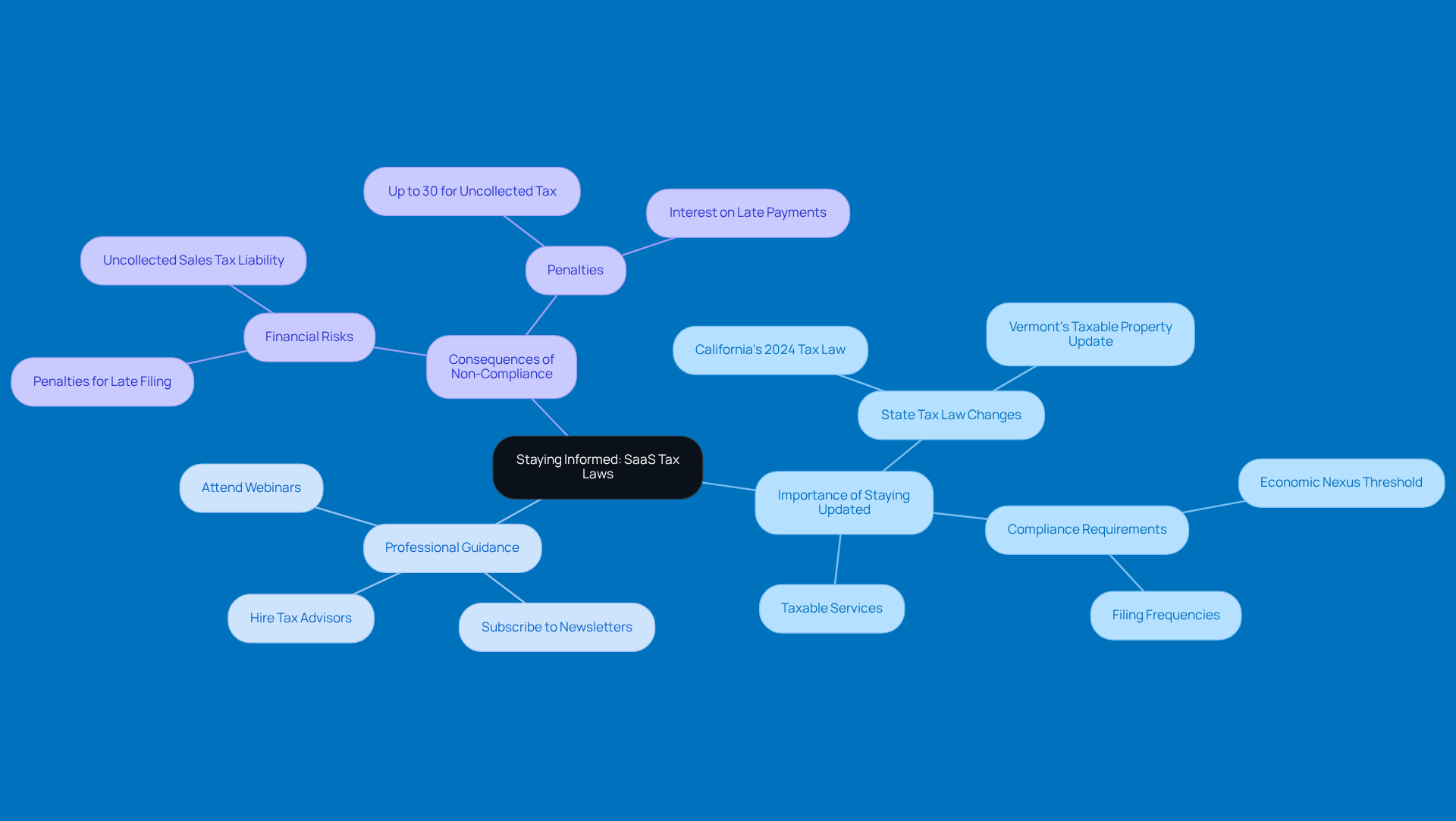

SaaS companies really need to keep an eye on SaaS tax regulations because they can significantly impact how things run. This means staying updated on changes in state tax laws, new compliance requirements, and understanding what counts as taxable services under SaaS tax. For example, California rolled out a law in 2024 that adds SaaS tax to certain digital services, showing just how important it is to adapt continuously.

Getting in touch with tax professionals is a smart move. They can offer tailored advice and keep you in the loop about the latest developments. As Manay CPA puts it, "Nothing surpasses the expert guidance of tax advisors who are consistently informed about the latest changes in tax legislation and can offer recommendations customized to your particular requirements." Plus, subscribing to industry newsletters, attending webinars, and joining tax seminars can really boost your awareness of these changes.

Don’t forget, states can impose penalties of up to 30% for uncollected sales tax, which highlights the financial risks associated with not staying compliant with SaaS tax. And understanding underpayment penalties is key too; the IRS expects taxpayers to pay at least 90% of their current year's tax liability or 100% of the previous year's tax to dodge penalties. By actively seeking out information and tapping into expert resources, you can tweak your practices to stay compliant and optimize your tax strategies, particularly your SaaS tax strategies, especially with the COVID-19 tax benefits winding down that might affect your overall tax refunds.

Continuous Learning: Resources for Mastering SaaS Taxation

Navigating the world of SaaS tax can feel pretty overwhelming, right? That’s why it’s super important for business owners to keep learning through various resources. Think online courses, webinars, and industry conferences—these are your go-to spots for picking up insights on tax compliance and best practices.

Organizations like the Tax Foundation and the American Institute of CPAs are fantastic for staying updated on the ever-changing tax laws and regulations. Seriously, they’re essential resources for anyone in the software game. By investing in your education, you’re not just checking a box; you’re deepening your understanding of tax obligations, which can lead to better compliance strategies and a lower risk of liabilities.

For example, many SaaS owners have seen real improvements in their SaaS tax compliance after joining specialized training programs. It’s a clear win that shows the tangible benefits of ongoing education in this fast-paced field. So, why not take that step? Dive into some training and see how it can help you navigate these complexities with confidence!

Conclusion

Understanding the world of SaaS tax compliance can feel like navigating a maze, especially for small agency owners who want to thrive in today’s fast-paced market. It’s crucial to get a grip on those tricky tax regulations and stay updated on state-specific requirements. Trust me, it can make a big difference in your financial health and how smoothly your operations run. By tapping into expert advice and adopting some proactive strategies, you can keep your business compliant while also optimizing your tax obligations.

So, what are the key takeaways?

- Regular compliance reviews are a must.

- Automation tools can be a game changer.

- Staying educated about changing tax laws is essential.

With states catching on to the revenue potential of taxing SaaS, understanding nexus and having solid tax planning strategies is more important than ever for your success.

In the end, small agency owners should take the reins of their tax strategies. Consult with professionals, embrace technology, and commit to ongoing learning. By doing this, you won’t just navigate the complexities of SaaS taxation; you’ll also set your business up for long-term growth and financial stability. So, what are you waiting for? Dive in and take charge!

Frequently Asked Questions

What is Steinke and Company’s focus in tax compliance for SaaS businesses?

Steinke and Company specializes in crafting tailored tax compliance strategies for small and micro SaaS businesses, helping them navigate tax regulations while minimizing tax liabilities legally.

What recent tax strategy changes should SaaS companies be aware of for 2025?

SaaS companies should be aware of local transaction tax regulations and the new economic nexus thresholds established by the South Dakota vs. Wayfair ruling, which requires them to collect taxes based on sales volume or transaction counts, regardless of physical presence in a state.

How can SaaS companies ensure compliance with tax regulations?

Tax experts recommend that SaaS companies regularly review their tax responsibilities and consider using automation tools to streamline their compliance processes. Partnering with firms like Steinke and Company can also help them stay compliant while focusing on growth.

Why are states increasingly targeting SaaS for tax revenue?

States are updating their tax codes to classify software as a taxable service to tap into the revenue potential of the growing digital economy, particularly in light of economic challenges. This trend has led to many jurisdictions implementing some form of SaaS tax.

What are some examples of states implementing SaaS tax?

States like Louisiana have added SaaS to their taxable base, while New York, Texas, and Washington have classified SaaS tax as applicable. Texas specifically taxes 80% of SaaS fees as data processing services.

What changes are expected in California and Florida regarding SaaS tax?

California is updating its tax regulations, taxing personal use of SaaS at the full state rate while offering a reduced rate for commercial use. Florida plans to eliminate sales tax on commercial rentals starting October 1, 2025, which may affect pricing strategies for software services.

How many jurisdictions in the U.S. will impose SaaS tax in 2025?

In 2025, SaaS tax will be imposed in some form across 25 U.S. jurisdictions, highlighting the complexity of compliance for SaaS companies.

What should SaaS companies do to prepare for changing tax regulations?

SaaS companies should stay informed about changing regulations, conduct regular compliance reviews, and invest in automated tax solutions to navigate the evolving tax landscape effectively.