Overview

This article dives into the must-know tax write-offs that small businesses can claim to lighten their tax load. We’re talking about deductions like:

- Home office expenses

- Car costs

- Meals and entertainment

- Advertising

- Professional fees

It’s super important to keep accurate records and stay on the right side of IRS regulations so you can really make the most of these benefits.

Have you thought about how much you could save? Keeping track of these deductions can feel like a chore, but it’s totally worth it. Just imagine how those savings could impact your business! So, let’s get into it and make sure you’re not leaving any money on the table.

Introduction

Navigating the tricky world of small business taxes can feel like a daunting task, right? But here’s the good news: understanding the tax write-offs available to you is key to boosting your financial efficiency. As a small business owner, you have a golden opportunity to lower your taxable income by claiming a variety of deductions—think home office expenses and professional fees. Yet, many entrepreneurs don’t realize just how many write-offs are out there or how to make the most of them. So, what are the essential deductions that could really change your business’s financial game? And how can you ensure you’re not missing out on any money come tax season?

Steinke and Company: Expert Tax Compliance Services for Small Businesses

Since 1974, Steinke and Company has been a go-to for micro and small businesses, helping them tackle the often tricky world of tax compliance. We specialize in service-oriented enterprises, offering tailored insights and strategies that not only help reduce tax liabilities through small business tax write offs but also ensure you’re fully compliant with the law. Our thorough approach blends planning, strategy, and coaching, making us a trusted partner for small business owners aiming to succeed in a competitive environment.

You might be surprised to learn that effective tax compliance can boost your operational efficiency and significantly contribute to your overall success. That’s why it’s crucial for micro and small enterprises to prioritize these strategies. With services like personalized tax planning, compliance audits, and guidance on new reporting requirements—such as the reduced 1099-K threshold—we’re here to help you navigate changing regulations, including small business tax write offs.

By tapping into our expert guidance, you can manage your tax obligations more effectively and steer clear of penalties, setting the stage for long-term growth and efficiency. Interested in learning how Steinke and Company can support your business? Don’t hesitate to reach out for a consultation—we’d love to chat!

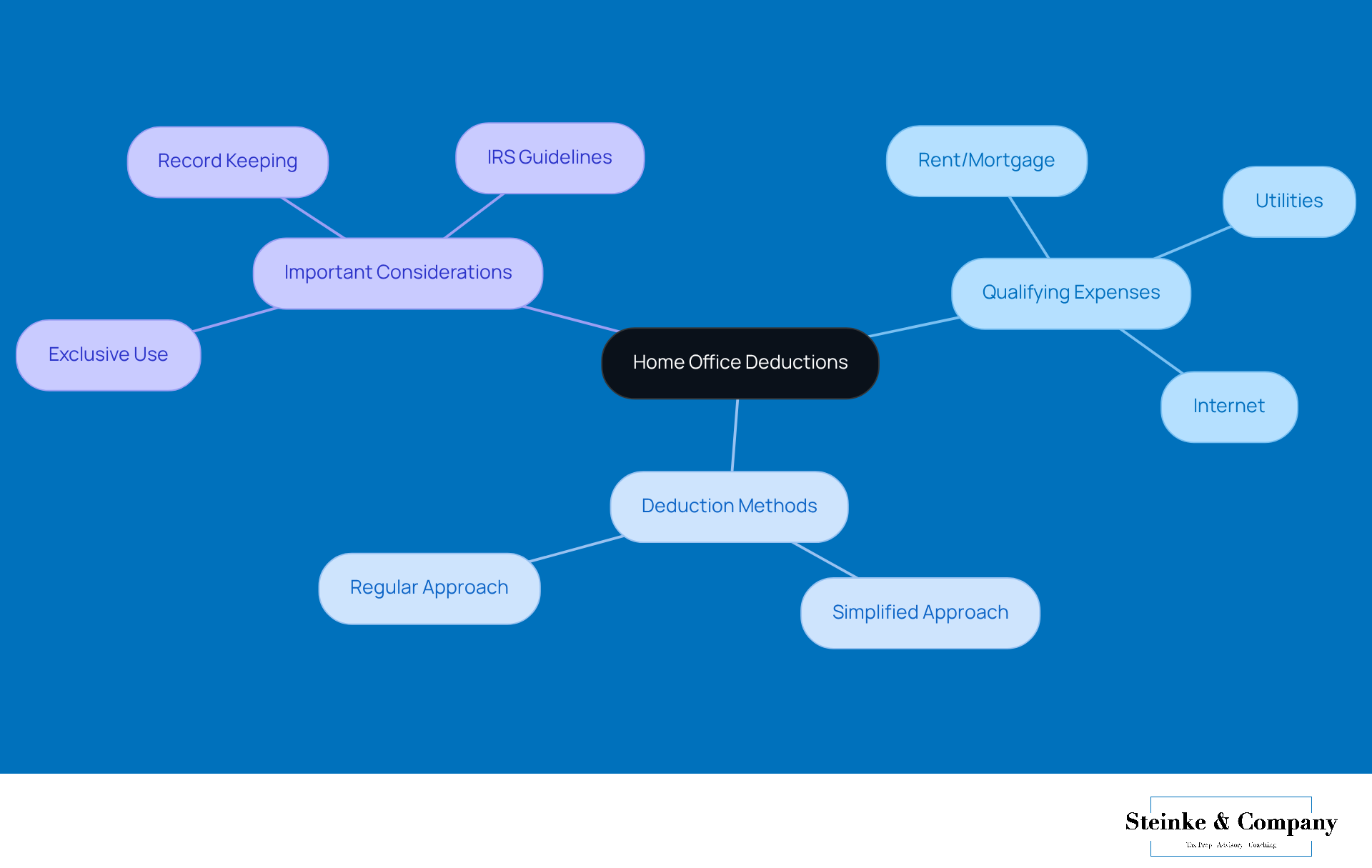

Home Office Expenses: Claiming Deductions for Your Workspace

Running a business from home allows you to utilize small business tax write offs for a portion of your household expenses, which can significantly help lower your taxable income. Qualifying expenses include a share of your rent or mortgage interest, utilities, and home internet bills. Just remember, to qualify for these deductions, your home office needs to be used exclusively for business. So, if your home office takes up 10% of your space, you can deduct 10% of those qualifying household costs.

To figure out your home office expenses accurately, you have two options: the simplified approach or the regular approach. With the simplified approach, you can deduct $5 for every square foot of your home office, up to a maximum of 300 square feet, which means you could get a total deduction of $1,500. On the flip side, the regular approach requires you to calculate the percentage of your home used for business activities, which can also include indirect costs like utilities and maintenance.

Recent IRS guidelines stress the importance of using your space exclusively for business to snag these tax benefits. Keeping accurate records of your expenses is crucial to back up your claims, especially if you ever face an audit. Plus, understanding the details on your paystub, like wages and withholdings, can help ensure you’re getting paid correctly and that the right amounts are set aside for taxes—this is key for your financial health.

Did you know that a significant number of small businesses are taking advantage of small business tax write offs through home office deductions? It’s a growing trend among entrepreneurs working remotely. Tax experts suggest that business owners stay informed about the latest IRS regulations to make the most of their deductions. By understanding the ins and outs of home office deductions, you can be sure you’re not leaving money on the table come tax season!

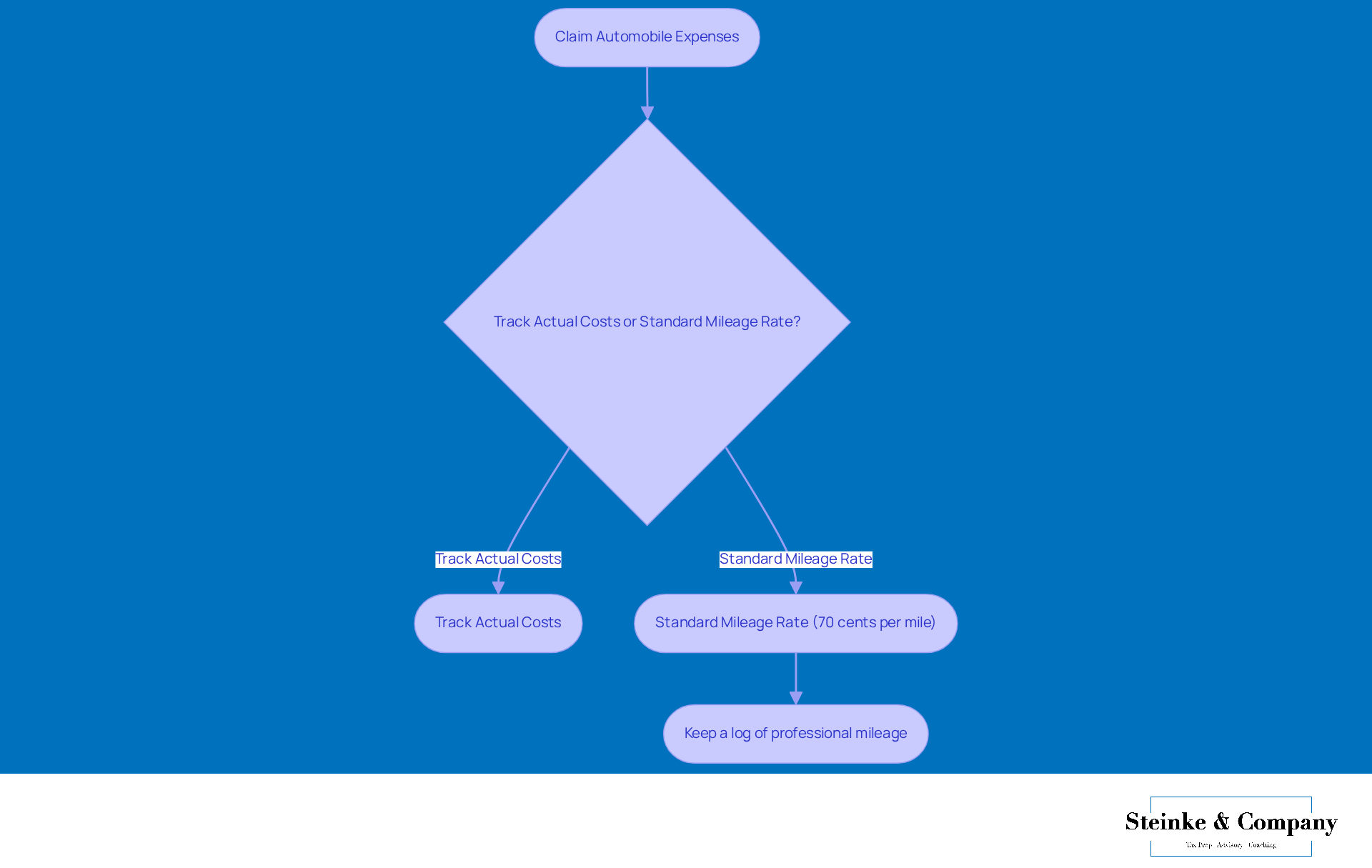

Automobile Expenses: Maximizing Deductions for Business Travel

Hey there, entrepreneurs! Did you know that some vehicle costs can be included as small business tax write offs when you're using your car for business? Yep, that includes small business tax write offs for expenses like:

- Fuel

- Maintenance

- Insurance

- Lease payments

Now, when it comes to claiming these expenses, you've got a couple of options. You can either:

- Track all your actual costs

- Go with the standard mileage rate, which is a lot simpler

For 2025, the standard mileage rate is set at 70 cents per mile. Just remember to keep a detailed log of your professional mileage to back up your claims. It's a small step that can really pay off!

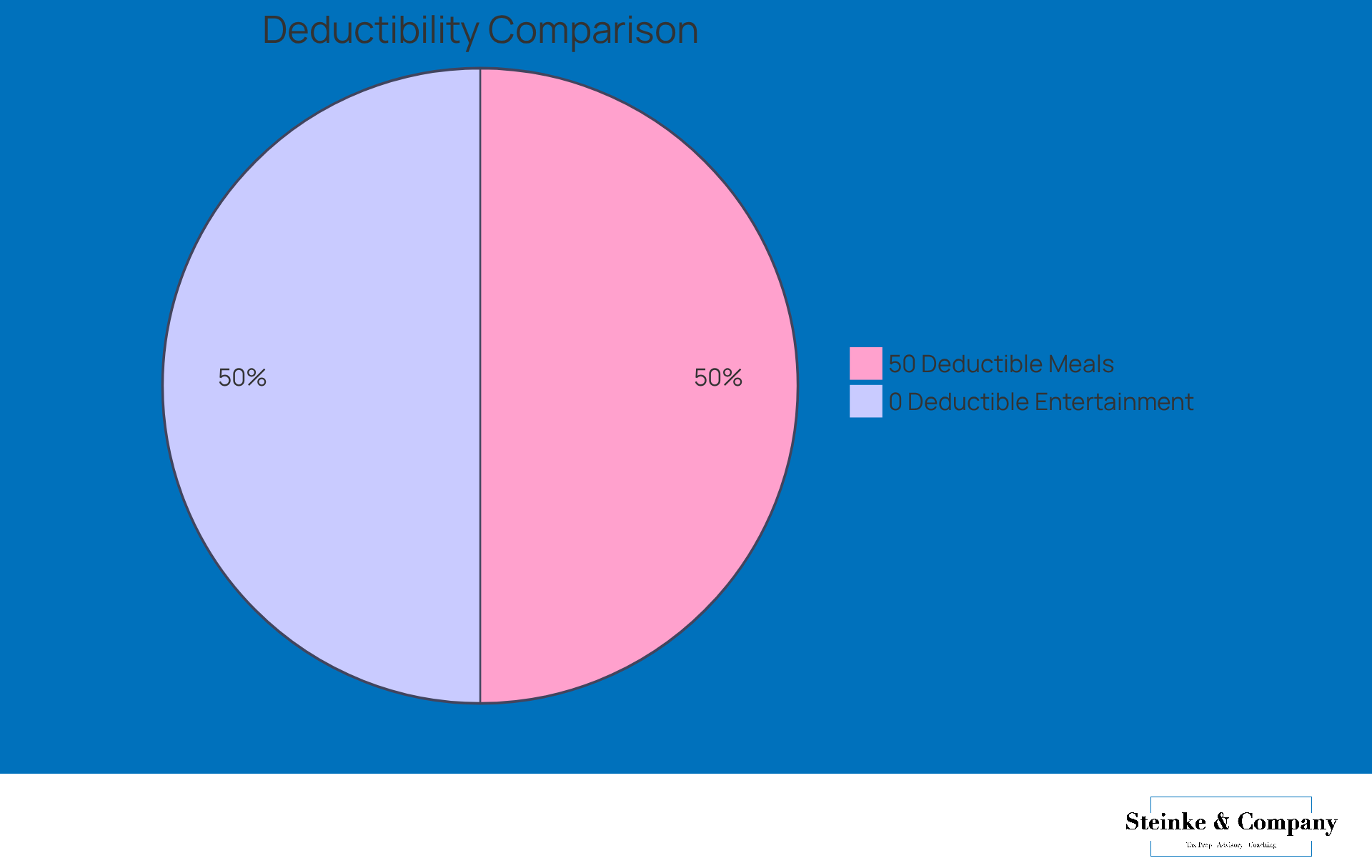

Meals and Entertainment: Understanding Deductible Business Expenses

When it comes to meals and entertainment, did you know that companies can usually deduct 50% of the expenses they rack up? This covers everything from meals with clients to staff parties and other business-related fun. But here’s the catch: to snag that deduction, the costs need to be directly tied to running your business. So, keeping good records is key—think receipts and notes about the purpose of each meal or entertainment expense.

Looking ahead to 2025, while meals will still be 50% deductible, entertainment costs will sadly be off the table. Small businesses often report an average of around $2,000 in small business tax write offs for meal expenses each year, which really highlights the potential savings available. There are plenty of success stories out there of businesses that have nailed their small business tax write offs on meals by ensuring their documentation is spot-on and meets IRS guidelines, maximizing those tax benefits.

If you’re looking to manage these deductions effectively, chatting with a tax expert can provide some valuable insights. After all, who wouldn’t want to make the most of their deductions while enjoying a nice meal with clients or colleagues?

Advertising Costs: Writing Off Your Marketing Expenses

Hey there! Did you know that small business tax write offs can be applied to costs related to advertising and marketing? This includes fees for online ads, print media, and promotional materials. It’s a game changer for companies looking to grow their customer base. For example, if you drop $1,000 on a digital marketing campaign, you can consider that expense as one of your small business tax write offs, allowing you to fully deduct it from your taxable income. Pretty neat, right?

Now, keeping track of all those advertising expenses is super important. You’ll want to have solid records to back up your claims when tax season rolls around. Plus, it’s crucial for small business owners to keep an eye on their small business tax write offs and tax obligations throughout the year. Nobody wants to deal with underpayment penalties from the IRS! By making sure estimated tax payments are made on time and meeting safe harbor criteria, businesses can dodge those costly penalties that come from underpayment.

Understanding these strategies not only helps with tax compliance but also encourages better financial planning as you navigate the sometimes tricky world of tax obligations. So, why not take a moment to reflect on your own tax practices? It could really pay off in the long run!

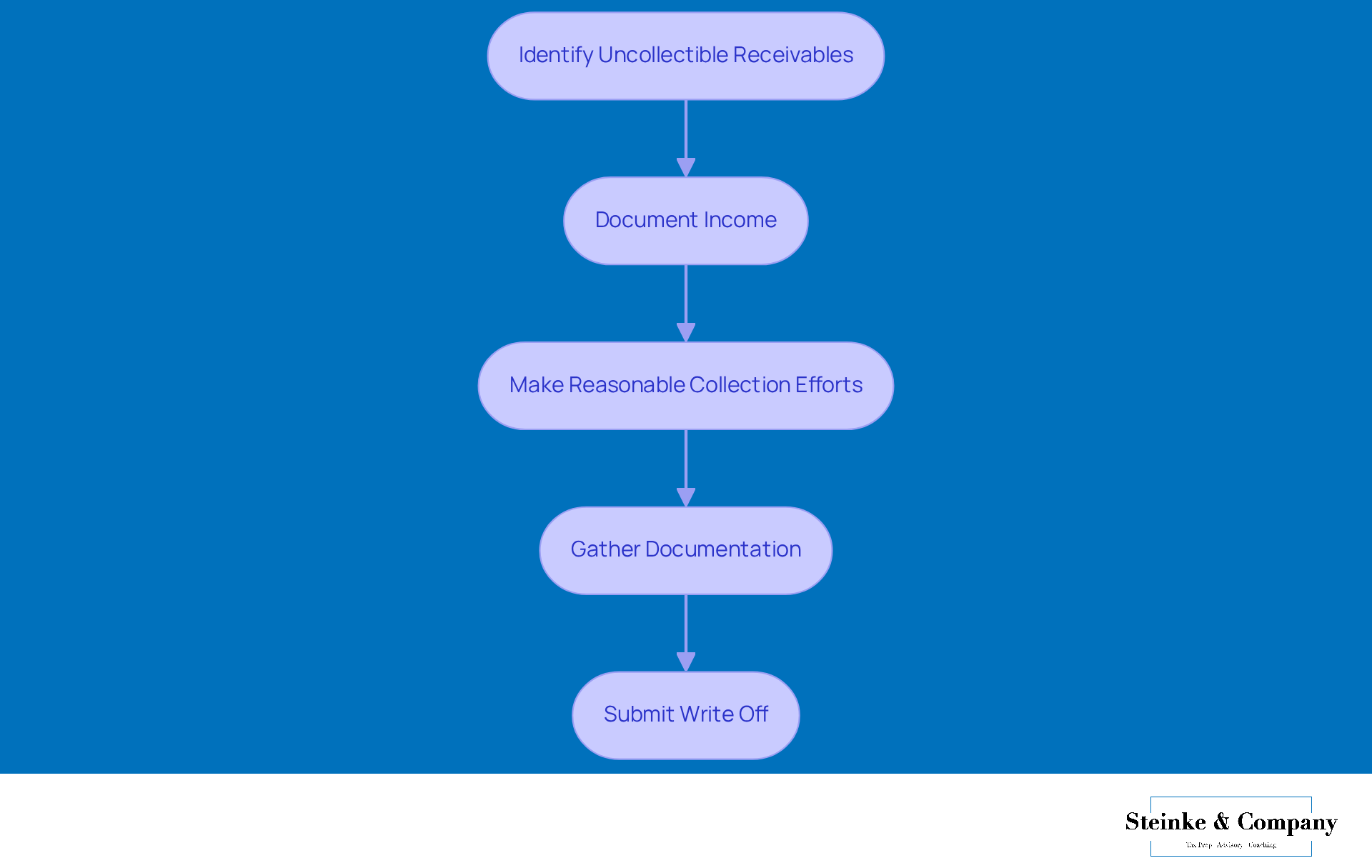

Bad Debts: How to Write Off Uncollectible Receivables

If your company is having trouble collecting payment from a client, you might be able to write off that amount as a bad debt. To qualify, you need to have previously included that amount in your income. For instance, let’s say a client owes you $500, and you figure it’s uncollectible. You can deduct that amount from your taxable income. Just remember, you’ll need proper documentation, like invoices and any correspondence with the client, to back up your claim. Plus, it’s important to show that you made reasonable efforts to recover the debt—this is key to the whole process.

Did you know that about 30% of small businesses face uncollectible receivables? This really highlights the importance of understanding small business tax write offs for effective tax compliance and financial management. Take, for example, a small agency that successfully claimed a bad debt deduction after documenting their attempts to collect a $1,000 invoice from a client who ended up declaring bankruptcy. Not only did this reduce their taxable income, but it also gave them a financial cushion during a tough time.

And here’s a tip: if you ever find yourself facing an IRS audit, having well-organized records of your income and collection efforts can make everything a lot smoother. The IRS will want proof of your claims, and keeping thorough documentation will help you navigate any inquiries. By ensuring that debts are recorded as income and that you can show reasonable collection efforts, small business tax write offs can help businesses tackle the complexities of tax compliance while also improving their cash flow. So, keep those records in check—it’ll pay off!

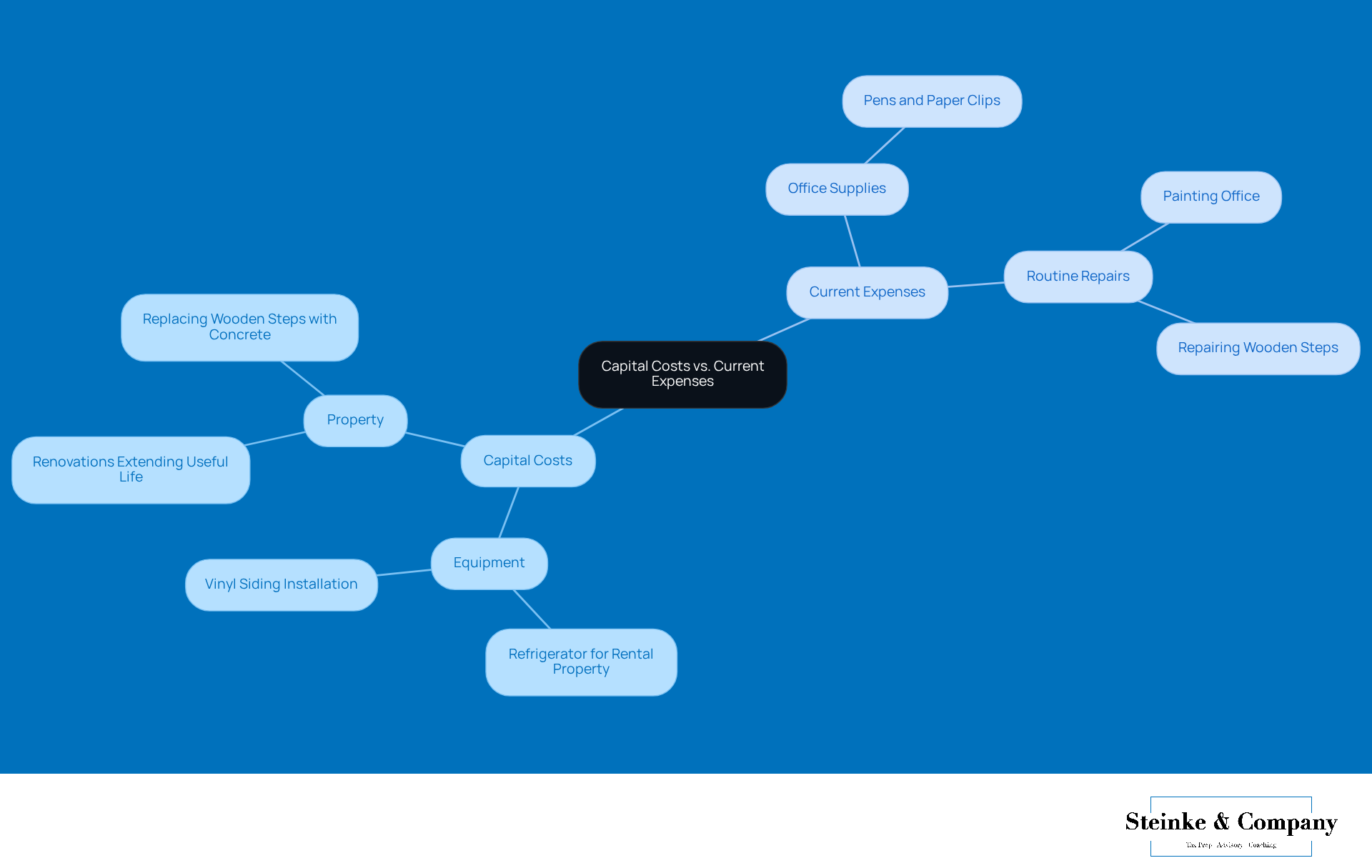

Capital Costs vs. Current Expenses: Navigating Tax Write-Offs

Understanding the difference between capital costs and ongoing costs is super important for managing your taxes effectively. Capital costs, like those investments you make in equipment or property, bring long-term benefits and usually get depreciated over several years. For example, if you buy a refrigerator for a rental property, that’s a capital cost because it has lasting value.

Now, current costs, such as office supplies or routine repairs, can be deducted in the year you spend on them, giving you immediate tax relief. Think about the cost of painting an office—it’s considered a current expense since it doesn’t enhance the property beyond its original state.

Getting these costs classified correctly not only boosts your small business tax write offs but also ensures compliance with tax laws, which is great for your business's financial health. The IRS has recently highlighted how crucial accurate classification is for small business tax write offs, because getting it wrong can mean missing out on valuable deductions.

Have you thought about chatting with tax specialists? They can provide great insights on managing these classifications effectively, helping small businesses like yours optimize their small business tax write offs.

Business Meals and Entertainment: Key Tax Write-Offs

When it comes to business meals and entertainment, you’ll typically find that these costs are deductible at 50%. But guess what? There are some exceptions that can really boost this benefit! For instance, meals served during professional meetings or events that are mainly about getting down to business can actually qualify for full deductibility. To make the most of these allowances, it’s super important to keep accurate records. This means holding on to receipts and any documentation that explains the purpose of each meal or entertainment expense.

Tax consultants often emphasize that it's crucial to show why these costs were incurred, not just for compliance, but also to maximize your tax benefits. For small businesses, meal costs can vary quite a bit, but many owners report that small business tax write offs allow them to deduct significant amounts, which really help with overall tax savings. By understanding the ins and outs of these allowances, entrepreneurs can effectively manage their tax obligations while enjoying the perks of networking and connecting with clients. So, why not dive in and explore how you can make the most of these opportunities?

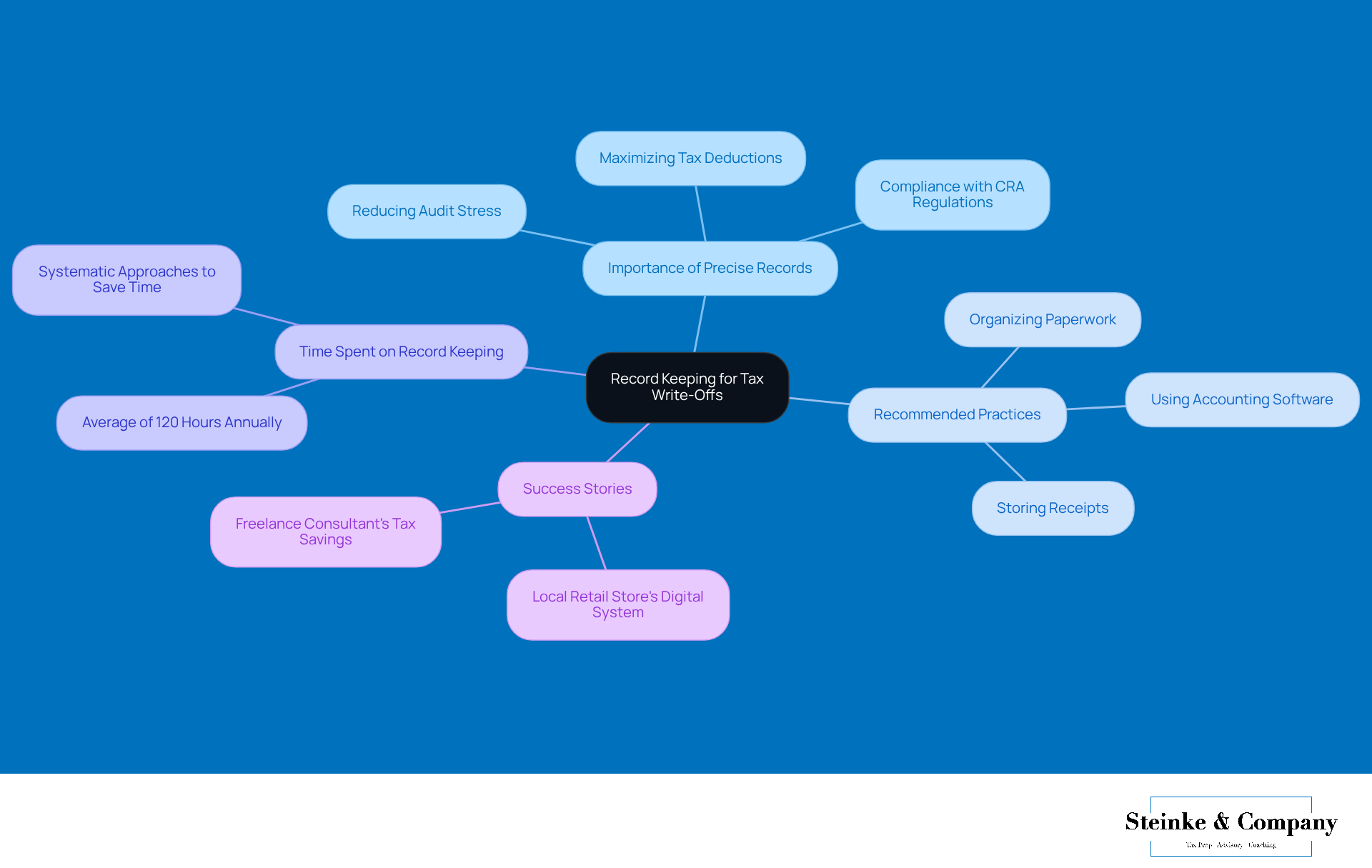

Record Keeping: Essential for Claiming Tax Write-Offs

Keeping precise records is super important for small businesses that want to maximize their small business tax write offs. This means you need to stay on top of your receipts, invoices, and any other paperwork that backs up your deductions. The Canada Revenue Agency (CRA) suggests hanging onto these records for at least six years after the tax year they belong to. Trust me, having a systematic approach to record-keeping can really lighten the load when tax season rolls around or during audits. Using accounting software or organizing your paper documents into clearly labeled folders can make this whole process a breeze.

Did you know that small businesses typically spend around 120 hours each year just on record-keeping? That really shows how crucial it is to have effective systems in place. As Tiffany Johnson once said, 'Accounting is the cornerstone of the corporate realm,' which perfectly captures how vital accurate financial documentation is.

There are plenty of examples of small businesses that have nailed their tax records, leading to smoother audits and maximizing small business tax write offs. Take, for instance, a local retail store that started using a digital receipt management system. They saw improved accuracy and cut down the time they spent preparing for taxes. By focusing on meticulous record-keeping, small businesses can not only comply with tax regulations but also maximize their small business tax write offs to enhance their financial health. So, why not start prioritizing your record-keeping today?

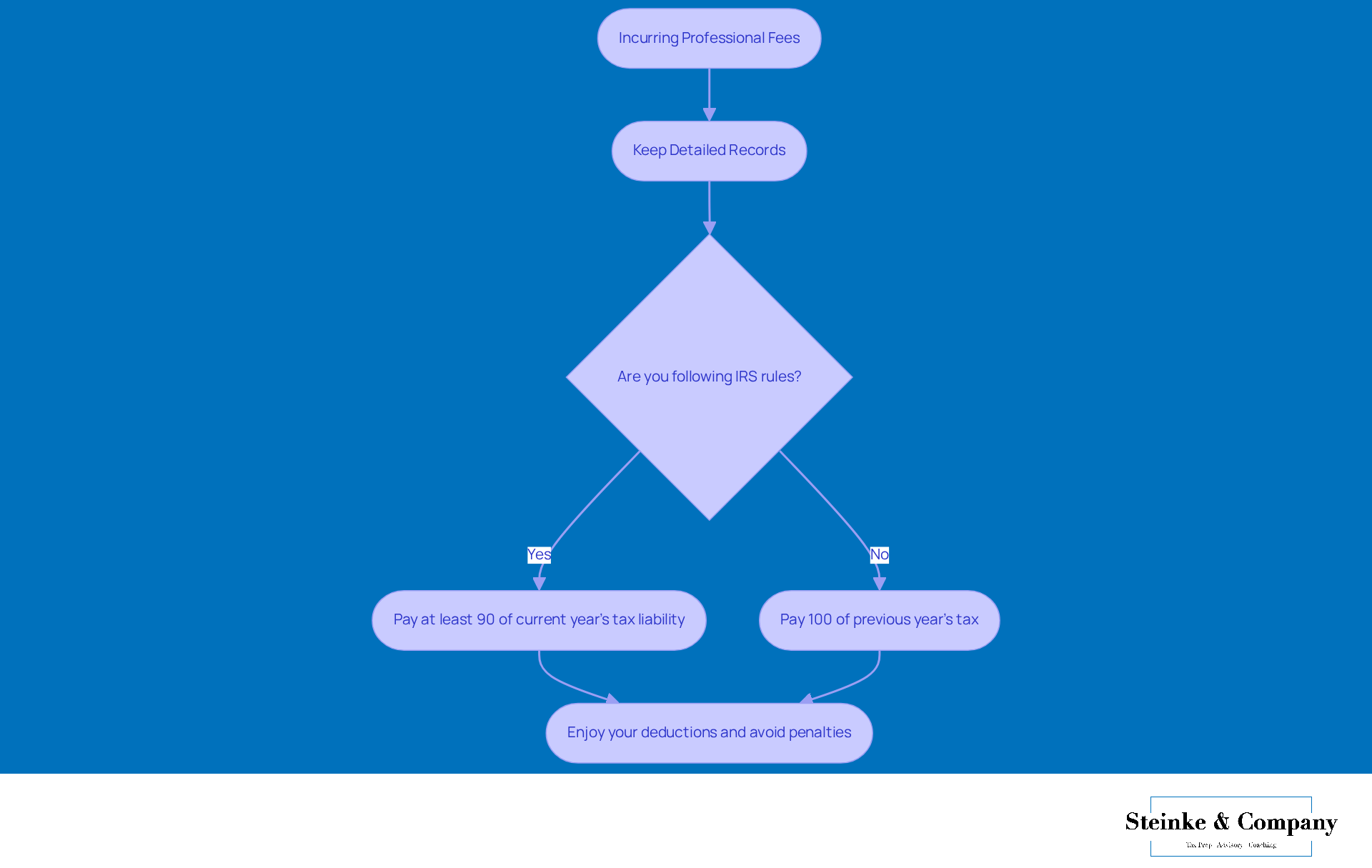

Professional Fees: Writing Off Costs for Expert Services

Hey there, small business owners! Did you know that small business tax write offs can help you benefit from deducting fees for professional services like legal, accounting, and consulting costs? These expenses are super important for keeping everything running smoothly and compliant. For example, if you hire an accountant to tackle your taxes and shell out $1,500, guess what? You can deduct that entire amount from your taxable income, which helps lower your overall tax bill. How great is that?

Now, here's a tip: it's crucial to keep detailed records of these costs. Why? Because having solid documentation is key when it comes to supporting your claims during tax season. The IRS allows you to subtract necessary expenses incurred for professional services, so precise record-keeping is a must. As one savvy accountant put it, "Small business tax write offs for consulting costs are a smart move for small businesses looking to boost their financial health and compliance."

But it doesn’t stop there! Small business owners should also take charge of understanding and managing their tax obligations to avoid those pesky underpayment penalties. The IRS has some rules that you need to follow:

- You must pay at least 90% of your current year's tax liability

- Or 100% of the tax shown on your return from the previous year

By planning ahead and making timely payments, you can dodge unnecessary financial stress and penalties. Investing in expert services and staying compliant not only saves you money but also sets you up for success in today’s competitive market. So, are you ready to take the plunge and make the most of these deductions?

Conclusion

Maximizing small business tax write-offs is key to boosting your financial health and staying compliant with tax regulations. When you understand and leverage various deductions, you can really trim down your taxable income, which can lead to better cash flow and growth opportunities. This article has pointed out some crucial areas where you can claim deductions—from home office expenses to professional fees—showing just how important informed tax planning is.

So, what are the takeaways? First off, keeping accurate records is a must to back up your claims. Plus, consulting with tax experts can really pay off. Think about it: using write-offs for expenses like advertising, meals, and automobile costs not only helps reduce your tax liabilities but also encourages smarter financial habits. And let’s not forget, the IRS guidelines are always changing, so it’s super important to stay updated and seek expert advice when needed.

In the end, small business tax write-offs aren’t just about saving a few bucks; they’re a chance to build a sustainable business model. By embracing these deductions and putting effective record-keeping practices into place, you can navigate the tricky waters of tax compliance while maximizing your financial potential. Taking the time to understand these strategies and chatting with experts can really set you up for long-term success in today’s competitive landscape. So, why not start exploring these opportunities today?

Frequently Asked Questions

What services does Steinke and Company provide for small businesses?

Steinke and Company offers expert tax compliance services, including personalized tax planning, compliance audits, and guidance on new reporting requirements, specifically tailored for micro and small businesses.

How can effective tax compliance benefit small businesses?

Effective tax compliance can boost operational efficiency and contribute significantly to overall success by helping businesses reduce tax liabilities and avoid penalties.

What are home office expenses, and how can they be deducted?

Home office expenses include a portion of household costs like rent or mortgage interest, utilities, and internet bills that can be deducted if the home office is used exclusively for business. The deduction can be calculated using either a simplified approach or a regular approach.

What are the two methods for calculating home office deductions?

The simplified approach allows a deduction of $5 per square foot of home office space, up to 300 square feet (totaling $1,500). The regular approach requires calculating the percentage of the home used for business, including indirect costs.

What recent IRS guidelines should small business owners be aware of regarding home office deductions?

Recent IRS guidelines emphasize that the home office must be used exclusively for business purposes to qualify for deductions, and keeping accurate records of expenses is essential for substantiating claims in case of an audit.

What automobile expenses can be claimed as small business tax write offs?

Small business tax write offs for automobile expenses can include fuel, maintenance, insurance, and lease payments when the vehicle is used for business purposes.

What are the two options for claiming automobile expenses?

Business owners can either track all actual vehicle costs or use the standard mileage rate, which is simpler. For 2025, the standard mileage rate is set at 70 cents per mile.

Why is it important to keep a detailed log of professional mileage?

Keeping a detailed log of professional mileage is crucial to back up claims for deductions and ensure compliance with tax regulations.