Introduction

Effective bookkeeping is the backbone of any successful business, right? Yet, many small and rural enterprises find themselves tangled in the complexities of financial management. In this article, we’re diving into ten essential steps for a thorough bookkeeping cleanup. These insights can really help transform financial chaos into clarity.

So, how can small business owners streamline their financial processes while boosting profitability and compliance? Well, you’re in luck! This guide is packed with actionable strategies to tackle these challenges head-on, allowing entrepreneurs to focus on what they do best - growing their businesses. Let’s get started!

Steinke and Company: Tailored Bookkeeping Cleanup for Rural Businesses

Steinke and Company is all about helping small and micro businesses in rural America with their bookkeeping cleanup. We know these businesses face unique challenges, like seasonal ups and downs and limited resources, which can make managing finances a real headache. That’s where we come in! By offering tailored solutions, we help our clients keep their records straight while staying true to what matters most to them.

Our approach combines accurate accounting with smart guidance, giving rural entrepreneurs the freedom to focus on growing their businesses without the stress of financial mismanagement. And let me tell you, the impact of effective bookkeeping cleanup is huge! Not only does bookkeeping cleanup boost financial accuracy, but it also contributes to increased profitability, allowing these businesses to thrive in their communities.

So, if you’re a small business owner feeling overwhelmed by your books, why not reach out? Let’s chat about how we can help you get back on track and focus on what you do best!

Reconcile All Accounts: Ensure Accuracy in Your Financial Records

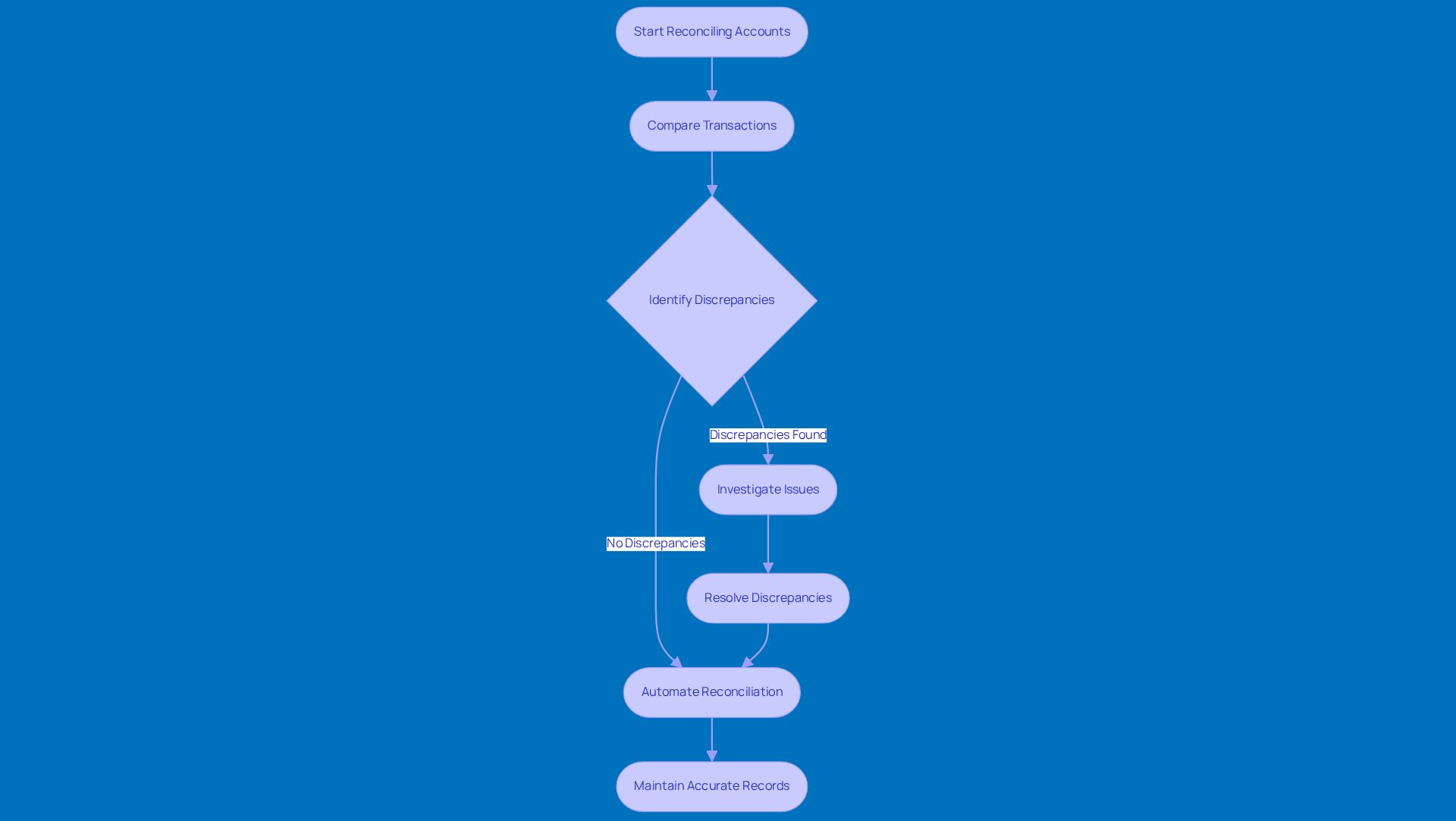

Let’s kick things off by reconciling all your bank and credit card accounts. This step is super important to make sure your records match up with your bank statements. It’s all about carefully comparing the transactions you’ve logged in your accounting software with what’s on your bank statements. If you spot any discrepancies, don’t just brush them off - investigate and resolve them right away! Regular reconciliation not only keeps your records accurate but also acts like an early warning system for any potential fraud or errors. Did you know that companies that reconcile regularly can catch fraudulent activities up to 12 months sooner?

Now, here’s something interesting: about 85% of finance professionals say that automation really cuts down on the administrative hassle during month-end processes. This means you can enjoy greater accuracy and efficiency! Plus, studies show that companies using automated reconciliation see a whopping 95% reduction in errors. That really highlights how crucial bookkeeping cleanup is for effective bookkeeping. By keeping all your monetary records precise and up-to-date, you’re setting yourself up for informed decision-making and sustainable growth. So, why not get started on this essential task today?

Categorize All Transactions: Streamline Your Financial Management

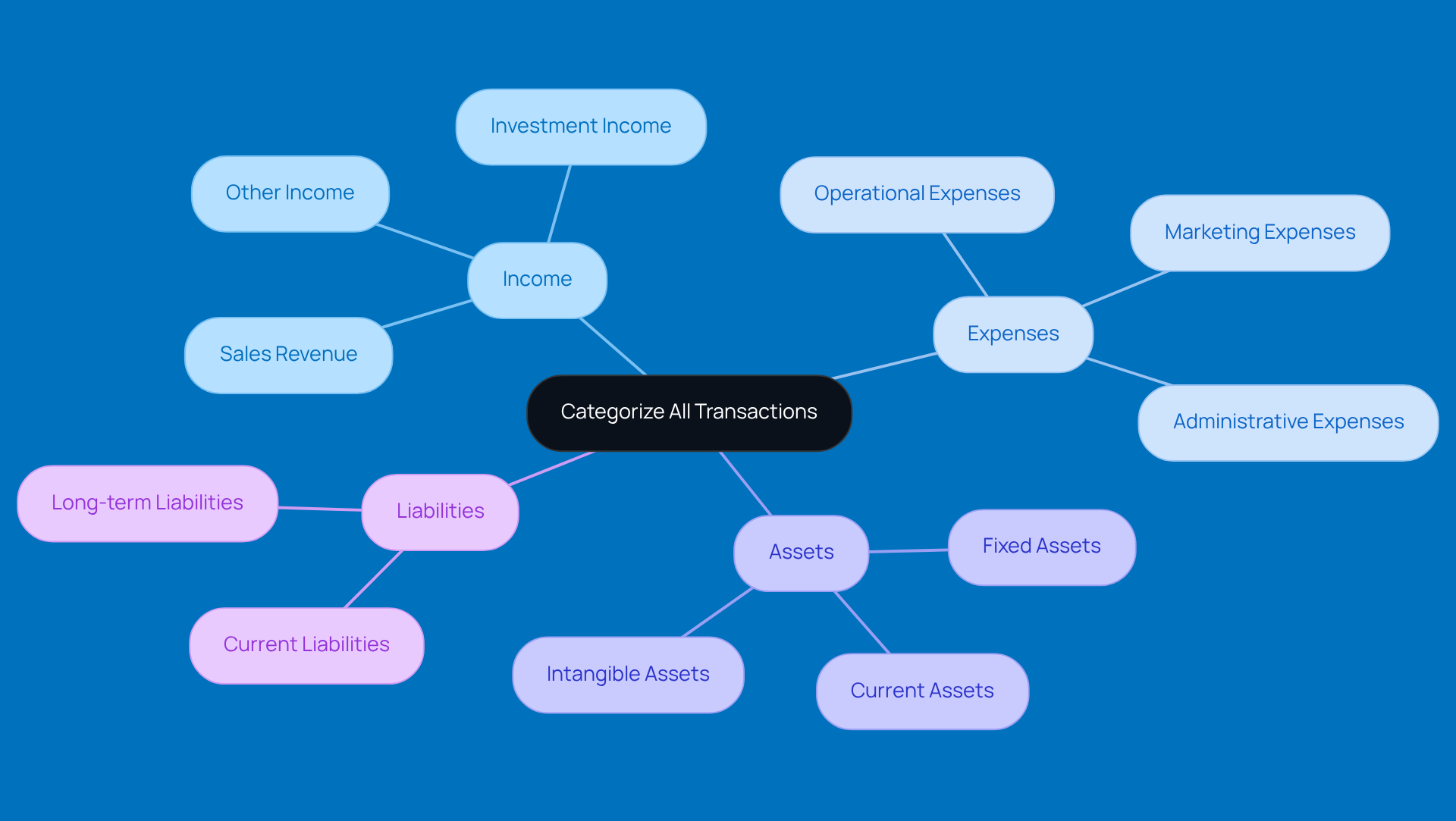

Once you’ve reconciled your accounts, a bookkeeping cleanup is needed to categorize all those transactions. Think of it like sorting your laundry - everything goes into its right place! You’ll want to break them down into categories like:

- Income

- Expenses

- Assets

- Liabilities

This little organization trick not only helps you whip up accurate financial reports but also contributes to a bookkeeping cleanup that gives you a peek into your spending habits.

Now, here’s a tip: if you can, use accounting software to automate this process. It’s like having a personal assistant who makes sure every transaction is consistently categorized. This way, you’ll find reporting and analysis a whole lot easier. Plus, who doesn’t love a little help to keep things running smoothly?

Review Accounts Receivable: Optimize Cash Flow Management

Take a good look at your accounts receivable to spot those overdue invoices. Did you know that nearly 56% of small businesses are waiting on an average of $17,000 because of unpaid bills? It’s a big deal! So, why not set up a follow-up process for collections? You could send friendly reminders or even offer early payment discounts. This little nudge can encourage clients to pay up sooner, which is great for your cash flow.

Understanding your cash flow situation is super important. Companies that have longer payment terms are:

- 1.6 times more likely to struggle with hiring

- 1.4 times more likely to run into cash flow issues

By using these strategies, you can make smarter choices about spending and investments. This way, your business can stay financially stable and bounce back from any challenges that come your way. So, what do you think? Are you ready to take control of your cash flow?

Review Accounts Payable: Maintain Healthy Supplier Relationships

Take a moment to review your accounts payable. It’s super important to make sure all invoices are accurately recorded and lined up for payment. You’ll want to prioritize these payments based on their due dates, and don’t forget to grab those early payment discounts from your suppliers when you can!

Building strong relationships with your suppliers is key. It helps you negotiate better terms and ensures you have a reliable supply of goods and services. Doug Roginson, the Head of Supplier Relationship Oversight at JPMorganChase, puts it nicely: 'Supplier relationship oversight is the process of strategically engaging a company’s most important suppliers and service providers with utmost care to maximize long-term value and deliver mutual success.'

Nurturing these connections can lead to better collaboration and shared growth, which is especially crucial for small businesses trying to thrive in competitive environments. Plus, effective accounts payable oversight doesn’t just streamline your operations; it builds trust and reliability with your suppliers, which is a big win for your business.

Did you know that 89% of companies keep tabs on how accounts payable pays their suppliers? This really highlights how important it is to manage these relationships diligently!

Update Asset & Depreciation Records: Ensure Accurate Financial Reporting

Hey there! It’s super important to regularly check in on your asset records. You want to make sure that every acquisition and disposal is documented accurately. This isn’t just about keeping the accountants happy; it’s also a key part of smart tax planning. Did you know that how you calculate depreciation - whether you go for straight-line or declining balance methods - can really impact your taxable income?

In fact, a whopping 43% of small businesses struggle with tracking their assets effectively. Many are still using outdated methods like spreadsheets, which can be a real headache. But here’s the good news: by adopting solid asset oversight practices, you can boost your financial accuracy and sharpen your tax strategies. Tax pros often stress that keeping precise asset records is crucial for minimizing tax liabilities and maximizing deductions.

So, what are some successful strategies for keeping those records in check? Think about:

- Using specialized software

- Conducting regular audits

- Training your staff on best practices

These steps not only make financial reporting smoother but also lead to better decision-making and resource allocation.

So, why not take a moment to reflect on your own asset tracking methods? Are there areas where you could improve? Let’s make sure you’re set up for success!

![]()

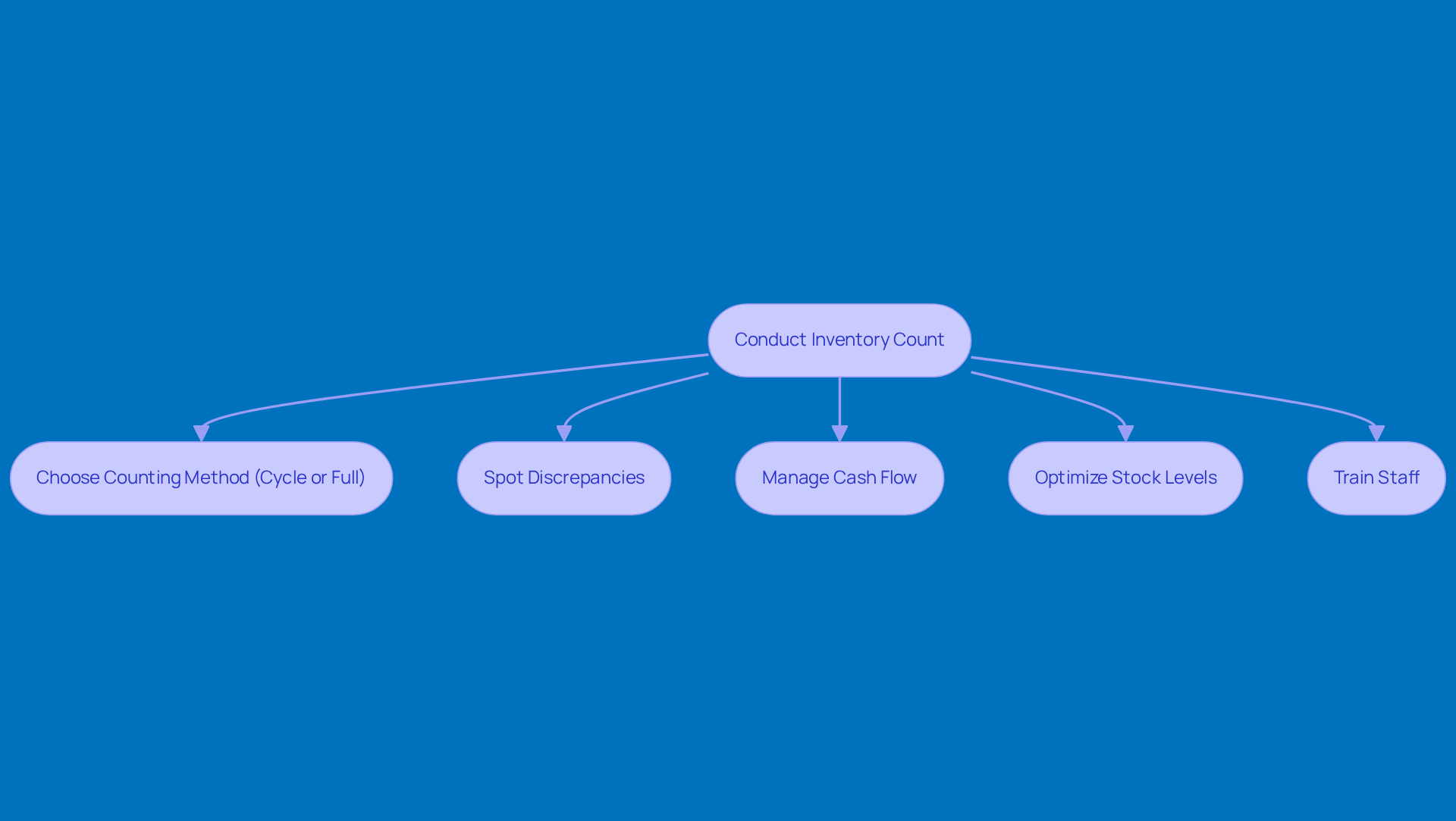

Conduct an Inventory Count: Maintain Accurate Stock Levels

Counting your inventory isn’t just a chore; it’s a game changer for keeping your stock in check and your business thriving. Whether you go for cycle counting or a full inventory count, this process helps you spot any discrepancies by comparing results with your existing records. And let’s be honest, knowing exactly what you have on hand is crucial for managing your cash flow effectively. Accurate counts mean you can meet customer demand without overcommitting resources, which can really strain your finances.

For small businesses, especially those in rural areas, nailing down effective inventory counting methods is key. Regular counts can lead to smarter purchasing decisions and better cash flow management. They help you spot trends and optimize your stock levels. As industry experts say, "Effective inventory oversight is the backbone of eCommerce success, directly impacting profits and customer satisfaction." Did you know that companies using automated inventory systems can cut down on stockouts by 30%? And those using demand forecasting tools often see a 10-15% drop in overall inventory levels, making it easier to fulfill customer orders on time.

Now, let’s talk about planning for those inventory counts. Organizing your stock areas and picking a date when things are quiet can really smooth out the counting process. Plus, training your staff on counting techniques ensures everyone’s on the same page, boosting accuracy and consistency.

In a nutshell, prioritizing precise inventory practices isn’t just about keeping tabs on stock; it’s about setting your business up for long-term success and growth. So, what are you waiting for? Let’s get counting!

Review Payroll & Contractor Payments: Ensure Compliance and Accuracy

Take a moment to review your payroll records. It’s super important to make sure all your employees and contractors are getting paid accurately and on time. Don’t forget about those tax withholdings - getting them right is crucial for staying compliant with labor laws. Regularly checking your payroll processes can really help; it’s a great way to spot any discrepancies and keep your business in line with regulations.

Did you know that 54% of U.S. employees face payroll issues? That’s why having a proactive strategy for payroll oversight is key. One handy tip is to set up a compliance calendar. This can help you keep track of important deadlines for tax deposits and filings, which can save you from penalties that can jump from 2% to 15% if you’re late. Plus, keeping the lines of communication open with your employees about timekeeping and pay transparency can build trust and improve accuracy in your payroll processes.

HR professionals often emphasize the importance of accurate contractor payments. It’s fundamental for compliance and helps avoid costly mistakes. And let’s not forget about paystubs! Understanding the details - like wages, taxes, and deductions - is essential for both employees and employers to ensure everything’s correct.

Interestingly, 62% of payroll experts believe that automation can really help reduce compliance risks. So, it might be worth considering automated solutions for your payroll operations. By focusing on these strategies, rural agencies can tackle the complexities of payroll management effectively, optimize tax compliance, and minimize the risk of underpayment penalties.

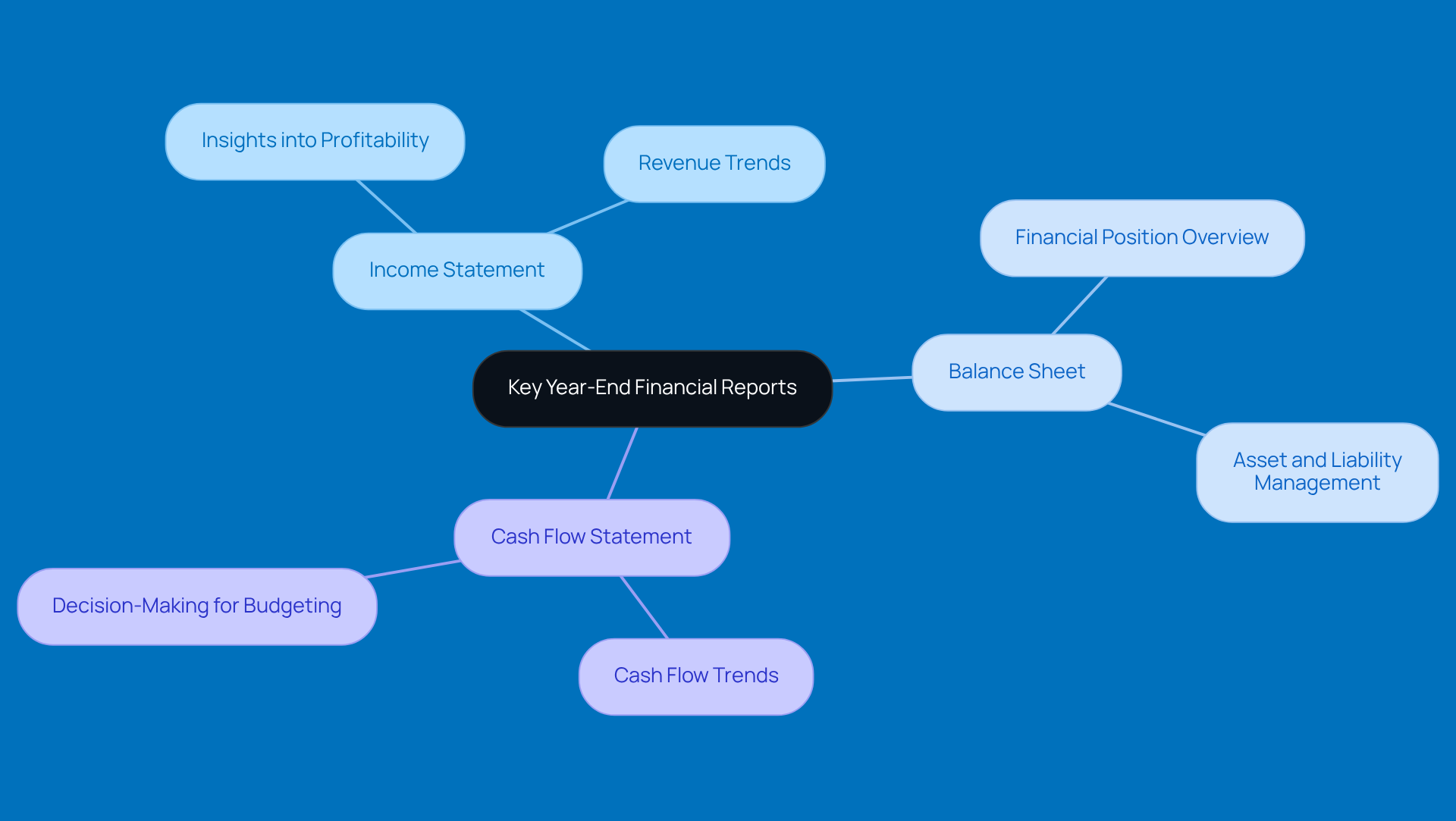

Run Key Year-End Reports: Gain Insights into Financial Health

As the year wraps up, it’s super important to whip up those key financial reports - think income statement, balance sheet, and cash flow statement. Taking a good look at these reports gives you some serious insights into how your organization is doing financially, its profitability, and those cash flow trends. This isn’t just a box to check off; it’s crucial for making smart decisions about budgeting, investments, and planning for the year ahead.

Financial analysts often point out that really understanding these reports can make a huge difference for small businesses when it comes to facing challenges and seizing opportunities. Did you know that nearly 22% of small businesses don’t make it past their first year? A lot of that comes down to cash flow issues and not enough demand for what they’re selling. By regularly checking in on your financial health through these key reports, you can tackle potential pitfalls head-on and boost your chances for long-term success.

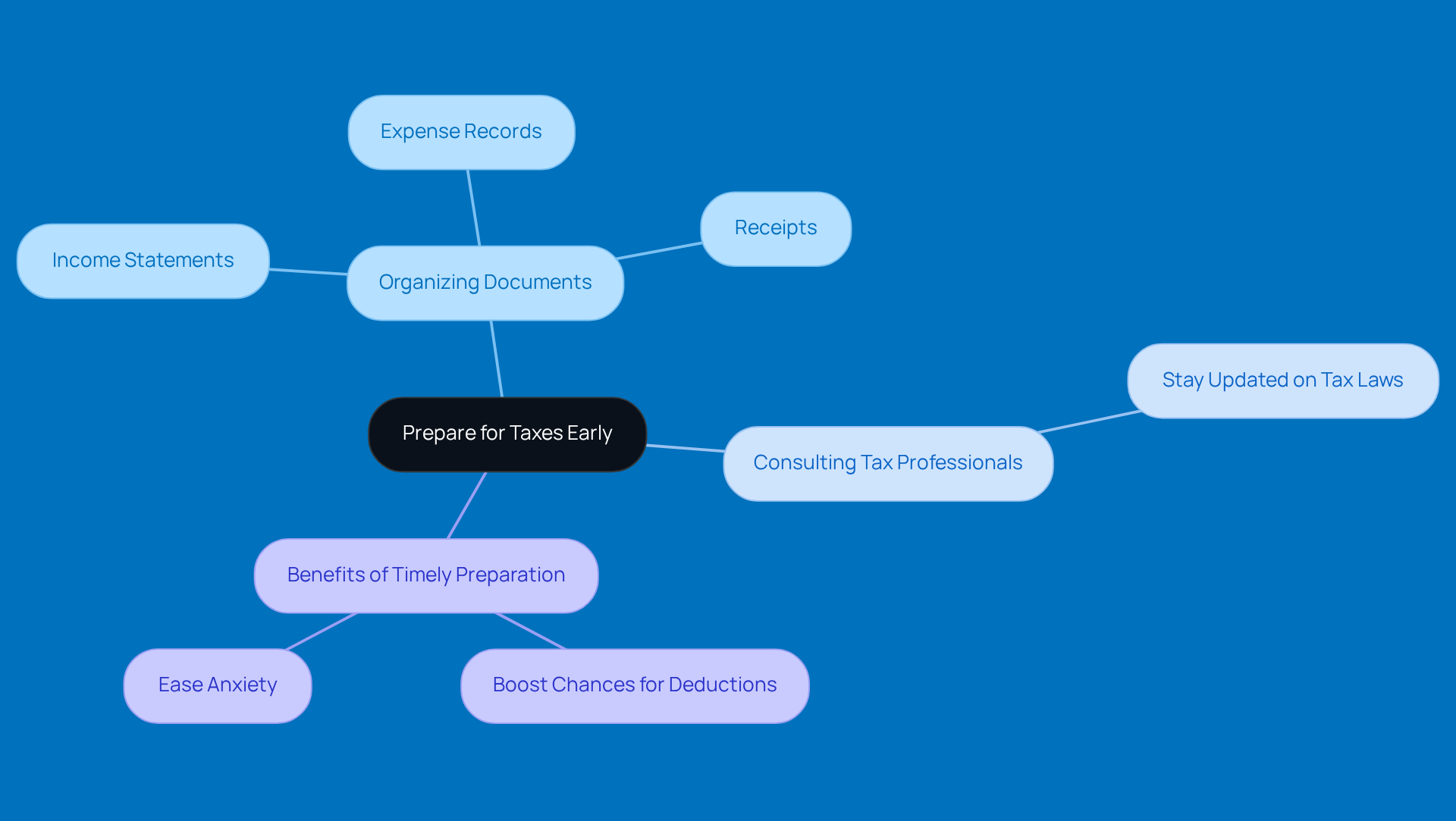

Prepare for Taxes Early: Avoid Last-Minute Stress and Ensure Compliance

Getting ready for tax season? It’s a good idea to start organizing your essential documents well ahead of time. Think income statements, expense records, and those pesky receipts. And hey, don’t forget to chat with a tax professional early on! They can keep you in the loop about any changes in tax laws that might affect your business.

Timely preparation isn’t just about avoiding stress; it can actually boost your chances for deductions, leading to better financial outcomes. Tax experts often say that steering clear of last-minute scrambles can really help with compliance and ease anxiety during this hectic time.

So, why not implement some smart strategies for organizing your documents and planning your taxes? This way, tax season can shift from being a source of stress to an opportunity for financial clarity and growth. Sounds good, right?

Conclusion

Effective bookkeeping cleanup isn’t just another task on your to-do list; it’s a crucial process that helps small and rural businesses stay financially healthy and grow. By following the essential steps we’ve laid out here, you can make sure your financial records are accurate, organized, and ready for those big decisions. Just look at how Steinke and Company tailors their bookkeeping solutions to tackle the unique challenges rural entrepreneurs face, letting them focus on what really matters: their business.

Throughout this article, we’ve highlighted key strategies like:

- Reconciling accounts

- Categorizing transactions

- Reviewing accounts receivable and payable

as vital parts of a solid bookkeeping cleanup. Plus, keeping accurate asset records, conducting inventory counts, and ensuring payroll accuracy are all necessary practices for building financial stability. By adopting these steps, you’re not just boosting your operational efficiency; you’re setting yourself up for long-term success.

So, let’s wrap this up: prioritizing bookkeeping cleanup is essential if you want your business to thrive in today’s competitive landscape. By taking proactive steps to keep your financial records accurate and preparing for tax obligations, you can reduce stress and make informed decisions that drive profitability. Embracing these practices isn’t just about compliance; it’s about empowering your business to reach its full potential. And if you’re feeling a bit overwhelmed, don’t hesitate to reach out to professionals like Steinke and Company for the support you need to navigate these challenges effectively.

Frequently Asked Questions

What services does Steinke and Company offer?

Steinke and Company provides tailored bookkeeping cleanup services specifically designed for small and micro businesses in rural America.

What challenges do rural businesses face regarding bookkeeping?

Rural businesses often encounter unique challenges such as seasonal ups and downs and limited resources, making financial management difficult.

How does bookkeeping cleanup benefit rural businesses?

Bookkeeping cleanup boosts financial accuracy, contributes to increased profitability, and allows businesses to thrive within their communities.

What is the first step in effective bookkeeping cleanup?

The first step is to reconcile all bank and credit card accounts to ensure that financial records match bank statements.

Why is regular reconciliation important?

Regular reconciliation helps maintain accurate records and serves as an early warning system for potential fraud or errors.

How does automation impact the reconciliation process?

Automation significantly reduces administrative hassle during month-end processes, leading to greater accuracy and efficiency, and companies using automated reconciliation see a 95% reduction in errors.

What should be done after reconciling accounts?

After reconciling accounts, it is important to categorize all transactions into groups such as income, expenses, assets, and liabilities.

How does categorizing transactions help in bookkeeping?

Categorizing transactions helps create accurate financial reports and provides insights into spending habits.

Is there a recommended tool for categorizing transactions?

Yes, using accounting software to automate the categorization process can simplify management and ensure consistency in transaction classification.