Introduction

Navigating the tricky world of taxes can feel overwhelming for small business owners, right? With tax regulations constantly changing, it’s no wonder many entrepreneurs find themselves in a bit of a bind. That’s where small business tax consultants come in! They’re like your trusty guides, helping you craft strategies that not only cut down on tax liabilities but also boost your financial health.

And let’s not forget about the big changes coming our way, like the One Big Beautiful Bill Act. The stakes are higher than ever, and it’s crucial for small business owners to figure out how to make the most of these upcoming tax benefits. So, how can you navigate this landscape and steer clear of common pitfalls? Let’s dive in!

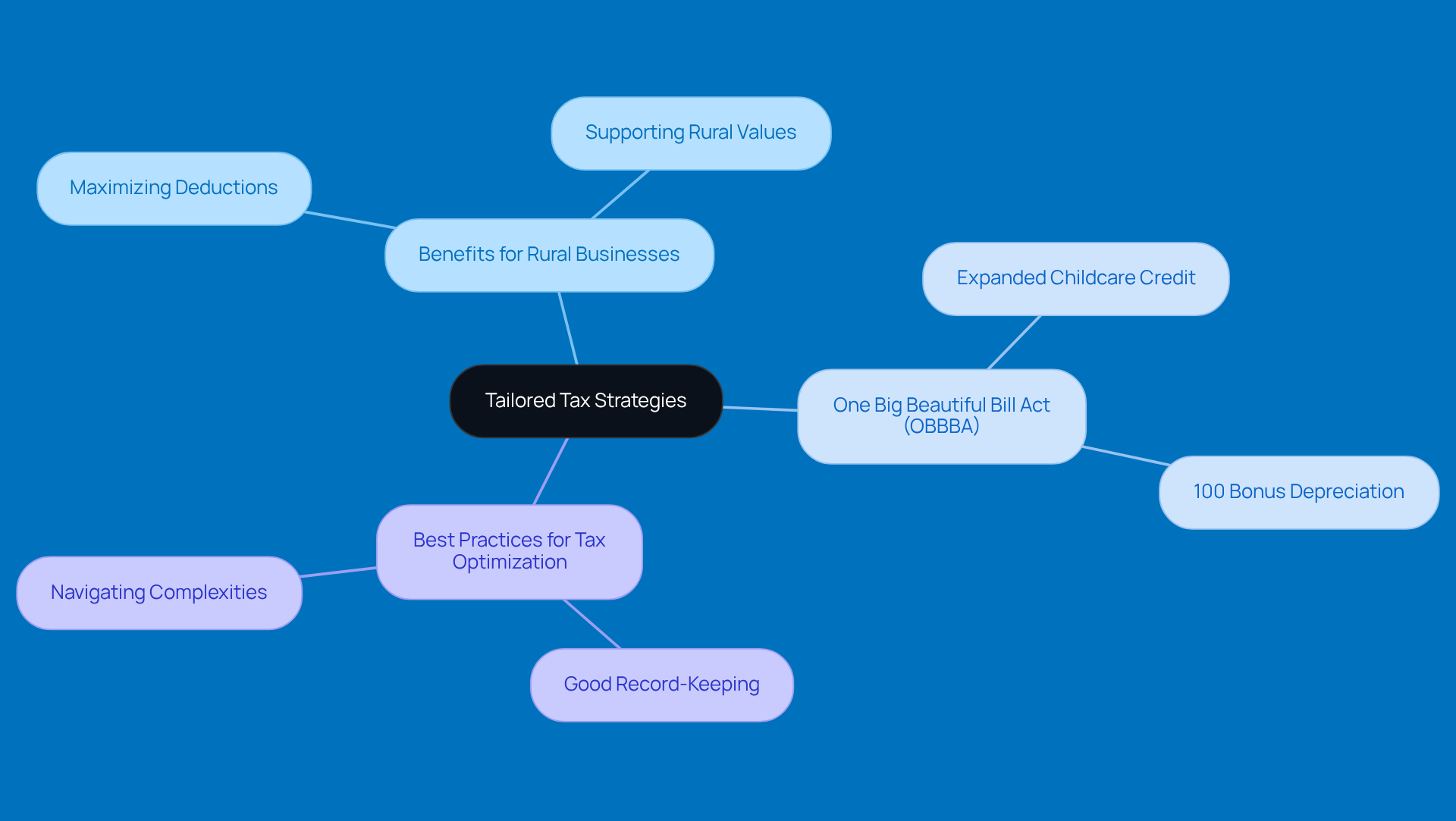

Leverage Steinke and Company's Tailored Tax Strategies

Steinke and Company is dedicated to crafting tax strategies that align with the unique needs of small business tax consultants working with small and micro businesses in rural America. By using these tailored approaches, entrepreneurs can really boost their tax situations, making sure they’re taking full advantage of all the deductions and credits out there. This personalized touch not only helps cut down on tax bills but also aligns perfectly with the values and day-to-day realities of rural enterprises, which small business tax consultants can effectively support.

Looking ahead to 2026, the One Big Beautiful Bill Act (OBBBA) is set to shake things up even more. It’s going to open the door to bigger deductions and credits, like the expanded childcare credit and the return of 100% bonus depreciation. These changes present a fantastic opportunity for rural businesses to enhance their financial health and sustainability.

For effective tax optimization, small business tax consultants highlight that keeping good records and following the rules is essential. This way, small business tax consultants can help small business owners navigate the complexities of taxes while maximizing their savings. Remember, tailored tax strategies aren’t just about ticking boxes for compliance; they’re crucial for driving growth and resilience in the rural business landscape. So, how are you planning to make the most of these opportunities?

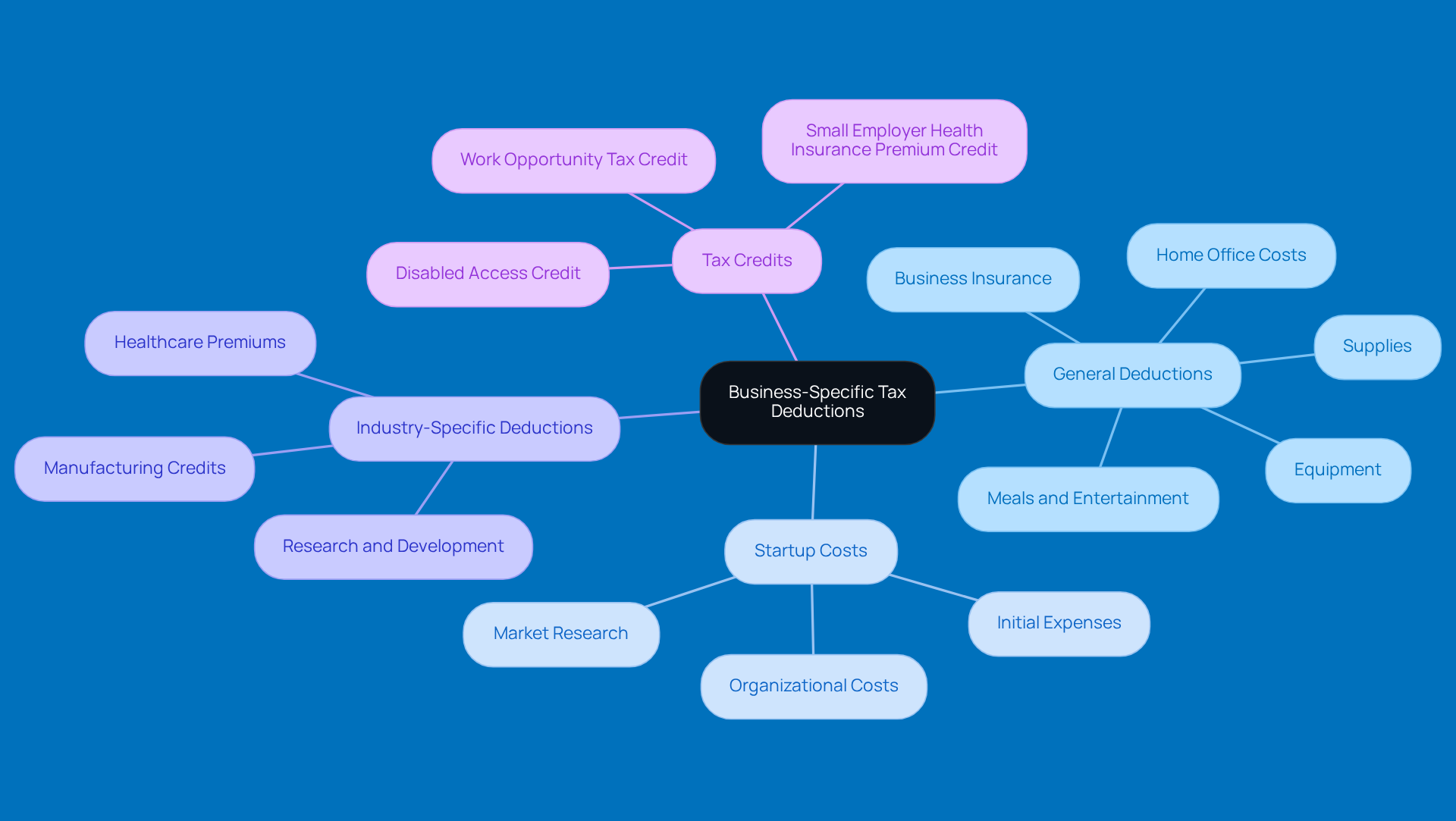

Identify and Utilize Business-Specific Tax Deductions

Hey there, small business owners! Let’s chat about something that can really help your bottom line: tax deductions. It’s super important to spot and make the most of those deductions that fit your industry. You might be surprised at what you can claim!

Think about expenses like equipment, supplies, and even your home office costs. Keeping track of these can really pay off. For instance, did you know the IRS lets you deduct startup costs? If you’re just getting started and your total expenses are under $50,000, you can write off up to $5,000 in your first year. That’s a nice little boost to help ease those early financial strains and let you focus on growing your business.

And don’t forget about industry-specific deductions! Whether it’s for research and development or buying new equipment, these can really add up and save you some serious cash. Understanding these opportunities is key to maximizing your financial efficiency and setting yourself up for long-term success. So, what deductions are you planning to take advantage of this year?

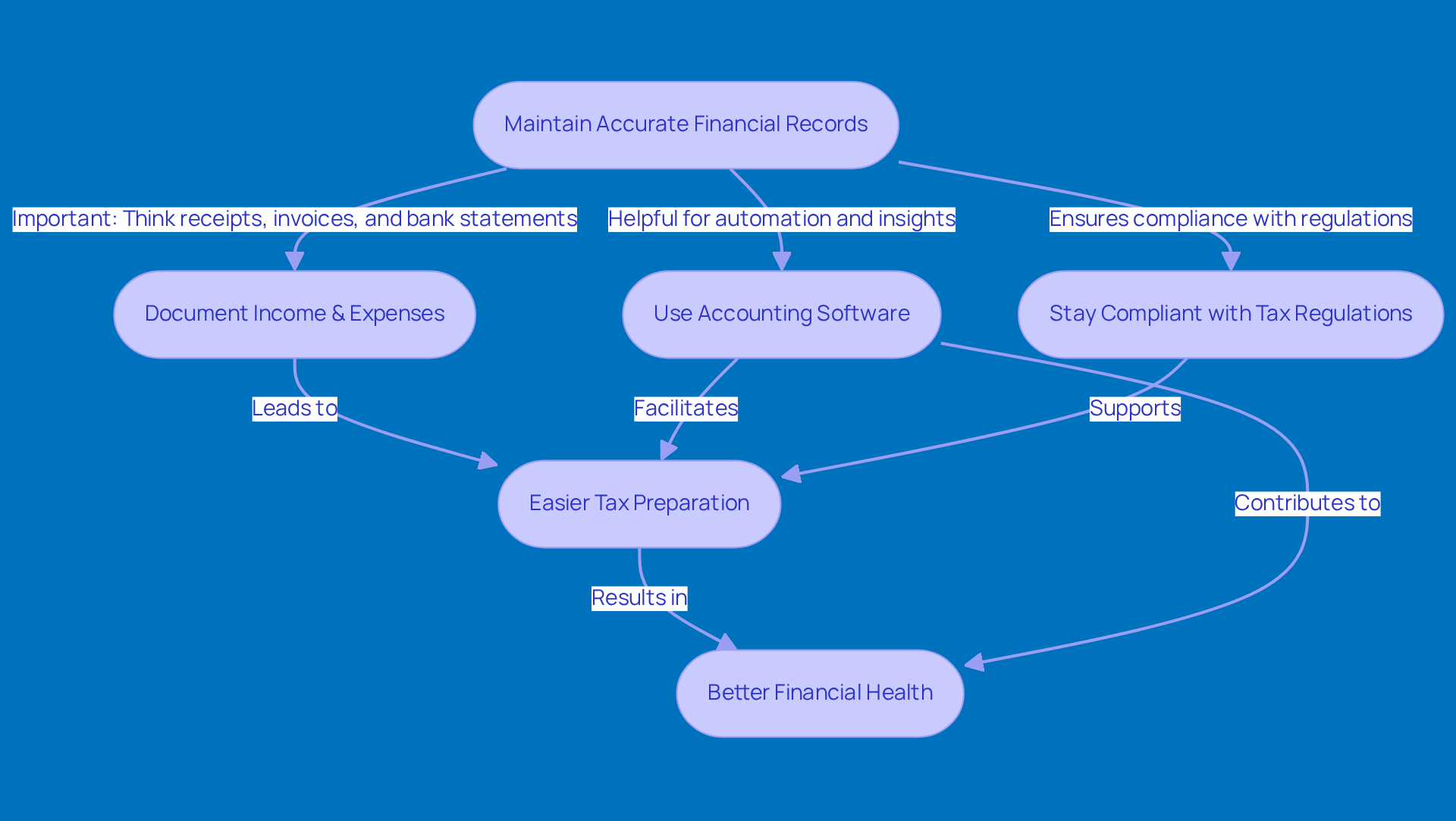

Maintain Accurate Financial Records for Effective Tax Preparation

Keeping accurate financial records is super important for getting your taxes right. As an entrepreneur, it’s a good idea to have a solid system for record-keeping. You want to make sure every bit of income and every expense is documented - think receipts, invoices, and bank statements.

Using accounting software can really make this whole process a breeze. It helps you prepare your taxes more easily and cuts down on mistakes. For example, if you’re running a rural business, there are software solutions that can automate data entry and give you real-time insights. This way, you can focus on growing your business while staying compliant with tax regulations.

By keeping your financial records organized, you’re not just making tax time easier - you’re also getting a clearer picture of your business’s financial health. So, why not take a moment to prioritize your record-keeping? It could really pay off!

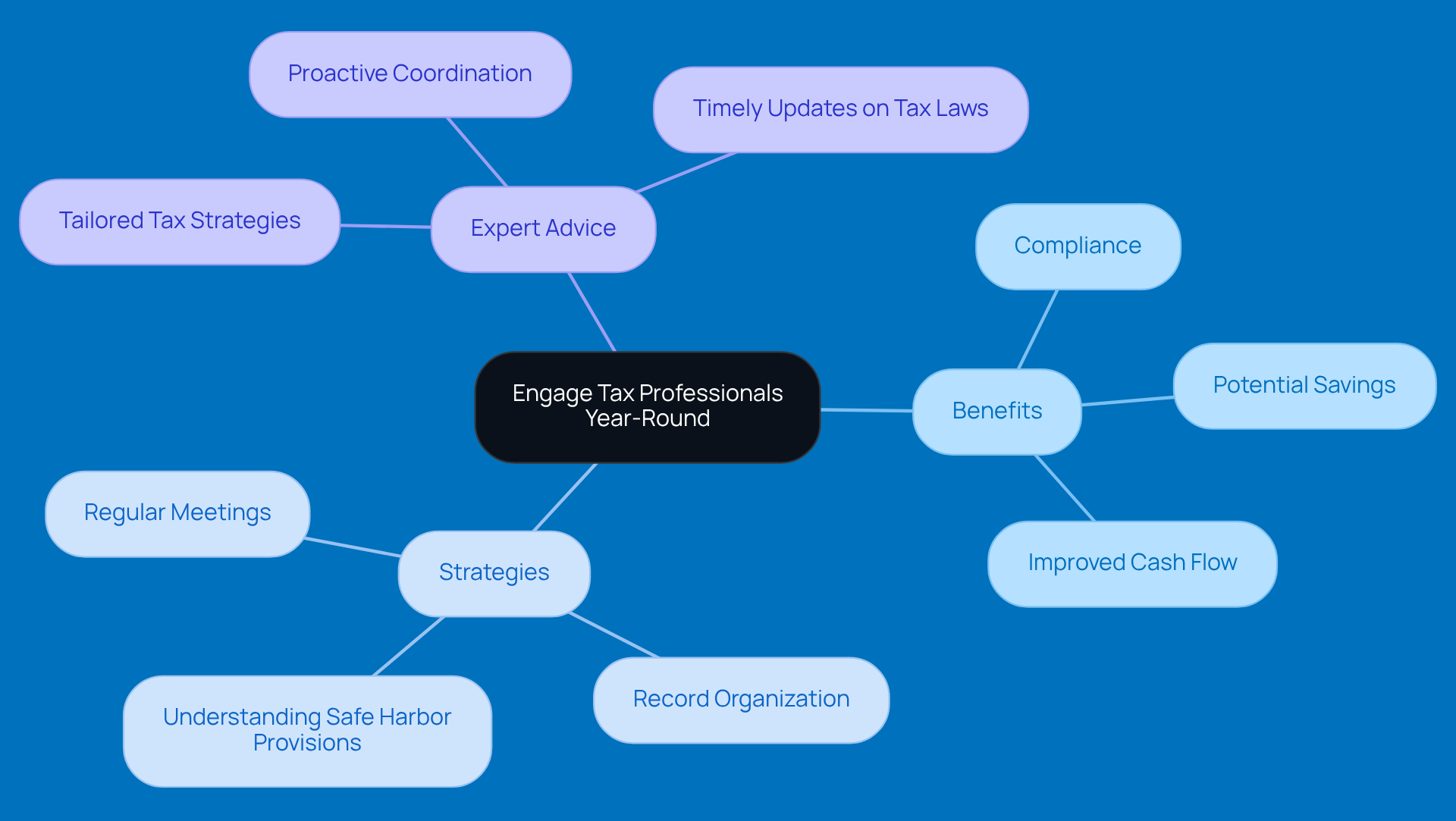

Engage Tax Professionals Year-Round for Proactive Planning

Engaging small business tax consultants throughout the year is a smart move for small business leaders. It keeps you in the loop about tax law changes and helps you take advantage of strategic planning opportunities. Regular chats with small business tax consultants can uncover potential savings and ensure you remain compliant with the ever-changing regulations. Did you know that the IRS has ramped up underpayment penalties? They can now pile up at an interest rate of 8% per year!

Understanding safe harbor provisions is key. These provisions help you dodge penalties by making sure you hit those necessary prepayment thresholds. Plus, statistics show that year-round tax planning can significantly lower tax responsibilities for small business tax consultants working with small businesses. This not only improves cash flow but also eases economic strain-something many firms struggle with due to poor cash flow management. And with the reduction of COVID-19 tax benefits affecting 2022 tax refunds, proactive planning is more important than ever.

As Blake Christian, a tax partner, puts it, "Tax planning in 2026 requires proactive coordination across entity structure, timing strategies, and OBBBA-specific provisions." By keeping your records organized and scheduling regular meetings with your small business tax consultants, you can confidently tackle the complexities of taxation. This proactive approach not only leads to better financial outcomes but also gives you peace of mind, knowing your tax matters are in expert hands.

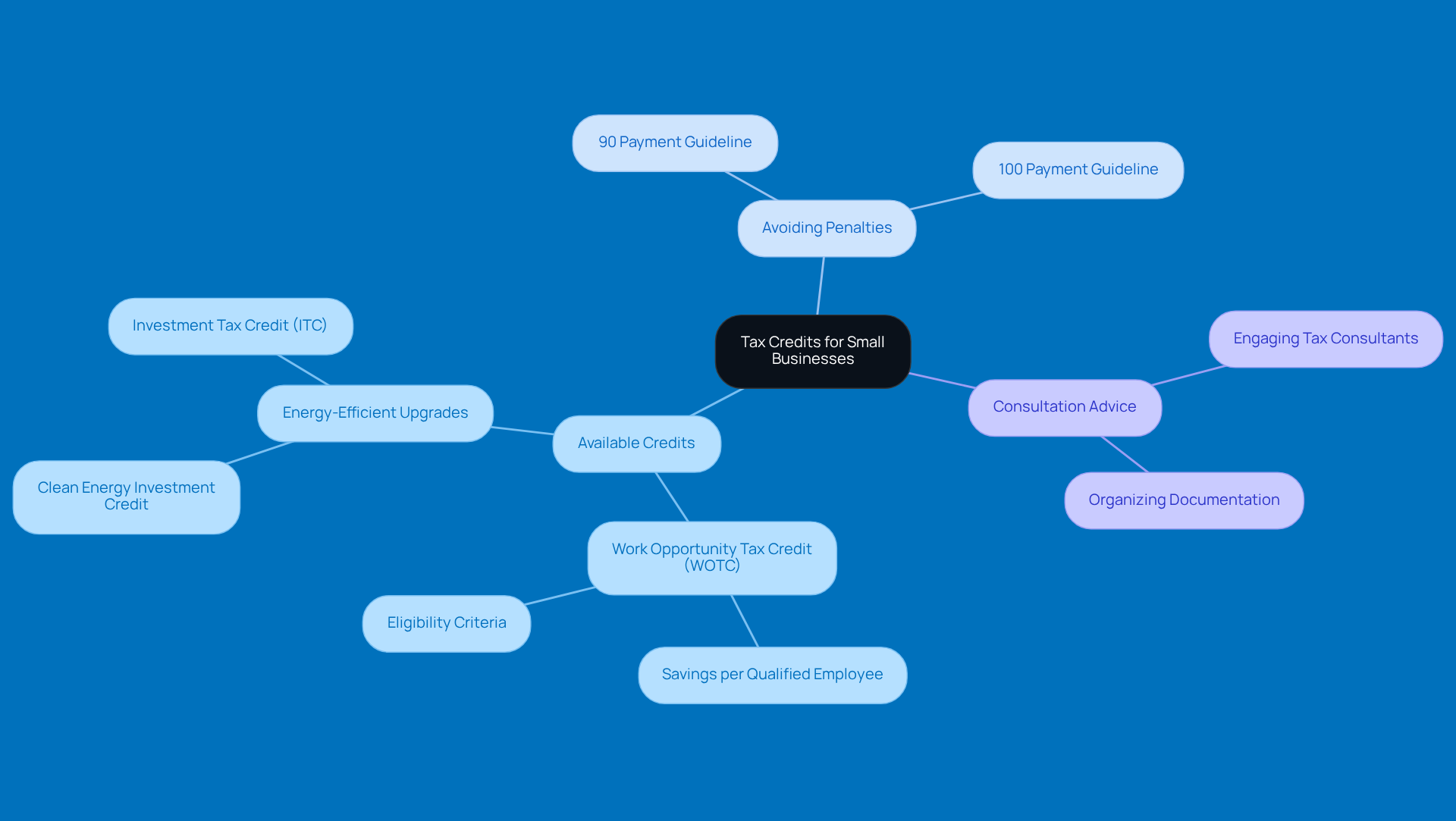

Explore Available Tax Credits for Small Businesses

Hey there, small business owners! Have you looked into the tax incentives that could lighten your tax burden? There are some great credits out there, like the Work Opportunity Tax Credit (WOTC) and those for energy-efficient upgrades, which can really save you some cash.

It’s also super important to understand underpayment penalties. You definitely want to steer clear of any unnecessary charges from the IRS! To avoid penalties, make sure you pay at least:

- 90% of your current year’s tax liability

- 100% of what you owed last year

It’s a good idea to chat with small business tax consultants who can help you determine which credits you might qualify for, ensure you claim them correctly, and develop a solid plan to manage your tax liabilities throughout the year.

Taking this proactive approach can really help cushion the blow from the reduced COVID-19 tax benefits on your overall tax situation. So, why not take a moment to explore these options? Your wallet will thank you!

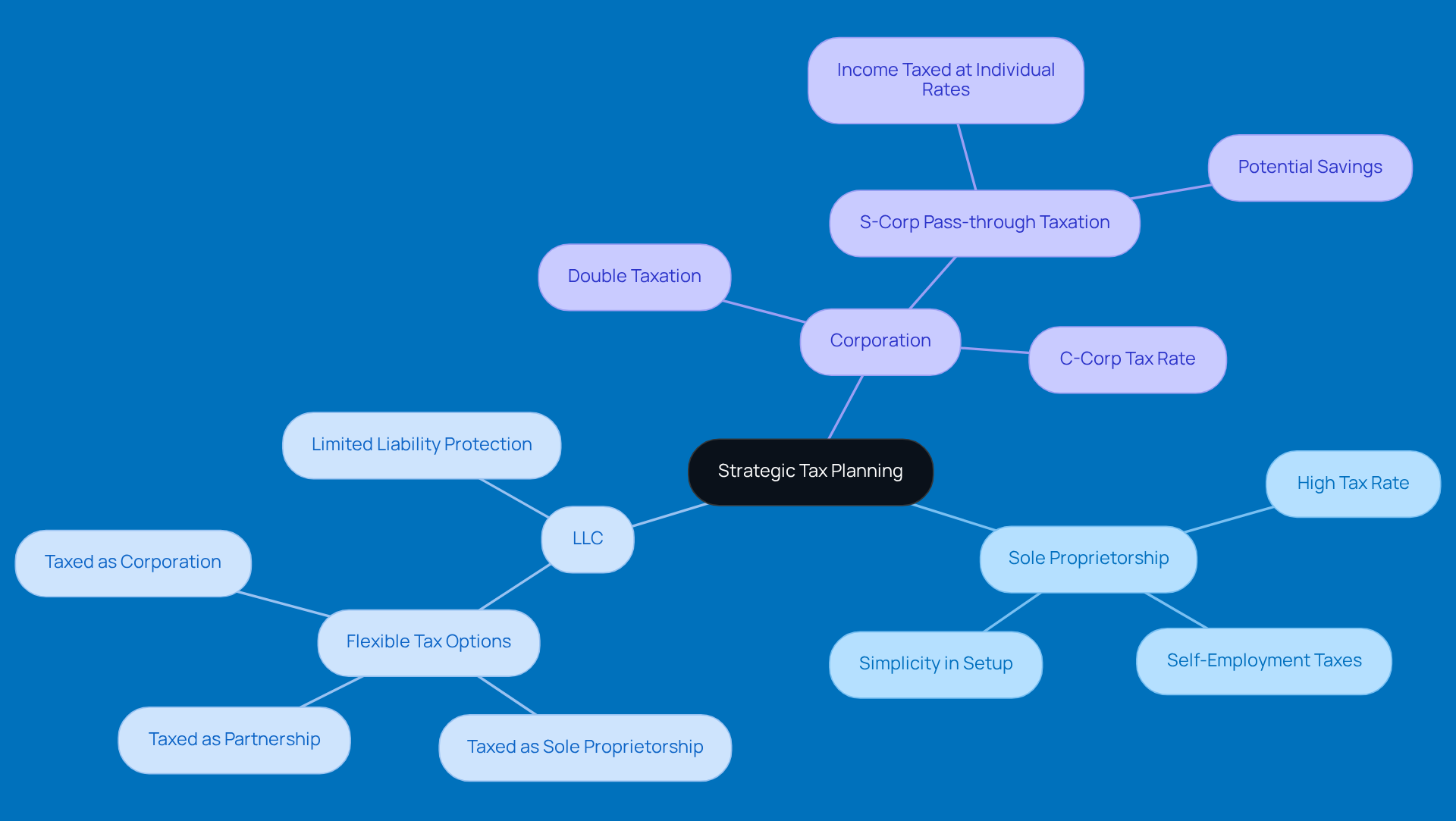

Implement Strategic Tax Planning Based on Business Structure

Choosing the right business structure - whether it’s a sole proprietorship, LLC, or corporation - can really impact your tax situation. It’s all about strategic tax planning tailored to your specific setup, which can help you get the most out of your finances. For example, S-Corps enjoy pass-through taxation, meaning income is taxed at individual rates instead of the corporate level. This can lead to some pretty significant savings!

On the flip side, LLCs are super flexible when it comes to income taxation. Owners can decide if they want to be taxed as a sole proprietorship, partnership, or corporation, depending on what works best for their financial situation. Did you know that pass-through entities like S-Corps and LLCs make up over 60% of net income in the U.S.? That really shows how important they are to our economy!

So, if you’re feeling a bit lost, don’t hesitate to reach out to a tax professional. Small business tax consultants can assist you in determining the best structure for your business, ensuring compliance while maximizing tax benefits. It’s all about making informed choices that work for you!

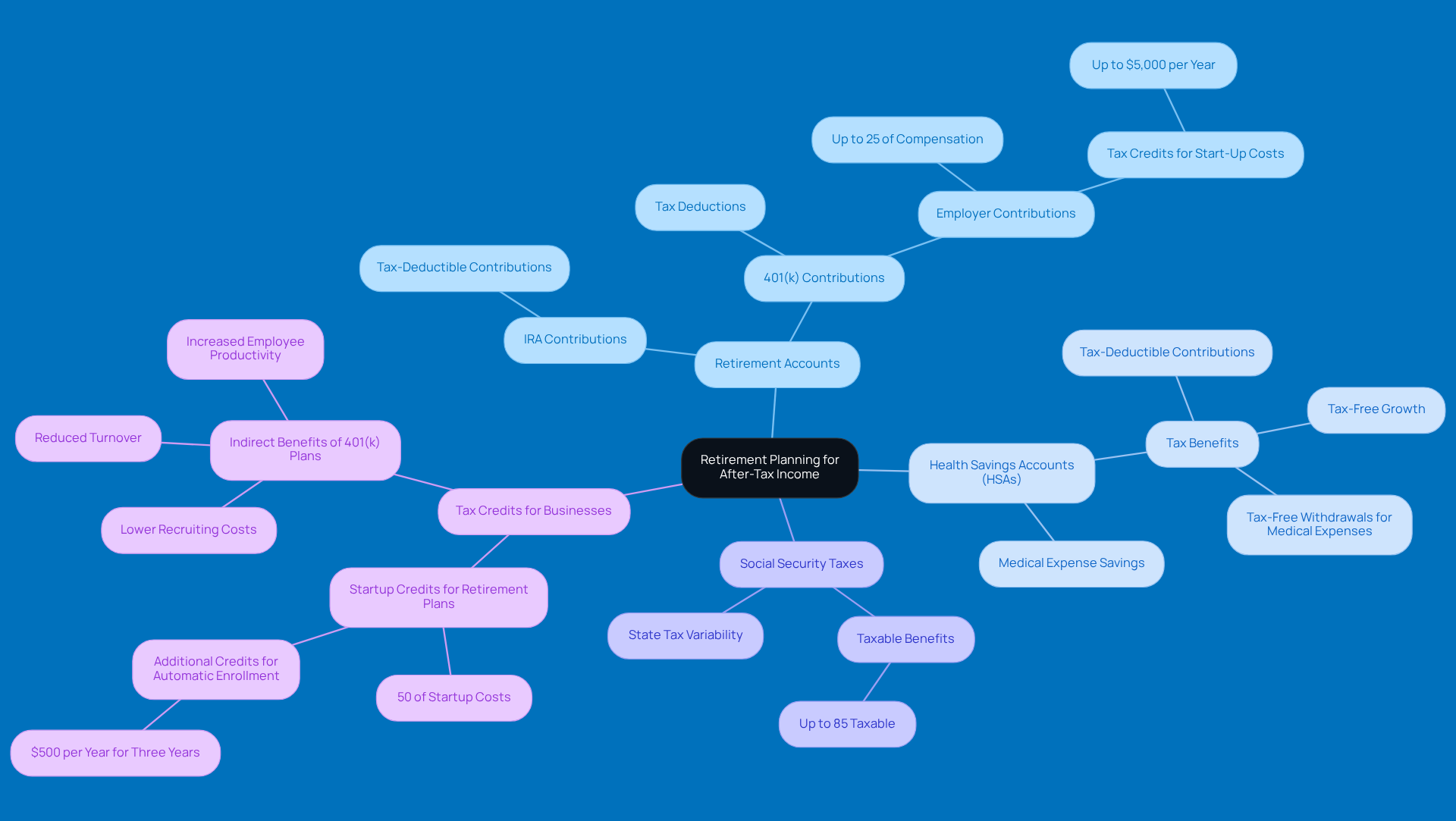

Incorporate Retirement Planning to Maximize After-Tax Income

Integrating retirement planning into your tax strategies can really boost your after-tax income. If you’re an entrepreneur, it’s worth considering contributions to retirement accounts like 401(k)s or IRAs. Not only do these contributions help secure your financial future, but they also give you immediate tax deductions, which can lower your taxable income. For example, small business owners can deduct employer contributions to a 401(k) plan, up to 25% of total participant compensation. That can really cut down on your overall tax bill!

And let’s not forget about Health Savings Accounts (HSAs). They’re a smart way to maximize your tax benefits. HSAs can double as a retirement account, letting you save for medical expenses while enjoying tax-free growth. Contributions to HSAs are tax-deductible, and when you withdraw money for qualified medical expenses, it’s tax-free. It’s a win-win for both your health and retirement planning!

Now, it’s also important to keep in mind the taxes on Social Security benefits. Did you know that up to 85% of these benefits might be subject to federal taxes, depending on your overall income? Plus, state taxes can vary a lot - some states tax retirement income while others don’t. Here’s a fun fact: companies that adopt retirement plans can snag tax credits covering 50% of startup costs, up to $5,000 annually for the first three years. This makes it easier for small business tax consultants to help small businesses implement these strategies.

Offering a 401(k) plan can also lead to some indirect perks, like lower recruiting costs and happier, more productive employees, which small business tax consultants can help maximize. By planning for retirement early, you’re not just boosting your financial stability; you’re also optimizing your tax situation. Think of retirement accounts as a strategic asset for maximizing your after-tax income. As Ascensus puts it, "The credit is designed to help cover setup and administrative fees - making offering a plan that much more affordable." So, why not take a step today towards a more secure financial future?

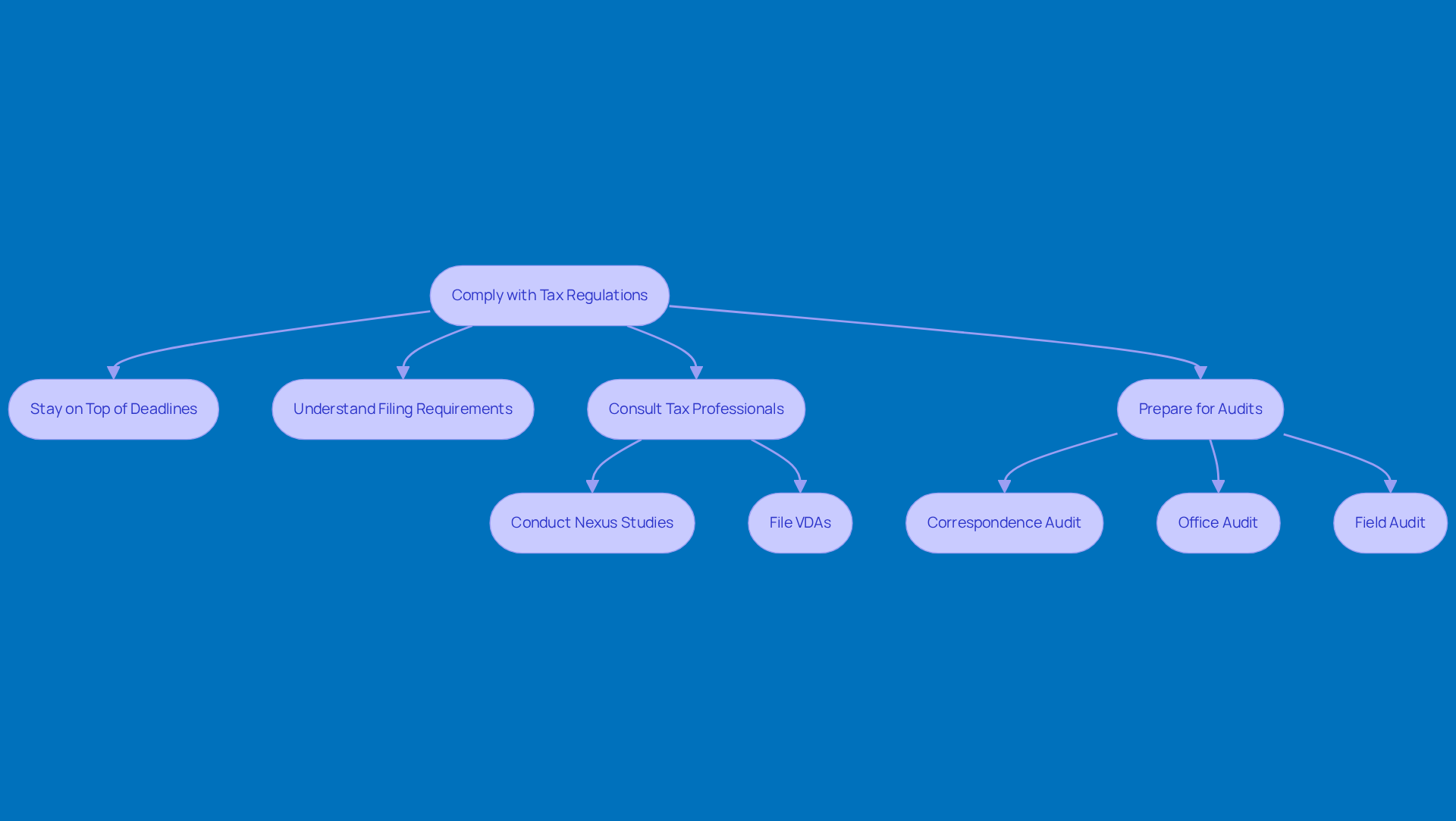

Comply with Tax Regulations to Avoid Penalties

Keeping up with tax regulations is super important for small businesses. You definitely want to steer clear of those hefty penalties and legal headaches! Staying on top of tax deadlines, filing requirements, and the ever-changing tax laws is key. For instance, if a company doesn’t collect or submit sales tax where they’ve got a presence, they could face fines ranging from 10% to 40% of what they owe, plus the risk of civil or even criminal charges. Did you know the IRS reported a whopping $696 billion tax gap for 2022? That really highlights the financial risks of not staying compliant.

Regular chats with tax pros can be a game changer. Small business tax consultants can offer great advice on keeping your records straight and filing on time. Plus, taking proactive steps like conducting nexus studies and filing Voluntary Disclosure Agreements (VDAs) can really help reduce risks. If you act before a state reaches out about non-compliance, you can cut down on penalties and limit your chances of an audit.

Now, if you do find yourself facing an IRS audit, it’s crucial to be prepared. Keep those records organized and know your rights under the Taxpayer Bill of Rights. This includes:

- The right to be informed

- The right to have representation

- The right to challenge IRS decisions

There are three types of audits to be aware of:

- Correspondence audits for minor errors

- Office audits that need in-person documentation

- Field audits where IRS agents come to your location

By prioritizing compliance and gearing up for potential audits, small businesses not only protect their operations but also boost their attractiveness to investors. That’s a win-win for long-term success!

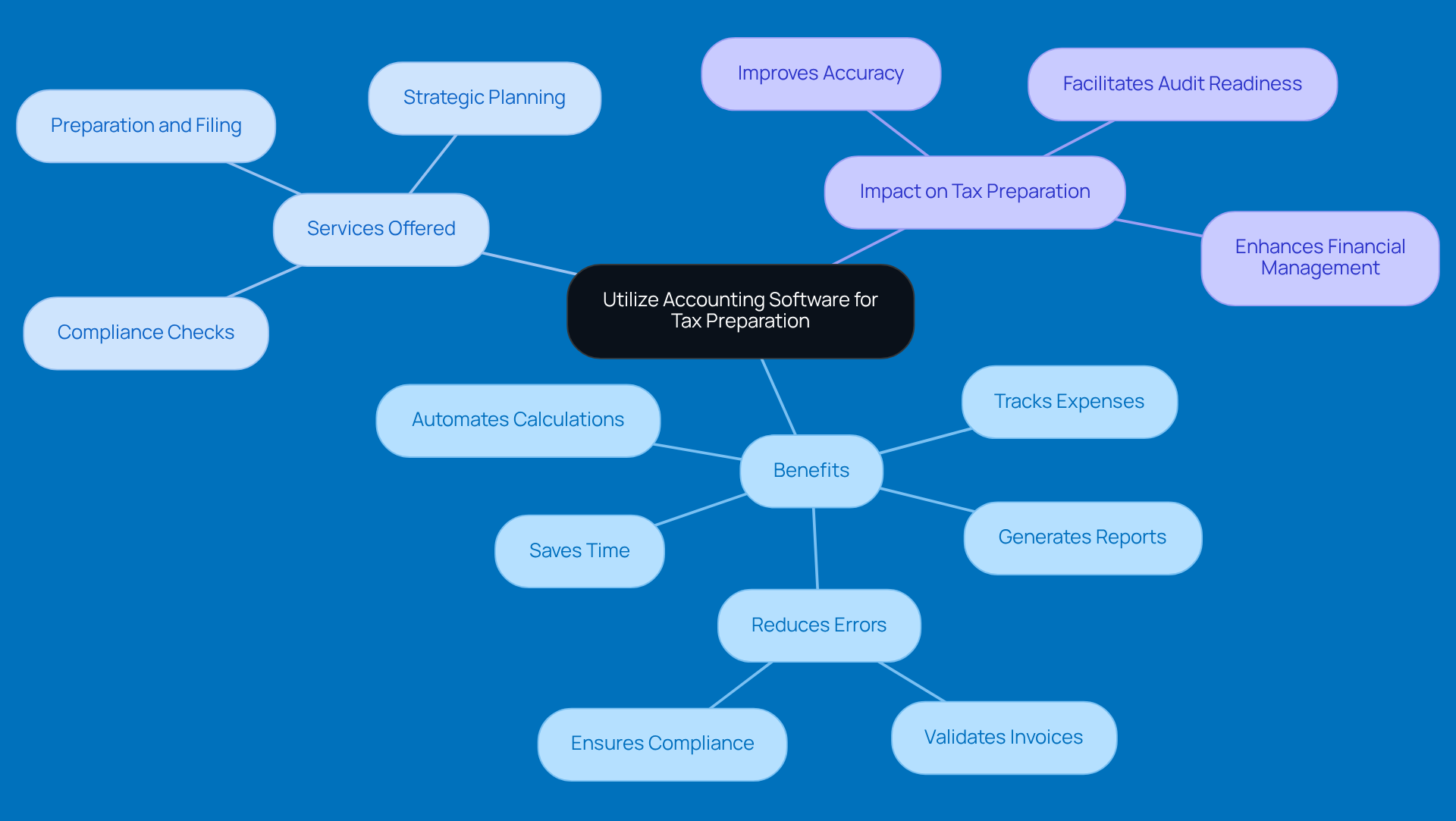

Utilize Accounting Software for Streamlined Tax Preparation

Using accounting software can really boost how efficiently small business tax consultants handle tax prep. These handy tools automate calculations, keep a close eye on expenses, and whip up essential reports, which helps cut down on mistakes. For instance, companies that use accounting software often see fewer tax-related errors, saving them from those pesky penalties. By bringing in solid accounting solutions, business owners not only save precious time but also keep their financial records neat and tidy.

At Steinke and Company, we make tax season a breeze-smooth, accurate, and stress-free. We handle both corporate and personal returns, ensuring everything’s compliant and minimizing any surprises. Here’s what we offer:

- Comprehensive preparation and filing of business and personal tax returns.

- Proactive compliance checks to dodge penalties.

- Strategic planning to lower tax liabilities.

This proactive approach turns tax season from a stressful hassle into a manageable process, enabling small business tax consultants to help entrepreneurs focus on growth and planning for the future. So, why not take the plunge and see how we can help you this tax season?

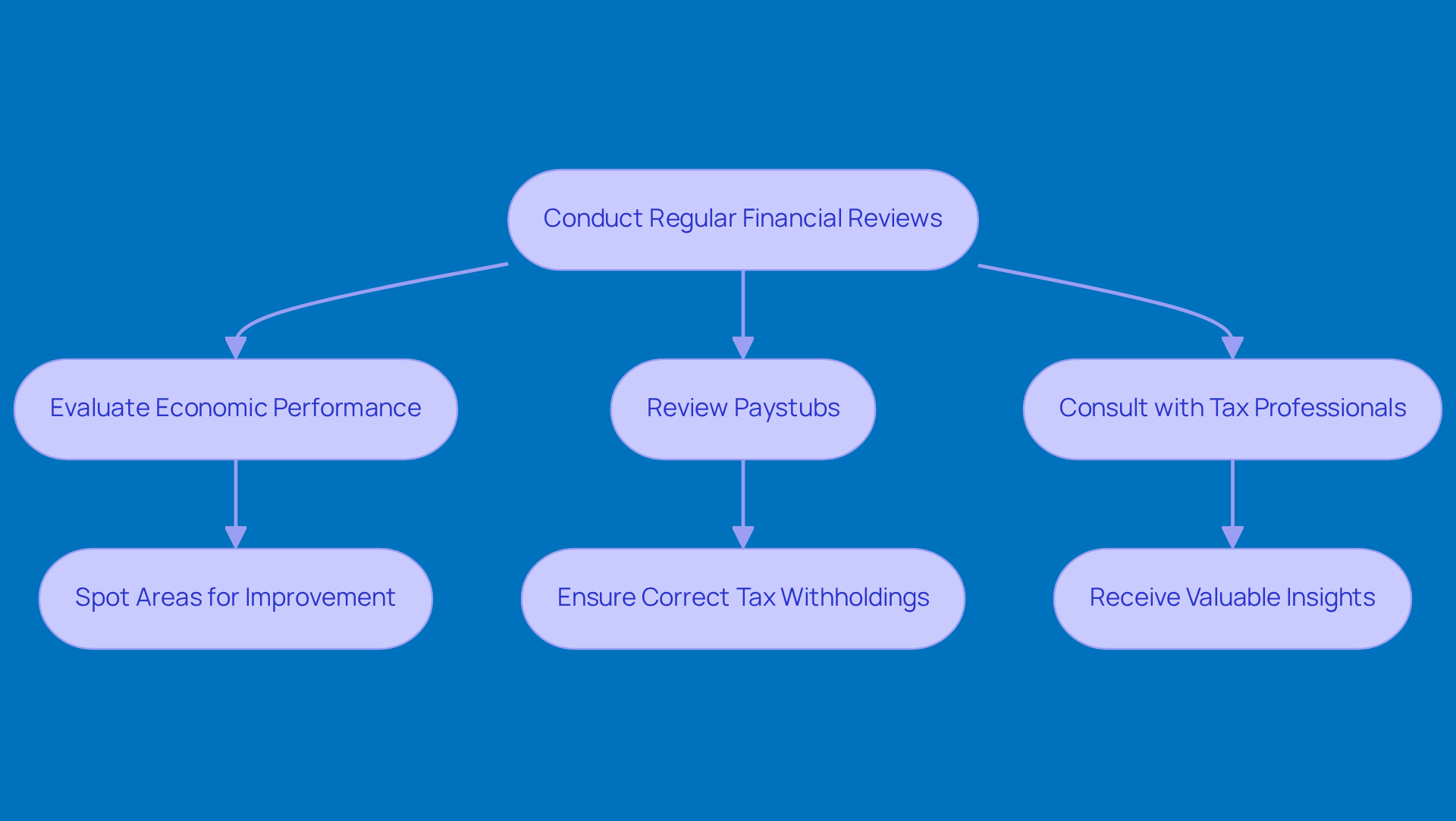

Conduct Regular Financial Reviews to Optimize Tax Strategies

Regular monetary reviews are a must for optimizing your tax strategies. Seriously, business owners should take a moment to evaluate their economic performance every now and then. It’s all about spotting areas for improvement and tweaking those tax strategies to fit. These reviews can uncover potential deductions, help you assess cash flow, and keep your organization on track to hit those financial goals.

Now, let’s talk about something that often gets overlooked: your paystub. Understanding it is crucial! You want to make sure the right amounts are being withheld for taxes. Many business owners might skip this step, but trust me, reviewing your paystubs can save you from some costly mistakes come tax time.

And here’s a tip: consider teaming up with small business tax consultants during these reviews. They can offer valuable insights and recommendations, especially when it comes to understanding paystub deductions and the importance of keeping tax records for compliance and future financial planning. So, why not take a proactive approach? Your future self will thank you!

Conclusion

Steinke and Company really gets how crucial tailored tax strategies are for small businesses, especially in rural America. By using personalized approaches, small business owners can seriously boost their tax situations, making sure they grab every deduction and credit available. This proactive approach is key, especially with changes like the One Big Beautiful Bill Act (OBBBA) on the horizon, which promises even more tax benefits to support these businesses' financial health.

Throughout the article, we’ve shared some key strategies to help small business owners tackle the complexities of tax obligations. Engaging with tax professionals year-round, keeping accurate financial records, and exploring available tax credits are just a few essential tips we highlighted. Plus, understanding the ins and outs of business structures and weaving retirement planning into tax strategies can lead to significant savings and better financial outcomes.

So, here’s the takeaway: small business owners should really take charge of their tax planning and compliance to protect their financial futures. By actively using the insights and strategies we discussed - like collaborating closely with tax consultants and utilizing accounting software - entrepreneurs can not only lighten their tax burdens but also promote growth and sustainability in their businesses. Embracing these practices isn’t just about checking boxes; it’s a smart move towards a brighter, more prosperous future.

Frequently Asked Questions

What services does Steinke and Company provide to small business tax consultants?

Steinke and Company crafts tailored tax strategies that align with the unique needs of small business tax consultants working with small and micro businesses in rural America, helping them maximize deductions and credits.

What upcoming legislation may affect tax strategies for rural businesses?

The One Big Beautiful Bill Act (OBBBA), set to take effect in 2026, will introduce larger deductions and credits, including an expanded childcare credit and the return of 100% bonus depreciation, presenting opportunities for rural businesses to improve their financial health.

Why is record-keeping important for small business tax consultants?

Good record-keeping is essential for effective tax optimization, allowing small business tax consultants to help business owners navigate tax complexities and maximize their savings while ensuring compliance.

What are some examples of tax deductions that small business owners should consider?

Small business owners should consider deductions for expenses such as equipment, supplies, home office costs, and startup costs, with the IRS allowing deductions of up to $5,000 in the first year for businesses with total expenses under $50,000.

How can accounting software benefit small business owners during tax preparation?

Accounting software can streamline the record-keeping process, automate data entry, reduce mistakes, and provide real-time insights, making tax preparation easier and helping entrepreneurs maintain compliance with tax regulations.

What is the significance of understanding industry-specific tax deductions?

Recognizing and utilizing industry-specific tax deductions, such as those for research and development or new equipment purchases, can significantly save small business owners money and enhance their financial efficiency.