Introduction

Navigating the ins and outs of tax obligations can feel like a real headache for small business owners, especially with all those deadlines creeping up. Knowing when your estimated tax payments are due in 2024 isn’t just about staying compliant; it’s also key to keeping your finances healthy and your mind at ease. With the risk of penalties for underpayment looming, you might be wondering: how can you tackle your tax responsibilities and steer clear of costly blunders in the year ahead?

Let’s break it down together!

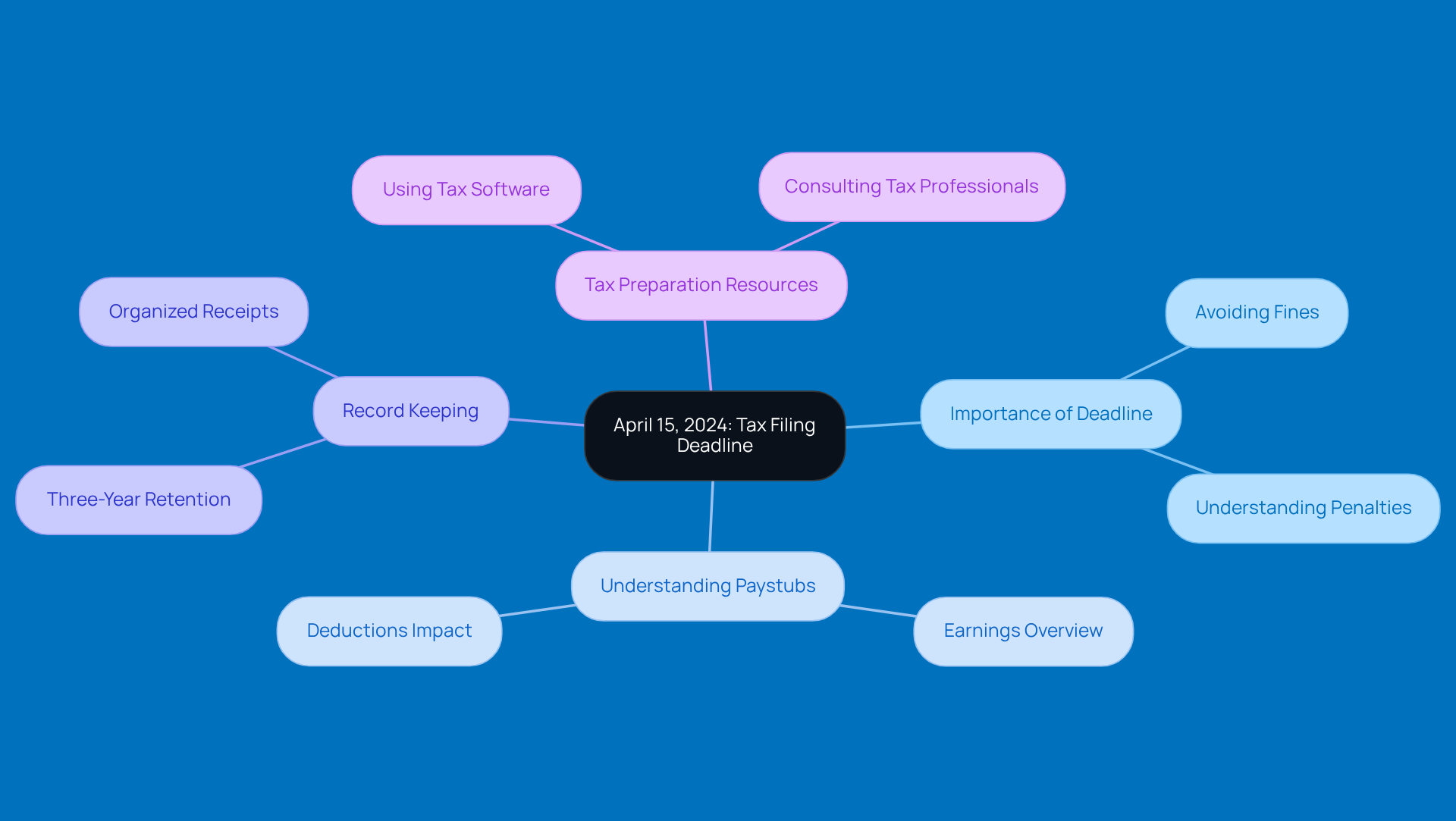

April 15, 2024: Final Filing Date for 2023 Taxes

Hey there! Just a heads up: April 15, 2024, marks the estimated tax payment due dates 2024 for most folks and businesses to submit their 2023 tax returns. This deadline is super important because it relates to the estimated tax payment due dates 2024, helping you dodge any pesky fines or interest charges. If you’re a small business owner, it’s a good idea to get your paperwork sorted out well ahead of time to avoid any last-minute scrambles.

Now, let’s talk about paystubs. Understanding yours is key! They give you a peek into your earnings and deductions, which can really affect your tax bill. And don’t forget, keeping your tax records for at least three years is a must. It’s all about staying compliant and backing up your filings.

Thinking about how to make this whole process easier? Using tax prep software or chatting with a tax pro can really help. They can guide you through strategies to avoid underpayment fees and ensure everything’s accurate and above board. So, why not take a little time to get organized? You’ll thank yourself later!

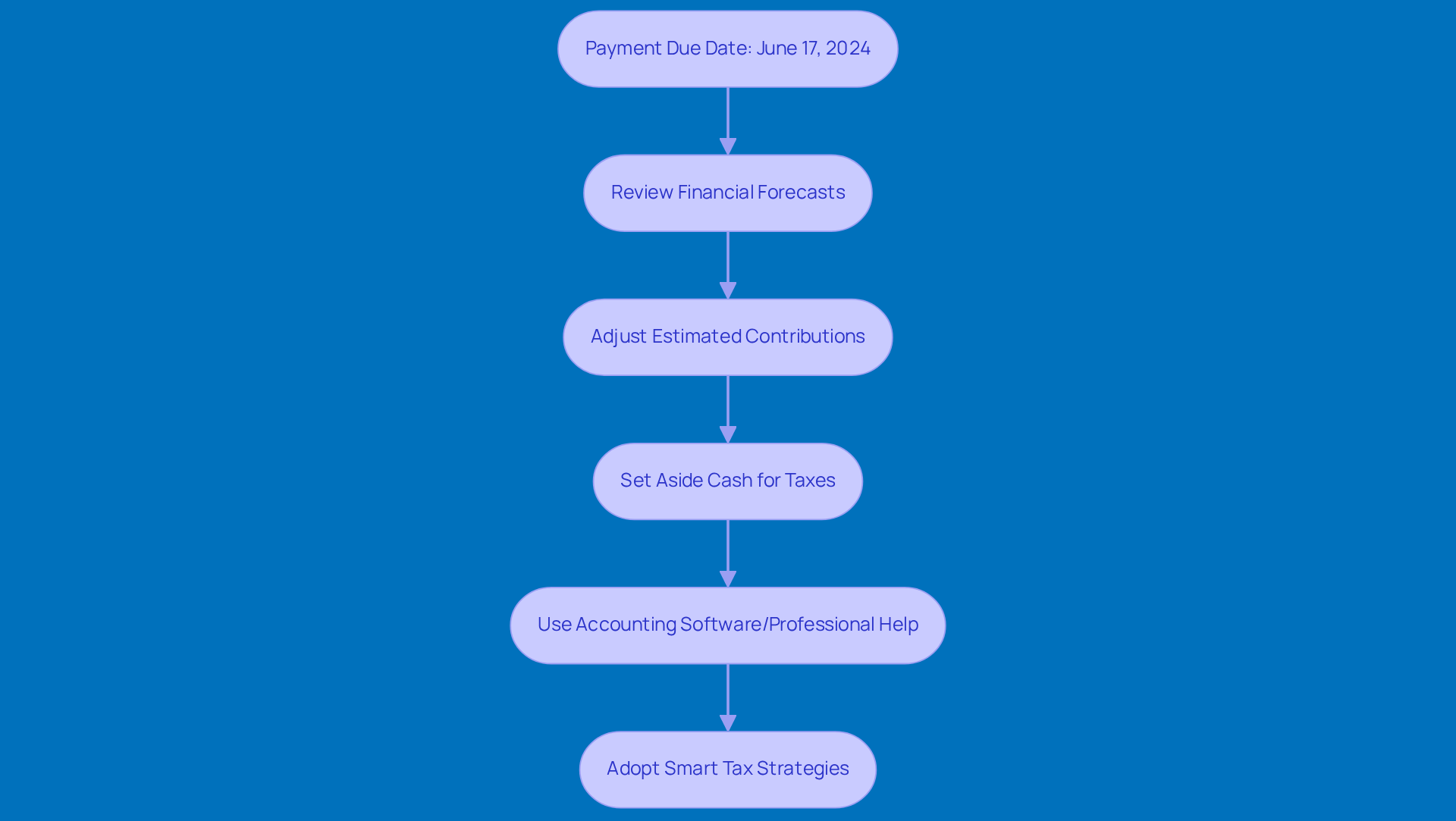

June 17, 2024: Payment Due Date for Second Quarter Estimated Taxes

Hey there! Just a quick reminder that the estimated tax payment due dates 2024 include the second quarter payment, which is due on June 17. This covers the income you earned from April 1 to May 31. To avoid those pesky underpayment charges, it’s super important for small business owners to get a handle on their expected tax obligations. Did you know the IRS has set the underpayment charge rate at 8% for 2024? Staying on top of your tax responsibilities is key!

One way to keep things in check is by regularly reviewing your financial forecasts and adjusting your estimated contributions as needed. This can really help you stay compliant and dodge any potential penalties. Financial advisors often suggest setting aside some cash specifically for tax obligations. And hey, don’t forget about the benefits of using accounting software or getting professional help to make the process smoother!

By adopting some smart tax strategies - like making timely contributions and taking advantage of deductions - you can keep your small business financially healthy and avoid unnecessary stress. So, what are you waiting for? Let’s make tax season a little less daunting!

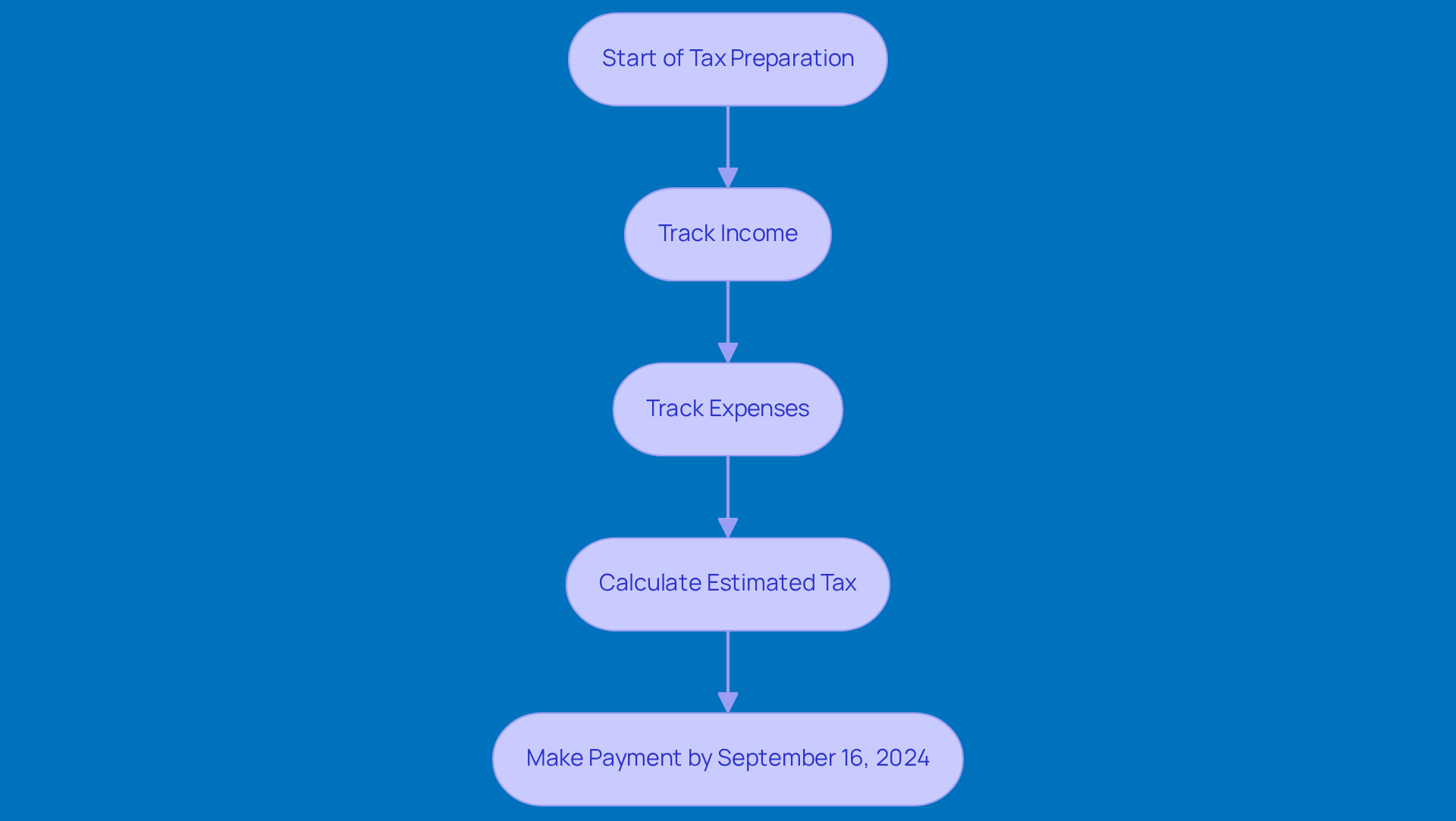

September 16, 2024: Payment Due Date for Third Quarter Estimated Taxes

Hey there! Just a quick reminder that the estimated tax payment due dates 2024 indicate that the estimated tax amount for the third quarter is due on September 16, 2024. This covers all the income you’ve earned from June 1 to August 31. If you’re a small business owner, it’s super important to take a close look at your earnings and expenses to make sure your payments are spot on.

Keeping detailed records throughout the year can really make this process a breeze. Plus, it helps you avoid any nasty surprises when tax time rolls around. A common mistake folks make is underestimating their income or forgetting to include all those deductible expenses. Trust me, you don’t want to end up with penalties!

Accountants often stress that good record-keeping is key for staying compliant with taxes. It can really lighten the load when tax season hits. By using some handy tools and strategies to track your financial transactions, you can tackle your tax obligations with confidence and clarity. So, how are you planning to keep track this year?

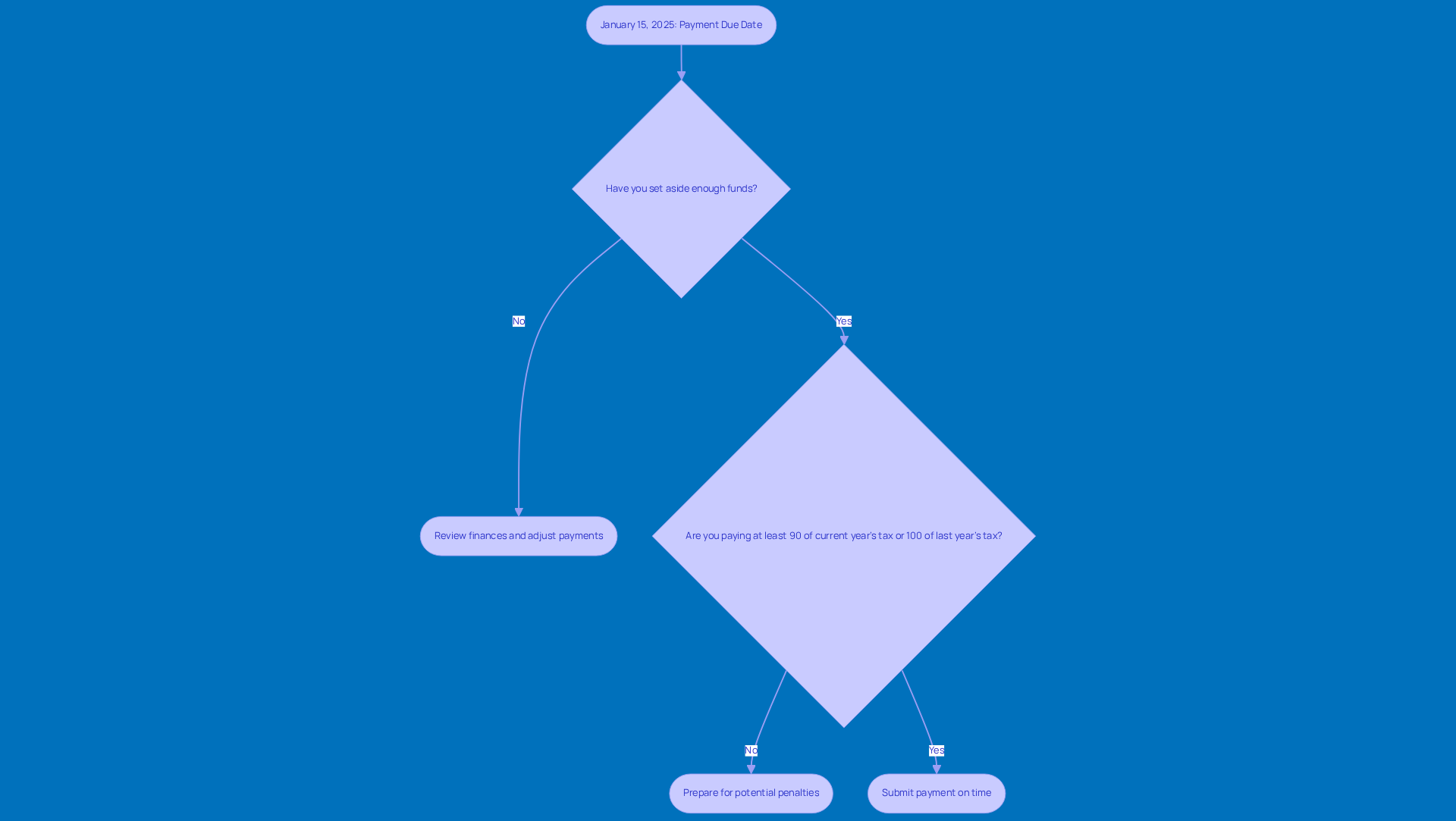

January 15, 2025: Payment Due Date for Fourth Quarter Estimated Taxes

Hey there! Just a quick reminder that the final estimated tax payment due dates 2024 is on January 15, 2025. This payment covers income earned from September 1 to December 31. If you’re running a business, make sure you’ve got enough set aside to meet this obligation. Trust me, you don’t want to face underpayment fines from the IRS!

Now, here’s something to keep in mind: the IRS expects you to pay at least 90% of your current year’s tax liability or 100% of what you owed last year to dodge those pesky penalties. And with the interest rate for underpayments sitting at 8% per year, compounded daily, the costs can really add up. So, it’s a great time to review how your finances have performed this year and make adjustments to your estimated tax payment due dates 2024. This way, you can stay on top of your tax game and avoid any unnecessary fees!

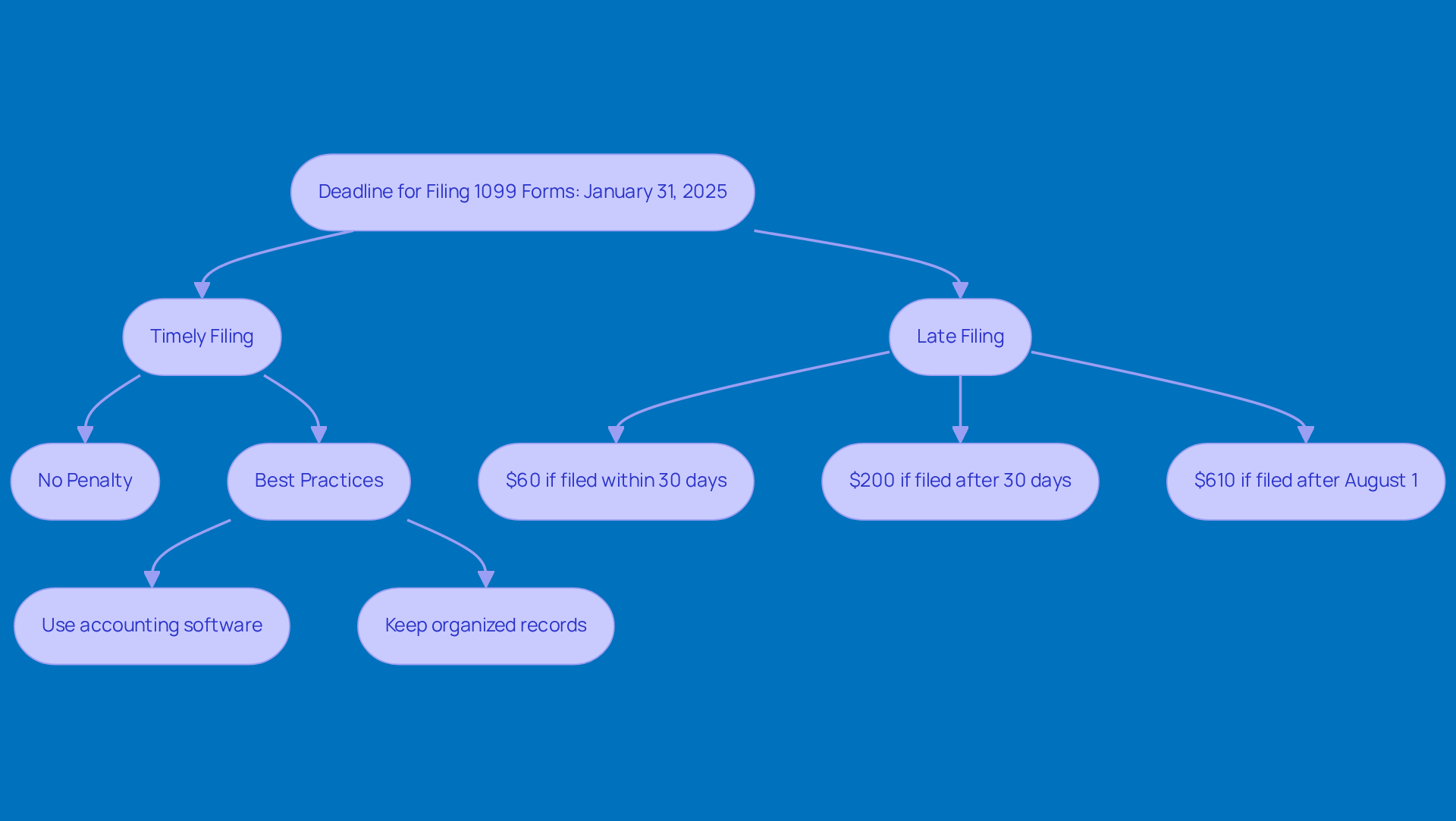

January 31, 2025: Deadline for Filing 1099 Forms

Hey there! Just a heads-up: January 31, 2025, is the big deadline for businesses to file those 1099 forms for the previous tax year. This includes reporting payments made to independent contractors and freelancers. Keeping your records straight is super important to avoid fines, which can range from $60 to $660 per form, depending on how late you file. For example, if you file within 30 days, you’ll face a $60 penalty, but if you wait until after August 1, that fine jumps to $610 per form.

To steer clear of these headaches, it’s a good idea for companies to keep organized records of all payments made throughout the year. And let’s not forget about your paystub! Understanding it and the deductions on it is key to making sure your financial records are accurate and compliant. Using accounting software like QuickBooks or Tax1099 can really help streamline this process and keep you in line with IRS regulations.

As tax expert Tom Smery puts it, "To avoid these fines, ensure timely filing, utilize tax software for reminders, and consider electronic submissions for efficiency." Plus, if you’re looking for a little extra help, Steinke and Company offers expert tax compliance and preparation services tailored for small businesses. They’ll make sure everything is accurate and legally sound, setting you up for long-term success.

By adopting these practices, you can focus on what you do best - running your business - without the stress of potential fines hanging over your head!

March 15, 2024: Filing Deadline for Partnership Tax Returns

Hey there! Just a quick reminder that the estimated tax payment due dates 2024 include the partnership tax returns due on March 15. It’s super important for partnerships to file Form 1065 to accurately report their income, deductions, and credits. You definitely don’t want to face fines, which can add up to $235 per shareholder or partner for each month the return is late. So, why not start gathering all the necessary documents now?

Getting ahead of the game not only helps you stay compliant but also makes reporting a breeze. This way, you can dodge common hiccups like discrepancies and missed deadlines. A smart move is to review your partnership agreements for any potential tweaks before the deadline rolls around - this could really maximize your tax benefits!

Accountants often stress the importance of thorough documentation. It’s crucial for backing up your claims and ensuring a smooth filing process. By preparing early and understanding what’s required, partnerships can navigate the complexities of tax filing and avoid those pesky, costly consequences. So, let’s get started!

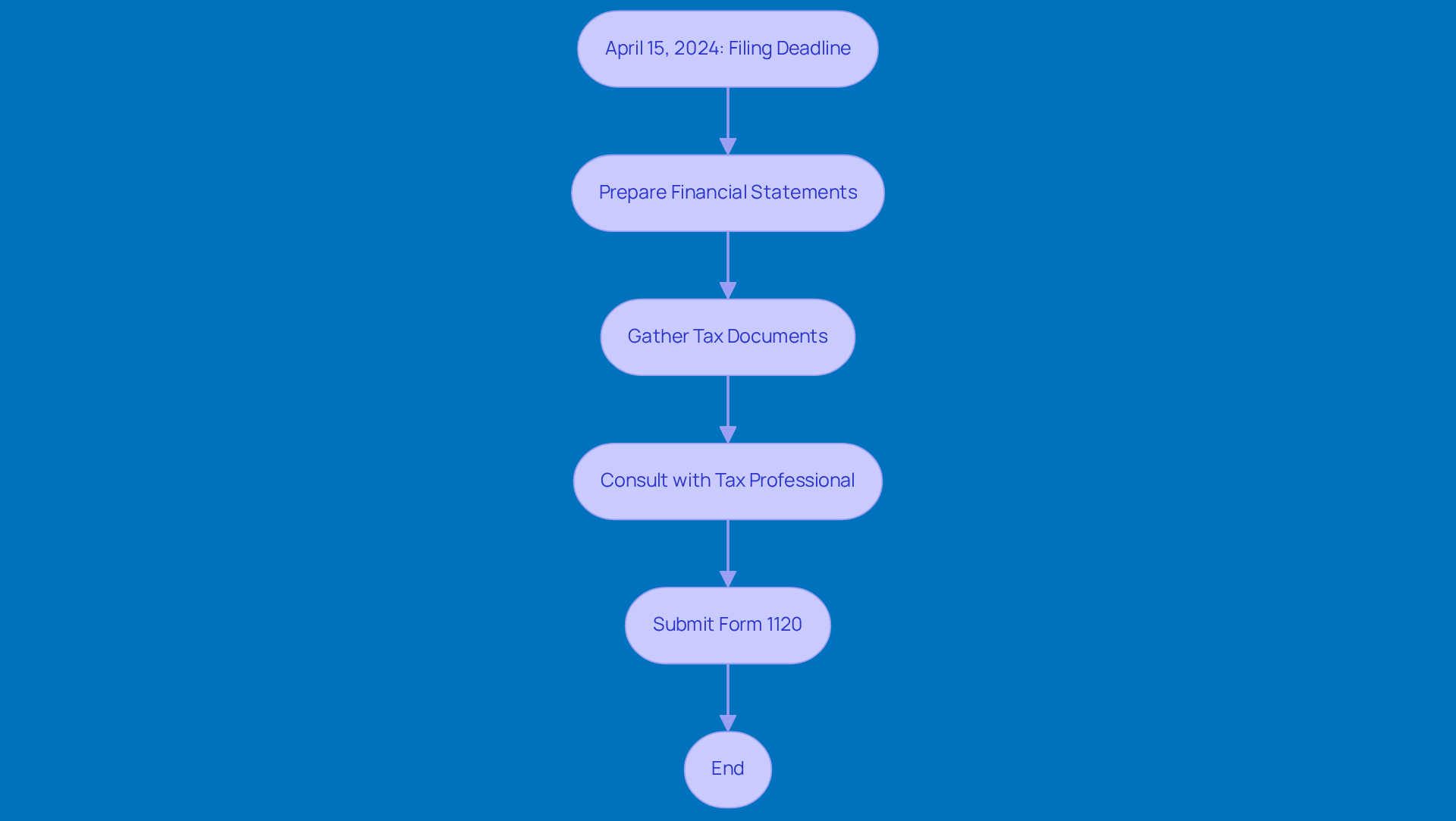

April 15, 2024: Filing Deadline for Corporate Tax Returns

Hey there! Just a heads-up: April 15, 2024, marks the estimated tax payment due dates 2024 for corporations filing their tax returns using Form 1120. This form lays out all the nitty-gritty details about income and expenses. Getting your submission in on time is super important - not just to dodge those pesky fines, but also to help you manage your responsibilities related to the estimated tax payment due dates 2024 like a pro.

Now, here’s a tip: preparing your financial statements and tax documents ahead of time can save you from those last-minute headaches. Nobody wants to scramble at the last minute, right? Plus, chatting with a tax professional can really pay off. They can offer insights that keep you compliant with regulations and help you optimize your tax strategies for better financial outcomes. So, why not take that step? It could make a world of difference!

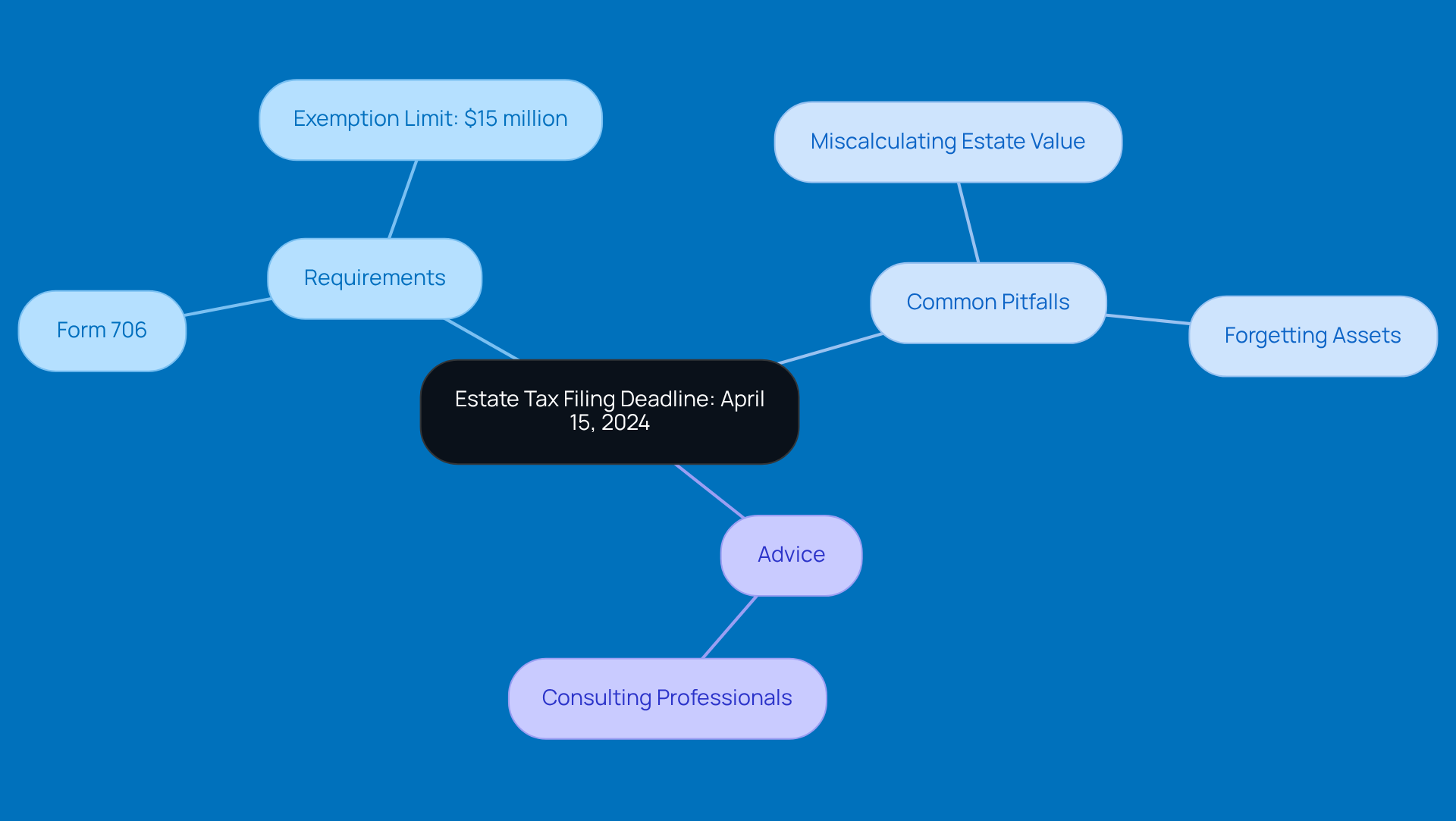

April 15, 2024: Filing Deadline for Estate Tax Returns

Hey there! Just a quick heads-up: the deadline for filing estate tax returns is coming up on April 15, 2024. If you're an executor, you'll need to submit Form 706 if the estate's value goes over the exemption limit, which is set at a whopping $15 million for 2026. To keep everything on track and avoid any hiccups, it’s super important to gather all the necessary documents and maybe even get some expert advice.

Now, let’s talk about some common pitfalls. Executors often run into issues like:

- Miscalculating the estate's value

- Forgetting to include certain assets

These can really complicate the filing process! That’s why teaming up with estate planning professionals can be a game changer. They can offer valuable insights and help you navigate the sometimes tricky waters of estate tax returns. So, don’t hesitate to reach out for help!

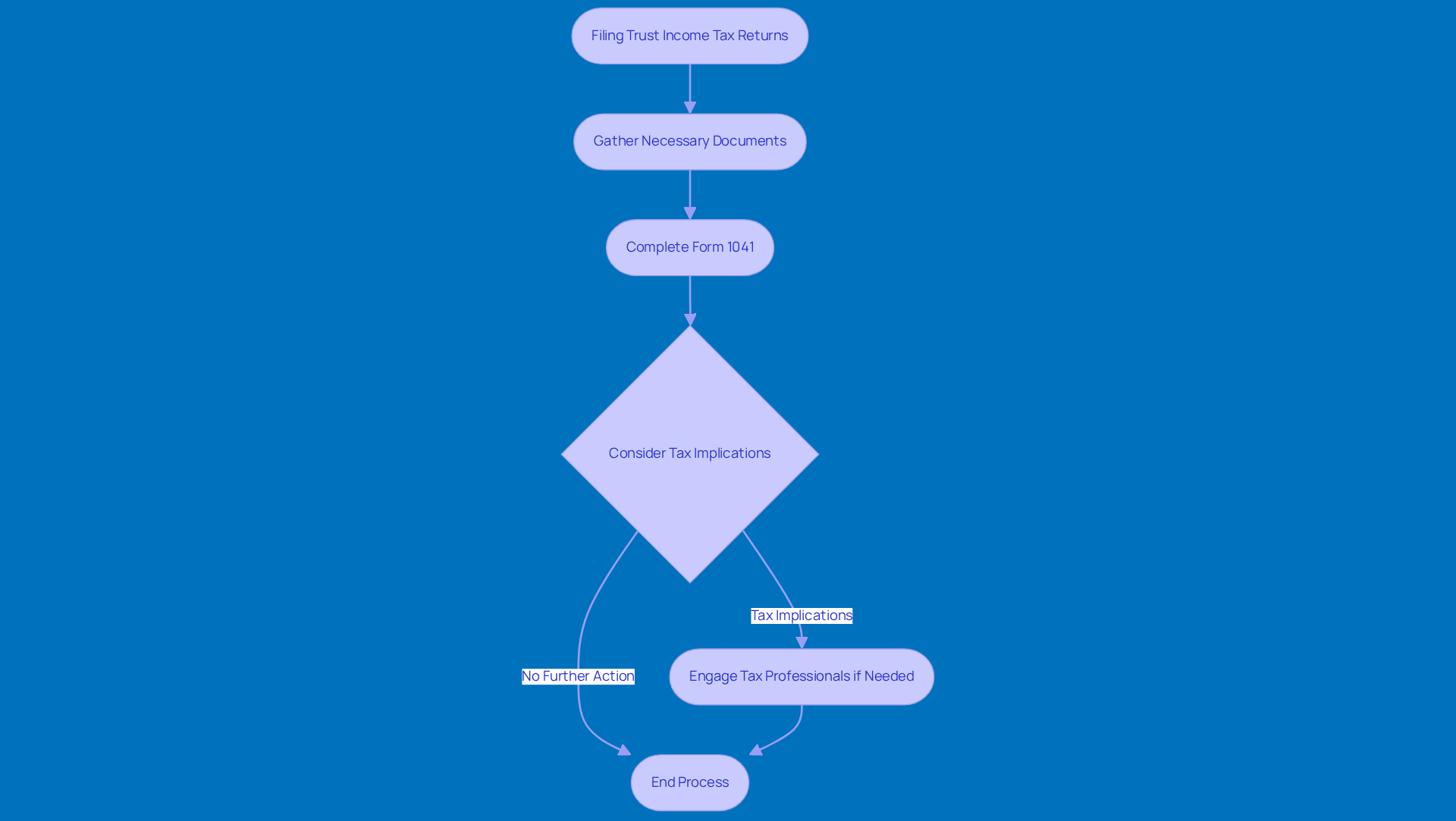

April 15, 2024: Filing Deadline for Trust Income Tax Returns

Hey there! Just a quick reminder that the estimated tax payment due dates 2024 include the due date for trust income tax returns on April 15. Trusts need to file Form 1041 to report their income, deductions, and credits. Getting this right is super important - any mistakes can lead to some serious tax headaches for both the trust and its beneficiaries. So, trustees, make sure to gather all the necessary documents ahead of time to stay in line with IRS regulations and make the filing process as smooth as possible.

Now, here’s something to keep in mind: if a trust has income over $15,200, it faces a top tax rate of 37 percent, plus an extra 3.8 percent net investment income tax. Yikes! This really highlights why strategic tax planning is key to optimizing the trust's overall tax position. Tax pros often stress that careful reporting on Form 1041 can help pinpoint allowable deductions, which can have a big impact on tax liabilities.

Trustees often run into challenges when it comes to tax filings, especially when it comes to understanding the ins and outs of allowable deductions and the 65-day rule. This rule lets trusts make distributions to beneficiaries that can actually lower the trust's tax burden. Engaging with tax experts can really help navigate these complexities, ensuring that trusts not only meet their filing obligations but also make the most of their financial situation.

So, if you’re a trustee, don’t hesitate to reach out for help! It could save you a lot of stress and money in the long run.

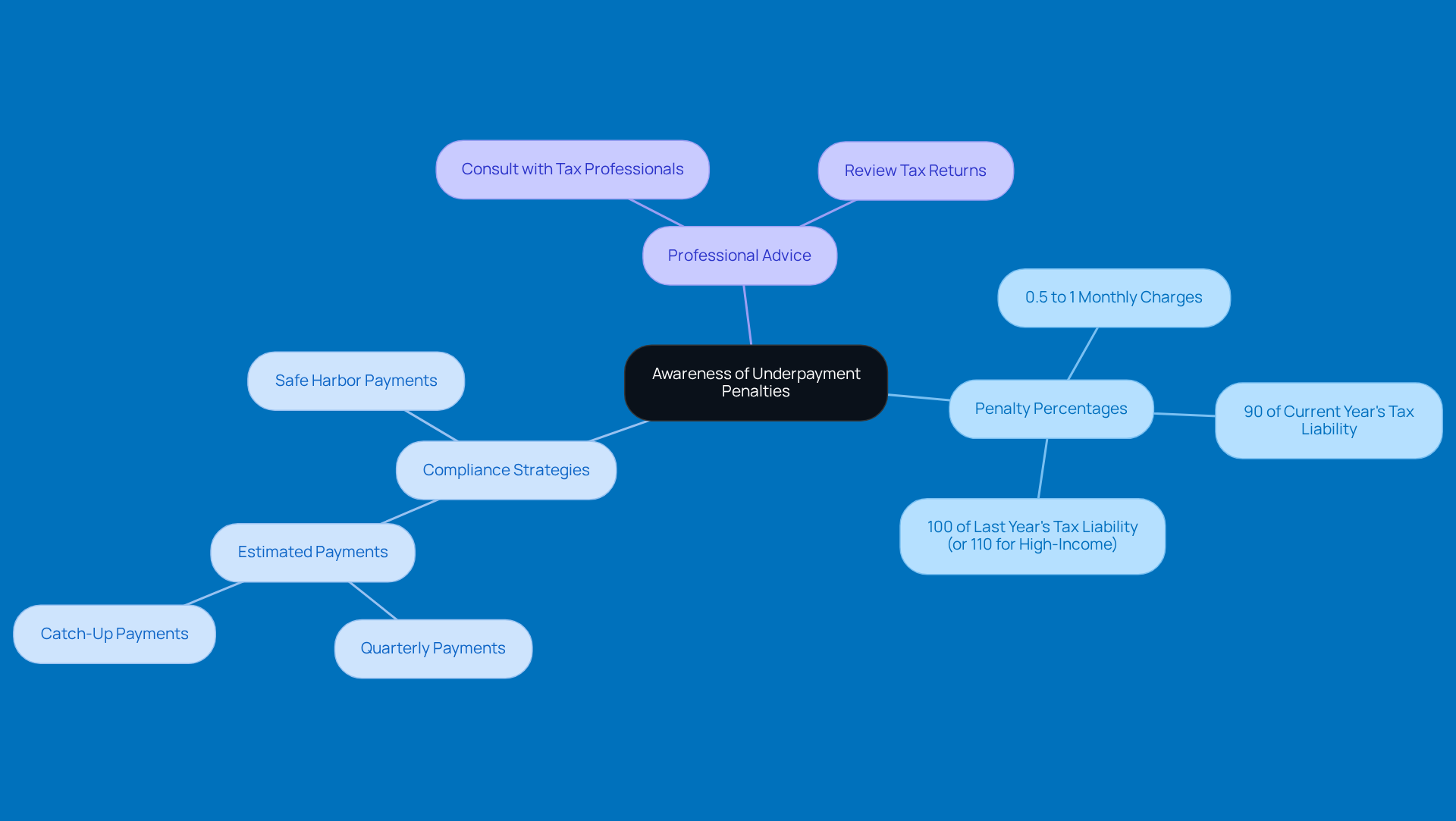

Ongoing: Awareness of Underpayment Penalties and Compliance Strategies

Hey there, small business owners! It’s super important to stay on top of underpayment charges throughout the year. The IRS isn’t shy about slapping hefty fines for not paying enough in taxes, and those charges can pile up quickly, putting a strain on your cash flow and overall business health. Did you know that the IRS can charge you between 0.5% to 1% each month on unpaid income tax bills? That can really add up over time!

So, what do you need to know about these underpayment penalties? Well, the IRS requires you to pay at least:

- 90% of your current year’s tax liability

- 100% of what you owed last year (or 110% if you’re in the higher-income bracket)

Keeping track of your income and expenses regularly is key to reducing these risks. Not only does it help you adjust your estimated payments, but it also keeps your financial records accurate and up-to-date.

And hey, don’t hesitate to consult with a tax professional! They can really help you navigate the complexities of tax obligations. As Cindy McGhee, CPA, wisely suggests, "Complete a thorough review of your most recently filed tax return to assess if you overpaid in taxes in any of these three ways."

By applying these compliance strategies, like making contributions by the estimated tax payment due dates 2024 if you expect to owe $1,000 or more, you can significantly lower your chances of facing IRS fines in 2024 and beyond. Plus, using safe harbor payments can protect you from those pesky underpayment penalties, ensuring you prepay a minimum amount of your tax obligation throughout the year. So, let’s keep those finances in check!

Conclusion

Staying on top of those estimated tax payment due dates for 2024 is super important for small business owners who want to keep things running smoothly and avoid any pesky penalties. By getting a handle on these deadlines and prepping ahead of time, you can manage your tax obligations like a pro, sidestepping the stress of last-minute scrambles.

Throughout this article, we’ve highlighted some key dates:

- April 15 for final filings

- June 17 for second quarter payments

- January 15, 2025, for the fourth quarter

It’s all about keeping meticulous records, chatting with tax professionals, and using tax prep software to make the process a breeze. Plus, being aware of underpayment penalties and having some proactive strategies in place can really help protect your business’s financial health.

Ultimately, taking the time to understand and prepare for these tax deadlines not only helps you stay compliant but also lets you focus on what really matters-growing your business and achieving success. So, prioritize your tax organization and don’t hesitate to seek expert guidance. You’ll navigate the complexities of tax season with confidence, paving the way for a smoother journey toward financial stability in the year ahead!

Frequently Asked Questions

What is the final filing date for 2023 taxes?

The final filing date for 2023 taxes is April 15, 2024.

Why is the April 15, 2024 deadline important?

This deadline is important because it relates to the estimated tax payment due dates for 2024, helping individuals and businesses avoid fines or interest charges.

What should small business owners do to prepare for tax filing?

Small business owners should get their paperwork sorted out well ahead of the deadline to avoid last-minute scrambles.

How long should tax records be kept?

Tax records should be kept for at least three years to stay compliant and back up filings.

What resources can help simplify the tax preparation process?

Using tax preparation software or consulting with a tax professional can help simplify the process and guide individuals in avoiding underpayment fees.

When is the payment due date for the second quarter estimated taxes in 2024?

The payment due date for the second quarter estimated taxes is June 17, 2024.

What income period does the second quarter payment cover?

The second quarter payment covers income earned from April 1 to May 31.

What is the IRS underpayment charge rate for 2024?

The IRS underpayment charge rate for 2024 is set at 8%.

How can small business owners avoid underpayment charges?

Small business owners can avoid underpayment charges by regularly reviewing their financial forecasts and adjusting their estimated tax contributions as needed.

When is the payment due date for the third quarter estimated taxes in 2024?

The payment due date for the third quarter estimated taxes is September 16, 2024.

What income period does the third quarter payment cover?

The third quarter payment covers all income earned from June 1 to August 31.

What is a common mistake to avoid when estimating taxes?

A common mistake is underestimating income or forgetting to include all deductible expenses, which can lead to penalties.

Why is good record-keeping important for taxes?

Good record-keeping is important for staying compliant with taxes and can ease the burden during tax season.