Overview

This article dives into income tax solutions tailored for small agency owners, helping you maximize your savings through strategic tax planning, compliance, and the smart use of technology. We'll explore various methods, like maximizing deductions and leveraging tax credits, all designed to minimize your tax liabilities and steer clear of any pesky penalties.

Have you ever felt overwhelmed by tax season? You're not alone! By utilizing technology, you can enhance efficiency and make the process a lot smoother. We'll break down how these strategies can work for you, making tax time less of a headache and more of an opportunity to save.

So, let’s get started on this journey to smarter tax planning together. You’ll find that with the right approach, tax savings can be within your reach!

Introduction

Navigating the complex world of income tax can feel like a daunting challenge for small agency owners, especially with the changes in regulations coming in 2025. In this article, we’ll explore ten essential income tax solutions that can help you maximize your savings and minimize your liabilities. As the stakes rise, you might be wondering: how can you effectively implement these strategies to not only comply with evolving tax laws but also boost your financial health?

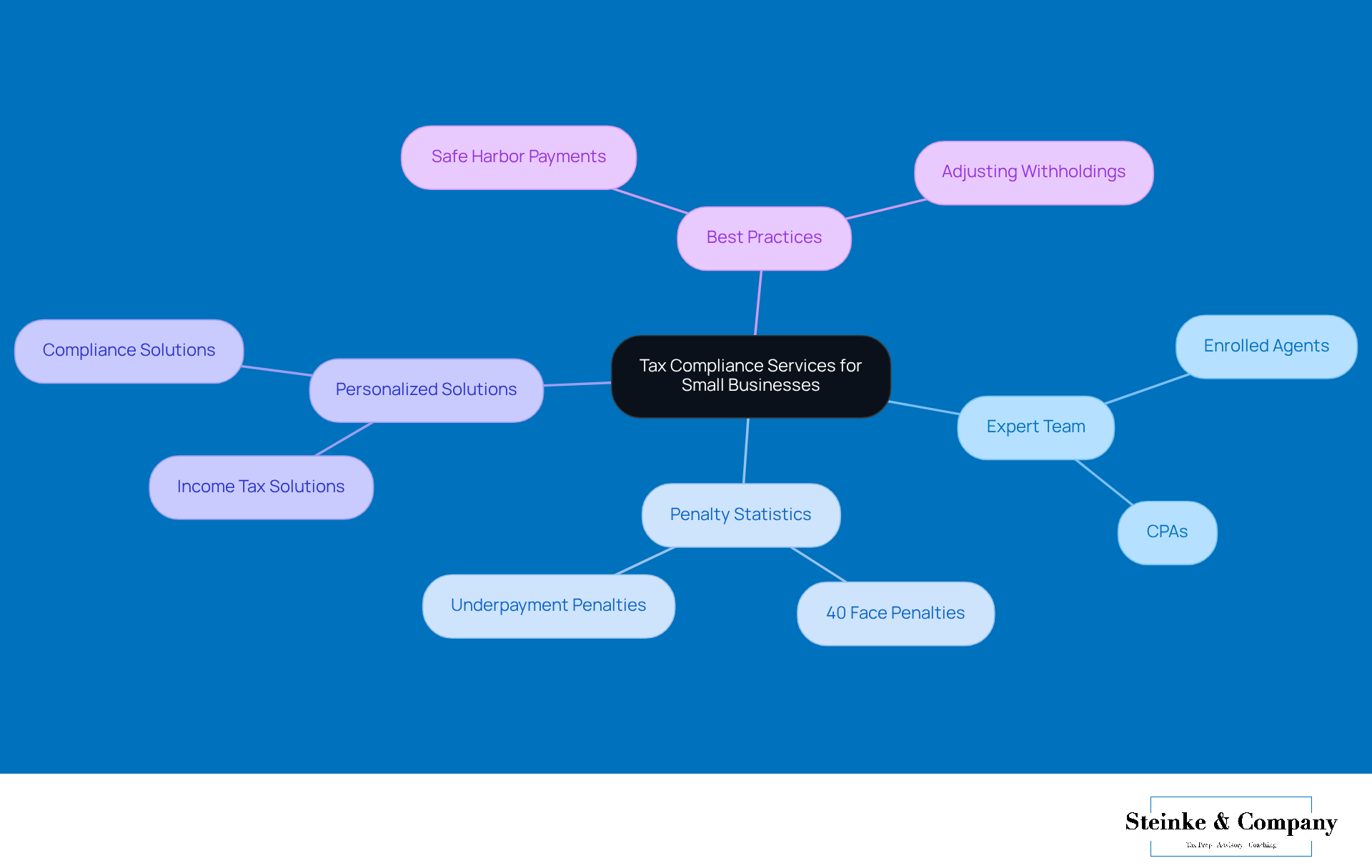

Steinke and Company: Comprehensive Tax Compliance Services for Small Businesses

At Steinke and Company, we’re all about helping small businesses navigate the sometimes tricky world of tax compliance. Our team, made up of seasoned Enrolled Agents and CPAs, is here to guide you through the maze of tax regulations. We know that understanding and avoiding those pesky underpayment penalties is crucial for your financial well-being, and we’re dedicated to making that process as smooth as possible.

We provide personalized income tax solutions and compliance solutions that empower small agency owners like you to minimize liabilities and avoid costly penalties. Did you know that around 40% of small businesses face penalties due to tax issues? That’s a big deal, and it highlights just how important expert guidance can be in navigating these complexities.

As Warren Buffet famously said, "Accounting is the language of commerce." With our commitment to effective tax strategies, we make sure you're well-equipped to tackle the evolving tax landscape in 2025 and beyond. By adopting best practices like safe harbor payments and adjusting your withholdings, you can focus on what really matters—running your business—while we help alleviate the stress that comes with tax-related challenges.

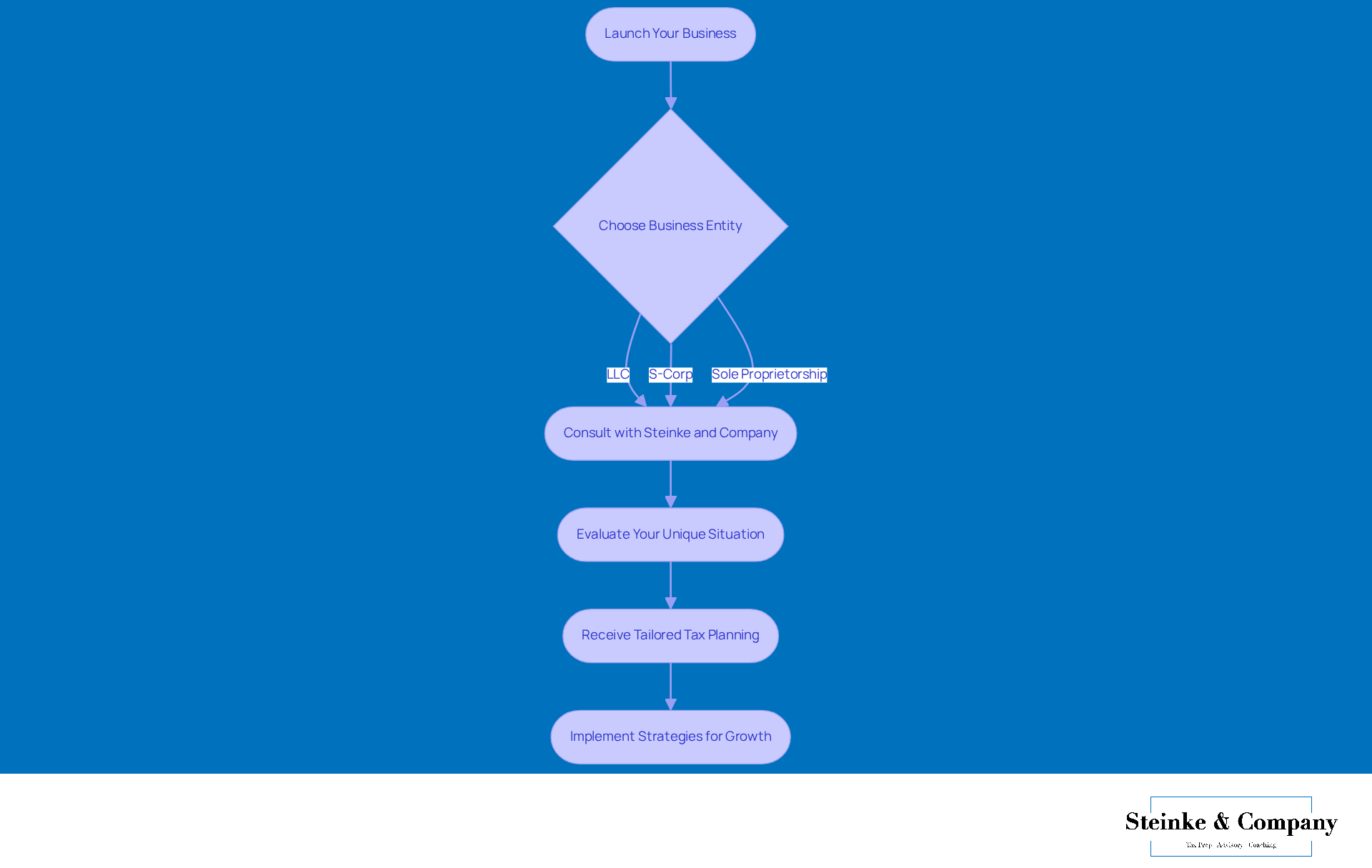

Business Startup Consultations: Choosing the Right Entity with Expert Guidance

When you're launching a venture, picking the right entity—like an LLC, S-Corp, or sole proprietorship—can really impact your taxes. That’s where Steinke and Company steps in! They offer expert consultations to help entrepreneurs navigate this crucial decision. By taking a good look at your unique situation and future goals, they guide you in choosing an entity that not only maximizes your tax benefits but also keeps you in line with state and federal regulations.

This strategic choice sets the stage for long-term success and can enhance your income tax solutions, potentially saving you a bundle and providing you with operational advantages. Plus, Steinke and Company doesn’t stop there; they provide tailored tax planning and advisory services. They meet with clients 1-3 times a year to go over tax returns and financial systems, spot missed opportunities, and craft clear strategies to lighten tax burdens and encourage growth.

Understanding underpayment penalties and accounting methods is super important, too! But don’t worry—Steinke and Company is here to help you navigate these complexities. So, how about taking that step toward smarter tax planning today?

Strategic Tax Planning: Essential Techniques to Minimize Liabilities

For small business leaders, strategic tax planning is crucial for finding effective income tax solutions. It’s all about forecasting your tax obligations and discovering smart income tax solutions to lower them. Think maximizing deductions, leveraging tax credits, and timing your income and expenses just right. By keeping detailed records of all your expenses, you can spot potential deductions and make sure you’re following tax regulations. For example, the 20% Qualified Business Income deduction under Section 199A can really boost your tax savings, making it a key factor for small businesses.

At Steinke and Company, we work closely with our clients to craft tailored tax strategies that fit their unique goals. Regular financial reviews and tweaks to these plans help small agency owners adjust to any changes, leading to significant reductions in tax burdens and better cash flow. Utilizing income tax solutions such as pass-through entities to avoid double taxation and Section 179 deductions for immediate expensing of qualifying purchases is essential for improving your tax outcomes.

As tax strategist Jerry Vance points out, effective tax planning not only keeps businesses compliant with legal requirements but also helps them maximize deductions and enhance their financial health. By using these strategic methods, small business leaders can set themselves up for long-term success while keeping those tax obligations in check.

Monthly Accounting Services: Keeping Your Finances in Check

Steinke and Company’s monthly accounting services are here to empower small business managers by giving them a complete view of their financial health. With regular financial statements, reconciliations, and cash flow analyses, clients can really see what’s going on and make informed choices. This proactive approach doesn’t just help with income tax solutions; it also spots potential financial hiccups early on, allowing for timely fixes. By keeping a close eye on their financial status, business leaders can tweak their strategies as needed, ensuring they grow sustainably and stay resilient in today’s ever-changing market.

Business Coaching: Aligning Values with Growth Strategies

At Steinke and Company, we focus on helping you align your personal values with your growth strategies. This comprehensive approach is designed to assist small business leaders like you in clarifying your vision and setting actionable goals. In our regular coaching sessions, you’ll have the chance to explore what motivates you, tackle challenges head-on, and craft strategies that truly resonate with your core values.

But that’s not all! Our monthly accounting services come into play here too, offering reconciliations, reports, and ongoing support. This means you’ll have the financial clarity you need to make informed decisions. And when your values align with your business strategies, it not only leads to personal fulfillment but also drives organizational success. Together, we can create a more sustainable and rewarding enterprise. So, are you ready to take the next step?

Operational Efficiency Strategies: Streamlining Your Business Processes

Operational efficiency is super important for small agency owners who want to boost their profits. At Steinke and Company, we help clients spot inefficiencies in their operations and come up with smart strategies to improve things. This often means embracing new technologies, fine-tuning workflows, and boosting teamwork.

When small businesses focus on operational efficiency, they can cut costs, improve service delivery, and ultimately see a nice increase in their profits. Did you know that companies with engaged employees can enjoy a 23% profit boost? That really shows how operational efficiency ties directly to financial success!

Plus, using tech solutions can help integrate different business functions, giving you real-time data that supports decision-making and process optimization. For example, businesses that have adopted automated systems often notice shorter lead times and fewer errors, proving the real benefits of technology.

As we move into 2025, it’s crucial for small business leaders to prioritize optimizing their processes to stay competitive and profitable in this ever-changing market.

So, what steps can you take to enhance your operational efficiency today?

Regular Strategic Planning: Identifying Opportunities for Growth

Regular strategic planning meetings with Steinke and Company help small business leaders spot and grab growth opportunities, all while keeping data security practices strong. By looking at market trends, client feedback, and internal performance metrics, clients can make smart decisions about where to head next. This proactive approach not only prepares organizations for potential challenges but also positions them perfectly to seize new opportunities as they pop up, fostering sustainable growth.

Plus, we can't forget how crucial income tax solutions are, especially when navigating GLBA compliance to safeguard customer information. This not only boosts operational efficiency but also builds trust with clients.

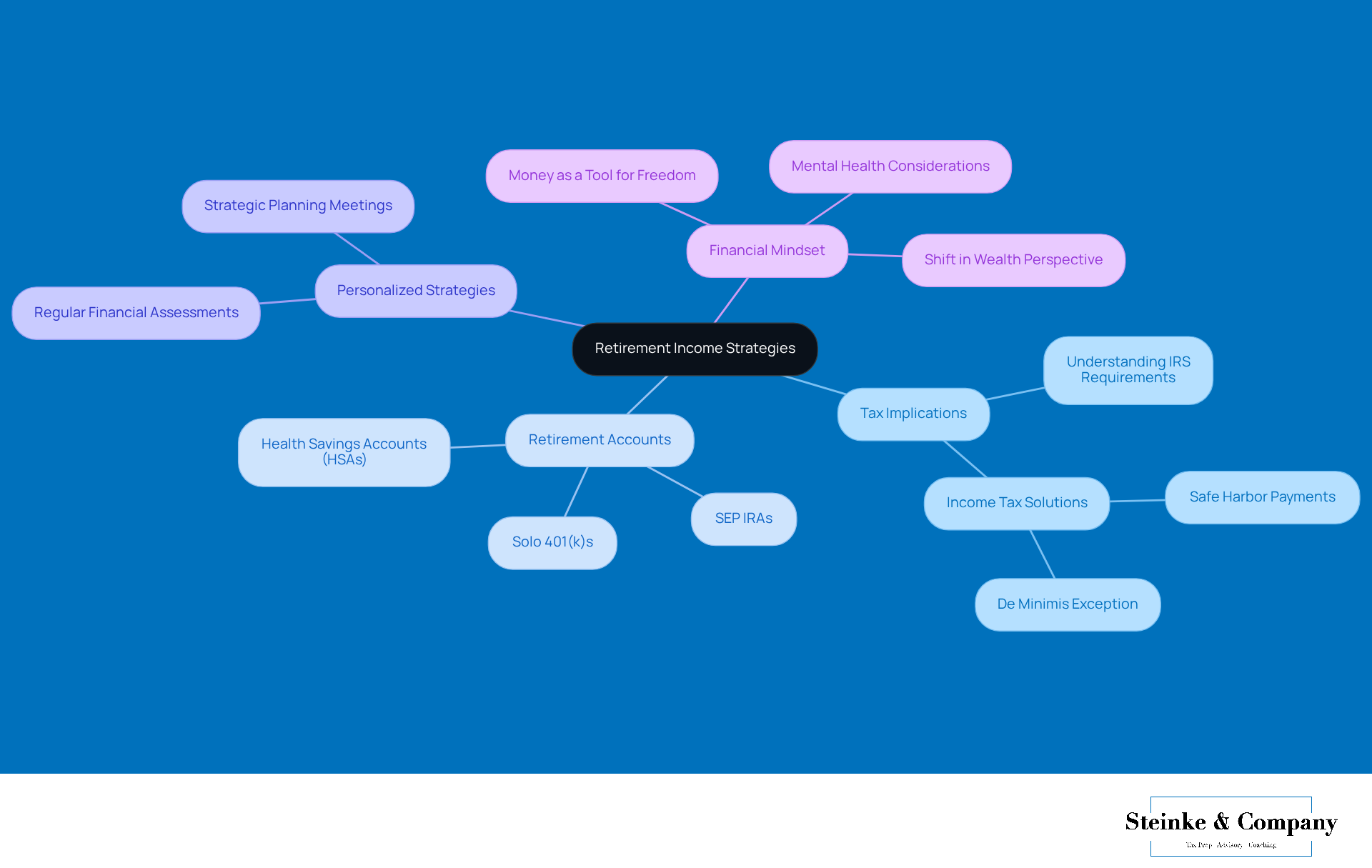

Retirement Income Strategies: Navigating Tax Implications for Small Business Owners

Getting ready for retirement is super important for small business owners, especially those running their own firms, because it directly impacts their financial stability and peace of mind. At Steinke and Company, we love helping clients navigate the tricky waters of retirement income strategies, especially by providing income tax solutions that can really make a difference in your savings. By taking advantage of options like SEP IRAs and Solo 401(k)s, agency leaders can tailor their retirement plans to fit their unique business structures while maximizing tax efficiency.

In 2025, grasping the tax implications of retirement planning is more vital than ever. Agency leaders need to realize that proactive planning not only helps maintain wealth but also enhances their quality of life in retirement. Financial experts often say that money should be seen as a tool for freedom and peace of mind, not just a number sitting in a bank account. This shift in mindset is crucial for achieving successful retirement outcomes.

Additionally, the average retirement savings for small business owners using SEP IRAs and Solo 401(k)s can vary widely, with many individuals saving anywhere from $50,000 to $200,000. This highlights the need for personalized strategies. Regular financial assessments and strategic planning meetings can help business leaders identify opportunities for income tax solutions that reduce tax burdens and avoid costly underpayment fees. Plus, understanding IRS requirements for estimated tax payments, including income tax solutions such as safe harbor payments and the de minimis exception, can really boost their financial strategies.

As noted in the case study "The Shift in Wealth Perspective," a fundamental change in how we think about wealth and financial security is key to effective retirement planning. Additionally, maximizing tax benefits through Health Savings Accounts (HSAs) can offer business leaders more avenues for income tax solutions, enabling them to contribute pre-tax dollars and grow their retirement funds without immediate tax consequences.

In the end, a well-structured retirement strategy empowers business leaders to navigate their financial landscape with confidence and clarity. To enhance your retirement plan, why not consider setting up a consultation with a financial advisor? They can help you explore customized options that align with your goals.

Tax Compliance Updates: Staying Informed to Avoid Penalties

Tax compliance can feel like a maze, right? That’s why it’s super important for small business owners to stay in the loop about any changes in regulations. That’s where Steinke and Company comes in! They’re like your trusty guide, providing timely updates on tax rules so you’re never caught off guard by new requirements or deadlines. This proactive approach not only helps you dodge those pesky penalties—because let’s face it, nobody wants to pay fines that can add up to thousands of dollars—but also lets you focus on growing your business without the stress of unexpected tax issues.

And it gets better! Steinke and Company doesn’t just stop at updates; they also offer regular training sessions and resources to keep you prepared for the ever-changing tax landscape. By fostering a culture of compliance awareness, you can significantly reduce your risk of penalties and boost your overall financial health. So, why not take advantage of these resources? Your future self will thank you for it!

Technology Solutions: Enhancing Tax Compliance and Business Efficiency

In today’s digital world, technology is key to boosting tax compliance and making organizations run more smoothly. At Steinke and Company, we help small agency operators embrace tech solutions that simplify accounting, improve data accuracy, and ensure compliance. Our expert tax compliance and preparation services make sure your organization ticks all the legal boxes, so you can avoid any nasty surprises come tax season.

Think about it: tools like cloud-based accounting software, automated tax filing systems, and financial management apps can really lighten the load for business owners. By adopting these technologies and proactive tax planning strategies, small agencies can concentrate more on what they do best while keeping everything compliant and efficient. This not only streamlines operations but also sets the stage for long-term success. So, why not take that leap into the tech world and see how it can transform your agency?

Conclusion

Maximizing income tax savings is super important for small agency owners, especially when navigating the tricky waters of tax compliance and strategic planning. By tapping into expert advice and customized solutions from professionals like Steinke and Company, small business leaders can really cut down on their tax liabilities and dodge those pesky penalties. This article emphasizes how crucial it is to get a grip on different tax strategies, pick the right business entity, and regularly check in on financial practices to boost overall financial health.

Key takeaways include:

- The need for proactive tax planning

- The perks of monthly accounting services

- How technology can streamline operations

Each of these pieces plays a vital role in a well-rounded approach that not only tackles immediate tax concerns but also nurtures long-term growth and sustainability. Plus, aligning personal values with business strategies through coaching and regular strategic planning is something we definitely can't overlook.

With these strategies in mind, small agency owners should feel encouraged to take some concrete steps toward improving their financial practices. Embracing expert consultations, staying updated on tax compliance changes, and leveraging tech solutions can really amp up operational efficiency and tax results. Ultimately, focusing on these areas will empower business leaders to confidently navigate their financial landscape, paving the way for a secure and prosperous future.

Frequently Asked Questions

What services does Steinke and Company provide for small businesses?

Steinke and Company offers comprehensive tax compliance services, personalized income tax solutions, and strategic tax planning to help small businesses navigate tax regulations and minimize liabilities.

Why is tax compliance important for small businesses?

Tax compliance is crucial because around 40% of small businesses face penalties due to tax issues. Understanding and adhering to tax regulations helps businesses avoid costly penalties and maintain financial well-being.

How can Steinke and Company assist with business startup consultations?

Steinke and Company provides expert consultations to help entrepreneurs choose the right business entity, such as an LLC or S-Corp, which can impact taxes and operational advantages, ensuring compliance with state and federal regulations.

What is strategic tax planning, and why is it important?

Strategic tax planning involves forecasting tax obligations and discovering methods to minimize them, such as maximizing deductions and leveraging tax credits. It is important for small business leaders to enhance financial health and ensure compliance with legal requirements.

What techniques can small businesses use to minimize tax liabilities?

Techniques include maximizing deductions, leveraging tax credits, timing income and expenses, and keeping detailed records of expenses to identify potential deductions, such as the 20% Qualified Business Income deduction under Section 199A.

How often does Steinke and Company meet with clients for tax planning?

Steinke and Company meets with clients 1-3 times a year to review tax returns and financial systems, identify missed opportunities, and develop strategies to lighten tax burdens and encourage growth.

What are some specific tax solutions mentioned in the article?

Specific tax solutions include utilizing pass-through entities to avoid double taxation and Section 179 deductions for immediate expensing of qualifying purchases.