Overview

So, what's the deal between a CPA and a tax preparer when it comes to small business owners? Well, it really boils down to their expertise, the ongoing support they offer, and how they handle strategic planning.

- CPAs are like your financial superheroes, providing comprehensive guidance and being there for you all year round.

- On the flip side, tax preparers are more about crunching those numbers during tax season.

So, when you're deciding who to go with, think about how complex your financial needs are and what fits your budget best. It's all about finding the right match for your business!

Introduction

Navigating the financial landscape of small business ownership can often lead to a big question: should you hire a Certified Public Accountant (CPA) or a tax preparer? Both options come with their own set of perks, but knowing the differences can really affect your business's financial health and compliance. In this article, we're diving into the key distinctions between CPAs and tax preparers, showcasing how each can cater to the unique needs of small businesses. So, as you weigh your choices, think about this: which professional can not only help you meet your tax obligations but also support your long-term growth and success?

Steinke and Company: Comprehensive Tax Preparation and CPA Services

At Steinke and Company, we’re all about helping micro and small businesses thrive by offering a wide range of services, including insights on CPA vs tax preparer options. Our team of seasoned experts is here to provide personalized support that covers everything from tax compliance and preparation to strategic advisory services. We make the tax process easier so you can focus on what really matters—growing your business and boosting operational efficiency.

We believe that keeping our clients informed and compliant with tax regulations is key. That’s why we position ourselves as your trusted partner in the often tricky world of management. So, whether you’re just starting out or looking to expand, we’re here to guide you every step of the way. Let’s tackle those tax challenges together and pave the way for your success!

CPA Certifications: Understanding the Credentials and Expertise

Certified Public Accountants (CPAs) are licensed pros who have tackled a tough exam and met specific educational and experience requirements. This certification shows they have a solid grasp of accounting, tax prep, and financial planning. To keep their license, CPAs need to continue their education, staying up-to-date with the latest tax laws and regulations. For small business owners, teaming up with a CPA means tapping into a wealth of knowledge and resources that can really boost their financial health.

Now, let’s talk stats: CPA candidates have a pretty challenging road ahead, with pass rates hovering around 44% in recent years. But here’s the good news—those who invest in quality CPA review courses can really up their chances of passing, with some programs boasting a 28% higher pass rate for their students. This just goes to show how valuable CPA credentials are in the context of CPA vs tax preparer when it comes to navigating complex financial landscapes.

Plus, there’s a noticeable trend in CPA education leaning towards advanced degrees. Many firms are now on the lookout for candidates with master’s degrees, reflecting the demand for higher expertise in financial planning. This shift really highlights the value CPAs bring to small businesses looking to fine-tune their financial strategies. So, if you're a small business owner, consider partnering with a CPA to enhance your financial game!

Tax Preparers: Specialized Services for Small Business Tax Compliance

Tax preparers are your go-to experts when it comes to getting tax returns ready for both individuals and businesses. While they might not always have the same formal education or certification as Certified Public Accountants (CPAs), many tax preparers come with a treasure trove of practical experience in tax prep, highlighting the differences in CPA vs tax preparer. Their main focus? Making sure you stick to tax regulations while helping you snag those all-important deductions. This is especially crucial for entrepreneurs looking to optimize their tax responsibilities and avoid those pesky underpayment penalties.

Are you considering the options of CPA vs tax preparer for your financial needs? It could be a smart move for small businesses, particularly during the hectic tax season, to evaluate the options of CPA vs tax preparer. Industry stats show that a significant number of independent business owners find that bringing on a CPA vs tax preparer not only eases the stress of tax filing but can also lead to substantial savings thanks to their expert knowledge of available deductions and credits. For instance, tax preparers can help identify specific tax benefits that small businesses might overlook, ensuring compliance while trimming down tax bills. They can also offer advice on strategies like safe harbor payments and the de minimis exception, which are key to steering clear of underpayment penalties.

Plus, tax preparers often provide tailored services that meet the unique needs of local businesses, such as bookkeeping and tax planning. This all-around support boosts operational efficiency and allows business owners to focus on growth and development. By tapping into the expertise of a tax preparer, business owners can tackle the complexities of tax compliance with greater confidence and ease, applying essential strategies to avoid underpayment penalties and foster long-term success.

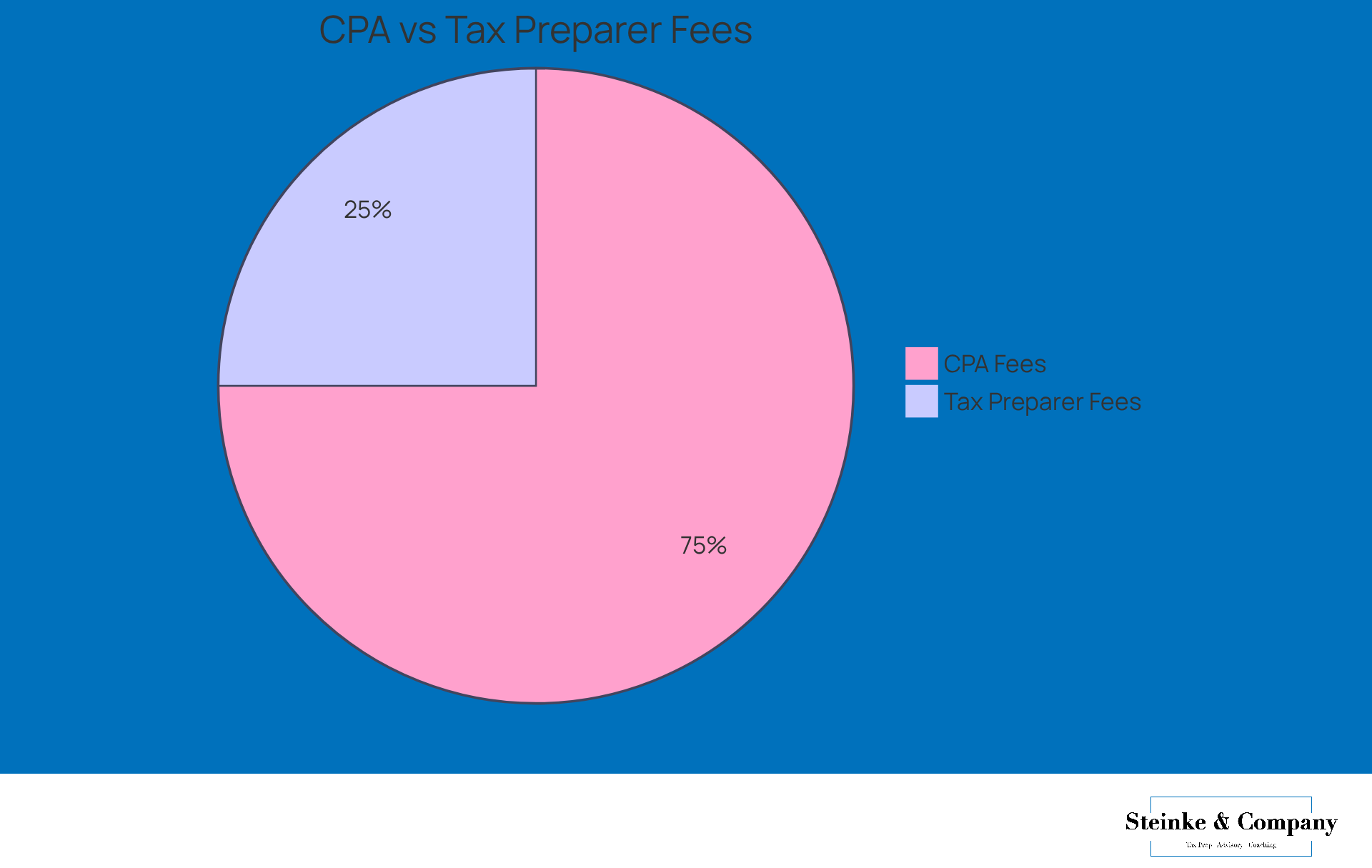

Cost Comparison: CPA Fees vs. Tax Preparer Charges

When considering costs, it’s pretty clear that in the CPA vs tax preparer comparison, CPAs usually charge more than tax preparers. Why? Well, it all comes down to their extensive training and the wide range of services they provide. You might find CPA fees anywhere from $150 to $450 an hour, depending on how complex the services are. On the flip side, tax preparers often have lower rates, typically between $50 and $150 per hour.

Now, while cost is definitely a big deal, if you’re a small business owner, it’s worth considering the long-term savings and benefits of working with a CPA vs tax preparer. They can really help with strategic tax planning and compliance, which can save you money in the long run. So, have you thought about how a CPA might fit into your financial picture?

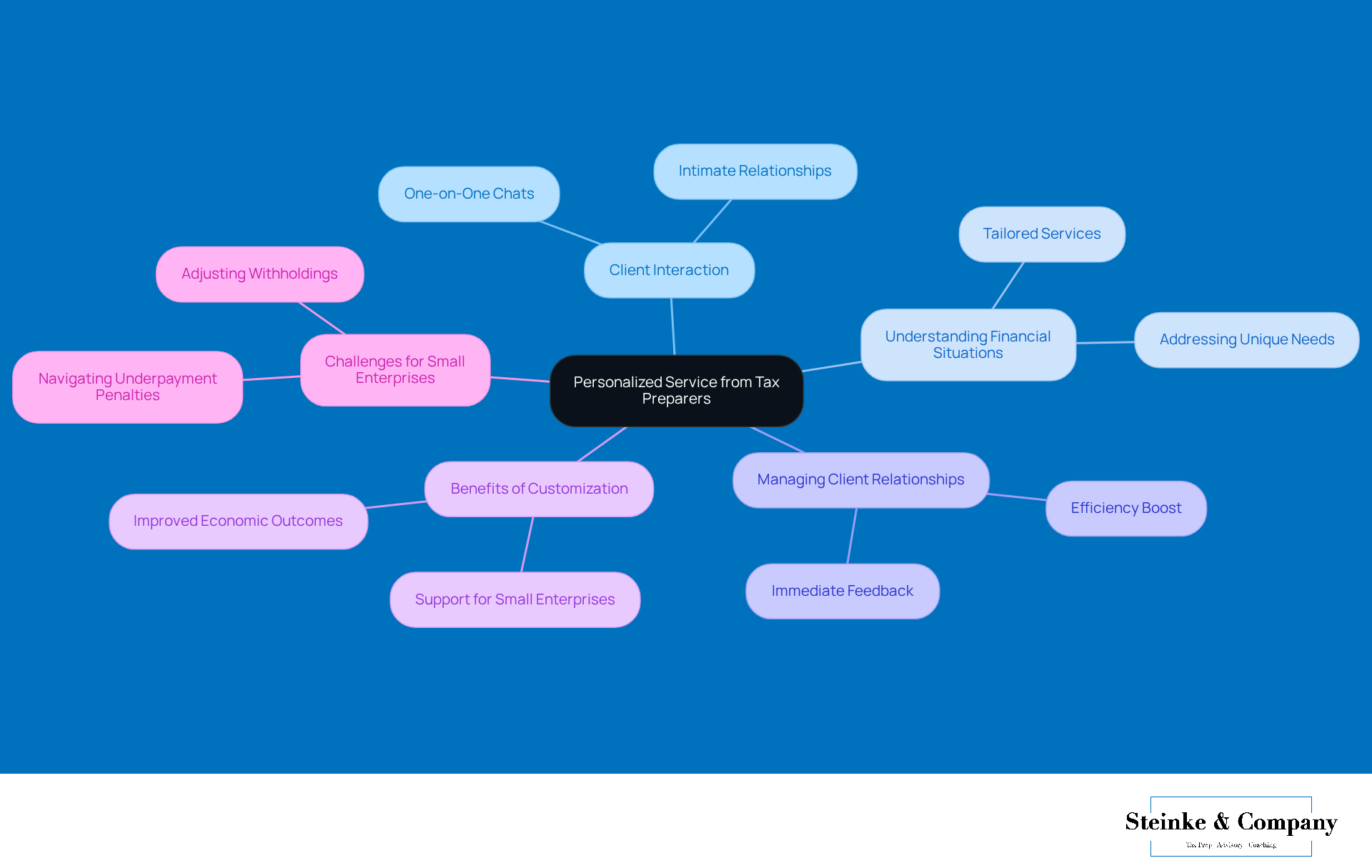

Client Interaction: Personalized Service from Tax Preparers

Tax preparers really shine when it comes to personalized service, often chatting with clients one-on-one. This close interaction helps them understand each client's unique financial situation, allowing for services that are tailored just for you. On average, tax preparers manage about 100 clients a year, which creates a more intimate relationship when considering the differences in client interaction in the CPA vs tax preparer comparison. This personalized touch not only makes the tax prep process smoother but also boosts efficiency, as tax preparers can quickly address your concerns and provide immediate feedback.

When it comes to navigating underpayment penalties and the impacts of reduced COVID-19 tax benefits, experts agree that this level of customization is a game changer for independent business owners. Tax preparers can roll out strategies that tackle the specific challenges small enterprises face, like adjusting withholdings or making estimated tax payments to dodge those pesky penalties. This means clients feel supported and understood throughout the tax prep journey, ultimately leading to better economic outcomes and staying compliant with IRS regulations. So, if you're feeling a bit lost in the tax maze, remember that a tax preparer could be just the ally you need!

Strategic Planning: The CPA Advantage for Business Growth

CPAs do so much more than just prepare taxes; they offer strategic planning services that can really make a difference in a company's growth journey. By diving deep into financial data, they provide crucial insights into cash flow management, budgeting, and investment strategies. This kind of guidance empowers small business owners to make smart decisions that align with their long-term goals, especially when it comes to avoiding underpayment penalties and optimizing tax compliance.

Now, to steer clear of those pesky underpayment penalties, it's important for business owners to get a grip on IRS requirements. Basically, they need to pay at least 90% of their current year's tax liability or 100% of the tax shown on their return from the previous year. And if your adjusted gross income is over $150,000? That threshold bumps up to 110% of last year's tax.

For instance, companies that tap into CPA strategic guidance often see a boost in their economic performance and sustainable growth. Take Bollinger Construction, for example. After rolling out a quality management program, they experienced a nearly 10% increase in profitability—marking the largest jump in their history! This partnership with CPAs turns them into invaluable allies, helping not just with compliance but also with proactive growth.

As Josh Bollinger, President of Bollinger Construction, puts it, 'After implementing Home Innovation's quality program, the company’s first-time pass rate with code inspectors went from 63 to 97 percent consistently.' So, if you're a small agency owner, consider bringing a CPA on board—not just for tax prep, but to understand the cpa vs tax preparer distinction, as a strategic partner to help you grow and avoid costly penalties while reaching your financial goals.

Seasonal Work: Tax Preparers vs. Year-Round CPA Support

Tax preparers usually work seasonally, mainly during tax season, which can make it tricky for them to provide ongoing support. On the flip side, when discussing CPA vs tax preparer, CPAs are here for you all year round, offering continuous help with planning, tax compliance, and strategy. This ongoing relationship is super important for independent owners because it means you can get quick advice on how to dodge those pesky underpayment penalties on estimated taxes, particularly when weighing the advantages of CPA vs tax preparer. By keeping an eye on your tax obligations throughout the year, you can better navigate the IRS maze and be ready for tax season and any financial bumps in the road.

Plus, CPAs can help you understand different accounting methods—cash, accrual, and hybrid—which can really boost your operational efficiency and set you up for long-term success. So, why not take advantage of their expertise? It could make a world of difference for your business!

Regulatory Compliance: Navigating Complex Tax Laws with a CPA

Navigating the complexities of tax regulations can feel pretty overwhelming for small business owners, right? That's where CPAs come in. They're armed with the knowledge and expertise to help you understand and comply with these tricky regulations. They stay updated on changes in tax laws and can offer you advice on making those essential adjustments to your operations. This proactive approach to regulatory compliance not only helps you dodge penalties but also boosts your organization's financial health. So, why not lean on their expertise to make your life a little easier?

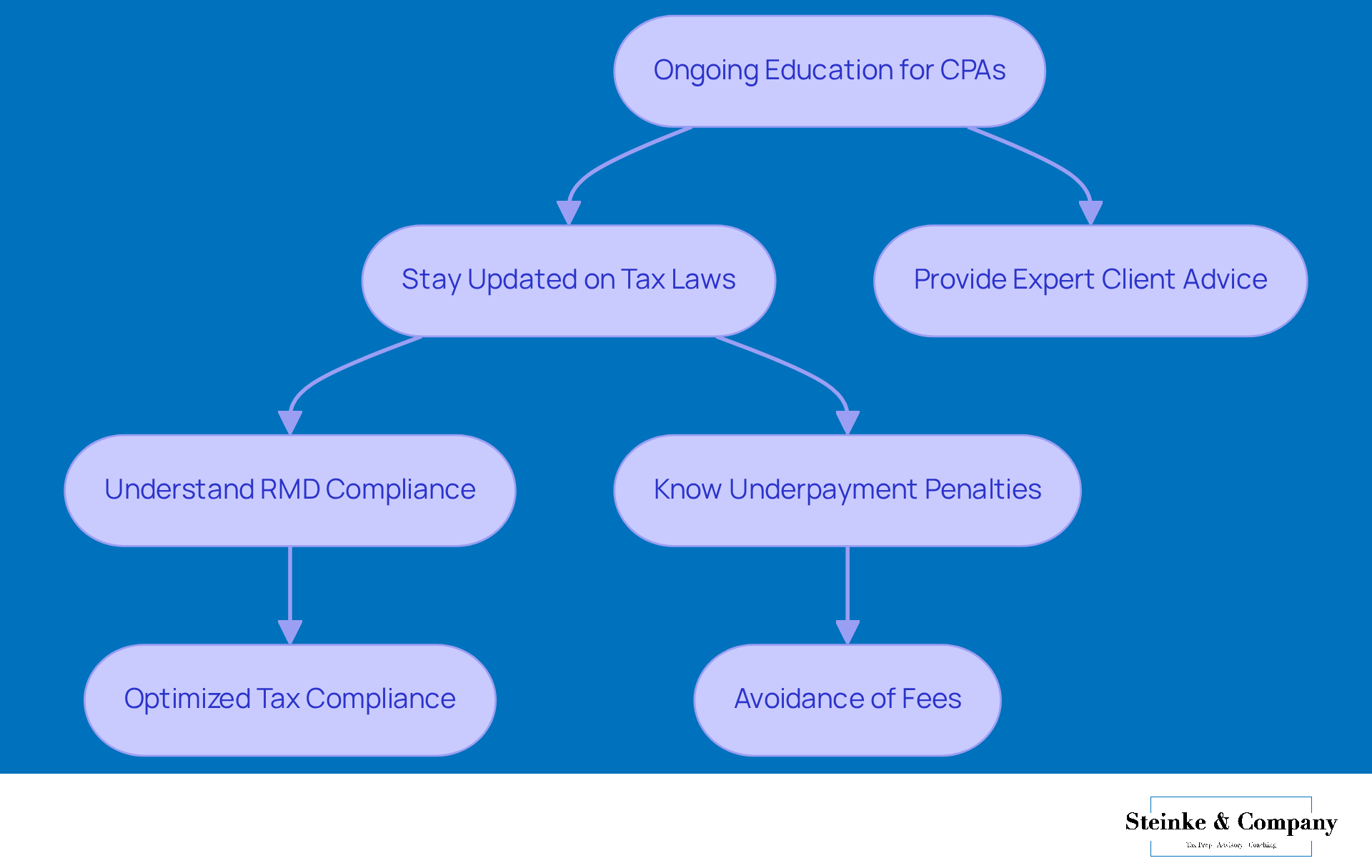

Ongoing Education: The Continuous Learning of CPAs

Hey there! Did you know that when considering CPA vs tax preparer, CPAs have to keep up with continuing education courses to maintain their certification? This is super important because it helps them stay in the loop with the latest tax laws and accounting practices. By committing to ongoing education, CPAs can give their clients the best advice, especially when it comes to tricky topics like Required Minimum Distributions (RMDs) and underpayment penalties.

For example, understanding RMD compliance is key for retirement planning. If you don’t take those required distributions, you could face some hefty penalties. Plus, with the IRS bumping up interest rates for underpayment penalties, it’s crucial for small business owners to stay on top of their tax obligations.

When considering CPA vs tax preparer, working with a CPA means you get access to a pro who knows the current regulations and can adapt to any future changes in the tax landscape. This way, you can optimize your tax compliance and steer clear of unnecessary fees. So, why not team up with a CPA? It could make all the difference!

Decision Factors: Choosing Between a CPA and a Tax Preparer

When small business owners face the choice of CPA vs tax preparer, there are a few key factors to consider. First off, consider the complexity of your financial situation. If your business has multiple revenue streams or significant investments, you might find that a CPA can offer more comprehensive planning and strategic advice. On the flip side, if your needs are pretty straightforward, a tax preparer could provide effective and budget-friendly services.

Ongoing support is another thing to keep in mind. CPAs typically offer year-round assistance, helping you navigate financial challenges and plan strategically, while tax preparers often focus mainly on the busy tax season. The distinction of CPA vs tax preparer can significantly impact your business’s long-term financial health.

Let’s not forget about budget constraints. Sure, CPAs might charge more because of their extensive qualifications and services, but that investment can pay off through smart tax planning and financial advice. On the other hand, tax preparers usually offer more affordable options for basic tax filing needs.

Real-world examples can shed some light here:

- A small retail business might thrive with a CPA’s guidance on inventory management and financial forecasting.

- A freelance graphic designer may find a tax preparer sufficient for their annual tax filings.

To really assess your financial needs, take a moment to evaluate your current and future goals. Think about growth plans, potential investments, and the complexity of your financial landscape. Chatting with financial consultants can provide valuable insights into these decision-making factors, ensuring that the service you choose fits your unique situation.

In the end, the decision-making process regarding CPA vs tax preparer should be thorough. Weigh your specific goals and financial circumstances to figure out whether a CPA or a tax preparer is the right choice for you.

Conclusion

Choosing between a CPA and a tax preparer is a big decision for small business owners, and it can really impact your financial health and compliance. Both professionals have important roles when it comes to managing taxes, but it’s essential to understand what sets them apart in terms of qualifications, services, and the unique value they offer.

CPAs provide a comprehensive range of services, including strategic planning and ongoing support throughout the year, which can lead to better financial outcomes. On the flip side, tax preparers tend to focus on seasonal work, offering personalized services that address immediate tax filing needs.

Let’s break down some key differences, like education levels, costs, and the types of services each offers:

- CPAs go through rigorous training and continuous education, making them well-equipped to navigate complex tax regulations and provide strategic insights that can help your business grow.

- Tax preparers shine when it comes to delivering tailored support and ensuring compliance with tax laws, often at a more budget-friendly rate.

Ultimately, your choice between a CPA and a tax preparer should reflect your specific business needs, financial complexity, and long-term goals. So, take a moment to assess your unique situation. Do you need comprehensive support from a CPA, or are your tax needs straightforward enough for a tax preparer? Taking the time to evaluate these options can lead to informed decisions that enhance your financial stability and growth. What do you think fits your situation best?

Frequently Asked Questions

What services does Steinke and Company offer?

Steinke and Company provides a wide range of services including tax compliance and preparation, strategic advisory services, and insights on CPA vs tax preparer options, specifically aimed at helping micro and small businesses thrive.

What is the role of a Certified Public Accountant (CPA)?

A CPA is a licensed professional who has passed a rigorous exam and met specific educational and experience requirements. They possess a solid understanding of accounting, tax preparation, and financial planning, and are required to continue their education to stay current with tax laws and regulations.

Why should small business owners consider partnering with a CPA?

Partnering with a CPA allows small business owners to access a wealth of knowledge and resources that can enhance their financial health and strategic planning, helping them navigate complex financial landscapes.

What are the pass rates for CPA candidates?

The pass rates for CPA candidates have been around 44% in recent years, but those who invest in quality CPA review courses can significantly improve their chances of passing.

How do tax preparers differ from CPAs?

Tax preparers are experts in preparing tax returns for individuals and businesses, often lacking the formal education or certification of CPAs. However, many tax preparers have extensive practical experience and focus on ensuring compliance with tax regulations while helping clients maximize deductions.

What benefits do tax preparers offer to small businesses?

Tax preparers help small businesses identify tax benefits, ensure compliance with regulations, and provide tailored services such as bookkeeping and tax planning, ultimately boosting operational efficiency and reducing tax liabilities.

When should small businesses consider hiring a CPA instead of a tax preparer?

Small businesses should evaluate the options of CPA vs tax preparer, especially during tax season, as CPAs can provide deeper insights and potentially lead to greater savings due to their expertise in deductions and credits.

What strategies can tax preparers offer to avoid underpayment penalties?

Tax preparers can advise on strategies like safe harbor payments and the de minimis exception, which are essential for avoiding underpayment penalties and ensuring compliance.