Overview

So, have you ever wondered if car repairs can be tax deductible for your small business? Well, you’re in luck! This article dives into just that. It explains that if you’re using your vehicle for business purposes, you can actually deduct those maintenance costs. Pretty neat, right?

Now, here’s the kicker: it’s super important to keep proper documentation. You want to make sure you can distinguish between repairs and improvements because that can really help you maximize those tax benefits. So, next time you’re in for a tune-up, remember to keep those receipts handy!

In conclusion, understanding these deductions can make a difference for your business finances. If you have any experiences or tips about vehicle expenses, feel free to share!

Introduction

Navigating the world of tax deductions can feel a bit overwhelming for small business owners, right? Especially when it comes to figuring out the ins and outs of vehicle expenses. With the recent changes in tax regulations, the opportunity to save on car repairs is more significant than ever. But here’s the big question: are car repairs really tax deductible? And how can you, as a business owner, make sure you’re getting the most out of your claims?

This article dives into the essential insights surrounding car repair deductions, aiming to provide you with clarity and practical guidance. We want to help small businesses like yours optimize their tax strategies, making the process a little less daunting and a lot more manageable.

Steinke and Company: Expert Guidance on Tax Deductions for Car Repairs

Since 1974, Steinke and Company has been a cornerstone for micro and small enterprises, offering specialized guidance in navigating the complexities of tax compliance. Their expertise is especially valuable when it comes to understanding whether car repairs are tax deductible. For service-oriented professionals, knowing how to properly claim these deductions can significantly ease the burden during tax season. And guess what? Recent updates suggest that small enterprises can benefit from higher eligibility limits and lowered tax rates, making it even more essential to stay aware of those possible deductions.

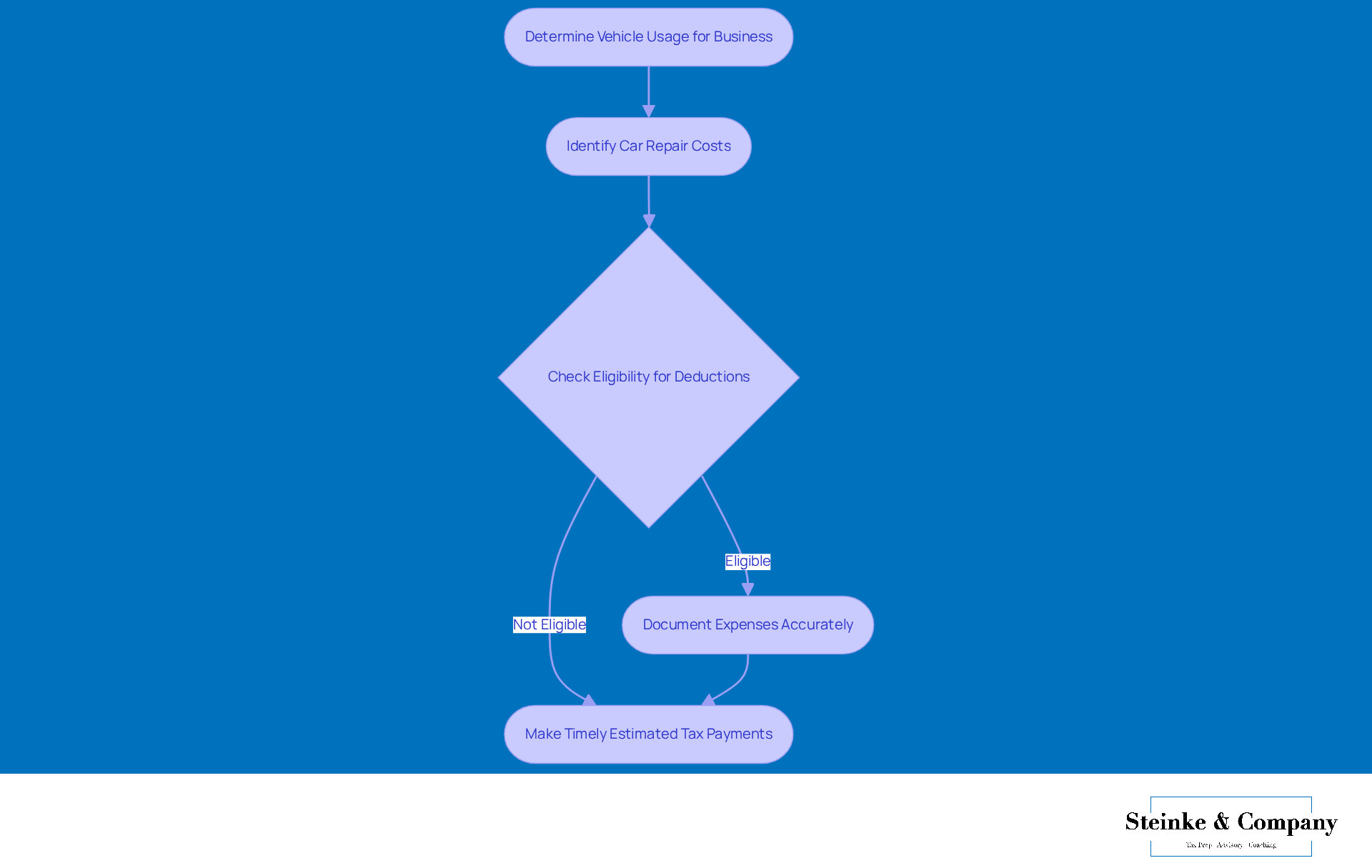

For instance, small business owners can subtract essential vehicle maintenance costs if they determine that car repairs are tax deductible and the automobile is used for business activities. This includes costs tied to maintenance, repairs, and considerations about whether car repairs are tax deductible. Steinke and Company is here to help clients document these expenses accurately, ensuring compliance with tax regulations while maximizing potential deductions.

Experts emphasize that proper tax compliance not only reduces liabilities but also boosts the overall financial health of small enterprises. Plus, small business owners should keep an eye out for underpayment penalties that can sneak up due to insufficient estimated tax contributions. To dodge these penalties, it’s wise to make timely estimated tax payments and consult with a tax professional to ensure compliance with IRS requirements.

By leveraging their extensive knowledge, Steinke and Company empowers clients to navigate these tax intricacies confidently, ultimately fostering sustainable growth and operational efficiency. So, small business owners, why not reach out to Steinke and Company? They can help you maximize your deductions and steer clear of those costly underpayment penalties!

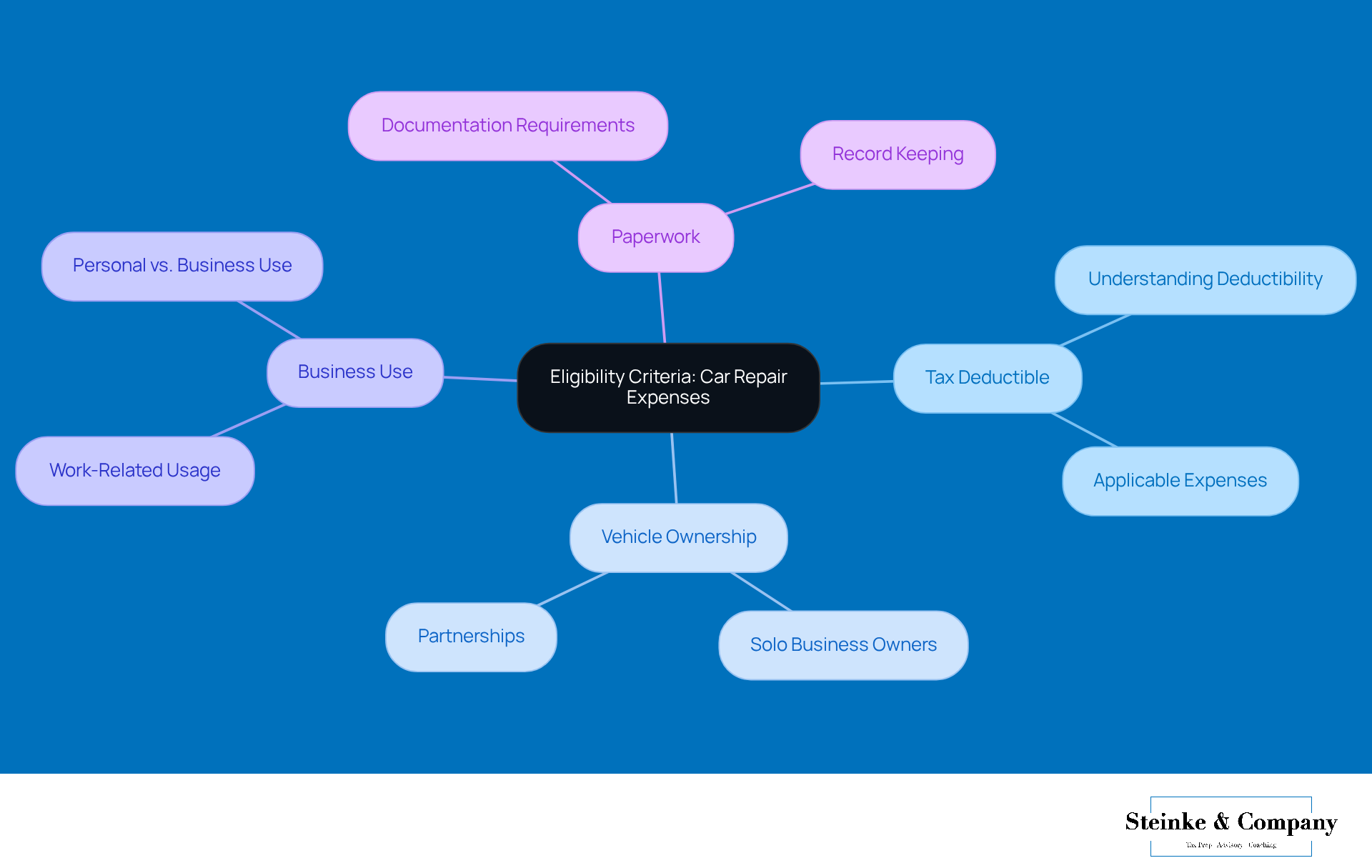

Eligibility Criteria: Who Can Claim Car Repair Expenses?

So, if you want to claim vehicle maintenance costs, you need to understand whether car repairs are tax deductible, and you should be using that car for work. This applies to vehicles owned by solo business owners or those shared in partnerships. Plus, it is important to know whether car repairs are tax deductible for your business to run smoothly. Don't forget to keep all the right paperwork handy to back up your claims!

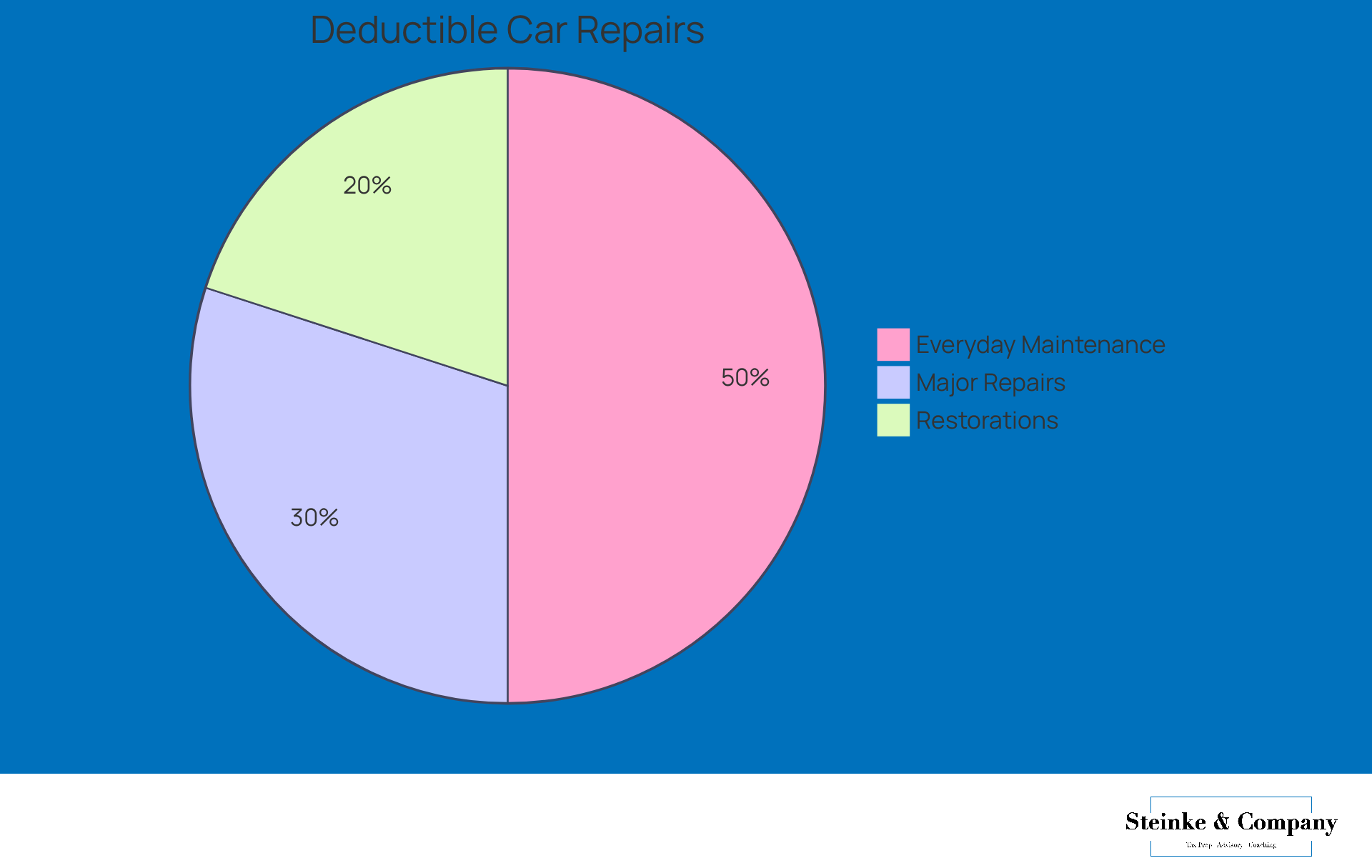

Deductible Expenses: Types of Car Repairs You Can Claim

When it comes to car maintenance, many people wonder if car repairs are tax deductible, including everyday tasks like oil changes, tire replacements, and brake services. But don’t forget about the essential maintenance that keeps your ride safe—things like fixing the transmission or exhaust system are car repairs tax deductible! Just a heads up, though: it’s important to know the difference between restorations and enhancements. Only restorations get that instant deduction, so keep that in mind as you plan your car care!

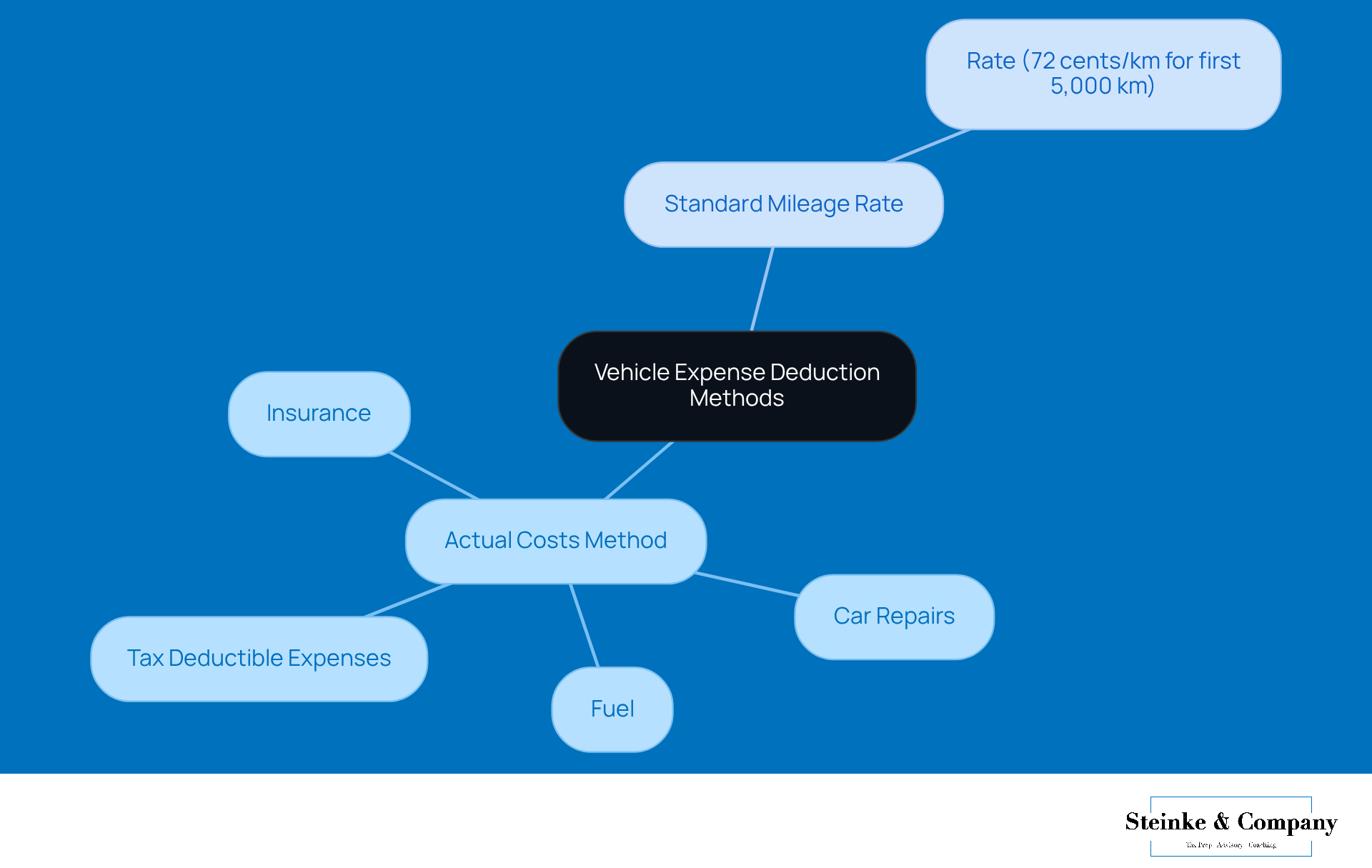

Deduction Methods: Actual Expenses vs. Standard Mileage Rate

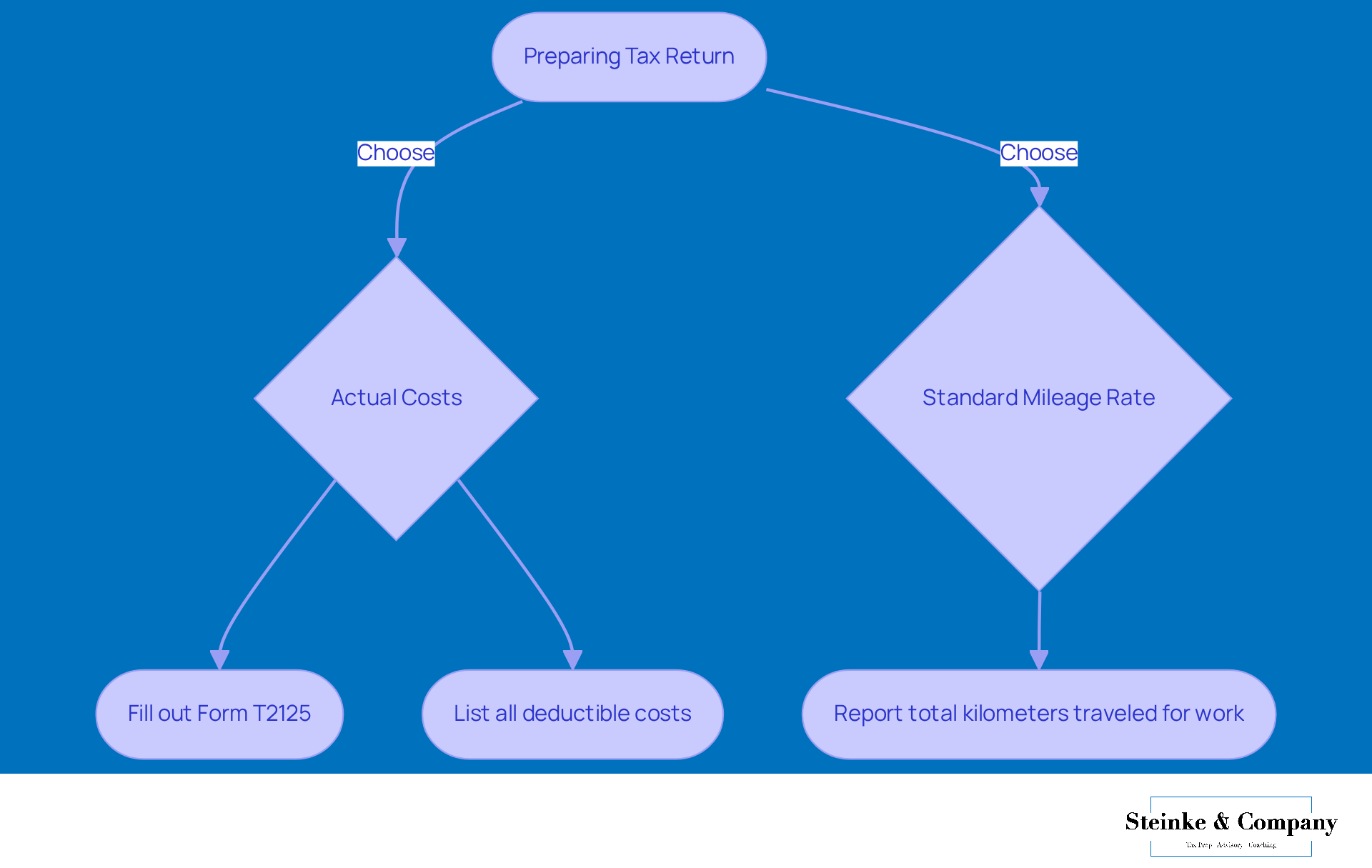

Hey there, small business owners! When it comes to deducting vehicle costs, you’ve got two choices: the actual costs method or the standard mileage rate. The actual costs method lets you deduct all vehicle-related expenses, and it raises the question of whether car repairs are tax deductible, along with fuel and insurance. On the flip side, the standard mileage rate offers a fixed rate of 72 cents per kilometer for the first 5,000 kilometers traveled for business in 2025.

So, how do you decide which one to go with? It all boils down to your overall vehicle expenses and how your company operates. To keep things smooth during tax season and avoid any surprises, it’s wise to engage in some proactive financial and tax planning. This means accurately preparing and filing both your corporate and personal returns.

And here’s a little tip: keep an eye on all your vehicle-related expenses and regularly review your financial documents. This can help you steer clear of budgeting mishaps and drive your business toward greater success!

Record-Keeping Essentials: How to Document Car Repair Expenses

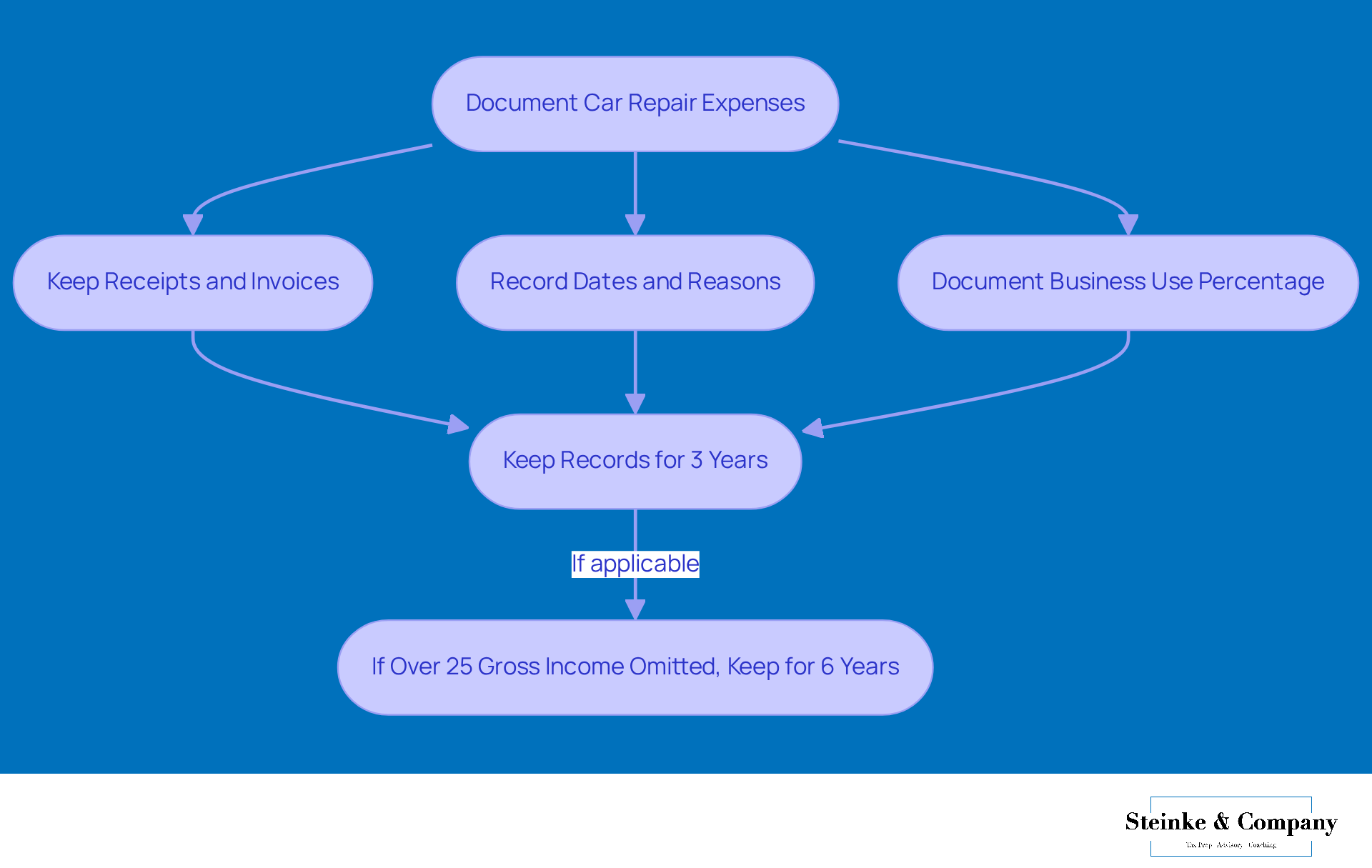

If you want to keep track of your vehicle maintenance costs, it’s super important to keep detailed records of all the repairs and upkeep. This means holding onto receipts, invoices, and jotting down the dates and reasons for each maintenance visit. And hey, if you’re using your vehicle for both business and personal stuff, don’t forget to document the percentage of business use!

Now, here’s a little tip: the IRS wants you to keep these records for at least three years after your tax return is due. But if you happen to leave out more than 25% of your gross income, that period can stretch to six years! So, to play it safe, it’s a good idea to keep all your vehicle maintenance records for at least six years. This way, you’ll be covered and ready to back up your claims when tax season rolls around.

Reporting Requirements: How to Include Car Repairs on Your Tax Return

When you're getting your taxes ready, don’t forget to jot down those vehicle maintenance costs on the right tax forms! For sole proprietors, this usually means filling out Form T2125, which is the Statement of Business or Professional Activities. It’s super important to make sure all your deductible costs, including whether car repairs are tax deductible, are listed accurately.

Now, if you’re going with the actual costs approach, make sure to include every relevant charge. But if you prefer the standard mileage rate, just report the total kilometers you’ve traveled for work. Easy peasy, right? Remember, keeping these details organized can save you some headaches down the road!

Repairs vs. Improvements: Understanding Deductible Expenses

Differentiating between maintenance and improvements is super important when determining if are car repairs tax deductible for claiming tax deductions on vehicle expenses. Think of repairs as necessary costs that help keep your vehicle in its current shape—like fixing a flat tire or swapping out worn brake pads, and consider whether are car repairs tax deductible. These expenses can be deducted in the year you incur them, giving you some immediate tax relief. On the flip side, improvements are all about boosting your vehicle's value or extending its lifespan. This could mean installing a new engine or upgrading the transmission. These enhancements need to be capitalized and depreciated over time, which can affect your tax benefits for several years.

For small businesses, getting a grip on these classifications can lead to some serious tax savings. Did you know that the average cost of vehicle maintenance has gone up by 4.1% each year from November 2013 to November 2023? Meanwhile, upgrades can often hit your wallet harder, typically requiring a bigger upfront investment. This distinction is crucial—while it is important to know if are car repairs tax deductible right away, improvements will impact your tax liabilities over a longer stretch.

Tax consultants really stress the importance of classifying these costs correctly. One expert even pointed out, "Getting our expert tax advice early on can save you from potential tax headaches." This just goes to show how vital it is for small business owners to chat with tax pros to navigate the ins and outs of vehicle cost classifications effectively.

Mixed-Use Vehicles: How to Allocate Car Repair Expenses

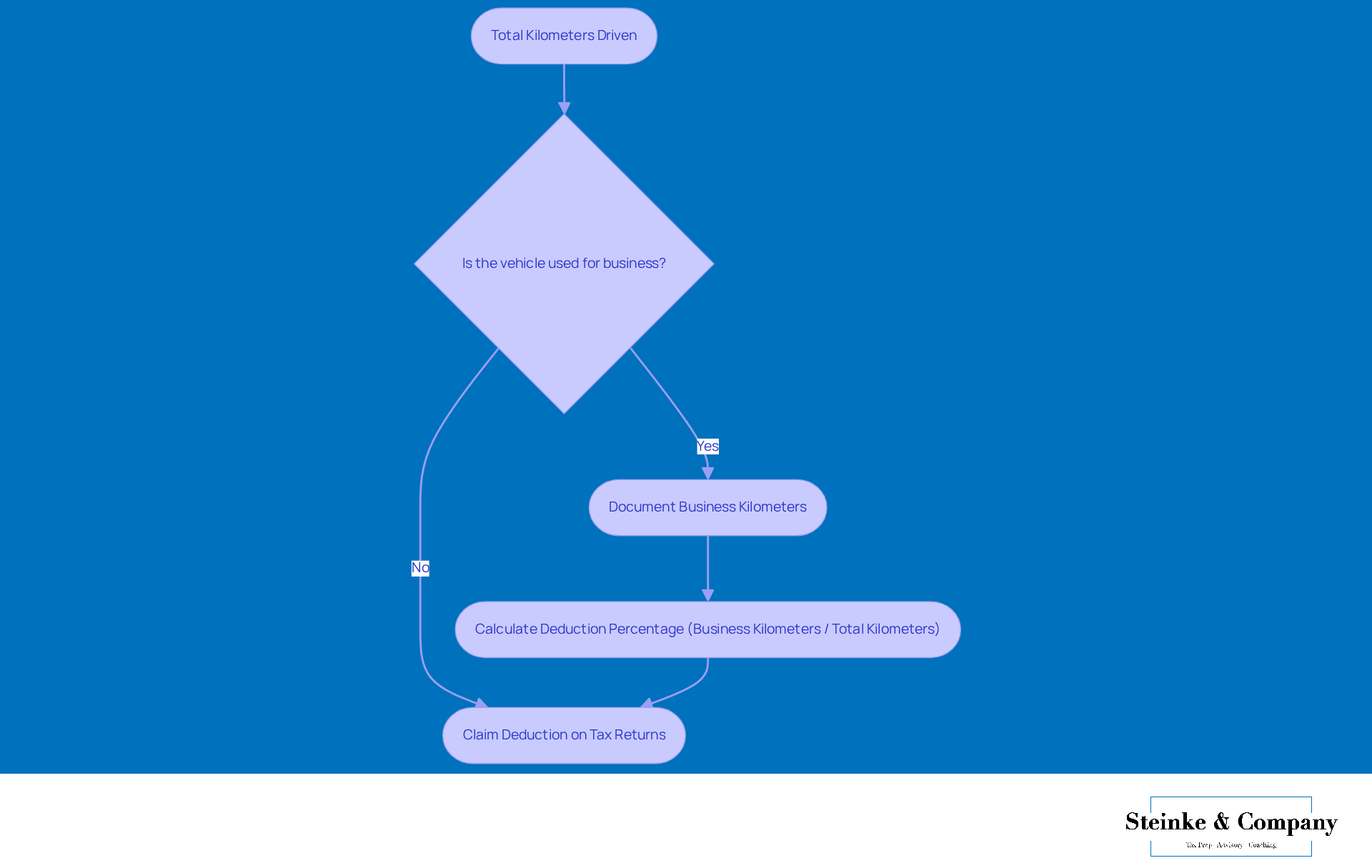

When a vehicle serves both personal and professional purposes, it's important to know whether car repairs are tax deductible, as only the costs tied to its professional use can be claimed for tax reductions. Keeping a detailed record of how much you drive for personal versus business is key to making sure you allocate vehicle maintenance expenses accurately. For instance, if you drive a total of 20,000 kilometers in a year and 15,000 of those are for work, you may wonder if car repairs are tax deductible, allowing you to deduct 75% of your repair costs. This approach not only aligns with tax regulations but also helps you get the most out of your deductions.

Tax pros often stress the importance of documenting the purpose of each trip, as this can really back up your claims when tax time rolls around. Small businesses might find that their vehicle usage varies quite a bit, but with careful tracking, there are definitely opportunities for boosting those tax savings. Have you thought about using automated mileage tracking solutions? They can make logging your vehicle use a breeze, ensuring you stay compliant and precise in your tax filings.

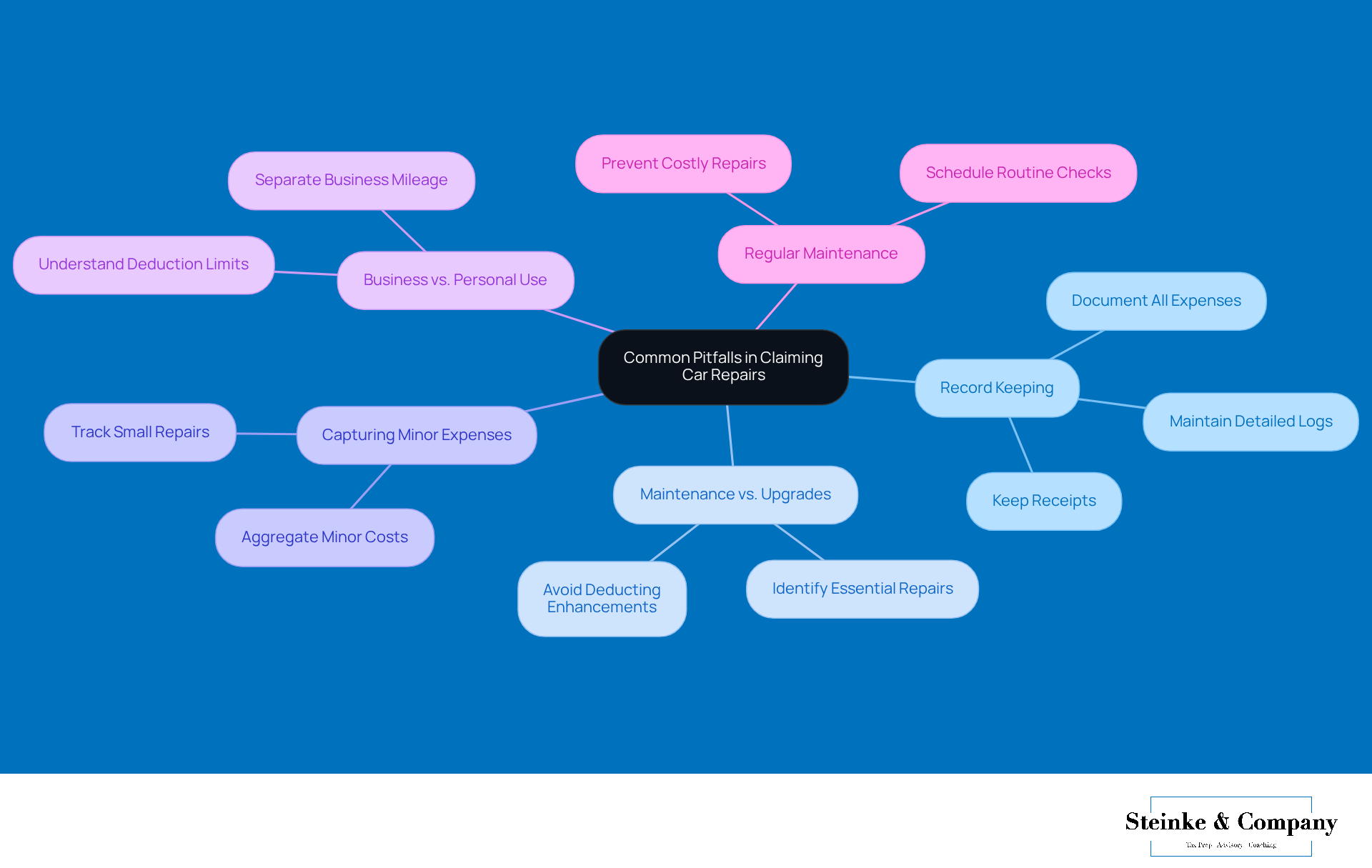

Common Pitfalls: Mistakes to Avoid When Claiming Car Repairs

When small business owners are trying to claim vehicle maintenance costs, they often wonder if car repairs are tax deductible, as they can run into a few bumps in the road that lead to missed deductions. One common pitfall? Not keeping good records. Seriously, having solid documentation—like receipts and a detailed log of maintenance—is crucial for backing up your claims. If you don’t have that paperwork, you could be leaving money on the table. Plus, be careful not to confuse maintenance with upgrades. Only the essential work that keeps your vehicle running smoothly is deductible; any enhancements that increase its value? Those aren’t going to cut it.

Another sneaky oversight is ignoring those minor maintenance expenses that might seem insignificant at first. But let’s be real: those little costs can add up and have a big impact on your overall tax bill. So, it’s super important to jot down every repair, no matter how small, to ensure you’re capturing all the deductions you’re entitled to, especially when considering if car repairs are tax deductible. And don’t forget to keep a close eye on how much you’re using the vehicle for business versus personal use—only the costs tied to professional use are deductible.

Keeping up with regular maintenance is also key to keeping those costs down. By staying on top of things, you can prevent small issues from turning into bigger, more expensive problems down the line. Did you know that small businesses reporting vehicle costs face higher audit rates? That just goes to show how important it is to keep your records straight and report accurately. By steering clear of these common mistakes and following best practices—like ensuring repairs are done by licensed pros—you can really maximize your deductions, especially when you know car repairs are tax deductible, and boost your financial health. And let’s not forget the 2025 IRS mileage rate of 70 cents per mile, which really highlights how vehicle costs can impact small businesses.

Consult a Tax Professional: Why Expert Advice Matters for Deductions

Navigating the complexities of tax regulations can feel overwhelming for small businesses, right? That's why consulting a tax professional isn't just a good idea—it's essential. A savvy tax advisor can offer tailored support that meets your unique needs, helping you make the most of your deductions while staying compliant with tax laws. For example, understanding whether car repairs are tax deductible can really make a difference to your bottom line. In fact, small businesses that engage in smart tax planning often reap significant rewards; one LLC even managed to slash its taxable income by 30% through careful documentation and claiming all eligible deductions. This really highlights the potential savings that come with expert advice!

Now, with the IRS bumping up the interest rate for underpayments to 8% annually, compounded daily, since October 1, 2023, it's super important for small business owners to stay on top of their tax responsibilities to avoid costly penalties. Strategies like:

- Utilizing safe harbor payments

- Understanding the de minimis exception

can be game-changers in reducing the risk of underpayment penalties. By keeping informed about income thresholds and your tax obligations, LLC owners can steer clear of unexpected liabilities and boost their financial health. Consulting with trusted professionals not only helps you navigate your financial landscape with confidence but also sets your business up for long-term success. So, why not reach out for that expert advice today?

Conclusion

Understanding the ins and outs of tax deductions for car repairs is super important for small businesses looking to boost their financial health. You might be surprised to learn that vehicle maintenance costs can actually be deductible if you’re using the vehicle for business. This little nugget of information can lead to some pretty significant tax savings, especially when small business owners keep track of their eligible expenses.

So, what’s on the table? We’re talking about:

- The types of car repairs that qualify for deductions

- How to tell repairs apart from improvements

- Why keeping meticulous records is a must

- The two main deduction methods—actual expenses versus the standard mileage rate

Staying informed about what’s eligible and dodging common pitfalls can save small business owners from costly mistakes and help them make the most of their deductions.

Now, let’s not forget how crucial it is to consult a tax professional. Seriously, getting expert advice can make navigating the maze of tax regulations a whole lot easier, ensuring you stay compliant while uncovering potential savings. Small business owners should definitely take the initiative to understand their tax obligations and seek out professional guidance to sharpen their financial strategies. By being informed and ready, businesses can not only reduce risks but also set the stage for sustainable growth and success. So, what are you waiting for? Dive into those tax details and watch your business thrive!

Frequently Asked Questions

What is the main focus of Steinke and Company?

Steinke and Company specializes in providing expert guidance on tax compliance, particularly regarding tax deductions for car repairs for micro and small enterprises.

Are car repairs tax deductible for small business owners?

Yes, small business owners can deduct essential vehicle maintenance costs if the automobile is used for business activities, including maintenance and repair expenses.

What types of car repair expenses can be claimed as tax deductions?

Tax deductible car repair expenses include everyday maintenance tasks like oil changes, tire replacements, and brake services, as well as essential repairs like fixing the transmission or exhaust system.

What is the difference between restorations and enhancements in terms of tax deductions?

Only restorations qualify for instant deductions, while enhancements do not. It’s important to distinguish between the two when planning car maintenance.

Who is eligible to claim car repair expenses?

Eligibility to claim car repair expenses applies to vehicles owned by solo business owners or those shared in partnerships, provided the vehicle is used for work.

Why is proper tax compliance important for small enterprises?

Proper tax compliance reduces liabilities and boosts the overall financial health of small enterprises, helping to avoid underpayment penalties.

How can small business owners avoid underpayment penalties?

Small business owners can avoid underpayment penalties by making timely estimated tax payments and consulting with a tax professional to ensure compliance with IRS requirements.

What should small business owners do to maximize their tax deductions?

Small business owners should keep accurate documentation of their vehicle maintenance expenses and consult with experts like Steinke and Company to navigate tax regulations effectively.