Introduction

Understanding LLC income tax rates can feel a bit like navigating a maze, right? But for small business owners, getting a grip on these intricacies is super important if you want to keep your financial health in check. With some savvy planning and a good handle on the latest tax regulations, you can actually save a chunk of change. So, how do you make sense of this complex tax landscape?

As tax laws change and differ from state to state, it’s crucial for LLC owners to stay informed. What steps can you take to ensure you’re making the smartest choices to lower your tax bills? Let’s dive in and explore this together!

Steinke and Company: Expert Guidance on LLC Income Tax Rates for Small Businesses

Since 1974, Steinke and Company has been a trusted partner for small businesses in rural America, focusing on the LLC income tax rate and compliance. We really get the tax landscape, which helps us craft strategies that not only minimize tax liabilities but also keep you on the right side of the law.

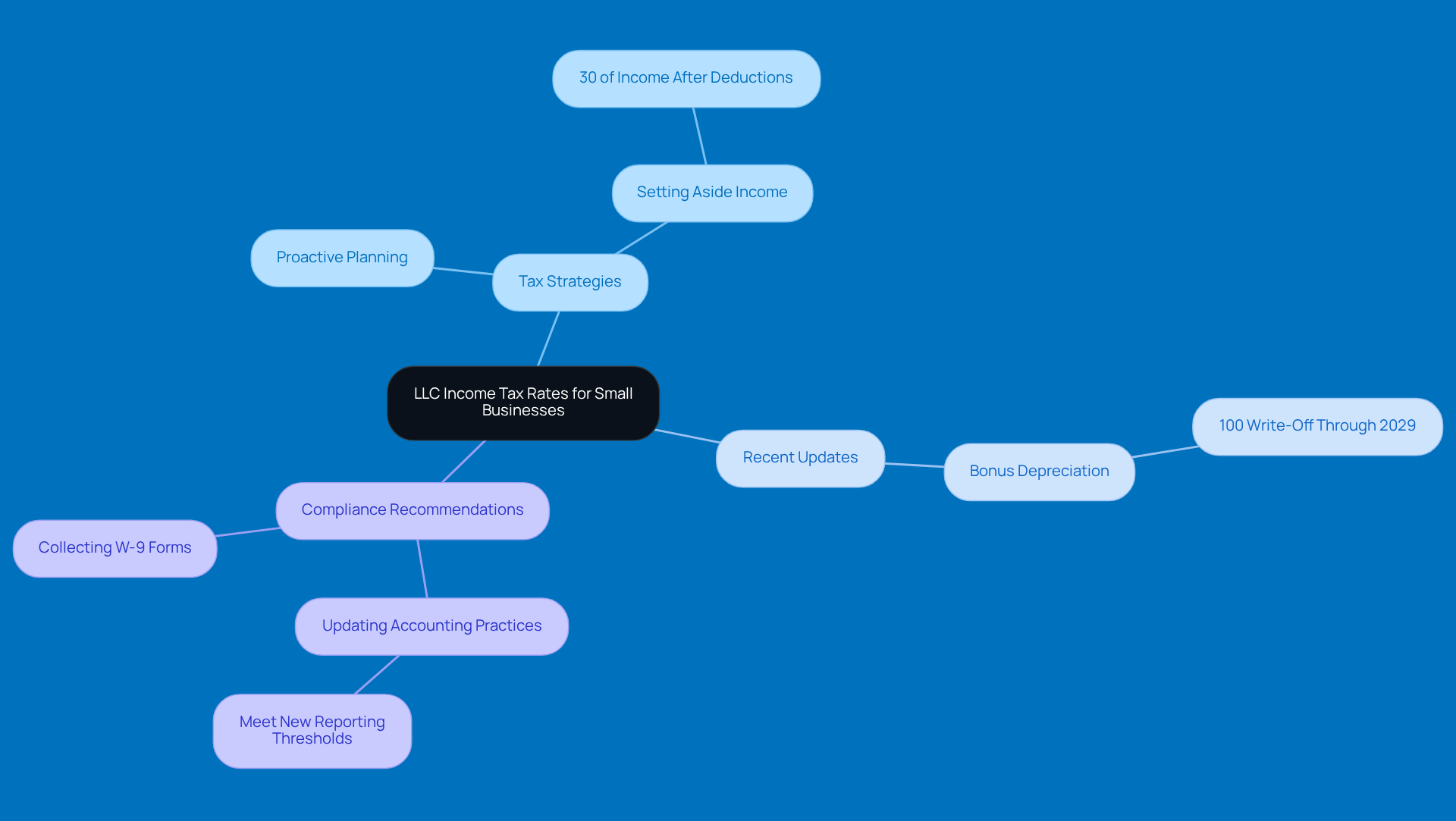

Have you heard about the recent updates? The reinstatement of bonus depreciation allows businesses to write off 100% of qualified property through 2029! That’s a big deal for potential tax savings. Our tax specialists often emphasize the importance of proactive planning. They recommend that small business owners set aside about 30% of their income after deductions to cover federal and state taxes.

For rural entrepreneurs, having effective strategies regarding the LLC income tax rate can lead to better financial stability and growth. Successful compliance strategies might include:

- Updating your accounting practices to meet new reporting thresholds

- Collecting W-9 forms from vendors to avoid unnecessary 1099 prep

By focusing on these tailored strategies, we help entrepreneurs navigate the complexities of taxes with confidence, allowing you to concentrate on what you do best: building strong and profitable businesses!

Understanding LLC Taxation: How LLCs Are Taxed and What It Means for Your Business

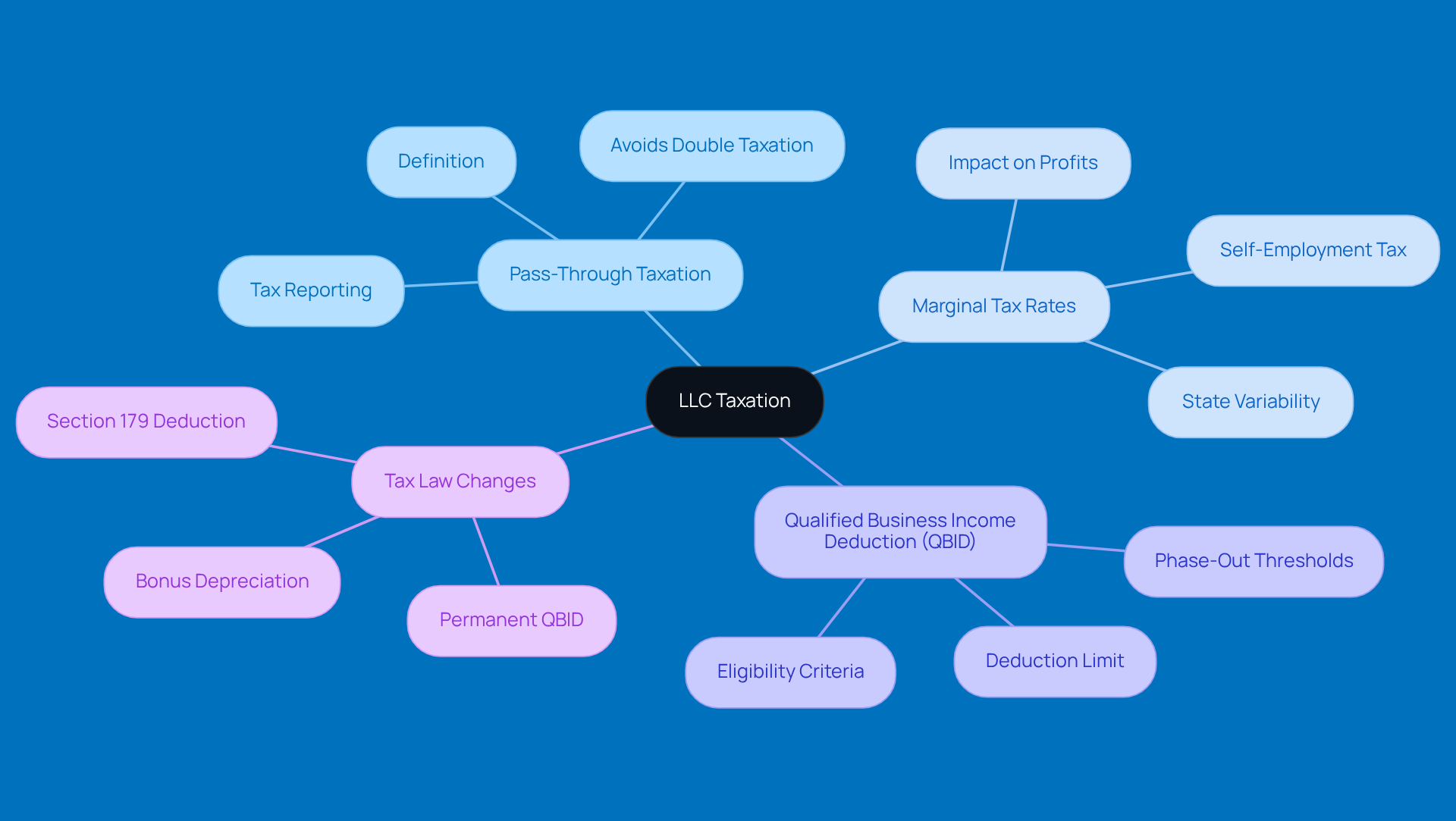

Limited Liability Companies (LLCs) are often considered pass-through entities in relation to the llc income tax rate. This means that the money your LLC makes goes straight onto your personal tax return. Pretty neat, right? It helps avoid that pesky double taxation, which is a big win for many small business owners. But, let’s be real - getting a grip on how the llc income tax rate works is super important since it can really impact your overall tax bill and financial planning.

Tax pros point out that while pass-through taxation gives you more flexibility, it can also throw some curveballs your way. For instance, some business owners might find themselves facing marginal tax rates that can hit over 50% in certain states, which can seriously eat into their profits. And don’t forget about the Qualified Business Income Deduction (QBID)! This nifty deduction lets eligible LLC owners take off up to 20% of their qualified income, but watch out - there are income limits and phase-outs, especially for specified service businesses, starting at $400,000 in individual earnings.

Let’s look at how this plays out in real life. Imagine a small business owner using the QBID to sharpen their tax strategy, making sure to report their income accurately to avoid any IRS headaches. Plus, with recent tax law changes - like the QBID becoming permanent and the increase in Section 179 deduction limits - there are some great chances for tax-smart growth. This means businesses can deduct the full cost of qualifying equipment in the year they buy it. How cool is that?

Ultimately, the llc income tax rate plays a significant role in the financial outcomes for small business owners due to pass-through taxation. It shapes not just their current tax responsibilities but also their long-term financial plans. As the world of LLC taxation keeps evolving, staying in the loop and being proactive is key for entrepreneurs who want to make the most of their benefits and keep those liabilities in check.

LLC Tax Rates Explained: Key Figures Every Business Owner Should Know

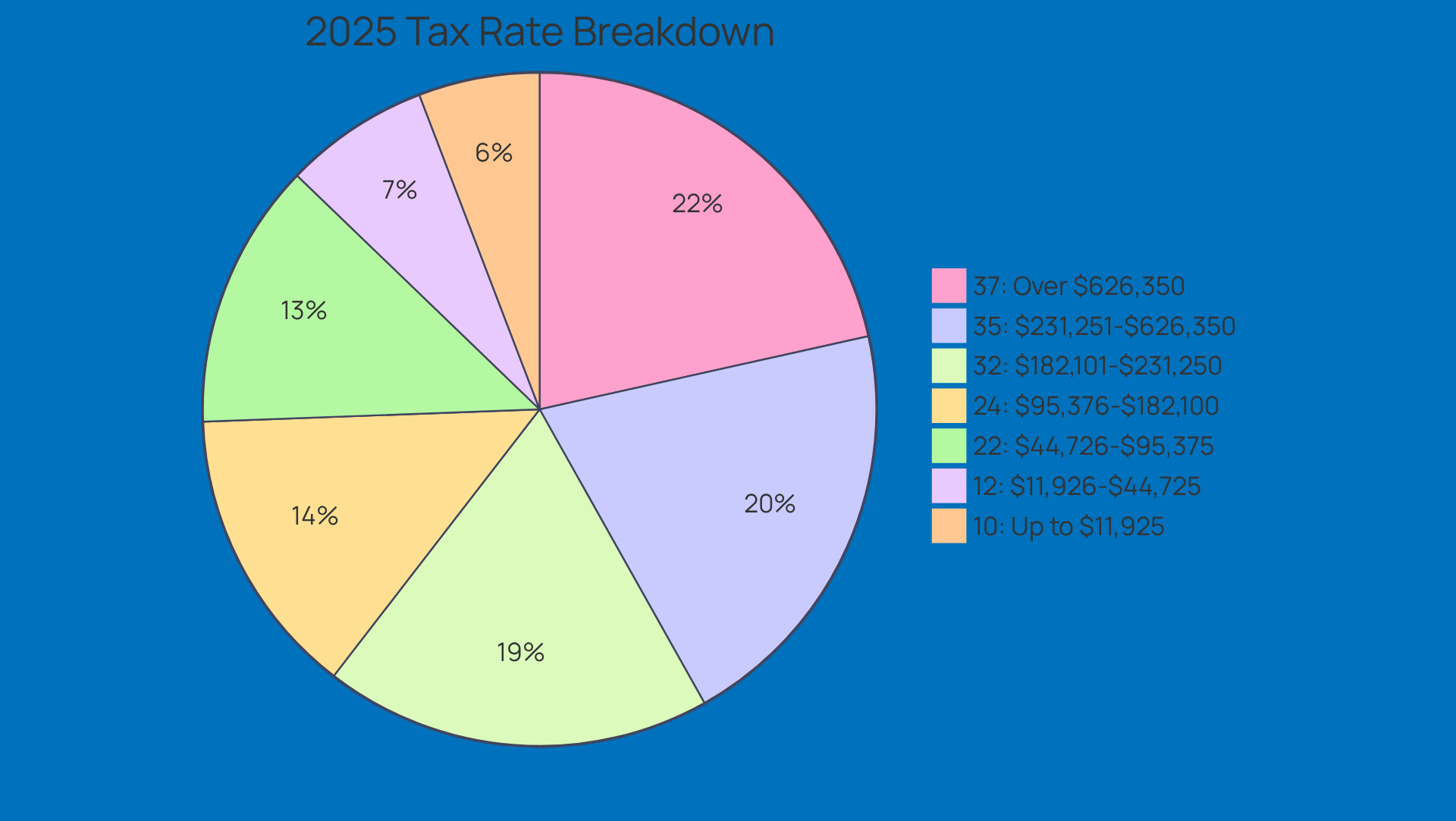

Hey there! If you're running an LLC in 2025, you'll want to keep an eye on the federal revenue tax brackets and the LLC income tax rate, which range from 10% to 37%, depending on how much you earn. For instance, if your earnings are up to $11,925, you're looking at a 10% tax rate. But if you're making over $626,350, that jumps to 37%.

Now, for small business owners, especially those in rural areas, understanding the LLC income tax rate brackets is crucial for smart tax planning and managing cash flow. Did you know that many LLC operators in rural regions often find their taxable income affected by the LLC income tax rate, sitting in the lower to middle ranges? That’s why having a solid strategy in place can really help lower those tax bills.

Tax advisors often stress the importance of proactive planning. Regular check-ins with a tax pro can help you spot deductions and credits you might qualify for, which can lead to some serious savings. Plus, with all the recent updates, staying informed about current tax rates and any changes is crucial since these can directly impact your business's financial health. So, how are you planning to tackle your taxes this year?

Self-Employment Tax Obligations: What LLC Owners Need to Consider

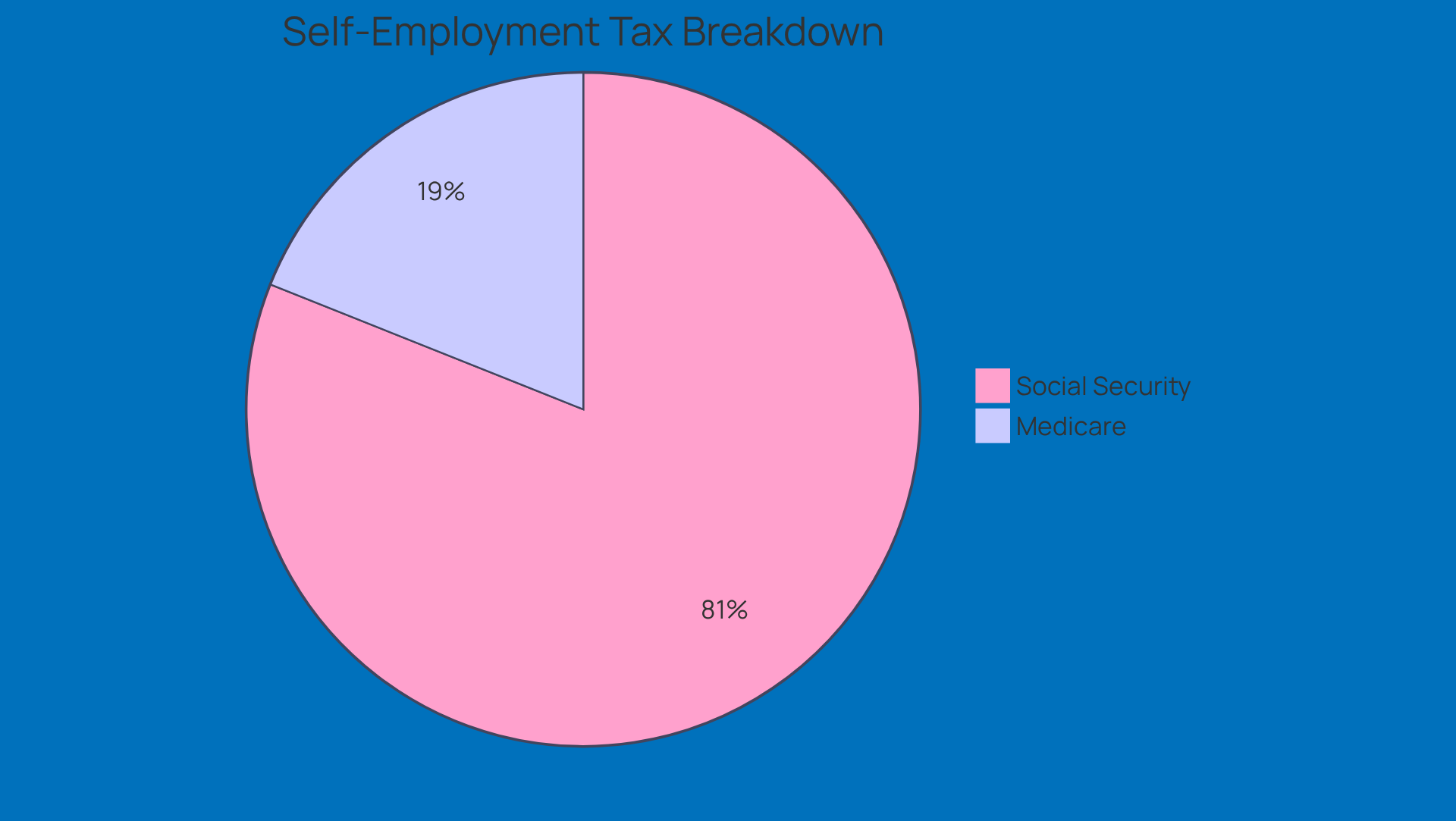

Hey there, LLC owners! Let’s talk about something that might be weighing on your mind: self-employment taxes. Did you know that these taxes sit at 15.3%? Yep, that includes both Social Security and Medicare contributions. For small business folks, especially those whose net earnings go over $400, this can really hit the wallet hard. Take Julia, for example. If she’s pulling in $72,000, her self-employment tax would be around $10,173. Ouch! That’s why having a solid financial plan is super important.

So, how can you ease the burden of those self-employment taxes? One option is to consider S-Corp status. This nifty choice lets you pay self-employment taxes only on your salary, while any profits can be divvied up as dividends, which don’t get taxed for self-employment. This could mean some serious savings for you!

Tax pros often stress the importance of keeping your records in check and planning ahead. Understanding the ins and outs of self-employment tax can really help you spot potential deductions and credits. For instance, don’t forget about those operational expenses - things like home office costs and health insurance premiums can really help lower your taxable income.

With the 15.3% self-employment tax rate looming, it’s crucial for LLC members to prepare for the LLC income tax rate. A good rule of thumb is to set aside about 30% of your earnings for taxes. And hey, teaming up with a CPA can really help you navigate the tricky waters of self-employment taxes, keeping your finances healthy and happy!

Single-Member vs. Multi-Member LLCs: Tax Rate Differences Explained

Hey there! Let’s chat about single-member LLCs. These little guys are considered disregarded entities when it comes to taxes, which means their earnings go straight onto the owner's personal tax return-usually using Schedule C. This setup makes tax filing a breeze, letting owners keep full control over their decisions without the hassle of a separate tax return. On the flip side, multi-member LLCs are taxed like partnerships, where profits and losses get passed through to each member's tax return via Schedule K-1. Understanding this difference is super important for smart tax planning since it affects how the LLC income tax rate is applied to income reporting and taxation.

Did you know that about 70% of all LLCs are single-member? That’s a pretty big deal, especially for solo entrepreneurs out there in rural America. This structure is often the go-to choice because it’s simple and offers some solid liability protection. But here’s the catch: single-member LLCs have to deal with self-employment tax on all profits, which can really add up and significantly affect their overall tax burden, including the LLC income tax rate.

Tax advisors often stress the need for strategic planning, especially considering the LLC income tax rate of the structure you choose. For example, multi-member LLCs can pool their resources and expertise, making tax planning a bit more flexible. It’s a good idea for LLC owners to regularly check their financial statements and chat with tax experts to navigate the tricky waters of tax obligations. By adopting tailored tax strategies-like opting for S Corp status when it makes sense-LLC owners can really optimize their tax positions and boost their financial health. So, what are you waiting for? Dive into those financials and see how you can make the most of your LLC!

State and Local Tax Considerations: Navigating LLC Tax Rates Across Regions

Did you know that the LLC income tax rate can vary significantly across the U.S. for state and local taxes? This can really impact the financial health of small businesses. Many states have franchise fees or extra income taxes on LLCs, which can heavily affect the LLC income tax rate and profitability. For instance, Delaware has a $300 annual tax for LLCs, while in California, the franchise tax can soar above 10% in some areas due to local taxes. So, understanding these obligations is super important for staying compliant and optimizing your tax strategies.

If you’re an entrepreneur, it’s essential to dig into your specific state’s tax requirements. Take Texas and Florida, for example; they don’t have a state earnings tax on LLCs, which is a nice perk for business owners. On the flip side, states like New Jersey can be a bit tougher, with the LLC income tax rate climbing to 9% for earnings. Yikes!

Tax pros really stress the importance of strategic planning to effectively navigate obligations related to the LLC income tax rate. They often suggest chatting with experts who know the local tax laws inside and out to ensure you’re compliant and to spot any potential deductions. And here’s a fun fact: as of 2025, 36 states plus the District of Columbia have jumped on the bandwagon with net income taxes at the passthrough entity (PTE) level. That just shows how complex state tax landscapes are getting!

There are plenty of small businesses out there that have successfully tackled these challenges, especially those that take advantage of tax credits and deductions unique to their states. By staying informed and proactive, LLC owners can really cut down on their tax liabilities and boost their overall financial performance. So, what are you waiting for? Get out there and start exploring your options!

Maximizing Business Deductions: Strategies to Lower Your LLC's Tax Rate

To effectively lower your LLC income tax rate, maximizing deductions is key. Think about it: common deductions like operating expenses, home office deductions, and health insurance premiums can really make a difference. For instance, small businesses that keep a close eye on their expenses can save thousands each year by claiming these deductions. Did you know that companies taking advantage of available deductions can save up to 30% on their taxable earnings? That's a big deal!

Tax pros often stress the importance of keeping meticulous records and planning ahead. One expert even points out, "Some small business owners can tweak the timing of their revenue and expenses to boost their tax outcomes." This smart strategy lets LLC owners push taxable earnings into future years while speeding up deductible expenses, especially if they think they'll stay in the same or a lower tax bracket.

Plus, there are plenty of success stories showing how small businesses have effectively reduced their LLC income tax rate through savvy deduction management. Take a local contractor, for example, who significantly reduced their taxable earnings by leveraging deductions for equipment purchases and operational costs. Consulting with a tax professional can really help you make the most of all available deductions, maximizing your savings and boosting your financial health. So, why not take that step today?

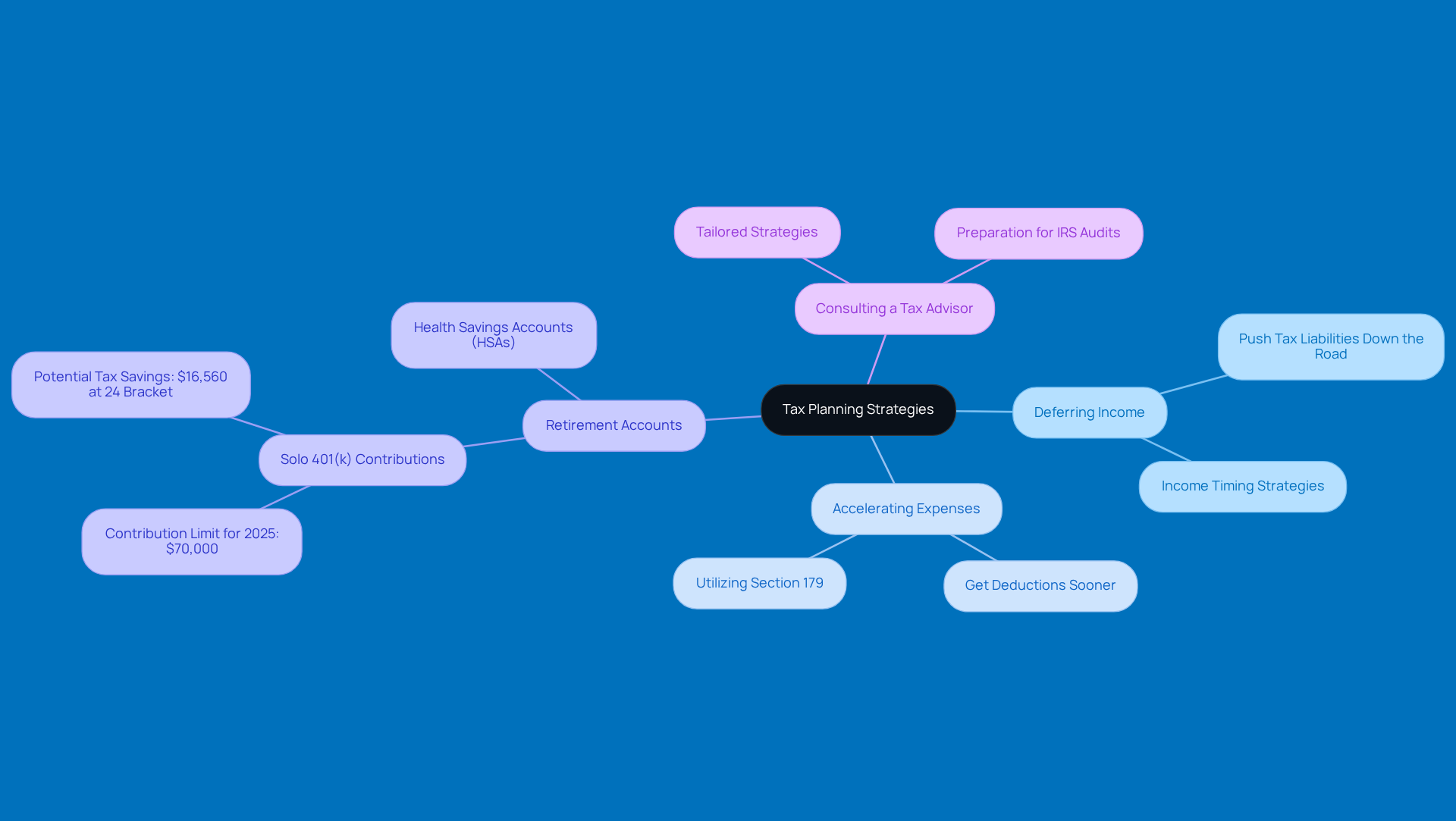

Tax Planning Strategies: Optimizing Your LLC's Income Tax Rate

Want to boost your LLC income tax rate? Implementing effective tax planning strategies can really make a difference in managing the LLC income tax rate! For starters, think about:

- Deferring income to push those tax liabilities down the road

- Accelerating expenses to get those deductions sooner

And don’t forget about retirement accounts like Solo 401(k)s - they can offer some serious tax perks. In fact, for 2025, you can contribute up to $70,000, which could mean immediate tax savings of over $16,000 if you’re in the 24% tax bracket.

Regular chats with a tax advisor, like the folks at Steinke and Company, are super important. They can help tailor these strategies to fit your unique business needs, making sure you stay compliant and avoid any nasty surprises come tax season. Plus, being ready for potential IRS audits is key! Keeping your records organized and knowing your rights - like those in the taxpayer bill of rights - can really help ease the stress and make the audit process smoother.

So, by prioritizing expert tax preparation and planning, you can tackle the complexities of tax obligations, such as the LLC income tax rate, head-on and boost your financial health. Ready to take charge of your taxes?

Avoiding Common Tax Mistakes: Tips for LLC Owners to Reduce Their Tax Burden

Hey there, LLC owners! Let’s talk about some common tax pitfalls you might run into. You know, things like:

- Not keeping your records straight

- Forgetting about those estimated tax payments

- Missing out on some sweet deductions

It’s super important to keep your financial records organized - not just to make tax prep easier, but also to stay compliant with the rules.

Did you know that about 47% of small businesses feel totally overwhelmed by regulatory compliance? That’s a big number! It really shows how crucial it is to manage your records effectively. And let’s not forget about tax deadlines; missing them can lead to penalties and extra costs. So, staying on top of those dates is key!

Thinking about consulting a tax professional? That could be a smart move! They can help you come up with tailored strategies to optimize your tax approach and keep you compliant. Experts say that understanding your available deductions and keeping accurate records can significantly reduce the LLC income tax rate for LLCs.

For example, businesses that have solid record-keeping practices often report feeling less stressed during tax season and have better compliance. So, if you prioritize these strategies, you’ll be able to navigate the tricky world of tax obligations more smoothly and protect your financial health. How does that sound?

The Value of Professional Tax Assistance: How Experts Can Help LLC Owners Save

If you're an LLC owner, getting a professional tax advisor on your team is a smart move. These experts are key to helping you navigate the sometimes tricky world of tax compliance. They can spot potential deductions, make sure you file on time, and create personalized strategies to help you save on taxes.

For example, small businesses that tap into the knowledge of tax advisors often see some pretty impressive savings, which can really boost their financial health. Plus, these advisors break down the complexities of the tax code, making it easier for you to understand. They also stick around to help you adjust to any changes in the law, so you can stay compliant while optimizing your tax situation.

By getting ahead with proactive tax planning, LLC owners can really take advantage of deductions and credits, ultimately benefiting their LLC income tax rate. This not only improves cash flow but also sets the stage for long-term success. So, why not consider reaching out to a tax advisor? It could be one of the best decisions you make for your business!

Conclusion

Understanding LLC income tax rates can feel a bit like navigating a maze, right? But for small business owners, getting a handle on this is key to optimizing financial outcomes. When you know how LLCs are taxed - think pass-through taxation, self-employment taxes, and those pesky state-specific obligations - you can tackle your tax responsibilities with confidence and boost your profitability.

Throughout this article, we’ve shared some important insights. For instance, proactive tax planning is a game changer! Maximizing deductions and consulting with tax pros can really make a difference. Plus, strategies like the Qualified Business Income Deduction and knowing the differences between single-member and multi-member LLCs are crucial for effective tax management. And don’t forget about those state-specific tax variations!

At the end of the day, managing LLC income tax rates isn’t just about checking boxes for compliance. It’s about using the resources at your disposal to help your business grow. So, take charge of your tax strategies! Seek out expert guidance and stay in the loop about changing regulations. By doing this, you’ll not only safeguard your financial health but also set your venture up for success in this ever-evolving tax landscape. Ready to take the next step?

Frequently Asked Questions

What is the focus of Steinke and Company regarding LLC income tax rates?

Steinke and Company specializes in providing expert guidance on LLC income tax rates and compliance for small businesses, particularly in rural America.

What recent tax update is mentioned in the article?

The reinstatement of bonus depreciation allows businesses to write off 100% of qualified property through 2029.

How much of their income should small business owners set aside for taxes?

Small business owners are recommended to set aside about 30% of their income after deductions to cover federal and state taxes.

What are some compliance strategies for LLCs mentioned in the article?

Effective compliance strategies include updating accounting practices to meet new reporting thresholds and collecting W-9 forms from vendors to avoid unnecessary 1099 preparation.

How are LLCs typically taxed?

LLCs are often considered pass-through entities, meaning the income they generate goes directly onto the owner's personal tax return, avoiding double taxation.

What is the Qualified Business Income Deduction (QBID)?

The QBID allows eligible LLC owners to deduct up to 20% of their qualified income, but there are income limits and phase-outs, particularly for specified service businesses starting at $400,000 in individual earnings.

What are the federal tax brackets for LLC income in 2025?

The federal revenue tax brackets for LLC income in 2025 range from 10% to 37%, depending on earnings. For example, earnings up to $11,925 are taxed at 10%, while earnings over $626,350 are taxed at 37%.

Why is it important for rural business owners to understand LLC income tax rates?

Understanding LLC income tax rates is crucial for smart tax planning and managing cash flow, as many rural LLC operators find their taxable income affected by these rates.

What should small business owners do to maximize tax savings?

Small business owners should conduct regular check-ins with tax professionals to identify potential deductions and credits, staying informed about current tax rates and changes that could impact their financial health.