Overview

This article dives into the essential differences between profit and income, especially for small business owners. Why does this matter? Well, understanding these concepts is key to keeping your financial health in check and making smart decisions for your business.

Think about it: when you know the difference, you can manage your expenses better and even optimize your tax responsibilities. This knowledge doesn’t just help you stay afloat; it supports sustainable growth and keeps you competitive in the market.

So, are you ready to take control of your financial future? Let’s explore these insights together and see how they can make a real difference in your business!

Introduction

Understanding the ins and outs of profit and income is super important for small business owners trying to make their way through the tricky financial landscape. As these entrepreneurs work hard for growth and sustainability, getting a grip on the difference between what they earn and what they can reinvest into their operations can open up doors for smarter decision-making.

But let’s be real—many still struggle with these concepts. So, how can really understanding profit versus income change the game for a business's financial health and strategic direction?

Think about it: when you know exactly what profit means versus income, you’re not just crunching numbers; you’re setting yourself up for success. It’s like having a map in a new city—you can navigate better and make choices that lead to growth.

So, let’s dive into this together and see how a clearer understanding can transform your business!

Steinke and Company: Expert Guidance on Profit and Income for Small Businesses

Hey there! Since 1974, Steinke and Company has been a trusted partner for local businesses in rural America. We’re all about helping entrepreneurs like you understand the difference between profit versus income. Why does that matter? Well, when you get a grip on these concepts, you can make smarter choices that boost your financial health and sustainability.

We also offer some handy tips to dodge those pesky underpayment penalties on estimated taxes. Think safe harbor payments and the de minimis exception—these strategies help keep you in the good graces of the IRS. And with the recent shake-up in 1099-K reporting requirements, it’s super important for independent entrepreneurs and gig economy folks to stay on top of their tax responsibilities.

Our proactive tax planning services are tailored just for you, supporting your growth and making your operations run smoother. We’re here to help you navigate the tricky world of tax compliance while maximizing your profits. So, let’s tackle this together and ensure you’re set up for success!

Understanding Profit: Definition and Importance for Small Businesses

The concept of profit versus income is fundamentally the difference between what you earn and what you spend, and it serves as a key indicator of how healthy a small business is. For small businesses, especially in rural America, understanding the difference between profit versus income is super important. It shows the distinction between profit versus income, indicating whether the business can make a little extra cash after covering all its costs. That extra cash can be put back into the business, shared with owners, or saved for a rainy day, which really helps with long-term sustainability, especially when considering profit versus income.

Experts say that the distinction between profit versus income isn’t just about numbers; it’s a foundation for lasting success. Think about it: businesses that focus on profit versus income are usually in a better position to handle economic ups and downs and can seize growth opportunities when they arise. There are plenty of case studies out there showing that companies that work on boosting their revenue have not only improved their efficiency but also become more competitive in the market.

Looking ahead to 2025, small businesses can really ramp up their profits by getting creative. This could mean streamlining operations or using tech to manage finances better. Typically, profit margins for small businesses in rural areas hover around 5% to 10%. This really highlights how important it is to have a solid plan and execute it well to achieve sustainable growth. By focusing on profit versus income, small business owners can ensure their ventures thrive, even in a tough market.

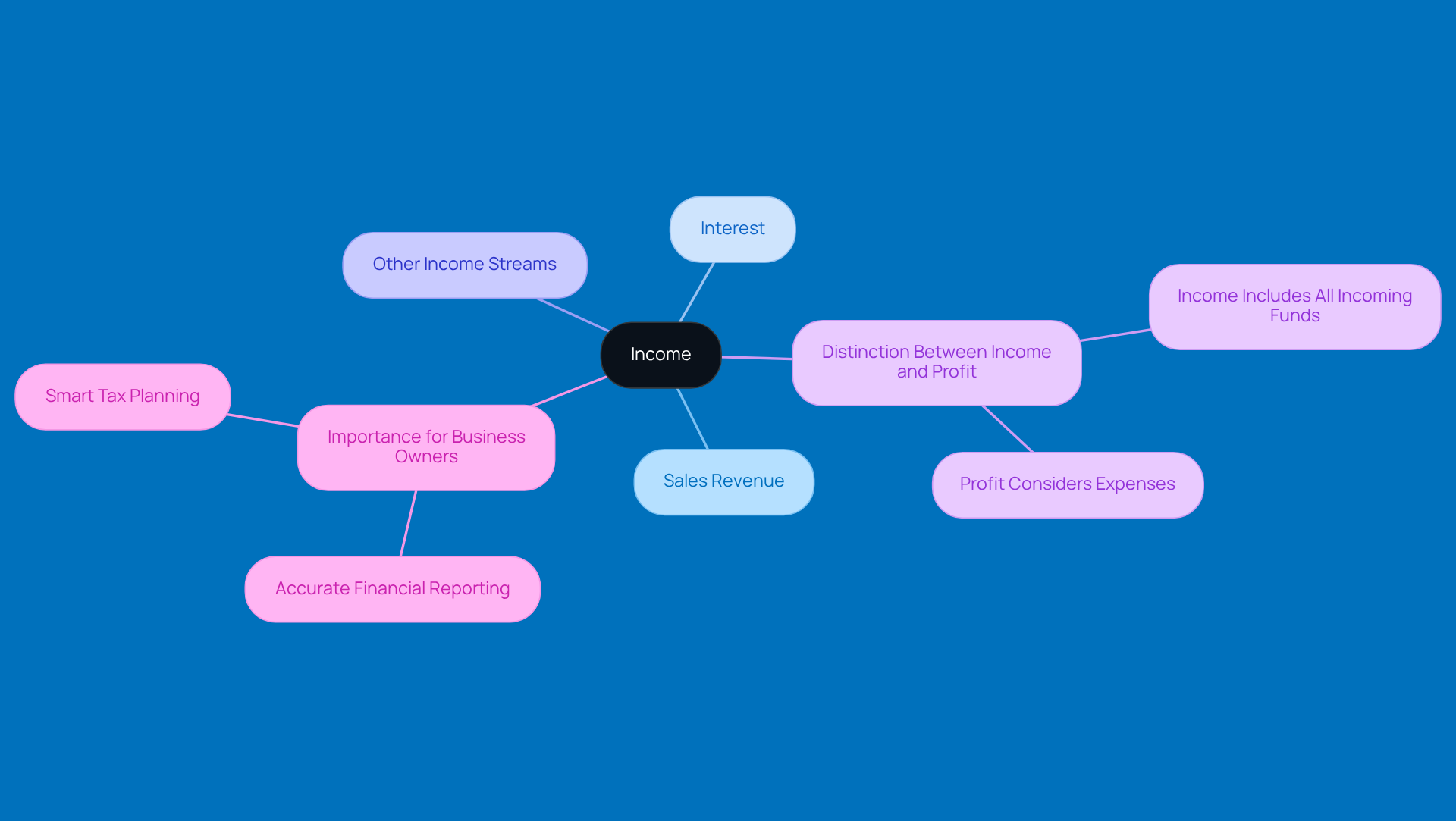

Defining Income: Key Concepts Every Business Owner Should Grasp

Income is all about the total earnings a business rakes in from its operations. This includes everything from sales revenue to interest and other income streams. Now, here’s the kicker: when discussing profit versus income, it is important to note that income is broader than profit. While profit versus income considers expenses, income reflects all the incoming funds.

It’s super important for business owners to really get a handle on the different types of income out there. Why? Because understanding these various forms is key for accurate financial reporting and smart tax planning. So, take a moment to think about your own business—how do you track your income? It’s a crucial part of keeping everything running smoothly!

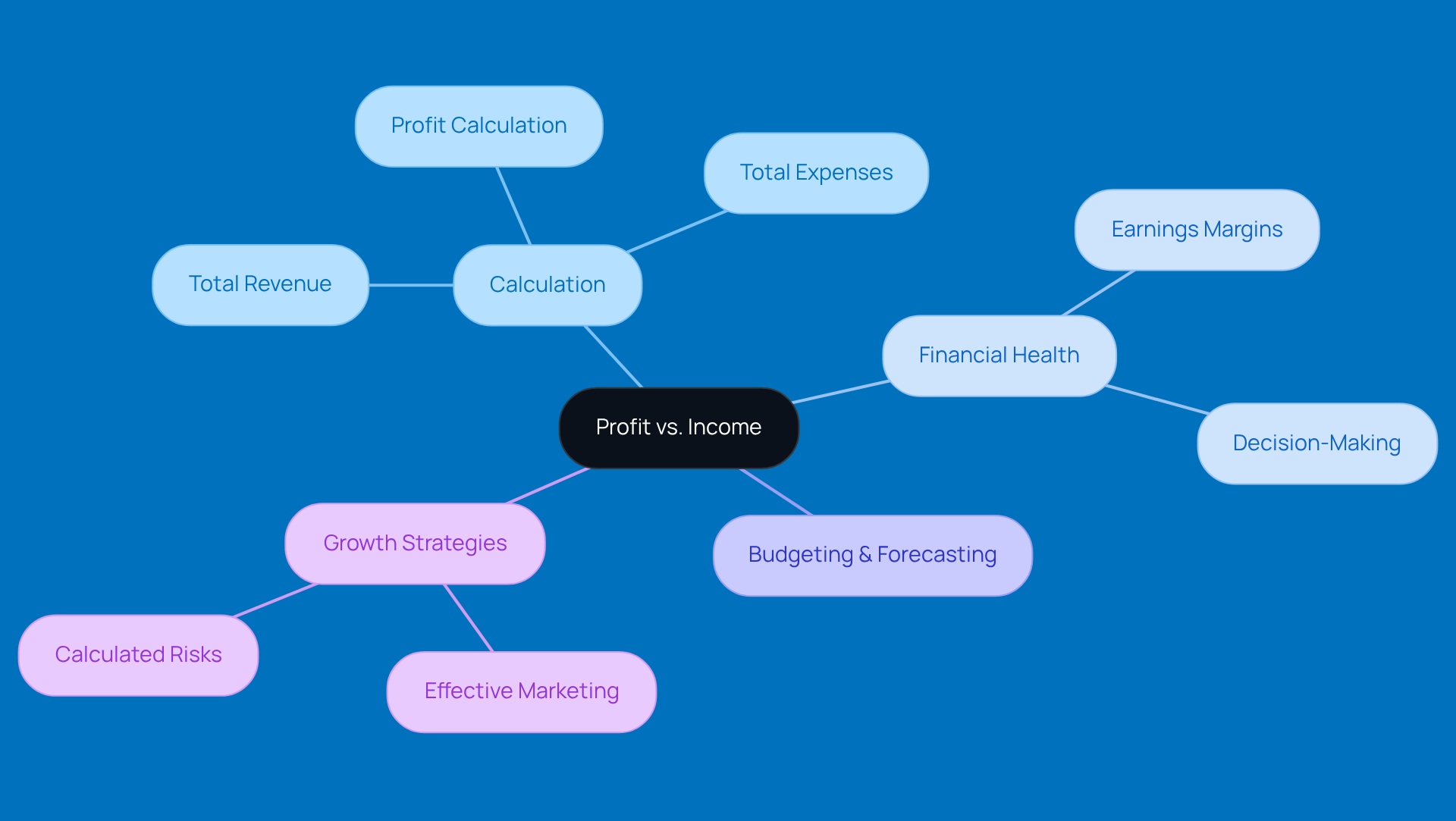

Profit vs. Income: Key Calculation Differences Explained

The concept of profit versus income is determined by what you get after subtracting your total expenses from your total revenue. Think of profit versus income as the total revenue your business generates. For example, if a small business rakes in $100,000 in revenue but spends $70,000 on expenses, the profit versus income would indicate that the profit is $30,000 while the income remains at $100,000. This distinction of profit versus income is super important for entrepreneurs because it helps them get a clear picture of their financial health and make smart decisions.

Understanding these numbers doesn’t just help you gauge performance; it also plays a big role in budgeting, forecasting, and planning investments. This is key for keeping your business sustainable in the long run. Financial analysts often point out that knowing your earnings margins—typically between 10% and 20% for smaller businesses—can really shape your decision-making and growth potential.

Now, if you’re a small agency owner looking to scale from $1 million to $10 million, adopting a growth mindset is crucial. You’ll want to embrace effective marketing strategies, which means being open to taking calculated risks and trying out new ways to connect with potential customers. By really understanding the difference between profit versus income, you can manage your financial planning better, avoid common budgeting pitfalls, and implement strategies that align with your growth goals. This way, you’ll be well-prepared for success!

The Role of Expenses: How They Affect Profitability

Expenses are crucial when it comes to analyzing profit versus income to determine how profitable your business really is. You’ve got your fixed expenses, like rent and salaries, and then there are variable expenses, such as materials and utilities. It’s crucial to keep a close eye on these to really maximize your earnings.

So, how often do you check your spending? It’s a good idea to regularly assess where your money is going, spot any chances to save a few bucks, and maybe even try out some budgeting techniques. This way, you can keep those profit margins nice and healthy!

Remember, managing expenses doesn’t have to be a chore. Think of it as a fun challenge to see how much you can save! What strategies have you found helpful in keeping your costs down? Let’s keep the conversation going!

Revenue Generation: Distinguishing Between Revenue, Profit, and Income

Revenue is basically the total cash a business brings in from sales before any expenses are taken out. It’s super important to understand that profit versus income is a key distinction, as revenue doesn’t factor in costs. For instance, a company might pull in $200,000 in revenue but only end up with $50,000 in profit after covering its expenses. Getting this difference is key for entrepreneurs; it helps them focus on ways to ramp up revenue while keeping a close eye on costs.

So, think about it: how can you boost your revenue? Maybe it’s time to explore new markets or tweak your pricing strategy. Whatever it is, knowing your revenue in terms of profit versus income can really help you make smarter business decisions. Keep that in mind as you strategize!

Tax Implications: Understanding How Profit and Income Are Taxed Differently

Profit and income? The different tax treatment can significantly impact small business owners when evaluating profit versus income. Generally, income gets hit with standard tax rates, while earnings face different treatments depending on how the business is structured. Take C corporations, for instance—they deal with double taxation. That means their earnings are taxed at the corporate level and then again when those earnings are handed out as dividends to shareholders. On the flip side, sole proprietors get to report profits right on their personal tax returns, enjoying pass-through taxation, which usually leads to lower overall tax rates.

Now, understanding the differences in profit versus income is super important for smart tax planning. For example, small-to-midsize businesses can snag research and development (R&D) tax credits. This means they can deduct current expenses or even claim credits for ramping up their research spending, which can really help lower their tax bills. Plus, the type of business structure you choose can influence your ability to offer employee benefits, which might come with some tax perks too.

Tax pros often stress the need for strategic planning. Did you know that picking the right organizational structure could lead to tax savings of anywhere from 10% to 40% each year? By navigating the maze of tax regulations and tapping into available credits, independent business owners can boost their financial results while staying on the right side of tax laws. This knowledge not only helps in maximizing profits but also clarifies the distinction of profit versus income, supporting long-term growth. So, what’s your strategy for tackling taxes this year?

Cash Flow Management: Its Connection to Profit and Income

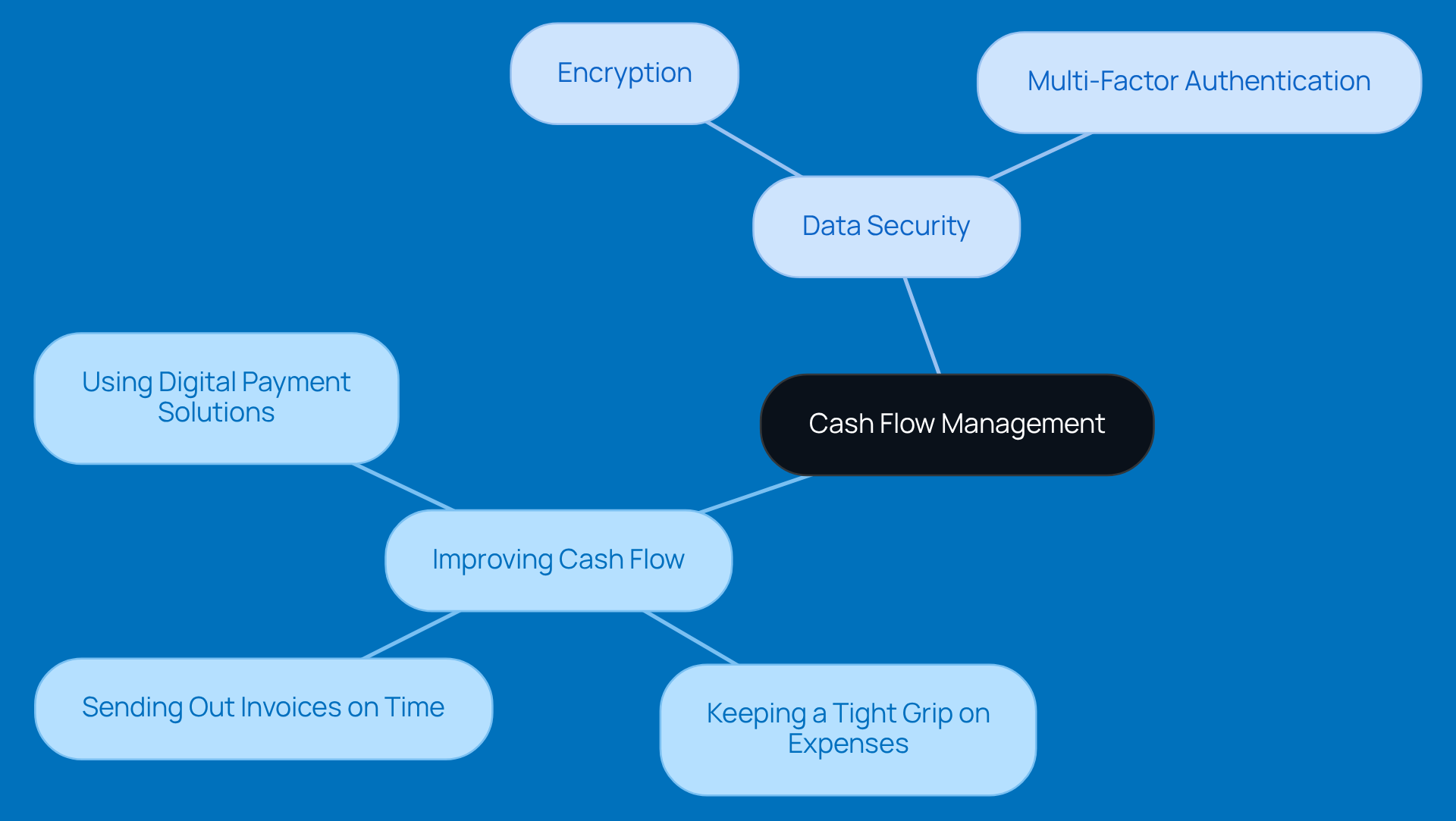

Managing cash flow effectively is super important for small businesses, especially in rural areas. When cash flow is positive, it means companies can meet their financial obligations and still have some left over to invest in growth opportunities. Keeping a close eye on cash flow is key; business owners should try to predict future cash needs based on what they expect to earn and spend.

So, how can you boost your cash flow? Well, strategies like:

- Sending out invoices on time

- Keeping a tight grip on expenses

- Using digital payment solutions

can make a big difference. Did you know that around 60% of small and mid-sized enterprises (SMEs) have a tough time managing their cash flow? That really shows how important it is to take proactive steps.

And let’s not forget about data security! Protecting customer information isn’t just about following the rules; it can seriously affect your cash flow and profits. Data breaches can hit hard, with an average cost of about $4.35 million globally in 2022. That’s a big hit that can really mess with your cash flow.

To keep your finances healthy, consider adopting strategies that include strong data security practices like:

- Encryption

- Multi-factor authentication

These steps can help safeguard your business. Plus, exploring cloud-based accounting solutions can streamline your financial processes while keeping you compliant with regulations like the GLBA. Focus on encrypting sensitive customer data and using multi-factor authentication to boost security and protect against those pesky data breaches.

Strategic Decision-Making: Leveraging Profit and Income Insights for Growth

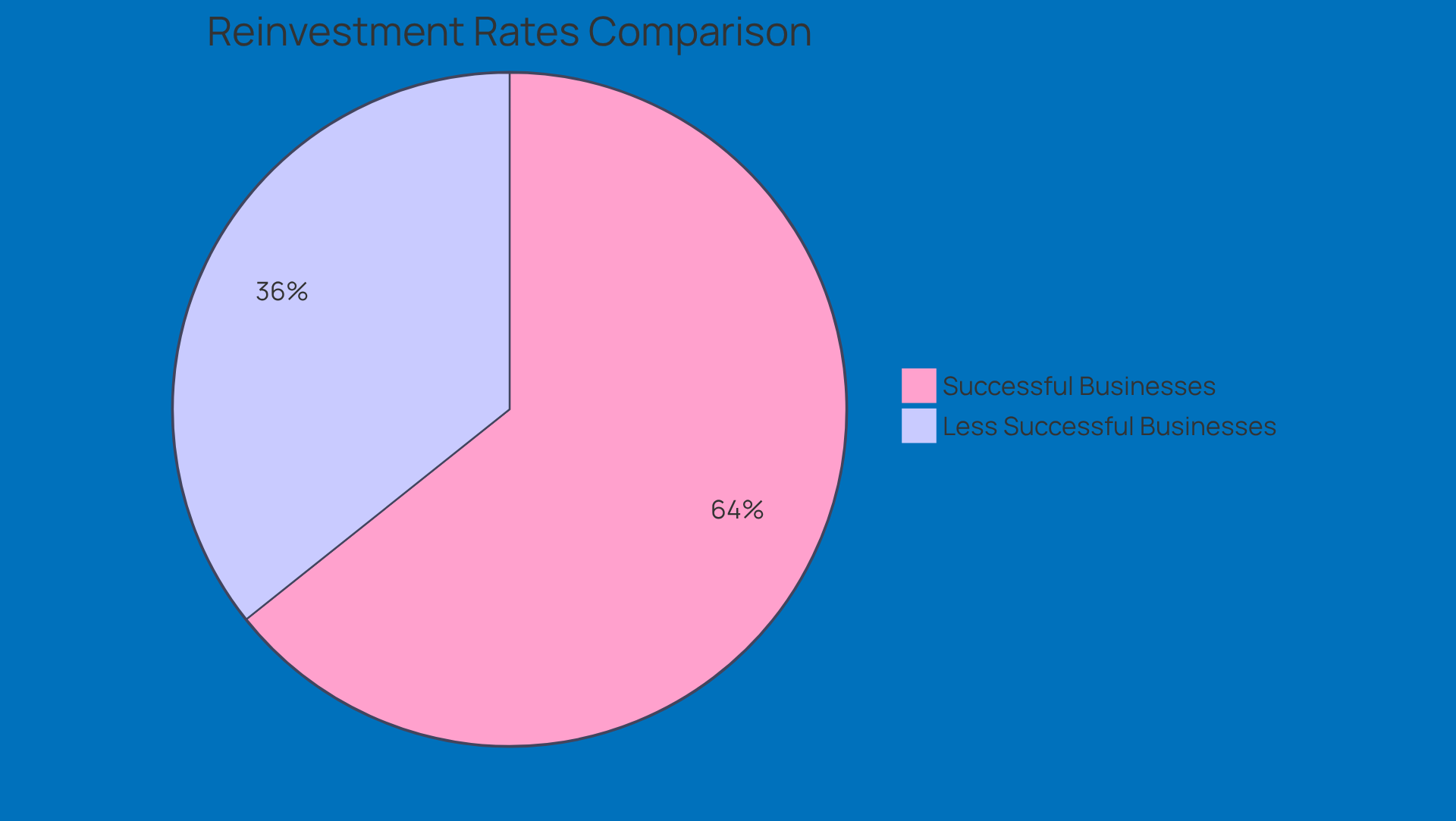

Understanding the differences between profit versus income is super important for small business owners who want to make smart choices that help their businesses grow. For example, many companies choose to reinvest their profits into areas like marketing, tech upgrades, or expansion projects after taking a good look at their revenue streams. This isn’t just about crunching numbers; it’s a strategic move that can really boost a company’s competitive edge.

Did you know that about 65.3% of small businesses are profitable? Those that actively reinvest their earnings often see even better results. In fact, successful companies typically reinvest around 9% of their profits, while their less successful counterparts only reinvest about 5%. This kind of reinvestment can be a game-changer for small and micro businesses, especially as they bounce back from the pandemic, where being adaptable and innovative is key.

Take, for instance, a local bakery that decided to put its earnings into a solid online ordering system and some targeted social media ads. This smart choice not only brought in more customers but also boosted its brand visibility, leading to a nice increase in sales. These kinds of stories really show how financial insights can help spot growth opportunities.

Business strategists often say that the heart of a successful growth strategy is all about making thoughtful decisions on where to put your resources. By focusing on reinvestment, entrepreneurs can create a culture of innovation and resilience, helping their businesses thrive in a constantly changing market. So, what’s your next move?

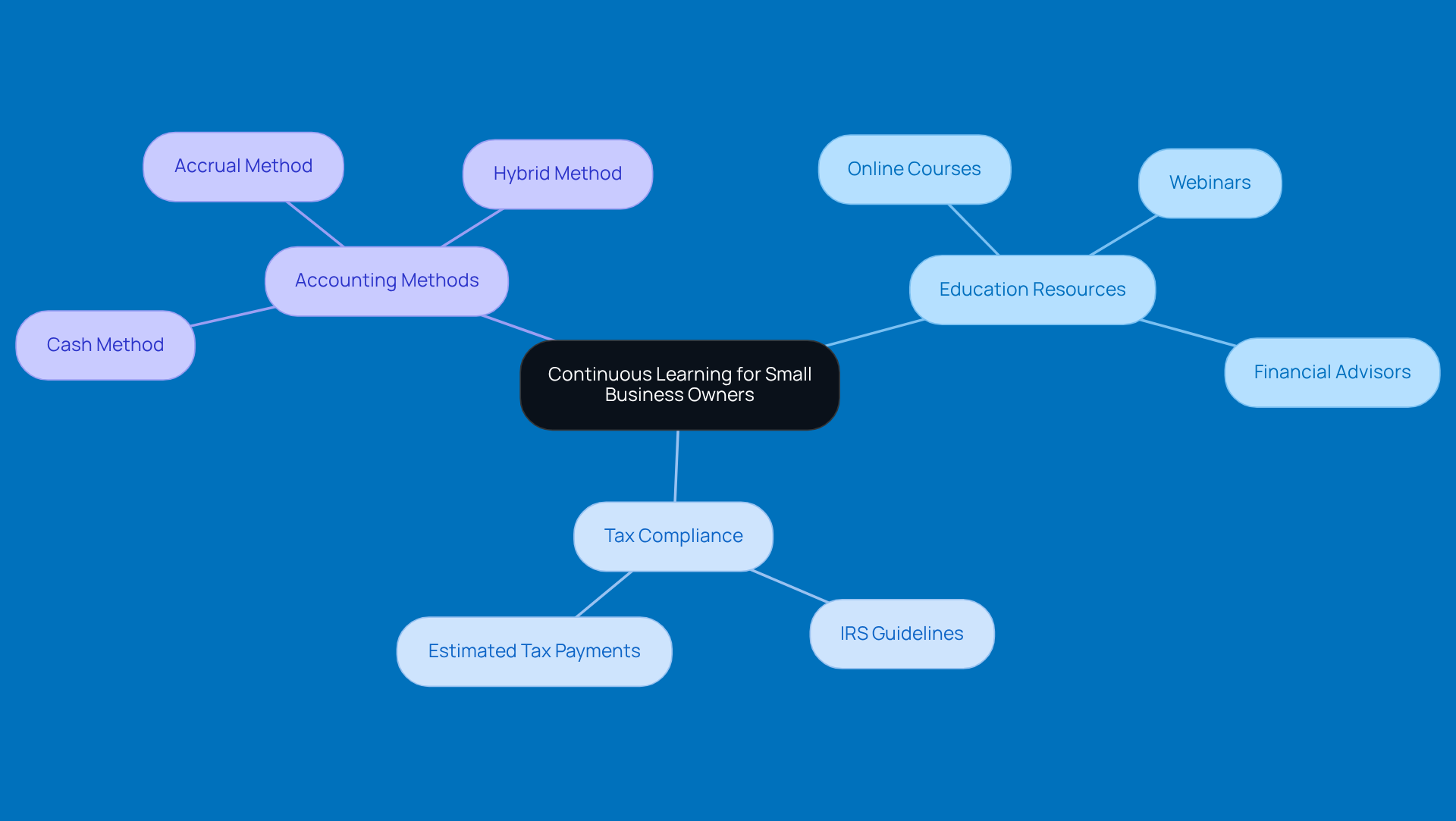

Continuous Learning: Resources for Small Business Owners on Profit and Income

Ongoing education is super important for small business leaders who want to get a better grip on profit versus income. Think about diving into online courses, webinars, or even industry publications—they can really open your eyes to valuable insights. Plus, chatting with financial advisors or joining workshops can help you stay in the loop about best practices and the latest trends in financial management.

Now, let’s talk about tax compliance. It’s crucial to understand the ins and outs, especially when it comes to avoiding those pesky underpayment penalties. Small business owners should definitely familiarize themselves with IRS guidelines on estimated tax payments and safe harbor regulations. This knowledge can really help you optimize your tax responsibilities.

And don’t forget about the different accounting methods out there—cash, accrual, and hybrid. Each one has its perks and can be tailored to fit your business's unique needs. By learning about these methods, you’ll be better equipped to make informed decisions that support your growth and keep you compliant. So, what are you waiting for? Dive into these resources and take charge of your financial education!

Conclusion

Understanding the differences between profit and income is super important for small business owners who want to boost their financial health and sustainability. When you get these concepts down, you can make smart decisions that not only improve your bottom line but also set your business up for long-term success. Remember, profit is what’s left after you take out your expenses from your income. This gives you a clearer view of how your business is doing and its potential for growth.

Throughout this article, we’ve highlighted why it’s essential to distinguish between profit and income. By managing your expenses wisely, understanding how to generate revenue, and being aware of the tax implications of both profit and income, you can navigate the tricky waters of financial management. Plus, strategies for cash flow management and a commitment to continuous learning can really empower you to make decisions that drive growth and resilience.

So, as we wrap things up, remember that the journey toward financial mastery starts with understanding profit and income. I encourage you to take the insights from this discussion and refine your financial strategies, invest in growth opportunities, and keep yourself updated on the best practices in financial management. Embracing this knowledge not only boosts your business performance but also strengthens the foundation for your future success. What steps will you take next to enhance your financial savvy?

Frequently Asked Questions

What is the main focus of Steinke and Company?

Steinke and Company focuses on helping small businesses understand the difference between profit and income, providing guidance to improve financial health and sustainability.

Why is understanding the difference between profit and income important for small businesses?

Understanding the difference is crucial as it indicates whether a business can generate extra cash after covering costs, which can be reinvested, shared with owners, or saved, aiding long-term sustainability.

How can small businesses benefit from focusing on profit?

Businesses that focus on profit are better positioned to handle economic fluctuations and seize growth opportunities, often leading to improved efficiency and competitiveness.

What are some strategies mentioned to avoid underpayment penalties on estimated taxes?

Strategies include safe harbor payments and the de minimis exception, which help maintain compliance with IRS requirements.

What does income encompass for a business?

Income includes all total earnings from operations, such as sales revenue, interest, and other income streams, making it broader than profit.

Why is it important for business owners to understand the different types of income?

Understanding various forms of income is key for accurate financial reporting and effective tax planning.

What are typical profit margins for small businesses in rural areas?

Profit margins for small businesses in rural areas typically range from 5% to 10%.

What proactive services does Steinke and Company offer?

They offer proactive tax planning services tailored to support business growth and ensure smooth operations while maximizing profits.