Overview

This article is a must-read for small business owners looking to get a grip on the key differences between profits and revenue. Understanding these two concepts is crucial for effective financial management, and we’re here to break it down for you in a friendly way.

We’ll dive into the different types of revenue and profit, explore how cash flow management plays a role, and share some strategies to help you balance revenue and profit. By the end, you’ll be equipped with the knowledge you need to optimize your financial health and keep your business growing.

So, are you ready to take your financial understanding to the next level? Let’s get started!

Introduction

Understanding the relationship between revenue and profit is super important for small business owners who want to grow sustainably. In this article, we’ll explore ten key insights that show how managing these financial elements effectively can lead to success. As entrepreneurs, you might find yourself juggling high revenue but struggling with low profitability. So, what strategies can you use to close that gap and make sure your business not only survives but thrives? Let's dive in!

Steinke and Company: Bridging the Gap Between Revenue and Profit for Small Businesses

At Steinke and Company, we’re all about helping small and micro enterprises thrive in rural America. We know that balancing income and profits revenue is crucial, and that’s where we come in! Our extensive services cover everything from proactive tax planning to financial management and strategic coaching. We’re here to help entrepreneurs like you navigate the tricky waters of profitability while staying true to your core values.

When it comes to tax planning, we don’t just set it and forget it. We believe in regular check-ins and tailored strategies that help you spot missed opportunities and lighten your tax load. It’s all about making sure you understand your profits revenue streams and optimizing them for sustainable growth. And with the recent changes to the 1099-K reporting standards, it’s more important than ever for small businesses and self-employed folks to stay on top of their tax responsibilities and how they might impact financial transparency.

This integrated approach is designed to prepare you to manage your finances efficiently and strategically grow your business. So, how are you planning to tackle your financial goals this year? Let’s chat about how we can help you make the most of your opportunities!

Definition of Revenue vs. Profit: Understanding the Basics

Revenue, which is essentially the total cash you bring in from selling your goods or services, contributes to your profits revenue before any expenses are subtracted. On the flip side, earnings are what’s left after you’ve paid all your bills—think operating costs, taxes, and interest. This difference is super important for small business owners because it can really shape how they plan their finances and handle taxes.

To keep a good handle on income and profit, small agency operators should keep track of every financial transaction. This isn’t just about being organized; it helps with accurate reporting and gets you ready for any potential IRS audits. You want to be able to back up your income and deductions, right? There are a few types of IRS audits—like correspondence, office, and field audits—and knowing what to expect can help ease some of that stress.

Plus, being aware of the taxpayer bill of rights can be a real comfort. It lays out the protections you have during audits, which can make the whole process feel a bit less daunting. Understanding your rights can help you focus on what really matters: growing your business and ensuring its sustainability. So, keep those records straight, and don’t hesitate to lean on your rights when the time comes!

![]()

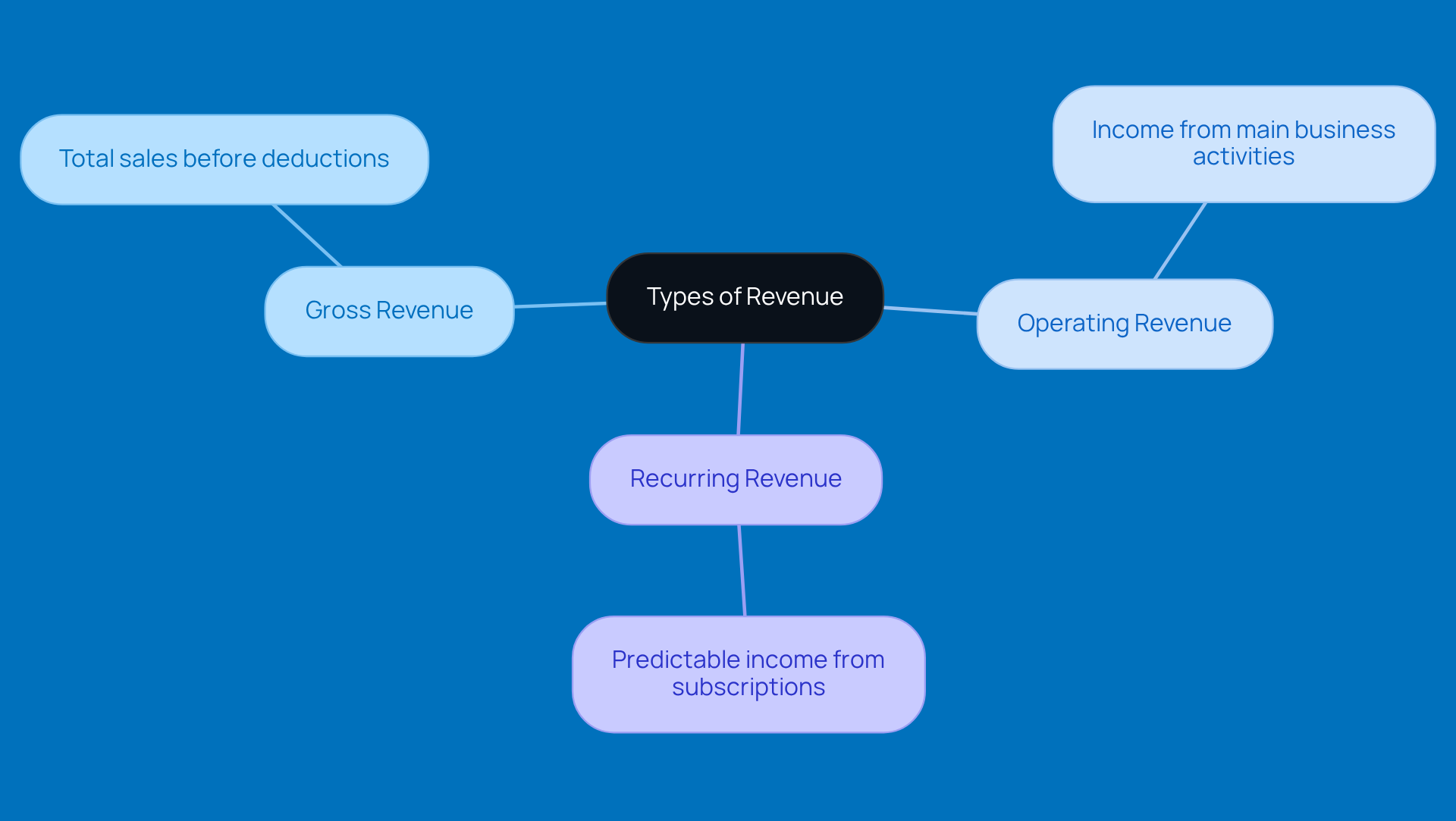

Types of Revenue: Exploring Gross, Operating, and Recurring Revenue

Hey there, small business owners! Let’s chat about the different types of revenue you should keep an eye on:

-

Gross Revenue: This is your total sales before any deductions. Understanding your gross revenue and profits revenue is super important because it lays the groundwork for figuring out your overall financial health and tax obligations.

-

Operating Revenue: This is the income you earn from your main business activities, which contributes to your overall profits revenue, excluding any side income. It’s key for assessing how well your core operations are running and ensuring you’re making the most of your profits revenue potential.

-

Recurring Revenue: Think of this as the predictable income that contributes to profits revenue regularly, like subscriptions or service contracts. Recognizing the value of recurring revenue can help you forecast your income more accurately and make smarter financial decisions.

Now, it’s also a good idea to regularly check your financial documents, like paystubs and tax records. This helps you stay compliant and boosts your tax efficiency. Ever looked closely at your paystub? It can really shed light on where your money goes, giving you insights into your financial stability and guiding your investment choices. Plus, keeping accurate records not only makes tax time easier but also supports your strategic planning for future growth.

So, how often do you review your financials? It might be time to dive in and see what you can learn!

Types of Profit: Gross, Operating, and Net Profit Explained

Let’s break down profit into three main types, shall we?

- Gross Profit: This is simply your profits revenue, which is calculated by subtracting the cost of goods sold (COGS). It gives you a peek into how efficiently your production is running.

- Operating Earnings: Here, we take gross earnings and subtract operating costs to calculate the profits revenue. This tells you how well your core operations are doing in terms of profitability.

- Net Earnings: Finally, we arrive at the bottom line—the final profits revenue after all expenses, taxes, and costs have been deducted.

Understanding these differences is super helpful for entrepreneurs. It’s like having a roadmap for assessing your financial strategies and figuring out how effective your operations really are. So, what do you think? How do these types of profit play into your business decisions?

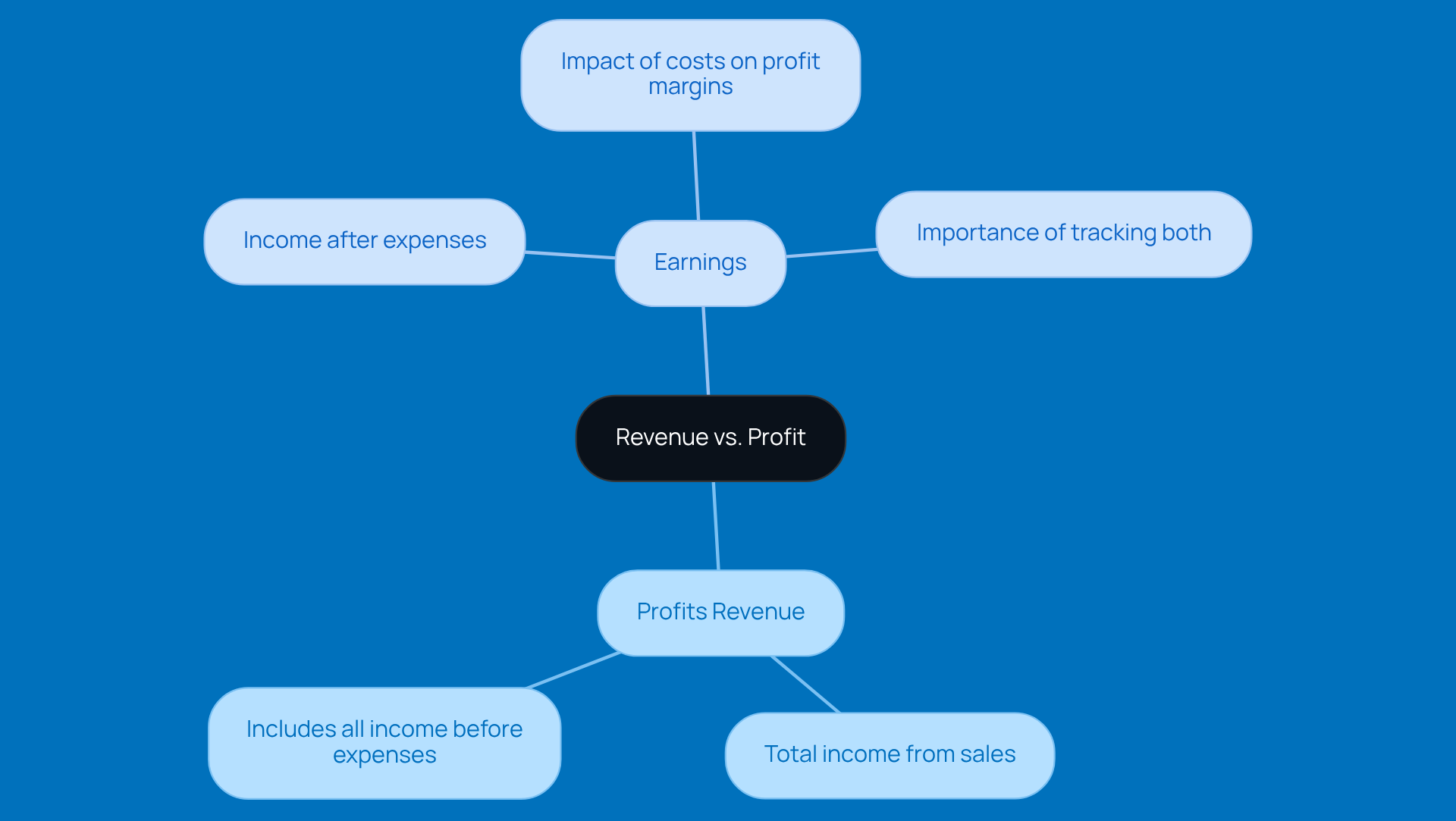

Key Differences Between Revenue and Profit: What Every Business Owner Should Know

Understanding the difference between income and earnings is super important for small businesses. It directly impacts their financial health and decision-making. So, let’s break it down:

- Profits revenue is the total income from sales, which includes everything before any expenses are taken out.

- On the flip side, earnings are what’s left after all those pesky operating costs, taxes, and other expenses are deducted.

This key difference shows that a business can have impressive income figures but still struggle with low or even negative margins if expenses are too high.

Take a small retail store, for example. It might rake in a lot of profits revenue during busy seasons, but if operational costs—like inventory, rent, and staffing—are just as high, the profit could be pretty slim. This highlights why it’s crucial for entrepreneurs to keep a close eye on both profits revenue and earnings. Recent data shows that about 65.3% of small businesses are achieving profits revenue, which is great, but it also means a significant number are still facing challenges with profitability.

Corporate consultants often stress that understanding this relationship is key for strategic planning. They suggest that small business managers regularly check their financial reports to spot trends in income and expenses. This practice not only helps with budgeting but also supports smart decisions about scaling operations or tweaking pricing strategies.

Moreover, small businesses face various challenges, such as managing fluctuating expenses and market demands, which can significantly impact both their profits revenue and earnings. For instance, inflation and rising supply costs are major concerns for 75% of small business owners, affecting their ability to maintain healthy margins.

In short, getting a grip on the differences between income and earnings is vital for small business owners. It empowers them to make informed financial decisions, helping their businesses stay strong and profitable in a competitive landscape. So, how are you tracking your income and earnings? It's worth a thought!

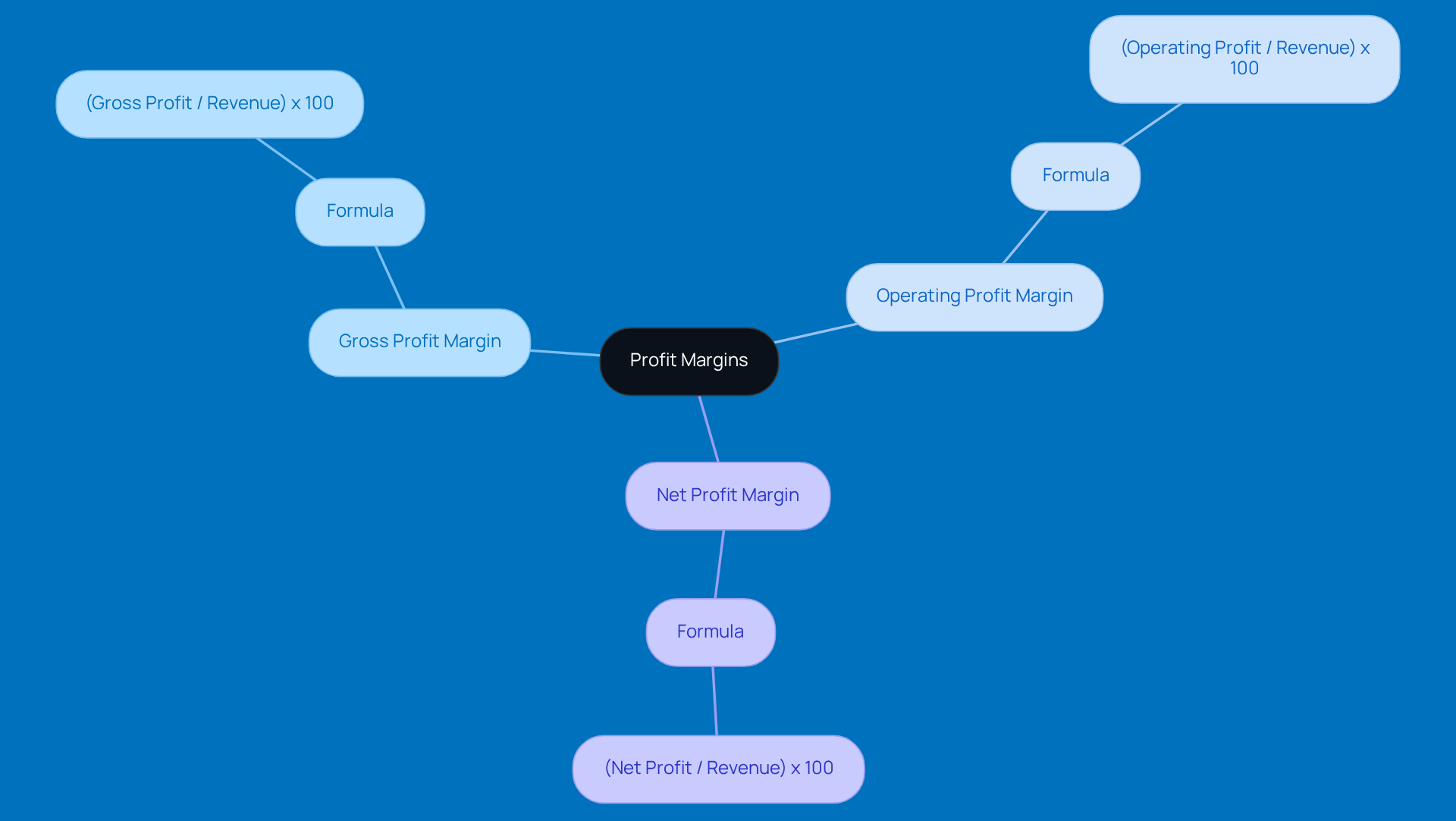

Profit Margins: Understanding Their Role in Business Success

Profit margins? They’re pretty important! Simply put, you find them by dividing your earnings by sales and expressing that as a percentage. There are three main types of profit margins you should know about:

- Gross Profit Margin: (Gross Profit / Revenue) x 100

- Operating Profit Margin: (Operating Profit / Revenue) x 100

- Net Profit Margin: (Net Profit / Revenue) x 100

Understanding these margins can really help you as a business owner. They give you insight into your pricing strategies and how efficiently you’re running things. So, why not take a closer look? It could guide you toward making better financial decisions!

How Revenue Impacts Profit: Analyzing the Connection

Income plays a big role in how much you earn. If you manage your expenses well, a higher income can lead to greater earnings. But here’s the catch: if you just focus on boosting your income without keeping an eye on expenses, you might find yourself facing diminishing returns. It’s like trying to fill a bucket with holes—no matter how much you pour in, it just won’t hold!

So, what’s the best approach? Business owners should really aim to do two things:

- Ramp up those sales

- Keep expenses in check

This way, when income grows, it actually translates into real profits revenue. Think of it as a balancing act—both sides need to work together for you to see the benefits.

Have you ever noticed how easy it is to get caught up in chasing higher sales? It’s exciting, but don’t forget about those pesky expenses! Keeping a close watch on both can make all the difference in your bottom line. So, let’s keep that conversation going—how do you manage your expenses while trying to grow your income?

Cash Flow Management: Ensuring Profitability Through Effective Revenue Handling

Managing cash flow is all about keeping an eye on the money coming in and going out, making sure your organization can meet its obligations. Here are some key strategies to consider:

-

Forecasting Cash Flow: It’s crucial to anticipate your future cash needs based on revenue projections. A fractional CFO can step in with financial strategies and projections that not only boost your operational performance but also help you forecast cash flow in a cost-effective way.

-

Managing Receivables: Timely invoicing and following up on outstanding payments are essential. A virtual CFO can whip up detailed monthly reports that include all the important data about your organization, spotting trends that impact your receivables and enhancing your cash flow management.

-

Controlling Expenses: Regularly reviewing and adjusting your spending is key to maintaining a healthy cash flow. With the know-how of a fractional CFO, you can optimize profitability and minimize risks by managing your assets and cash flow effectively.

Effective cash flow management is vital for keeping your profits revenue on track and for supporting growth initiatives. By tapping into the tailored support of a fractional CFO, small agency leaders can make informed financial choices that align with their goals. So, what are you waiting for? Let’s get that cash flow in check!

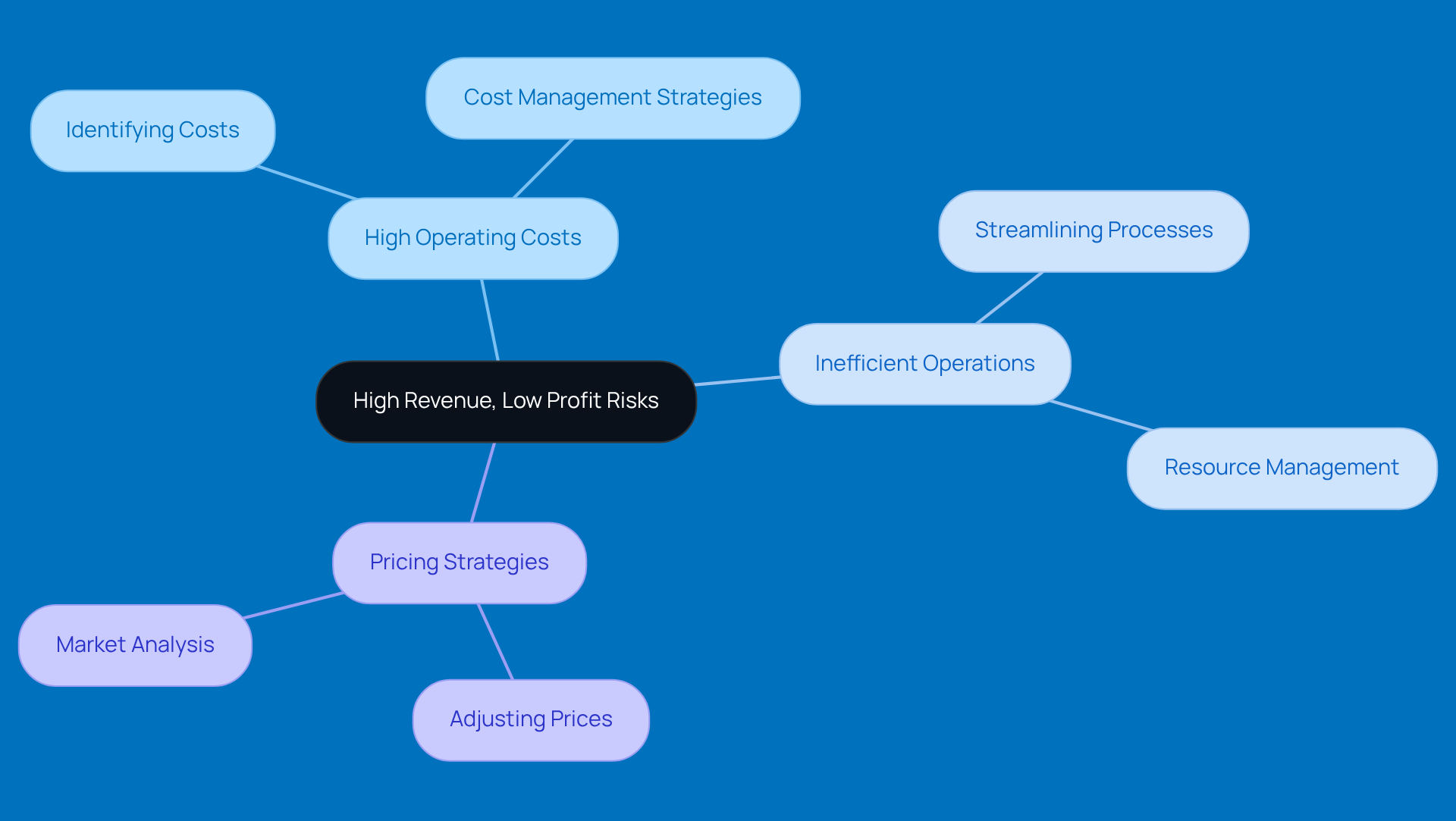

High Revenue, Low Profit: Understanding the Risks for Small Businesses

When a business is generating high revenue but struggling with low profits, it often points to some underlying issues. Let’s break it down:

-

High Operating Costs: If expenses are through the roof, they can really eat into those profit margins. This is where a fractional CFO comes in handy. They can help pinpoint those pesky costs and manage them effectively, making sure your spending aligns with your financial goals while finding cost-effective solutions.

-

Inefficient Operations: Sometimes, it’s just poor resource management that leads to waste and higher costs. With the expertise of a fractional CFO, company leaders can streamline operations and boost efficiency. This tailored assistance can ultimately help improve profits.

-

Pricing Strategies: Sure, low prices can drive sales, but they might also hurt your bottom line. A fractional CFO can provide valuable insights into pricing strategies, helping entrepreneurs take a closer look at their operations and adjust prices to ensure that revenue growth translates into real profits.

By tapping into the strategic benefits of a fractional CFO, small agency operators can tackle these challenges head-on, turning that substantial income into significant profits. So, what’s holding you back from making that leap?

Balancing Revenue and Profit: Strategies for Sustainable Business Growth

If you're a small business owner looking to strike that sweet balance between revenue and profit, there are a few strategies you might want to consider:

-

Diversify Revenue Streams: Why stick to just one source of income? Exploring new markets or products can really help reduce that reliance on a single stream. It’s like not putting all your eggs in one basket, right?

-

Optimize Pricing: Take a moment to regularly review your pricing strategies. Are they reflecting the value you provide? Make sure they cover your costs too. It’s all about finding that sweet spot!

-

Enhance Operational Efficiency: Streamlining your processes can do wonders for reducing expenses and boosting those margins. By focusing on both growing your revenue and optimizing your profits revenue, you’re setting your business up for sustainable success.

So, what do you think? Have you tried any of these strategies before? Let’s keep the conversation going!

Conclusion

Understanding the relationship between revenue and profit is super important for small business owners who want to grow sustainably. Let’s break it down: revenue is all the money you make from sales, while profit is what’s left after you’ve paid all your expenses. Knowing this difference is key for smart financial planning and decision-making.

We talked about tracking different types of revenue—like gross, operating, and recurring—and understanding the various profit types, including gross, operating, and net profit. Plus, we touched on why profit margins and cash flow management matter, especially when you have high revenue but low profit. These insights highlight why it’s crucial for small businesses to take strategic steps to boost both revenue and profitability.

So, what can you do? Small business owners should dive into financial management practices that balance bringing in revenue with keeping costs in check. Think about:

- Diversifying your revenue streams

- Optimizing your pricing strategies

- Improving operational efficiency

By embracing these strategies, you can set your business up for long-term success. Remember, navigating the complexities of financial health doesn’t have to be daunting—these insights can empower you to reach your business goals!

Frequently Asked Questions

What services does Steinke and Company offer to small businesses?

Steinke and Company provides a range of services including proactive tax planning, financial management, and strategic coaching aimed at helping small and micro enterprises thrive.

Why is understanding the difference between revenue and profit important for small business owners?

Understanding the difference is crucial because revenue is the total income before expenses, while profit is what remains after all expenses are paid. This knowledge helps business owners plan their finances and manage taxes effectively.

What are the different types of revenue that small business owners should be aware of?

Small business owners should be aware of Gross Revenue (total sales before deductions), Operating Revenue (income from main business activities), and Recurring Revenue (predictable income from subscriptions or contracts).

How does Steinke and Company approach tax planning for small businesses?

Steinke and Company emphasizes regular check-ins and tailored strategies to help businesses identify missed opportunities and optimize their tax loads, especially in light of recent changes to 1099-K reporting standards.

What is the significance of keeping track of financial transactions for small business owners?

Keeping track of financial transactions is essential for accurate reporting, preparing for potential IRS audits, and backing up income and deductions. It also aids in overall financial management and compliance.

What types of IRS audits should small business owners be aware of?

Small business owners should be aware of correspondence audits, office audits, and field audits, as understanding these can help alleviate stress during the audit process.

What protections do small business owners have during IRS audits?

The taxpayer bill of rights outlines the protections available to individuals during audits, which can provide reassurance and help business owners focus on growing their business.

How can reviewing financial documents like paystubs and tax records benefit small business owners?

Regularly reviewing financial documents helps ensure compliance, improves tax efficiency, and provides insights into financial stability, which can guide investment decisions and strategic planning for future growth.