Overview

This article dives into the essential insights about the differences and management strategies between revenue and gross profit, specifically for small agency owners. So, why does it matter? Well, understanding the gap between total income (that’s your revenue) and the earnings left after direct costs (hello, gross profit!) is super important for making smart financial decisions. This knowledge helps owners fine-tune their pricing strategies and boost operational efficiency, paving the way for sustainable growth.

Think about it: when you know how much you’re really making after covering your costs, you can make better choices that impact your bottom line. It’s all about optimizing your approach! Plus, this understanding can lead to more informed decisions that not only enhance profitability but also support long-term success. So, are you ready to take your financial game to the next level?

Introduction

Hey there, small agency owners! Let’s talk about something that’s super important for your business: understanding the financial landscape. It can be a bit tricky, especially when it comes to revenue and gross profit. These two metrics often get mixed up, but they’re key players in shaping your business strategies and helping you grow sustainably.

So, what’s the difference? Simply put, it’s all about knowing your total income and what’s left after you’ve covered your costs. By digging into these details, you can uncover insights that really boost your profitability and operational efficiency. But here’s the kicker: many small businesses are grappling with cash flow challenges.

How can you use these insights to improve your financial health and set yourself up for long-term success? Let’s dive in!

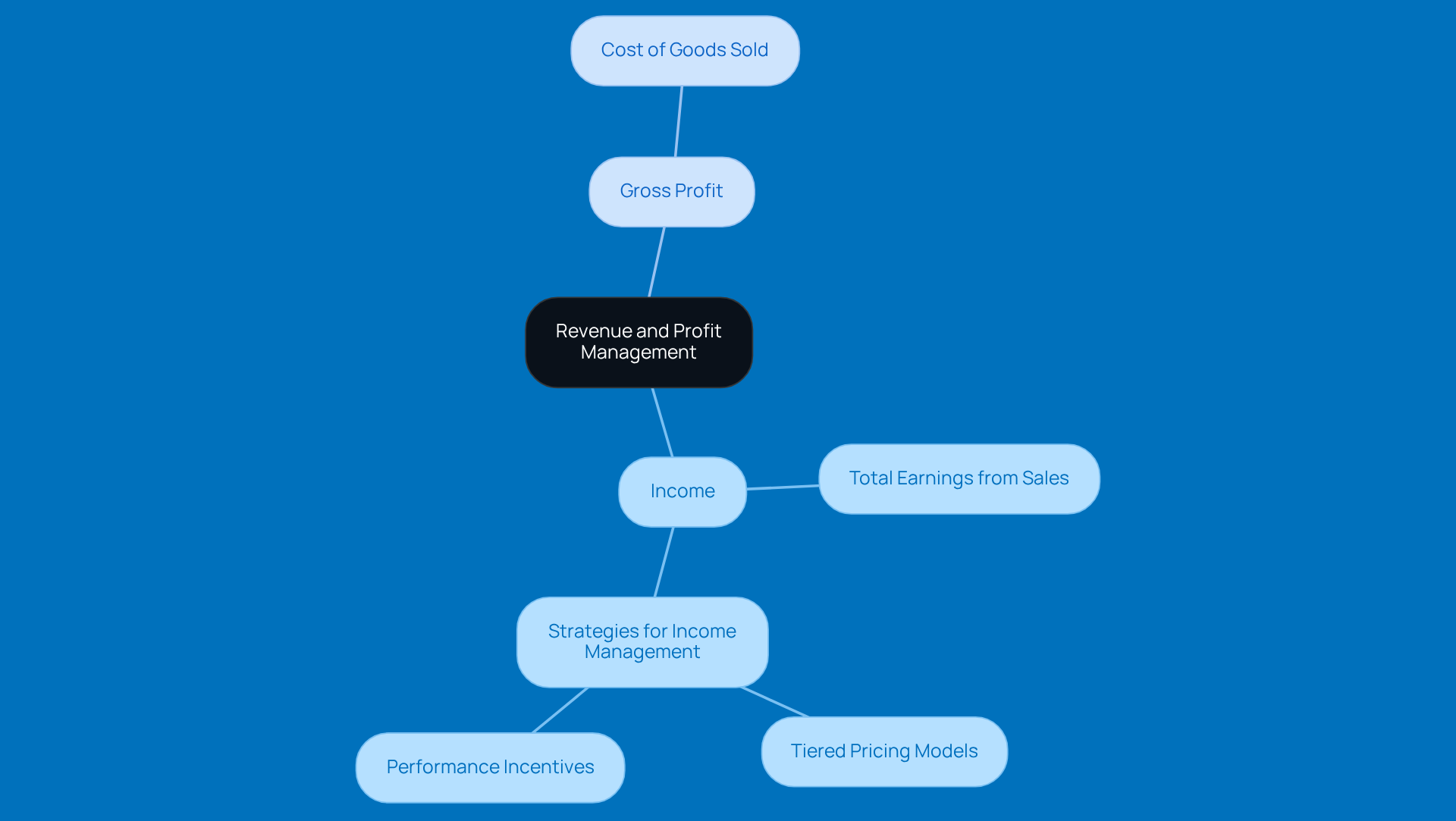

Steinke and Company: Expert Guidance on Revenue and Profit Management

Steinke and Company is all about giving tailored advice to small agency owners, and they really shine a light on the key differences between income and gross earnings management. If you’re in a rural business, understanding these concepts is super important, especially since unique challenges often pop up. Financial specialists point out that when discussing revenue vs gross profit, income is essentially the total earnings from sales, while gross profit is what you have left after deducting the cost of goods sold. Getting this distinction right is crucial for making smart economic decisions that can lead to sustainable growth.

When it comes to effective income strategies for rural organizations, think tiered pricing models and performance incentives. These strategies link compensation to client results, which not only boosts profitability but also helps build stronger relationships with clients. Lately, we’ve seen a trend where small enterprises are jumping on automated expense tracking and integrated management systems. These tools make it easier to keep accurate profit and loss statements, which is a game changer.

Now, let’s talk about how efficient income management can really impact small agency profitability. Agencies that regularly check their performance metrics can spot opportunities for scaling operations, hiring new staff, or investing in fresh initiatives. With 65.3% of small businesses reporting profitability, it’s clear that strategic income management is key to achieving financial success.

In today’s world, where 82% of small enterprises are facing cash flow issues, understanding the ins and outs of revenue vs gross profit management is more important than ever. Steinke and Company offers proactive tax planning services, including regular check-ins and strategic planning sessions. These are designed to help small business owners navigate the complexities of taxation, ensuring they maximize their after-tax income. By focusing on these areas, rural businesses can tackle economic challenges head-on and set themselves up for long-term sustainability and growth.

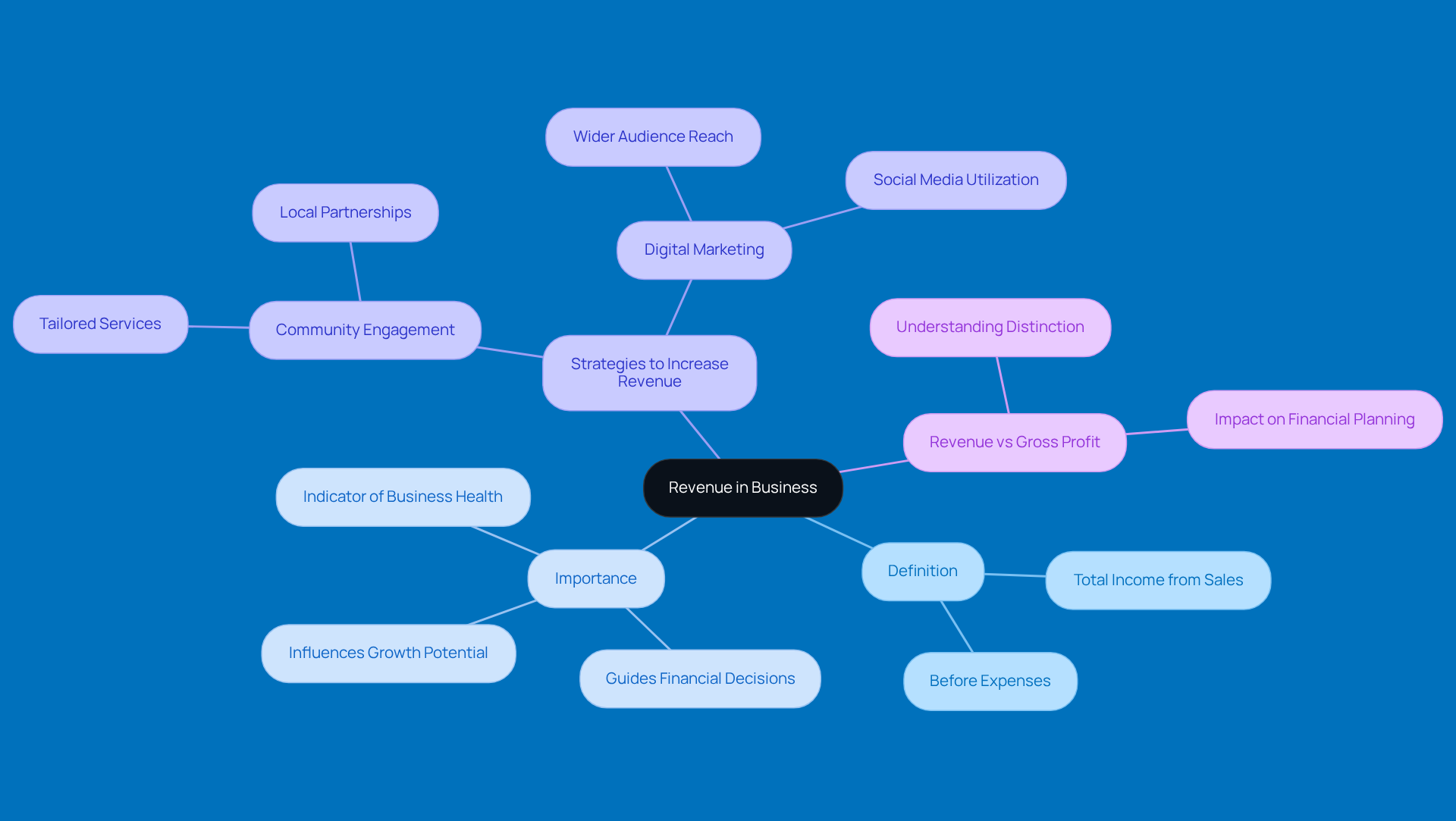

Revenue Defined: Understanding Its Role in Business Financials

Revenue is basically the total income you make from selling goods or services before any expenses come into play. Think of it as a key indicator of how well your business is doing—it shows how effective your sales strategies are and how much demand there is in the market. For small business owners, getting a grip on what income really means is super important for figuring out growth potential and how well things are running.

When you understand income, it helps you take a good look at your financial health and make smart decisions. It’s like a yardstick for measuring success, guiding you in planning your strategy and where to allocate resources. Plus, when your income grows, it often reflects the overall health of your business, influencing everything from hiring new staff to investing in the latest tech.

For small businesses, having effective sales strategies can really ramp up income generation. Take rural businesses, for example—they can tap into local partnerships and engage with the community to boost their visibility and attract more customers. Tailoring services to fit the specific needs of the community can also drive sales, since personalized offerings tend to resonate better with local folks. And let’s not forget about digital marketing tools—they can help you reach a wider audience and make it easier to bring in new clients, which is a big win for profit growth.

In the end, really understanding income not only helps you evaluate how your business is performing but also plays a key role in fostering sustainable growth for small firms. It’s crucial to remember that while total income shows your overall earnings, understanding revenue vs gross profit indicates what’s left after all expenses are taken out. Getting this distinction of revenue vs gross profit down is vital for small business owners because it directly impacts financial planning and business strategy.

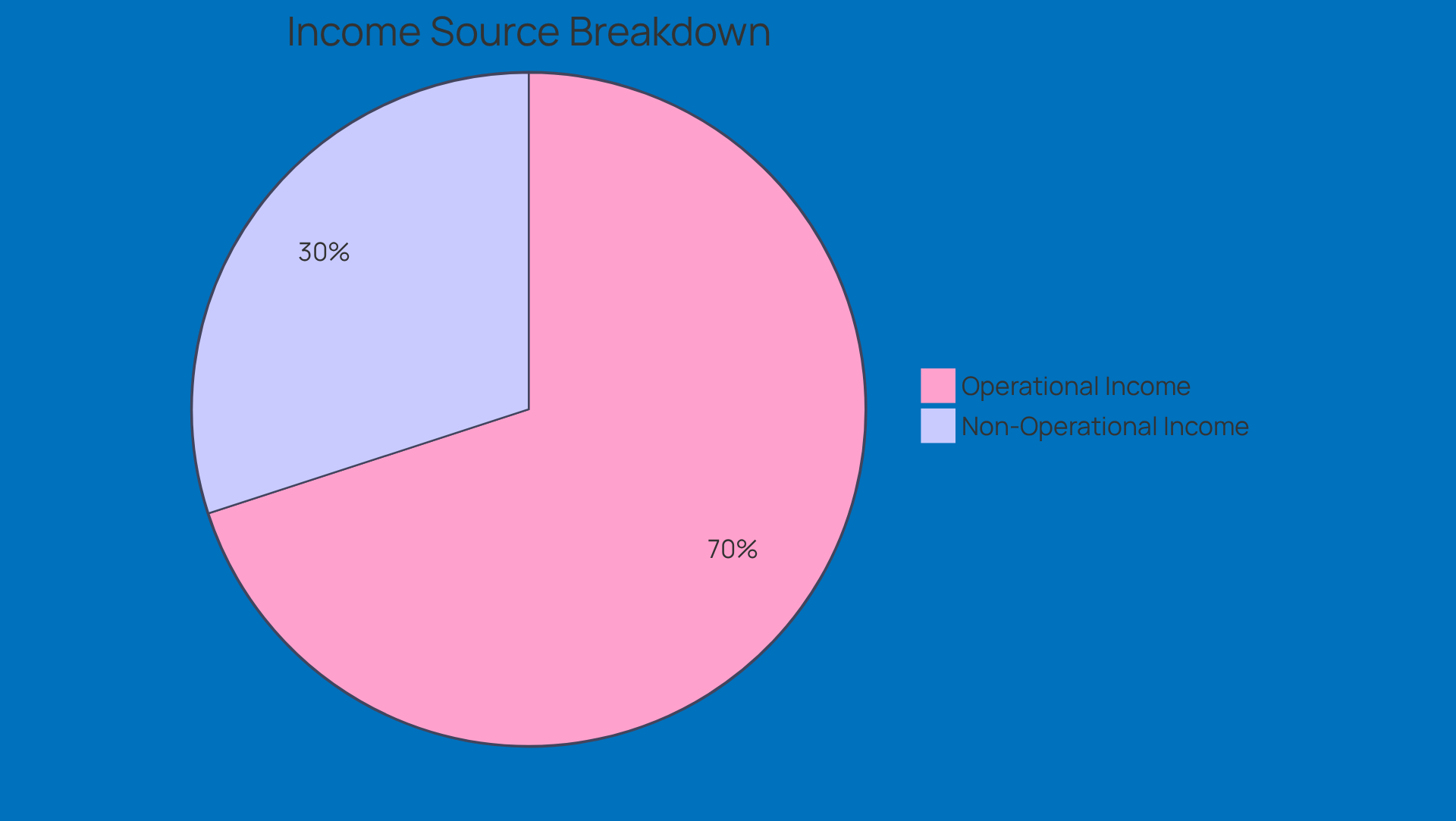

Types of Revenue: Exploring Sources and Their Importance

When it comes to income for small firms, you can really break it down into two main types: operational income and non-operational income. Operational income comes from the heart of your business—think services you provide or products you sell. On the flip side, non-operational income is like the cherry on top, coming from things like investments or selling off assets. Understanding these differences is super important for small agency owners. It helps you spot growth opportunities and fine-tune your income strategies.

Now, operational income is crucial for keeping your daily operations running smoothly and ensuring you have that economic stability. Non-operational income, however, can be a lifesaver, especially when times get tough. For instance, small businesses that diversify their income sources often find they can weather market ups and downs much better. Did you know that 65% of small enterprises worry about cash flow? That really highlights why having a balanced income strategy is key.

Financial advisors often emphasize that operational earnings should ideally make up a big chunk of your overall income. A solid income strategy might look something like this:

- 70% operational earnings

- 30% non-operational earnings

This way, you can keep a steady income while also exploring other financial avenues.

So, what are some effective ways to diversify your income? Think about:

- Broadening your service offerings

- Using digital marketing to pull in new clients

- Teaming up with others to create new income streams

Plus, bringing in a fractional CFO can provide tailored management and strategic insights that help you maximize both operational and non-operational income. By focusing on both types of income and leveraging the expertise of a fractional CFO, you can build a strong financial foundation that supports long-term growth and stability.

What do you think? Are you ready to explore these strategies and take your business to the next level?

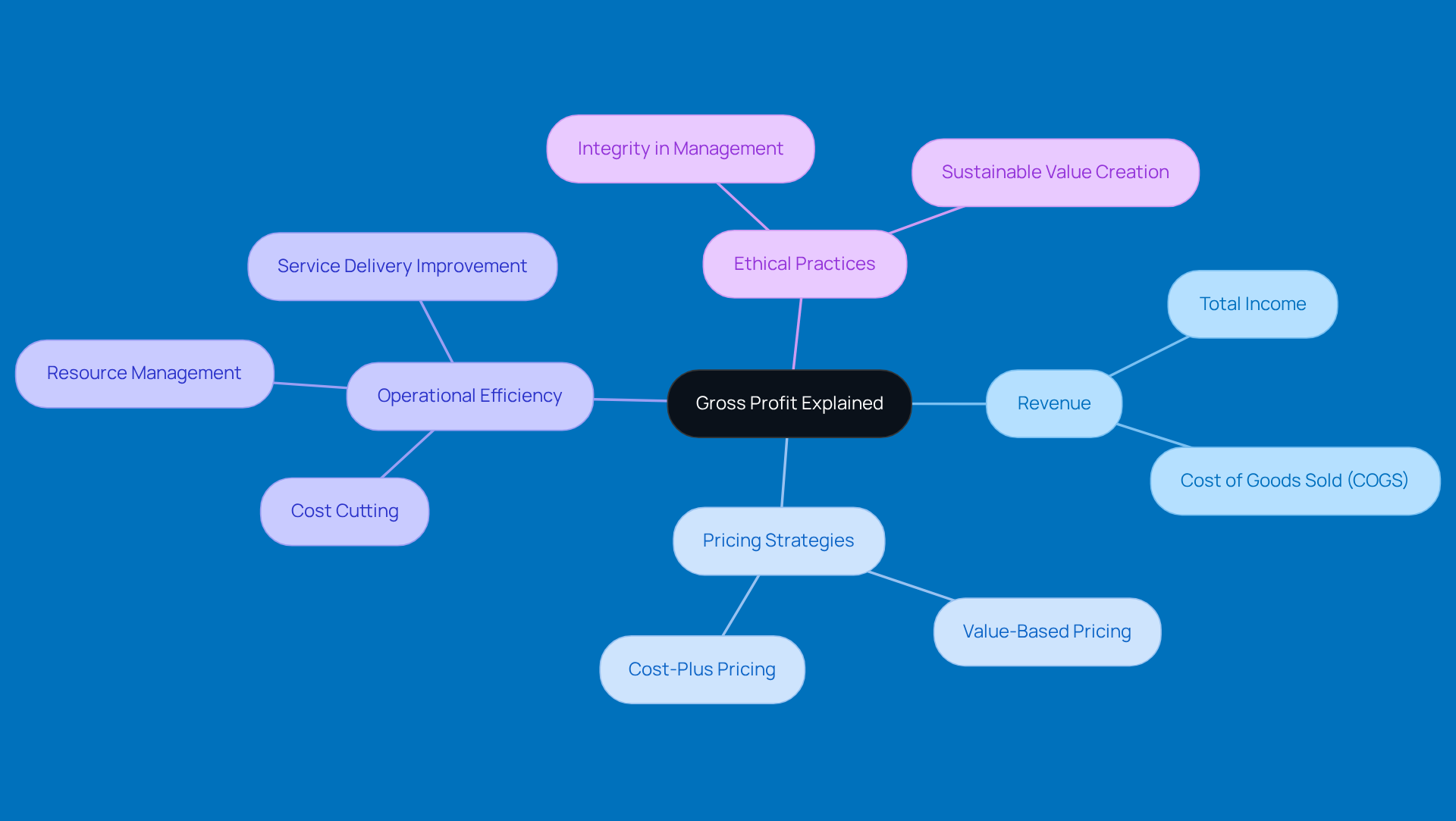

Gross Profit Explained: Key Differences from Revenue

Gross earnings are calculated by taking total income and subtracting the cost of goods sold (COGS), highlighting the difference in revenue vs gross profit. This gives you a clear picture of how well a business is doing in producing its goods or services. Now, total revenue just tells you how much you sold, but what is the difference between revenue vs gross profit? That’s a key measure for small business owners to check their operational efficiency and craft pricing strategies that boost profitability. As Peter Drucker wisely said, 'Earnings are essential for survival,' which really highlights how important gross earnings are for keeping a business afloat.

For business owners, understanding revenue vs gross profit is super important—not just for checking financial health but also for making smart pricing decisions. Implementing pricing strategies that maximize gross returns can really impact overall financial success. For example, agencies might want to try value-based pricing, where prices are set based on what clients perceive as valuable, rather than just on costs. This approach can lead to higher overall earnings margins, which is especially crucial in the consulting world, where average margins typically hover between 40% and 60%.

But wait, there’s more! Gross earnings also play a vital role in operational efficiency. By examining revenue vs gross profit margins, agency owners can identify areas where they can cut costs and enhance processes. This ultimately leads to better resource management and service delivery. As Warren Buffett points out, ethical business practices and solid management are key to a company’s growth and profitability. So, focusing on total earnings not only helps with financial sustainability but also aligns with ethical practices that foster long-term growth.

So, what do you think? How are you currently measuring your business's effectiveness? Let’s keep the conversation going!

Calculating Revenue and Gross Profit: Methods and Best Practices

Calculating revenue is pretty straightforward: just sum up all your sales transactions over a specific period. This gives you a clear picture of your total income. Now, if you want to figure out your gross profit, it’s as simple as using this formula:

Gross Profit = Revenue - Cost of Goods Sold (COGS)

This illustrates the concept of revenue vs gross profit. Keeping your monetary records precise is super important! The best way to do this? Consider using accounting software for real-time monitoring and make it a habit to regularly check your accounts. This way, your calculations will accurately reflect how your business is doing.

Did you know that 34% of small business owners take a peek at their statements every week? That really highlights how crucial regular monitoring is! If you’re looking for some popular accounting software options, here are a few:

- QuickBooks

- Xero

- FreshBooks

These are favorites among small agencies. They make financial tracking and reporting a breeze, helping you stay on top of your game.

![]()

Profit Margins: Understanding Their Impact on Business Success

Profit margins, shown as a percentage, tell us how much a business keeps for every dollar it makes. There are a couple of key types to know: the gross profit margin, which looks at the difference in revenue vs gross profit, and the net profit margin, which takes all expenses into account. For small business owners, keeping an eye on these margins is crucial for understanding their economic health and making smart choices about pricing, managing costs, and exploring investment opportunities.

Now, let’s talk about the benefits of hiring a fractional CFO. This can be a game-changer for small to mid-sized businesses. A fractional CFO offers cost-effective financial management and tailored support, giving agency owners access to top-notch monetary expertise without the hefty price tag of a full-time hire. They can help analyze financial margins, providing insights that can refine pricing strategies and enhance overall financial success. Plus, they offer services like KPI tracking, financial strategies, and cash flow management—essential tools for making informed decisions.

As we look at current trends in margin assessment, it’s clear that businesses need to embrace advanced analytics and machine learning tools. These can help them anticipate future trends and improve decision-making. In a changing market, grasping both fixed and variable costs is key for effective pricing strategies, allowing agency owners to tweak their offerings based on economic shifts.

To boost margin levels in small businesses, a mix of cost-saving initiatives and revenue growth strategies often works best. For example, negotiating better terms with suppliers can lead to significant savings, while tiered pricing or product bundling can increase average order values. Regularly reviewing economic metrics, perhaps with the guidance of a fractional CFO, can help spot revenue leaks and inform necessary changes related to revenue vs gross profit, ensuring sustainable business practices.

In the end, maintaining healthy margins is crucial for the longevity of small businesses. They not only reflect how efficiently a business operates but also impact its ability to secure loans and attract investors. By focusing on these vital economic metrics and leveraging the expertise of a fractional CFO, agency owners can foster long-term growth and resilience in an increasingly competitive landscape.

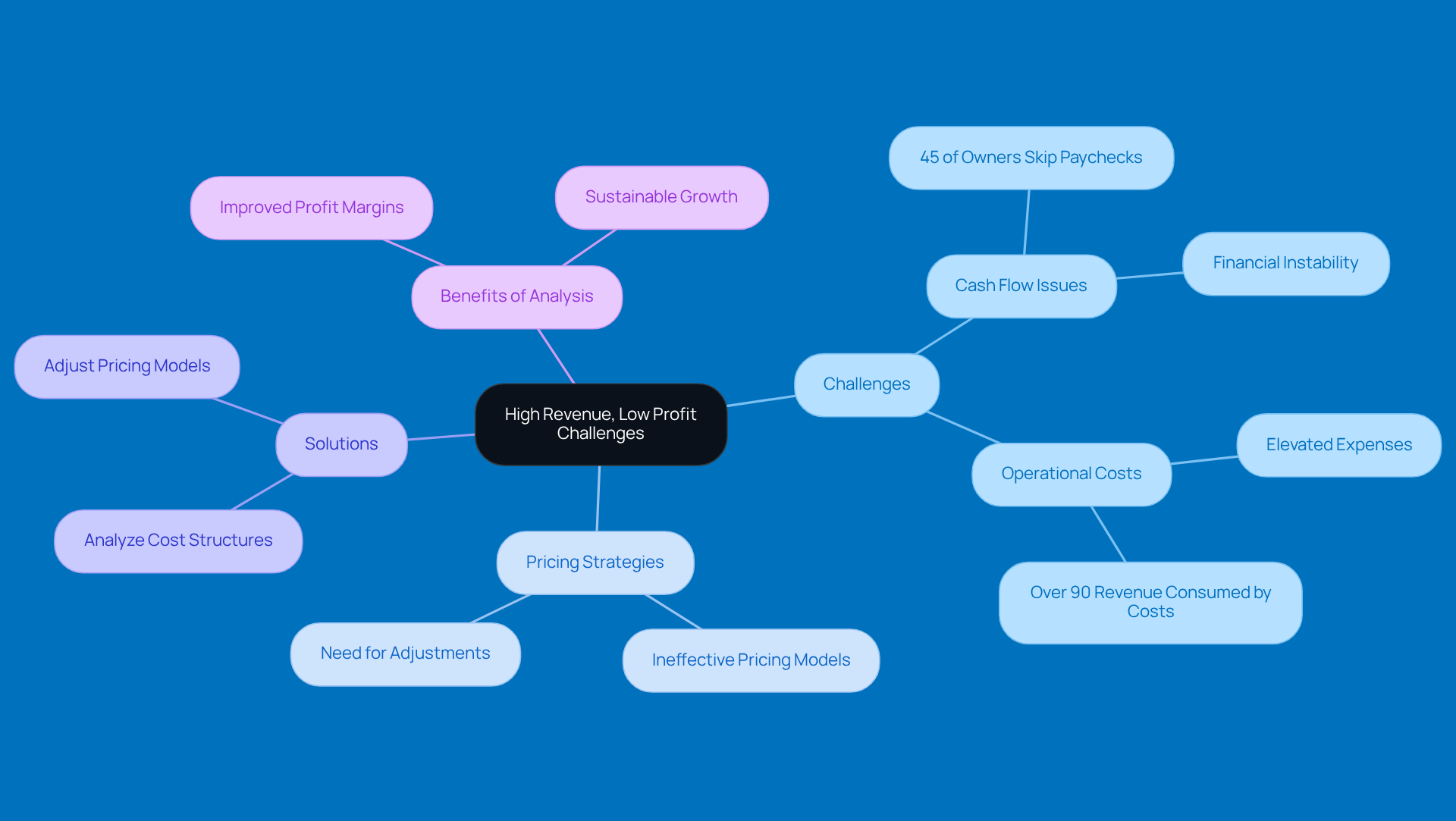

High Revenue, Low Profit: Risks and Considerations for Small Businesses

Many small businesses might flaunt impressive revenue numbers, but in the context of revenue vs gross profit, they often struggle with low profit margins. Why? Elevated operational costs and pricing strategies that just don’t hit the mark. This mismatch can lead to cash flow headaches and financial instability, putting long-term success at risk. In fact, a staggering 45% of U.S. small business owners have reported skipping their own paychecks because of cash flow issues. Talk about a wake-up call!

So, what can small business owners do to tackle these challenges? Regularly analyzing cost structures and pricing models is a great start. By understanding how operational expenses impact financial returns in the context of revenue vs gross profit, businesses can tweak their pricing strategies to boost those profit margins. For example, aiming for a Delivery Margin of 60-70% of Gross Income (AGI) on a per-project basis is crucial for keeping revenue levels healthy.

And here’s the kicker: case studies reveal that businesses that focus on structured measurement and analysis of their financial metrics are way better at navigating economic ups and downs. By honing in on cash flow and aligning pricing strategies with what’s actually happening operationally, small firms can turn income growth into sustainable success. This way, they can thrive even in a competitive landscape. So, how are you planning to enhance your business’s financial health?

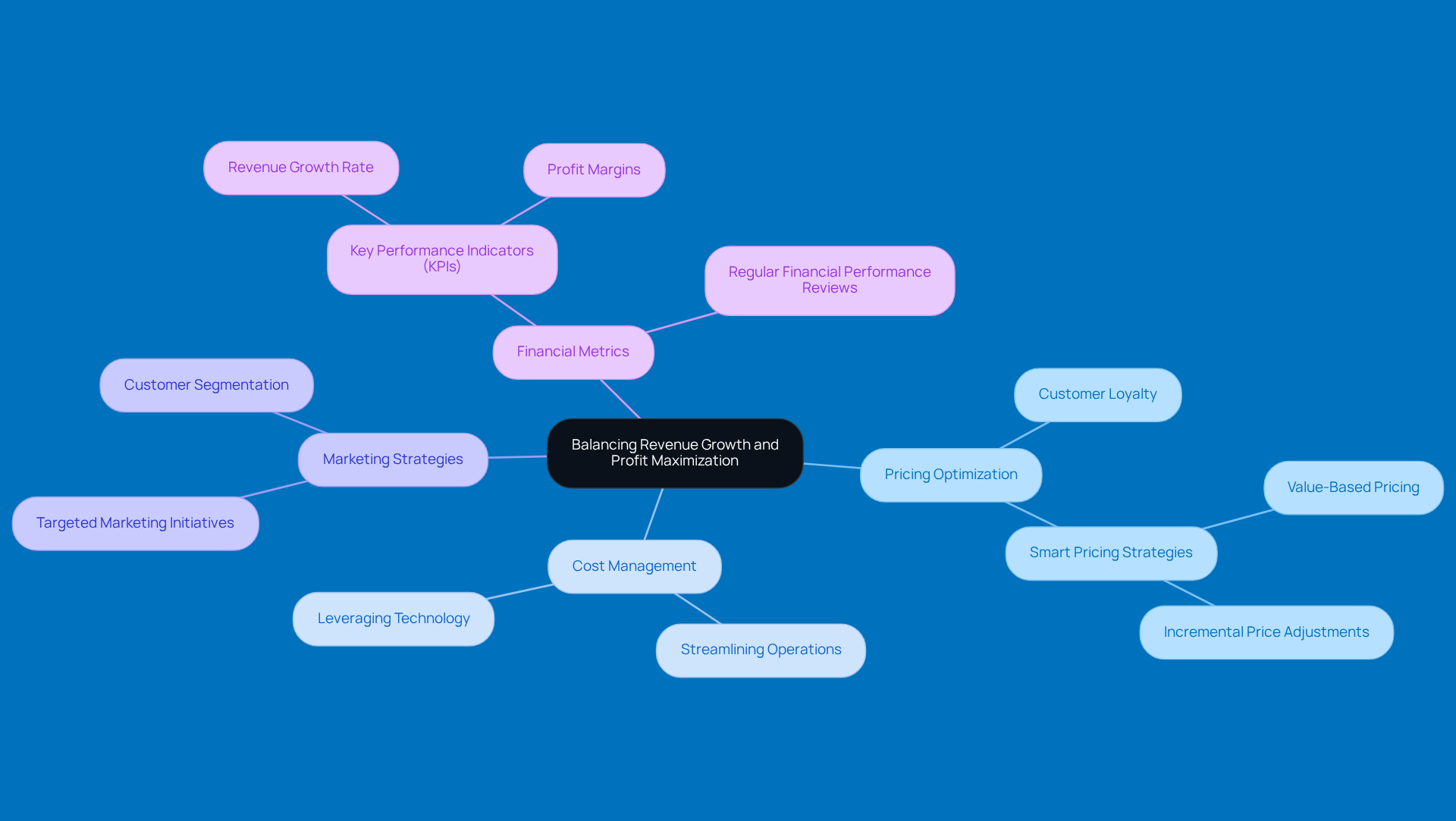

Balancing Revenue Growth and Profit Maximization: Strategic Insights

For small agency owners, achieving sustainable growth is all about striking the right balance between boosting income and maximizing earnings. A key part of this strategy is optimizing pricing, which can really make a difference in both your income and profit margins. Financial experts often point out that pricing is the only element in the marketing mix that actually brings in revenue, so it’s definitely worth your attention. By fine-tuning your pricing structures, you can not only ramp up your income but also build customer loyalty and satisfaction.

But pricing isn’t the only piece of the puzzle. Cutting down on operational costs is just as crucial. Streamlining processes and leveraging technology can lead to significant savings, allowing you to allocate resources more effectively. Plus, investing in targeted marketing initiatives that engage customers is super important, as it drives sales and nurtures long-term relationships.

Now, let’s talk about the difference between revenue vs gross profit. When discussing revenue vs gross profit, it's important to note that revenue refers to total income, while gross profit reflects what you actually earn after expenses. This distinction between revenue vs gross profit is key when it comes to making strategic decisions. It ties into the bigger picture of wealth and income, which can really shape how agency owners think about growth.

Regularly checking in on your financial performance metrics is essential for spotting areas that need improvement. Key performance indicators (KPIs) like revenue growth rate and profit margins give you a clear picture of your business health and operational success. By diving into these metrics, you can make informed decisions that align with your strategic goals, paving the way for sustainable growth in a competitive landscape.

Understanding customer personas is another must for effective marketing strategies. By crafting detailed buyer personas, you can tailor your marketing efforts to better meet the needs of your target audience, ultimately driving growth.

Recent stats show that companies that embrace smart pricing optimization tactics can see significant boosts in their margins. For example, those that take a phased approach to pricing adjustments often find it leads to smoother transitions and greater customer acceptance. Balancing income growth with cost management is crucial for long-term success in the ever-changing world of small agencies.

Reporting Revenue vs. Profit: Key Differences and Best Practices

Understanding the difference between revenue and earnings is super important for effective financial reporting. Revenue, often called the top line, refers to the total income your business brings in before any expenses are deducted, which is essential when analyzing revenue vs gross profit. On the flip side, the income statement highlights revenue vs gross profit, showing what you earn after accounting for costs and expenses.

To keep your financial reporting on point, small agency owners should consider these best practices:

- Keep Clear Records: Having accurate and organized financial records not only fosters transparency but also builds trust with your stakeholders. When your documentation is clear, it reduces the chances of misstatements and boosts confidence among investors and partners.

- Use Standardized Accounting Methods: Sticking to consistent accounting practices, like accrual or cash basis accounting, helps you produce reliable reports that meet regulations.

- Stay Compliant with Tax Regulations: Following tax laws is crucial—not just to avoid penalties but also to enhance your agency's reputation. Regular updates and accurate reporting are key to maintaining compliance and showing accountability.

These days, clarity and precision in financial reporting are more important than ever. As industry leaders point out, effective financial management isn’t just about crunching numbers; it’s about understanding the story those numbers tell. For instance, Michael Dell has stressed that managing cash flow is vital for keeping operations sustainable, which highlights why small firms need to focus on both income and earnings.

By prioritizing these best practices, small business owners can tackle the complexities of financial reporting and ensure they’re presenting a true picture of their company’s performance. So, what steps are you taking to enhance your financial reporting?

Common Misconceptions: Clarifying Revenue vs. Gross Profit

A common misunderstanding among small agency owners is thinking that income and revenue vs gross profit are the same thing. But here’s the scoop: income is all the money you bring in from sales, while the difference between revenue vs gross profit is what’s left after you subtract the direct costs tied to those sales, like materials and labor. This distinction between revenue vs gross profit is crucial for gaining a clear understanding of your financial performance and making informed decisions.

Let’s break it down with an example. Imagine a small business that rakes in $500,000 in revenue vs gross profit while spending $400,000 on direct costs. That leaves them with gross earnings of $100,000. This really shows how crucial it is to keep an eye on production expenses if you want to boost profitability. When business owners understand this difference, they can better evaluate their operational efficiency and spot areas that need improvement.

Now, let’s talk about how revenue vs gross profit influences decision-making. This understanding can really steer an agency’s growth. By honing in on gross profit, owners can get a better sense of whether their business model is sustainable and tweak their pricing strategies or cost management practices as needed. As educators often point out, grasping the nuances between these two metrics is key to building long-term success and resilience in a competitive market.

Also, it’s essential to realize that just looking at income doesn’t give you the full picture of your financial health. You could have a hefty income but still be in the red if your costs are sky-high. So, keeping tabs on both revenue vs gross profit metrics is vital for a clear view of your economic well-being. This approach fosters long-term success and resilience in a competitive landscape.

And here’s a thought: small firm owners might want to consider the strategic benefits of hiring a fractional CFO. This cost-effective resource can provide tailored support, helping you navigate tricky issues like underpayment penalties and ensuring you’re following IRS regulations. By tapping into the expertise of a fractional CFO, agency owners can fine-tune their financial strategies, ultimately boosting both revenue and profit.

Conclusion

Understanding the differences between revenue and gross profit is super important for small agency owners who want to grow sustainably. Think of revenue as your total income and gross profit as what’s left after you’ve paid for production costs. This distinction can really shape your strategic decisions! It’s not just about keeping tabs on your financial health; it also helps you craft better pricing strategies and streamline operations.

Throughout this article, we’ve shared some key insights. For instance, tiered pricing models can be a game changer, and having diverse income sources can really cushion your business. Plus, hiring a fractional CFO can provide that tailored financial management you might need. By keeping an eye on performance metrics and diving into advanced analytics, small agencies can spot growth opportunities and boost profit margins. And let’s not forget, clearing up common misconceptions about revenue and gross profit can help you navigate your financial landscape more effectively.

In today’s competitive market, it’s crucial for small agency owners to adopt best practices in managing revenue and profit. By focusing on financial education and tapping into expert advice, you can not only survive but truly thrive! The road to long-term success is all about balancing income growth with profit maximization. Every financial decision should contribute to building a strong and resilient business model. So, embrace these insights and take those proactive steps toward enhancing your agency's financial well-being!

Frequently Asked Questions

What is the difference between revenue and gross profit?

Revenue is the total income earned from sales before any expenses are deducted, while gross profit is what remains after subtracting the cost of goods sold from revenue.

Why is understanding income and gross profit management important for rural businesses?

Understanding these concepts is crucial for making informed economic decisions that can lead to sustainable growth, especially given the unique challenges faced by rural businesses.

What strategies can rural organizations use to improve income management?

Effective strategies include implementing tiered pricing models and performance incentives that link compensation to client results, boosting profitability and client relationships.

How can small agencies benefit from regular performance metrics checks?

Regularly checking performance metrics helps agencies identify opportunities for scaling operations, hiring new staff, or investing in new initiatives, which can enhance profitability.

What percentage of small businesses report profitability, and why is this significant?

65.3% of small businesses report profitability, highlighting the importance of strategic income management for achieving financial success.

What proactive services does Steinke and Company offer to small business owners?

Steinke and Company provides proactive tax planning services, including regular check-ins and strategic planning sessions, to help small business owners navigate taxation complexities and maximize after-tax income.

What are the two main types of revenue for small firms?

The two main types are operational income, which comes from core business activities, and non-operational income, which includes earnings from investments or asset sales.

Why is it important for small businesses to diversify their income sources?

Diversifying income sources helps small businesses weather market fluctuations better and can provide additional financial stability.

What is a recommended income strategy for small businesses?

A balanced income strategy might consist of 70% operational earnings and 30% non-operational earnings to maintain steady income while exploring other financial avenues.

How can a fractional CFO assist small businesses?

A fractional CFO can offer tailored management and strategic insights to help maximize both operational and non-operational income, supporting long-term growth and stability.