Introduction

Navigating the world of SaaS taxability can feel like a real maze, especially for small agencies. With state regulations constantly changing, it’s no wonder many feel overwhelmed. Did you know that by 2025, 25 states will have implemented sales tax on software services? Understanding the ins and outs of compliance isn’t just a nice-to-have; it’s crucial for keeping your finances healthy.

In this article, we’re diving into some key insights that will help SaaS providers manage their tax obligations effectively while minimizing risks. So, how can small businesses adapt their strategies to not just survive but thrive in this complex landscape? Let’s explore how to avoid those pesky penalties and keep your business on the right track!

Steinke and Company: Expert Tax Compliance for SaaS Businesses

At Steinke and Company, we’re all about helping software-as-a-service businesses, especially those in rural America, navigate the tricky waters of tax compliance. We totally get the unique hurdles that small agencies face, which is why we craft tailored strategies that not only ensure you’re compliant but also help cut down on those pesky tax liabilities. By blending solid accounting practices with strategic insights, we position ourselves as your go-to partner in tackling the complex tax landscape.

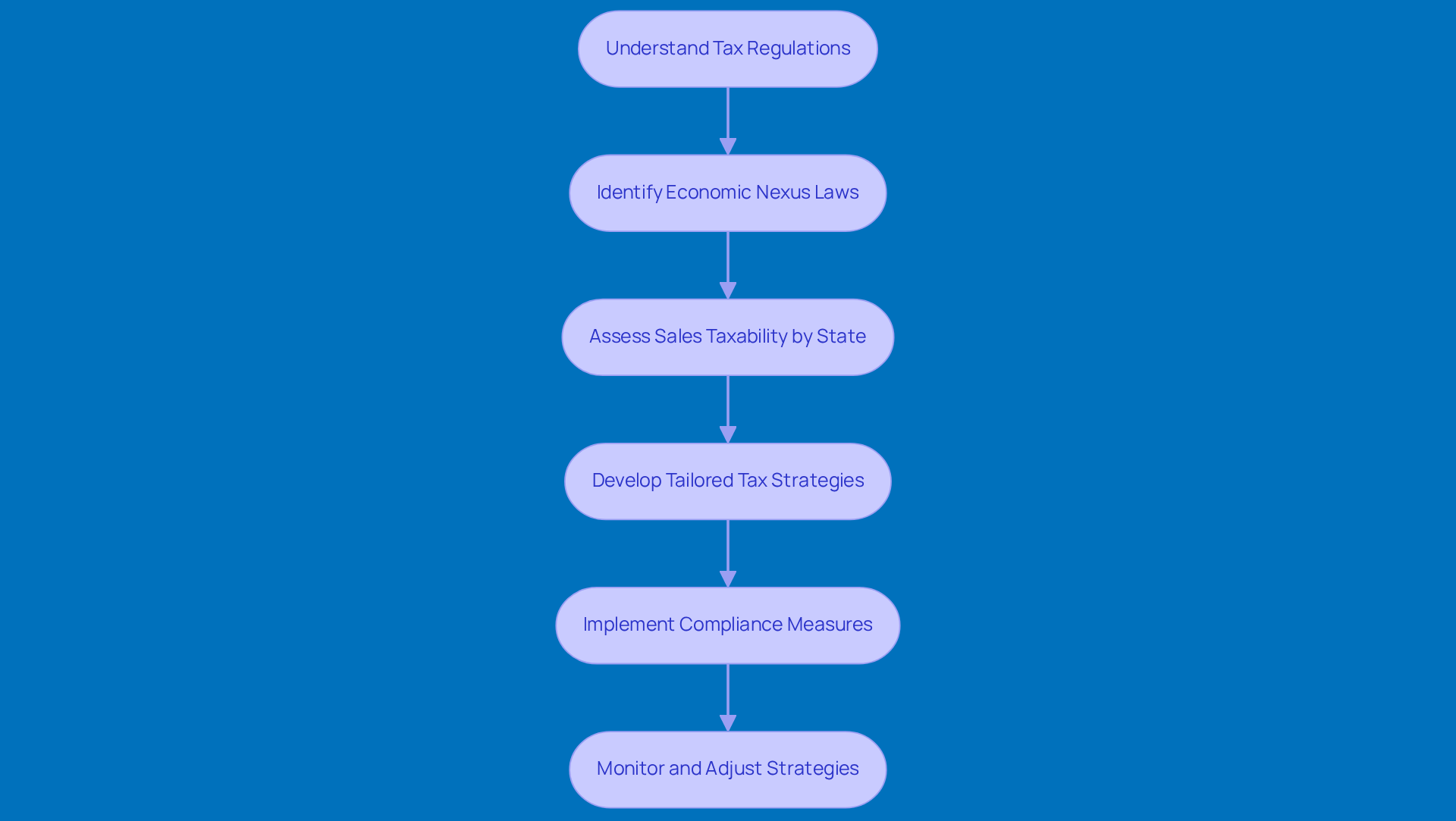

You know, with all the recent changes in tax regulations, staying in the loop is more important than ever. Take economic nexus laws, for example. Many states now require SaaS providers to understand saas taxability by state based on sales thresholds, even if they don’t have a physical presence there. This can make compliance a real headache, especially for smaller agencies that might not have the resources to keep up with these shifts.

Tax experts warn that not keeping up can lead to some serious financial pitfalls, including penalties that can average around 4.3% of income for those who fall out of compliance. That’s why it’s crucial to develop effective tax strategies that not only keep you compliant but also boost your bottom line. Our approach goes beyond just ticking boxes; we aim to enhance your overall business performance by ensuring your tax obligations are met efficiently.

For rural SaaS firms, the stakes are even higher. Understanding local sales tax regulations, particularly saas taxability by state, and how they apply to software products is key to avoiding costly mistakes. That’s where our expertise comes in - we help these businesses navigate the maze of tax regulations, ensuring they stay compliant while focusing on what they do best: growing their business. By prioritizing tax compliance, rural software companies can not only survive but thrive in a competitive market, turning potential challenges into exciting opportunities.

Understanding the Complexity of SaaS Taxation

Navigating SaaS taxability by state can feel like a maze, right? With all the different regulations across states, it’s no wonder businesses are scratching their heads. As of 2025, 25 states have jumped on the sales tax bandwagon for software services, but the SaaS taxability by state varies widely depending on how you use the software, how it’s delivered, and who’s using it. Take New York, for instance - if you download software electronically or use SaaS, you need to be aware of SaaS taxability by state. But in Colorado? Not so much. This kind of inconsistency can really throw a wrench in the works for businesses trying to navigate SaaS taxability by state.

Experts are quick to point out that understanding local laws is crucial. Ignoring them can lead to some pretty hefty penalties. Sam Ross, co-founder of Numeral, highlights how the tax treatment of software services differs from that of tangible products, making compliance a real challenge. As states look to the digital sector for revenue, maintaining awareness of SaaS taxability by state and keeping up with changing regulations is more important than ever for SaaS companies.

Let’s talk real-world implications. Companies operating in multiple states need to stay on their toes and regularly review their tax policies, particularly concerning SaaS taxability by state. Just look at Maryland, which is set to introduce a 3% sales tax on IT and digital services starting July 1, 2025. This new tax is a reminder that non-compliance can hit hard, as it highlights the importance of understanding SaaS taxability by state, with SaaS companies potentially losing an average of 4.3% of their revenue due to sales tax-related expenses. And don’t forget Florida’s recent decision to remove sales tax on commercial real estate rentals; it’s a clear example of how state regulations can shift, impacting financial planning for SaaS providers.

With over 11,000 tax jurisdictions in the U.S., understanding SaaS taxability by state is essential due to the complex landscape that demands careful attention. Companies that invest in tax compliance tools can make their lives a lot easier, reducing the risk of errors and ensuring they stay on the right side of state regulations. As the digital economy keeps growing, getting a handle on SaaS taxability by state will be key to staying competitive. So, how are you managing your tax obligations in this ever-changing environment?

States That Tax SaaS: A Comprehensive Overview

As of 2025, the SaaS taxability by state is presenting various tax challenges for Software as a Service (SaaS) providers across 25 states, including major ones like New York, Texas, and Washington. Each state has its own rules about tax rates and exemptions, and guess what? These rules can change pretty frequently! For example, New York treats SaaS as a taxable service, while Washington sees it as tangible personal property. This means businesses need to stay on their toes and adjust their compliance strategies accordingly.

In New York, if you're a SaaS provider, you’ve got to collect the right sales tax from your customers. The state has a base rate of 4%, but local jurisdictions might throw in some extra taxes too. On the flip side, Texas has set a 6.25% sales tax on SaaS, but there are specific exemptions for certain types of software.

Now, let’s talk about some recent changes that have made things a bit trickier. In Washington, the repeal of the 'human effort' exclusion means that services mainly focused on data processing are now taxable, starting October 1, 2025. This change really underscores how important it is for SaaS companies to keep an eye on shifting regulations.

Tax advisors emphasize the need to understand SaaS taxability by state. One specialist put it well: "Navigating the intricacies of state tax regulations is essential for software companies to avoid penalties and maintain adherence." With tax regulations constantly evolving - especially in states like Maryland and Louisiana, where new taxes on digital services are popping up - SaaS firms need to have solid compliance strategies in place to manage their obligations effectively.

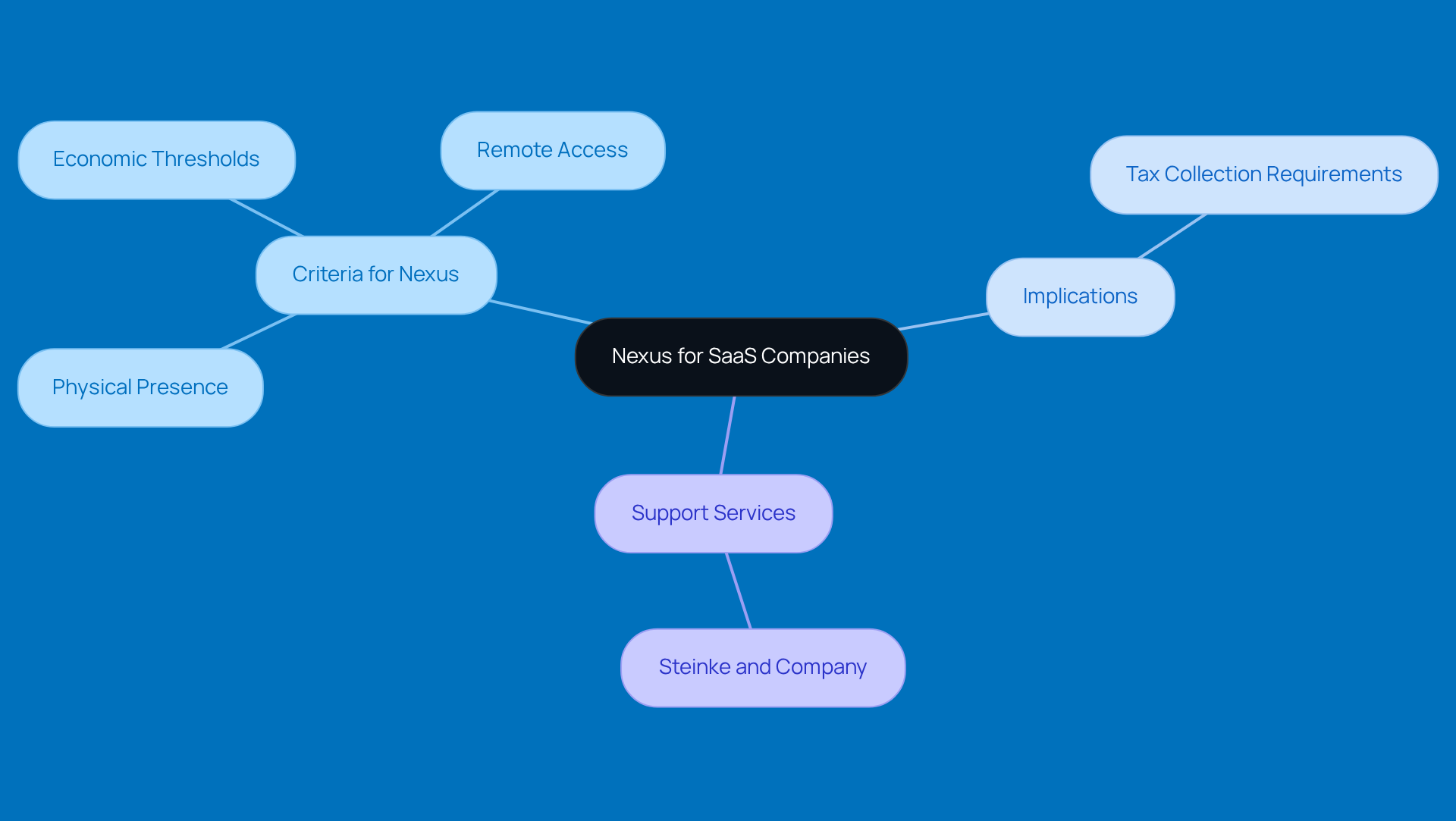

Establishing Nexus: What SaaS Companies Need to Know

Nexus is basically the connection between a company and a state that requires the company to collect sales tax. For SaaS companies, saas taxability by state can occur through various means, such as having a physical presence, reaching specific economic thresholds, or merely offering remote access to services. Starting in 2025, a bunch of states are rolling out economic nexus laws. This means that if your sales cross $100,000 or you make 200 transactions in a year in that state, you’ll need to start collecting tax.

At Steinke and Company, we totally get that navigating these rules can feel like a maze. That’s why our professional tax preparation and planning services are here to help you stay on track and avoid any nasty surprises. We want small agency owners like you to focus on what you do best - running your business - without the stress of tax season hanging over your head.

By putting financial and tax planning front and center, we help you dodge those budgeting pitfalls and set you up for long-term success. So, why not take a moment to think about how we can help you simplify your tax journey? Let’s make tax season a breeze together!

Compliance Challenges for SaaS Companies

Software as a Service (SaaS) firms often find themselves navigating a maze of regulatory challenges. Think about it: keeping up with ever-changing tax laws, managing multi-state tax responsibilities, and understanding SaaS taxability by state can feel like a full-time job! Plus, since SaaS operates online, pinpointing where services are actually provided can complicate things even more. It’s crucial for these businesses to have a solid strategy in place to avoid those pesky penalties.

And let’s not forget about data security! Small businesses, especially those handling sensitive customer information, need to comply with regulations like the Gramm-Leach-Bliley Act (GLBA), which is all about protecting customer data. Implementing security measures like encryption and multi-factor authentication isn’t just about ticking boxes for compliance; it’s also about building trust with your clients. By focusing on both tax compliance, including SaaS taxability by state, and data protection, SaaS firms can secure their operations and boost their reputation in the market.

So, how are you tackling these challenges in your own business? It’s a lot to juggle, but with the right approach, you can navigate these waters smoothly!

Automating Sales Tax Compliance for SaaS

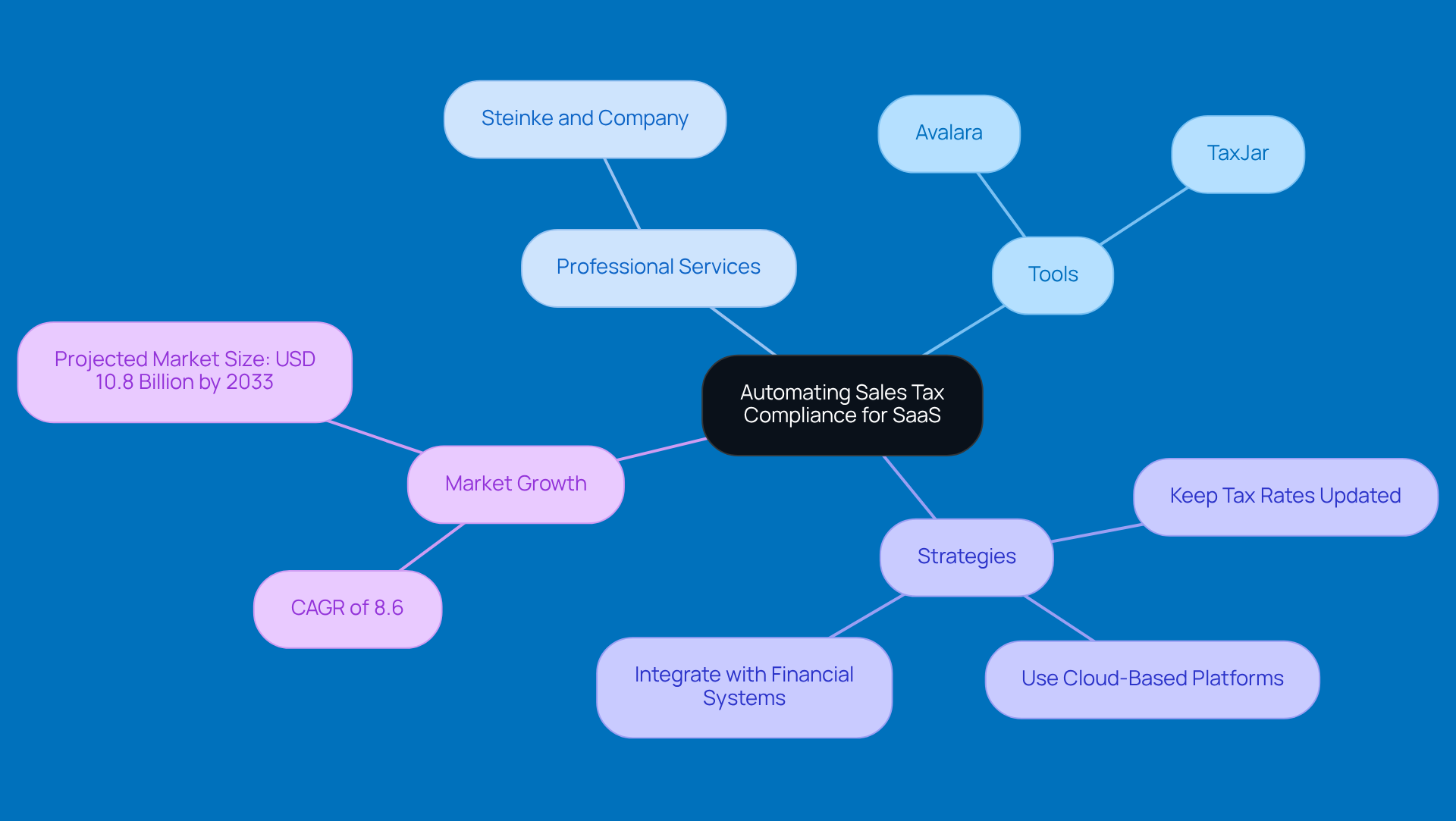

Automating sales tax adherence is super important for SaaS companies looking to manage SaaS taxability by state and handle their tax obligations smoothly. Tools like Avalara and TaxJar really help by automating tax calculations, tracking nexus, and filing returns across different states. This tech not only cuts down on manual errors but also makes sure submissions are on time, letting businesses focus on growing instead of getting bogged down by regulatory headaches.

And let’s not forget about professional tax prep and planning services, like those from Steinke and Company. They really step up the game by ensuring compliance with regulations and minimizing surprises come tax season. Steinke and Company tailors strategies that include detailed tax planning, regular regulatory checks, and personalized support, so small agency owners can tackle tax season without the stress.

The sales tax automation sector is expected to grow at a CAGR of 8.6% from 2025 to 2033, hitting USD 10.8 billion by 2033. That’s a clear sign that more folks are recognizing the need for efficient regulatory solutions. To make the most of these tools, it’s best to:

- Keep tax rates updated regularly

- Use cloud-based platforms for scalability

- Integrate with existing financial systems to boost operational efficiency

Firms like Numeral demonstrate how software-as-a-service companies can navigate SaaS taxability by state through automation, providing accurate calculations and support tailored to their unique challenges. As tax regulations keep evolving, embracing automated solutions alongside expert tax services will be key to staying compliant and fostering growth. So, how are you planning to tackle your tax obligations this year?

Top Tools for Managing SaaS Sales Tax Compliance

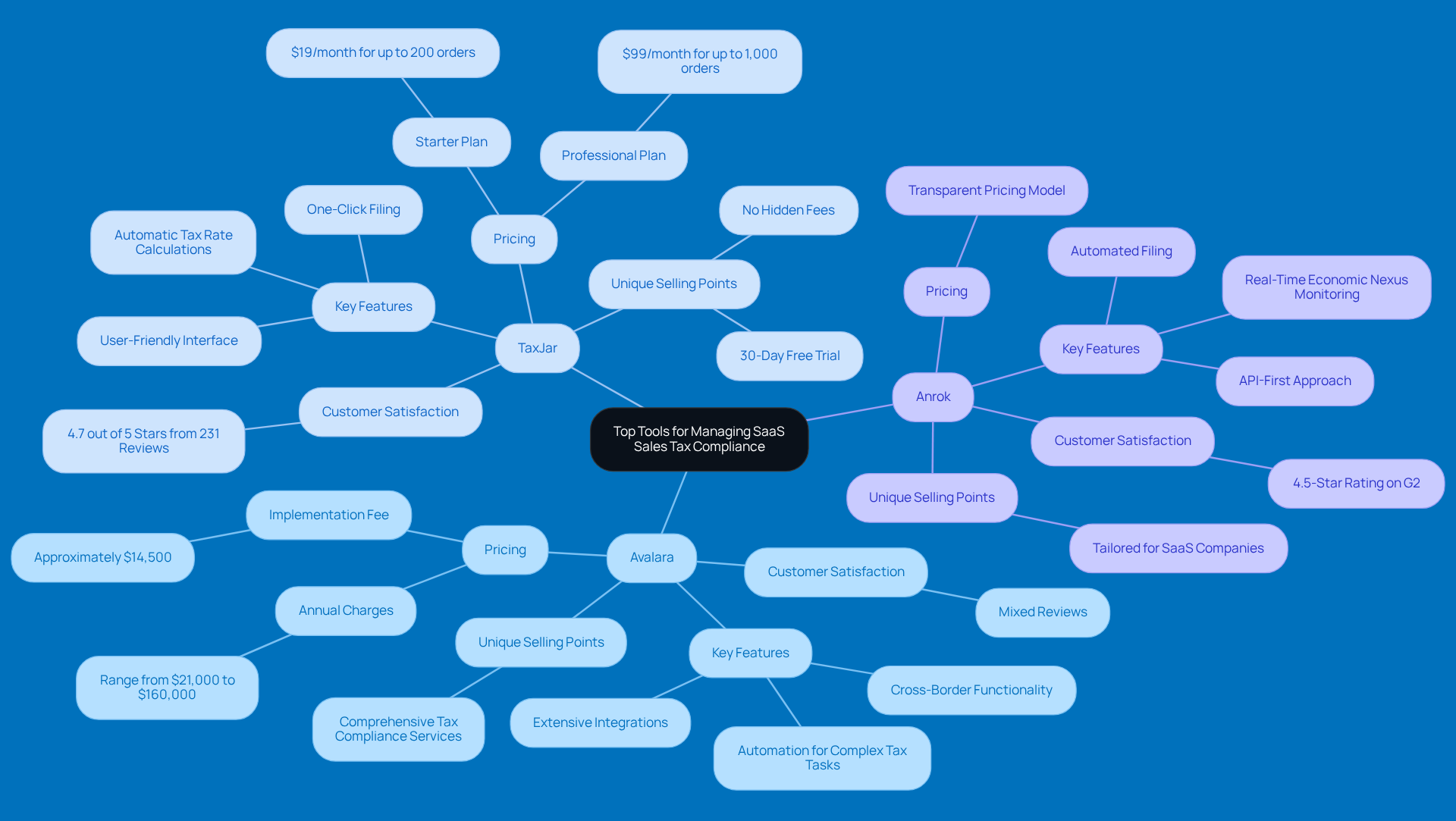

When it comes to managing SaaS taxability by state, a few tools really shine. Let’s take a look at some of the top contenders:

-

Avalara: This one’s a big name in tax automation! Avalara is known for its extensive solutions that integrate smoothly with over 600 applications. If your business has complex international tax needs, this could be your go-to. Just a heads up, their pricing can get pretty steep, potentially hitting up to $160,000 annually for high transaction volumes. But hey, their automation features are a lifesaver for navigating those tricky tax regulations across different jurisdictions. Just keep in mind that customer support reviews are a mixed bag, so it’s worth considering before you dive in.

-

TaxJar: If you’re looking for something user-friendly, TaxJar might be right up your alley. It simplifies tracking sales tax obligations and filing returns, which is a huge plus! Plus, their pricing is straightforward-no hidden fees here-making it a great fit for small to medium-sized businesses. With a solid customer satisfaction rate of 4.7 out of 5 stars from 231 reviews, folks love their effective support and easy monthly plans. And guess what? They even offer a 30-day free trial, so you can test the waters without any upfront costs. Talk about a low-risk option!

-

Anrok: Now, if you’re in the SaaS game, Anrok is tailored just for you. They focus on sales tax compliance specifically for software-as-a-service companies, tackling the unique challenges of SaaS taxability by state head-on. Their API-first approach means you can integrate it with your own billing systems, making tax management a breeze. Plus, with real-time economic nexus monitoring and automated filing, it’s a fantastic choice for modern software companies.

These tools not only make regulatory processes easier but also help reduce the risk of mistakes. This way, SaaS companies can focus on what they do best-growing their business-while staying compliant with SaaS taxability by state regulations. So, which one do you think would work best for you?

International SaaS Sales Tax Considerations

If you're running a SaaS company that operates internationally, getting a grip on VAT and GST obligations is super important. Did you know that many countries slap taxes on digital services? And the rules can really differ from one place to another! Take the EU, for example; they have some pretty strict VAT regulations that require businesses to charge VAT based on where the customer is located.

Now, here's the kicker: if you don’t comply with these international tax laws, you could be looking at some hefty fines and a hit to your reputation. Nobody wants that, right? So, it’s crucial to stay informed and ensure you're following the rules. Have you thought about how these regulations might affect your business? It’s worth considering!

The Future of SaaS Sales Tax Legislation

As digital services continue to grow, it appears that more states are preparing to propose laws that address SaaS taxability by state. You might have noticed the trends hinting at a broader tax base and tighter enforcement of the rules we already have. So, what does this mean for Software as a Service firms? Well, it’s time to stay on your toes!

Being alert and flexible is key here. You want to make sure your compliance strategies are robust enough to handle these shifting regulations. Think of it like keeping your car in good shape for those unexpected road trips - better safe than sorry, right?

So, how are you preparing for these changes? It’s a good idea to keep an eye on the evolving landscape and maybe even share your thoughts with others in the industry. After all, staying informed is half the battle!

Key Takeaways for SaaS Taxability Awareness

Navigating the complexities of SaaS taxability by state can feel a bit overwhelming, but with a strategic approach, you can effectively manage your tax obligations. Let’s break it down into some essential insights that can help you along the way:

-

Understand State-Specific Tax Obligations: Did you know that each state has its own unique tax regulations regarding SaaS? For example, the SaaS taxability by state varies, with some states treating SaaS as taxable tangible personal property, while others might exempt it as a service. Keeping up with these distinctions is crucial for staying compliant.

-

Proactively Establish Nexus: Nexus is basically the connection between your business and a taxing authority, and it can be created through various factors, like having remote employees. Understanding where your business activities create nexus is key to avoiding any unexpected tax liabilities.

-

Leverage Automation Tools: Have you thought about using automation software like TaxJar or Avalara? These tools can really streamline your tax compliance processes. They help track sales tax obligations across different jurisdictions, which can significantly reduce the risk of errors and non-compliance.

-

Stay Informed on Global Responsibilities: If your software service is going global, it’s important to be aware of your international tax duties, like VAT/GST. For instance, the EU requires VAT collection based on the buyer's location, which could affect your pricing strategies.

-

Monitor Legislative Changes: Tax laws are always changing, right? Staying informed about these changes allows you to adjust your compliance strategies proactively, ensuring your business stays within regulations and avoids any penalties.

By focusing on these areas, SaaS companies can effectively manage their tax responsibilities and minimize risks while ensuring compliance with SaaS taxability by state to support sustainable growth. And hey, consulting with tax professionals can really enhance your compliance strategies, making sure you’re well-prepared for audits and regulatory reviews. So, what do you think? Are you ready to tackle your tax obligations head-on?

Conclusion

Navigating the complexities of SaaS taxability by state is crucial for small agencies aiming to thrive in a competitive landscape. It’s not just about compliance; understanding the nuances of tax regulations across different states is a strategic necessity that can really impact your bottom line. As the digital economy evolves, so do the tax obligations that come with it. Staying informed and proactive is a must for SaaS businesses.

Let’s dive into some key insights. First off, establishing nexus is super important. Then, there are automation tools for tax compliance that can really make your life easier. And don’t forget to keep an eye on legislative changes that could affect your tax obligations. Each state has its own unique tax rules, and non-compliance can lead to hefty penalties. By preparing yourself, you can meet those obligations head-on. Tools like Avalara and TaxJar can help streamline compliance processes, letting you focus on growth instead of getting bogged down by regulatory challenges.

Ultimately, the future of SaaS tax compliance is all about adaptability and vigilance. As tax laws keep changing, small agencies need to prioritize staying informed and developing solid compliance strategies. Engaging with tax professionals and using automation can really boost your compliance efforts. This way, you’ll stay on the right side of the law while seizing growth opportunities. Embracing these practices not only helps mitigate risks but also positions your SaaS company for long-term success in an increasingly complex tax landscape. So, what are you waiting for? Let’s get started on making tax compliance a breeze!

Frequently Asked Questions

What does Steinke and Company specialize in?

Steinke and Company specializes in helping software-as-a-service (SaaS) businesses, particularly in rural America, navigate tax compliance and reduce tax liabilities.

Why is understanding SaaS taxability by state important?

Understanding SaaS taxability by state is crucial because many states have different regulations regarding sales tax for software services, which can lead to compliance challenges and potential penalties for businesses that fail to comply.

What are the financial consequences of not keeping up with tax compliance?

Not keeping up with tax compliance can lead to significant financial pitfalls, including penalties that can average around 4.3% of income for businesses that fall out of compliance.

How many states tax SaaS as of 2025, and can you give an example of the differences?

As of 2025, 25 states tax SaaS, with significant differences in tax treatment. For example, New York treats SaaS as a taxable service, while Washington considers it tangible personal property.

What are some recent changes in tax regulations affecting SaaS businesses?

Recent changes include Maryland introducing a 3% sales tax on IT and digital services starting July 1, 2025, and Washington repealing the 'human effort' exclusion, making certain data processing services taxable beginning October 1, 2025.

Why is it especially challenging for rural SaaS firms regarding tax compliance?

Rural SaaS firms face unique challenges due to limited resources and the need to understand local sales tax regulations, which can vary widely and are critical to avoiding costly mistakes.

What should SaaS companies do to manage their tax obligations effectively?

SaaS companies should regularly review their tax policies, stay informed about changing regulations, and consider investing in tax compliance tools to reduce errors and ensure adherence to state laws.