Introduction

If you're a rental property owner, understanding the ins and outs of the Qualified Business Income (QBI) deduction can really give you an edge when it comes to your taxes. In this article, we’re diving into ten key insights that shine a light on the benefits, eligibility criteria, and some smart strategies for making the most of the QBI deduction. As tax laws change, you might be wondering: how can you ensure you’re maximizing your savings while keeping up with all the compliance details? Let’s explore these insights together and see what opportunities might be waiting to boost your financial game!

Steinke and Company: Your Partner in Understanding the QBI Deduction

At Steinke and Company, we’re all about helping small and micro enterprises, especially in rural America, tackle the tricky world of tax compliance. We’ve got a special focus on the QBI deduction rental property benefit, and our dedicated team is here to craft personalized strategies that help landlords make the most of their tax perks while staying on the right side of the latest regulations.

So, what’s new with the QBI allowance for 2026? Well, the phase-out ranges have widened! Now, they’re set at $200,000 to $275,000 for single filers and $400,000 to $550,000 for those married filing jointly. Plus, there’s a new minimum benefit of $400 for anyone with at least $1,000 in QBI. This is fantastic news for smaller businesses! For instance, property owners can now confidently claim up to 20% of their eligible business income thanks to the QBI deduction rental property, leading to some serious tax savings. Just imagine - if a business owner has $200,000 in QBI, they could see a whopping $40,000 reduction in taxable income. That’s a game changer for financial health!

To really make the most of the QBI deduction rental property and avoid those pesky underpayment penalties, we recommend keeping your records organized for at least three years. It’s also crucial to ensure that your leasing activities qualify as a trade or business under IRS guidelines to benefit from the QBI deduction rental property. This means logging at least 250 hours of qualifying rental services each year, which is totally doable with some proactive management and thorough documentation. And don’t forget about estimated tax payments and safe harbor regulations - they can really help you avoid underpayment penalties, making it easier for landholders to manage their tax responsibilities. Our approach combines precise accounting with strategic coaching, making us the perfect partner for anyone looking to optimize their financial outcomes. As tax experts often say, the QBI benefit is one of the best tax incentives out there for small business operators, and with our expertise, you can navigate its complexities with confidence!

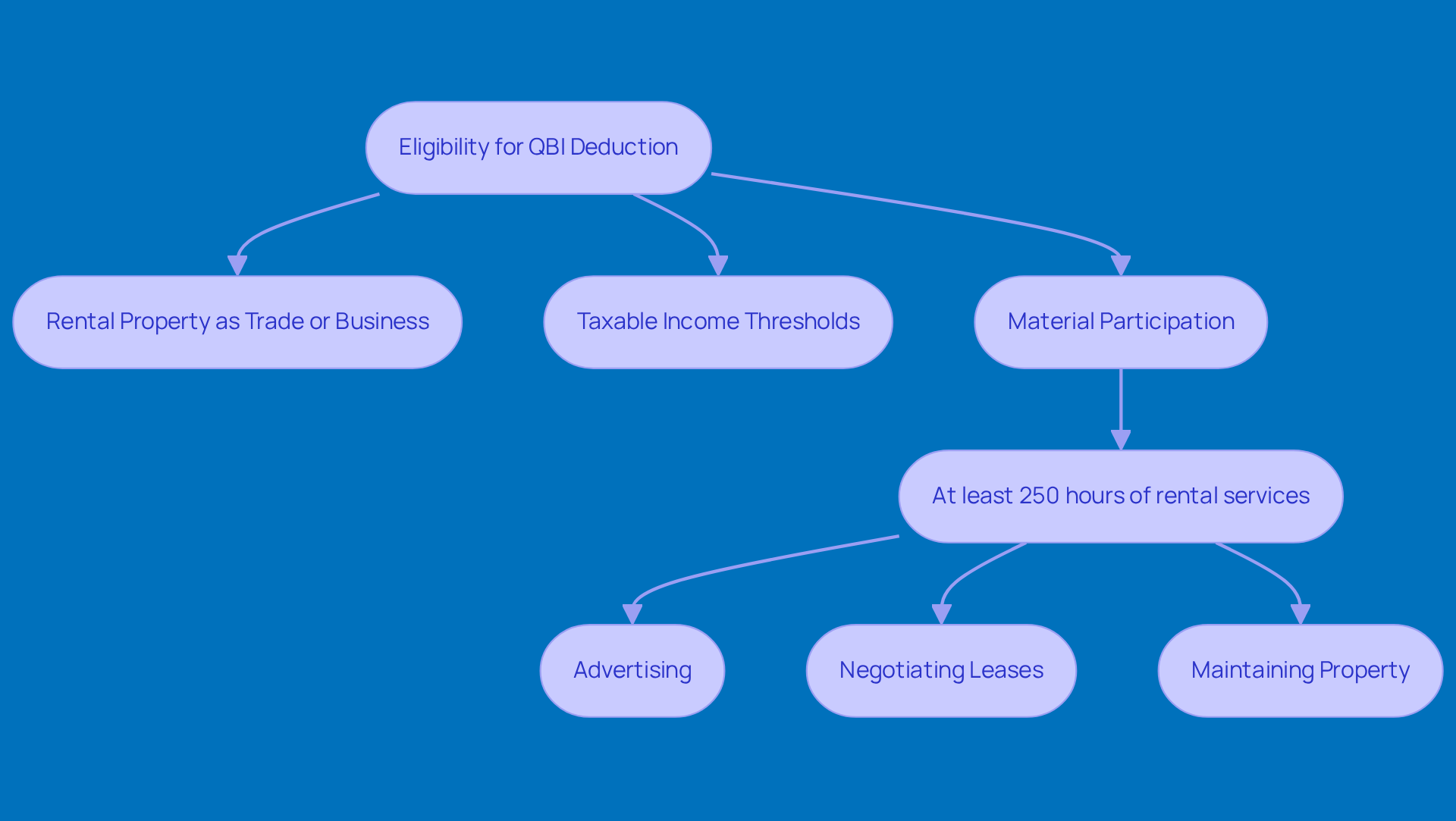

Eligibility Criteria for the QBI Deduction: Who Qualifies?

If you're a landlord looking to take advantage of the QBI deduction for rental property, there are some IRS guidelines you need to keep in mind. First off, your rental property must qualify as part of a trade or business to be eligible for the QBI deduction. Plus, your taxable income needs to be below certain thresholds - think $50,000 to $75,000 for single filers and $100,000 to $150,000 for married couples filing jointly. And yes, those numbers get adjusted for inflation each year, so keep an eye on that!

Now, here’s where it gets a bit more hands-on: you’ll need to report your rental activity on Schedule E. But that’s not all! You also have to materially participate in the rental operations. What does that mean? Well, typically, you’re looking at at least 250 hours of rental services each year. This could include everything from:

- Advertising your property

- Negotiating leases

- Maintaining the real estate itself

To make sure you’re eligible for that sweet tax benefit, it’s super important to keep detailed records. Jot down the hours you work, the services you provide, and the dates you do it all. Trust me, staying organized will pay off!

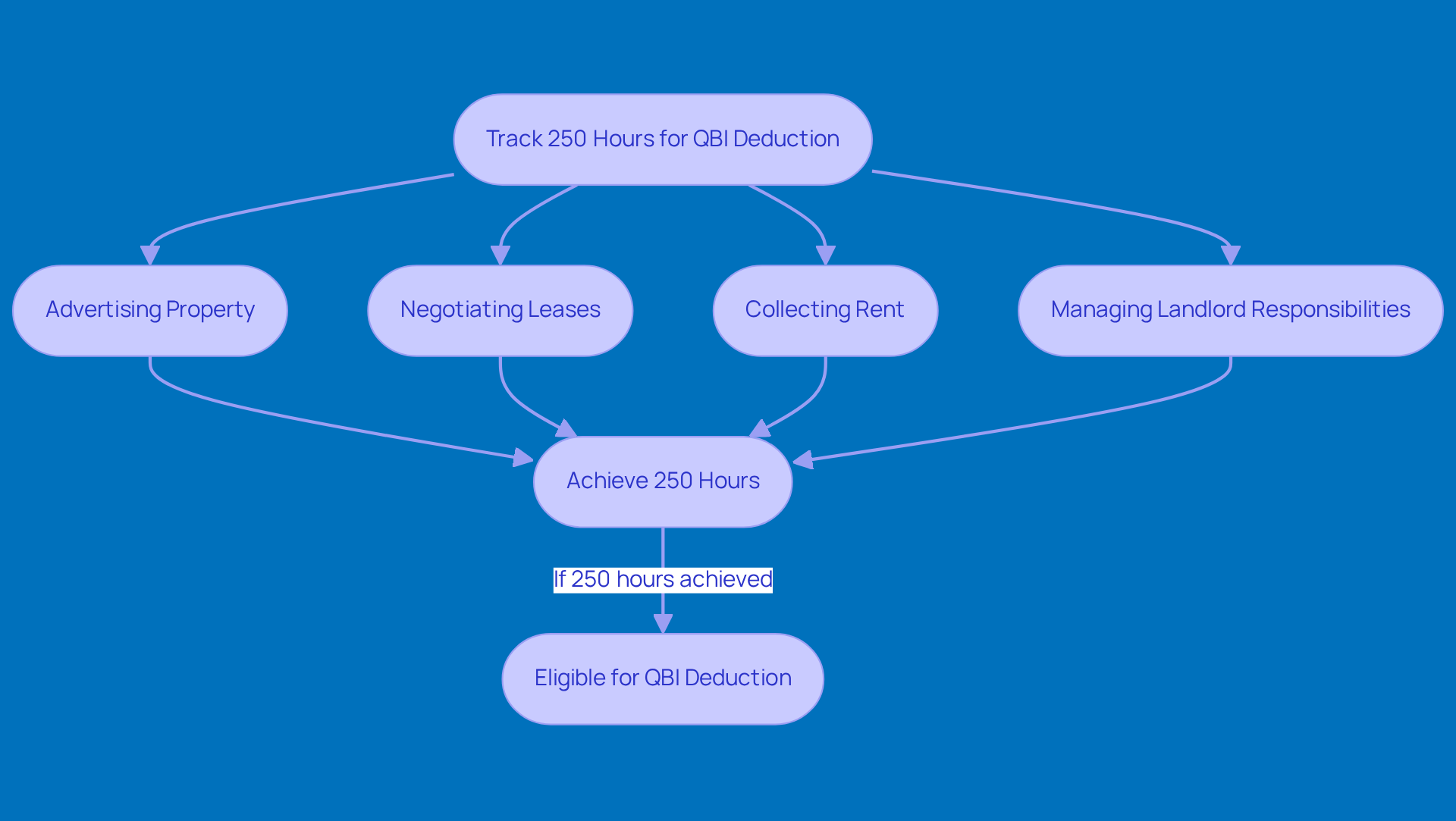

Understanding the 250-Hour Rule for Rental Properties

If you're a rental owner looking to take advantage of the qbi deduction rental property, here's the scoop: you need to clock in at least 250 hours of rental services each year. What does that mean? Well, it covers a bunch of activities like:

- Advertising your property

- Negotiating leases

- Collecting rent

- Managing everything that comes with being a landlord

Now, keeping track of those hours is super important. Why? Because it backs up your claims for the deduction. Tax advisors often stress that having solid documentation not only proves you're eligible but also boosts the credibility of your rental business.

So, how can you keep track? Simple! You can jot down your hours by logging tasks you’ve completed, like chatting with tenants or handling maintenance issues.

But here’s the kicker: if you don’t hit that 250-hour mark, you might miss out on the qbi deduction rental property benefit altogether. That’s why being diligent about record-keeping is key to maximizing your tax advantages. So, grab a notebook or an app, and start tracking those hours - it could really pay off!

Safe Harbor Provisions: Protecting Your Rental Real Estate Income

Safe harbor provisions are a real game-changer for landlords looking to snag the QBI benefit without having to meet that pesky 250-hour requirement. As long as they check off certain boxes, they can qualify. If the leasing activity counts as a trade or business and the landlord keeps separate books and records, they might just be in the clear for that deduction. This provision not only gives peace of mind but also makes compliance a whole lot easier for many landlords.

Take Sarah, for example. She’s a dedicated single-family landlord who cleverly combines her two properties into one real estate venture. This smart move simplifies the tax compliance maze, letting her focus on boosting her investment returns while enjoying the tax perks available. Did you know that around 30% of leaseholders are already taking advantage of these safe harbor provisions? They’re recognizing the potential for greater profits through the QBI allowance.

As Candice Reeves, a Content Marketing Manager, puts it, 'This 'safe harbor' provides a definitive checklist; if you meet the criteria, your leasing enterprise is automatically regarded as a trade or business for the QBI deduction rental property purposes.' So, if you’re a landlord, why not see if you qualify? It could make a big difference in your bottom line!

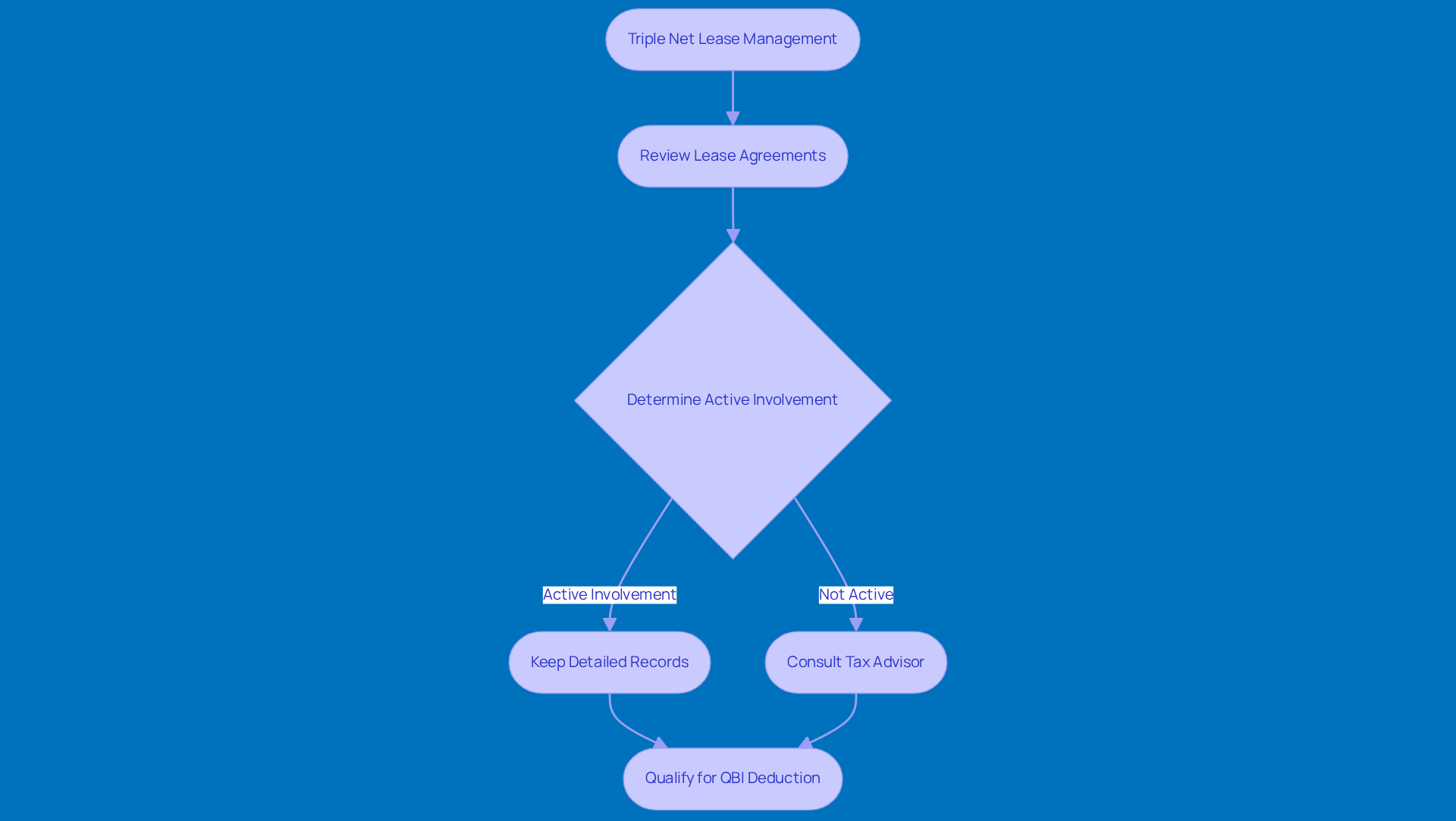

Triple Net Leases and Their Effect on QBI Eligibility

Triple net leases can be a bit of a puzzle, can't they? When tenants take on responsibilities for taxes, insurance, and maintenance, it can complicate matters significantly regarding the QBI deduction rental property eligibility. Usually, earnings from these leases are classified as passive income, which often results in missing the QBI deduction rental property unless the leasing activity is recognized as a trade or business. To get in on that benefit, owners need to show they’re actively involved in managing their assets. This could mean keeping separate books and records and putting in at least 250 hours of rental services each year.

Tax pros really stress the need to dig into those lease agreements. A well-negotiated net lease can bring some nice tax perks, but it takes careful planning to make sure all financial responsibilities fit into the tenant's business strategy. One expert even said, "Review your activities with your tax advisor before assuming that your enterprise with triple net leases wouldn’t qualify for Section 199A treatment." Wise advice, right?

Now, here’s something to keep in mind: the IRS has made it clear that just because you have assets under triple net leases doesn’t mean you automatically qualify for the QBI deduction rental property. Landlords need to actively manage their properties and maintain detailed records to substantiate their QBI deduction rental property claims. Consulting a tax advisor can really help navigate these tricky waters and make the most of potential benefits, especially with tax regulations changing all the time. Plus, it’s important to know that the QBI allowance limits vary based on your filing status. For example, a married couple with a QBI of $400,000 and taxable income of $300,000 might see their allowance capped at $60,000. Understanding these little details is key for landlords looking to effectively plan their tax strategies, particularly regarding the QBI deduction rental property.

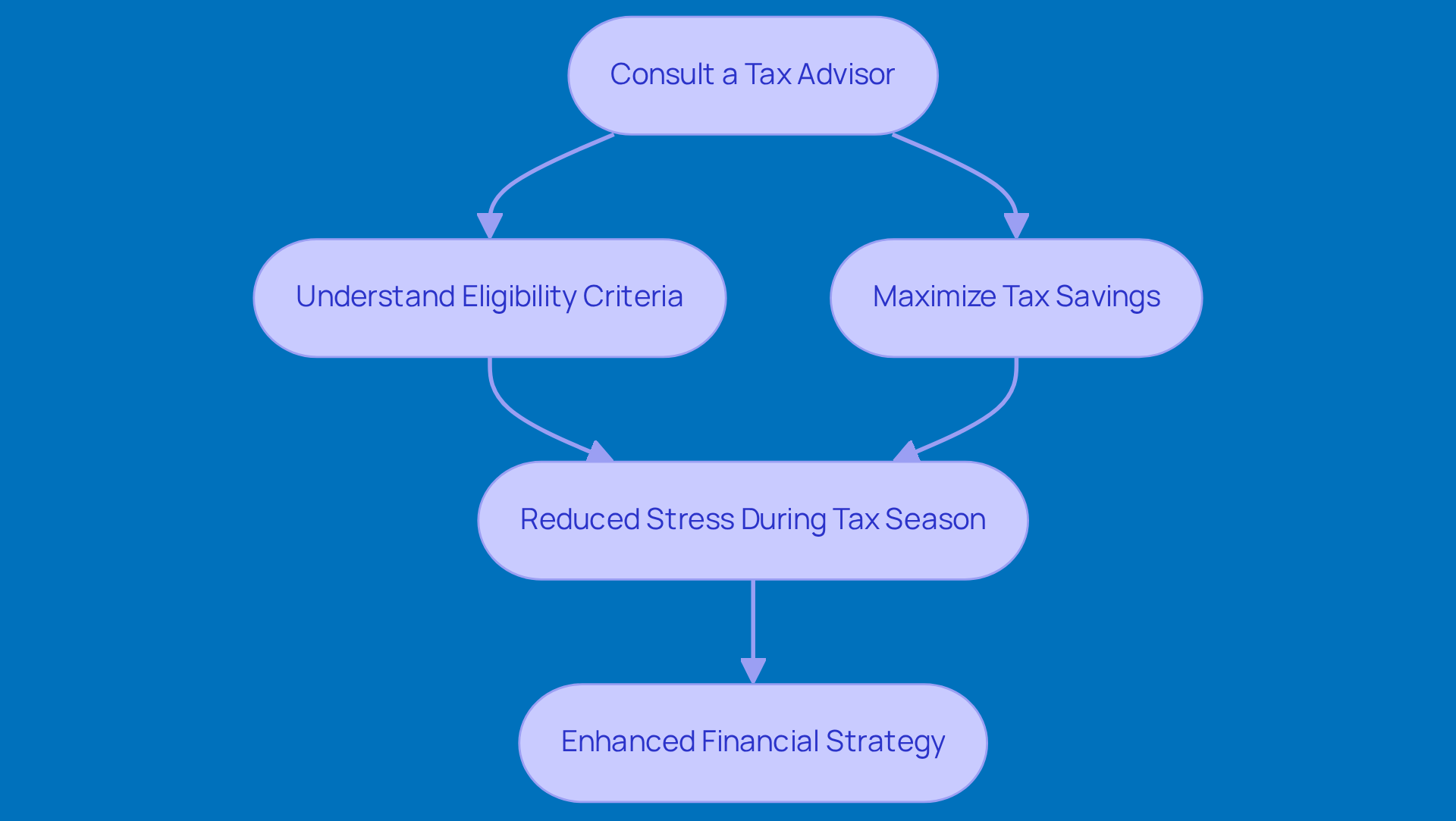

Consult a Tax Advisor: Navigating QBI Deduction Complexities

Navigating the ins and outs of the QBI deduction rental property can feel like a maze for rental asset holders, right? That’s why teaming up with a qualified tax advisor is a smart move. These pros don’t just break down complicated tax rules; they also make sure you meet all the eligibility criteria, helping you snag the maximum benefits possible.

For instance, many real estate owners who consult with tax experts often report significant tax savings - sometimes even tens of thousands of dollars each year! How great would that be? This proactive approach not only eases the stress of tax season but also boosts your confidence in staying compliant. It lets you focus on what really matters: your investments, not the tax headaches.

By tapping into the expertise of tax specialists, folks with rental properties can really maximize their QBI deduction rental property claims and enhance their overall financial strategy. So, why not consider reaching out to a tax advisor? It could be a game changer for your financial journey!

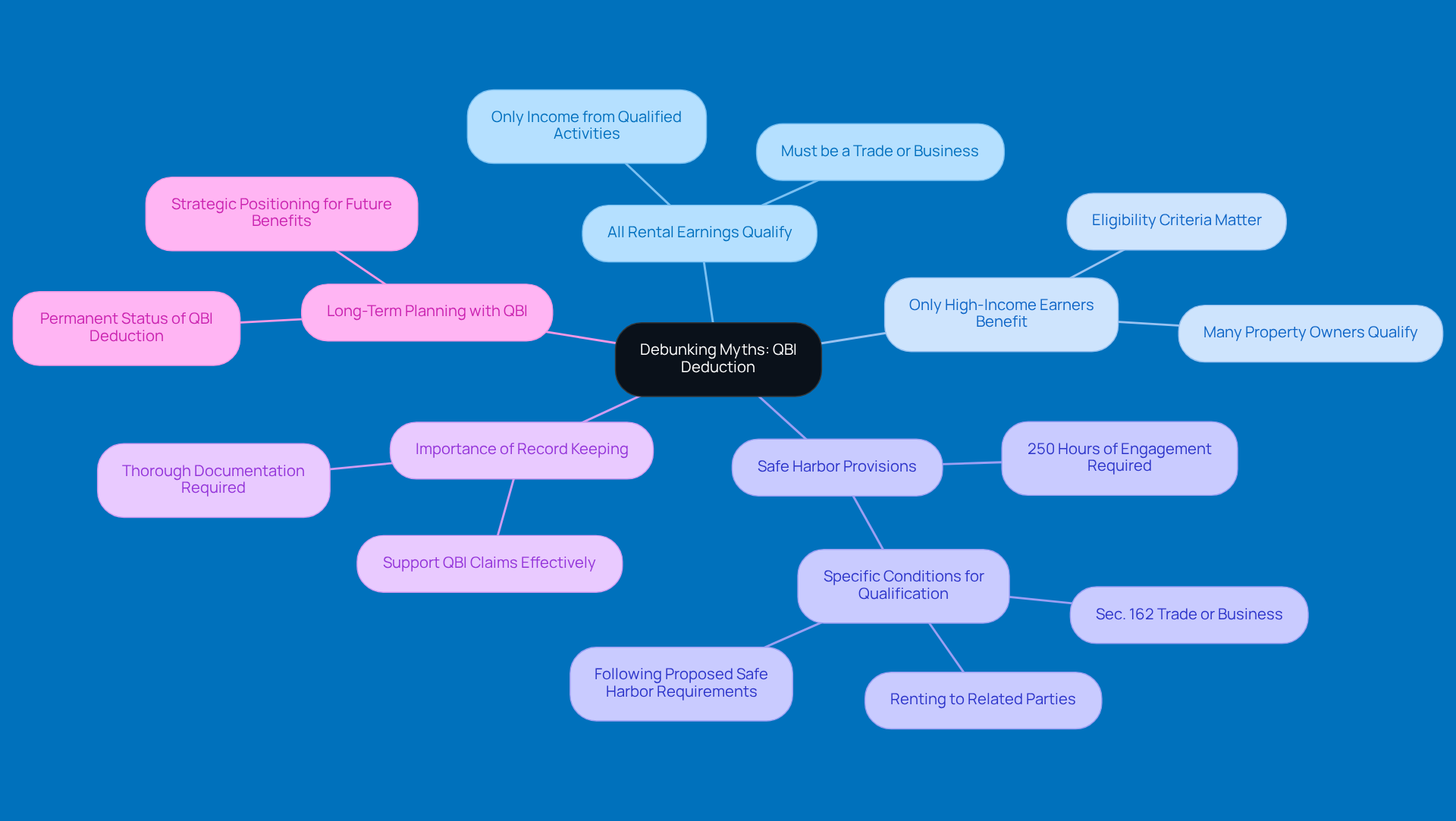

Debunking Myths: Common Misconceptions About the QBI Deduction

There are quite a few myths floating around about the QBI allowance that can really mislead owners of leased spaces. One common misconception is that all rental earnings automatically qualify for this allowance. Not quite! Only income from assets that are categorized as a trade or business is eligible. So, just leasing out a unit doesn’t mean you get to enjoy this tax benefit right away.

Another thing people often think is that the QBI allowance is only for high-income earners. But here’s the good news: many property owners can actually take advantage of the QBI deduction for rental property, regardless of their income level, as long as they meet the necessary eligibility criteria. Understanding these details is super important for maximizing your tax benefits and staying in line with IRS regulations.

For instance, if you want to qualify under the safe harbor provisions, your leasing activities need to involve a significant amount of engagement-specifically, at least 250 hours of leasing services each year. Plus, rental real estate activities can qualify as a trade or business for the QBI deduction for rental property purposes if they meet one of three conditions:

- They qualify as a Sec. 162 trade or business.

- You’re renting to specific related parties.

- You’re following the proposed safe harbor requirements related to the QBI deduction for rental property.

This really highlights the importance of keeping thorough records to back up your QBI claims and actively engaging in asset management to secure the QBI deduction for rental property benefit. And let’s not forget, the permanent status of the QBI allowance means you can plan your taxes with confidence for the long haul. So, it’s crucial for real estate holders to stay informed about these provisions!

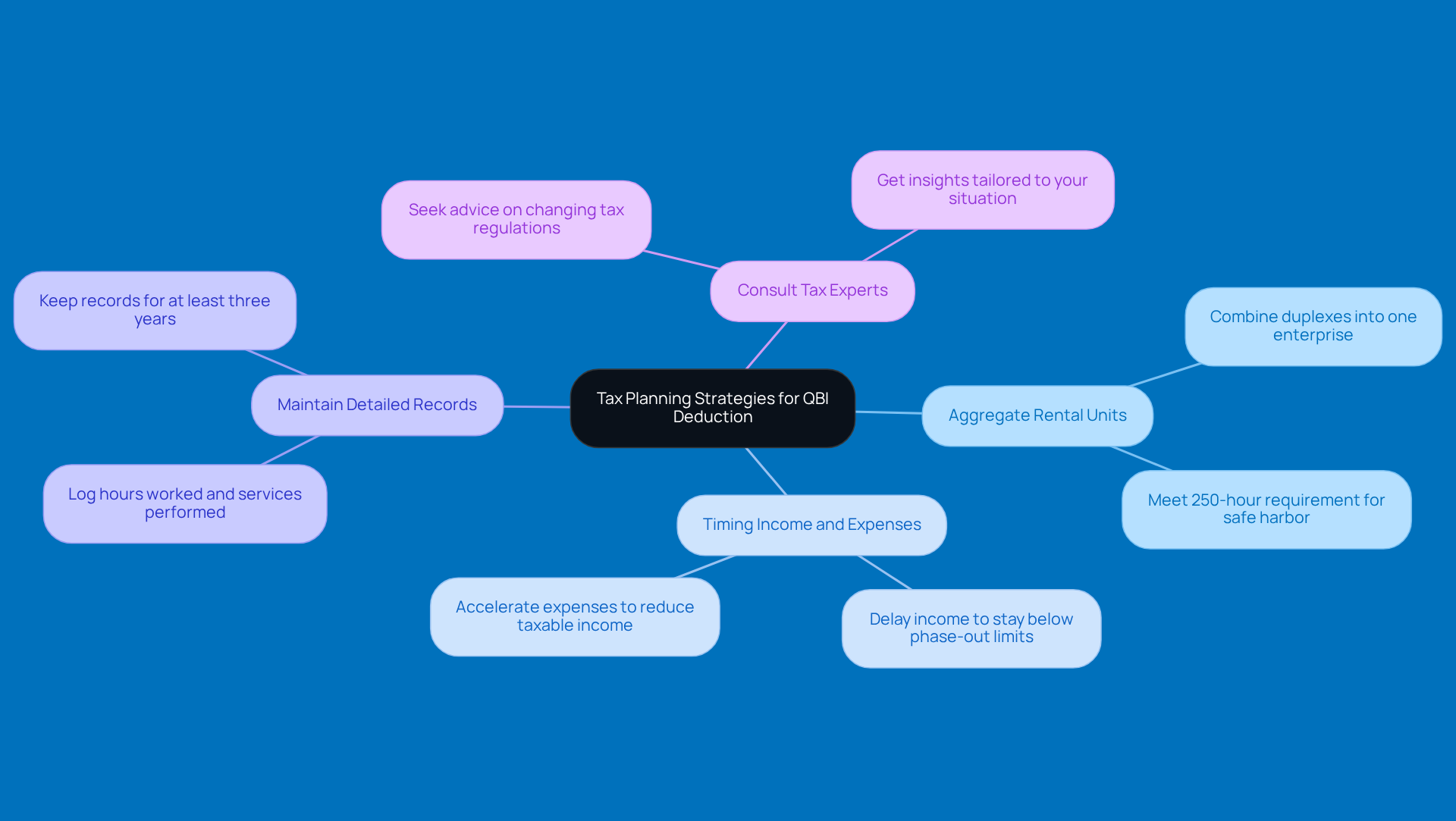

Tax Planning Strategies to Maximize Your QBI Deduction

If you're a real estate owner looking to make the most of your QBI deduction rental property, there are some smart tax planning strategies you might want to consider. One great approach is to aggregate your rental units. This can help you meet the 250-hour requirement needed for the safe harbor provision. For instance, if you manage three duplexes, you can combine them into one Rental Real Estate Enterprise. This not only simplifies compliance but also boosts your chances of qualifying for the QBI deduction rental property benefit.

Another key tactic is timing your income and expenses just right. By delaying income or speeding up your expenses, you can potentially keep your taxable earnings below those phase-out limits. Plus, keeping detailed records of all your leasing activities is a must. Make sure to jot down the hours you work, the dates, and what services you performed. These records are crucial for backing up your claims if you ever face an audit.

Don’t forget to chat regularly with tax experts! They can provide valuable insights into the ever-changing tax landscape and your unique situation, helping you stay compliant while maximizing your deductions. Interestingly, statistics show that many property owners who use aggregation strategies see better eligibility for the QBI deduction rental property. This really highlights how important proactive tax planning is in this area. So, why not take a moment to reflect on your own tax strategies? You might just find a way to optimize your benefits!

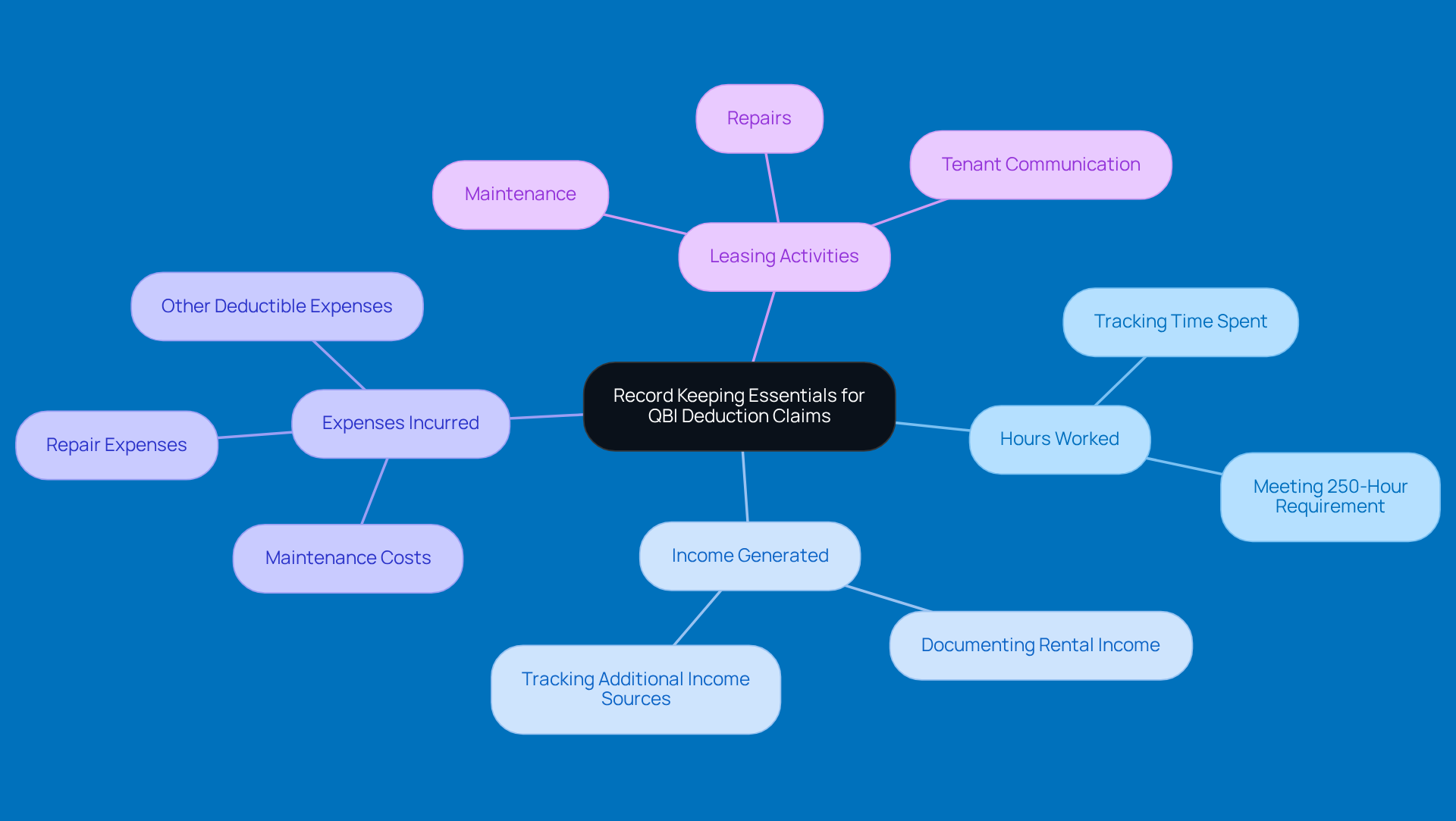

Record Keeping Essentials for QBI Deduction Claims

Keeping precise and thorough records is crucial for landlords seeking to claim the QBI deduction rental property. You’ll want to track your hours worked, income generated, and expenses incurred. It’s a good idea to carefully note all your leasing activities, like maintenance, repairs, and any chats with your tenants.

Did you know that many landlords struggle with keeping up with their records? This can really hold them back from snagging those tax advantages. But don’t worry! Using accounting software can make this whole process a breeze, ensuring you have all the necessary documents ready when tax time rolls around.

Tax consultants often say that good record-keeping not only supports your claims for the QBI deduction rental property but also helps you manage your finances better overall. This way, you can really maximize your tax savings! For instance, if you keep a close eye on your activities, you can easily show that you meet the 250-hour requirement, which is key to qualifying for the QBI deduction rental property.

So, by prioritizing accurate documentation, you can tackle the complexities of tax regulations and grab the financial perks you deserve!

Key Takeaways: Essential Facts About the QBI Deduction

Hey there! Have you heard about the Qualified Business Income (QBI) allowance? It’s a fantastic opportunity for qualifying real estate investors to take advantage of the QBI deduction rental property, allowing them to subtract up to 20% of their qualified business income, which can really boost your tax efficiency. However, to qualify for the QBI deduction rental property, you need to meet specific qualification standards, including income limits and being actively involved in your rental activities.

One key thing to keep in mind is the 250-hour rule. This means you need to show that you’re significantly engaged in managing your properties to claim the benefit. Don’t worry, though - there are safe harbor provisions that can make compliance a bit easier for you.

Starting in 2026, the phase-in ranges for the QBI tax break will open up even more chances for landlords to qualify, which could really enhance your after-tax cash flow. Plus, reorganizing your leasing activities can help you meet those safe harbor criteria, making it easier to optimize your tax strategies.

It’s a smart move to chat with a tax advisor to help you navigate the ins and outs of the QBI benefit. They can help you optimize your tax strategies effectively. And don’t forget about keeping accurate records! This is super important as it backs up your claims and ensures you’re in line with IRS regulations. By getting a handle on these essential facts, you can leverage the QBI deduction to maximize your tax savings and improve your overall financial health. So, what are you waiting for? Let’s make the most of those tax benefits!

Conclusion

Understanding the Qualified Business Income (QBI) deduction is super important for rental property owners who want to make the most of their tax strategies. This deduction can really help lower taxable income, giving landlords a nice financial boost if they meet the eligibility criteria. By getting involved in their rental activities and keeping their records organized, property owners can fully tap into this tax incentive, making it a key tool for improving their financial health.

So, what’s the deal with the 250-hour rule? Well, it means landlords need to show they’re significantly involved in their rental operations to qualify for the deduction. Plus, there are safe harbor provisions that offer a simpler way to get eligible, letting landlords enjoy the QBI deduction without those strict hour requirements. And hey, chatting with a tax advisor can really help clear up any confusion, making sure property owners navigate the rules smoothly and maximize their savings.

In wrapping this up, leveraging the QBI deduction isn’t just about knowing tax laws; it’s about planning ahead and getting involved in rental activities. By staying in the loop about eligibility requirements, keeping detailed records, and seeking expert advice, rental property owners can snag some serious tax savings. Embracing these strategies not only boosts financial outcomes but also helps build confidence in managing rental investments. So, why not take a step today to explore how the QBI deduction can work for you?

Frequently Asked Questions

What is the QBI deduction and how does it benefit landlords?

The QBI (Qualified Business Income) deduction allows landlords to claim up to 20% of their eligible business income, leading to significant tax savings. For example, a business owner with $200,000 in QBI could see a $40,000 reduction in taxable income.

What are the new phase-out ranges for the QBI deduction in 2026?

The phase-out ranges for the QBI deduction in 2026 are set at $200,000 to $275,000 for single filers and $400,000 to $550,000 for those married filing jointly. Additionally, there is a new minimum benefit of $400 for anyone with at least $1,000 in QBI.

What are the eligibility criteria for landlords to qualify for the QBI deduction?

To qualify for the QBI deduction, landlords must have their rental property classified as part of a trade or business, and their taxable income must be below certain thresholds: $50,000 to $75,000 for single filers and $100,000 to $150,000 for married couples filing jointly.

What is the 250-hour rule for rental properties?

The 250-hour rule requires landlords to perform at least 250 hours of rental services each year to qualify for the QBI deduction. Activities that count towards this include advertising the property, negotiating leases, collecting rent, and managing the property.

How should landlords keep track of their rental service hours?

Landlords should keep detailed records of the hours worked on rental services, including the tasks completed and the dates. This documentation is crucial to support their claims for the QBI deduction and enhance the credibility of their rental business.

What are the implications of not meeting the 250-hour requirement?

If landlords do not meet the 250-hour requirement for rental services, they may be ineligible for the QBI deduction, which could result in missing out on potential tax benefits.

How can landlords avoid underpayment penalties related to the QBI deduction?

Landlords can avoid underpayment penalties by keeping organized records for at least three years, ensuring their leasing activities qualify as a trade or business, and making estimated tax payments in accordance with safe harbor regulations.