Introduction

Navigating the world of U.S. tax obligations can feel pretty overwhelming for green card holders. Many think that just because they have residency status, they’re off the hook when it comes to taxes. But understanding the tax landscape is super important - not just for your wallet, but also for your immigration status and any future residency applications you might have in mind.

So, what happens if permanent residents ignore their tax responsibilities? And how can they tackle these complexities to steer clear of hefty penalties? In this article, we’ll dive into the essential tax responsibilities every green card holder should know to stay compliant and protect their residency. Let’s get started!

Steinke and Company: Expert Guidance on Tax Responsibilities for Green Card Holders

At Steinke and Company, we’re all about helping permanent residents understand whether do people with green cards pay taxes and tackle their tax obligations with ease. Our dedicated team understands the unique hurdles that rural business owners face, and we’re here to provide tailored advice that keeps you compliant with U.S. tax laws while minimizing those pesky liabilities. Let’s be real - navigating tax responsibilities can be tricky, and noncompliance can lead to serious consequences, like losing your legal status or running into issues with naturalization.

Did you know that, as part of filing U.S. tax returns every year, do people with green cards pay taxes regardless of where their income comes from? It’s true! For instance, if you’re an individual permanent resident under 65, you must consider do people with green cards pay taxes if your income exceeds $12,550. And if you’re married and filing jointly, that threshold jumps to $25,100. Plus, if you have overseas financial accounts totaling more than $10,000 at any point during the year, you’ll need to submit the Report of Foreign Bank and Financial Accounts (FBAR). It’s a lot to keep track of, but we’re here to help!

Our expert insights also highlight some great benefits, like the Foreign Tax Credit and the Foreign Earned Income Exclusion. These can really help cut down your U.S. tax liabilities if you’re living abroad. By teaming up with tax experts, permanent residents can confidently navigate the complexities of do people with green cards pay taxes, ensuring compliance and boosting their financial outcomes.

Now, let’s talk about underpayment penalties - nobody wants those! The IRS can hit you with penalties if you don’t pay enough of your tax liability through withholding or estimated payments throughout the year. To dodge these penalties, consider strategies like safe harbor payments, which ensure you prepay a minimum amount of tax, or the de minimis exception, which lets those with a tax liability under $1,000 off the hook. By staying proactive with your tax responsibilities and using these strategies, you can avoid the financial stress of underpayment penalties.

At Steinke and Company, we’re committed to empowering permanent residents with the knowledge and strategies they need to understand how do people with green cards pay taxes effectively. So, let’s tackle this together!

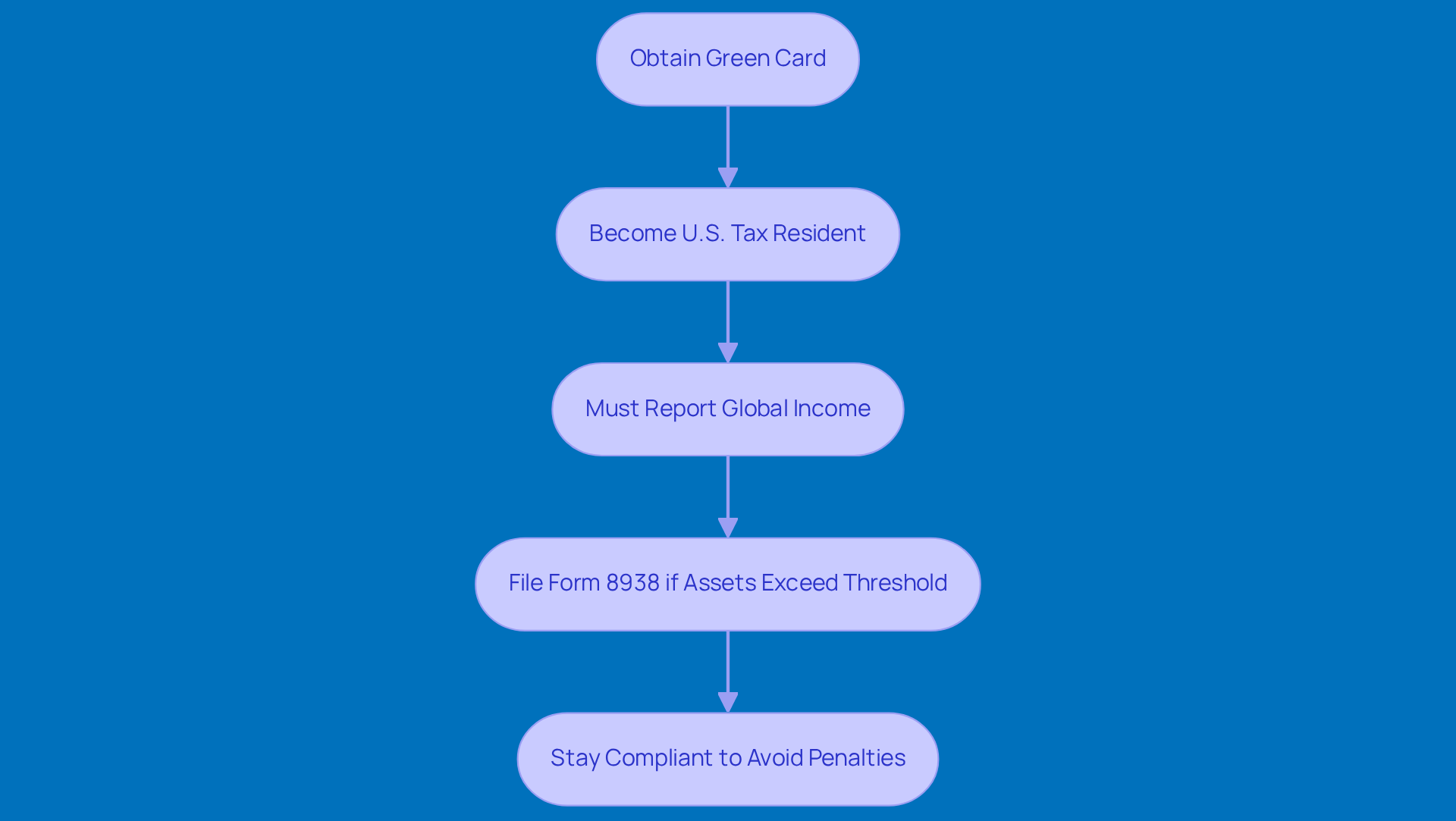

Tax Residency Status: Understanding When Green Card Holders Become U.S. Tax Residents

As of 2025, there are over 14 million permanent residents in the United States. Did you know that once you get your residency permit, it raises the question of do people with green cards pay taxes as U.S. tax residents? This status kicks in the moment your permanent resident document is issued and sticks around as long as you keep your residency.

Tax consultants really emphasize how important this classification is. A common question is, do people with green cards pay taxes, as permanent residents must follow U.S. tax regulations and declare their global income. For instance, if you’ve been living in the U.S. for a while, you might not realize that your earnings from overseas investments also need to be reported to the IRS.

Let’s look at a real-world example: one person was shocked after getting their residency permit to find out they had to submit Form 8938 because their overseas financial assets exceeded the reporting threshold. It’s a wake-up call! Understanding these obligations is super important for staying compliant and avoiding any nasty penalties. The IRS wants thorough documentation of all income sources, so it’s best to be on top of things.

So, if you’re a permanent resident, it’s essential to understand what it means when people ask, do people with green cards pay taxes? It’s all about making sure you meet those legal requirements and keep everything running smoothly!

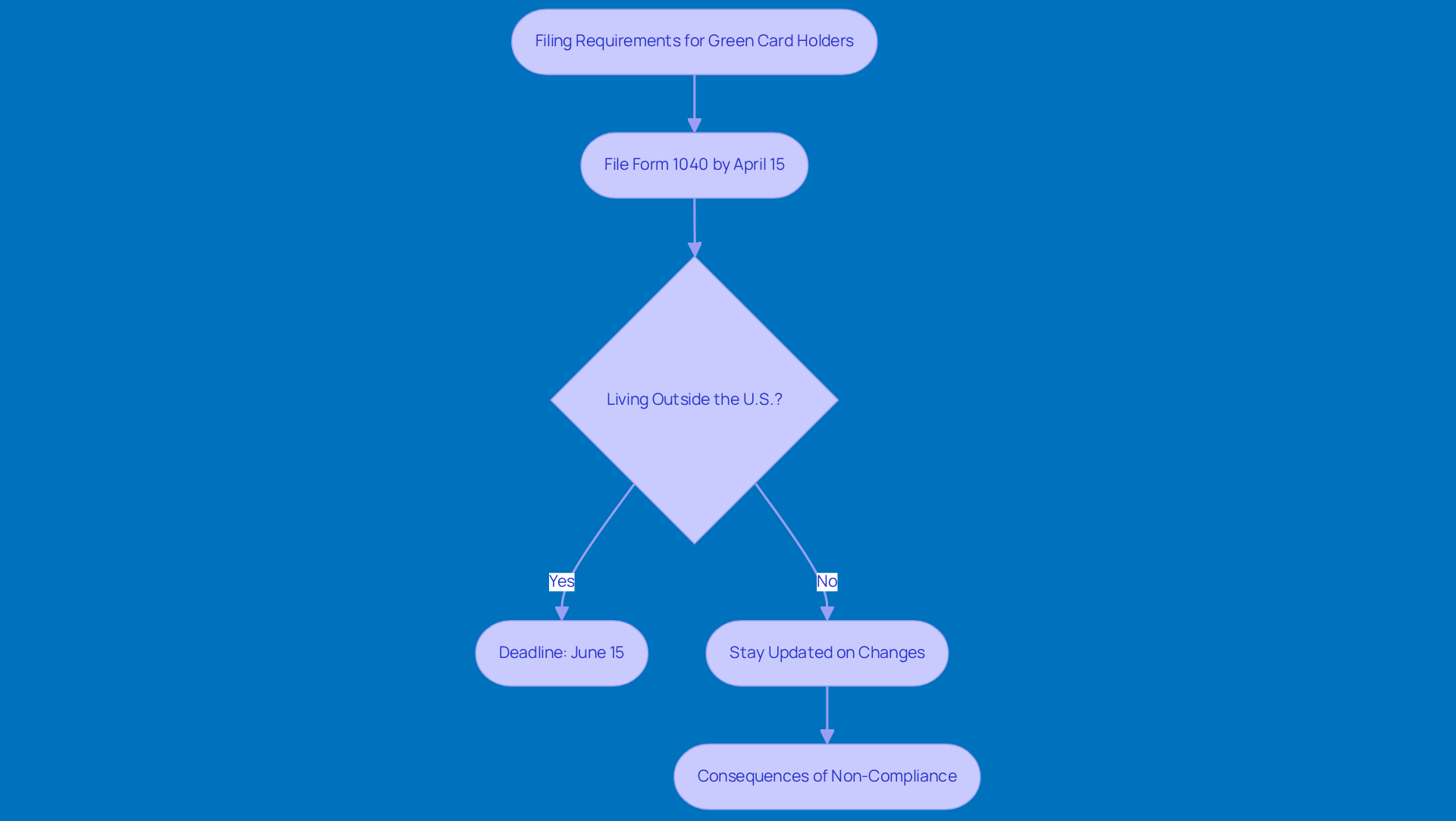

Filing Requirements: Essential Forms and Deadlines for Green Card Holders

If you’ve got a resident visa, it raises the question of do people with green cards pay taxes by needing to file Form 1040, the U.S. Individual Income Tax Return, by April 15 each year. But if you’re living outside the U.S., don’t worry! You get an automatic two-month extension, which means your deadline is pushed to June 15. It’s super important to stay updated on any changes in filing requirements to avoid any nasty penalties.

You know, statistics show that compliance rates among permanent residents raise the question of do people with green cards pay taxes, and these rates can vary quite a bit. Many folks aren’t even aware of their responsibilities, such as do people with green cards pay taxes, which can lead to some serious issues with their immigration status. Take, for instance, a resident with permanent status in Germany who managed to submit their taxes on time. This really highlights how crucial it is to understand these deadlines.

Tax professionals often stress that if you fail to file correctly or on time, it could jeopardize your residency status, which raises the question: do people with green cards pay taxes? So, it’s essential to be vigilant about meeting these obligations. As tax regulations evolve, it’s a good idea for permanent residents to stay proactive in handling their tax responsibilities, including understanding how do people with green cards pay taxes. Remember, staying informed is key!

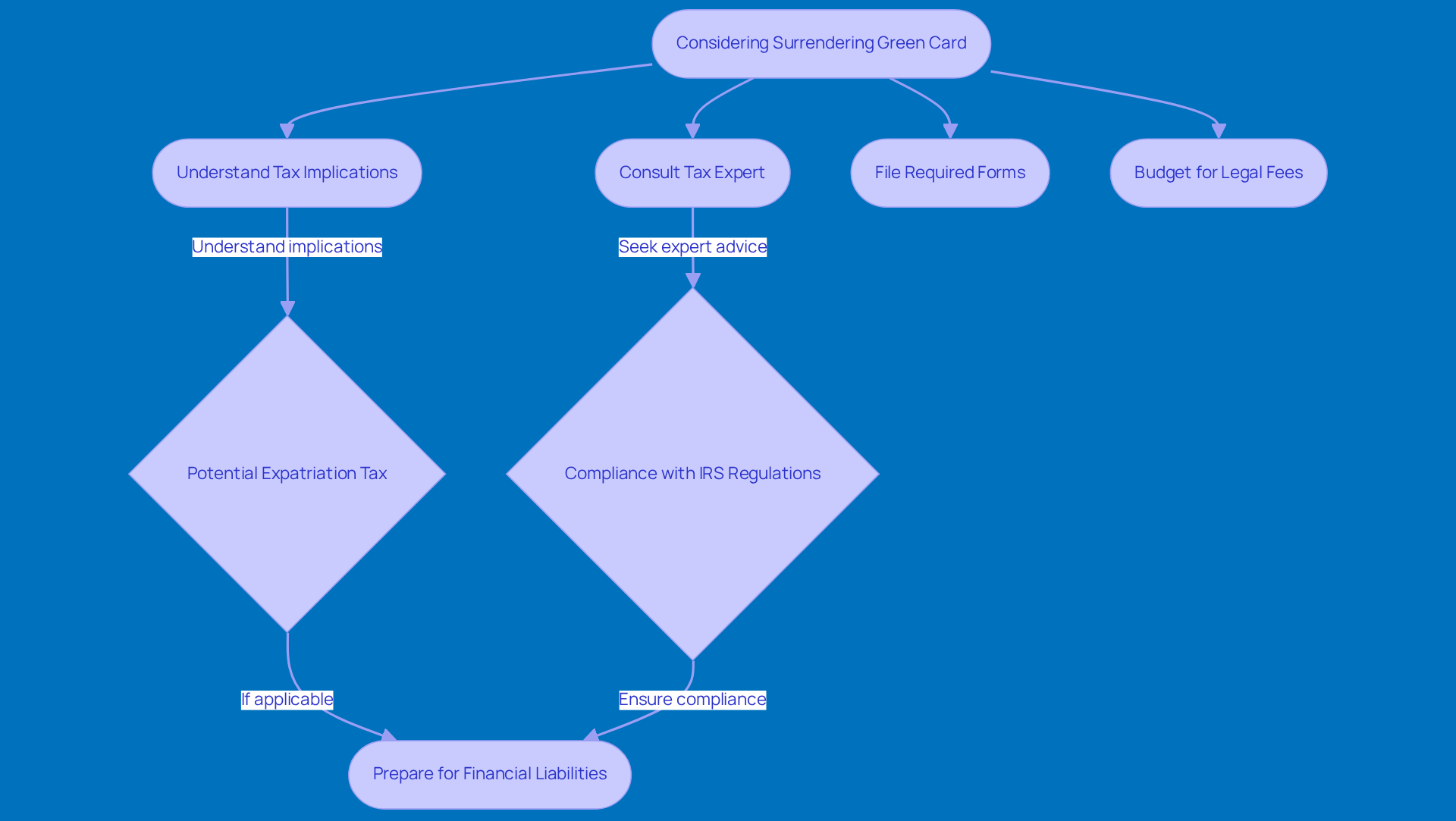

Surrendering a Green Card: Tax Implications and Residency Considerations

Giving up a permanent resident document can really shake things up, especially regarding whether do people with green cards pay taxes. If you’ve held onto your green card for at least eight out of the last fifteen years, you might run into the expatriation tax. This tax hits you on unrealized gains from your global assets, and it’s calculated as if you sold everything at fair market value the day before you expatriate. Yikes! That could mean some hefty financial liabilities. For example, if you’re a covered expatriate, you could face capital gains tax on property you received as a gift - even if you haven’t sold it yet. Talk about complicated!

Now, looking ahead to 2025, the exit tax for permanent residents is still a big deal. More and more folks are finding themselves in this situation. Recent stats show that expatriation is on the rise, as many permanent residents give up their status each year to avoid the tricky tax responsibilities associated with whether or not do people with green cards pay taxes. Just to give you an idea, the number of people expatriating jumped from about 4,300 in 2015 to over 5,400 in 2016. That’s a 26% increase! Clearly, the question of do people with green cards pay taxes is driving this trend.

Tax consultants can’t stress enough how important it is to chat with an expert before you decide to give up your residency permit. As tax attorney Dennis Brager puts it, "Willful failure to do so can result in criminal charges and/or civil tax fraud penalties." Understanding the ins and outs of the Internal Revenue Code and the specific filing requirements is key for effective tax planning. If you don’t comply, you could face some serious penalties, including criminal charges for willful non-compliance. So, if you’re thinking about expatriation, careful planning and documentation are a must.

Plus, don’t forget that you’ll need to file specific forms to show you’re complying with the Expatriation Tax requirements. It’s also a good idea to budget for legal and immigration expertise fees when you’re making this big decision. Better safe than sorry, right?

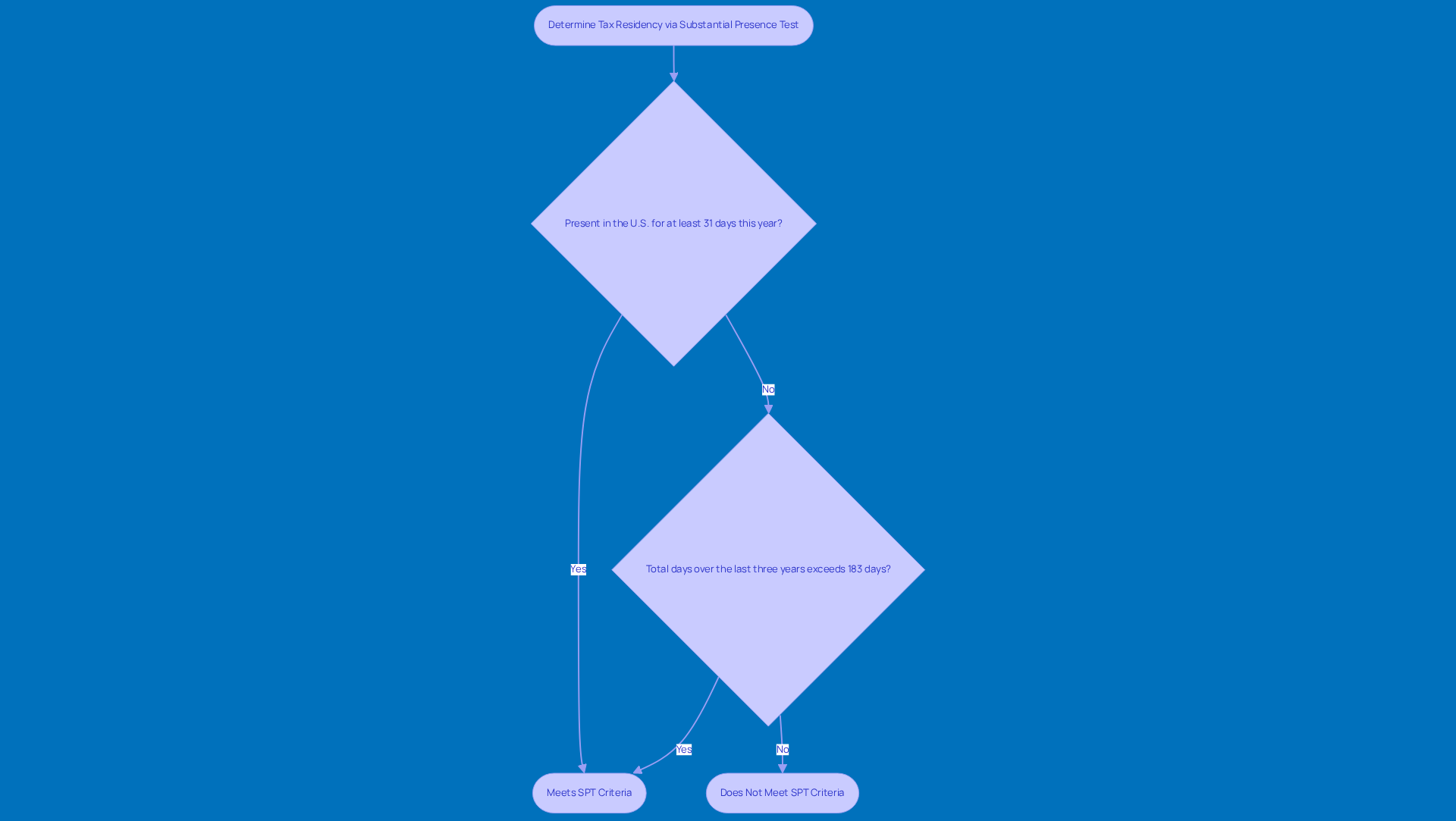

Substantial Presence Test: Criteria for Tax Residency Beyond Green Cards

Hey there! Let’s chat about the Substantial Presence Test (SPT) - it’s a key factor in figuring out tax residency in the U.S., especially if you don’t have a green card. So, what’s the deal? To qualify, you need to be physically present in the U.S. for at least 31 days this year and rack up a total of 183 days over the last three years. How do you calculate that? It’s pretty straightforward: count all the days you’re here this year, add one-third of the days from last year, and one-sixth of the days from the year before that.

Let’s break it down with an example. Imagine you’re a non-permanent resident who spends 150 days in the U.S. this year, 120 days last year, and 90 days the year before. Guess what? You’d meet the SPT criteria because your total would exceed 183 days! This is super important for business travelers and expats who often find themselves in the U.S. for work or personal reasons. If you go over those thresholds, you might end up with some unexpected tax responsibilities.

Tax pros really stress the need to keep track of your days in the U.S. You don’t want to accidentally end up classified as a U.S. tax resident! Many folks without a green card might not realize that their time spent here can trigger tax residency, leading to questions about whether do people with green cards pay taxes. So, it’s crucial to understand the SPT and how it impacts your tax planning and compliance.

So, what do you think? Have you ever considered how your time in the U.S. might affect your taxes? It’s definitely worth keeping in mind!

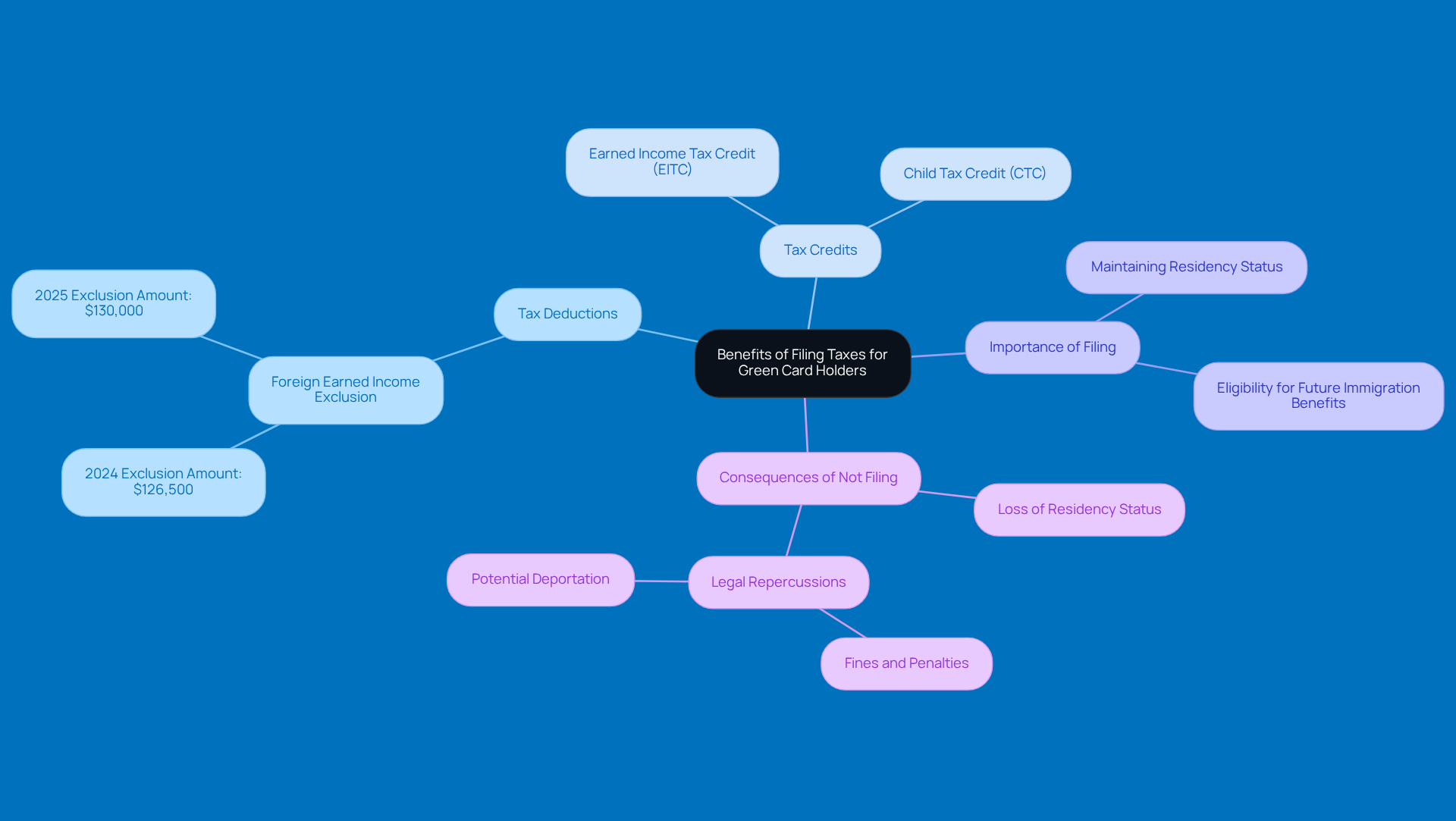

Benefits of Filing Taxes: Why Green Card Holders Should Consider U.S. Tax Returns

Hey there! If you’re a permanent resident in the U.S., it’s super important to know do people with green cards pay taxes when submitting your tax returns. Why? Well, it opens the door to some great tax perks, like deductions and credits that can really lighten your tax load. For instance, in 2025, you can take advantage of the Foreign Earned Income Exclusion, which lets you exclude up to $130,000 of foreign-earned income from your taxable income. That’s some serious savings, especially if you’re living abroad!

Now, let’s talk about tax credits. The Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) are game-changers for immigrant families. They provide crucial financial support, and many permanent residents with U.S. citizen kids rely on these credits to boost their financial stability. Tax advisors often say that using these credits can save you thousands of dollars each year, depending on your situation. Pretty neat, right?

But here’s the thing: for permanent residents, understanding how do people with green cards pay taxes is key to keeping up with U.S. tax rules. It helps you maintain your residency status and ensures you’re eligible for future immigration benefits. If you skip out on filing your taxes, you could face some serious consequences, including losing your residency status. So, understanding and making the most of those tax deductions and credits isn’t just a smart financial move; it’s also essential for keeping your permanent residency intact.

So, what are you waiting for? Dive into those tax benefits and make sure you’re on top of your tax game!

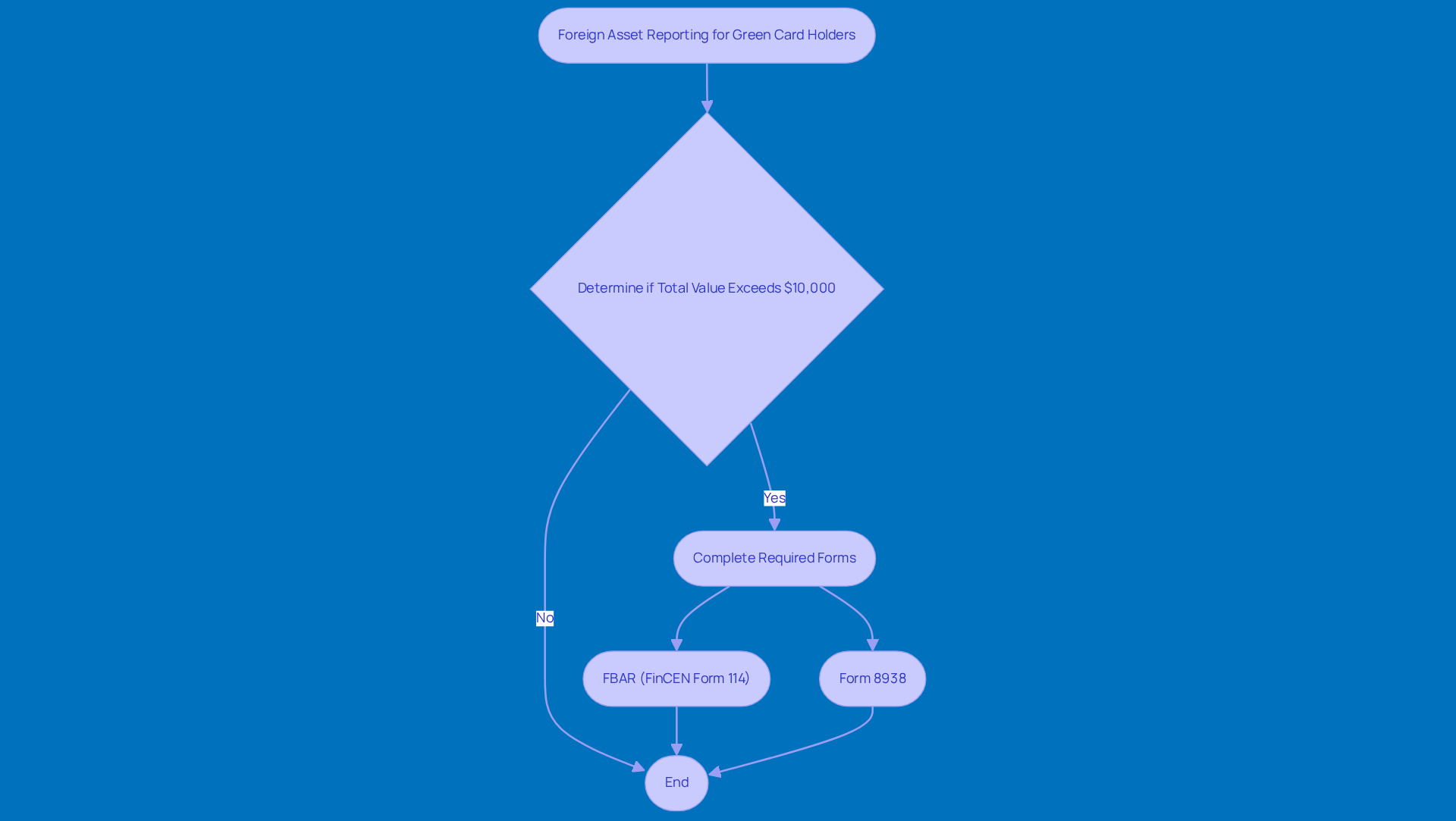

Additional Filing Requirements: Foreign Asset Reporting for Green Card Holders

If you’ve got a green residency permit, here’s something important to keep in mind: you need to declare any overseas financial accounts if their total value goes over $10,000 at any point during the year. This is done through the FBAR (FinCEN Form 114) and Form 8938, which helps report specific foreign financial assets. Not following these rules can lead to some hefty penalties, so it’s really crucial to get a handle on what’s required.

So, what does this mean for you? Well, it’s all about staying on top of your finances and making sure you’re compliant. Think of it as a way to keep everything above board and avoid any nasty surprises down the line. If you’re unsure about how to navigate this, don’t hesitate to reach out for help. It’s always better to ask questions than to risk penalties!

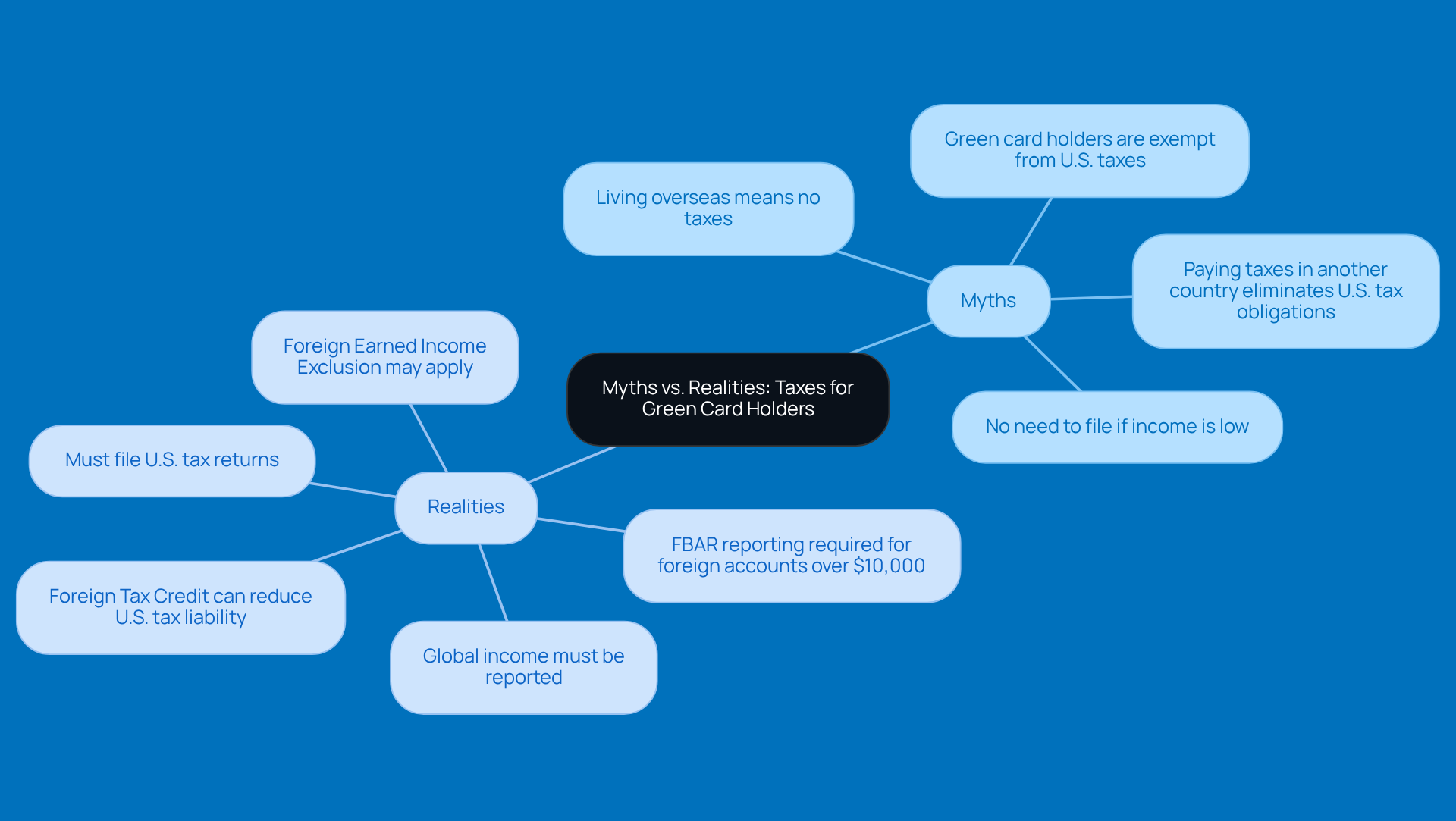

Myths vs. Realities: Common Misconceptions About Taxes for Green Card Holders

Many permanent residents think they’re off the hook when it comes to U.S. taxes just because they’re living overseas. But here’s the deal: if you’re a permanent resident, do people with green cards pay taxes and still need to file U.S. tax returns while reporting your global income, no matter where you are? Recent surveys reveal that around 40% of permanent residents don’t even realize they have these tax obligations. That’s a big gap in understanding! Believing that living outside the U.S. means you’re free from tax duties can lead to some serious penalties and even complications with your residency status.

Take, for instance, an immigrant with a residence permit living in Europe. They thought they could skip filing their tax returns for several years because they believed their overseas income wasn’t subject to U.S. taxes. Unfortunately, this oversight not only landed them hefty fines but also raised eyebrows about their intent to keep their residency in the U.S. The USCIS might see not filing as a sign that they’ve abandoned their residency intent.

Tax advisors stress how crucial it is to stay updated on obligations, such as whether do people with green cards pay taxes. One specialist shared, "Many permanent residents are shocked to find out they need to file returns even if they haven’t earned anything or if their income is below the threshold." Ignoring these requirements can lead to significant headaches later on, including those pesky penalties and potential challenges to your residency status. So, understanding these realities is key to staying compliant and avoiding unnecessary trouble.

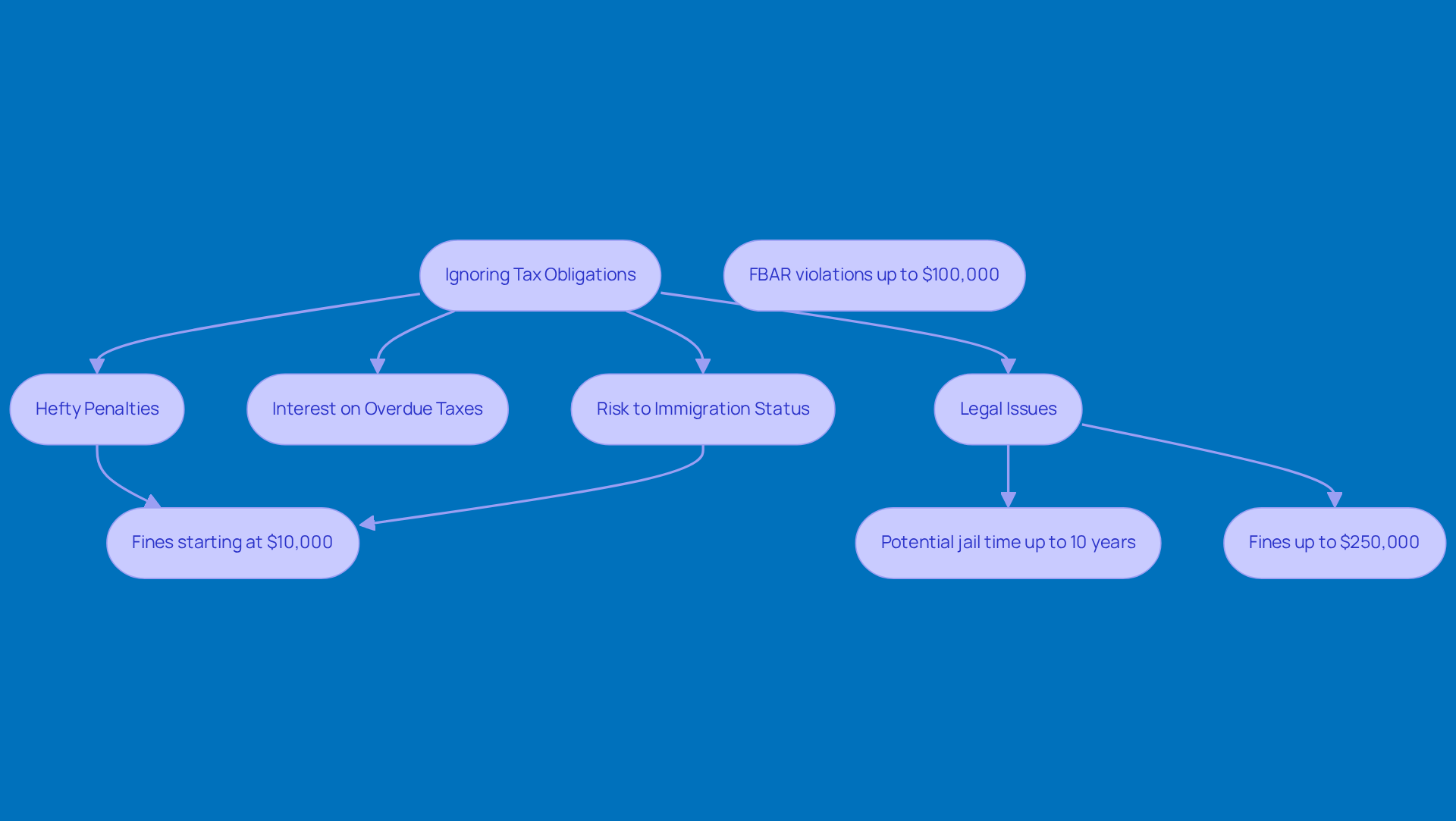

Penalties for Non-Compliance: Risks for Green Card Holders Ignoring Tax Obligations

If you’ve got a green immigration permit, it’s super important to know if and how do people with green cards pay taxes. Ignoring them can lead to some serious trouble, like hefty penalties, interest on overdue taxes, and even legal issues. For example, if you forget to file the necessary forms, you could face fines starting at $10,000, which can pile up to $50,000 over time! And don’t get me started on FBAR violations - those can hit you with penalties as high as $100,000 or 50% of your total account balance. Yikes! It’s easy to see how these financial burdens can snowball, especially if you’re not fully aware of what you need to do.

But that’s not all. Not keeping up with your tax obligations can put your immigration status at risk and make future residency applications a lot trickier. The IRS isn’t just about the money; they can impose penalties that mess with your financial standing and complicate your path to citizenship. And let’s be real - tax evasion is a criminal offense that could land you in prison for up to 10 years, along with fines that can reach $250,000. That’s a pretty big deal!

Tax experts often point out that many new permanent residents don’t realize their tax obligations, including the question of do people with green cards pay taxes, which can lead to some nasty penalties. Take a recent case study, for instance: a lawful permanent resident faced significant fines for not declaring foreign financial accounts. This really highlights how crucial it is to understand U.S. tax regulations.

So, what’s the takeaway? The risks of ignoring your tax responsibilities are pretty significant. It’s essential for permanent residents to understand do people with green cards pay taxes, seek professional tax advice, and stay compliant to avoid some serious consequences. Don’t wait until it’s too late!

Seeking Professional Advice: The Importance of Consulting Tax Experts for Green Card Holders

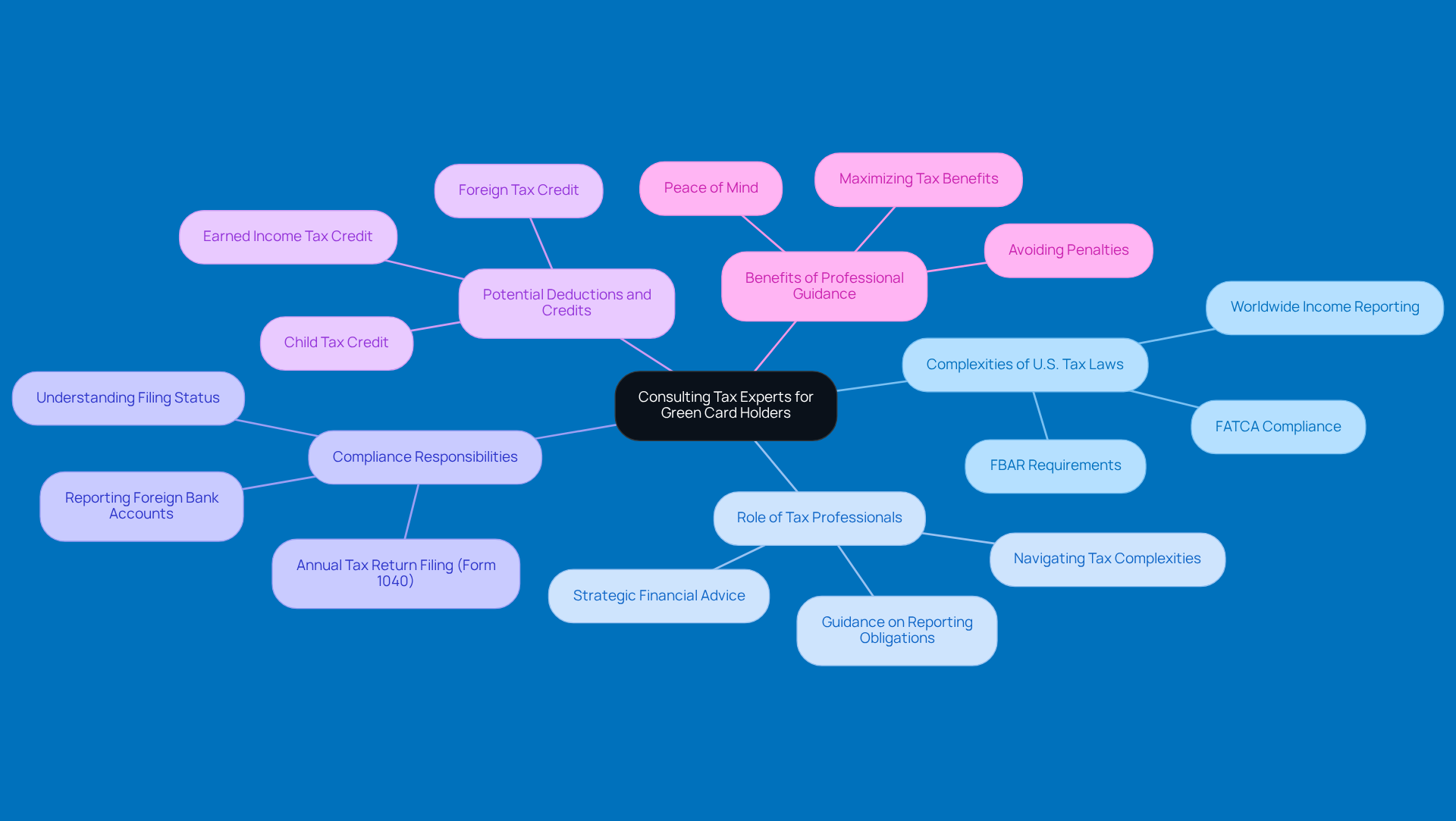

Navigating the complexities of U.S. tax laws can feel overwhelming for permanent residents, particularly when they wonder do people with green cards pay taxes. That’s why it’s so important to team up with tax professionals who really get expatriate tax issues. At Steinke and Company, we offer tailored tax compliance and preparation services that address the unique challenges faced by permanent residents, like filing requirements and compliance obligations. By consulting with our knowledgeable tax advisors, you can boost your compliance rates significantly. They’ll help you understand your responsibilities, such as reporting worldwide income and foreign bank accounts that exceed $10,000. Ignoring these accounts can lead to hefty penalties, which is why professional guidance is crucial.

For instance, many permanent residents have successfully avoided penalties and audits by working with our tax consultants. They guide clients through necessary reporting duties like the Foreign Bank Account Reporting (FBAR) and the Foreign Account Tax Compliance Act (FATCA). Plus, our experts can assist qualified permanent residents in claiming up to $2,000 for each qualifying child under the Child Tax Credit, which can really lighten the tax load. By partnering with Steinke and Company, you can clarify your dual tax responsibilities and ensure timely submission of required forms, leading to better tax outcomes.

Our tax advisors are also key in helping clients spot potential deductions and credits that can further lower tax liabilities. Their insights into the latest tax regulations empower permanent residents to make informed financial decisions, ensuring compliance while maximizing benefits. As one of our tax advisors puts it, "Staying informed about changes in tax laws is critical for avoiding costly mistakes and ensuring that clients can navigate their tax responsibilities with confidence."

In short, working with Steinke and Company not only eases your stress but also empowers green card holders to understand how do people with green cards pay taxes. It paves the way for a smoother journey toward compliance and financial success. So, why not reach out and see how we can help you today?

Conclusion

Understanding your tax responsibilities as a green card holder is super important for staying compliant and avoiding hefty penalties. As a permanent resident, you need to file U.S. tax returns and report your global income, no matter where you call home. This obligation really highlights why it’s crucial to be in the know about tax regulations and the potential fallout from not following them.

In this article, we’ve touched on some key points, like the need to file essential forms such as the 1040 and FBAR, the implications of expatriation, and the perks of tax credits available to green card holders. Plus, we can’t stress enough how beneficial it is to consult with tax professionals who can help you navigate the maze of U.S. tax laws. By doing this, you not only ensure compliance but also set yourself up for better financial outcomes.

Given the complexities of tax obligations, it’s vital for green card holders to actively seek expert advice and stay updated on their responsibilities. Understanding these tax duties isn’t just a legal box to check; it’s a key part of keeping your residency status and securing future immigration benefits. So, take the initiative to educate yourself and reach out to professionals-this can really pave the way for a more secure financial future!

Frequently Asked Questions

Do people with green cards pay taxes?

Yes, individuals with green cards must pay U.S. taxes on their global income, regardless of where that income comes from.

What are the income thresholds for green card holders to file taxes?

For individual permanent residents under 65, the income threshold is $12,550. If married and filing jointly, the threshold increases to $25,100.

What is the FBAR and when do green card holders need to file it?

The Report of Foreign Bank and Financial Accounts (FBAR) must be filed by green card holders if they have overseas financial accounts totaling more than $10,000 at any point during the year.

What are the benefits available to green card holders regarding taxes?

Green card holders can benefit from the Foreign Tax Credit and the Foreign Earned Income Exclusion, which can help reduce their U.S. tax liabilities if they are living abroad.

What penalties can green card holders face for underpayment of taxes?

Green card holders can incur penalties from the IRS if they do not pay enough of their tax liability through withholding or estimated payments throughout the year.

What strategies can help avoid underpayment penalties?

Strategies such as safe harbor payments, which ensure a minimum amount of tax is prepaid, and the de minimis exception, which relieves those with a tax liability under $1,000, can help avoid penalties.

When does a green card holder become a U.S. tax resident?

A green card holder becomes a U.S. tax resident as soon as their permanent resident document is issued and maintains that status as long as they keep their residency.

What tax form must green card holders file annually?

Green card holders must file Form 1040, the U.S. Individual Income Tax Return, by April 15 each year. If living outside the U.S., they receive an automatic two-month extension, making the deadline June 15.

What happens if green card holders fail to file their taxes on time?

Failing to file taxes correctly or on time can jeopardize a green card holder's residency status and lead to serious issues with immigration.

How can green card holders stay informed about their tax responsibilities?

Green card holders should stay updated on tax regulations and filing requirements to ensure compliance and avoid penalties.