Introduction

Navigating the world of tax deductions can really change the game for small businesses, especially now that 100% bonus depreciation is back in play. This tax strategy is a big deal because it lets companies write off the full cost of qualifying assets in the year they start using them, which can really boost cash flow.

But as businesses get ready to take advantage of these deductions, they often find themselves facing the tricky parts of eligibility and timing.

So, how can small businesses make the most of this opportunity to not just improve their financial performance but also ensure they grow sustainably in this ever-changing economic landscape?

Steinke and Company: Leveraging 100% Bonus Depreciation for Cash Flow Optimization

Steinke and Company helps clients make the most of the 100 bonus depreciation example to maximize their tax deductions. This means companies can deduct the full cost of qualifying assets in the year they start using them. Pretty neat, right? This approach can really boost cash flow, especially since the full asset write-off is permanent for property put into use after January 19, 2025.

For instance, imagine a construction company that invests in new equipment. They can write off the entire cost right away, which frees up capital for other investments or operational expenses. Not only does this strategy lower taxable income, but it also improves liquidity, helping firms manage seasonal fluctuations and unexpected costs more effectively.

As financial specialists point out, 'Instead of recouping an asset’s expense over several years, an accelerated write-off allows you to deduct a significant portion-now 100% for many assets, which can be seen in a 100 bonus depreciation example-in the year the property is put into operation. This speeds up deductions and usually enhances after-tax cash flow.' By teaming up with financial consultants, companies can craft tailored strategies to boost their cash flow through special deductions, keeping them strong and competitive in their markets.

Just a heads-up: to qualify for those extra write-offs, assets need to be tangible, depreciable under MACRS, and put into service after January 19, 2025. Plus, businesses should keep an eye out for potential caveats, like implications for projects that were 10% or more complete as of that date. So, what do you think? Are you ready to explore how these deductions can work for you?

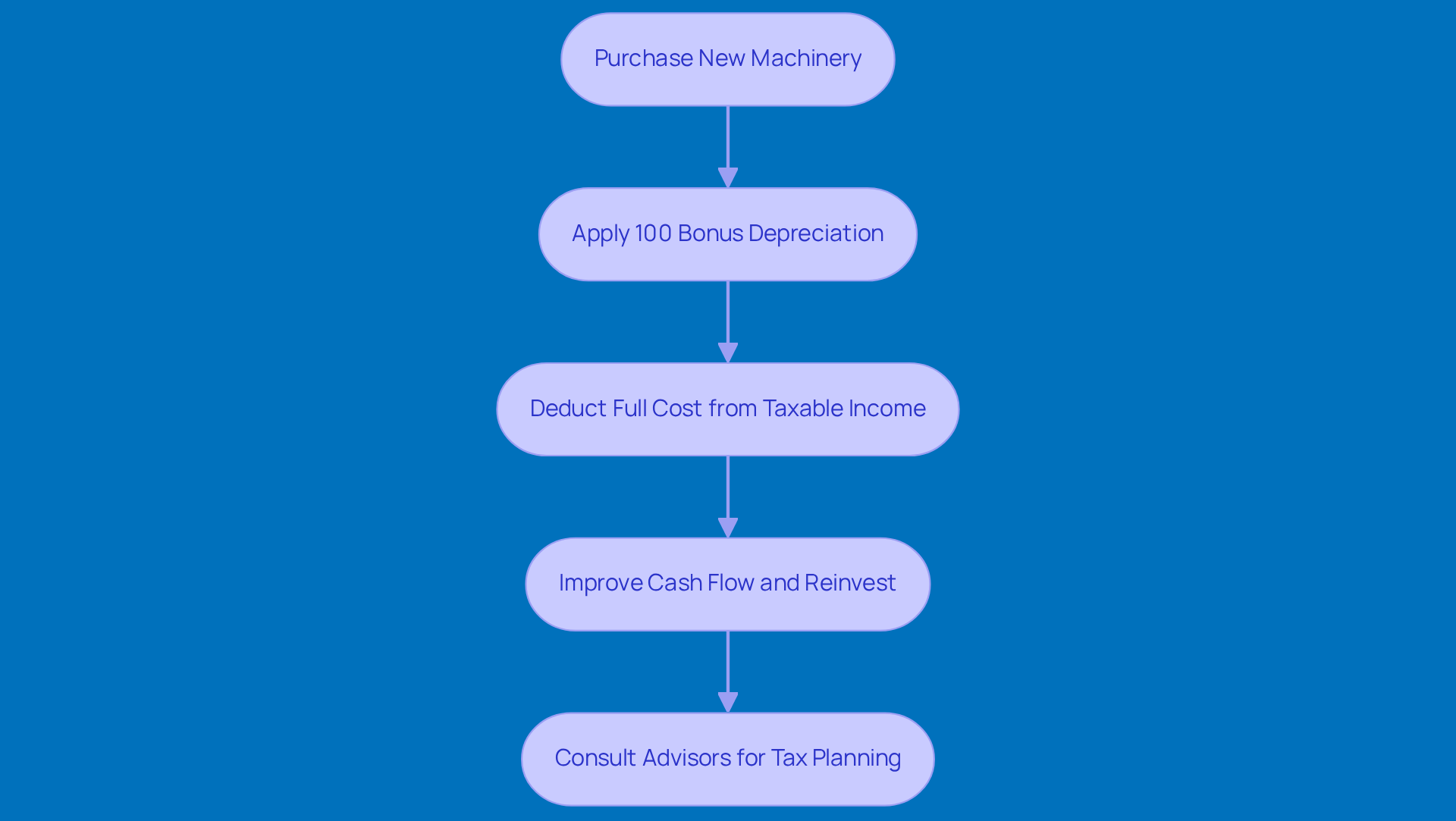

Construction Companies: Utilizing Bonus Depreciation to Enhance Financial Performance

Hey there! Did you know that a 100 bonus depreciation example can help construction firms significantly boost their tax savings? They can accomplish this by applying a 100 bonus depreciation example, which enables them to write off the full cost of new machinery and equipment in the year they buy it. For instance, a 100 bonus depreciation example shows that if a contractor spends $500,000 on new gear, they can deduct that entire amount from their taxable income. That’s a big deal! This immediate deduction not only helps with cash flow but also gives them the chance to reinvest in more projects or even expand their workforce. Talk about improving financial performance!

Now, to snag that 100% deduction, the property needs to be up and running on or after January 19, 2025, and ready to roll by December 31, 2025. As the construction industry gears up for the permanent reinstatement of this full deduction in 2026, companies are expected to see some pretty impressive financial metrics. Many are even reporting greater profitability and operational capacity. Financial analysts are buzzing about how these tax savings from equipment purchases can really strengthen the bottom line, helping contractors ride out market ups and downs while investing in growth opportunities.

But here’s the kicker: it’s super important for firms to chat with experienced advisors. Navigating the complexities and planning challenges that come with the 2025 tax reform can be tricky. So, don’t hesitate to reach out for guidance!

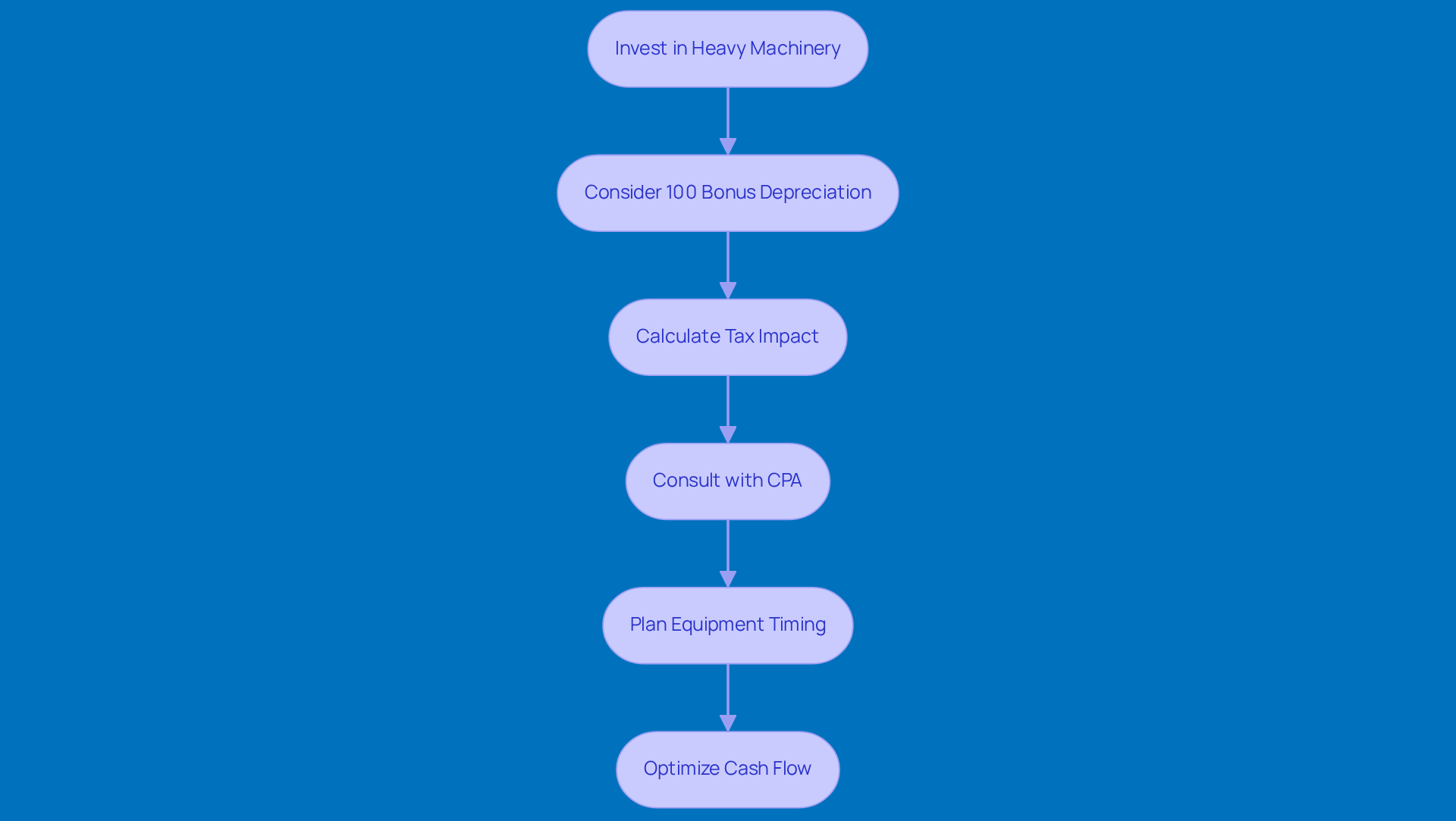

Heavy Equipment Purchases: Maximizing Cash Flow with Vehicle Bonus Depreciation

If your company is investing in heavy machinery - think trucks or construction gear - you might want to consider how strategic write-offs can really boost your cash flow. A 100% bonus depreciation example is when a company purchases a $200,000 truck and deducts the entire purchase price in the first year. This means a significant drop in taxable income, which not only lightens the tax burden but also frees up cash that can be reinvested into other areas of the business. That’s a win-win for growth and efficiency!

Now, with the full tax write-off benefits back in action, as outlined in Notice 2026-11 from the Department of the Treasury and the IRS, it’s a great time for companies to rethink their equipment purchasing strategies. Baldwin CPAs puts it nicely: "With full bonus depreciation back in play and Section 179 limits rising, the 100% bonus depreciation example in 2025 offers a powerful window to refresh your equipment fleet, reduce taxable income, and strengthen cash flow."

Planning and documentation are key here. It’s a smart move to team up with your CPA to model how these deductions can impact your cash flow and debt ratios. And don’t forget about timing! If your equipment shows up in December but isn’t operational until January, that could change the deduction year. Plus, the Section 179 deduction limit is set to rise to $1.25 million for 2025, giving businesses even more chances to optimize cash flow through new equipment purchases.

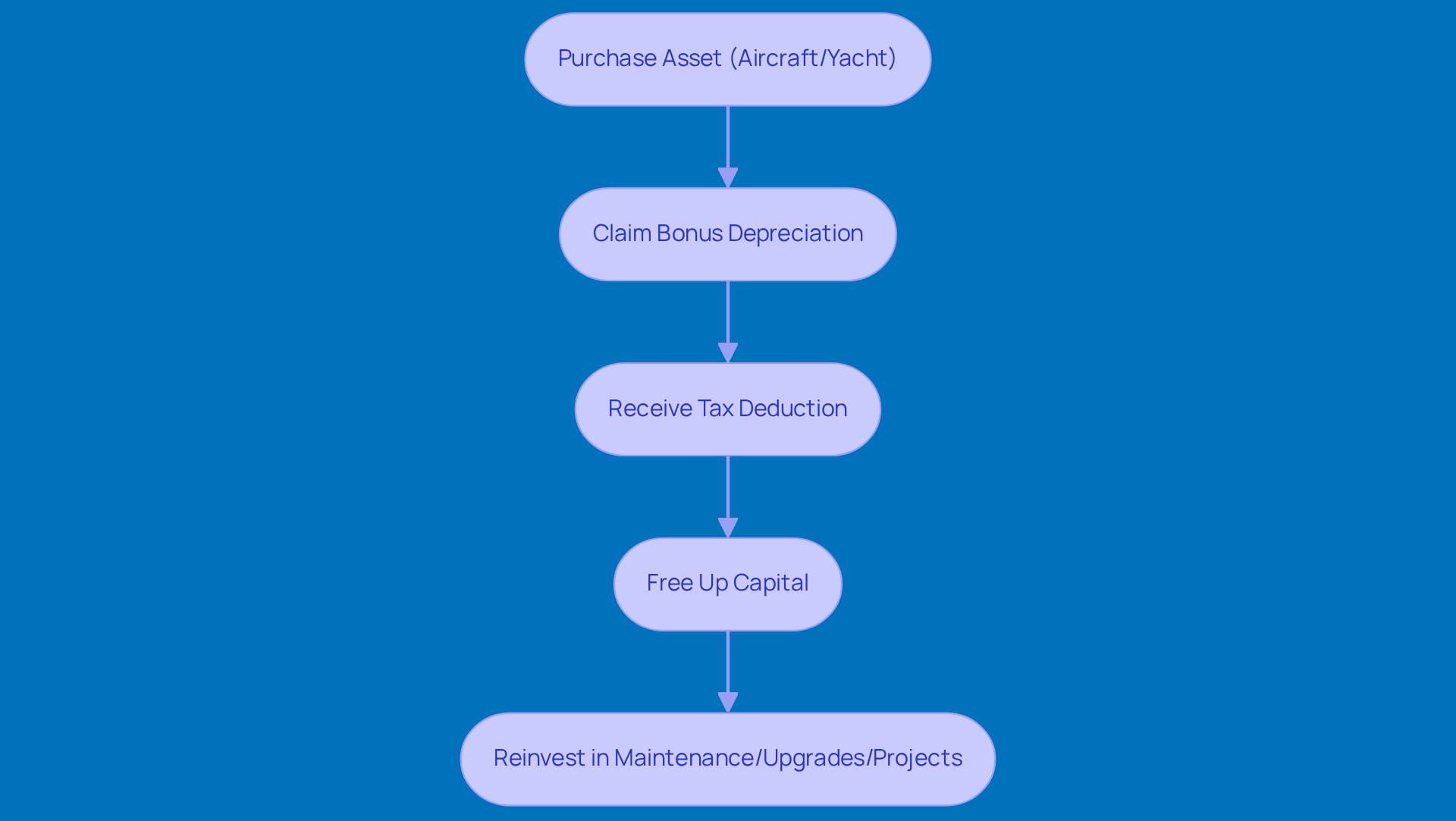

Aviation and Marine Industries: Capitalizing on Bonus Depreciation for Cash Flow Gains

In the aviation and maritime industries, companies can really boost their cash flow with enhanced write-offs. For example, if a company buys a $1 million aircraft, they can deduct the entire purchase price in the year they acquire it. That’s a big tax saving! This quick deduction not only frees up capital but also lets companies reinvest in maintenance, upgrades, or new projects, which can really ramp up their operational efficiency and financial stability.

Marine businesses can also take advantage of these extra write-offs to improve their cash flow. By showing that a yacht is used for commercial purposes, owners can snag some significant deductions that cover costs like insurance, maintenance, and dockage. Picture this: a yacht bought for $1.5 million in 2025 can give a full tax deduction of $1.5 million, bringing the net expense down to about $945,000 after tax savings. This savvy financial move helps marine enterprises allocate their resources better, keeping them competitive and resilient in a tough market.

Overall, the reinstatement of the 100 bonus depreciation example for assets put into service between January 20, 2025, and December 31, 2029, provides a fantastic opportunity for both aviation and marine businesses. It’s a chance to optimize financial strategies and really enhance cash flow. So, why not take a closer look at how these write-offs could work for you?

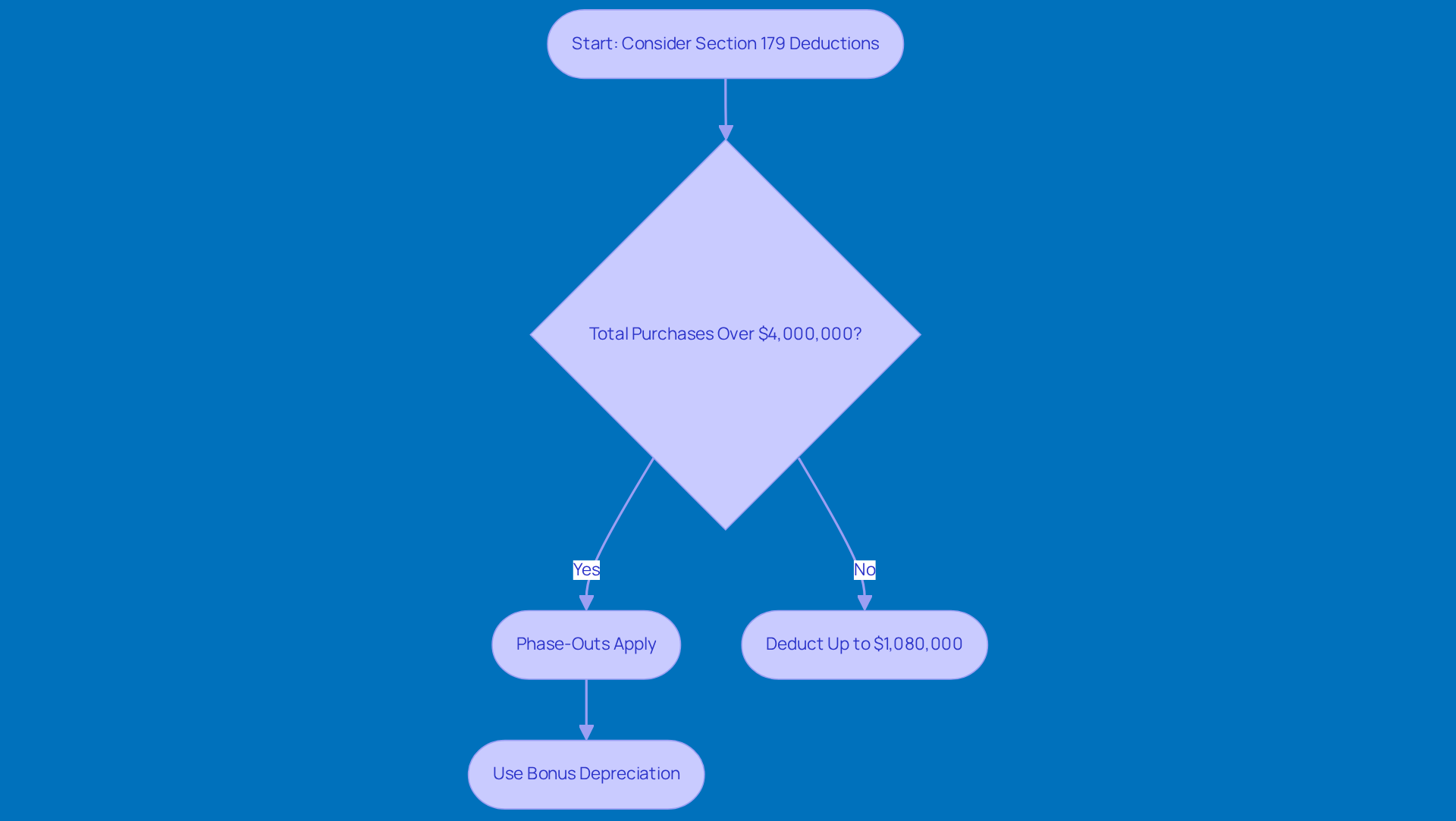

Section 179 Deductions: Complementing Bonus Depreciation for Enhanced Cash Flow

Hey there! Let’s talk about Section 179 deductions and how they can really work in your favor when it comes to taxes. You see, businesses can combine these deductions with other write-offs to really maximize their tax benefits. For example, you can use Section 179 to deduct up to $1,080,000 on qualifying equipment purchases. Pretty neat, right? But here’s the catch: once your total purchases hit $4,000,000 in 2025, the phase-outs for Section 179 kick in.

Now, don’t worry if you hit that limit! You can still tackle any leftover costs using a 100% bonus depreciation example. This serves as a 100% bonus depreciation example, allowing you to write off eligible assets fully in the year they’re put into service. It’s a smart move that can significantly lower your taxable income and boost your cash flow. More cash flow means more capital for reinvestment, which is always a good thing!

By using both deductions, companies can really optimize their tax strategies. This way, they keep more of their earnings for growth and operational needs. As the tax strategists at Steinke and Company often say, combining these deductions can lead to some serious financial perks, especially for small businesses looking to invest in new equipment and infrastructure.

So, if you’re feeling a bit lost in all this tax talk, don’t hesitate to consult with a qualified tax advisor. They can help you navigate these options and make sure you’re maximizing your deductions while staying compliant. Trust me, you’ll want to avoid any surprises when tax season rolls around!

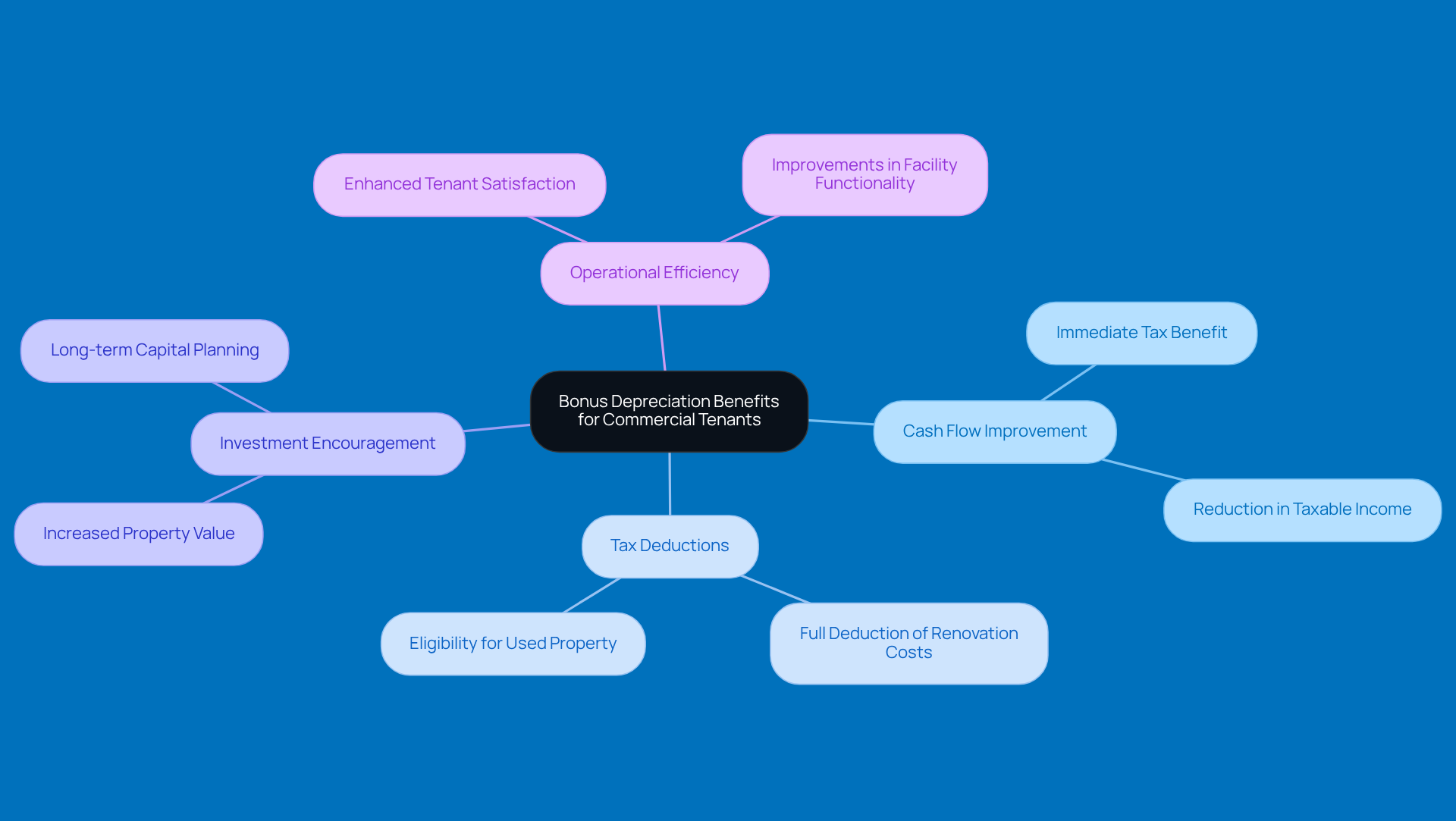

Commercial Tenants: Unlocking Cash Flow Benefits Through Bonus Depreciation

Hey there! If you're a commercial renter, you might want to know how you can really boost your cash flow. One great way is by using the 100 bonus depreciation example to accelerate write-offs and deduct expenses for any eligible improvements you make to your rented space. For example, in the context of a 100 bonus depreciation example, let’s say you decide to invest $100,000 in renovations. You can actually deduct that entire amount in the first year! How cool is that? This means a significant drop in your taxable income right off the bat.

Not only does this immediate tax benefit help your cash flow, but it also encourages you to invest in your leased space. And guess what? That can increase the overall value of the property too! Financial advisors often suggest this strategy because it fits nicely into broader tax planning goals. It’s all about maximizing your investment while keeping those pesky tax liabilities in check.

Plus, if your renovations qualify for extra tax perks, you could see improvements in operational efficiency and tenant satisfaction. That’s a win-win! So, as we look ahead to 2026 and beyond, consider how these strategies can work for you. Have you thought about making some upgrades? It might just be the best move for your business!

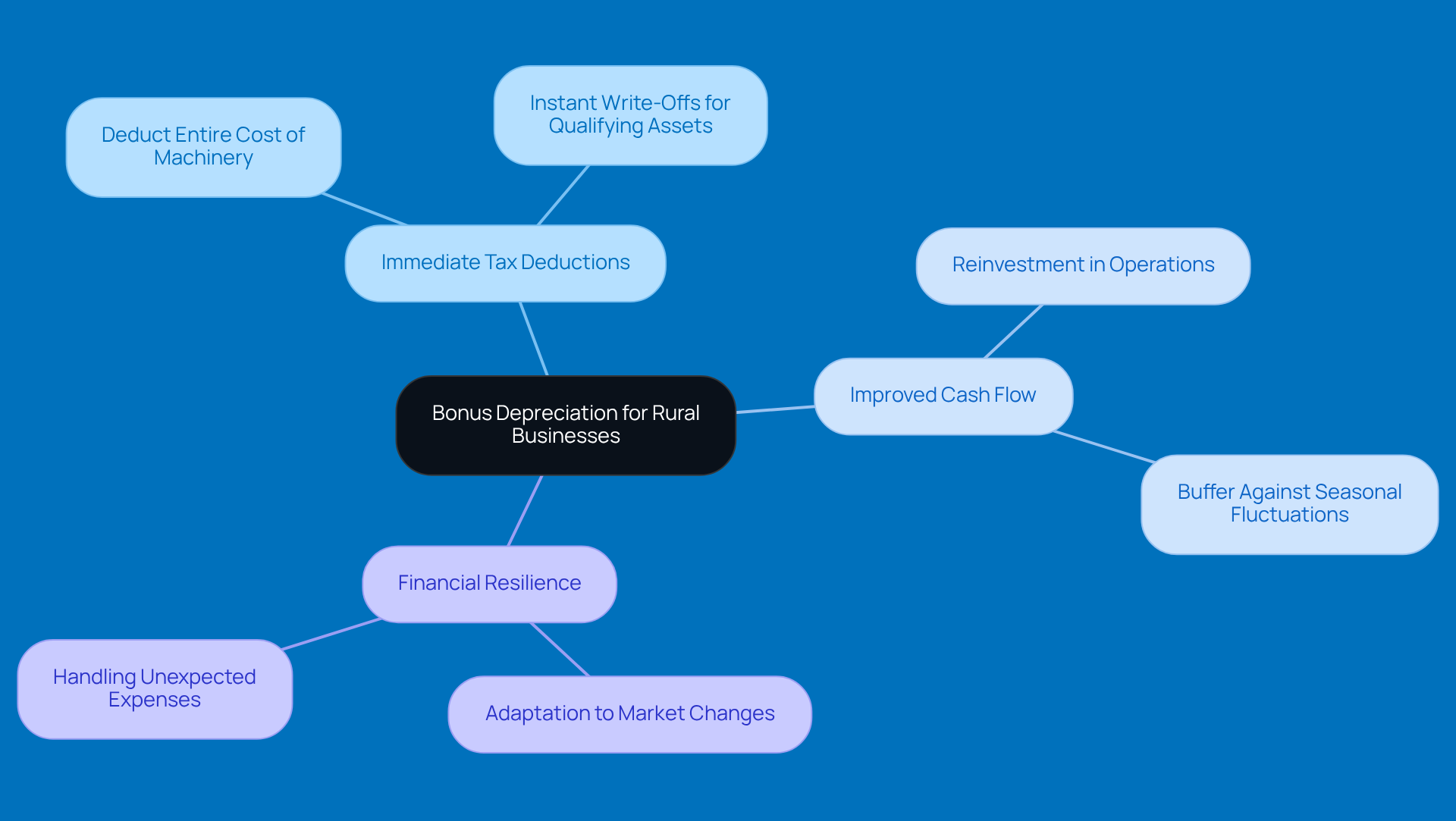

Rural Businesses: Harnessing Bonus Depreciation for Financial Resilience

Rural enterprises can really boost their financial stability by taking advantage of accelerated write-offs. These allow for instant tax deductions on qualifying assets, which is pretty neat! For instance, a 100 bonus depreciation example would show that if a local farm invests in new machinery, they can deduct the entire cost in the year they buy it.

This immediate deduction not only helps improve cash flow but also makes it easier to reinvest in operations. And let’s be honest, that’s crucial for handling seasonal ups and downs and those unexpected expenses that pop up. Financial advisors often point out that using these tax deductions can really strengthen the overall financial health of agricultural businesses. It enables them to adapt more effectively to market changes and operational challenges.

So, if you’re in the farming game, why not consider how these write-offs could work for you? It might just be the boost you need!

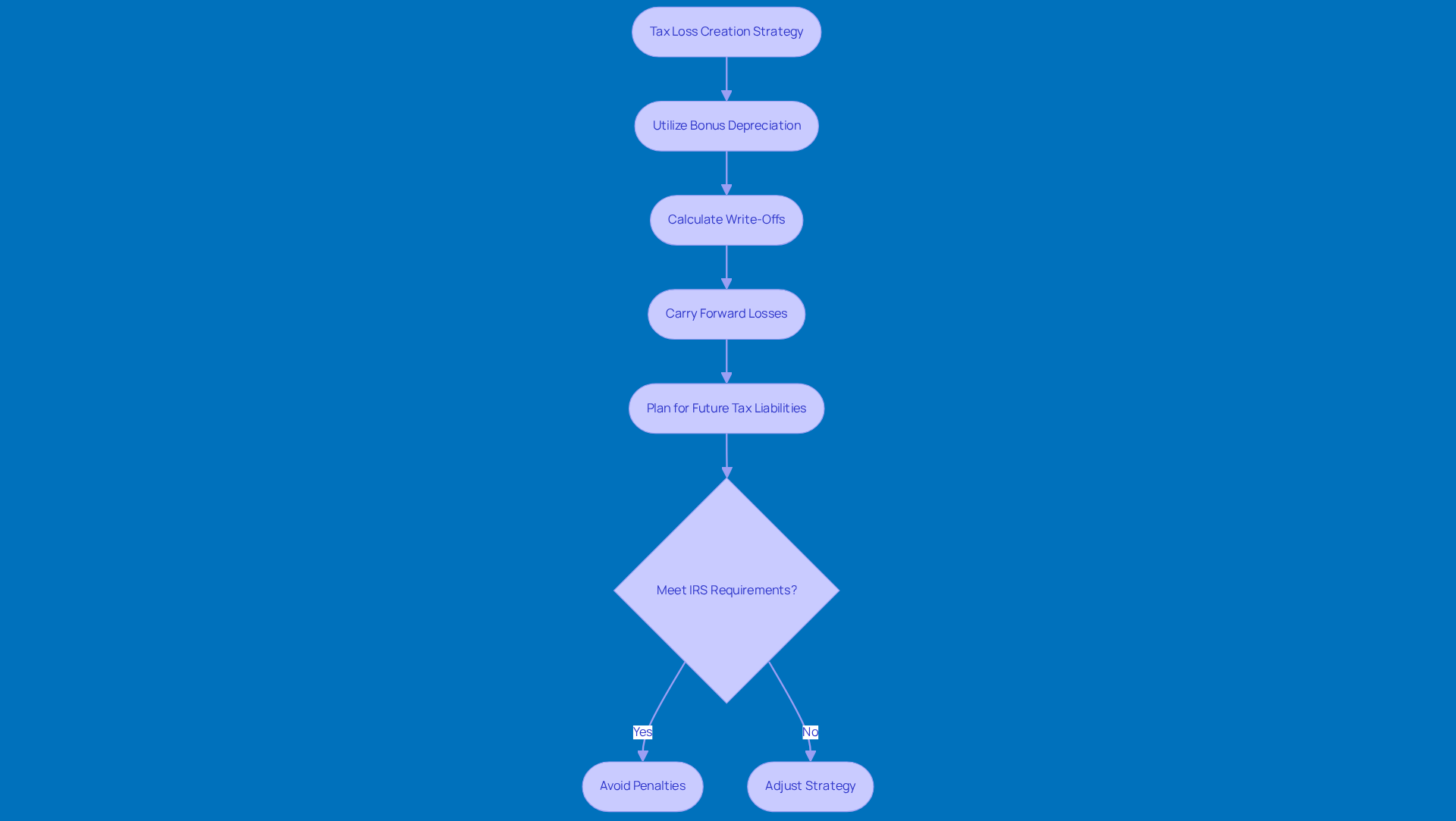

Tax Loss Creation: Using Bonus Depreciation to Offset Future Income

Companies can strategically use extra write-offs to create tax losses that help balance out future earnings. For instance, a 100 bonus depreciation example shows that if a company takes a hit of $50,000 from bonus depreciation deductions, that loss can be carried forward to offset taxable income in the years to come. This approach not only cuts down current tax bills but also acts as a safety net for future income, making long-term financial planning a bit easier.

Tax experts really emphasize how important this strategy is. It allows companies to hang onto more cash for reinvestment and growth while keeping their tax obligations in check. As Andrew G. Klapac puts it, "Under the OBBBA, a taxpayer can potentially write off up to $2.5 million with the Section 179 deduction," which shows just how much tax savings can be on the table.

Now, let’s talk about underpayment penalties, which are crucial for small business owners to understand. The IRS wants taxpayers to pay at least 90% of their current year's tax liability or 100% of the tax shown on their return from the previous year to dodge those pesky penalties. By using Steinke and Company's smooth and accurate tax preparation services, businesses can navigate these tricky waters with ease.

This proactive tax planning strategy, which includes the ins and outs of additional write-offs and the January 19, 2025 cutoff for qualifying property, serves as a 100 bonus depreciation example that helps companies fine-tune their tax positions and boost their financial resilience. So, why not take a closer look at how these strategies can work for you?

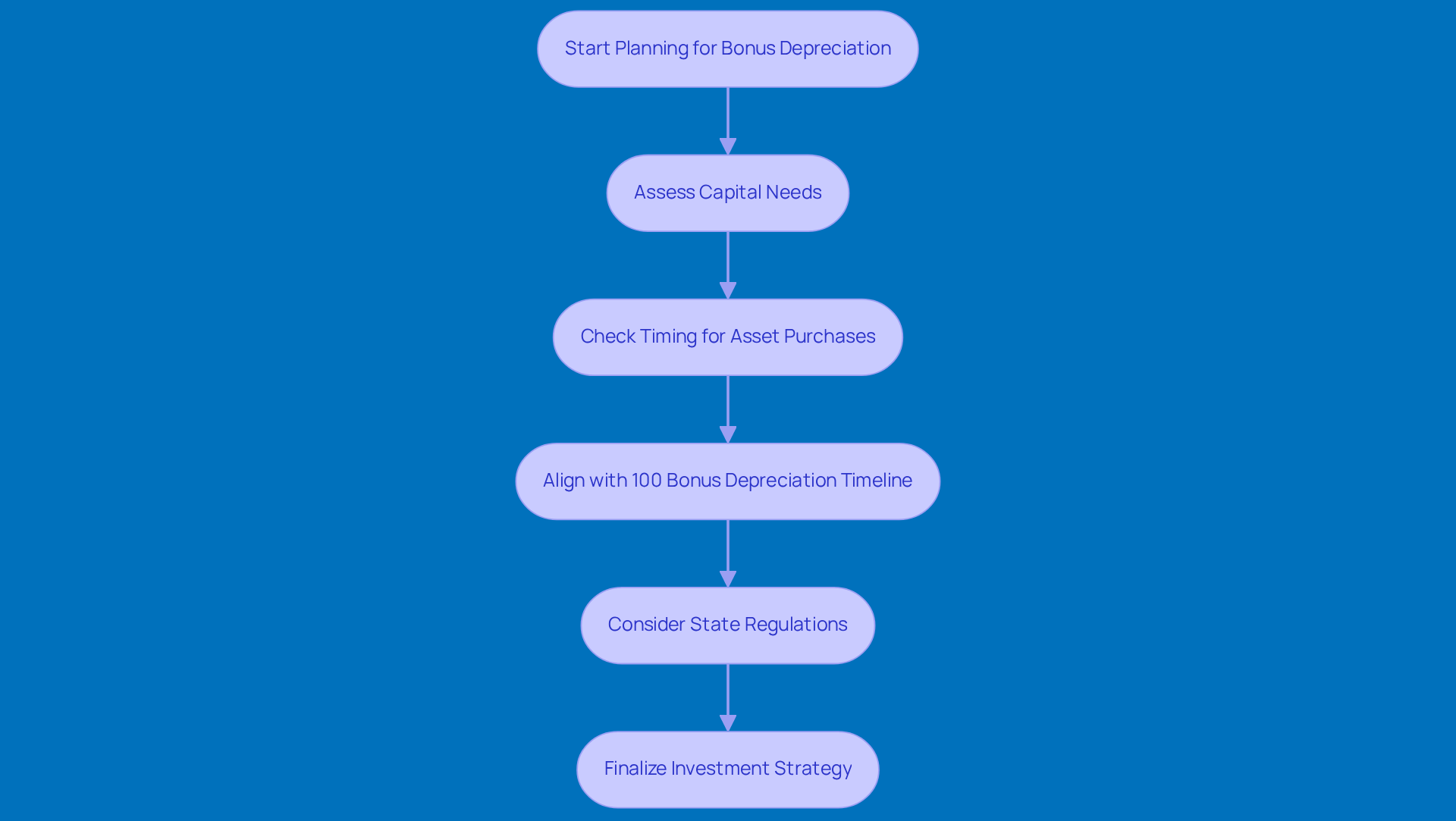

Understanding Expiration: Timing Your Bonus Depreciation for Maximum Benefit

To really take advantage of those extra write-offs, companies need to be on top of the timing for their capital investments. With the reestablishment of the 100% bonus depreciation example for assets put into use after January 19, 2025, there’s a fantastic opportunity for some savvy financial planning. By syncing up the timing of asset purchases with this reinstatement, businesses can maximize their deductions, as seen in a 100% bonus depreciation example, leading to better cash flow and lower tax bills. And here’s the kicker: accelerated write-offs are automatic unless you decide to opt out, making it easier for companies to snag this tax benefit.

For example, think about planning major investments like new equipment or facility upgrades to line up with this timeline. This way, you can enjoy immediate expensing! It’s a proactive move that not only meets operational needs but also bolsters long-term investment strategies. Plus, Section 179 is a great addition to those accelerated write-offs, helping companies fine-tune their tax strategies effectively. Financial consultants often emphasize that careful planning around tax allowances can lead to better tax situations as laws evolve. So, it’s super important for companies to reassess their capital spending strategies in light of these changes.

And don’t forget, if you’re operating in different jurisdictions, it’s wise to check how state rules might differ from federal incentive amortization. This can lead to some inconsistencies in amortization timelines. Lastly, understanding the acquisition date is key for figuring out eligibility under the new 100% rule versus phasedown rules, which can really impact your capital expenditure planning. So, how are you planning to navigate these changes?

Bonus Depreciation vs. Section 179: Choosing the Right Strategy for Cash Flow Maximization

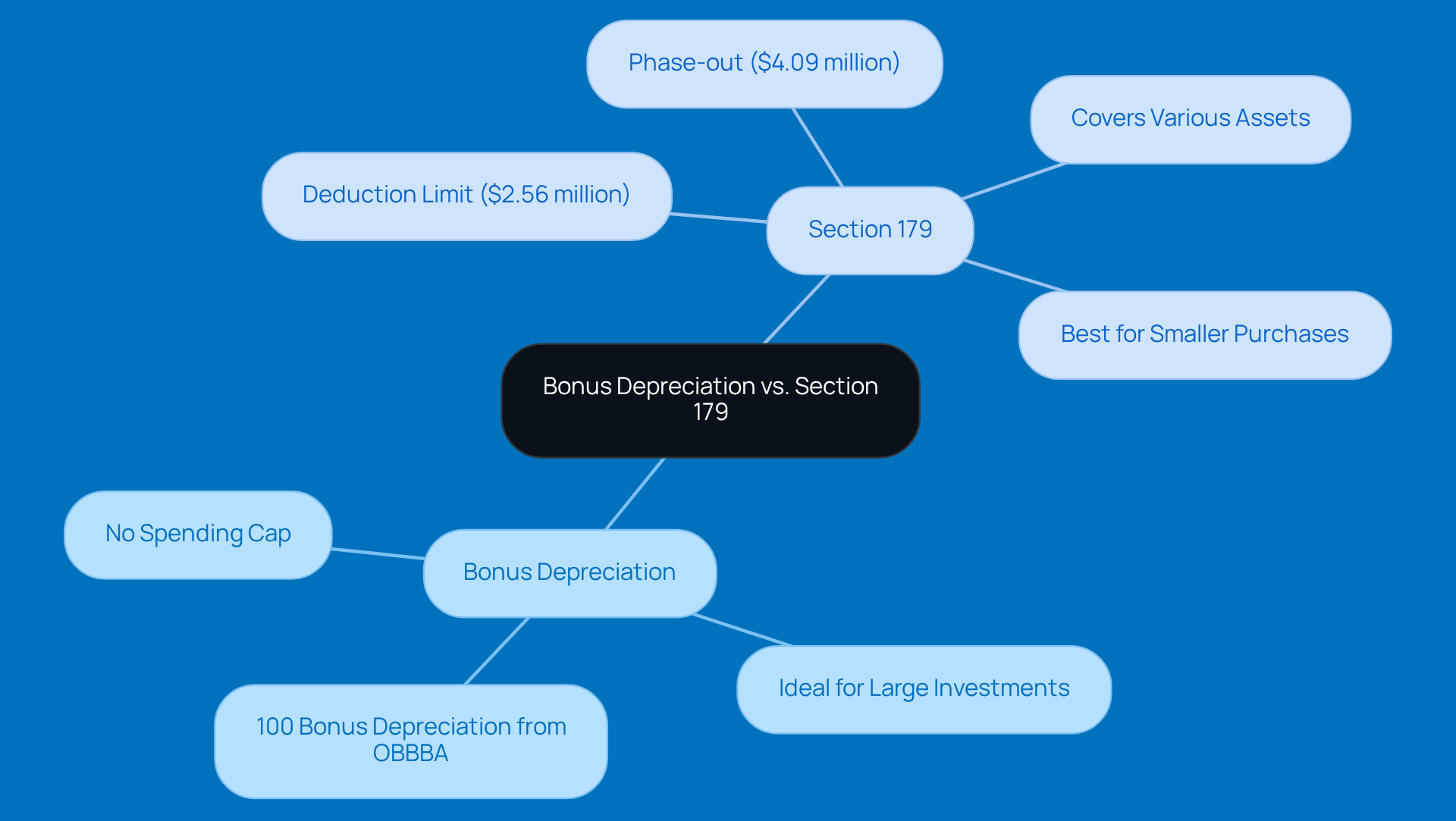

When you're weighing the options between bonus write-offs and Section 179, it’s super important to take a good look at your company’s financial situation. Bonus write-offs can be a real game-changer since they offer a bigger deduction without any spending cap. This is especially great for businesses that are making hefty capital investments.

On the flip side, Section 179 does have a limit on deductions - $2.56 million in 2026, with a phase-out starting at $4.09 million - but it covers a wider range of assets. Think machinery, packaging equipment, and computers. This makes it a solid choice for companies looking to maximize deductions on smaller purchases. For instance, if a production company is investing a lot in new gear, they might find those tax deductions really helpful because of the quick and unrestricted write-off potential.

Now, if you’re a small retail business making several smaller equipment buys, Section 179 could be your best friend. It allows for significant upfront deductions that can really boost your cash flow. Plus, don’t forget about the One Big Beautiful Bill Act (OBBBA), which brings back a 100% bonus depreciation example permanently for qualified property bought after January 19, 2025. This could definitely sway your decision-making process.

Understanding these differences is key for effective tax planning and optimizing your cash flow management. So, what’s your take? Have you thought about how these options could work for your business?

Conclusion

The 100% bonus depreciation strategy is a fantastic opportunity for small businesses to really optimize their tax positions and boost cash flow. By letting companies deduct the full cost of qualifying assets in the year they’re put into service, businesses can significantly lower their taxable income and free up some capital for reinvestment. This immediate financial perk is especially crucial for firms dealing with fluctuating market conditions and unexpected expenses.

Throughout this article, we’ve seen various real-world examples showcasing how bonus depreciation can be applied across different industries - from construction and heavy equipment purchases to aviation and marine sectors. Each case highlights how strategic planning and timely investments can lead to substantial tax savings and improve overall financial performance. Plus, combining Section 179 deductions with bonus depreciation opens up even more avenues for businesses to maximize their tax benefits, emphasizing the need for tailored financial strategies.

As we look ahead to the reinstatement of these deductions in 2025, it’s super important for small businesses to connect with financial advisors to navigate the complexities of tax planning. By grasping the nuances of these tax incentives and timing their capital investments just right, companies can not only boost their cash flow but also set themselves up for sustained growth and resilience in an ever-changing economic landscape. Taking proactive steps now can lead to significant long-term advantages, so it’s essential for business owners to explore how these deductions can work for them. What steps are you considering to make the most of these opportunities?

Frequently Asked Questions

What is 100% bonus depreciation?

100% bonus depreciation allows companies to deduct the full cost of qualifying assets in the year they start using them, significantly boosting cash flow and reducing taxable income.

How does 100% bonus depreciation benefit construction companies?

Construction companies can write off the entire cost of new machinery and equipment in the year of purchase, improving cash flow and enabling reinvestment in projects or workforce expansion.

What are the requirements for qualifying for 100% bonus depreciation?

To qualify, assets must be tangible, depreciable under MACRS, and put into service after January 19, 2025, and ready for use by December 31, 2025.

How can heavy equipment purchases utilize bonus depreciation?

Companies can deduct the entire purchase price of heavy machinery, such as trucks, in the first year, reducing their taxable income and freeing up cash for reinvestment.

What should companies consider when planning for bonus depreciation?

Companies should consult with financial advisors to navigate complexities and ensure proper timing and documentation, as the operational date of equipment can affect the deduction year.

What is the impact of the upcoming tax reform on bonus depreciation?

The reinstatement of full bonus depreciation in 2026 is expected to enhance financial performance, with companies reporting greater profitability and operational capacity due to tax savings on equipment purchases.

What is the Section 179 deduction limit for 2025?

The Section 179 deduction limit is set to rise to $1.25 million for 2025, providing additional opportunities for businesses to optimize cash flow through new equipment purchases.