Overview

Let’s talk about something that can really boost your business—finding the right accounting firm! This article shines a light on small accounting firms that offer tailored support services, with Steinke and Company taking center stage. Why Steinke? Well, they provide a fantastic range of specialized services like:

- Tax compliance

- Strategic planning

- Ongoing support

These are exactly what small businesses need to improve their financial health and operational efficiency.

Have you ever felt overwhelmed by the complexities of managing your business finances? Steinke and Company is here to help! Their approach is all about making things easier for you, so you can focus on what you do best. With their expertise, you can navigate the financial landscape with confidence and clarity. Plus, having that ongoing support means you’re never alone in this journey.

So, if you’re a small business owner looking for that extra edge, consider reaching out to firms like Steinke and Company. They’re not just about numbers; they’re about building lasting relationships and helping you thrive. Give it a thought—your business deserves the best support it can get!

Introduction

In a world where small businesses are constantly adapting, having the right support can truly make the difference between thriving and just getting by.

Let’s dive into the essential services that local accounting firms offer, and see how tailored business support can empower entrepreneurs like you to tackle financial challenges, boost operational efficiency, and align your core values with your growth strategies.

But with so many options out there, how do you find the perfect partner to help you reach your unique goals and navigate the hurdles of today’s market?

Steinke and Company: Expert Tax Compliance and Strategic Planning for Small Businesses

Steinke and Company has really made a name for itself as a go-to for specialized tax compliance and strategic planning services, especially for small businesses in service-oriented fields. They dive deep into the nitty-gritty of tax regulations, ensuring their clients stay compliant while working to reduce their tax liabilities. Their offerings include preparing and submitting both corporate and personal returns—essential for a smooth tax season!

What’s cool is that the company holds tactical planning meetings that help business owners align their financial goals with practical plans that promote sustainable growth and operational efficiency. They regularly assess potential tax savings and compliance risks, including strategies to dodge those pesky underpayment penalties. This proactive approach empowers clients to make informed decisions that can really boost their financial health. Did you know that businesses that engage in strategic planning are more likely to grow? In fact, firms with structured planning processes can see revenue increases of up to 30%! By tapping into these insights, Steinke and Company helps clients navigate the complexities of tax compliance while creating a growth-friendly environment.

And with the recent changes to COVID-19 tax benefits, the firm is all set to guide clients through these shifts and enhance their tax strategies for the upcoming season. So, if you’re feeling a bit lost in the tax maze, Steinke and Company has got your back!

Tailored Business Coaching: Aligning Values with Growth for Small Agency Owners

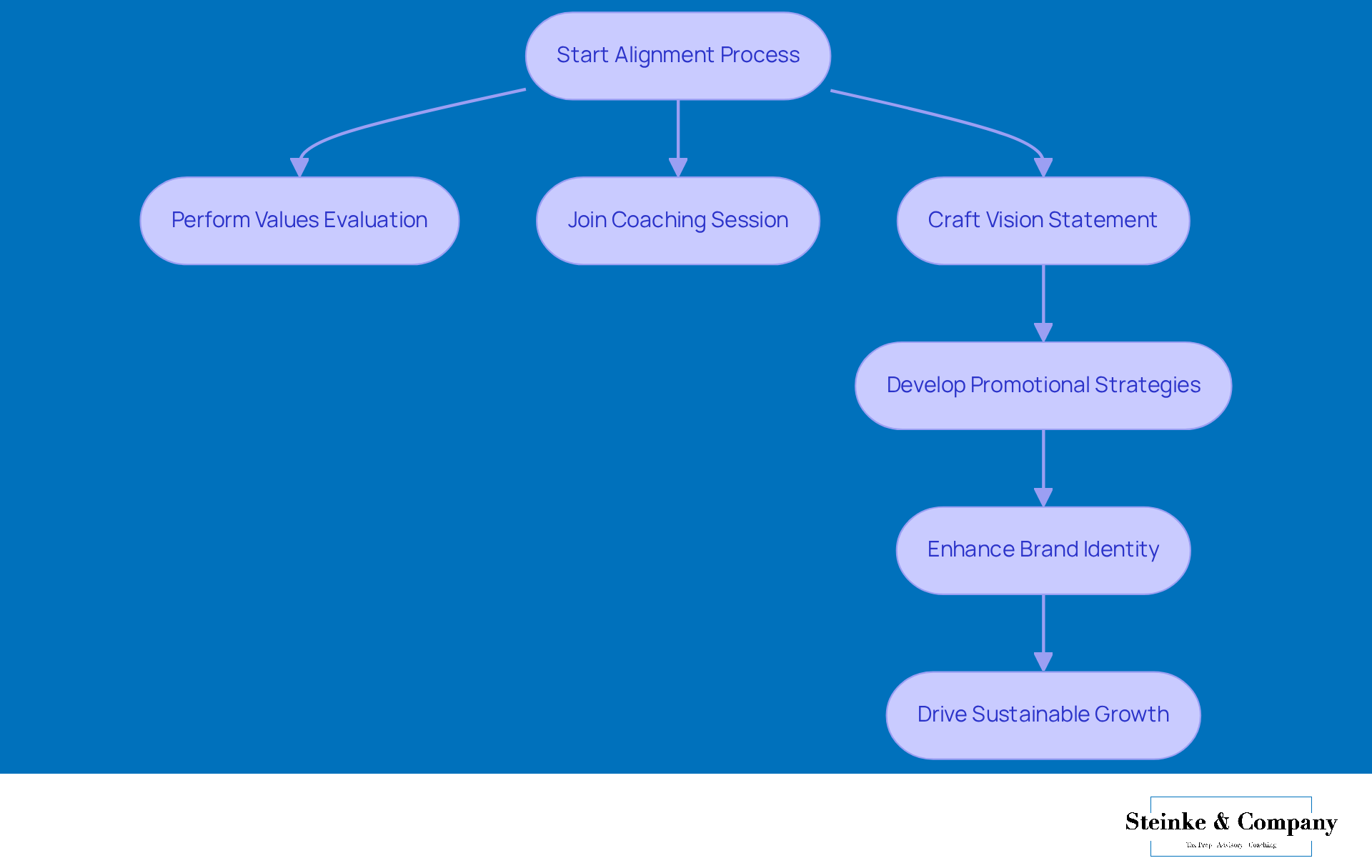

Customized coaching for enterprises is a key part of what we do at Steinke and Company. We're all about helping small agency owners harmonize their personal values with their growth. Why is this important? Well, when your values align with your business goals, decision-making becomes clearer, and you cultivate a deeper sense of purpose within your organization. Our coaches work closely with you to pinpoint those core values and weave them into your plans, ensuring that every choice you make is in sync with your mission.

For example, imagine a coaching session where you craft a vision statement that truly reflects your values. This statement can guide your promotional strategies and how you interact with customers, leading to a more cohesive brand identity. By embedding your personal values into the heart of your organization, you not only boost your performance but also forge a more authentic connection with your clients, paving the way for sustainable growth.

But that’s not all! Steinke and Company also offers expert corporate planning and advisory services, acting as your CFO in your corner. We provide regular check-ins and strategic planning sessions tailored to your goals—covering everything from pricing and cash flow to operations and scaling. By managing your books monthly and delivering reconciliations and reports, we ensure you have financial clarity and can make smart decisions without the stress.

Ready to kick off this alignment process? Small agency owners can start by performing a values evaluation or joining a coaching session to explore how their personal values can be integrated into their strategies. Ultimately, aligning your personal values with your organizational growth not only enhances your performance but also strengthens your connection with clients, driving that sustainable growth you’re aiming for.

Monthly Accounting Services: Ensuring Financial Health and Operational Efficiency

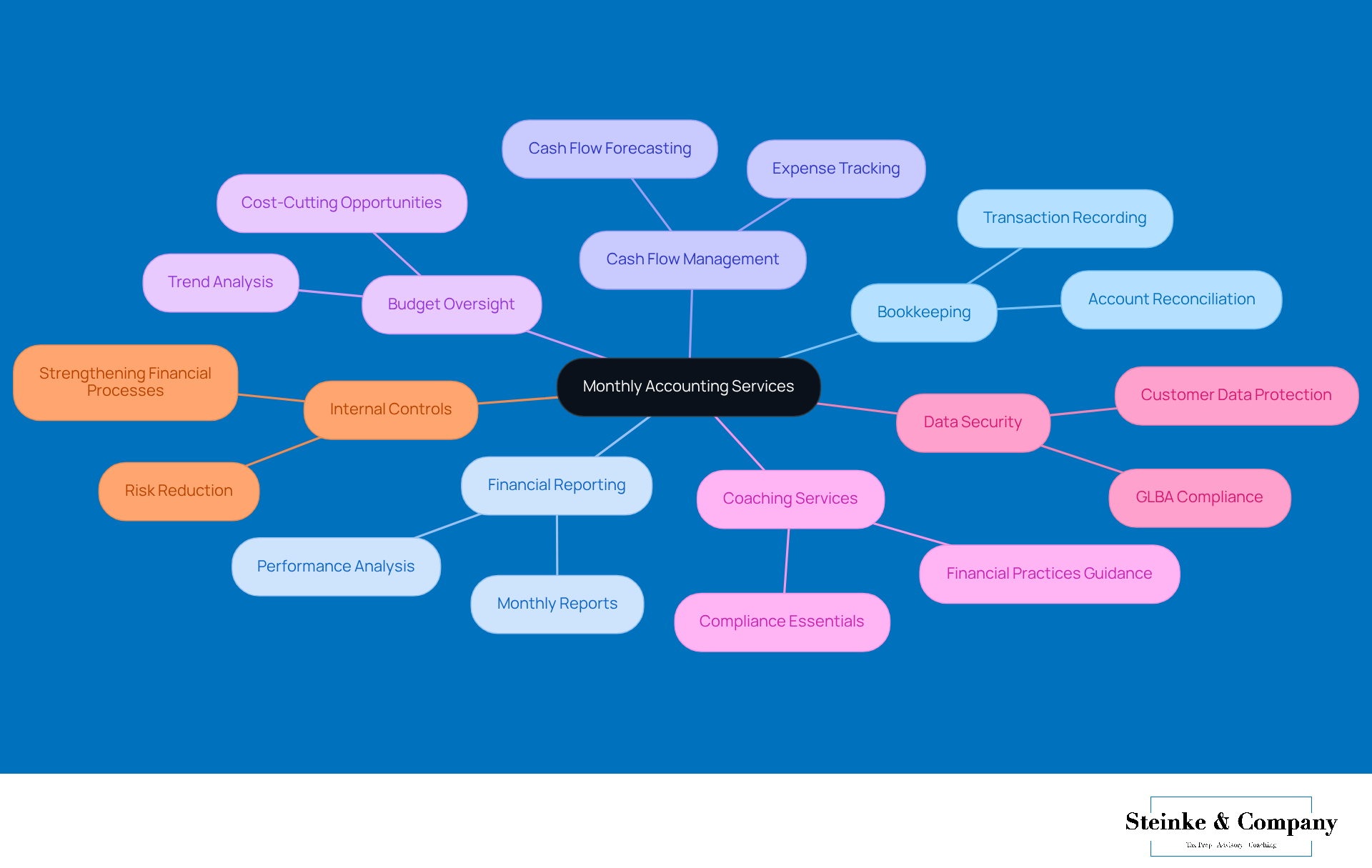

At Steinke and Company, we’re all about helping small accounting firms near me thrive with our essential monthly accounting services. Think of us as your financial sidekick, enhancing your economic well-being and operational effectiveness. Our offerings, like bookkeeping, financial reporting, and cash flow management, give you a clear view of your monetary landscape.

With regular budget oversight, you can spot trends, manage expenses, and make smart, data-driven decisions that fuel your growth. For instance, a monthly budget report might uncover chances to cut costs, allowing you to reallocate resources wisely and boost your profitability. Did you know that 35% of small and medium enterprises (SMEs) spend more time on accounting tasks than on growth initiatives? This highlights just how crucial effective resource management is for your business.

By utilizing the monthly accounting services of small accounting firms near me, you can focus on what you do best while we ensure your financial operations are smooth and transparent. Plus, our coaching services are here to guide you through financial practices and compliance essentials, helping you stay aligned with industry standards while promoting purposeful growth.

Working alongside CPAs can also strengthen your internal controls and reduce risks tied to reporting, making outsourcing a smart choice for many businesses. And let’s not forget about data security! We stress the importance of following the Gramm-Leach-Bliley Act (GLBA) Safeguards Rule to protect customer data. After all, safeguarding your customers' information builds trust and keeps them coming back for more!

Startup Consultations: Establishing Effective Financial Systems for New Businesses

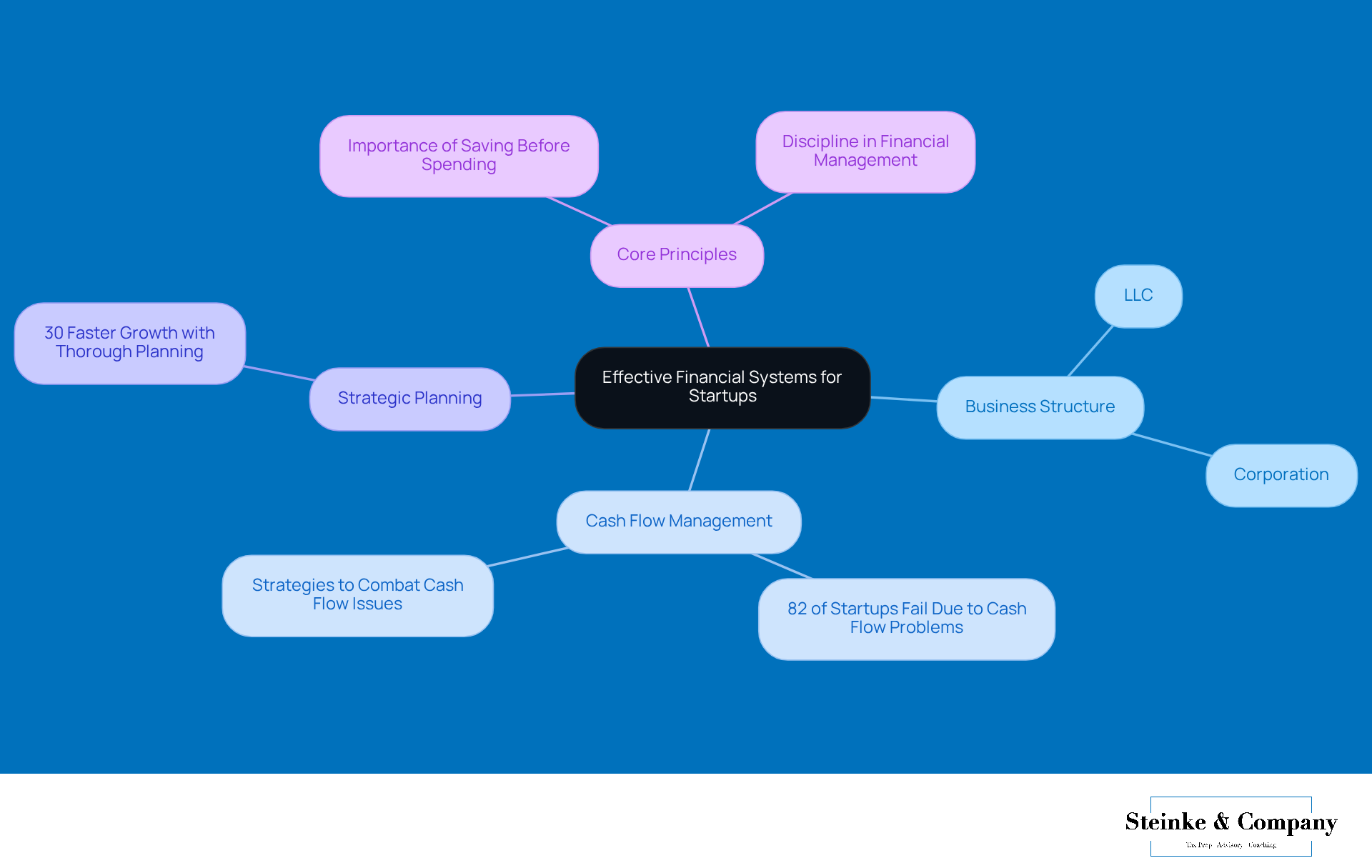

At Steinke and Company, our startup consultations are all about helping new businesses set up strong financial systems that are crucial for long-term success. Our experienced consultants work closely with clients to choose the right business structure—whether it's an LLC or a corporation—tailored to their unique needs and financial goals. For example, we might help an entrepreneur navigate the tricky waters of liability protection and tax implications, making sure the chosen structure supports their growth ambitions and keeps them compliant.

Now, let’s talk about cash flow. Did you know that nearly 82% of startups fail due to cash flow problems? That’s a staggering number! By putting solid accounting practices and financial controls in place, new businesses can reduce risks and boost their operational efficiency. And here’s a fun fact: startups that develop thorough plans actually grow 30% faster than those that don’t. This really highlights how important it is to have a strategic financial plan right from the start.

In today’s competitive world, having a solid financial foundation isn’t just a nice-to-have; it’s essential for survival and growth. As Warren Buffett wisely puts it, 'Do not save what is left after spending; instead, spend what is left after saving.' This principle is key for entrepreneurs looking to build a sustainable business model. So, let’s make sure you’re set up for success!

Strategic Planning Sessions: Identifying Opportunities and Enhancing Business Performance

Strategic planning sessions at Steinke and Company are super important for uncovering growth opportunities and boosting overall performance. In these sessions, we dive deep into the commercial landscape, check out the competitive context, and assess our internal strengths. This thorough examination helps our clients craft practical plans that really drive growth.

For instance, during a strategic planning session, businesses might spot emerging market segments that align perfectly with their strengths. This kind of insight can lead to the creation of targeted marketing strategies aimed at engaging these specific audiences effectively. Looking ahead to 2025, current trends in market segmentation highlight how crucial it is to understand customer needs and preferences. This understanding allows service-oriented firms to tailor their offerings just right.

Effective market segmentation often involves using data analytics and comprehensive market research to pinpoint areas of opportunity. By honing in on strategic planning, organizations can not only adapt to changing market conditions but also position themselves to seize new trends and meet customer needs. As industry specialists often say, keeping a close eye on customers and understanding their challenges is key to spotting viable opportunities. This ensures that strategies are both relevant and meaningful.

Tax Planning Services: Minimizing Burdens and Preparing for Tax Season

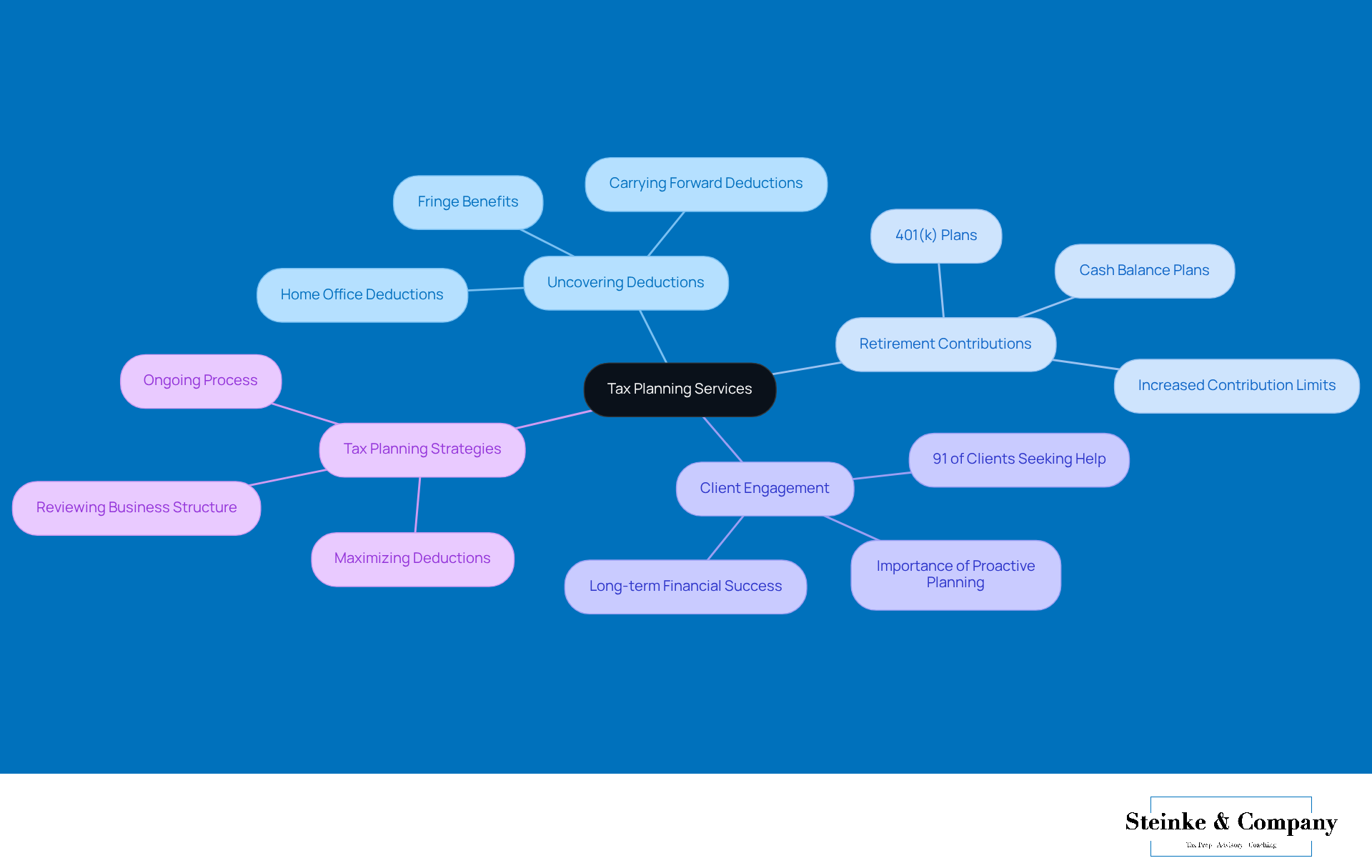

Tax planning services from Steinke and Company are a game changer for small businesses looking to lighten their tax load and navigate the complexities of tax season with ease. By keeping a close eye on your financial landscape throughout the year, we help you uncover potential deductions and credits that could lead to some serious savings on your tax bill.

For example, a proactive tax planning session might just open the door to opportunities like boosting your retirement contributions. Whether it's switching to a 401(k) or setting up a Cash Balance Plan, these strategies not only bolster your retirement savings but also lower your company's taxable income. It's a win-win! In fact, businesses that regularly engage in tax planning discussions often see a noticeable drop in their average tax liabilities, which could be especially beneficial in 2025 with new regulations on the horizon.

And here's a fun fact: 91% of clients are actively seeking tax planning help! This shows that small business owners really get the importance of being proactive rather than just ticking boxes for compliance. By tapping into this knowledge, Steinke and Company empowers its clients to not just react to changes, but to thrive in the midst of them, paving the way for long-term financial success and smooth operations.

Holistic Business Support: Integrating Strategy, Technology, and Coaching

Steinke and Company takes a holistic approach to business support, blending strategy, technology, and coaching into one seamless service model. This integration helps customers tackle the complexities of their operations, especially when aiming to grow from $1 million to $10 million in revenue.

By combining strategic planning with cutting-edge technology solutions, the firm empowers clients to adopt software that not only streamlines processes but also aligns with their long-term goals. This synergy boosts productivity and profitability, allowing businesses to thrive in a competitive landscape. Plus, recognizing the importance of financial and tax planning, Steinke and Company aids clients in dodging budgeting pitfalls, ensuring they’re set for future growth.

Did you know that 85% of small business owners say they’ve found success through technology integration? By the end of 2023, 68% had even set up a website, thanks in part to the guidance from Steinke and Company. As digital transformation accelerates, small enterprises are realizing the need to embrace innovative tools to remain agile and responsive to market shifts. In fact, 54% of small business leaders feel ready for market changes, thanks to the adoption of AI and automation—showing just how crucial technology is in today’s operations and how Steinke and Company supports this journey.

Moreover, as businesses increasingly adopt a holistic marketing strategy, they can look forward to better customer experiences and improved internal collaboration. This approach not only fosters proactive communication between departments but also ensures that all parts of the organization are working toward a common goal, ultimately driving success and growth. And with data security becoming ever more important, Steinke and Company emphasizes compliance with regulations like the GLBA, helping clients protect sensitive customer information and build trust in their practices.

Operational Efficiency: Streamlining Processes for Small Agency Success

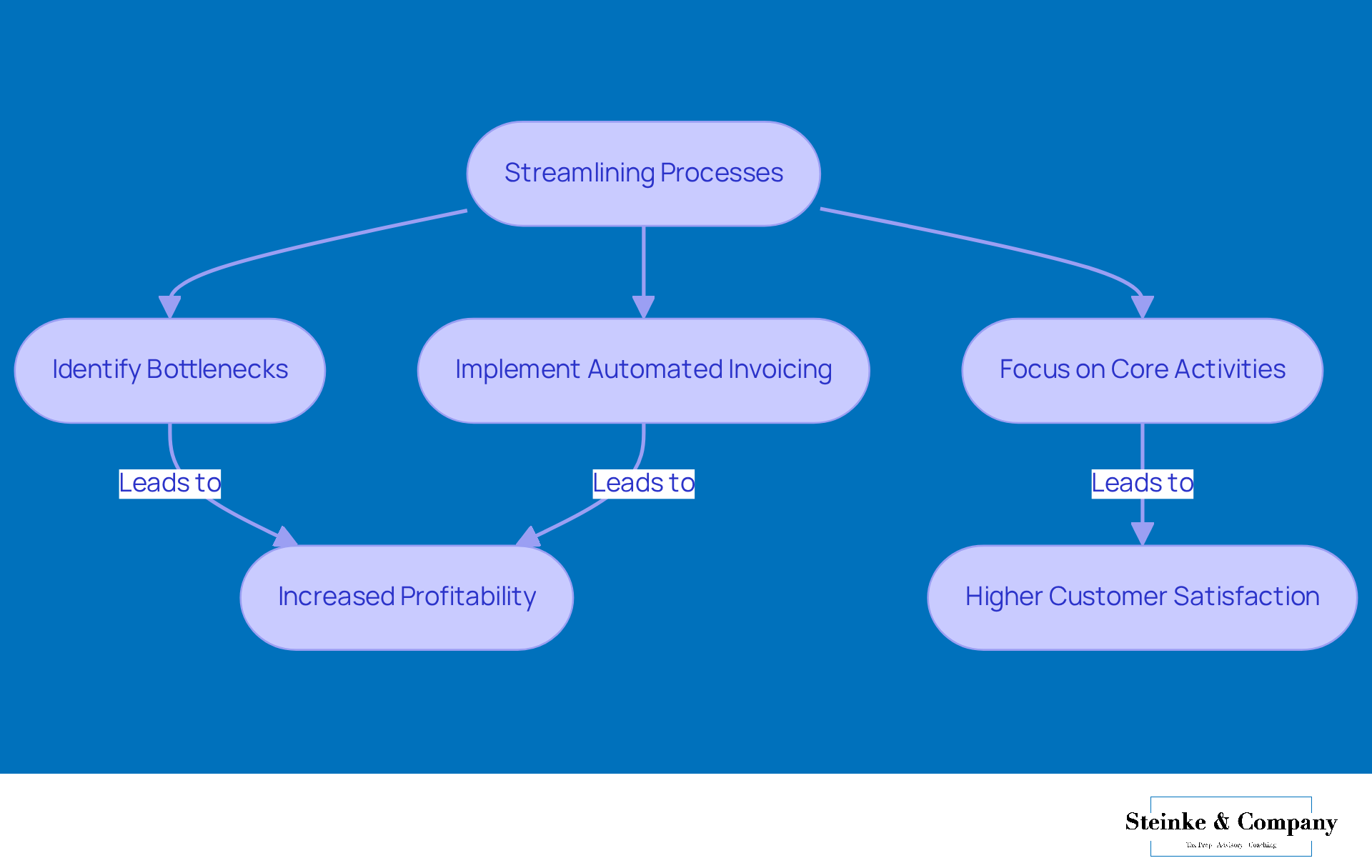

At Steinke and Company, we believe that operational efficiency is key to success, especially for small agencies. We focus on streamlining processes to help you thrive. By taking a close look at your existing workflows and identifying those pesky bottlenecks, we can offer tailored recommendations that not only boost efficiency but also cut down on operational costs.

Take automated invoicing systems, for example. Implementing these can save you a ton of time and minimize mistakes, freeing you up to concentrate on what really matters—your core activities—rather than getting bogged down by administrative tasks. This approach is right in line with what’s happening across the industry. Organizations that embrace automation can see revenue increases of about 32% and a boost in customer satisfaction too!

And it doesn’t stop there. Streamlining your processes can lead to a 15% increase in profitability. That’s a clear win! So, if you’re looking to enhance your service-oriented firm, consider the tangible benefits of operational improvements. Ready to take the next step?

Client Acquisition Strategies: Overcoming Challenges with Targeted Support

When it comes to client acquisition, small businesses really need to get creative to tackle market challenges and grow their customer base. That’s where Steinke and Company steps in! We help our clients craft targeted marketing strategies that resonate with their ideal audience, making sure their outreach is both effective and efficient.

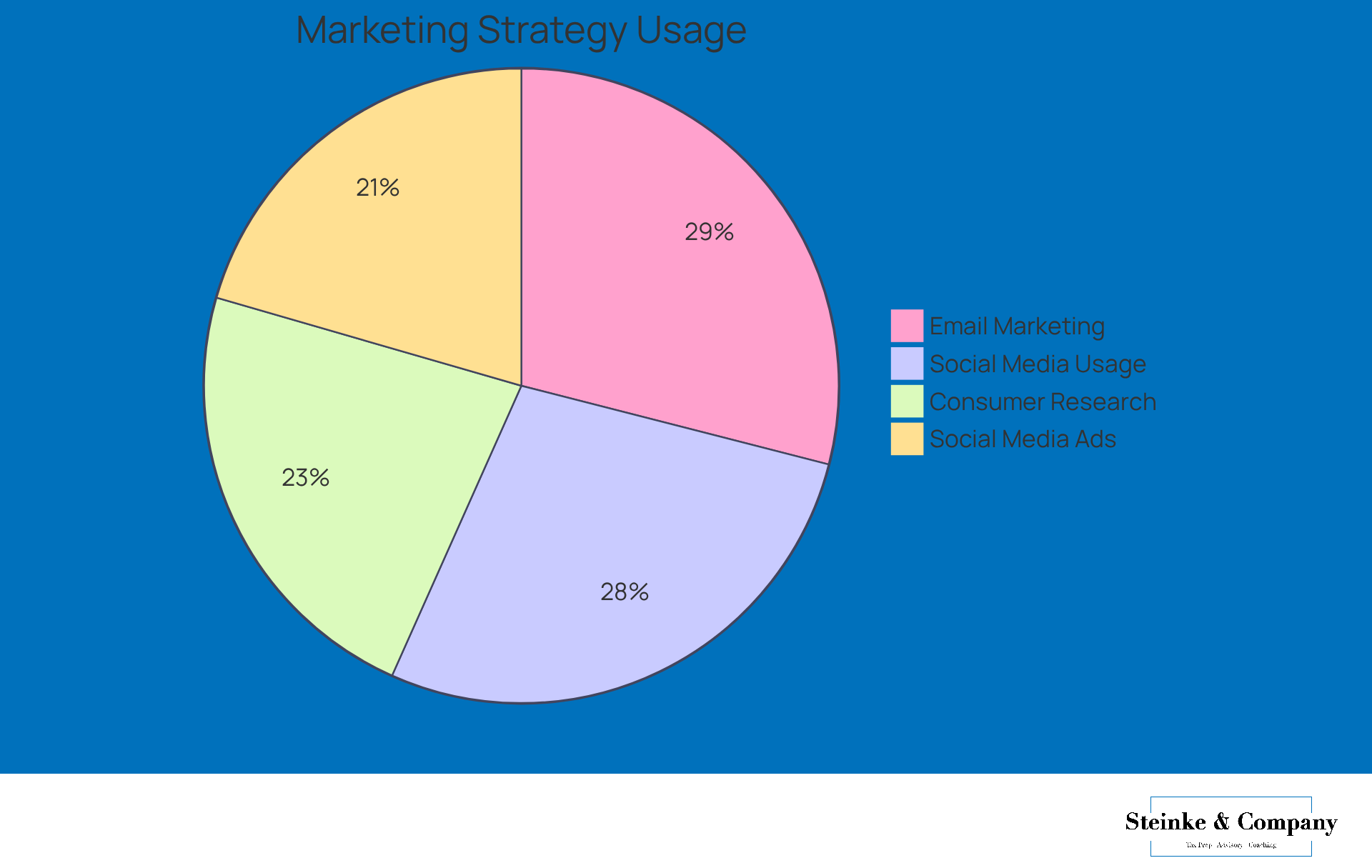

Take social media, for example. It’s a game-changer for expanding your audience reach! Did you know that:

- 85% of small businesses are using these platforms to promote themselves?

- 63% say social media ads are their most effective marketing strategy?

- 70% of consumers do their homework on small businesses before making a purchase?

Having a solid social media presence is essential.

By focusing on tailored campaigns, businesses can really ramp up their marketing efforts, leading to sustainable growth and stronger customer relationships. And let’s not forget about email marketing—89% of marketers rely on it for lead generation. This just goes to show how important it is to mix things up when it comes to attracting customers. So, what strategies are you considering for your business?

Ongoing Support and Check-Ins: Adapting and Thriving in a Changing Business Landscape

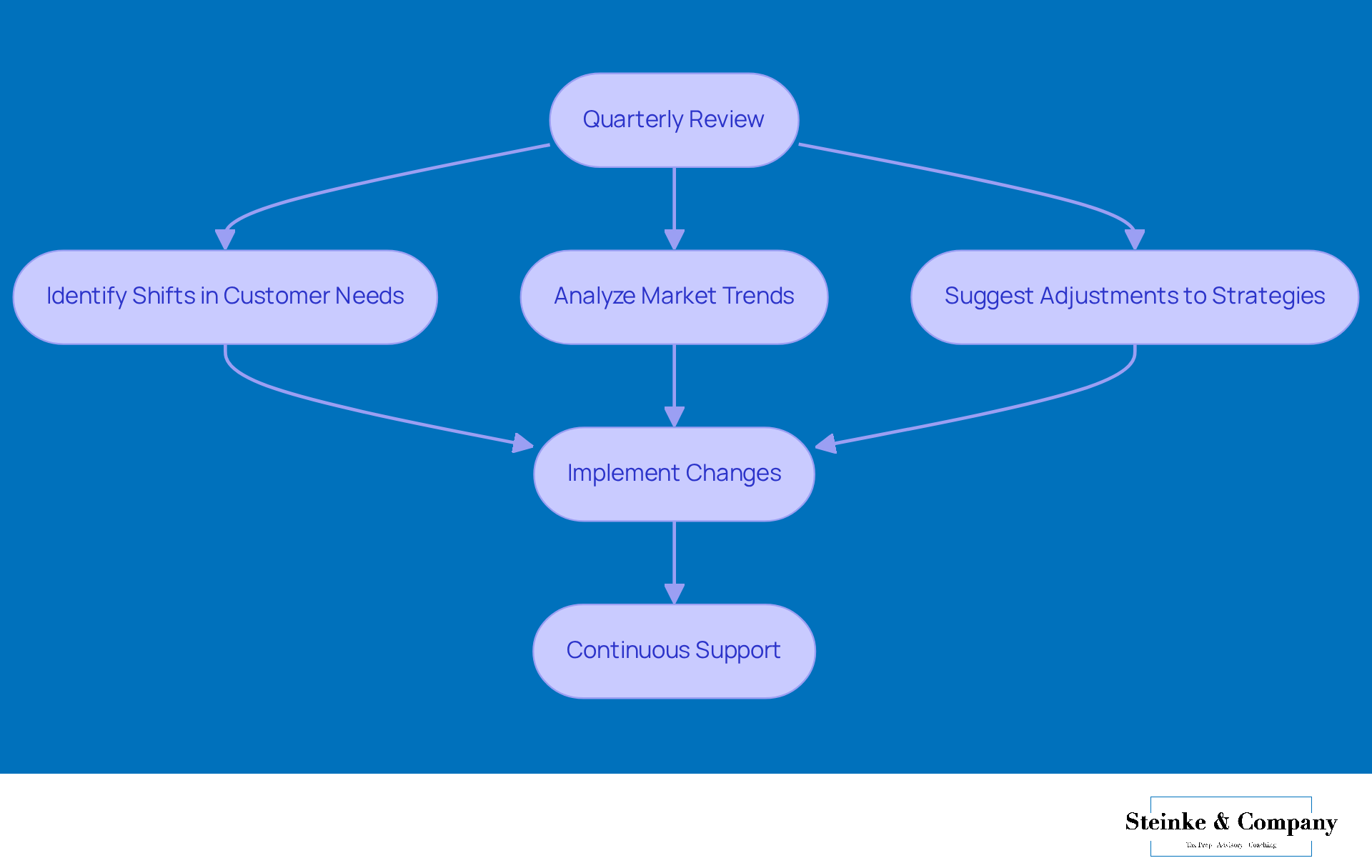

At Steinke and Company, we believe that continuous support and regular check-ins are essential for helping our customers thrive in today’s fast-paced business world. These proactive interactions allow us to make quick adjustments to our strategies, keeping everything in sync with the latest market trends and performance metrics.

Take a quarterly review, for example. It’s a great opportunity to spot any shifts in customer needs or new market trends. When we notice these changes, we can suggest tweaks to service offerings or marketing strategies. This kind of adaptability not only helps our clients stay competitive but also nurtures a culture of ongoing improvement. As the landscape shifts, being able to pivot and refine our approaches is crucial for sustaining growth and success.

So, how do you stay ahead in your business? Let’s chat about it!

Conclusion

Steinke and Company really shows how small accounting firms can make a big difference for businesses by offering tailored services that meet specific financial needs. They focus on key areas like tax compliance, strategic planning, and operational efficiency, helping clients navigate the sometimes tricky financial waters while promoting sustainable growth and development.

Throughout the article, we’ve seen how crucial it is to align personal values with business strategies, set up effective financial systems, and have ongoing support to adapt to market changes. Whether it’s monthly accounting services that keep finances in check or startup consultations that lay the foundation for future success, every service is crafted to boost operational efficiency and drive performance.

In today’s fast-paced business world, the importance of proactive financial management and strategic planning is hard to ignore. Partnering with a firm like Steinke and Company not only simplifies the complexities of accounting but also helps businesses thrive in the face of challenges. So, small business owners, it’s time to take action! Whether you’re looking for personalized coaching, optimizing your financial systems, or embracing technology, there are plenty of ways to secure a bright future and reach your growth goals.

Frequently Asked Questions

What services does Steinke and Company offer for small businesses?

Steinke and Company provides specialized tax compliance and strategic planning services, including preparing and submitting both corporate and personal tax returns, tactical planning meetings, and assessments of potential tax savings and compliance risks.

How does Steinke and Company help businesses with tax compliance?

They ensure clients stay compliant with tax regulations while working to reduce tax liabilities, and they help navigate complexities, especially with recent changes to COVID-19 tax benefits.

What is the significance of strategic planning for small businesses?

Engaging in strategic planning can lead to revenue increases of up to 30%, as it helps align financial goals with practical plans, promoting sustainable growth and operational efficiency.

How does Steinke and Company assist small agency owners with coaching?

They offer customized coaching to help small agency owners align their personal values with their business goals, enhancing decision-making and fostering a deeper sense of purpose within the organization.

What are the benefits of integrating personal values into business strategies?

Aligning personal values with business goals leads to clearer decision-making, a cohesive brand identity, and a stronger connection with clients, which contributes to sustainable growth.

What monthly accounting services does Steinke and Company provide?

They offer bookkeeping, financial reporting, cash flow management, and budget oversight to enhance financial health and operational efficiency for small accounting firms.

Why is effective resource management important for small and medium enterprises (SMEs)?

Many SMEs spend more time on accounting tasks than on growth initiatives, making effective resource management crucial for focusing on growth and profitability.

How does Steinke and Company ensure data security for their clients?

They emphasize compliance with the Gramm-Leach-Bliley Act (GLBA) Safeguards Rule to protect customer data, which builds trust and encourages customer loyalty.