Overview

Hey there, small business owners! Did you know that you can maximize your savings and stay compliant with some smart tax strategies? It’s all about leveraging those available deductions and credits, plus getting a little professional guidance. Implementing year-round tax planning is key, and don’t forget to keep those detailed records handy. Staying updated on tax law changes is super important too!

These practices not only help reduce your tax liabilities but also boost the overall financial health of your business. Think of it as a way to keep your financial house in order. So, how are you planning to tackle your taxes this year? Let’s make sure you’re set up for success!

Introduction

Navigating the intricate world of small business taxes can feel overwhelming for entrepreneurs, right? With regulations getting more complex every day, it's easy to get lost. But here’s the good news: understanding and implementing effective tax strategies can lead to significant savings and keep you compliant, setting your business up for success.

What if I told you that the secret to maximizing your financial health is all about proactive tax planning and taking advantage of available credits? In this article, we’ll dive into ten essential small business tax strategies that can help you reduce liabilities, boost compliance, and ultimately drive sustainable growth. So, let’s explore these strategies together!

Steinke and Company: Comprehensive Tax Compliance Services for Small Businesses

Steinke and Company provides a variety of small business tax strategies tailored for micro and small enterprises, especially those in service-oriented sectors. By breaking down the complexities of tax regulations, they help clients stay compliant while maximizing their savings. Their experienced team is here to provide personalized consultations, meticulous tax preparation, and strategic planning, making them a trusted ally for entrepreneurs navigating a competitive landscape.

Now, let’s talk about why effective small business tax strategies are crucial for micro enterprises. Not only do they help reduce risks, but they also boost overall performance. When businesses utilize tax compliance services, they enjoy less stress during tax season, fewer surprises, and the freedom to focus on what they do best. In fact, companies that prioritize tax compliance often see better success rates because they can allocate resources more efficiently and take advantage of available tax incentives.

With recent updates in tax compliance, the landscape is getting more complex. Compliance costs are expected to hit around $546 billion annually! This really underscores the need for smaller enterprises to seek expert guidance. As industry experts point out, the burden of tax compliance tends to weigh heavier on smaller businesses, so it’s vital for them to implement small business tax strategies to thrive. Steinke and Company really shines by blending planning, strategy, and coaching into their service model, ensuring clients not only meet compliance requirements but also achieve sustainable growth.

To steer clear of underpayment penalties, owners of small businesses should keep an eye on specific small business tax strategies like safe harbor payments, which allow them to prepay a minimum amount of their tax obligation, and the de minimis exception, which can exempt them from penalties if their total tax liability is under $1,000. Consulting with a tax professional can be a game-changer in navigating these complexities and avoiding costly penalties. So why wait? Take action today to get your enterprise on the right track for tax compliance and savings!

Maximize Deductions and Credits: Essential Strategies for Tax Savings

To maximize your tax savings, small business owners must utilize small business tax strategies to pinpoint all eligible deductions and credits. Common deductions, which are important in small business tax strategies, can include essential operational costs like office supplies, travel, and utilities, helping to shrink your taxable income. For instance, everyday expenses such as pens, paper, and software subscriptions are fully deductible, allowing you to account for those must-have supplies while also cutting down on your tax bill. Plus, implementing small business tax strategies like the Small Business Health Care Tax Credit can lead to significant savings, easing some financial stress.

Looking ahead to 2025, local businesses can tap into various tax credits, especially those aimed at boosting employee health and wellness programs. Not only do these initiatives uplift workplace morale, but they also provide advantages through small business tax strategies! Staying informed about small business tax strategies, including the ability for independent entrepreneurs to deduct 50% of meal and entertainment costs directly tied to generating income, is key to reducing overall tax liabilities.

Moreover, planning the timing of your purchases and expenses can significantly improve your small business tax strategies for maximizing deductions in the current tax year. Investing in professional services, like accounting or legal advice, is fully deductible and can lead to greater savings than their costs. Also, keeping an eye on your paystubs is important to ensure the right amount of taxes is withheld, helping you avoid surprises when tax time rolls around. Don’t forget, maintaining proper receipts and documentation is essential for claiming these deductions and staying compliant with tax regulations. By effectively using small business tax strategies, you can significantly lower your tax liabilities, which allows you to reinvest in growth and boost your overall financial health.

Implement Year-Round Tax Planning: Avoid Last-Minute Issues and Optimize Finances

Implementing year-round small business tax strategies is crucial for small business owners who want to effectively manage their tax obligations and make smart financial decisions. By chatting regularly with a tax expert, you can spot potential issues early and tweak your strategies before they become a problem. This not only takes the stress out of tax season but also boosts your overall financial health.

Understanding your paystub is a key part of this process. It ensures you’re getting paid accurately and that the right amounts are being deducted for your obligations. Many independent entrepreneurs might overlook the importance of checking their paystubs, but doing so can help you avoid costly mistakes when tax season rolls around.

Did you know that businesses that implement small business tax strategies throughout the year are more likely to improve their finances? They can take full advantage of available deductions and credits. By prioritizing proactive tax strategies, you can navigate the tricky world of tax regulations and strengthen your financial stability. So, why not start the conversation today?

Choose the Right Business Structure: Impact on Tax Obligations and Efficiency

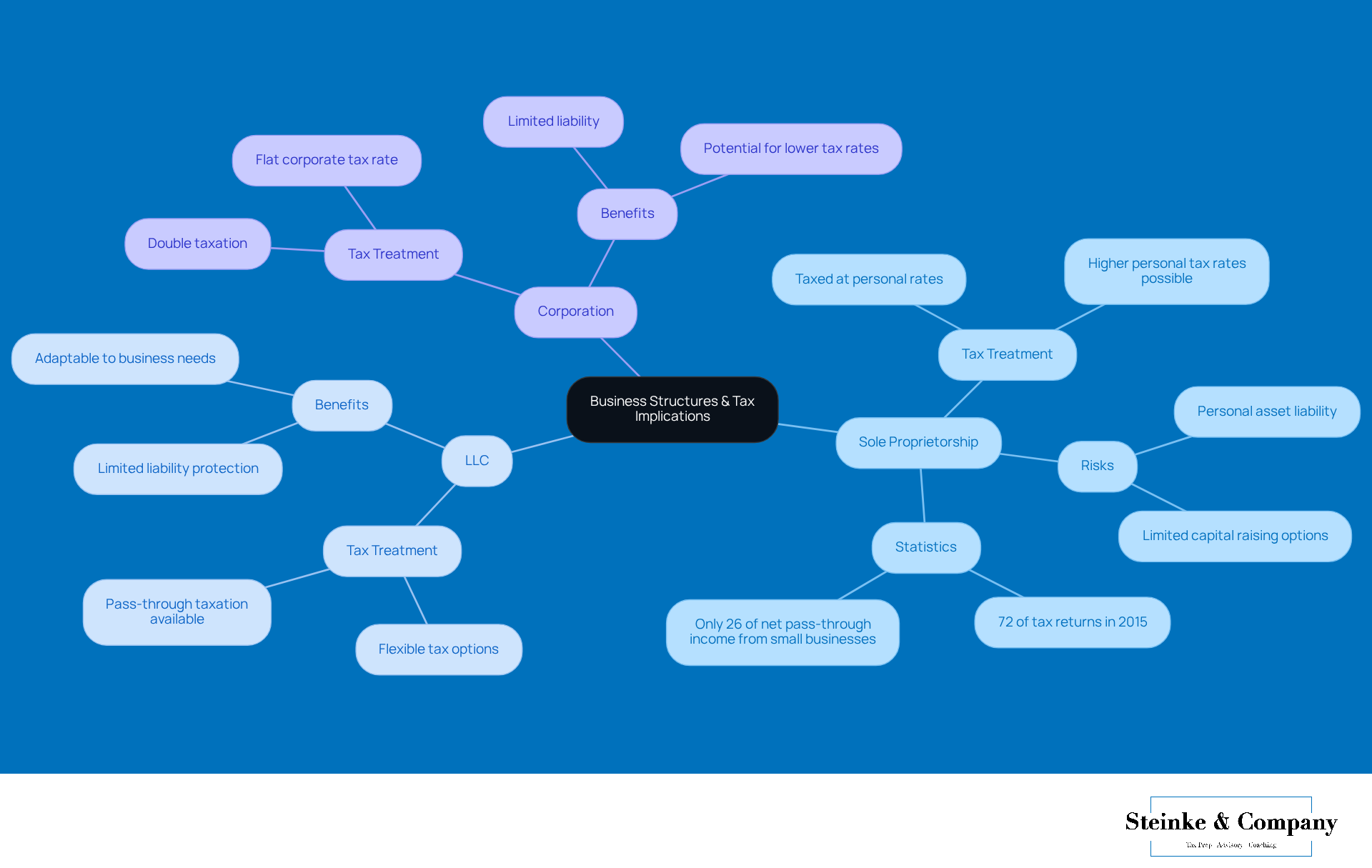

Choosing the right organizational structure—be it a sole proprietorship, LLC, or corporation—can greatly influence your small business tax strategies and potential savings. Each type has its own tax treatment that affects how your income is taxed and what deductions you can claim when considering small business tax strategies. For example, sole proprietorships can put your personal assets at risk and often lead to higher personal tax rates. On the flip side, LLCs provide a bit more flexibility in how you're taxed and offer limited liability protection.

Did you know that in 2015, sole proprietorships made up a whopping 72% of tax returns? Yet, only 26% of net pass-through income came from actual small businesses. This shows that many of those pass-throughs aren't as small as they seem! So, if you're an entrepreneur, it is a smart move to chat with a tax expert about small business tax strategies. They can help you navigate these tricky waters, ensuring you pick a structure that fits your goals and maximizes your small business tax strategies.

As Jackie Cunningham points out, understanding the implications of different structures can lead to informed decisions that pave the way for long-term success in your business. So, what structure are you thinking about? It’s worth considering how it aligns with your vision!

Utilize Available Tax Credits: Unlock Financial Relief for Your Business

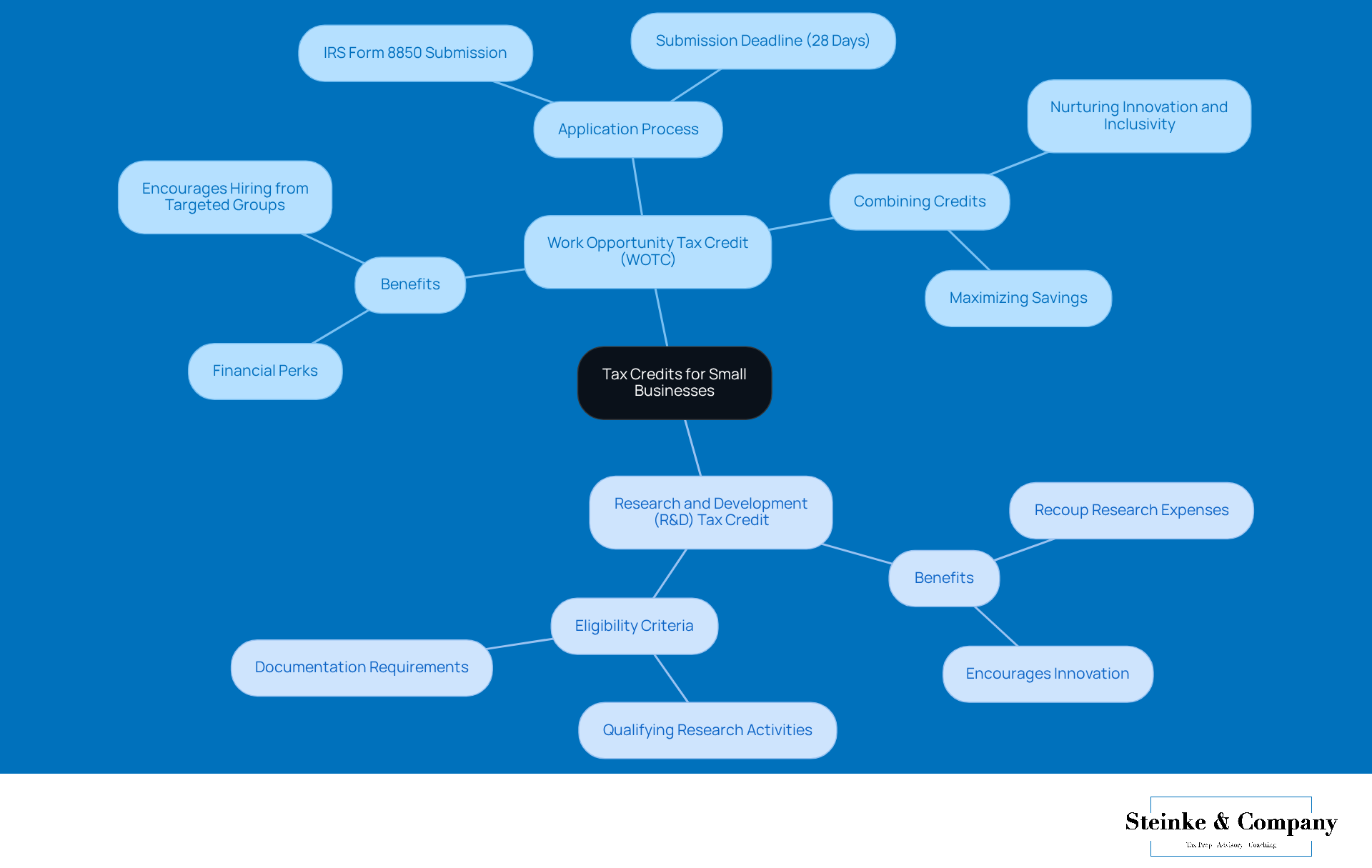

Small enterprises can effectively reduce their tax bills by actively pursuing small business tax strategies and available tax credits. Two standout options are the Work Opportunity Tax Credit (WOTC) and the Research and Development (R&D) Tax Credit, both of which can offer significant financial perks. For instance, WOTC encourages companies to hire individuals from targeted groups, with credits that can add up to thousands of dollars for each qualified hire. If you're looking to apply for WOTC, just remember that company leaders need to fill out IRS Form 8850 and submit it to their state workforce agency within 28 days of the employee's start date.

The impact of WOTC can be game-changing; businesses that take advantage of this credit can boost their cash flow and reinvest in growth opportunities. On the flip side, the R&D Tax Credit rewards companies for their innovative efforts, allowing them to recoup part of their research expenses. By getting a handle on the eligibility criteria and application processes for these credits, small business owners can utilize small business tax strategies to tap into valuable resources that enhance their bottom line.

But wait, there’s more! Combining the benefits of WOTC with the R&D Tax Credit can lead to even greater savings since companies can claim both for eligible activities and hires. This strategic move not only incorporates small business tax strategies to lower tax liabilities but also nurtures a culture of innovation and inclusivity within the workforce. So, embracing these credits is a smart way to maximize savings and stay compliant in today’s ever-changing business landscape. Why not explore these opportunities and see how they can work for you?

Leverage Income Splitting: Reduce Your Overall Tax Burden

Income splitting is a smart strategy that involves sharing income among family members or partners to take advantage of those lower tax brackets. This can really lighten the tax load through effective small business tax strategies! Entrepreneurs can significantly reduce their tax responsibilities by using small business tax strategies, such as transferring income to family members who earn less. For instance, families can enjoy tax-free capital gains up to $24,000 each year and dividend income up to $50,000. That’s a nice boost to overall savings, right?

But hold on—navigating this strategy means keeping an eye on IRS regulations to steer clear of any penalties. The IRS has specific rules about income splitting, especially with the Tax on Split Income (TOSI) guidelines, which can make things a bit tricky. It’s important for entrepreneurs to ensure that any income given to family members is justifiable and matches the services they provide to the business.

Let’s look at how effective income splitting works in real life. Imagine an entrepreneur paying a salary to a partner or child who’s actively helping out in the business. This way, they can shift income to take advantage of those lower tax rates. Plus, employing small business tax strategies like using family trusts can be a game-changer for income splitting. Parents or grandparents can lend money at the CRA prescribed interest rate, helping lower-income family members enjoy tax-efficient income distribution.

As we look ahead to 2025, with IRS regulations constantly changing, it’s crucial for entrepreneurs to stay informed. Consulting tax experts, like those at Steinke and Company, can help ensure you’re following the rules while maximizing your small business tax strategies through income splitting. Don’t forget to regularly review your strategies to adapt to any financial changes and keep your tax efficiency in check. Starting with a conversation with an accounting firm that understands both the legal landscape and your business needs is a smart move. This proactive approach not only aids in effective tax planning but also helps minimize surprises during tax season and eases the stress of potential IRS audits.

Maintain Detailed Records: Essential for Maximizing Deductions and Compliance

Keeping thorough and orderly documentation is super important for entrepreneurs, right? We're talking about receipts, invoices, and financial statements that back up those deductions you claim on your tax returns. Good record-keeping not only makes tax season a breeze, but it also provides essential documentation if you ever face an audit. Did you know that small businesses with messy records tend to get audited more often? That just goes to show how crucial it is to manage your finances carefully.

So, how can you make this easier? Implementing a reliable accounting system can really streamline the whole process, helping you keep track of your expenses and income without the headache. A few best practices include:

- Regularly updating your records

- Categorizing transactions as they come in

- Using accounting software to automate some of those tedious tasks

By adopting these small business tax strategies, you can maximize your tax deductions and stay compliant, which is a win for your financial health!

Engage Professional Tax Services: Gain Expert Guidance and Support

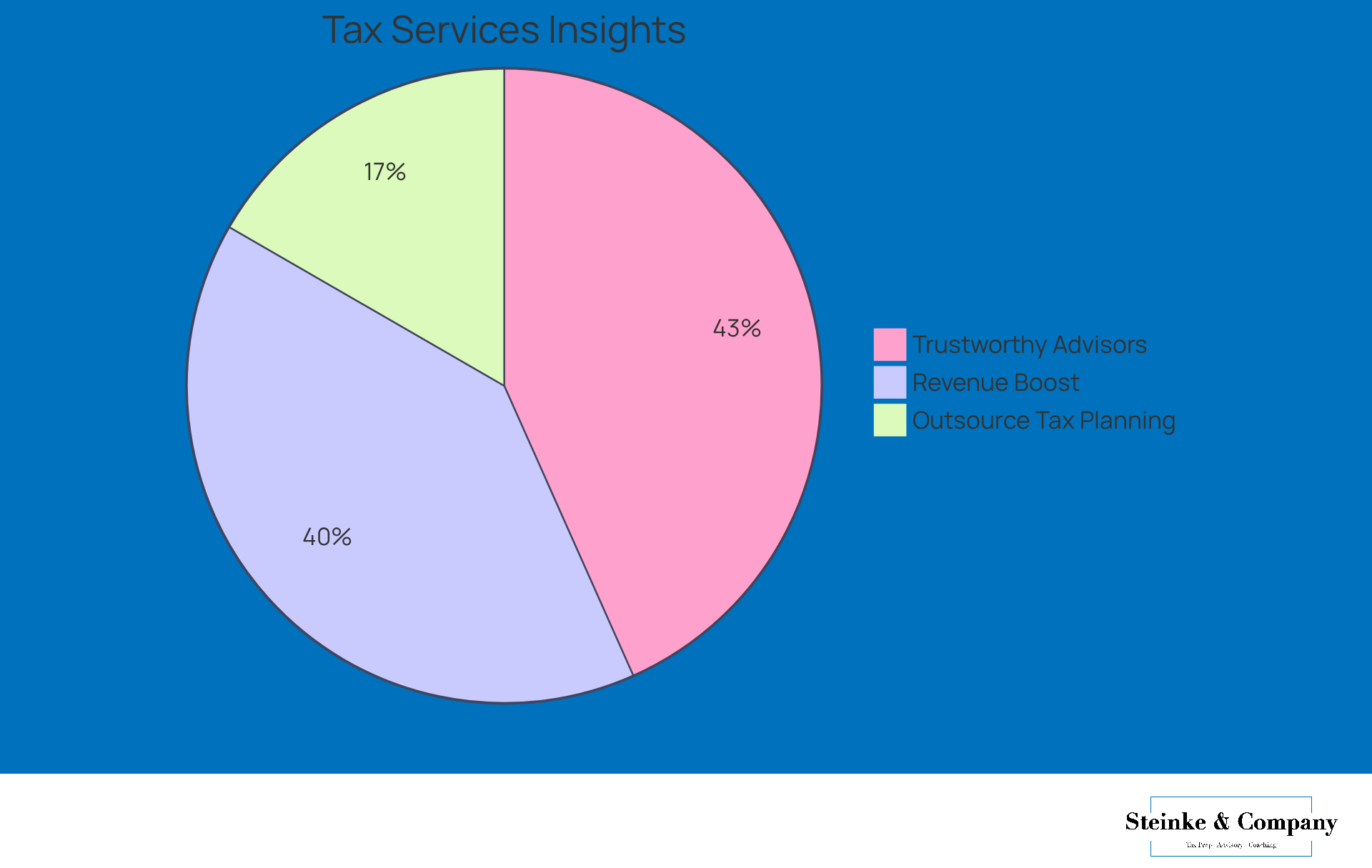

Utilizing expert small business tax strategies can significantly benefit small business owners. Tax compliance specialists provide tailored advice on small business tax strategies that assist businesses in maximizing deductions and credits while adhering to the rules. This kind of support not only eases the stress of tax season but also lets owners concentrate on what they do best—running their business.

Did you know that about 30% of small businesses choose to outsource their tax planning? This trend shows just how much these businesses rely on tax experts. Plus, hiring a tax advisor can actually save money; many clients discover that the savings from eligible deductions often outweigh the advisor's fees. For example, a whopping 72% of accounting and bookkeeping firms reported a revenue boost last year, thanks in part to enhanced services like tax advisory.

And here’s something interesting: 78% of small to medium-sized businesses consider having a trustworthy tax advisor very important. This really highlights how professional tax services can build trust and ensure compliance. By tapping into expert advice, small businesses can effectively navigate the complexities of tax compliance using small business tax strategies, helping them stay competitive and financially sound.

Now, let’s talk about underpayment penalties. The IRS requires taxpayers to pay at least 90% of their current year’s tax liability or 100% of the previous year’s to avoid penalties. With the interest rate for underpayments sitting at 8% per year, compounded daily, the stakes are pretty high! And with the recent cuts to COVID-19 tax benefits, tax refunds might take a hit. This makes it even more important for entrepreneurs to collaborate with tax experts who can assist them in adapting and refining their small business tax strategies.

Plan for Retirement: Ensure Long-Term Financial Stability and Tax Efficiency

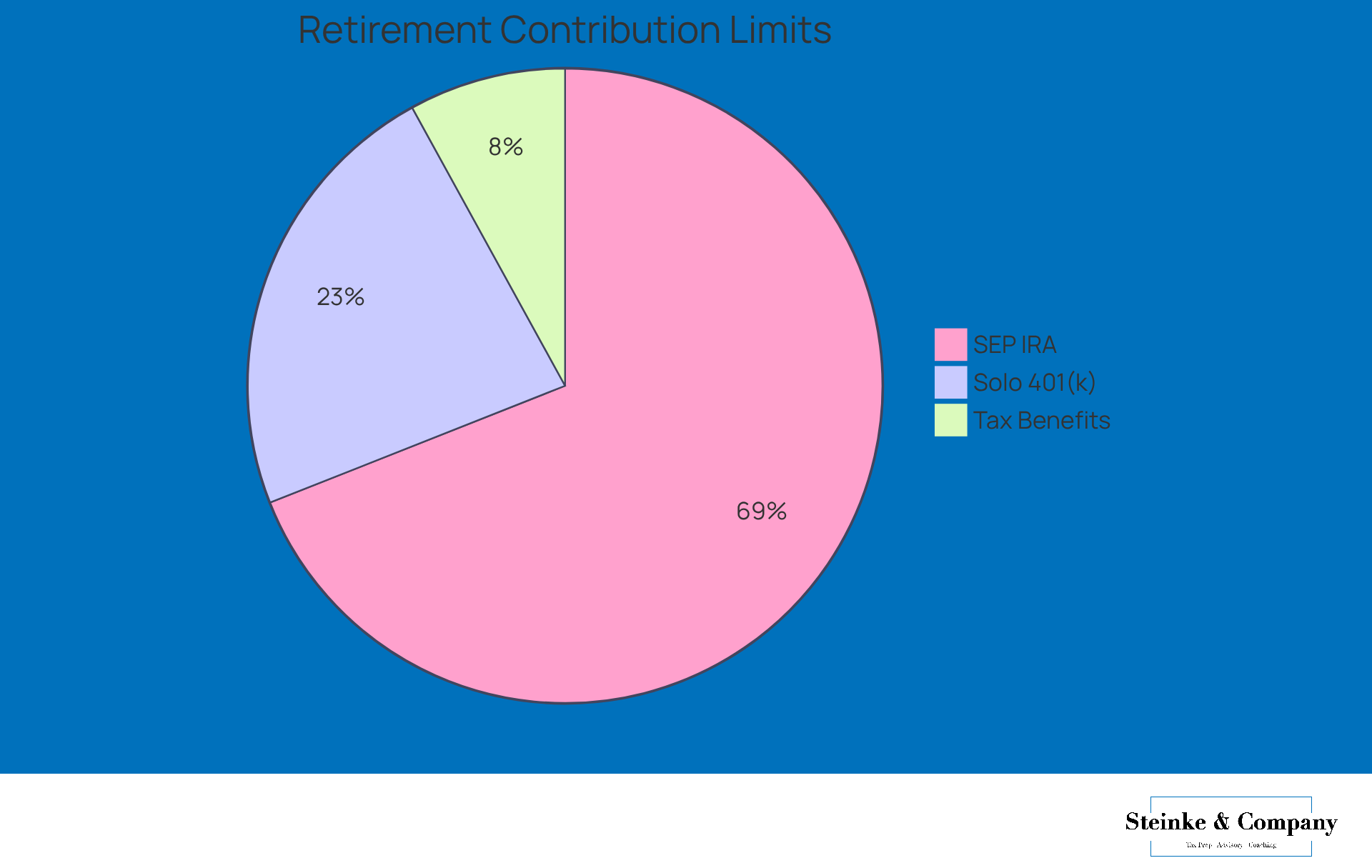

Retirement planning is super important for any small business tax strategies within its financial game plan. Options like SEP IRAs and Solo 401(k)s not only help secure your future income but also provide effective small business tax strategies. Contributions to these retirement plans are tax-deductible, which can be considered one of the small business tax strategies to lower your taxable income and ease that overall tax burden.

For example, in 2024, you can contribute up to $23,000 to a Solo 401(k)—or $30,500 if you're 50 or older. That’s a fantastic way to save on taxes while gearing up for a comfy retirement!

And let’s not forget about SEP IRAs, where you can contribute up to $69,000. This is especially great for self-employed folks or entrepreneurs with just a few employees. By incorporating small business tax strategies into your retirement plans, you can enhance your long-term financial stability while maximizing those tax benefits.

So, are you ready to take charge of your retirement planning?

Stay Informed on Tax Law Changes: Adapt Your Strategies for Compliance and Success

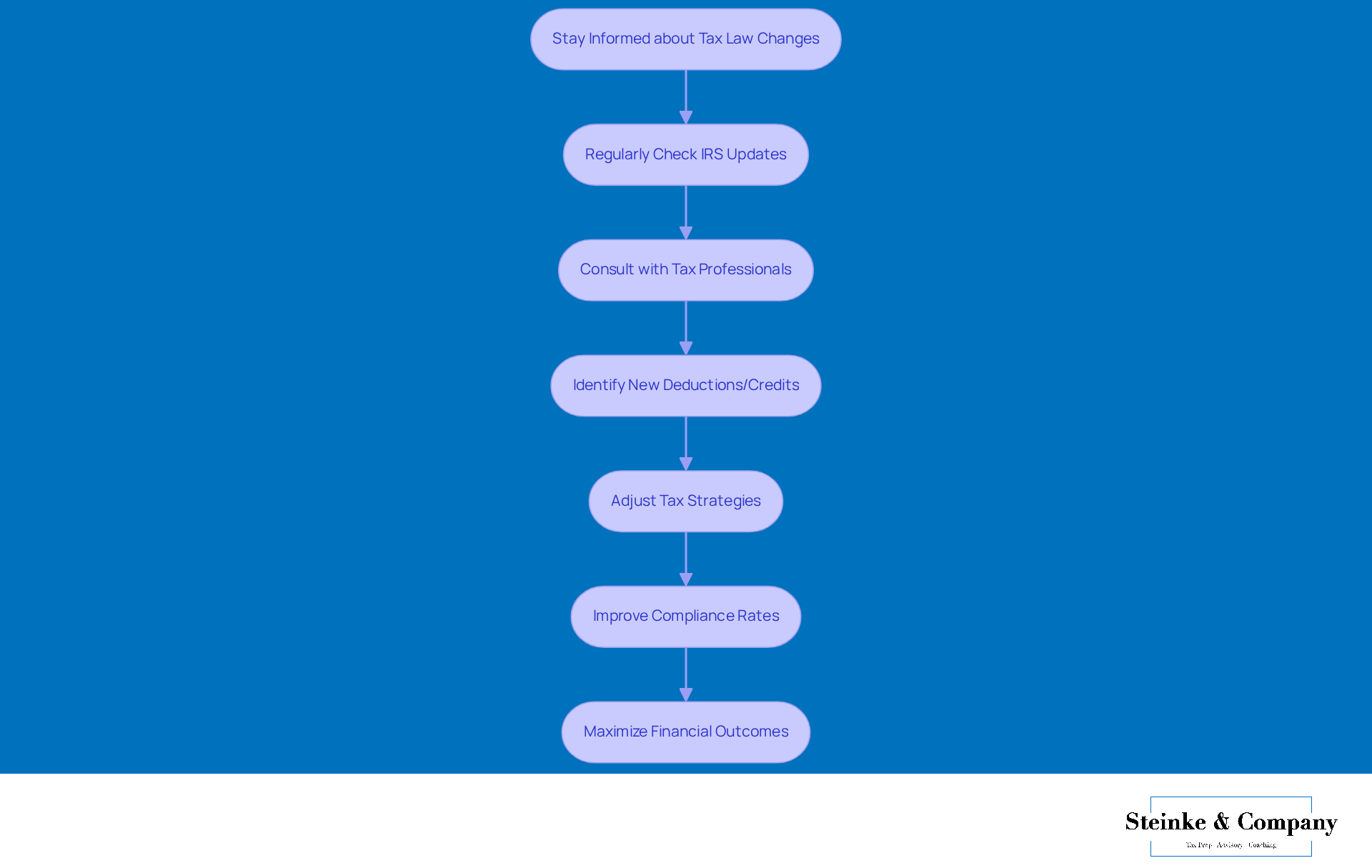

Staying informed about tax law changes is super important for small businesses that want to implement effective small business tax strategies to save money and remain compliant. Regularly checking updates from the IRS and chatting with tax pros can really boost an organization’s ability to tweak its strategies effectively. For instance, companies that keep an eye on tax regulations often find new deductions or credits that can lead to significant savings.

Plus, adjusting tax strategies when laws change can really help improve compliance rates. Research shows that small businesses that actively change their practices according to updated tax laws face fewer compliance hiccups. This proactive approach not only lowers the risk of penalties but also allows organizations to take advantage of favorable tax provisions.

Industry leaders have pointed out how crucial this adaptability is:

"Most entrepreneurs don’t have pensions and depend on the final sale of their enterprise, along with the safeguard of the Lifetime Capital Gains Exemption, as their retirement strategy."

This really highlights how important strategic tax planning is for long-term financial health.

So, in a nutshell, by staying informed and adjusting small business tax strategies as needed, small business owners can navigate the complexities of tax compliance while maximizing their financial outcomes. How are you planning to keep up with these changes?

Conclusion

When it comes to small business tax strategies, getting it right is crucial for saving money and staying compliant in an ever-evolving landscape. By tapping into expert advice and planning ahead, small businesses can tackle tax obligations more easily, ease the stress of tax season, and boost their overall financial health.

Throughout this article, we’ve highlighted some key strategies—like:

- Maximizing deductions and credits

- Working with professional tax services

- Keeping meticulous records

- Staying updated on tax law changes

Each of these approaches not only helps to lower tax liabilities but also promotes a culture of compliance and strategic growth. Plus, let’s not forget how vital it is to choose the right business structure and make the most of available tax credits; these decisions can really make a difference in your tax efficiency.

So, what’s the takeaway for small business owners? It’s all about taking charge of your tax strategies. Seek out expert advice and stay sharp on any changes in tax regulations. By doing this, you can unlock valuable resources, lighten your tax load, and pave the way for long-term financial stability. Embracing these strategies now sets your business up for future success, allowing you to focus on growth and innovation while keeping compliance in check.

Frequently Asked Questions

What services does Steinke and Company offer for small businesses?

Steinke and Company provides tax compliance services, personalized consultations, meticulous tax preparation, and strategic planning specifically tailored for micro and small enterprises, particularly in service-oriented sectors.

Why are effective small business tax strategies important for micro enterprises?

Effective small business tax strategies help reduce risks, boost overall performance, and minimize stress during tax season. Businesses that prioritize tax compliance often experience fewer surprises and can allocate resources more efficiently, leading to better success rates.

What are the expected compliance costs for small businesses?

Compliance costs for small businesses are projected to reach around $546 billion annually, highlighting the importance of seeking expert guidance in navigating tax regulations.

What are some specific strategies to avoid underpayment penalties?

Small business owners can utilize strategies such as safe harbor payments, which allow prepayment of a minimum tax obligation, and the de minimis exception, which can exempt them from penalties if their total tax liability is under $1,000.

How can small business owners maximize their tax savings?

Small business owners can maximize tax savings by identifying eligible deductions and credits, such as operational costs for office supplies and travel, and utilizing specific strategies like the Small Business Health Care Tax Credit.

What future tax credits should local businesses be aware of?

Looking ahead to 2025, local businesses can benefit from various tax credits aimed at enhancing employee health and wellness programs, which can also improve workplace morale.

Why is year-round tax planning important for small business owners?

Year-round tax planning helps small business owners manage their tax obligations effectively, spot potential issues early, and make informed financial decisions, ultimately reducing stress during tax season.

How can understanding paystubs assist small business owners?

Understanding paystubs ensures that small business owners are paid accurately and that the correct amounts are deducted for tax obligations, helping to avoid costly mistakes during tax season.

What is the benefit of consulting with a tax professional?

Consulting with a tax professional can help small business owners navigate the complexities of tax regulations, implement effective tax strategies, and avoid costly penalties.