Introduction

Navigating the tricky world of taxation can feel overwhelming for small business owners, especially with everything constantly changing. But here’s the good news: understanding and using effective tax strategies can lead to some serious savings and a healthier financial outlook. In this article, we’ll explore ten essential strategies that can help small businesses optimize their tax positions, boost cash flow, and ultimately drive growth. With so many options out there, though, how can entrepreneurs figure out which strategies will work best for their unique situations? Let’s dive in!

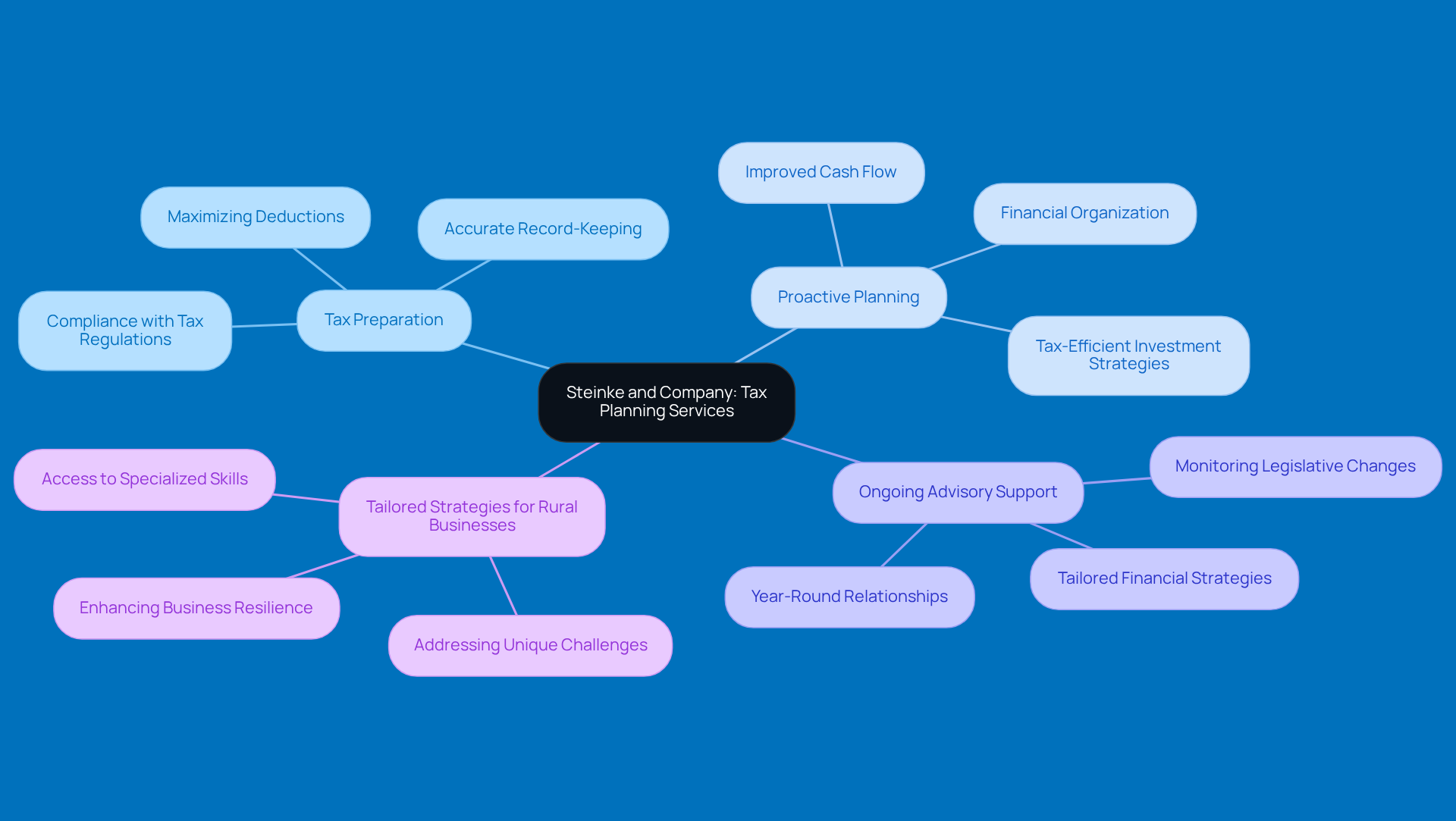

Steinke and Company: Comprehensive Tax Planning Services for Small Businesses

Steinke and Company provides a tailored range of taxation strategies specifically designed for small businesses in rural America. They blend tax compliance with strategic coaching, utilizing taxation strategies to help clients not only meet their tax obligations but also boost their economic outcomes. This includes a variety of services like tax preparation, proactive planning, and ongoing advisory support, all customized to tackle the unique challenges rural entrepreneurs face.

For example, effective taxation strategies can significantly reduce liabilities. Just look at Gadget Guru, which improved its cash flow and profitability through smart taxation strategies. This kind of comprehensive support lets clients concentrate on what they do best while keeping an eye on their financial health, ultimately fostering resilience and growth in their businesses.

So, if you're a small business owner in a rural area, why not explore how Steinke and Company can help you navigate the tax landscape? It could be the boost your business needs!

Retirement Account Maximization: Boost Your Savings and Reduce Taxable Income

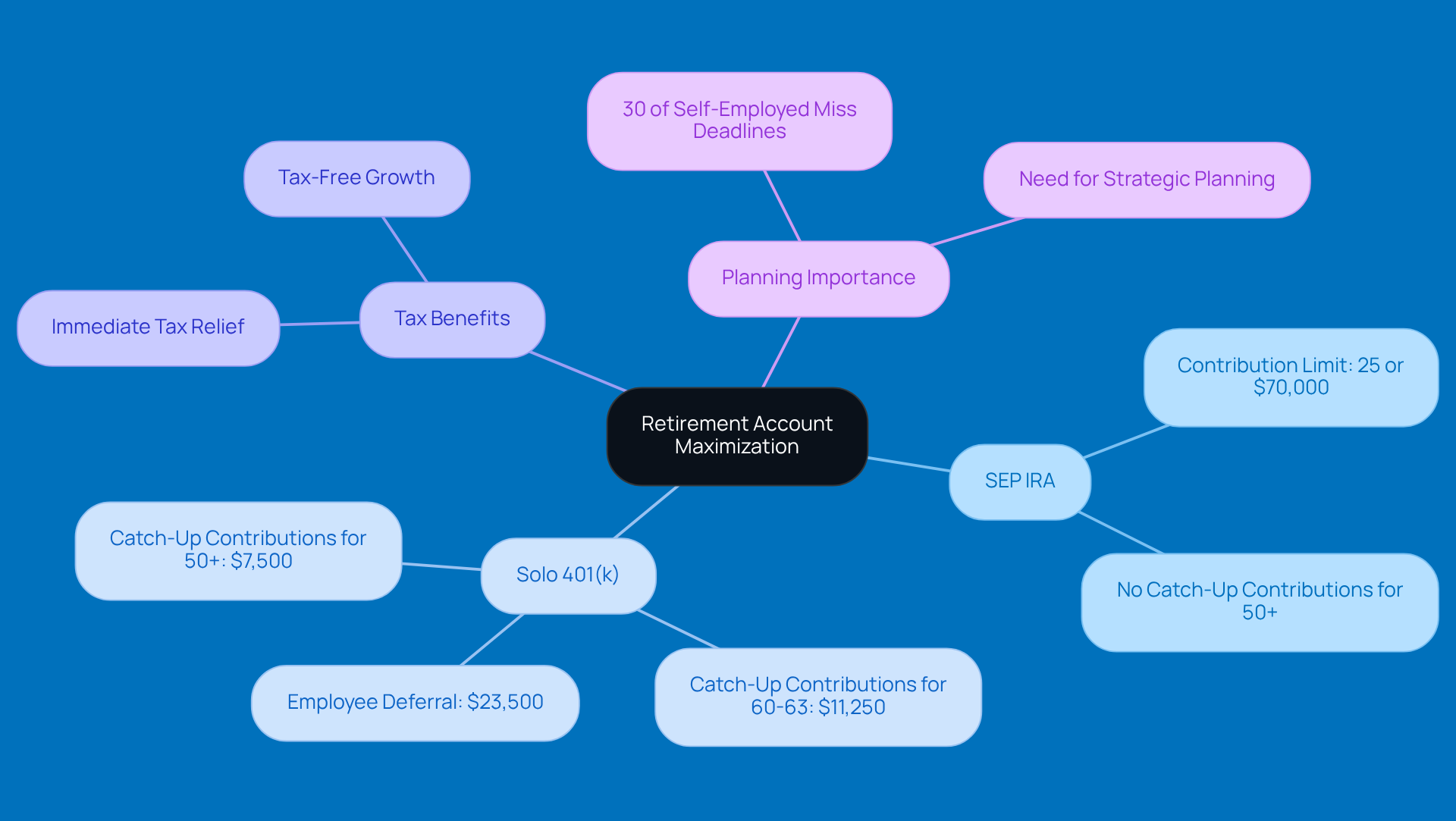

If you're running a small business, maximizing your contributions to retirement accounts like SEP IRAs and Solo 401(k)s can be a smart move. Not only does it help you save more, but it also lowers your taxable income. For 2025, the contribution limits have been bumped up! You can now put away up to 25% of your income or a whopping $70,000 into a SEP IRA. And if you’re looking at a Solo 401(k), you can defer up to $23,500 as an employee, plus there are catch-up contributions if you’re 50 or older.

This means you have a fantastic opportunity to reduce your taxable income significantly, which can lower your overall tax bill. Plus, these retirement accounts grow tax-free until you withdraw, giving you the double whammy of immediate tax relief and the potential for long-term growth.

Interestingly, more and more small business owners are catching on to the benefits of these retirement accounts. However, did you know that about 30% of self-employed folks miss important Solo 401(k) deadlines? That’s a big deal! It really highlights the importance of planning ahead.

So, by making the most of these retirement accounts, you’re not just securing your financial future; you’re also improving your taxation strategies. It’s a win-win!

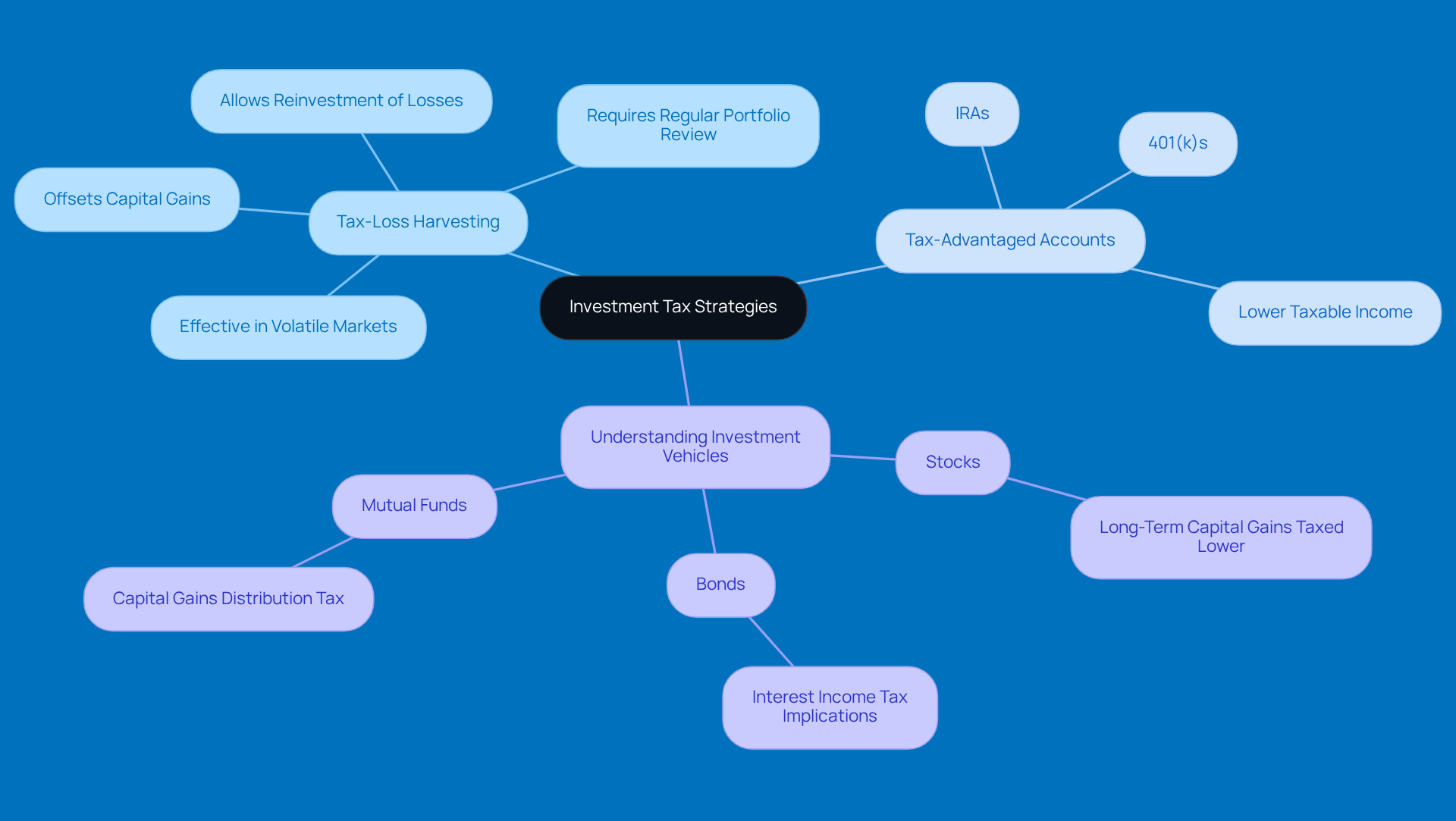

Investment Tax Strategies: Optimize Your Portfolio for Tax Efficiency

If you're looking to boost tax efficiency in your investment portfolio, there are some smart strategies you can adopt. One of the best is tax-loss harvesting. This means selling off those underperforming investments to offset your capital gains. Not only does this help reduce your tax bill, but it also lets you reinvest those realized losses, which could lead to even better returns down the line. Plus, placing high-yield investments in tax-advantaged accounts like IRAs or 401(k)s can really help lower your taxable income and overall tax exposure.

Now, understanding the tax implications of different investment vehicles - like stocks, bonds, and mutual funds - is super important. It helps you make informed choices that maximize your after-tax returns. For example, did you know that capital gains from long-term investments are usually taxed at lower rates? That makes them a lot more appealing than short-term gains.

Regularly checking in on your portfolio is key, too. It allows you to tweak your strategies as tax regulations and your personal economic goals change. By staying proactive, you can keep your investment strategies aligned with your objectives, optimizing tax efficiency and boosting your overall financial health. Financial experts often say that a balanced approach, along with frequent reassessments, is essential for implementing effective taxation strategies to achieve the best outcomes in your investment portfolio. So, how often do you review your strategies?

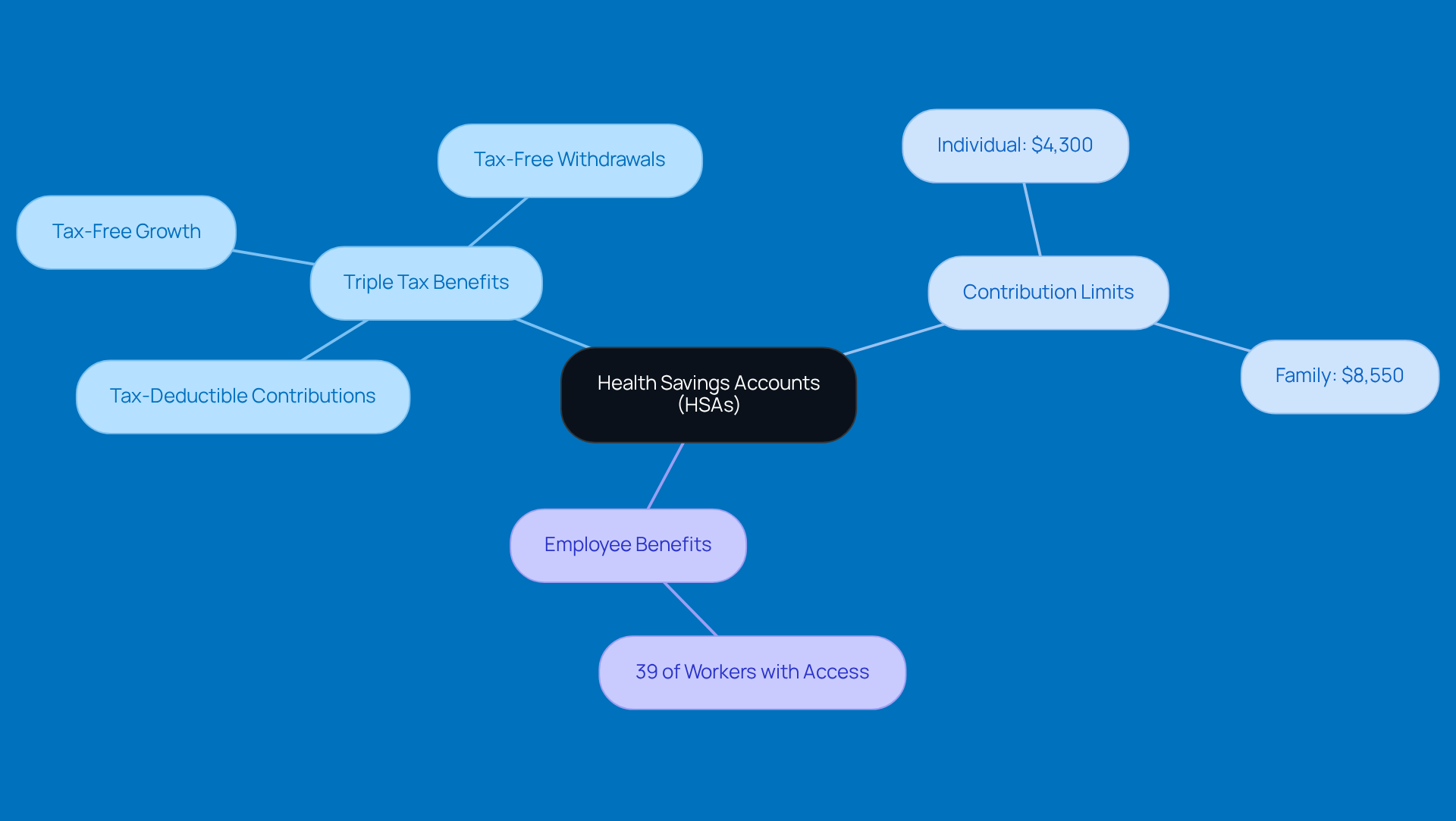

Health Savings Accounts (HSAs): Leverage Triple Tax Benefits for Your Business

Health Savings Accounts (HSAs) are pretty awesome, offering a triple tax advantage that’s hard to beat! You get tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, you can contribute up to $4,300 if you’re an individual, or $8,550 for families.

Now, if you’re a small business owner, think about this: by adding HSAs to your employee benefits package, you’re not just helping your team manage healthcare costs, but you’re also employing taxation strategies to reduce payroll taxes. It’s a win-win! This not only boosts your employees' financial well-being but also makes HSAs a smart move for attracting and keeping top talent. Did you know that in 2024, 39% of workers had access to HSAs through their employers? Offering this benefit can really give your organization a leg up in the competitive job market.

And let’s not forget about entrepreneurs! HSAs can be a fantastic resource for setting aside funds for future healthcare expenses while benefiting from taxation strategies that help your savings grow. So, what can small businesses do?

- Promoting HSAs as part of a comprehensive benefits package can lead to happier, more loyal employees.

Sounds good, right?

Strategic Deductions: Maximize Personal and Business Tax Benefits

If you want to save on taxes, it’s crucial for small business owners to implement effective taxation strategies by taking a hands-on approach in spotting and claiming all the deductions they can. Think about it: common deductible expenses like office supplies, travel costs, and even home office expenses can really add up. Don’t forget about health insurance premiums and contributions to retirement plans, either! Recent data shows that businesses that actively seek out these deductions can significantly reduce their taxable income. In fact, some estimates suggest that being proactive about claiming deductions can save small enterprises thousands each year.

Now, keeping detailed records is key. Not only does this ensure you don’t miss out on any deductions, but it also prepares you for any potential audits down the line. Have you thought about consulting with a tax expert? They can provide tailored insights to help you maximize your deductions based on your unique situation. Plus, using software tools for real-time expense tracking can really simplify things, making it easier to spot those eligible deductions and optimize your tax benefits.

By implementing these taxation strategies, small business leaders can boost their financial health and lower their overall tax bills. So, why not start today? Your wallet will thank you!

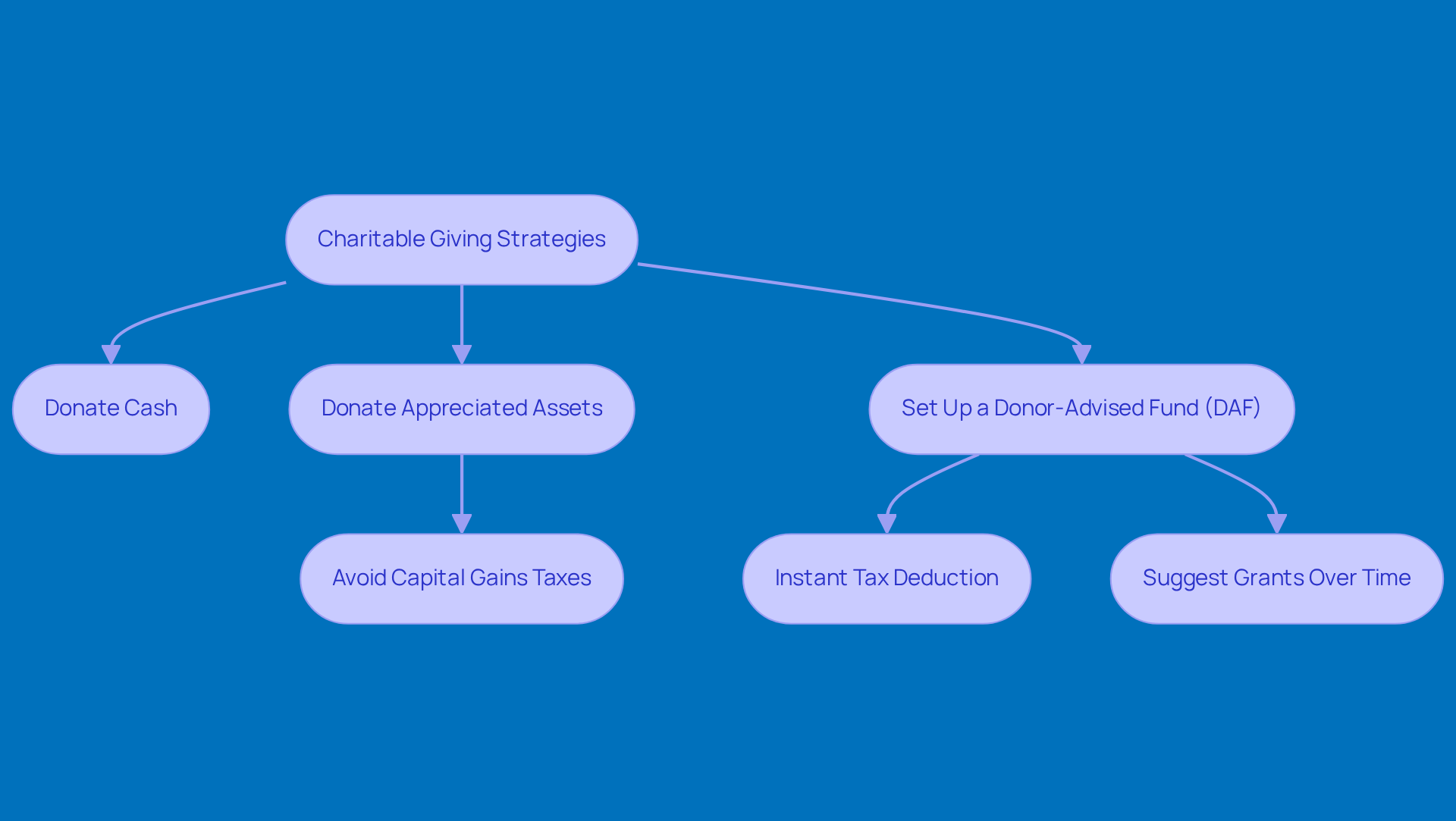

Charitable Giving Strategies: Enhance Your Tax Position While Supporting Causes

Charitable contributions do more than just support community initiatives; they can also bring some pretty nice tax benefits for small business owners. When you donate to qualified charitable organizations, you can deduct those contributions, which helps lower your taxable income. One smart move is to donate appreciated assets like stocks or real estate instead of cash. This way, you can dodge capital gains taxes, making your contributions even more valuable while giving your tax situation a boost.

Now, if you really want to streamline your charitable giving, consider setting up a donor-advised fund (DAF). With a DAF, you can make a single contribution that gives you an instant tax deduction, and then you can suggest grants to charities over time. This lets you align your giving with your personal values and financial goals.

Don’t forget to chat with a tax advisor to craft a giving strategy that maximizes your taxation strategies. As economic experts point out, understanding the ins and outs of charitable contributions can lead to serious advantages in taxation strategies. It’s a reminder that strategic philanthropy isn’t just about being generous; it’s also a savvy financial move. By weaving charitable contributions into their financial plans, small business owners can enhance their taxation strategies while also making a real difference in their communities. So, why not start thinking about how you can give back?

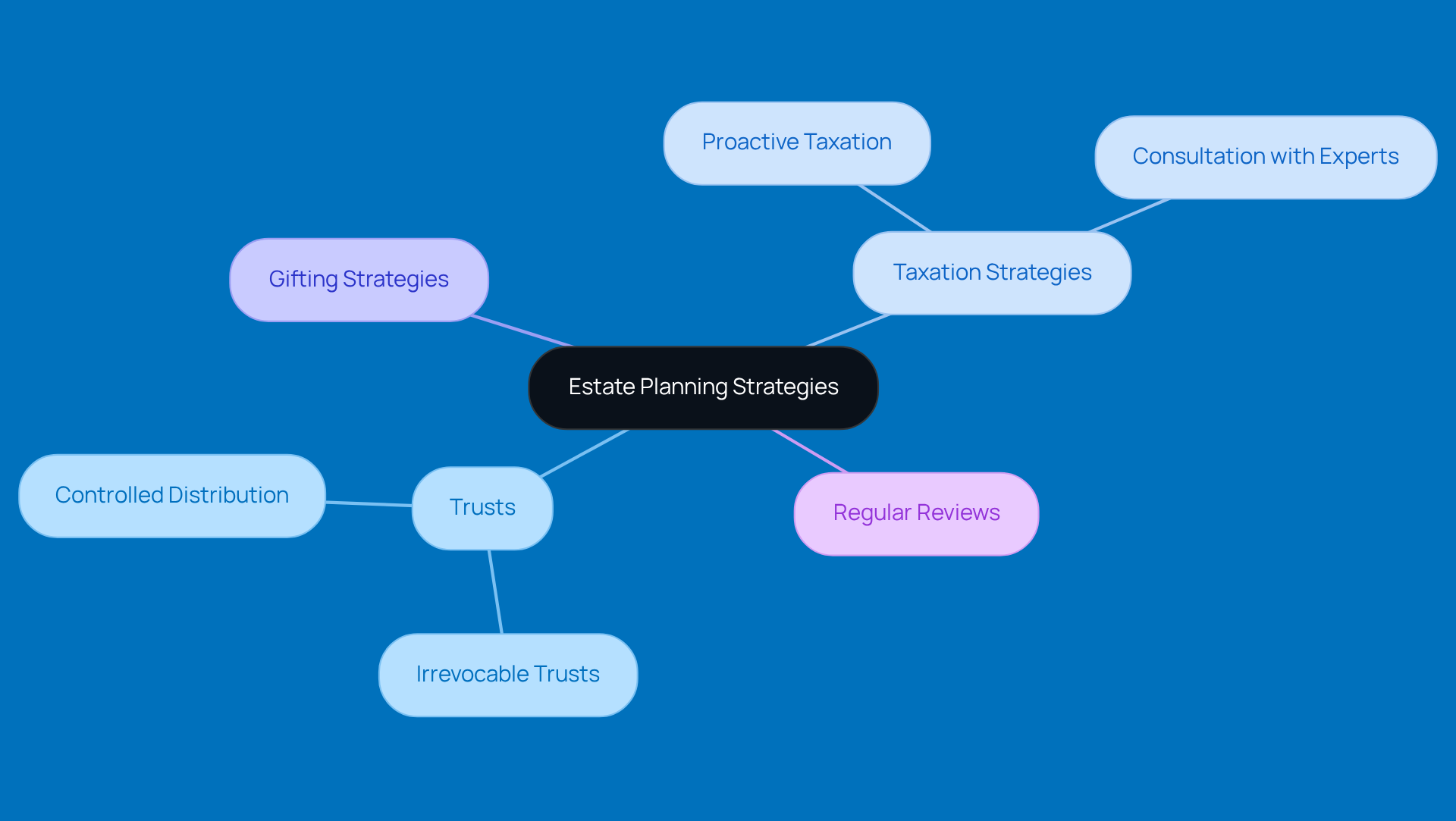

Estate Planning Strategies: Secure Your Legacy and Optimize Tax Outcomes

Estate planning is super important for small business owners. It helps make sure your assets are protected and passed on just the way you want. One great way to do this is by setting up trusts. They can really help cut down on estate taxes while making sure your heirs get what they need in a tax-friendly way. Trusts not only keep your assets safe but also allow for controlled distribution, which is a big plus for entrepreneurs who want to keep their business running smoothly after they’re gone.

And let’s not forget about the proactive taxation strategies provided by Steinke and Company! They can help you spot missed opportunities and develop taxation strategies to lighten your tax load. By meeting regularly to go over tax returns and financial plans, you can make sure your estate plan is in line with the latest tax rules and your personal situation.

You might also want to think about gifting strategies to shrink your taxable estate. By giving away assets while you’re still around, you can lower the total value of your estate, which might help reduce the estate tax burden for your loved ones. It’s crucial to regularly review and update your estate plans, especially with all the changes in tax laws and personal circumstances, to implement the best taxation strategies.

When it comes to reducing estate taxes through trusts, picking the right type of trust is key. Irrevocable trusts, for example, can help keep assets out of your taxable estate, but they need to be funded properly. Consulting with an estate planning attorney, along with the strategic advice from Steinke and Company, can give you personalized solutions that fit your goals. To keep your estate plan effective, why not schedule a review with Steinke and Company? They can help you figure out how recent tax changes might affect your planning.

529 College Savings Plans: Tax-Advantaged Savings for Education

529 College Savings Plans are a smart way for business owners to save for their kids' education while enjoying some pretty sweet tax perks. When you contribute to these plans, your money grows without being taxed, and when it’s time to withdraw for eligible education expenses, you won’t face any taxes there either. In 2025, you can put in up to $19,000 a year without worrying about gift taxes, which means families can really boost their savings potential.

Starting a 529 plan early is key! It lets families take advantage of compound growth, which can seriously cut down on college tuition costs. And get this: by mid-2025, there are about 16.8 million active 529 accounts holding a whopping $508 billion! That’s a clear sign that more families are catching on to the benefits of these plans.

If you’re an entrepreneur, it’s a great idea to weave 529 plans into your taxation strategies. Not only can they help you save for education, but they also provide valuable taxation strategies. Financial advisors often say that using a 529 plan is a smart move. Plus, under certain conditions, you can even shift those funds to a Roth IRA, which can really amp up your long-term financial planning. So, why not consider starting a 529 plan today?

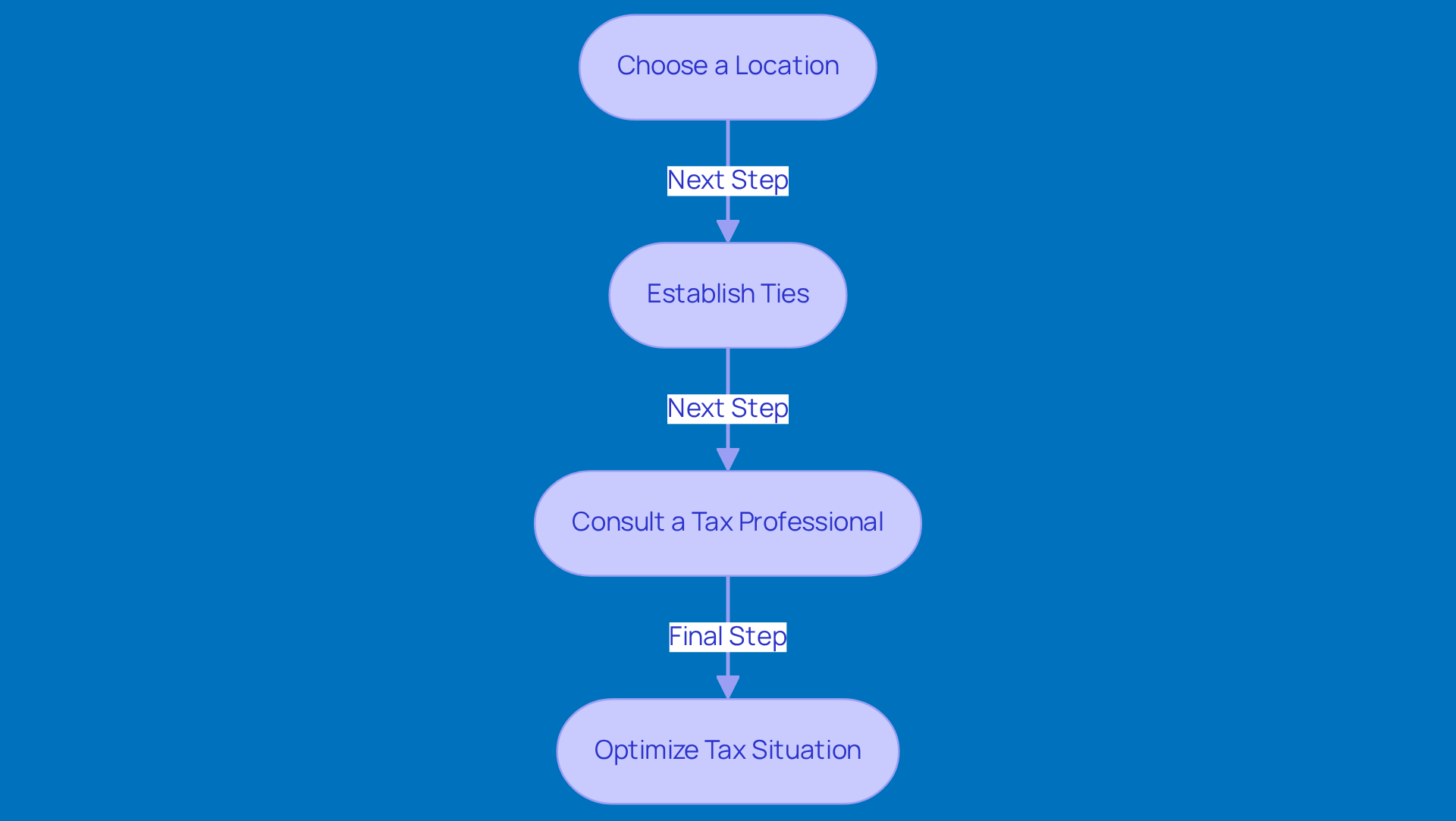

Domicile Planning: Optimize Your Tax Situation Through Strategic Location Choices

Domicile planning is super important for small business owners looking to implement effective taxation strategies to lighten their tax load. By picking the right place to call home, entrepreneurs can really benefit from different state tax rates and rules. For instance, moving to a state with lower taxes can lead to some serious savings, which means more money to reinvest back into the business. Who wouldn’t want that?

Now, if you’re thinking about establishing a new domicile, it’s crucial to build some solid ties to your new location. This means getting a driver’s license, registering to vote, and updating your business registrations. These steps not only show that you’re serious about your move but also help you steer clear of any surprises related to deemed residency, which could lead to unexpected tax bills. Nobody wants that headache!

It’s a good idea to chat with a tax professional when navigating the ins and outs of domicile laws. They can help you make sense of the state regulations and keep you compliant. This proactive approach can really help small business leaders make smart decisions that boost their financial health and align with their long-term goals. By understanding the taxation strategies involved in relocating, entrepreneurs can set themselves up for success in a friendlier tax environment. So, what are you waiting for? Let’s get planning!

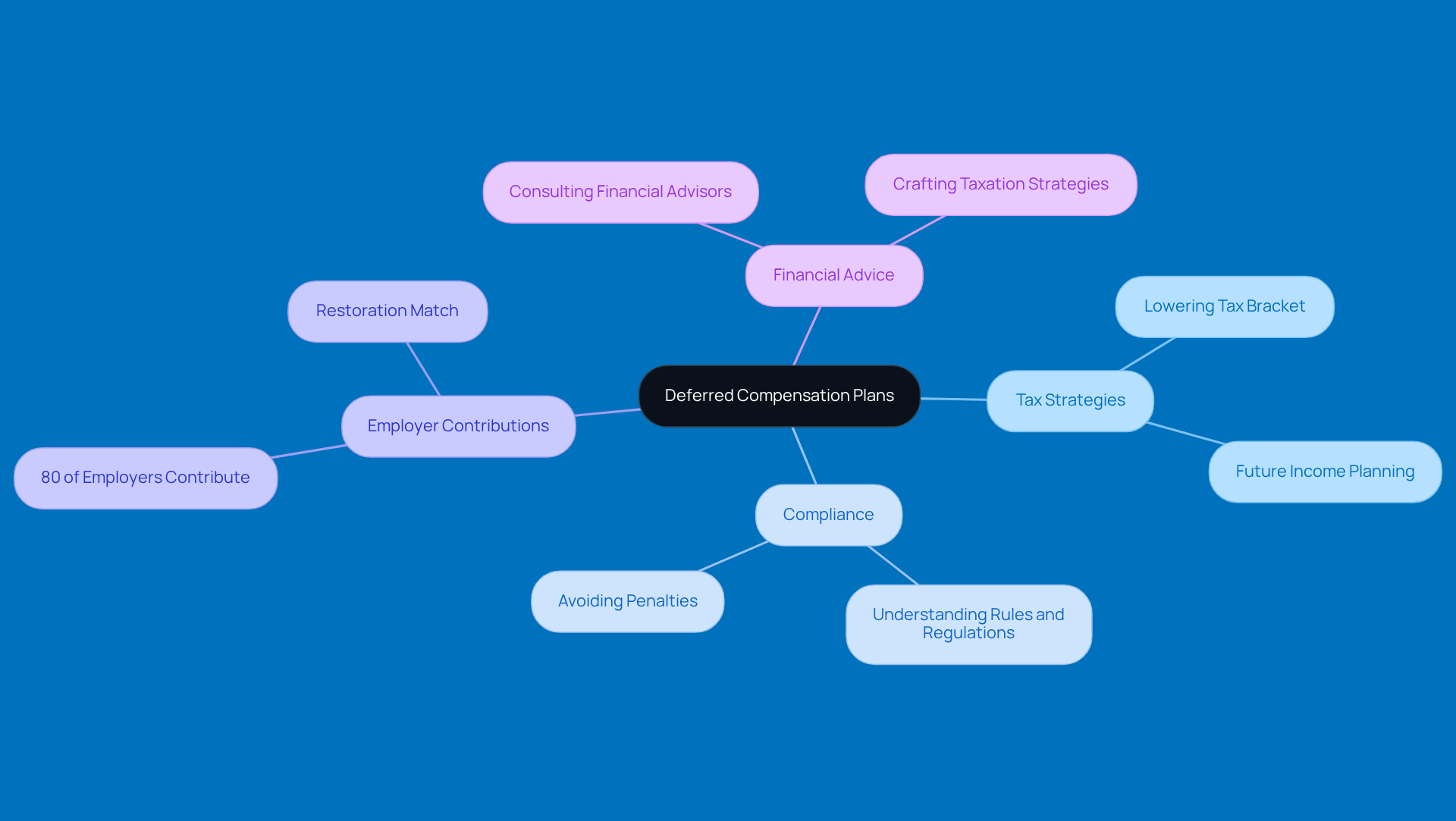

Deferred Compensation Plans: Manage Your Income and Tax Liabilities Wisely

Deferred compensation plans are a smart way for entrepreneurs to employ taxation strategies by deferring some of their income to a later date, which helps them manage their tax responsibilities. By delaying income, business owners might lower their current tax bracket, which can lead to significant tax savings through various taxation strategies. Plus, these plans can be set up to provide income during retirement or to meet other future financial needs, making them a flexible tool for planning.

Now, it’s super important to understand the rules and regulations around these plans to avoid any penalties and stay compliant. Did you know that nearly 80% of employers contribute to nonqualified deferred compensation (NQDC) plans? Many even allow distributions at the end of service, which can really boost financial flexibility. That’s why chatting with a financial advisor is key to crafting taxation strategies and a deferred compensation strategy that fits your unique financial goals. After all, navigating tax liabilities can be tricky! As one financial expert put it, "Money is a tool. And the real goal is using it wisely." This really highlights how crucial strategic planning is for achieving long-term financial success.

Conclusion

Implementing effective taxation strategies is super important for small business owners who want to boost their financial health and save some cash. By using tailored approaches like retirement account contributions, investment tax strategies, and health savings accounts, small businesses can really cut down on their taxable income while securing their financial future. The insights shared in this article highlight just how crucial proactive planning and smart decision-making are when it comes to navigating the tricky world of taxes.

Some key strategies we’ve talked about include:

- Maximizing contributions to retirement accounts like SEP IRAs and Solo 401(k)s

- Using tax-loss harvesting for investments

- Taking advantage of the triple tax benefits of Health Savings Accounts

- Exploring charitable giving

- Strategic deductions

- Effective estate planning

Each of these strategies not only gives you immediate tax relief but also supports long-term growth and stability for your business.

So, here’s the deal: small business owners should definitely take a proactive approach to their tax planning. By teaming up with knowledgeable professionals like Steinke and Company, you can uncover opportunities to optimize your tax situation and ultimately boost your financial resilience. Embracing these strategies not only leads to a healthier bottom line but also empowers you to focus on what you do best-running your business with confidence!

Frequently Asked Questions

What services does Steinke and Company offer for small businesses?

Steinke and Company provides a tailored range of taxation strategies for small businesses, including tax preparation, proactive planning, and ongoing advisory support, all customized to address the unique challenges faced by rural entrepreneurs.

How can effective taxation strategies benefit small businesses?

Effective taxation strategies can significantly reduce tax liabilities, improve cash flow, and enhance profitability, allowing business owners to focus on their operations while maintaining financial health.

What retirement accounts can small business owners maximize to reduce taxable income?

Small business owners can maximize contributions to retirement accounts such as SEP IRAs and Solo 401(k)s, which help save more and lower taxable income.

What are the contribution limits for SEP IRAs and Solo 401(k)s in 2025?

In 2025, small business owners can contribute up to 25% of their income or $70,000 into a SEP IRA, and for a Solo 401(k), they can defer up to $23,500 as an employee, with additional catch-up contributions available for those aged 50 or older.

What is tax-loss harvesting and how does it work?

Tax-loss harvesting involves selling underperforming investments to offset capital gains, which helps reduce tax bills and allows for reinvestment of realized losses for potentially better returns.

Why is it important to understand the tax implications of different investment vehicles?

Understanding the tax implications of stocks, bonds, and mutual funds helps investors make informed choices that maximize after-tax returns, as capital gains from long-term investments are typically taxed at lower rates.

How often should investors review their investment strategies?

Investors should regularly check in on their portfolios to adjust their strategies in response to changing tax regulations and personal economic goals, ensuring alignment with their objectives for optimal tax efficiency.