Overview

This article dives into some key insights about recapture tax and how it relates to Capital Cost Allowance (CCA) for small business owners. When selling depreciable assets, understanding this tax is crucial—it can really impact your financial planning and cash flow.

Have you ever thought about how recapture tax might affect your next asset sale? It’s worth considering! The article suggests a few strategies to help you navigate this, like timing your asset sales just right and thinking about reinvesting in new assets. These tactics can help you manage potential tax liabilities more effectively.

So, as you plan your next move, keep these insights in mind. They could make a real difference in your financial strategy!

Introduction

Understanding the nuances of recapture tax is super important for small business owners trying to navigate the tricky waters of their financial landscape. When businesses invest in depreciable assets, there’s always that looming possibility of unexpected tax liabilities, especially if these assets are sold for more than what’s left of their undepreciated capital cost.

In this article, we’ll dive into the key insights around Capital Cost Allowance (CCA) recapture and share some strategies that can help lighten the tax load and boost your financial outcomes.

So, how can small businesses tackle these tax implications and stay financially nimble in today’s ever-changing economic environment?

Define CCA Recapture and Its Relevance for Small Businesses

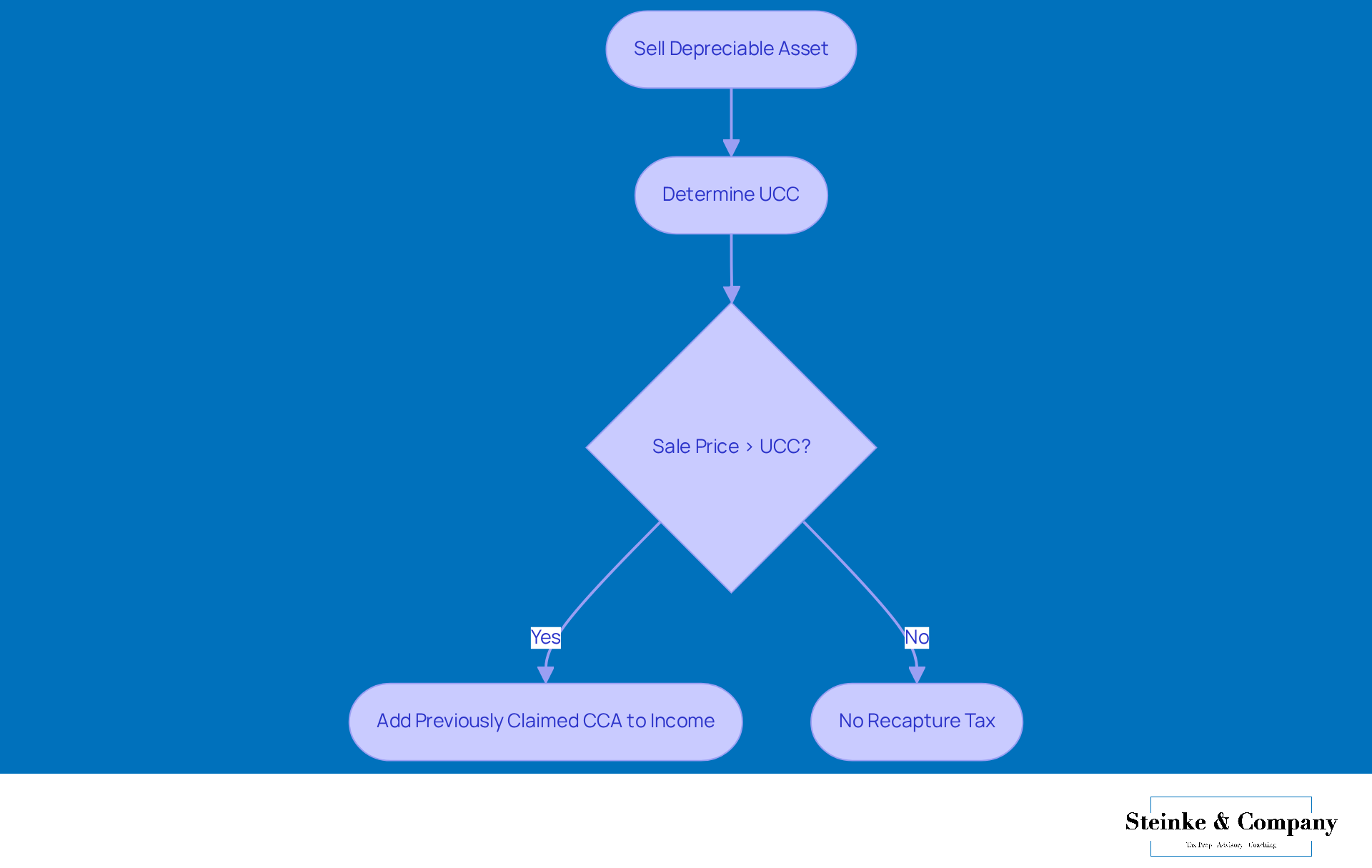

Hey there! Let’s discuss recapture tax in relation to Capital Cost Allowance (CCA)—an important concept for small businesses. It happens when you sell a depreciable asset for more than its remaining undepreciated capital cost (UCC). If you’ve claimed CCA on an asset and then sell it for more than its UCC, guess what? You have to add that previously claimed CCA back to your income for recapture tax purposes. This recaptured tax amount is fully taxable, which can lead to some hefty tax bills.

For example, imagine a small business bought a computer for $1,000 and claimed $300 as CCA in the first year. If they later sell that computer for $800, the UCC would be $700. Since the sale price is higher than the UCC, that $300 they claimed before needs to be reported as income, which can really affect their overall tax liability.

Understanding CCA recovery is super important for small business owners because it impacts cash flow and recapture tax planning. If you overlook this, you might face some unexpected tax bills come tax season, which can really complicate your financial planning. Experts suggest that small businesses should take a close look at their asset sales and consider how the recapture tax will affect their tax obligations. By staying on top of these details, businesses can not only comply with tax regulations but also optimize their financial outcomes.

Explain the Importance of CCA Recapture in Tax Planning

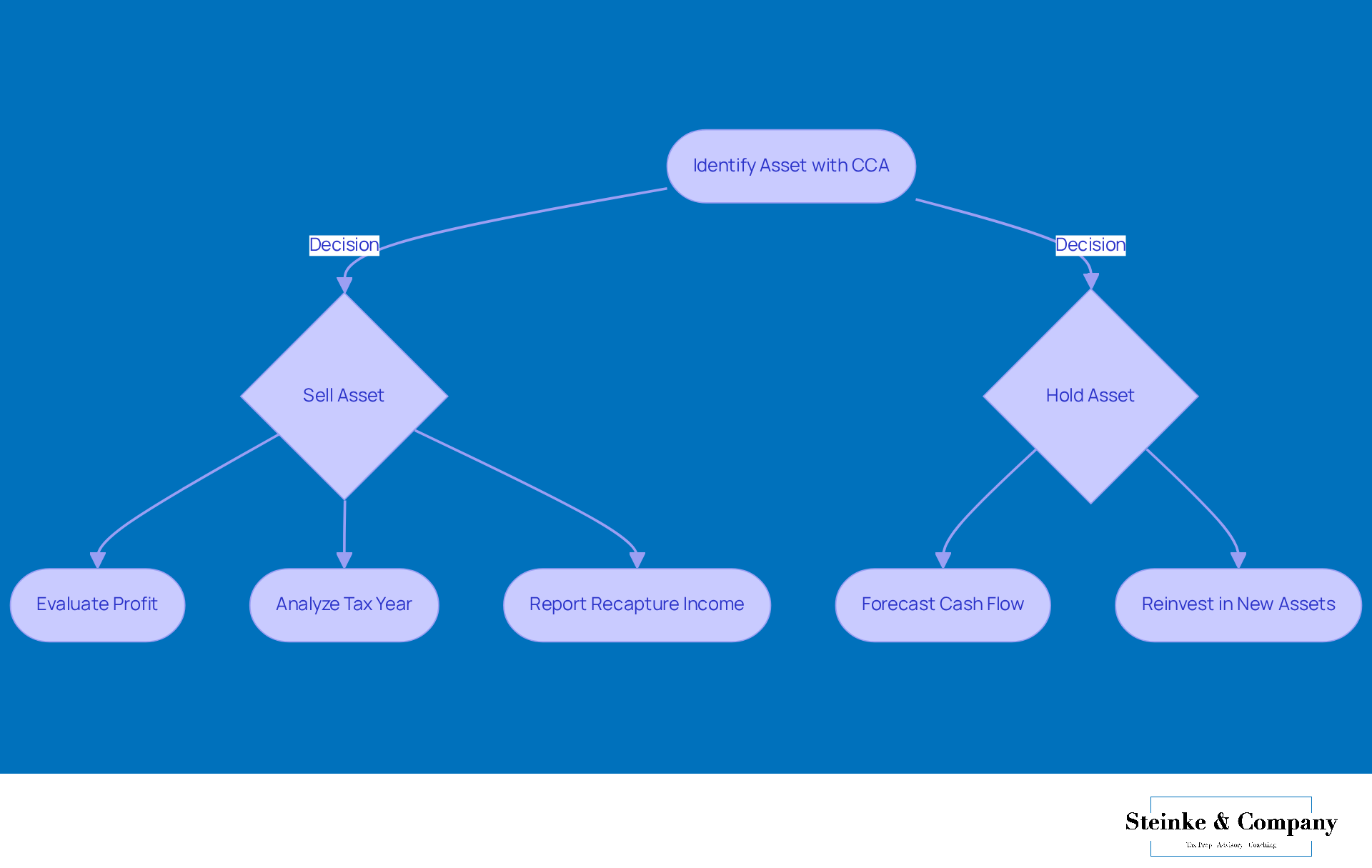

Including Capital Cost Allowance (CCA) recovery in tax planning is super important for small businesses looking to manage their tax obligations efficiently. By anticipating potential recovery events, companies can make smart decisions about when to sell assets and how to structure transactions. For example, if a business owner realizes that selling a depreciable asset will lead to a CCA recovery, they might decide to hold off on the sale until a more advantageous tax year or consider reinvesting in new assets that provide better tax benefits.

Understanding recapture tax also helps in forecasting cash flow needs since tax implications can significantly affect a company’s financial health. Take the story of Amy, an entrepreneur who owned a taxi. After claiming a hefty CCA on her vehicle, she cleverly delayed selling it until her profits were at their peak, maximizing her tax advantages. This proactive strategy not only reduced her tax burden but also improved her overall financial game plan.

By teaming up with Steinke and Company, small business owners can benefit from tailored tax planning and advisory services that focus on proactive strategies to lighten tax loads and foster growth. These services include spotting overlooked opportunities and laying out clear plans, making sure that owners are fully aware of their tax situations. Regular check-ins and strategic planning sessions are key to navigating the complexities of asset management with ease. It’s worth noting that the Canada Revenue Agency requires reporting the recapture tax associated with the recovery of capital cost allowance as income in certain situations. By incorporating CCA recovery into their tax strategies, small business owners can be well-prepared for any tax consequences that come from their decisions.

Strategies to Mitigate CCA Recapture Risks

To effectively tackle the risks tied to Capital Cost Allowance (CCA) recapture, small business owners can adopt a few savvy strategies:

-

Asset Management: It’s super important to regularly review and assess the value of your depreciable assets. By understanding their market value, you can make informed decisions about when to sell, which can greatly affect your recapture tax liabilities. Plus, keeping good records of every transaction is key—it helps confirm the accuracy of your reported cost basis and prepares you for any potential tax implications down the road.

-

Timing of Sales: Have you thought about when to sell your assets? Timing can make a big difference in minimizing tax impacts. If you can hold off on selling until a year when you expect lower income, it might lighten your tax load related to recovery, giving you a bit more breathing room for financial planning. And don’t forget—timing your sales to avoid short-term capital gains can be a smart move since long-term gains usually come with a lower tax rate.

-

Reinvestment: What about reinvesting in new capital assets that qualify for additional CCA claims? This could help reduce the amount you have to recover, providing a nice financial cushion against any potential recapture tax obligations. Also, consider the perks of tax-deferred investments, which can really boost your overall tax efficiency.

-

Consultation with Tax Professionals: Regular chats with tax professionals are a must! Staying in the loop about changing tax regulations and strategies can be a game changer. Their expert advice can help you navigate the complexities of CCA recovery and optimize your tax situation, including managing estimated tax payments and understanding recapture tax to steer clear of underpayment penalties.

By embracing solid asset management practices and weaving in strategies from mutual fund tax planning, small business owners can not only enhance their operational efficiency but also reduce the chances of unexpected recapture impacts.

Conclusion

Understanding CCA recapture is super important for small business owners because it directly affects your tax obligations and financial planning. When you sell a depreciable asset for more than its remaining undepreciated capital cost, you have to add back the Capital Cost Allowance you previously claimed to your income. This can lead to some unexpected tax liabilities. So, it’s really crucial to plan ahead and manage your assets wisely to avoid any financial headaches down the line.

In this article, we’ve highlighted some key strategies to help manage CCA recapture risks:

- Regularly assessing your assets

- Timing your sales strategically

- Reinvesting in qualifying capital assets

- Keeping in touch with tax professionals

Not only do these strategies help lessen the impact of recapture tax, but they also empower you to make informed decisions that can boost your overall financial health.

Ultimately, navigating the complexities of CCA recapture takes a bit of diligence and foresight. By weaving CCA recovery into your tax strategies, you can gear up for potential tax consequences, optimize your financial outcomes, and even spot new growth opportunities. Embracing these insights will help ensure your business stays compliant while maximizing financial efficiency in today’s ever-changing tax landscape. So, take a moment to reflect on how you can integrate these strategies into your planning!

Frequently Asked Questions

What is CCA recapture?

CCA recapture occurs when a small business sells a depreciable asset for more than its remaining undepreciated capital cost (UCC), requiring the business to add the previously claimed Capital Cost Allowance (CCA) back to its income for tax purposes.

How does CCA recapture affect small businesses?

CCA recapture can lead to a significant tax liability because the recaptured amount is fully taxable, which may result in unexpected tax bills and affect the overall financial planning of the business.

Can you provide an example of CCA recapture?

If a small business buys a computer for $1,000 and claims $300 as CCA in the first year, the UCC would be $700. If they later sell the computer for $800, since the sale price exceeds the UCC, they must report the $300 claimed as income, impacting their tax obligations.

Why is understanding CCA recovery important for small business owners?

Understanding CCA recovery is crucial because it directly impacts cash flow and recapture tax planning, helping businesses avoid unexpected tax bills and allowing for better financial management.

What should small businesses do regarding recapture tax?

Small businesses should closely examine their asset sales and consider how recapture tax will affect their tax obligations to ensure compliance with tax regulations and optimize their financial outcomes.