Introduction

Business advisory services consulting is super important for helping small agencies tackle the tricky landscape of today’s market. Small businesses are a big deal when it comes to job creation and boosting the economy, and the right advisory practices can really help unlock their potential, improve decision-making, and support sustainable growth. But let’s be real - the path to making this work isn’t always smooth. There are challenges like resistance to change and limited resources that can get in the way.

So, how can small agencies push through these obstacles and truly take advantage of business advisory services to thrive in this ever-changing business world? Let’s dive in and explore!

Define Business Advisory Services and Their Importance for Small Agencies

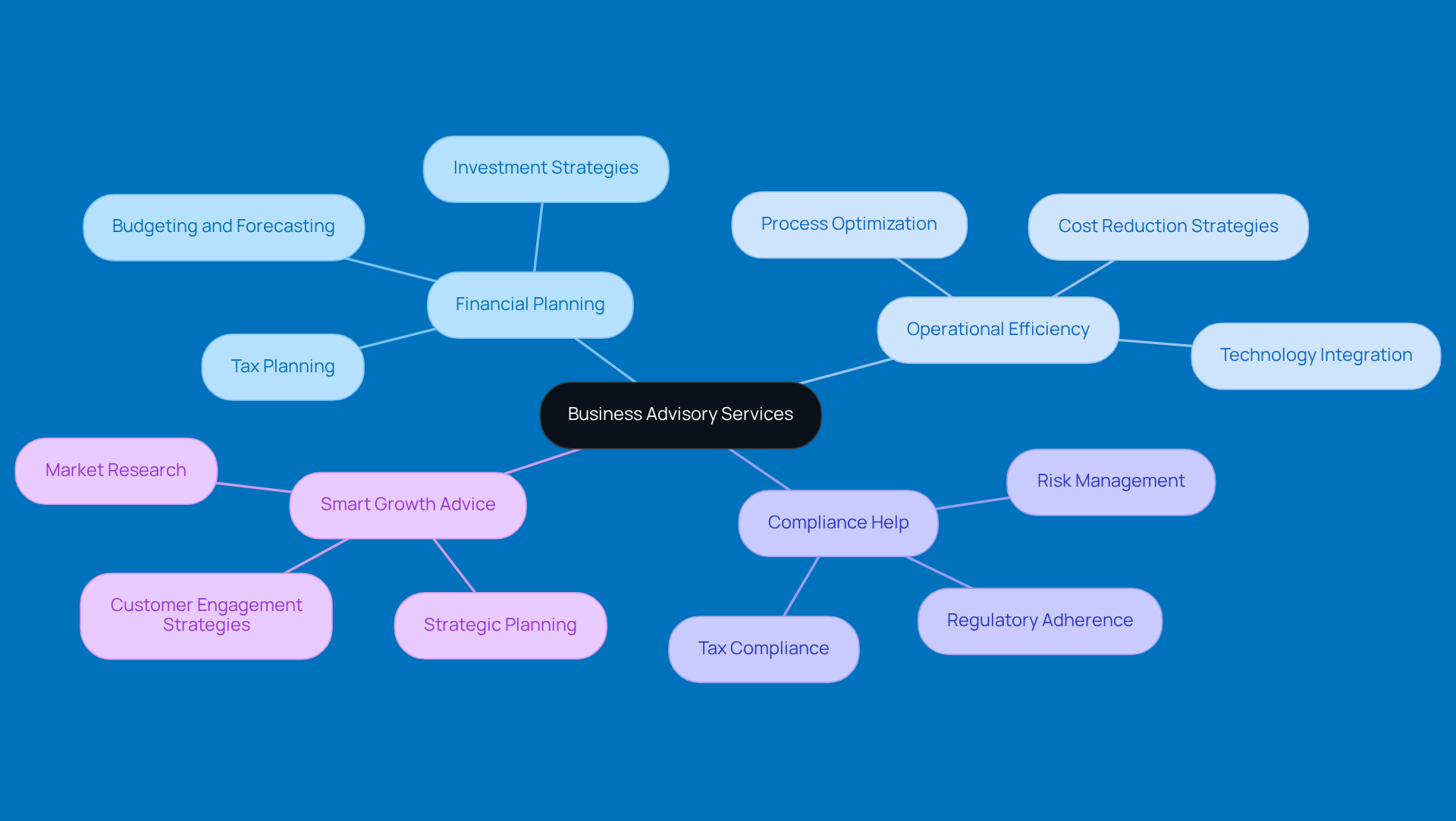

When it comes to business advisory services consulting, there’s a whole range of professional support designed to help small businesses boost their performance, tackle tricky challenges, and hit those strategic goals. Think of things like financial planning, operational efficiency checks, compliance help, and smart growth advice. For small agencies, especially those in rural areas, these services are a game changer. They offer tailored support that really gets to the heart of local issues, like limited resources and market access.

Did you know that small businesses accounted for a whopping 62.7% of net new job creation from 1995 to 2023? That’s a big deal and shows just how vital they are to our economy. At Steinke and Company, we like to get together 1-3 times a year to go over your tax return or current records. We’ll help you spot those missed opportunities and craft a clear plan to reduce your tax burden while growing your business.

By leveraging business advisory services consulting, small firms can boost their operational resilience, make smarter decisions, and drive sustainable growth. Plus, our proactive tax planning keeps you compliant and minimizes those pesky surprises, letting you focus on scaling your business effectively. So, are you ready to take your business to the next level?

Implement Proven Strategies for Effective Business Advisory Services

To really nail effective business advisory services, small agencies should focus on a few key strategies:

-

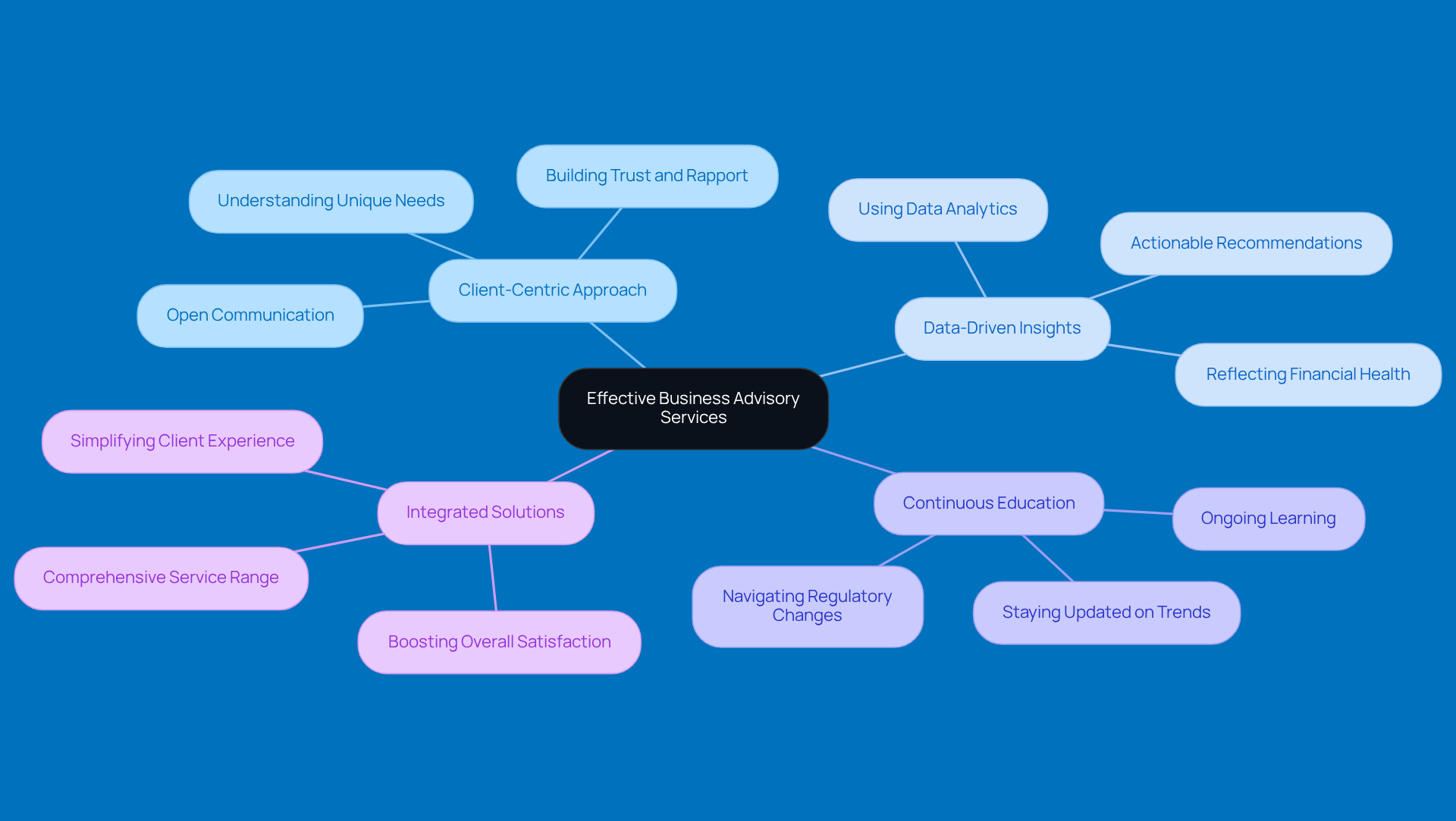

Client-Centric Approach: First things first, get to know your clients! Understanding their unique needs through thorough assessments is crucial. Plus, keeping the lines of communication open helps build trust and rapport. It’s all about making them feel valued.

-

Data-Driven Insights: Next up, let’s talk data. Using data analytics can really steer decision-making in the right direction. By providing clients with actionable recommendations that reflect their financial health and current market trends, you’re not just improving the business advisory services consulting process-you’re empowering them to make informed choices.

-

Continuous Education: Staying in the loop is key! Committing to ongoing learning about industry trends and regulatory changes ensures that the advice you give is timely and relevant. This dedication positions you as a trusted advisor who can navigate complexities with ease.

-

Integrated Solutions: Lastly, think about offering a comprehensive range of services. By including business advisory services consulting, compliance, and tax options, you’re addressing all aspects of a client’s business. This integration simplifies their experience and boosts overall satisfaction.

By embracing these strategies, you can really enhance your offerings, build stronger client relationships, and establish yourself as an essential partner in your clients' success. So, what are you waiting for? Let’s get started!

Highlight Benefits of Business Advisory Services for Growth and Resilience

When it comes to business advisory services consulting, small agencies can really benefit from what’s available. Let’s break down some of the key advantages:

-

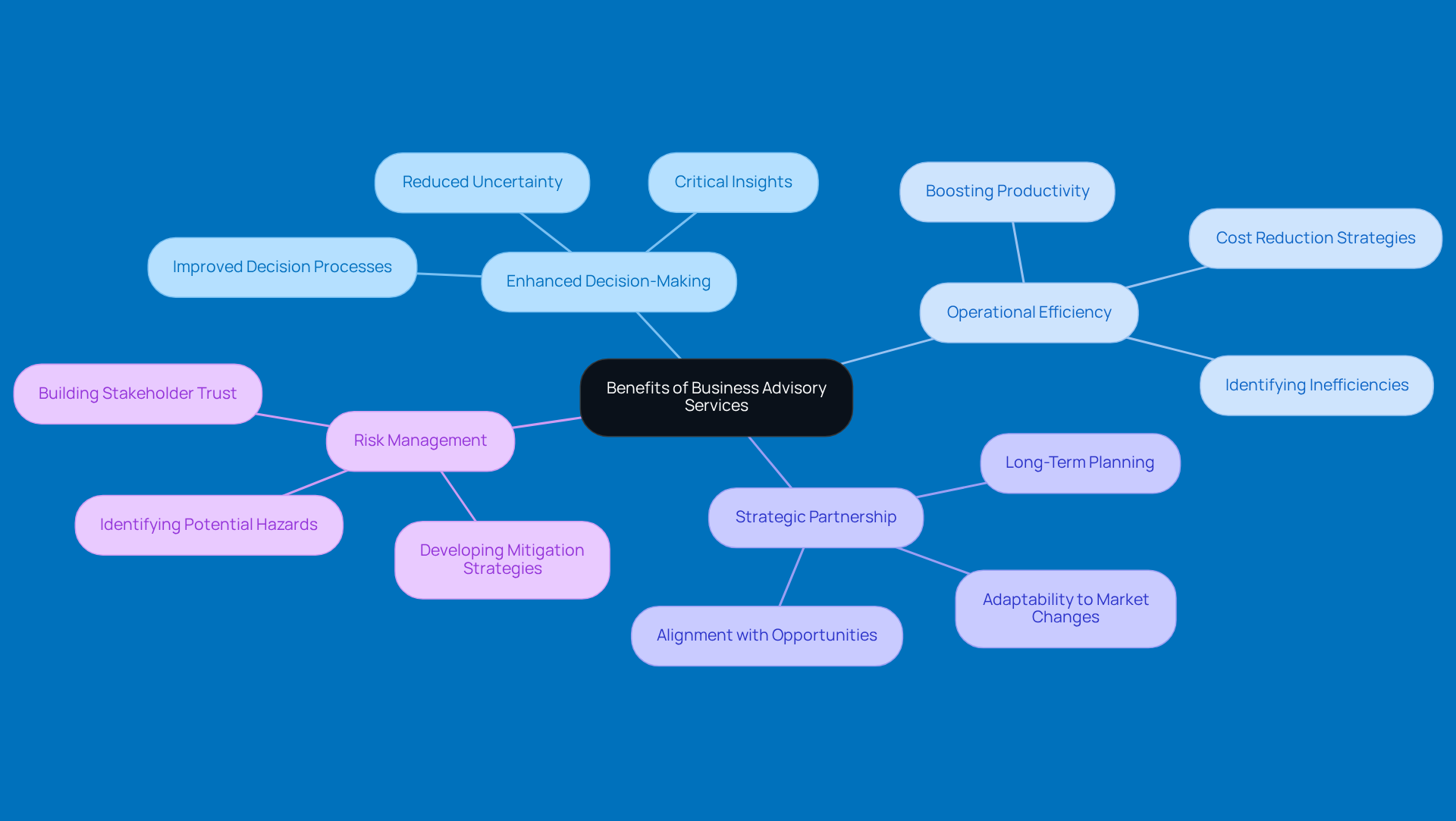

Enhanced Decision-Making: Think about it - having an advisor means you get critical insights that help you make informed decisions. This can really cut down on uncertainty and the risks that come with it. Businesses that engage in business advisory services consulting often find their decision-making processes get a serious boost.

-

Operational Efficiency: Who doesn’t want to save money and boost productivity? Business advisory services consulting can help advisors spot inefficiencies and suggest improvements that streamline operations. For instance, companies that upgrade their accounting systems or fine-tune their supply chains often see a drop in operational costs while their performance soars.

-

In the realm of business advisory services consulting, advisors serve as your strategic partners, helping you craft long-term plans that align with new market opportunities. In today’s competitive landscape, being adaptable is crucial, and having a solid strategy can make all the difference.

-

Risk Management: Let’s face it - every business faces risks. Consulting through business advisory services consulting can help you identify potential hazards and come up with strong strategies to tackle them. Good risk management not only protects your assets but also builds trust with stakeholders, which is key for long-term success.

All these advantages come together to create a resilient framework that can adapt to changing market conditions. So, if you’re looking to grow and thrive, consulting might just be the way to go!

Address Challenges in Implementing Business Advisory Services

Implementing business advisory services consulting can be a bit tricky for small agencies, but don’t worry! Let’s break down some common challenges you might face:

-

Resistance to Change: It’s totally normal for businesses to hesitate when it comes to adopting new consulting practices. Many see them as extra costs instead of smart investments. To tackle this, it’s important to clearly communicate the benefits of your consultancy services. Show how they can actually boost profitability and streamline operations. Plus, involving clients in the transition can help them feel more invested and less anxious about the changes.

-

Resource Limitations: Small organizations often have limited resources, so it’s key to prioritize the most impactful consulting services. By honing in on high-impact areas and gradually expanding your offerings, you can manage your capabilities without overwhelming your team.

-

Skill Gaps: It’s essential that your staff gets enough training in advisory practices. Investing in professional development and using technology can help bridge those gaps, ensuring your team is ready to provide valuable insights and support to clients.

-

Client Engagement: Building strong relationships with clients is crucial for your advisory services to thrive. Regular check-ins and feedback cycles not only boost client satisfaction but also help you spot additional needs and tailor your offerings. Being proactive can lead to higher retention rates and a greater willingness from clients to invest in your strategic services.

By facing these challenges head-on, small agencies can successfully implement business advisory services consulting, leading to better client relationships and sustainable growth. So, what’s your next step in this journey?

Conclusion

When it comes to business advisory services, they really play a vital role in helping small agencies tackle challenges and reach their strategic goals. By offering tailored support, these services not only boost operational resilience but also pave the way for sustainable growth. Honestly, the value of consulting like this can't be overstated; it gives small businesses the tools they need to thrive in a competitive world.

So, what are some key strategies for effective business advisory services? Well, a client-centric approach is a must, along with leveraging data-driven insights, committing to continuous education, and providing integrated solutions. Each of these strategies helps build stronger relationships with clients and enhances service offerings. This way, advisors become essential partners in their clients' success. Plus, by addressing common hurdles like resistance to change, resource limitations, and skill gaps, small agencies can really make the most of these services.

In a nutshell, the perks of business advisory services go way beyond just solving immediate problems; they lay the groundwork for long-term growth and resilience. Small agencies should definitely consider embracing these practices and investing in their consulting capabilities. Doing so can lead to big improvements in decision-making, operational efficiency, and risk management. Sure, the journey to implementing effective business advisory services can be challenging, but overcoming those bumps can lead to amazing results for both advisors and their clients. So, why not take that leap? Your future self will thank you!

Frequently Asked Questions

What are business advisory services?

Business advisory services are professional support designed to help small businesses improve their performance, address challenges, and achieve strategic goals. This includes areas like financial planning, operational efficiency, compliance assistance, and growth advice.

Why are business advisory services important for small agencies?

These services are crucial for small agencies, particularly in rural areas, as they provide tailored support that addresses local issues such as limited resources and market access. They help small businesses enhance their operational resilience and make informed decisions for sustainable growth.

How significant are small businesses to the economy?

Small businesses accounted for 62.7% of net new job creation from 1995 to 2023, highlighting their vital role in the economy.

How often does Steinke and Company meet with clients to review their financial records?

Steinke and Company typically meets with clients 1-3 times a year to review tax returns and current records.

What benefits can small firms gain from leveraging business advisory services?

Small firms can boost operational resilience, make smarter decisions, drive sustainable growth, and benefit from proactive tax planning that ensures compliance and minimizes unexpected issues.

What is the focus of proactive tax planning offered by business advisory services?

Proactive tax planning focuses on reducing the tax burden for businesses while ensuring compliance, allowing owners to concentrate on scaling their operations effectively.