Introduction

Offshore tax preparation is becoming quite the game-changer for small businesses, especially in service sectors where keeping costs down and getting expert advice is key. By tapping into external resources, these companies can not only lighten their tax load but also boost their operational efficiency. This means they can free up valuable internal resources to focus on growth initiatives.

But here’s the kicker: navigating the ins and outs of offshore tax compliance can be tricky. So, how can small businesses pick the right partners and put effective practices in place to reap the benefits while keeping risks at bay?

Understand the Importance of Offshore Tax Preparation for Small Businesses

Offshore tax preparation is becoming a go-to strategy for small businesses, especially those in service industries. By tapping into external resources, these companies can significantly cut down on their tax bills while still playing by the rules. This is particularly helpful for small businesses in rural areas, where traditional tax help might be hard to find or just too expensive.

Understanding the value of external tax organization means recognizing how it can streamline operations and boost financial efficiency. For example, businesses that hire skilled external tax preparers can slash costs by 50% or more. This frees up in-house teams to focus on strategic, value-added tasks. As one expert puts it, "Outsourcing tax preparation services can be a game changer for your accounting or CPA firm, especially during those hectic times of the year."

Plus, with tax laws constantly shifting, staying informed about international options can help businesses tackle compliance challenges more effectively. Offshore tax accountants know the ins and outs of IRS changes and multi-jurisdictional regulations, making sure that all filings hit the mark. This proactive approach not only cuts down on mistakes but also boosts accuracy in tax filings, which is key for rural businesses looking to thrive in a competitive landscape.

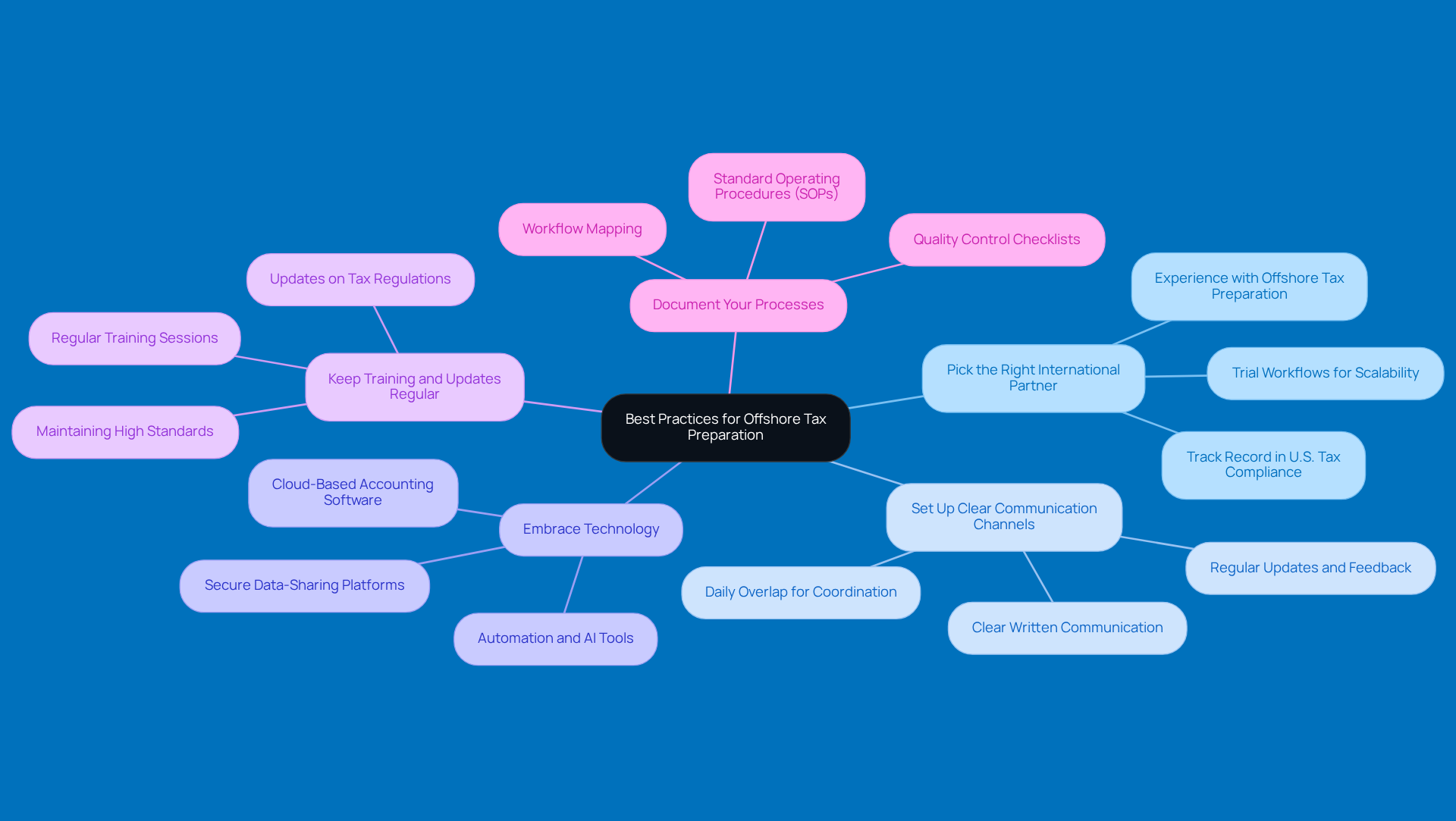

Implement Key Best Practices for Efficient Offshore Tax Preparation

When it comes to getting your external tax organization right, small businesses should think about these friendly tips:

-

Pick the Right International Partner: It’s super important to choose a service provider that knows their stuff when it comes to U.S. tax compliance. Look for companies that have a solid track record and really understand the ins and outs of offshore tax preparation.

-

Set Up Clear Communication Channels: Good communication is key! Regular updates and feedback can help clear up any misunderstandings and keep everyone on the same page about expectations and deadlines. Try to aim for at least 3-4 hours of daily overlap for smooth coordination.

-

Embrace Technology: Why not take advantage of cloud-based accounting software and secure data-sharing platforms? They make it easy to collaborate with remote teams, boost efficiency, and keep sensitive info safe from data breaches.

-

Keep Training and Updates Regular: Make sure your remote team is in the loop about the latest tax regulations and compliance requirements. Regular training sessions can help maintain high standards and minimize errors, so your team is always ready for whatever the tax landscape throws at them.

-

Document Your Processes: It’s a great idea to create standard operating procedures (SOPs) for all your external tax tasks. This way, you have a handy reference point that helps keep quality and compliance consistent while making workflows smoother.

Leverage the Benefits of Offshore Tax Preparation for Financial Success

Small businesses can really reap fantastic benefits from offshore tax preparation that can boost their financial health. Let’s break it down:

-

Cost Savings: Many companies have found that they can save a pretty penny - often between 30% to 70% - by opting for offshore tax services instead of local ones. Imagine what you could do with those extra resources! Maybe invest in growth initiatives or treat your team to a nice lunch?

-

Access to Expertise: Offshore providers often bring in experts who specialize in U.S. tax compliance. This means you’re getting top-notch service that meets all legal standards. With their know-how, you can expect more accurate filings and a lower risk of audits. And let’s be honest, nobody wants to deal with those pesky underpayment penalties from the IRS!

-

Enhanced Productivity: By outsourcing your tax processing, you free up your internal resources. This lets your team focus on what they do best - core operations and strategic development. The result? Improved productivity and a boost in overall performance. Who wouldn’t want that?

-

Scalability: Offshore tax services can easily scale with your business. Whether it’s peak tax season or a quieter time, they can handle the workload without you needing to hire more staff permanently. Talk about flexibility!

-

Improved Adherence: Tax regulations can be a bit of a maze, right? Having specialized international teams on your side helps ensure you stay compliant with all those changing laws. This minimizes the risk of penalties and fines. Plus, understanding the ins and outs of underpayment penalties and strategies like safe harbor payments can really save you from headaches down the line.

So, if you’re looking to enhance your tax compliance and reduce financial risks, consider utilizing offshore tax preparation services. It could be a game-changer for your small business!

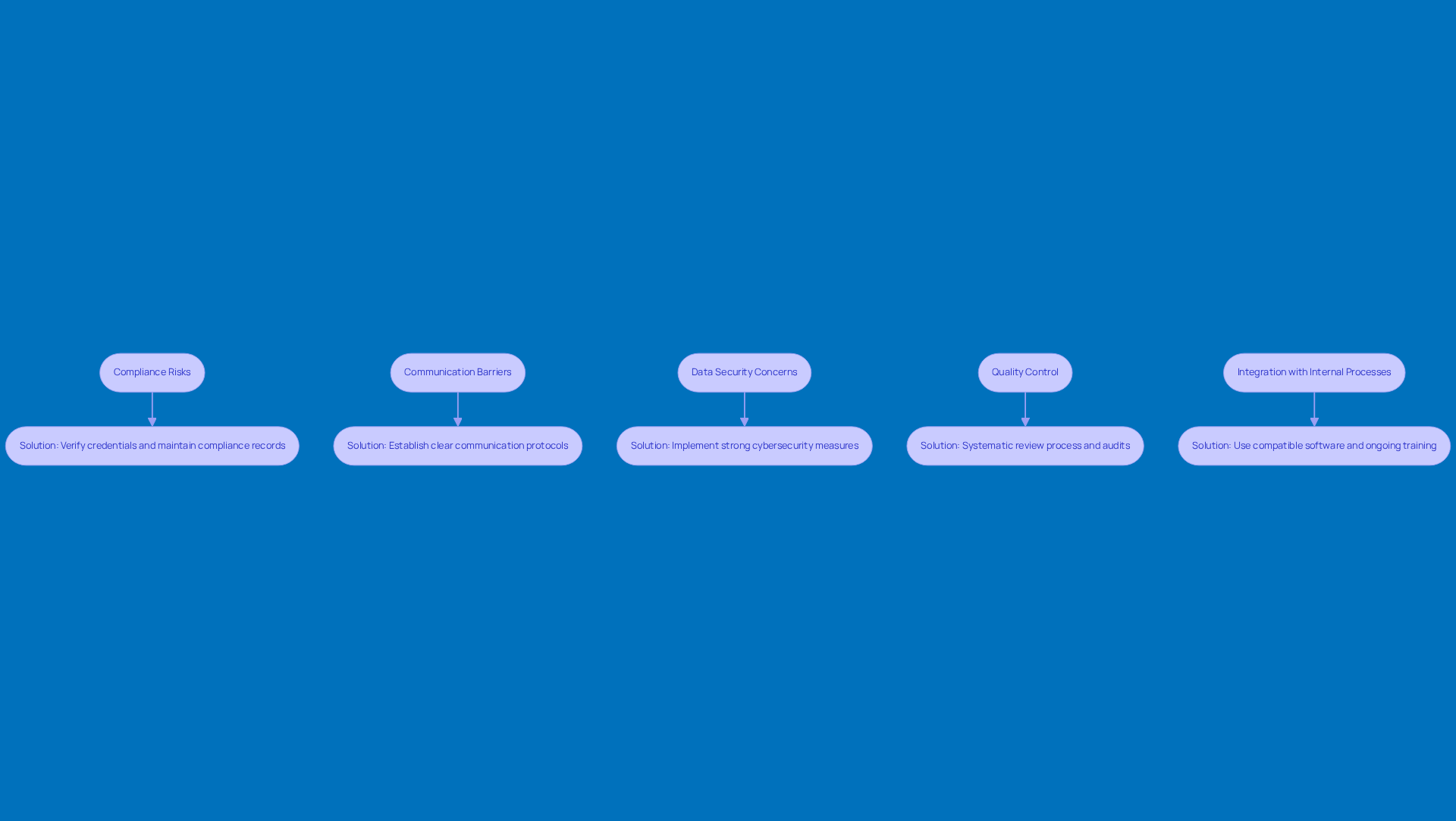

Navigate Challenges in Offshore Tax Preparation with Effective Solutions

Offshore tax preparation can be a game changer for small businesses, but let's be real - there are some bumps in the road. Here’s how to tackle those challenges head-on:

-

Compliance Risks: First off, compliance is key. When picking international partners, do your homework! Make sure they really know U.S. tax laws and can show they’re following IRS rules. This means checking their credentials and keeping solid records of compliance.

-

Communication Barriers: Ever tried to communicate across cultures? It can get tricky! Setting up clear communication protocols and using project management tools can really help. Plus, regular check-ins keep everyone on the same page about what’s needed and when.

-

Data Security Concerns: Protecting your financial info is a must. Strong cybersecurity measures - like encryption and secure data transfer - are your best friends here. And don’t forget to ensure your partners are on board with strict data protection standards. This is crucial for keeping client trust and staying compliant with the Gramm-Leach-Bliley Act (GLBA). Think encrypting sensitive customer info and having a solid breach notification plan in place.

-

Quality Control: Want to keep your outputs top-notch? Implement a systematic review process for all external work. Regular audits and constructive feedback can help you catch any issues early, ensuring the quality of service meets your expectations.

-

Integration with Internal Processes: Make sure your external tax processes mesh well with your internal accounting systems. This can be done with compatible software and ongoing training for both teams, which helps everyone work together smoothly.

By tackling these challenges with proactive strategies, you can turn offshore tax preparation into a powerful growth tool while keeping compliance and quality in check. So, what’s your next step?

Conclusion

Offshore tax preparation is a fantastic opportunity for small businesses to fine-tune their financial strategies. By tapping into external resources, companies can really cut down on their tax bills while staying compliant with those tricky regulations. This not only boosts operational efficiency but also lets businesses zero in on growth and innovation.

Throughout this article, we’ve highlighted some key practices for effective offshore tax prep:

- Picking the right international partner

- Keeping communication clear

- Embracing tech

- Offering regular training

- Documenting processes

These are all essential steps for successful collaboration. Plus, the many perks of offshore tax prep - like cost savings, access to expertise, improved productivity, and better compliance - really show its worth for small businesses eager to thrive in a competitive landscape.

So, what’s the takeaway? The smart implementation of offshore tax preparation can truly change the game for small businesses. By following these best practices and tackling potential challenges head-on, companies can not only protect their compliance but also unlock some serious financial benefits. Embracing this approach might just be the key to driving sustainable growth and achieving long-term success in a constantly changing market.

Frequently Asked Questions

What is offshore tax preparation and why is it important for small businesses?

Offshore tax preparation is a strategy where small businesses utilize external resources to manage their tax obligations. It is important because it can significantly reduce tax bills while ensuring compliance with regulations, especially beneficial for small businesses in rural areas where traditional tax assistance may be limited or costly.

How can offshore tax preparation benefit small businesses financially?

Businesses that hire skilled external tax preparers can potentially cut costs by 50% or more. This reduction in expenses allows in-house teams to concentrate on more strategic and value-added tasks.

What advantages does outsourcing tax preparation provide during busy tax seasons?

Outsourcing tax preparation services can be a game changer for accounting or CPA firms, particularly during hectic periods. It alleviates the workload on in-house teams, allowing them to focus on critical tasks while ensuring that tax filings are handled efficiently.

How do offshore tax accountants help businesses with compliance challenges?

Offshore tax accountants are knowledgeable about IRS changes and multi-jurisdictional regulations. They ensure that all tax filings are accurate and compliant, which helps businesses avoid mistakes and tackle compliance challenges effectively.

Why is staying informed about international tax options important for small businesses?

Staying informed about international tax options helps businesses navigate the constantly changing tax laws. This proactive approach enhances accuracy in tax filings, which is essential for rural businesses aiming to succeed in a competitive environment.