Introduction

Navigating the world of corporate tax planning can feel a bit daunting, right? With all the changing regulations and incentives, it’s easy to get lost in the details. But understanding the latest tax laws, like those from the 'One Big Beautiful Bill Act,' is super important for companies looking to optimize their tax positions and boost profitability.

As new opportunities pop up, challenges come along too. So, how can businesses make the most of these changes while staying compliant? In this article, we’ll explore four best practices that help corporations not just stay in the loop but also strategically position themselves for tax efficiency in 2025 and beyond. Let’s dive in!

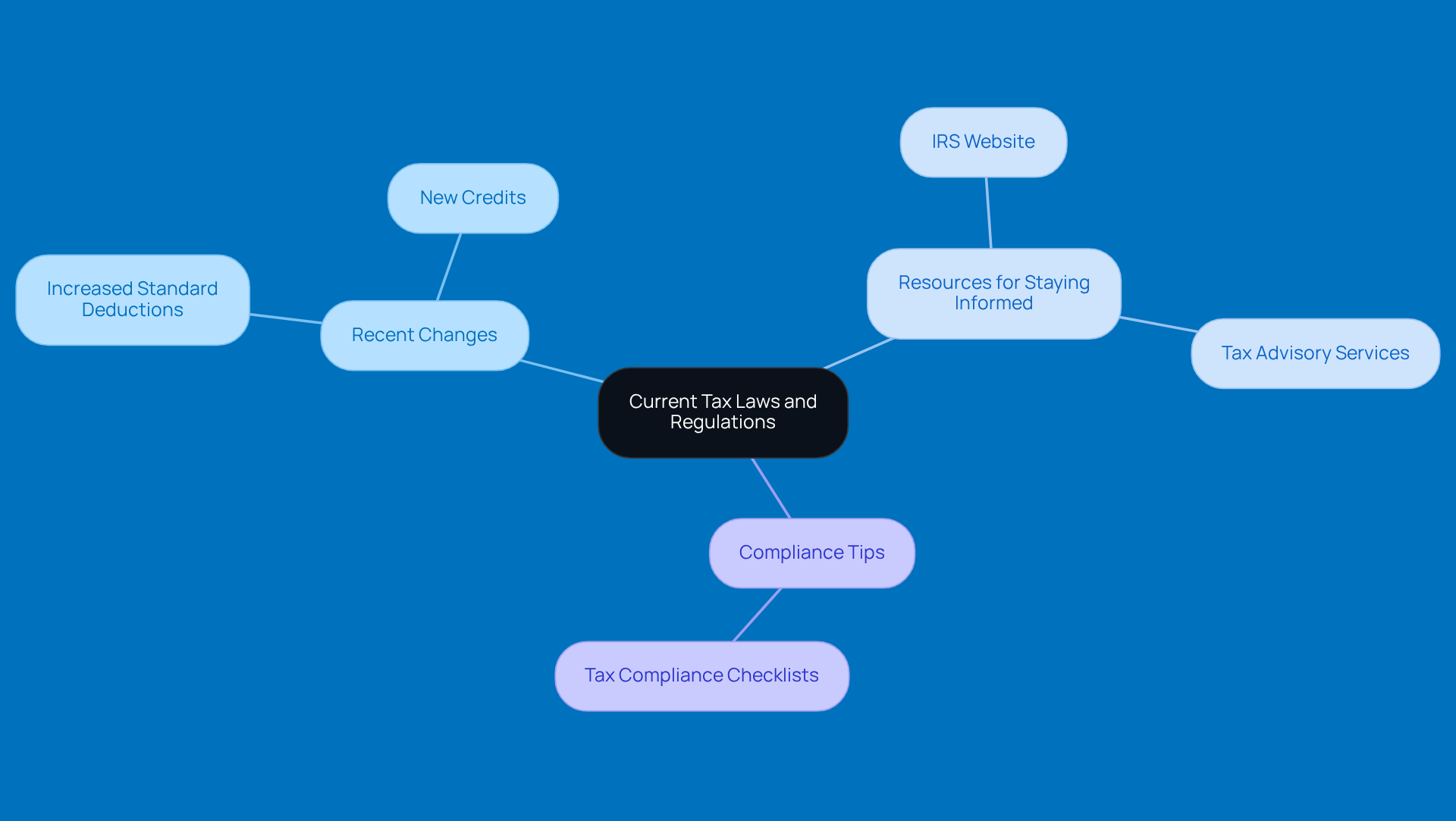

Understand Current Tax Laws and Regulations

When it comes to tax planning for corporations, staying in the loop about current fiscal laws and regulations is key. It’s all about understanding how recent laws, like the 'One Big Beautiful Bill Act,' have shaken things up with federal taxes, benefits, and deductions. Business owners should make it a habit to check out resources like the IRS website and tax advisory services to keep up with the latest updates.

And here’s a tip: using tax compliance checklists can be a lifesaver! They help ensure that all your filings and payments are on point and made on time, which can save you from those pesky penalties and interest. For example, did you know that the 2025 tax changes include:

- Increased standard deductions

- New credits

These can really make a difference in your tax liabilities.

Staying informed isn’t just about compliance; it’s also a great way to explore tax planning for corporations options. So, how are you keeping up with the latest tax news? Let’s make sure you’re not missing out!

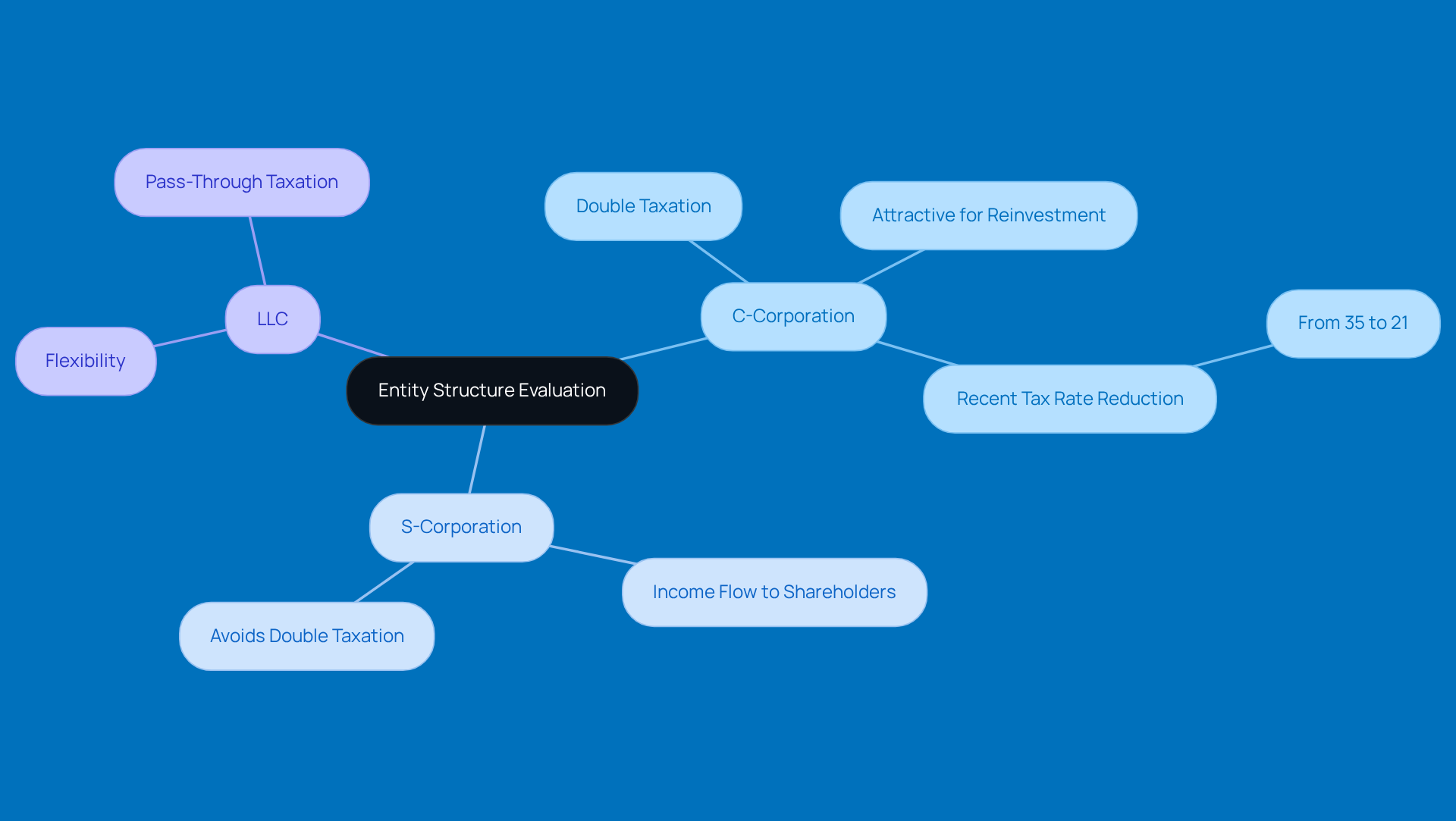

Evaluate and Optimize Entity Structure

Choosing the right entity structure, like a C-Corporation, S-Corporation, or LLC, is crucial for effective tax planning for corporations and can significantly impact your tax situation. C-Corporations deal with double taxation on profits, but S-Corporations let income flow straight to shareholders, which helps avoid that headache. With the recent drop in the corporate tax rate from 35% to 21% thanks to the Tax Cuts and Jobs Act (TCJA), C-Corporations are looking more attractive for some businesses, especially those wanting to reinvest profits for growth. For example, companies that are restructuring to take advantage of these lower rates can really boost their financial standing and competitive edge.

It's a good idea for business owners to regularly check how their current structure relates to tax planning for corporations in response to these tax law changes. Have you thought about consulting a tax expert? They can help uncover opportunities for restructuring that align with your goals and enhance tax planning for corporations. It’s super important to do these evaluations, especially during big changes in your organization or when tax laws get updated, to make sure your entity is performing at its best and staying compliant.

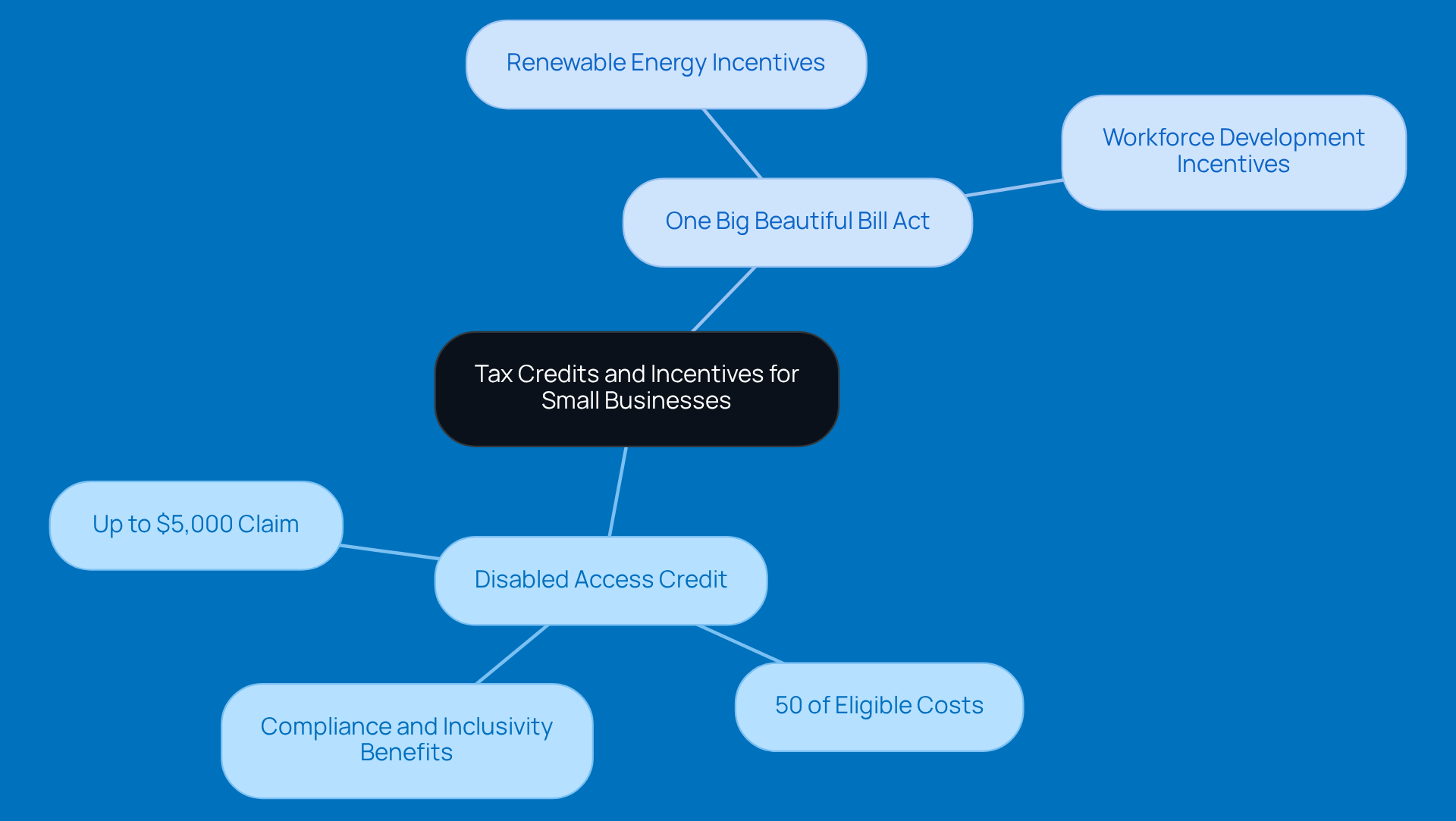

Leverage Tax Credits and Incentives Strategically

Many small business owners don’t realize that tax planning for corporations can significantly lighten a corporation's tax burden. Take the Disabled Access Credit, for example. It lets qualifying businesses claim up to $5,000 for making their facilities accessible, covering 50% of eligible costs up to $10,250. Not only does this help with compliance to the Americans with Disabilities Act, but it also fosters inclusivity, which can help attract more customers.

And let’s not forget about the 'One Big Beautiful Bill Act.' This new legislation has rolled out some exciting tax incentives for companies that invest in renewable energy and workforce development. These incentives are super important, especially with the growing emphasis on sustainability and social responsibility in the business world.

To truly take advantage of these benefits, entrepreneurs should explore the available rebates and incentives through effective tax planning for corporations. Chatting with a tax professional can help ensure you’re assessing your eligibility correctly and not leaving any money on the table. Plus, keeping a close eye on eligibility criteria and application deadlines for these credits can lead to some serious savings, which is key for the long-term success and profitability of your business.

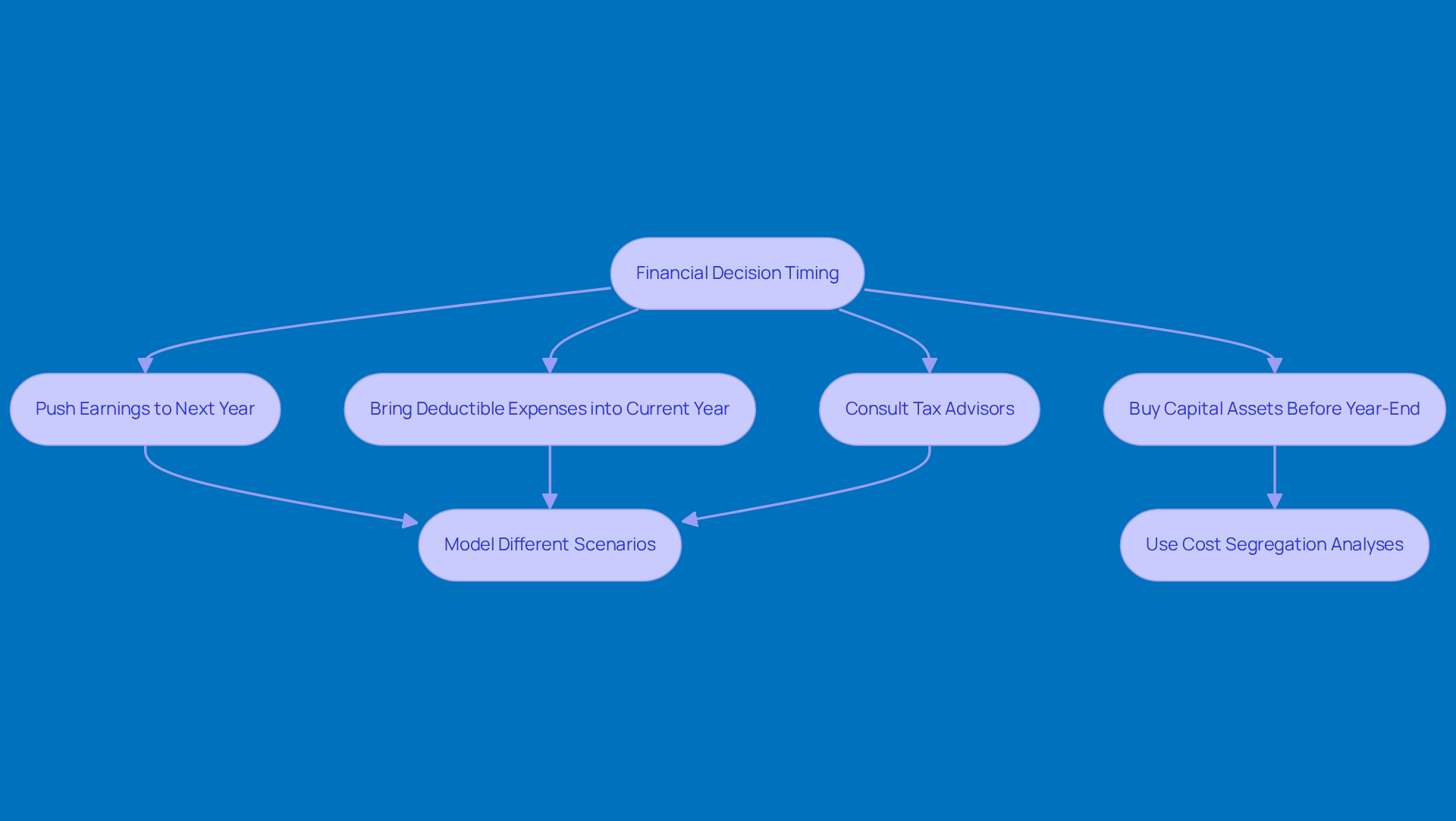

Time Financial Decisions for Optimal Tax Outcomes

Timing really matters when it comes to tax planning, especially for corporations looking to get the most out of their tax positions. By pushing earnings to the next tax year and bringing deductible expenses into the current year, companies can effectively lower their taxable earnings. For example, if a company buys capital assets before December 31, they can take advantage of bonus depreciation provisions, which boosts their immediate tax benefits.

Looking ahead to 2026, the changes in tax laws - especially those from the One Big Beautiful Bill Act - are going to shake things up in how earnings and expenses are managed. Companies can use cost segregation analyses to speed up depreciation on assets, which can create or enhance a Net Operating Loss (NOL) that offsets future earnings. This approach not only maximizes deductions but also acts as a safety net against income fluctuations.

It’s super important to regularly chat with tax advisors to navigate these complexities and make sure financial decisions align with tax strategies. Experts suggest modeling different scenarios, like recognizing gains up to lower capital gain target brackets, to effectively fill those lower marginal tax bands. By timing financial decisions wisely, corporations can improve their tax planning for corporations, thereby boosting their tax efficiency and staying compliant with changing regulations.

Conclusion

Staying ahead in tax planning for corporations isn’t just about ticking boxes for compliance; it’s a golden opportunity to boost your financial performance. By getting a grip on current tax laws, evaluating your entity structures, leveraging available credits, and timing your financial decisions just right, you can really amp up your corporation's tax efficiency and overall success.

Let’s highlight some key practices here. First off, keeping up with tax law changes is crucial - take the 'One Big Beautiful Bill Act,' for example. And don’t underestimate the power of choosing the right entity structure! Plus, utilizing tax credits like the Disabled Access Credit or incentives for renewable energy investments can lead to some serious savings. Timing your financial decisions effectively? That’s the cherry on top, helping you optimize your tax positions and make the most of those deductions and credits.

In a world where tax regulations are always shifting, it’s super important to engage proactively with tax professionals. By embracing these best practices, corporations can not only navigate the tricky waters of tax planning but also set themselves up for long-term growth and profitability. So, why not adopt a strategic approach to tax planning? It’s not just a good idea; it’s essential for any corporation looking to thrive in today’s competitive landscape!

Frequently Asked Questions

Why is it important for corporations to understand current tax laws and regulations?

Understanding current tax laws and regulations is crucial for corporations as it helps them navigate changes in federal taxes, benefits, and deductions, ensuring compliance and optimizing tax planning strategies.

What recent law is mentioned that has impacted federal taxes?

The 'One Big Beautiful Bill Act' is mentioned as a recent law that has had an effect on federal taxes.

What resources can business owners use to stay updated on tax laws?

Business owners can check resources like the IRS website and tax advisory services to keep up with the latest updates on tax laws and regulations.

How can tax compliance checklists be beneficial for corporations?

Tax compliance checklists can help ensure that all filings and payments are accurate and made on time, which can prevent penalties and interest.

What are some specific changes in tax laws expected in 2025?

The 2025 tax changes include increased standard deductions and new credits, which can significantly impact tax liabilities.

How does staying informed about tax laws benefit corporations beyond compliance?

Staying informed about tax laws also allows corporations to explore various tax planning options, potentially leading to more favorable tax outcomes.