Introduction

Navigating the world of tax prep and planning can feel like a maze for small business owners, right? With regulations constantly changing, it’s easy to feel overwhelmed. But here’s the thing: understanding the ins and outs of tax compliance doesn’t just help you dodge liabilities; it sets you up for long-term financial success. So, what if we flipped the script? How can entrepreneurs turn tax season from a stressful chore into a chance for growth and savings? Let’s dive in!

Understand Tax Preparation and Planning Services

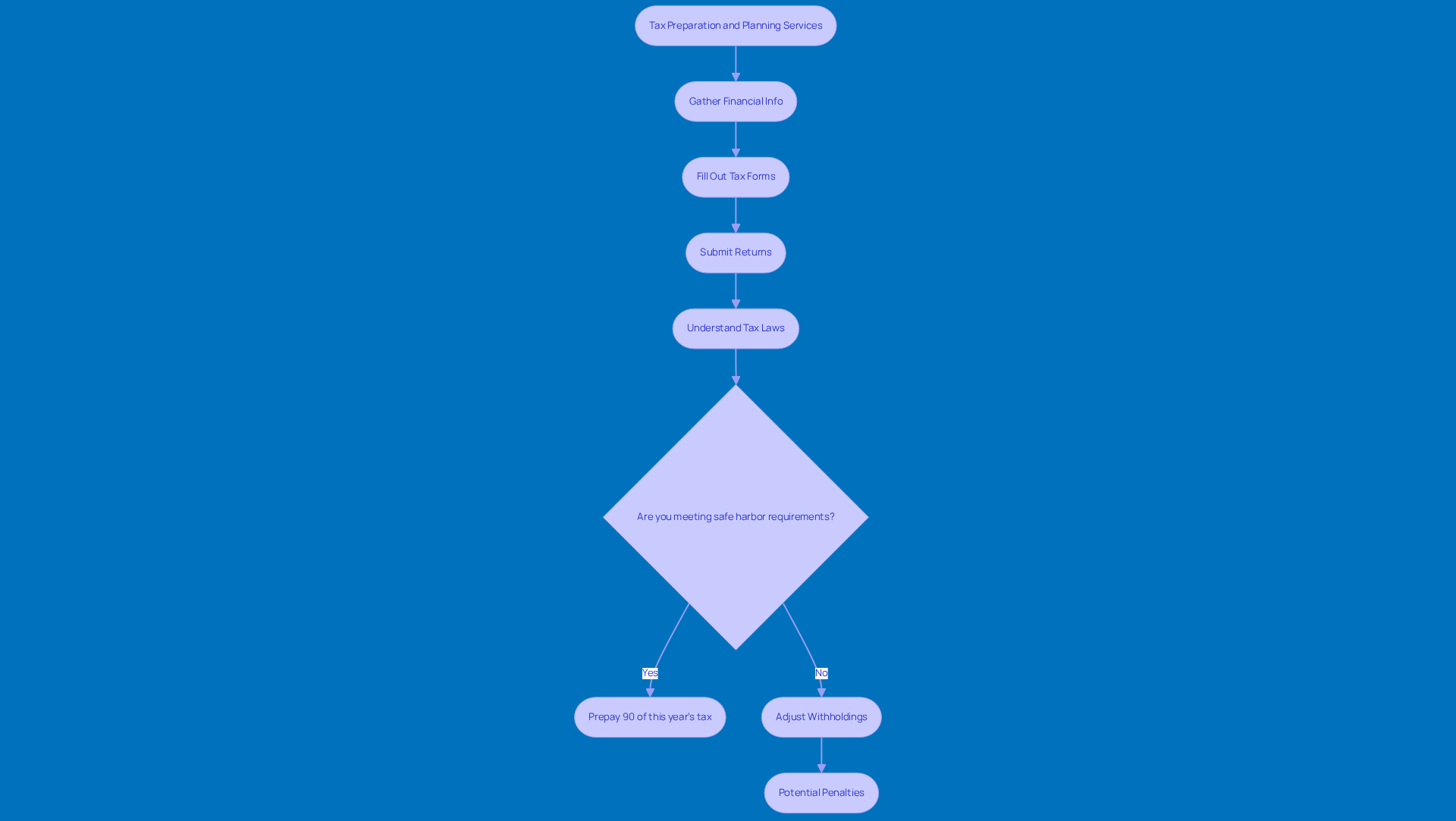

Tax preparation and planning services are key parts of managing money effectively for small businesses. When we talk about tax preparation and planning services, we’re looking at gathering financial info, filling out tax forms, and submitting returns to stay compliant with tax laws. It often feels like a reactive process, focusing on what’s already happened financially. On the flip side, tax preparation and planning services focus on being proactive-minimizing what you owe and optimizing your financial future. This means taking a good look at your financial situation, understanding tax laws, and making smart decisions throughout the year to snag deductions, credits, and other tax-saving opportunities.

For small business owners, getting a grip on underpayment penalties is super important. The IRS hits you with these penalties if you don’t pay enough of your tax bill through withholding or estimated payments during the year. To dodge these penalties, you’ll want to meet the safe harbor requirements, which usually means prepaying either 90% of this year’s tax or 100% of last year’s tax (or 110% if you’re a higher-income taxpayer). Plus, there’s a de minimis exception that lets you off the hook if your total tax liability minus withholdings and credits is less than $1,000. By keeping an eye on estimated tax payments and tweaking withholdings, you can really lower your chances of facing penalties that could hit your wallet hard.

And let’s not forget about rural entrepreneurs! Understanding tax preparation and planning services can result in better financial decisions and reduced stress when tax time arrives. Partnering with Steinke and Company can give you personalized strategies that not only keep you compliant but also help your business grow and run smoothly. In the end, it’s all about setting yourself up for long-term success!

Leverage Proactive Tax Planning for Financial Optimization

Proactive tax preparation and planning services are extremely important for small business leaders. It helps them see and cut down on tax liabilities more effectively. Here are some key best practices you might want to consider:

-

Year-Round Monitoring: Make it a habit to regularly check your financial statements and tax obligations. This way, you can spot potential tax-saving opportunities. Keeping an eye on things helps you notice trends and areas for improvement, so you’re always ready for any changes in tax laws.

-

Utilize Tax-Advantaged Accounts: Think about contributing to retirement accounts like SEP IRAs or Solo 401(k)s, as well as Health Savings Accounts (HSAs). These can really help lower your taxable income while also building up savings for the future. Not only do these accounts give you immediate tax benefits, but they also support your long-term financial health.

-

Strategic Timing of Income and Expenses: The timing of when you recognize income and deduct expenses can really affect your taxes. For example, if you can hold off on recognizing income until next year, you might lower your tax bill for this year. On the flip side, speeding up deductible expenses before the year ends can help your cash flow.

-

Engage in Tax-Loss Harvesting: This strategy is all about selling off underperforming investments to offset capital gains, which can help reduce your overall tax liability. By managing your investment portfolio wisely, you can really optimize your tax situation.

-

Consult with a tax expert: Regular chats with a tax consultant from tax preparation and planning services are key for crafting personalized strategies that fit your specific goals and financial situation. A good expert can help you find new credits and deductions, making sure you get the most savings possible.

By embracing these proactive practices, rural entrepreneurs can boost their financial stability, improve cash flow, and stay compliant with changing tax regulations. So, why not start planning today?

Choose the Right Tax Professional for Your Business Needs

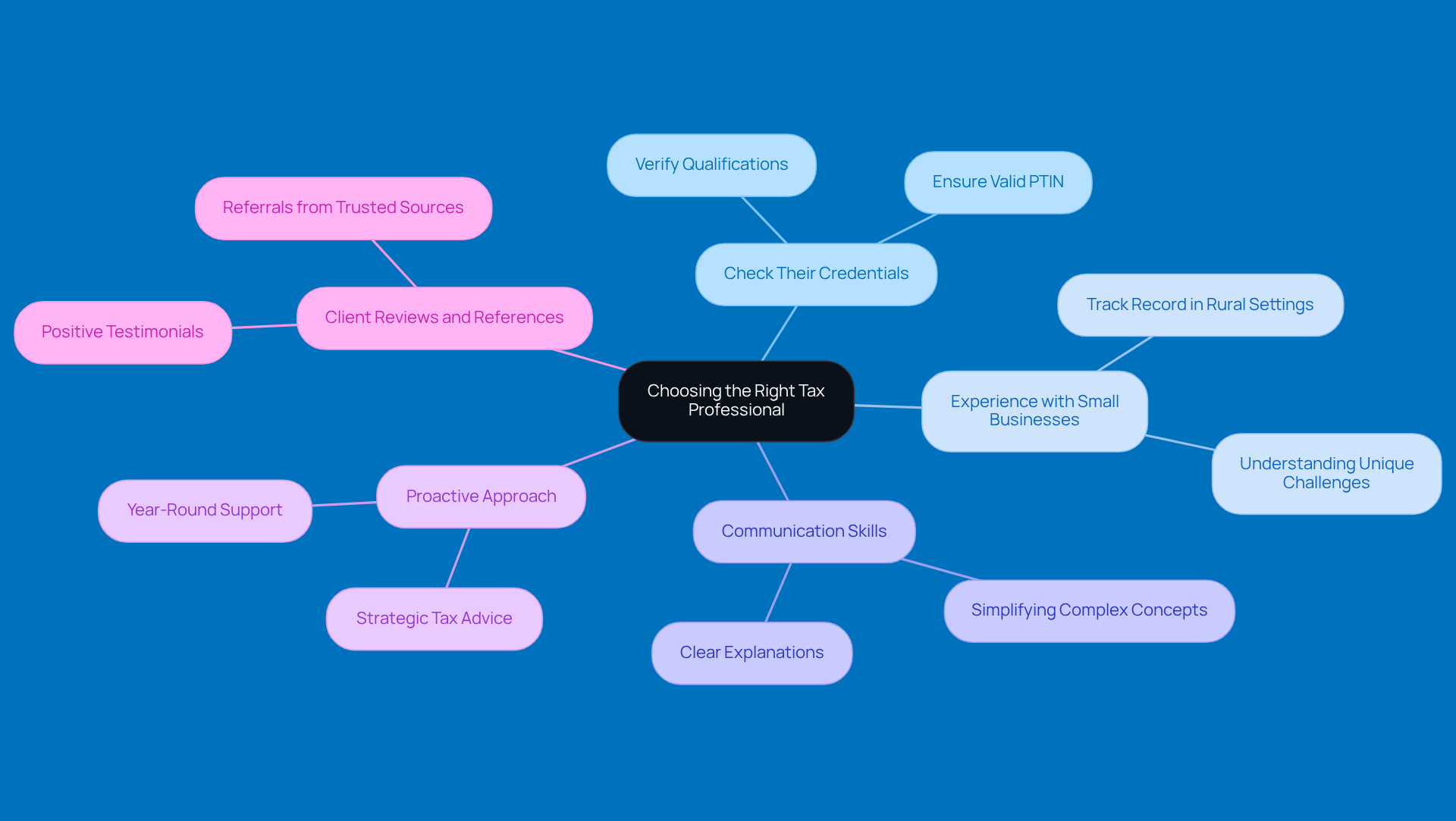

Choosing the right tax expert is super important for small business owners, especially if you’re in a rural area. Here are some key things to think about when making your choice:

-

Check Their Credentials: Make sure your tax pro has the right qualifications, like a CPA or Enrolled Agent designation. These credentials show they know their stuff and follow professional standards.

-

Experience with Small Businesses: Look for someone who has a solid track record with businesses like yours, particularly in rural settings. They’ll understand the unique challenges you face and can offer valuable insights.

-

Communication Skills: You want a tax advisor who can explain things clearly and break down complex tax concepts into simple terms. Good communication helps you grasp your tax situation and strategies better.

-

Proactive Approach: A good tax professional doesn’t just prepare your taxes; they should also provide strategic advice throughout the year. This proactive support can help you lower your tax bills and make smarter financial choices.

-

Client Reviews and References: Don’t forget to check out feedback from other clients. Positive testimonials can give you a good sense of whether the professional is reliable and effective.

By taking the time to choose the right tax expert, rural entrepreneurs can confidently tackle the complexities of tax preparation and planning services with the help they need.

Implement Best Practices for Tax Compliance and Preparation

To keep your tax game strong, small business owners should really consider these best practices:

-

Keep Those Records Straight: You know how important it is to have your financial records in order, right? Keeping detailed and organized records throughout the year simplifies tax preparation and planning services. Using accounting software can help you track income and expenses easily, cutting down on mistakes and making sure you don’t miss out on any deductions. Trust me, poor recordkeeping is a common reason businesses lose out on valuable deductions every year. Plus, understanding your paystub is key; it ensures you’re getting paid right and that the correct amounts are withheld for taxes.

-

Know Your Deadlines: Let’s face it, nobody likes late penalties. That’s why being familiar with key tax deadlines is super important. Setting reminders for filing and payment dates can help you stay on top of things and avoid that last-minute scramble. And hey, keeping your tax records for at least three years after filing is a smart move. It gives you a handy reference for past returns and supporting documents if you ever need them.

-

Look Back at Previous Returns: Ever thought about checking out your past tax returns? Analyzing them can show you trends and highlight areas where you might improve your current tax strategy. This isn’t just about spotting missed deductions; it also helps you forecast future tax obligations. Keeping copies of your tax returns and W-2s is a must for verifying income and prepping for any potential audits.

-

Use Checklists: Who doesn’t love a good checklist? Creating or using existing tax prep checklists can help ensure you gather all the necessary documents before filing. Think W-2s, 1099s, receipts, and other important paperwork. These are crucial for backing up your claims and avoiding disputes with the IRS. Staying organized can really cut down on stress if you ever face an audit.

-

Stay Updated on Tax Law Changes: Tax laws change all the time, and keeping yourself in the loop is essential. Subscribing to IRS updates or chatting with a tax pro can give you valuable insights into new opportunities and compliance requirements.

By following these best practices, small business owners can enhance their tax compliance efforts and protect valuable deductions through effective tax preparation and planning services, while also lowering the chances of errors or penalties. So, what are you waiting for? Get started today!

Conclusion

When it comes to effective tax preparation and planning, small business owners really can’t afford to overlook this crucial aspect of their financial strategy. By shifting gears from a reactive to a proactive approach, you’re not just ticking boxes for tax compliance; you’re also setting yourself up to minimize those pesky tax liabilities and boost your overall financial health.

Let’s dive into some best practices that can make a real difference in your tax prep and planning:

- Year-round financial monitoring

- Tapping into tax-advantaged accounts

- Timing your income and expenses just right

- Engaging in tax-loss harvesting

- Consulting with a qualified tax professional

These strategies empower you to make informed decisions that can lead to significant savings and keep you in line with the ever-evolving tax regulations.

But here’s the kicker: embracing these proactive tax strategies isn’t just about dodging penalties. It’s about building a solid foundation for long-term financial success. By prioritizing effective tax preparation and planning, you can confidently navigate the complexities of the tax landscape, ensuring your business not only survives but thrives in this fast-paced environment. So why wait? Taking action today can pave the way for a more secure and prosperous financial future!

Frequently Asked Questions

What are tax preparation and planning services?

Tax preparation and planning services involve gathering financial information, filling out tax forms, and submitting returns to comply with tax laws. They focus on both reactive processes (addressing past financial events) and proactive strategies (minimizing tax liabilities and optimizing financial futures).

Why is it important for small business owners to understand underpayment penalties?

Small business owners need to understand underpayment penalties because the IRS imposes these penalties if they do not pay enough of their tax bill through withholding or estimated payments during the year.

How can small business owners avoid underpayment penalties?

To avoid underpayment penalties, small business owners should meet safe harbor requirements by prepaying either 90% of the current year's tax or 100% of the previous year's tax (or 110% for higher-income taxpayers). Additionally, a de minimis exception applies if the total tax liability minus withholdings and credits is less than $1,000.

What strategies can help reduce the likelihood of facing tax penalties?

By monitoring estimated tax payments and adjusting withholdings, small business owners can lower their chances of incurring penalties that could negatively impact their finances.

How can rural entrepreneurs benefit from tax preparation and planning services?

Rural entrepreneurs can benefit from tax preparation and planning services by making better financial decisions and reducing stress during tax season. These services can lead to personalized strategies that ensure compliance and support business growth.

What role does partnering with a firm like Steinke and Company play in tax preparation and planning?

Partnering with a firm like Steinke and Company can provide personalized strategies that help small businesses remain compliant with tax laws while also promoting growth and smooth operations, ultimately setting them up for long-term success.