Introduction

Navigating the tricky world of taxes can feel overwhelming for small business owners. You’re already juggling a ton of responsibilities while trying to grow your business, right? Well, understanding how to implement effective tax strategy services can not only help you stay compliant but also unlock some serious financial perks. But with tax laws changing all the time and the constant hustle to keep cash flow steady, how can you craft a tax strategy that really works for you?

Let’s dive into this together!

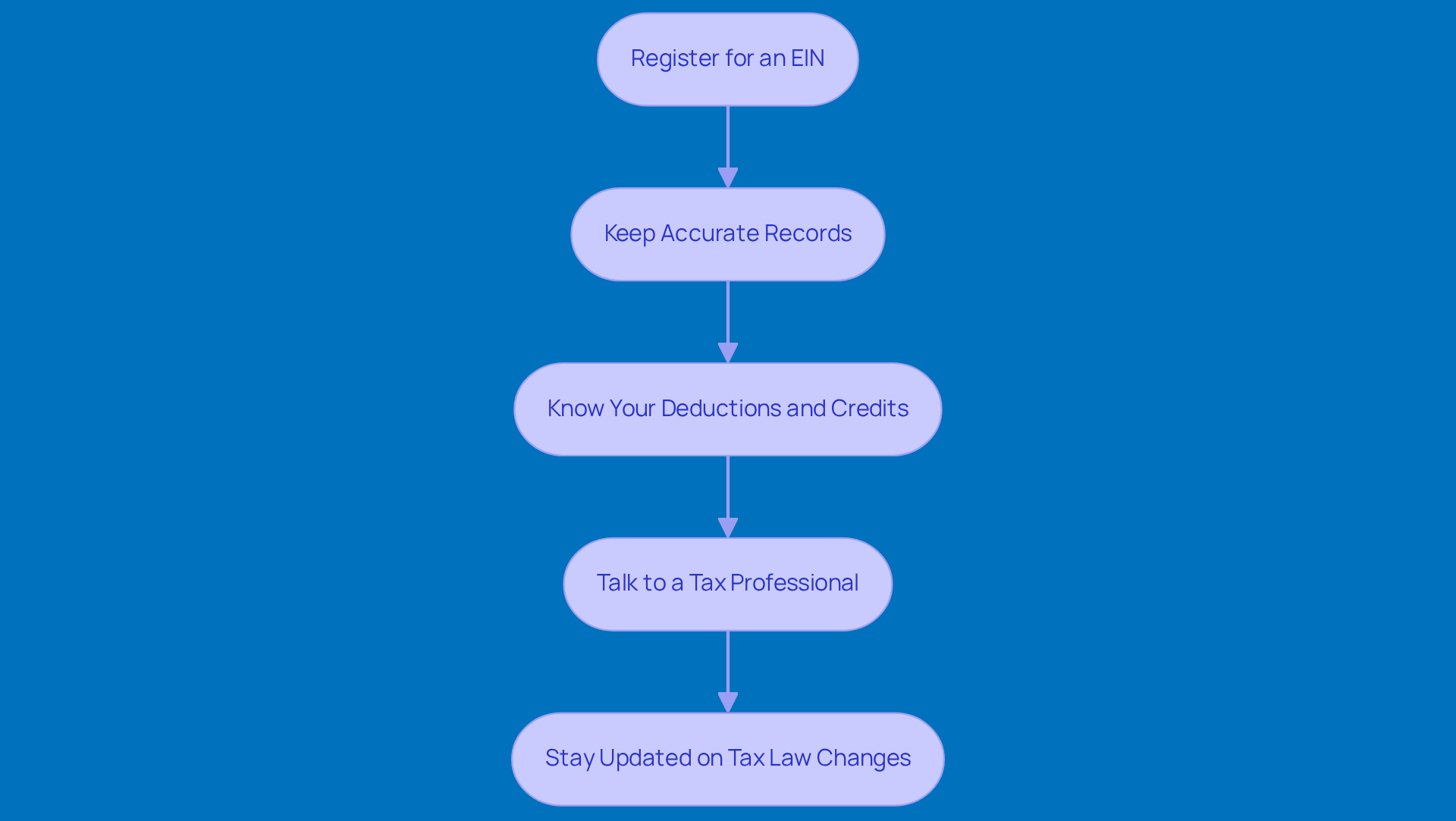

Establish Tax Compliance and Preparation Foundations

To build a solid foundation for tax compliance, small business owners should first get a grip on the specific tax responsibilities tied to their business structure. This means understanding federal, state, and local taxes, along with any industry-specific regulations. Here are some key steps to keep in mind:

- Register for an Employer Identification Number (EIN): Think of this as your business’s social security number. It’s crucial for tax purposes and a must-have if you have employees.

- Keep Accurate Records: Set up a straightforward system for record-keeping that tracks all your income, expenses, and receipts. This will make tax prep a breeze and help you stay compliant. Plus, having well-organized files of your financial statements, invoices, and receipts is super important, especially if the IRS comes knocking and you need to back up your deductions.

- Know Your Deductions and Credits: Get familiar with the tax deductions and credits available to you. They can really help lower your tax bill, and knowing about them can change your overall tax strategy.

- Talk to a Tax Professional: A tax advisor can be your best friend when it comes to navigating the tricky world of tax regulations. They’ll provide personalized advice and help you stay compliant while utilizing their tax strategy services to optimize your approach.

- Stay Updated on Tax Law Changes: Tax laws can change pretty frequently, so it’s important to keep an eye on any new rules that might affect your business. Make it a habit to check out resources from the IRS and other reliable sources regularly.

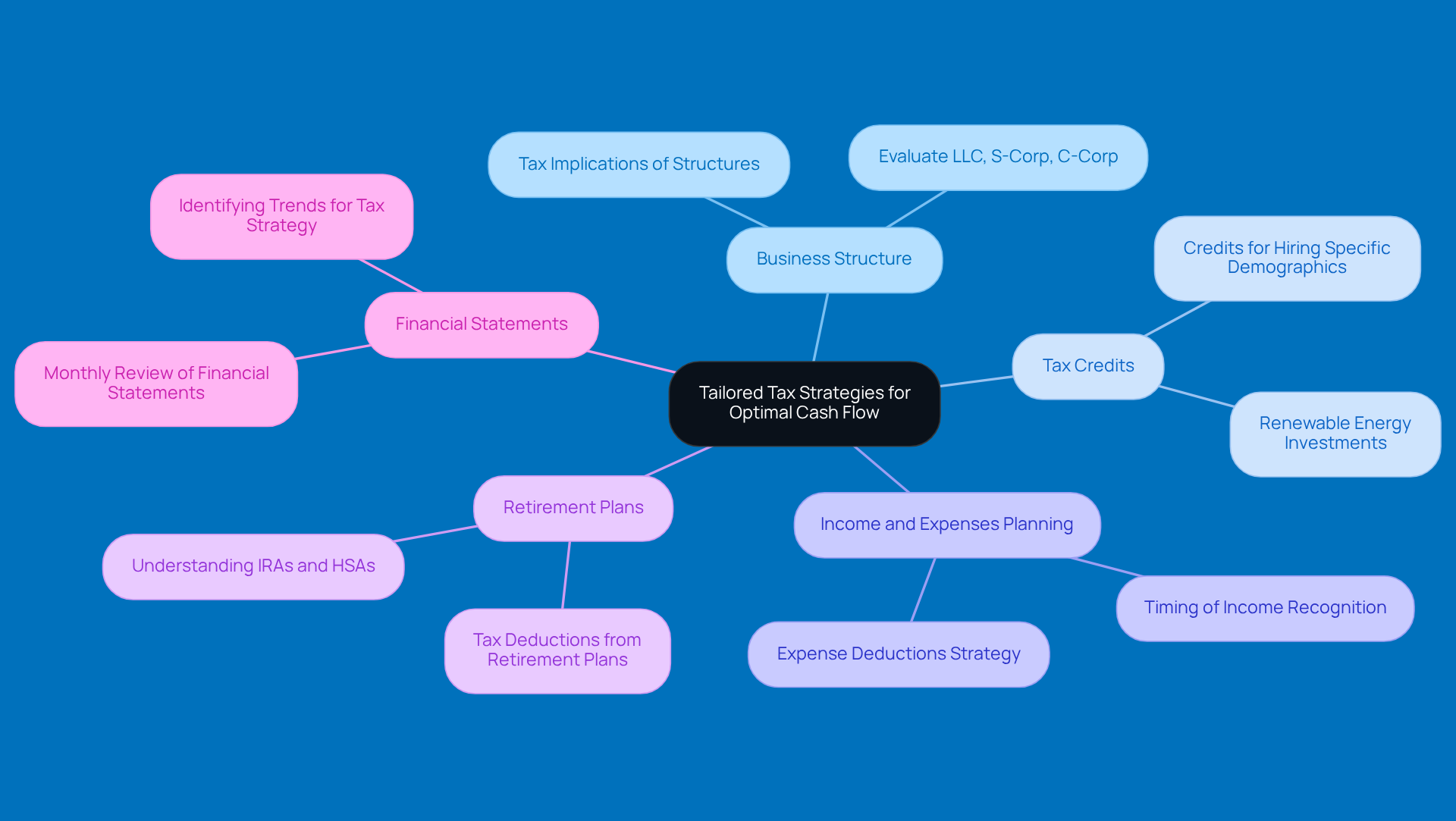

Develop Tailored Tax Strategies for Optimal Cash Flow

If you’re looking to boost your cash flow through smart tax strategies, here are some friendly tips for small business owners:

-

Take a Look at Your Business Structure: Have you thought about whether your current setup - like an LLC, S-Corp, or C-Corp - is the best choice for your taxes? Each structure comes with its own tax implications that can really impact your cash flow, making tax strategy services crucial.

-

Don’t Miss Out on Tax Credits: There are tax credits out there that your business might qualify for! For example, if you hire employees from specific demographics or invest in renewable energy, you could snag some savings.

-

Plan Your Income and Expenses Wisely: Timing is everything! You can really maximize your cash flow by employing tax strategy services to strategically plan when you recognize income and deduct expenses. For instance, deferring income to the next tax year might help lower your current-year tax bill.

-

Think About Retirement Plans: Setting up retirement plans isn’t just great for your employees; it can also give you some nice tax deductions that improve your cash flow. Plus, understanding the tax implications of different retirement options, like IRAs and HSAs, can significantly enhance your tax strategy services.

-

Keep an Eye on Your Financial Statements: Make it a habit to review your financial statements every month. This way, you can spot trends and make informed decisions about tax strategy services that could boost your cash flow. Staying proactive helps you stay compliant and avoids any surprises come tax season, making your filing process smoother and more accurate.

So, what do you think? Have you tried any of these strategies before? Let’s chat about what’s worked for you!

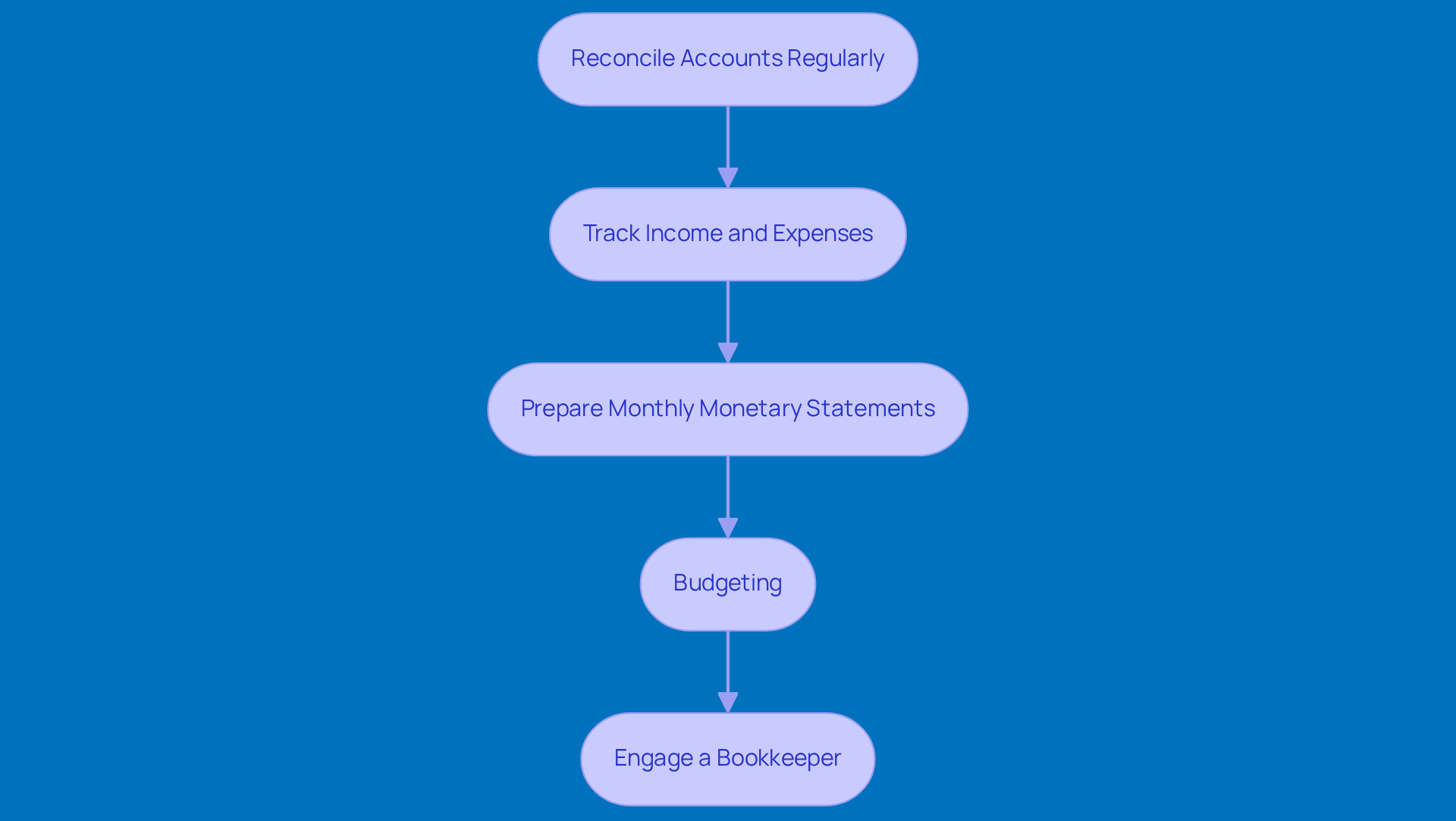

Implement Monthly Accounting and Financial Oversight

To keep your monthly accounting and financial oversight on point, here are some friendly tips for small business owners:

-

Reconcile Accounts Regularly: Make it a habit to check your bank and credit card statements every month. This helps you spot any discrepancies and keeps your records accurate. Trust me, it’s a lifesaver for avoiding errors and staying compliant!

-

Track Income and Expenses: Why not use accounting software to categorize and keep an eye on all your income and expenses? It makes tax time a breeze and gives you great insights into your cash flow management - super important for keeping your business running smoothly.

-

Prepare Monthly Monetary Statements: Generate those monthly income statements and balance sheets! They’re key to understanding your financial health. Regularly reviewing these documents helps you make informed decisions and plan strategically for the future.

-

Budgeting: Create a monthly budget that aligns with your business goals. It’s a good idea to compare your actual performance against this budget regularly. This way, you can easily spot areas that need a little boost and ensure you’re hitting your financial targets.

-

Engage a Bookkeeper: If managing money feels like a bit much, consider bringing in a bookkeeper. They can help keep your records straight and provide essential support for your financial oversight, allowing you to focus on growing your business and running operations.

So, what do you think? Have you tried any of these practices? Let’s keep the conversation going!

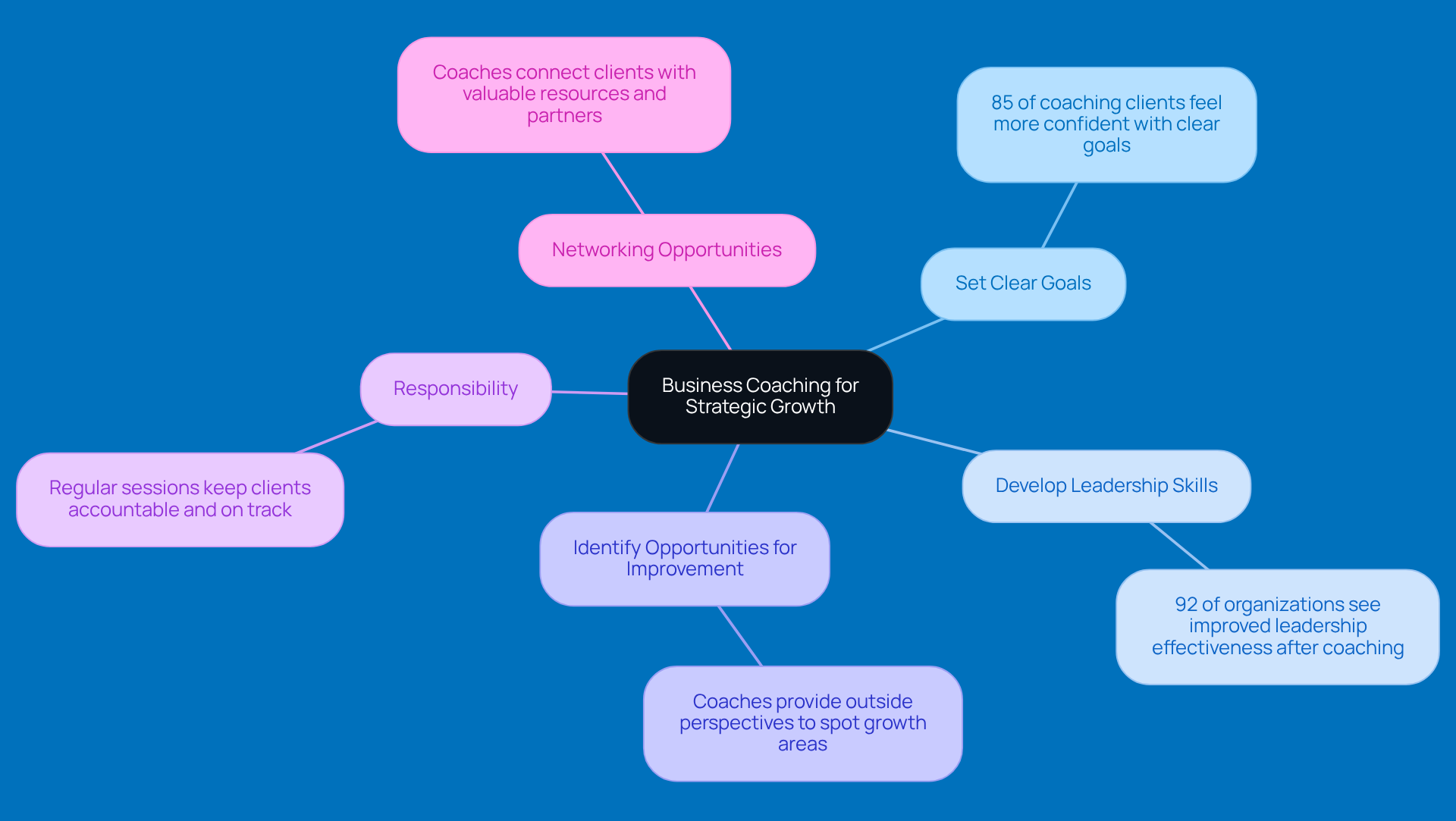

Incorporate Business Coaching for Strategic Growth

If you're a small business owner looking to boost your growth, business coaching can be a game changer. Here are some best practices to consider:

-

Set Clear Goals: Team up with a coach to nail down clear, measurable objectives that resonate with your vision. Think of it as your roadmap-every decision you make should steer you toward those goals. Did you know that 85% of coaching clients feel more confident when they have well-defined goals? That’s a pretty solid reason to get started!

-

Develop Leadership Skills: Coaching can really amp up your leadership game, creating a positive vibe in your company and supercharging team performance. Strong leadership is key to tackling challenges and inspiring your team to shine. In fact, 92% of organizations see a boost in leadership effectiveness after coaching. That’s a big deal!

-

Identify Opportunities for Improvement: A coach brings an outside perspective, helping you spot growth areas that might be hiding in plain sight. This fresh insight can spark some serious changes that push your business forward. As Marshall Goldsmith puts it, "Coaching is where I learn everything." It’s all about valuing those external viewpoints!

-

Responsibility: Regular coaching sessions can help keep you accountable, making sure you stay on track with your goals and strategies. This structure helps you maintain momentum and encourages steady progress. Plus, having someone check in on you can challenge your assumptions, which is crucial for long-term success.

-

Networking Opportunities: Coaches often have a treasure trove of connections and can introduce you to valuable resources, partners, and opportunities that can help your business grow. Tapping into these networks can open up new paths for collaboration and expansion. As Tony Robbins says, "Everyone needs a coach," highlighting just how beneficial a supportive network can be.

So, what do you think? Are you ready to explore how coaching can elevate your business?

Conclusion

Wrapping up, let’s talk about why having a solid tax strategy is a game changer for small businesses looking to grow sustainably and stay compliant. By honing in on the basics - like knowing your tax responsibilities, making the most of deductions and credits, and teaming up with tax pros - you’re setting yourself up for success. These strategies not only keep you on the right side of the law but also boost your financial performance, helping you thrive in a competitive market.

Key takeaways from our discussion emphasize the need for personalized tax strategies, regular financial check-ins, and the value of business coaching in driving growth. Taking the time to review your financial statements, reconcile your accounts, and whip up a budget are all essential steps that lead to smarter decision-making. Plus, having a business coach can sharpen your leadership skills and keep you accountable, which ultimately fuels strategic growth and enhances your overall business health.

In today’s fast-paced tax landscape, it’s crucial for small business owners to stay proactive and informed. By putting these best practices into action, you’ll not only boost your tax compliance but also pave the way for better cash flow and sustainable growth. Remember, embracing these strategies isn’t just about managing taxes; it’s about empowering your business to reach its full potential in an ever-changing marketplace. So, what’s your next step?

Frequently Asked Questions

What is the first step in establishing tax compliance for a small business?

The first step is to understand the specific tax responsibilities tied to your business structure, including federal, state, and local taxes, as well as any industry-specific regulations.

What is an Employer Identification Number (EIN)?

An Employer Identification Number (EIN) is like a social security number for your business, essential for tax purposes, especially if you have employees.

Why is record-keeping important for tax compliance?

Accurate record-keeping helps track income, expenses, and receipts, making tax preparation easier and ensuring compliance, especially if the IRS requires documentation for deductions.

How can knowing deductions and credits benefit a small business?

Understanding available tax deductions and credits can significantly lower your tax bill and influence your overall tax strategy.

Why should small business owners consider talking to a tax professional?

A tax professional can provide personalized advice, help navigate complex tax regulations, and optimize your tax strategy to ensure compliance and maximize benefits.

How can small business owners stay updated on tax law changes?

It's important to regularly check resources from the IRS and other reliable sources to stay informed about any new tax rules that may affect your business.