Introduction

Nonprofit organizations are essential in tackling societal needs, but let’s be honest - many of them face real challenges when it comes to financial management. Effective financial planning isn’t just a nice-to-have; it’s crucial for ensuring these organizations can sustain their missions and make a real impact. So, how can nonprofits tackle the tricky waters of budgeting, reporting, and cash flow management to not just survive, but thrive in today’s competitive landscape?

In this article, we’ll explore some best practices that can help nonprofits sharpen their financial strategies. Think of it as a roadmap to greater transparency, accountability, and ultimately, fulfilling their missions. Ready to dive in?

Establish a Comprehensive Budgeting Framework

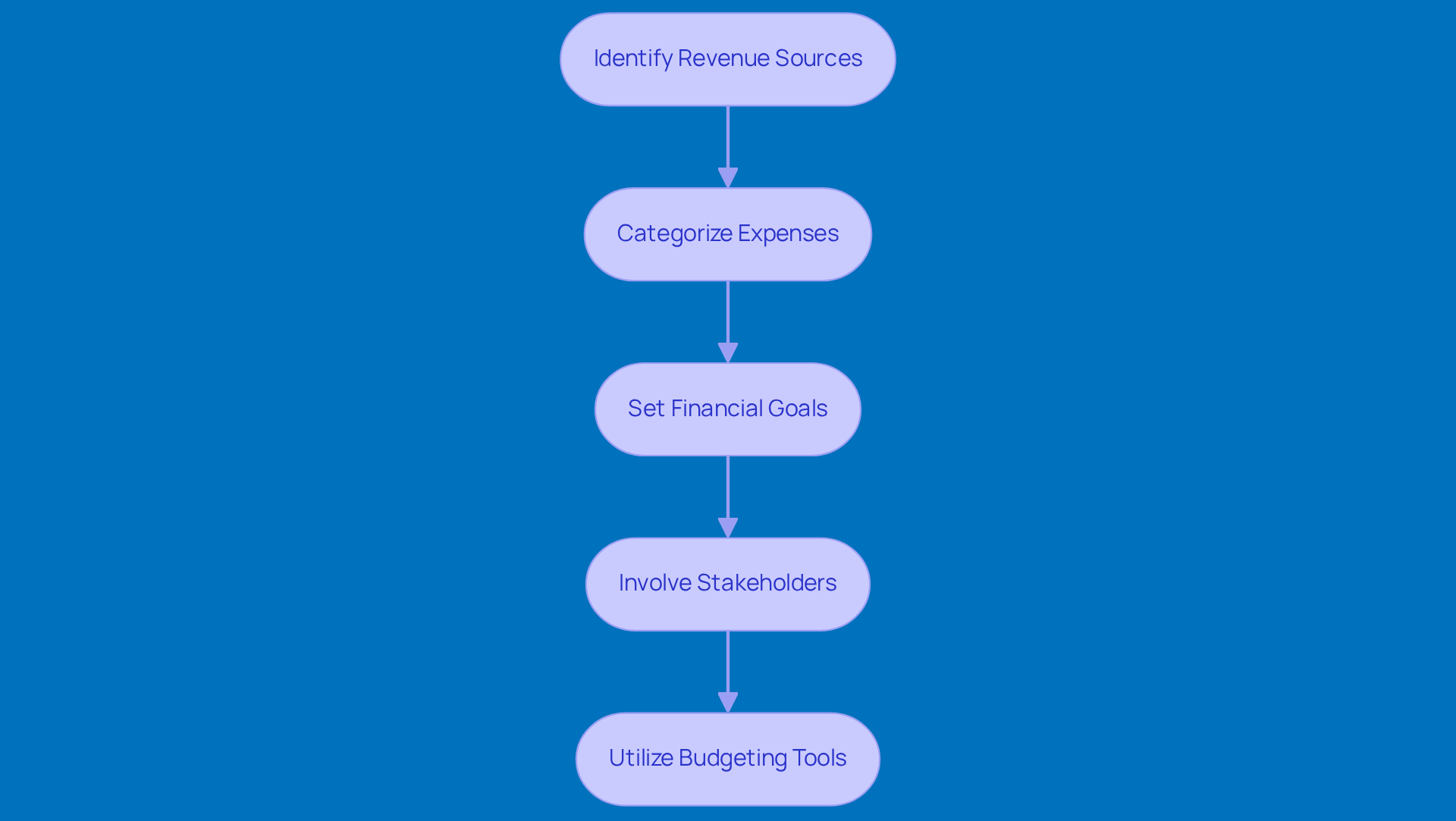

To kick off a solid budgeting framework, organizations should first nail down their mission and strategic goals. Here’s how to get started:

-

Identifying Revenue Sources: It’s crucial to know where your funding will come from - think grants, donations, and those fundraising events. This helps in crafting a realistic revenue prediction. Did you know that 97% of charitable organizations rely on financial planning for nonprofit organizations that involves budgets under $5 million each year? And with 88% of them spending less than $500,000 annually, it’s super important to engage in financial planning for nonprofit organizations that fits within these limits.

-

Categorizing Expenses: Next up, break down your expenses into fixed and variable categories. Fixed costs are things like salaries and rent, while variable costs can include program-related expenses that might change from month to month.

-

Setting financial goals is essential in the financial planning for nonprofit organizations to ensure that your financial plan aligns with your organization’s strategic objectives. For instance, if your nonprofit wants to expand its outreach, your budget should reflect a higher investment in marketing and community engagement.

-

Involving Stakeholders: Don’t forget to bring board members and key staff into the budgeting process! Their insights can lead to a more accurate and comprehensive budget that truly reflects the community's needs and highlights the importance of diverse leadership.

-

Utilizing Budgeting Tools: Finally, consider using software tools that make budgeting and expense tracking a breeze. This way, your framework stays adaptable and easy to manage.

By following these steps, you can build a strong budgeting framework that not only supports your mission but also boosts your economic stability, especially as we navigate the changing financial landscape of 2026. So, are you ready to get started?

Implement Effective Financial Reporting Practices

To implement effective financial reporting practices, nonprofits should think about a few key things:

-

Regular Economic Statements: It’s a good idea to prepare monthly or quarterly economic reports, like balance sheets, income statements, and cash flow statements. Keeping this regularity helps you monitor economic performance and spot trends, which is super important for making informed choices. Did you know nonprofits usually take about 30 days to prepare these statements? That just shows how crucial timely reporting is!

-

Budget vs. Actual Reports: Creating reports that compare budgeted figures to actual performance is essential. This analysis helps you understand variances and make necessary adjustments. Frequent evaluations of budget-to-actual reports can lead to better spending strategies and fundraising initiatives. There are plenty of case studies out there where organizations successfully tweaked their fiscal strategies based on these insights.

-

Clarity in Reporting: Make sure your monetary reports are clear and easy to understand for everyone involved, including donors and board members. Using plain language and some visual aids can really enhance understanding. Clarity is key to building trust, and organizations that communicate their economic status effectively often enjoy strong donor retention rates.

-

Compliance with Standards: It’s important to stick to Generally Accepted Accounting Principles (GAAP) and other relevant standards. This ensures your reports are credible and reliable, which fosters confidence among stakeholders and supports effective governance. And let’s be honest, that’s essential for long-term sustainability!

-

Utilizing Technology: Think about implementing accounting software that automates your reporting processes. This can help reduce errors and save you time. Plus, technology can enable real-time reporting, allowing for quicker decision-making and improving overall monetary oversight. Organizations that embrace technology often find they spend significantly less time on financial reporting tasks.

By adopting these practices, you can significantly improve your financial planning for nonprofit organizations, enhancing transparency and accountability. And hey, being aware of common pitfalls-like not tracking donor retention rates or overlooking compliance with financial standards-can help you steer clear of missteps in your financial management. So, what do you think? Ready to take your financial reporting to the next level?

Optimize Cash Flow Management Strategies

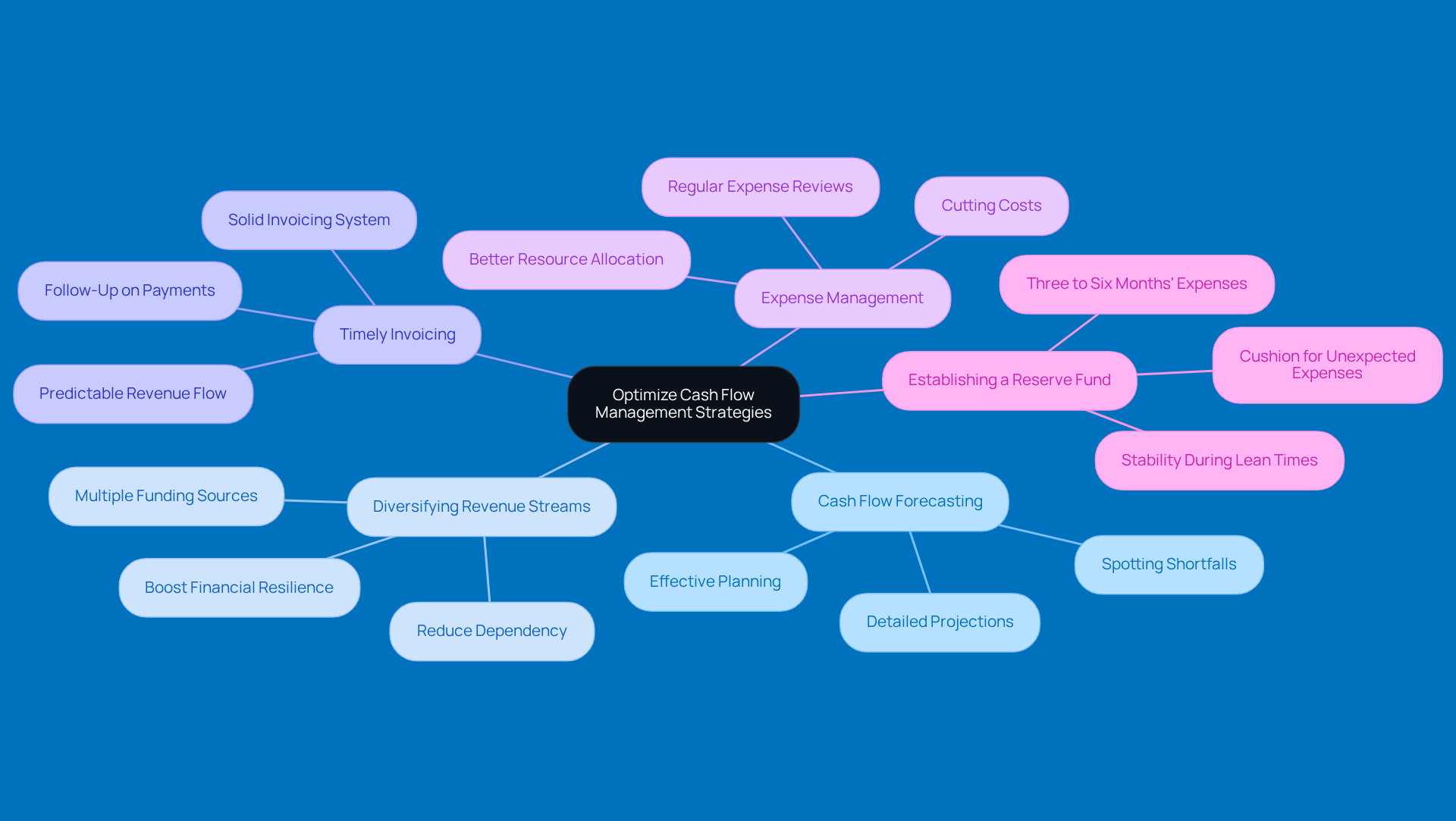

To optimize cash flow management, nonprofits can really benefit from a few key strategies:

-

Cash Flow Forecasting: Start by creating detailed cash flow forecasts that project future cash inflows and outflows. This proactive approach helps organizations spot potential shortfalls ahead of time, allowing them to plan effectively and tackle any economic challenges that come their way.

-

Diversifying Revenue Streams: It’s a smart move to actively seek out multiple funding sources - think grants, donations, and earned income. By not relying too heavily on just one income stream, organizations can boost their financial resilience and stability, which is super important in today’s uncertain funding landscape.

-

Timely Invoicing: Developing a solid system for timely invoicing and following up on outstanding payments is crucial. Steady revenue inflows are key to keeping operations running smoothly, and good invoicing practices can really help make revenue flow more predictable. As David M. Rottkamp points out, leadership teams are rethinking how to use their limited resources and which expenses truly help advance their mission.

-

Expense Management: Regularly reviewing expenses can uncover opportunities to cut costs without compromising service quality. This might mean renegotiating contracts or finding more cost-effective suppliers, ultimately leading to better resource allocation.

-

Establishing a Reserve Fund: Setting up a reserve fund is a great way to cushion against unexpected expenses or revenue dips. Nonprofits should aim to have at least three to six months’ worth of operating expenses saved up. This provides essential stability during lean times, helping them keep their mission-critical activities going strong, especially given the funding volatility many organizations face today.

By focusing on these strategies, organizations can enhance their cash flow management through financial planning for nonprofit organizations, ensuring they remain financially sound and ready to achieve their missions effectively. So, what strategies are you considering to improve your cash flow?

Conduct Regular Budget Reviews and Adjustments

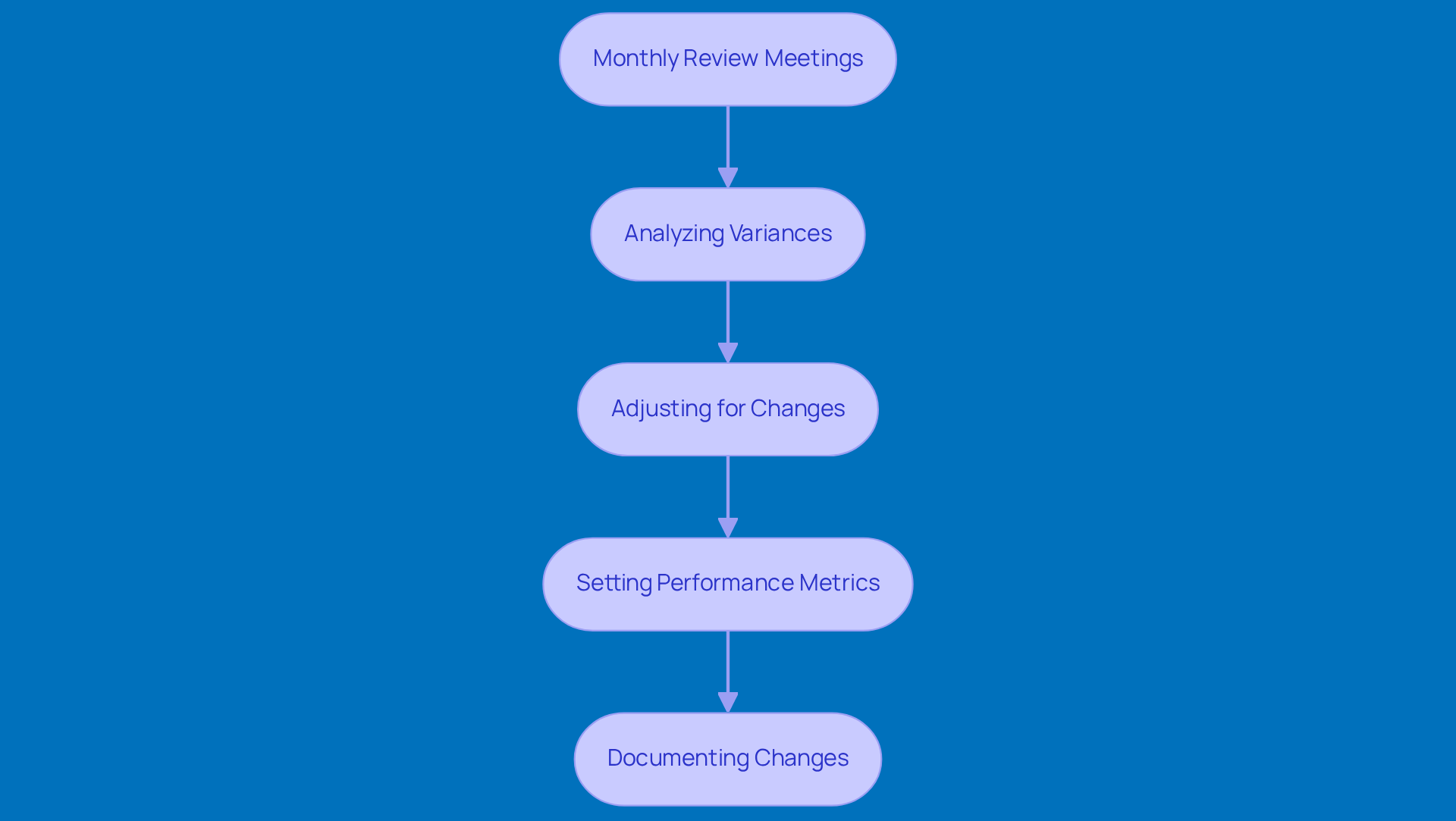

To keep your nonprofit's budget on track, regular reviews and adjustments are key. Here are some friendly practices to consider:

-

Monthly Review Meetings: How about setting up monthly get-togethers? These meetings are a great way to check in on your financial performance compared to your plan. Involve your key staff and board members - getting different perspectives can really help!

-

Analyzing Variances: Ever noticed the differences between what you budgeted and what actually happened? Identifying and analyzing these variances can be super insightful. Understanding why they occurred can guide your future budgeting decisions.

-

Adjusting for Changes: Life happens, right? Be ready to tweak your budget when funding changes, program needs shift, or the economy takes a turn. Flexibility is crucial for keeping your financial health intact.

-

Setting Performance Metrics: Let’s talk about key performance indicators (KPIs). Establishing these metrics helps you measure your financial health and how effective your programs are. Regularly checking in on these can inform any necessary financial adjustments.

-

Documenting Changes: Keep a record of any financial adjustments you make and why you made them. This documentation can be a goldmine for future budgeting cycles and helps enhance accountability.

By regularly reviewing and adjusting your budget, your nonprofit can enhance its financial planning for nonprofit organizations, allowing it to stay agile and responsive. This way, you’ll manage your resources effectively and keep moving toward your mission!

Conclusion

Creating a solid financial planning framework is crucial for nonprofits to not just survive but truly thrive in their missions. This article highlights why comprehensive budgeting, effective financial reporting, smart cash flow management, and regular budget reviews are so important. By sticking to these best practices, nonprofits can boost their financial stability and stay on track with their strategic goals.

Let’s dive into some key insights! First off, it’s essential to:

- Pinpoint those revenue sources

- Categorize expenses

- Get stakeholders involved in the budgeting process

Plus, implementing regular economic statements and clear reporting standards really helps build transparency and trust with donors and stakeholders. And don’t forget about cash flow! Optimizing it through diverse revenue streams and timely invoicing can really strengthen an organization’s financial resilience. Regular budget reviews and adjustments are also super important for adapting to changes and keeping financial health in check.

So, what’s the takeaway? The importance of effective financial planning for nonprofits is huge! By embracing these strategies, nonprofits can navigate the tricky funding landscape, boost accountability, and push their missions forward. It’s vital for organizations to prioritize these practices to ensure they’re sustainable and impactful in their communities. By adopting these best practices, nonprofits not only secure their financial future but also empower themselves to make a real difference in the lives they touch.

Frequently Asked Questions

What is the first step in establishing a comprehensive budgeting framework for organizations?

The first step is to nail down the organization's mission and strategic goals.

Why is identifying revenue sources important in the budgeting process?

Identifying revenue sources is crucial because it helps in crafting a realistic revenue prediction, knowing where funding will come from, such as grants, donations, and fundraising events.

What percentage of charitable organizations rely on financial planning for budgets under $5 million?

97% of charitable organizations rely on financial planning for budgets under $5 million each year.

How should expenses be categorized in the budgeting framework?

Expenses should be broken down into fixed and variable categories. Fixed costs include salaries and rent, while variable costs include program-related expenses that may change from month to month.

Why is setting financial goals essential in financial planning for nonprofit organizations?

Setting financial goals is essential to ensure that the financial plan aligns with the organization’s strategic objectives, such as expanding outreach or increasing investment in marketing and community engagement.

Who should be involved in the budgeting process?

Board members and key staff should be involved in the budgeting process to provide insights that lead to a more accurate and comprehensive budget.

What tools can be utilized to assist with budgeting and expense tracking?

Organizations can consider using software tools that make budgeting and expense tracking easier, ensuring the framework remains adaptable and manageable.

What is the overall benefit of following these budgeting steps?

Following these steps helps build a strong budgeting framework that supports the organization's mission and boosts economic stability, especially in the changing financial landscape.