Introduction

Navigating the ins and outs of estimated tax payments can feel pretty overwhelming, right? This is especially true for self-employed folks and small business owners. With the IRS breathing down your neck with strict deadlines and the threat of penalties for underpayment, it’s super important to get a handle on this financial obligation.

In this article, we’re diving into some effective strategies and best practices that can help you tackle your estimated tax payments with confidence and ease.

So, how can you stay compliant while keeping stress levels low and dodging those pesky penalties?

Understand Estimated Tax Payments: Key Concepts and Requirements

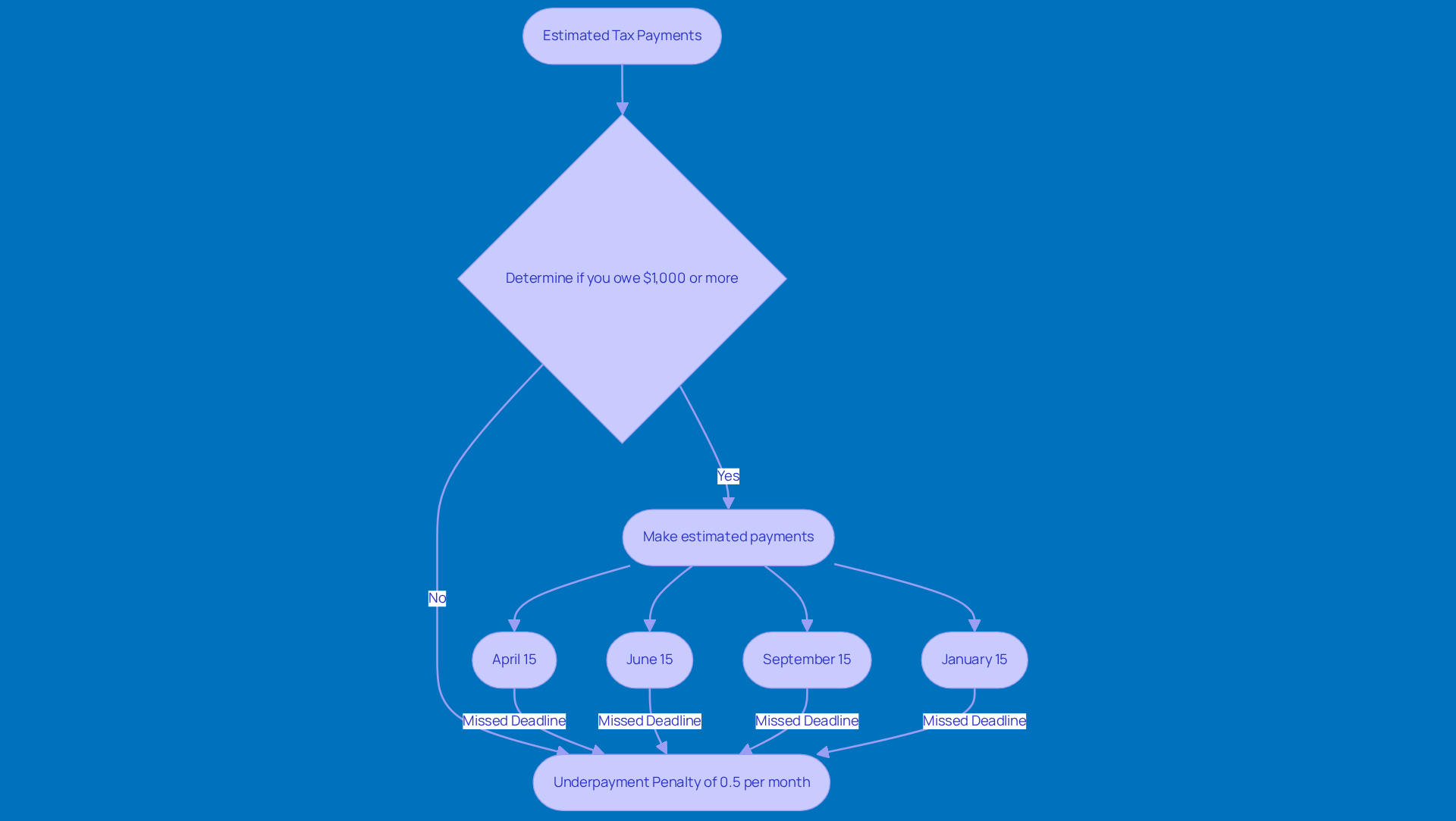

For folks like you and small business owners who earn income that doesn’t have taxes withheld, such as self-employment income, rental income, or investment income, making estimated tax payments is super important. If you think you’ll owe $1,000 or more for the year after accounting for withholdings and refundable credits, you need to consider making estimated tax payments. The IRS has set up four quarterly installment periods, with due dates on April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can lead to underpayment penalties, which can pile up at a rate of 0.5% per month on unpaid taxes, potentially hitting up to 25%!

For self-employed individuals, understanding estimated tax contributions is especially key. By making estimated tax payments, you can manage your tax obligations throughout the year, ensuring you’re not caught off guard when tax season rolls around. Financial experts often say that making estimated tax payments in smaller, more frequent contributions is easier to handle than making larger quarterly payments. This way, you can budget better and reduce the risk of those pesky underpayment penalties.

Tax pros emphasize the importance of keeping accurate records and using reliable tax software or professional help to figure out your projected tax responsibilities efficiently. By staying on top of IRS guidelines and deadlines, small business owners can tackle their tax duties with confidence, ensuring they stay compliant and financially stable.

Implement Effective Calculation Strategies for Estimated Taxes

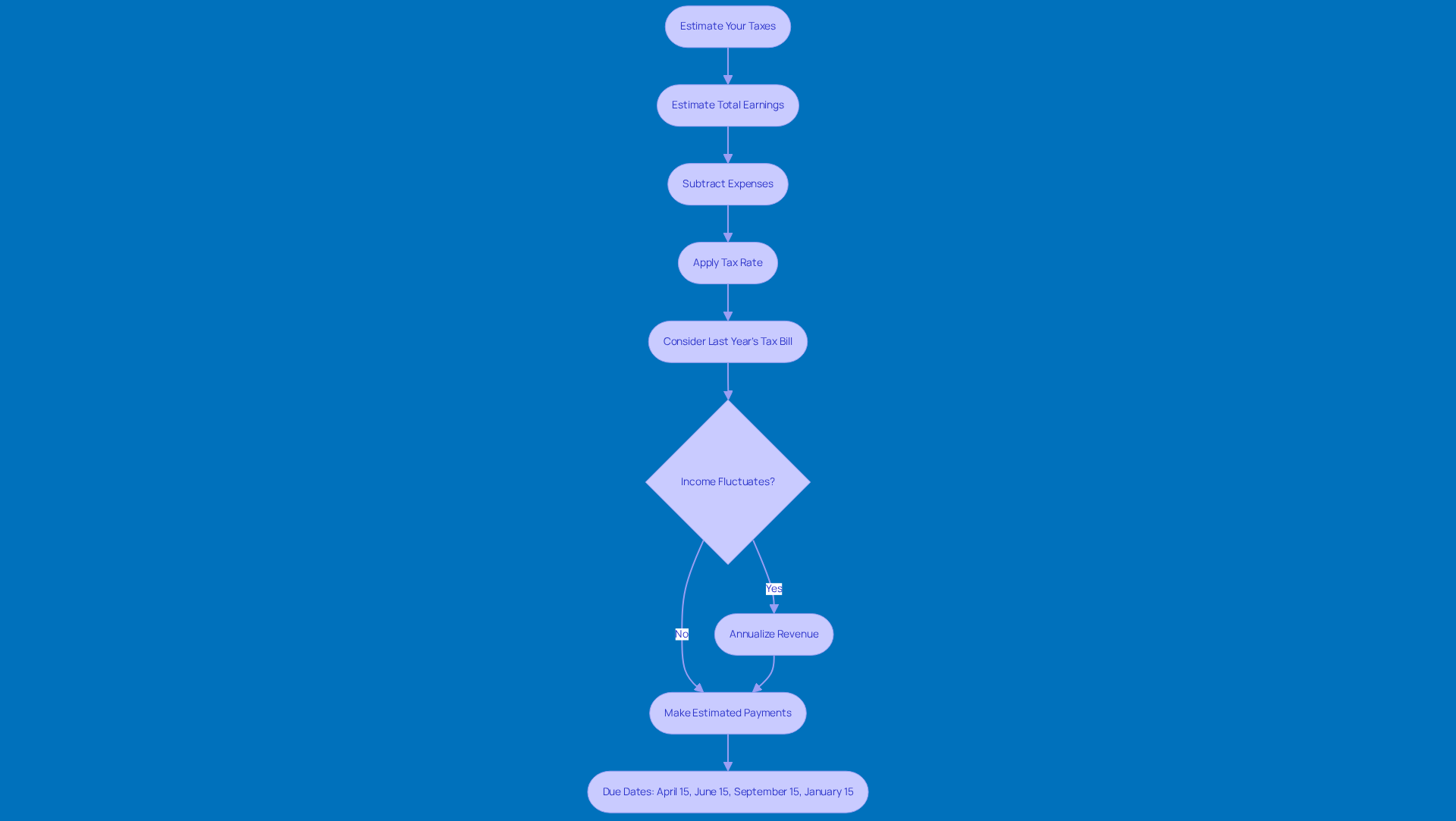

Figuring out your projected tax contributions can actually be pretty straightforward with a few handy techniques. One popular method is to estimate your total earnings for the year, subtract any expenses you can claim, and then apply the relevant tax rate. Another approach that many folks find helpful is to base their estimated payments on last year's tax bill - just take that total and divide it by four. This can be especially useful for those with fluctuating incomes, giving you a solid reference point that helps ease the stress of uncertain earnings.

Tax consultants, like the team at Steinke and Company, often suggest using tax software or chatting with a tax pro to boost the accuracy of your calculations. These tools let small agency owners input their expected earnings and expenses, helping them stay compliant while optimizing their tax situation. Plus, if your income varies, you might want to think about annualizing your revenue. This way, you can adjust your projected contributions based on your actual earnings throughout the year. It’s a smart move that not only helps align your payments with your income but also reduces the risk of those pesky underpayment penalties.

Now, here’s something important to keep in mind: if you think you’ll owe $1,000 or more when you file your return, you need to be making estimated tax payments. For 2026, mark your calendar - those contributions are due on April 15, June 15, September 15, and January 15, 2027, for income earned in the last quarter of 2026. By using these strategies, small business owners can tackle the ins and outs of estimated tax obligations with confidence, making estimated tax payments to ensure they meet their responsibilities without the added stress. And don’t forget, understanding your paystub and keeping good tax records are key steps toward achieving financial stability and compliance, which will only strengthen your overall tax strategy.

Establish a Timely Payment Schedule to Avoid Penalties

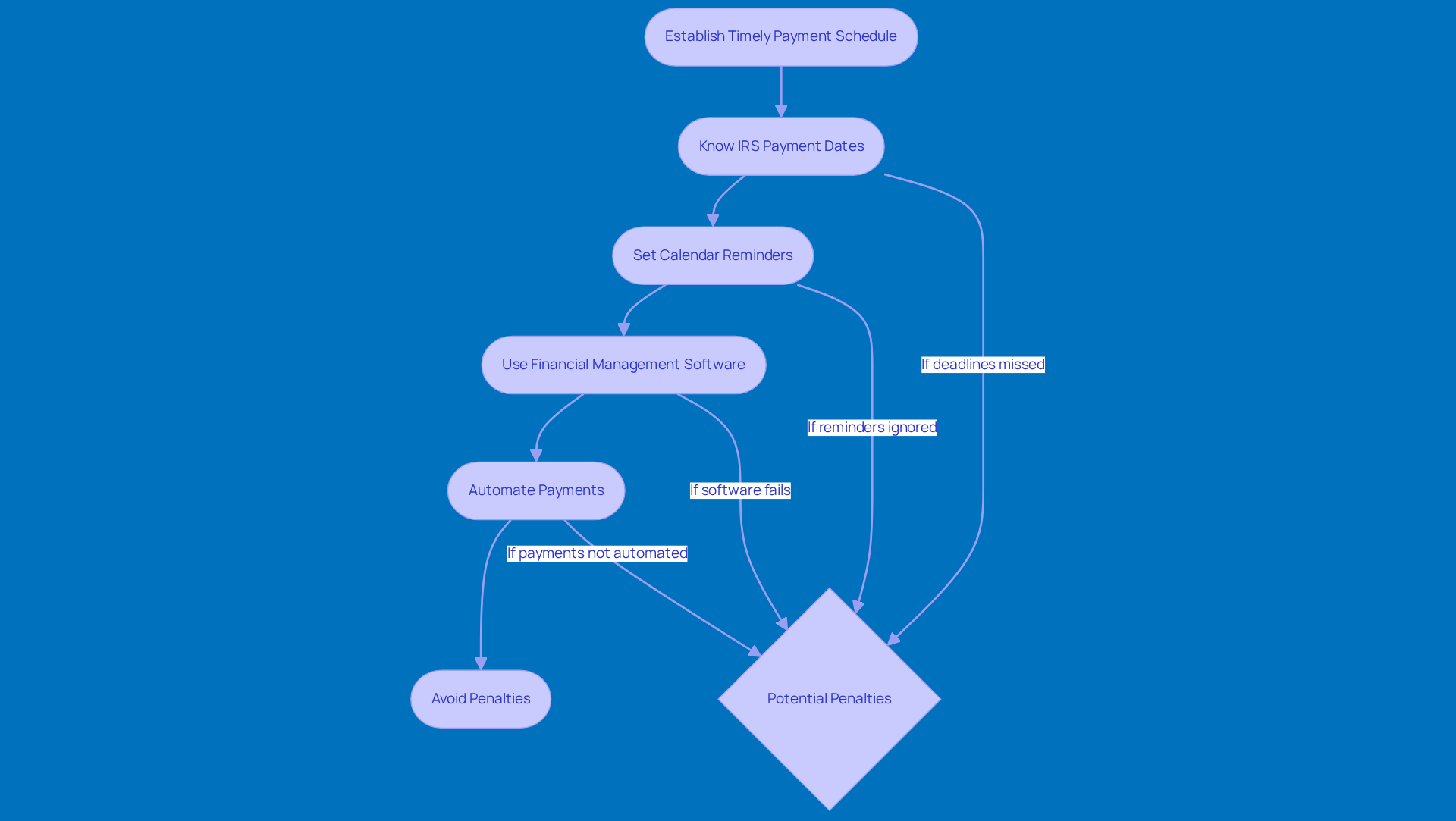

To avoid penalties, sticking to the IRS schedule is super important. Making estimated tax payments is usually due on April 15, June 15, September 15, and January 15 of the following year. If small businesses consistently hit these deadlines, they can really cut down on the risk of facing hefty penalties for late payments. Just think about it: in 2025, taxpayers who don’t pay enough in estimated taxes might see penalties pile up quickly. It really shows how crucial it is to stay on top of things!

Setting up calendar reminders or using financial management software can be great ways to keep yourself on track. Plus, automating payments through the IRS Direct Pay system or your bank can help ensure you submit everything on time. This proactive approach not only reduces the chances of missing deadlines but also takes a load off when it comes to tax stress. Financial planners often stress that making estimated tax payments on time is a key part of solid financial management. Staying organized and informed can lead to much better outcomes for small business owners, don’t you think?

Mitigate Risks: Understand Penalties and How to Avoid Them

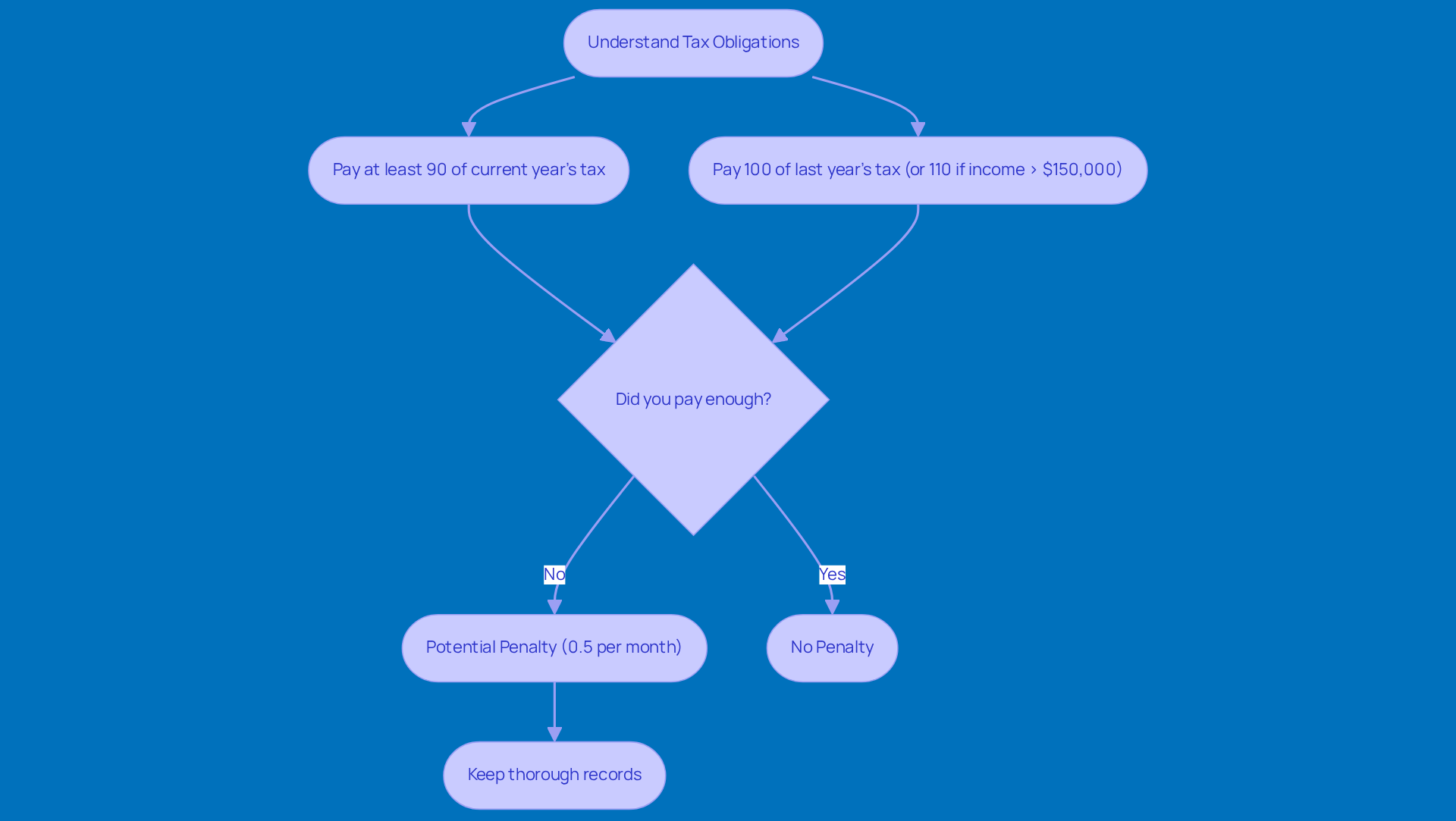

Hey there! Did you know that the IRS can hit you with penalties if you underpay your projected taxes while making estimated tax payments? Yep, they can pile up at a rate of 0.5% of the unpaid tax amount each month, and before you know it, you could be looking at a maximum of 25%! To steer clear of these pesky penalties, make sure you pay at least:

- 90% of your current year's tax obligation

- 100% of what you owed last year (or 110% if your adjusted gross income is over $150,000)

Keeping an eye on your earnings and adjusting your projected contributions is key to managing your tax obligations like a pro.

Now, if you’re running a small business, proactive tax planning is a must. For instance, if you have a seasonal business, you might want to tweak your expected contributions based on the income you anticipate throughout the year. This not only helps you dodge penalties but also keeps your cash flow steady.

But what if you do end up with a penalty? Don’t sweat it! You can appeal if you can show reasonable cause, which is why keeping thorough records is super important. Plus, knowing the average penalty amounts for underpayment in 2025 can really help you with your financial planning. By staying informed and engaged with your tax obligations, you can navigate the tricky waters of making estimated tax payments and minimize those unexpected liabilities. So, how are you planning to tackle your taxes this year?

Conclusion

Making estimated tax payments is super important for folks and small business owners who earn income without taxes being withheld. By getting a handle on these payments - like knowing the deadlines and how to calculate them - taxpayers can dodge penalties and manage their finances better. A little proactive planning and timely action not only keeps you in line with IRS rules but also takes the stress out of tax season.

In this article, we’ve highlighted some key strategies, such as:

- Setting up a clear payment schedule

- Using effective calculation methods

- Keeping accurate records

These practices empower you to make smart choices about your tax obligations. By sticking to deadlines and using the tools available, you can really cut down on the chances of facing penalties, which ultimately leads to better financial health.

So, to wrap things up, understanding and putting into practice the best strategies for estimated tax payments is crucial for keeping your finances stable and compliant. Small business owners and self-employed individuals should take charge of their tax responsibilities by:

- Staying organized

- Seeking professional advice when needed

- Adjusting their payments based on actual income

By doing this, you can navigate the complexities of the tax system with confidence and steer clear of those pesky underpayment penalties.

Frequently Asked Questions

Who needs to make estimated tax payments?

Individuals and small business owners who earn income without taxes withheld, such as self-employment income, rental income, or investment income, need to make estimated tax payments if they expect to owe $1,000 or more for the year after accounting for withholdings and refundable credits.

When are the estimated tax payment deadlines?

The IRS has set four quarterly installment periods for estimated tax payments, with due dates on April 15, June 15, September 15, and January 15 of the following year.

What happens if I miss the estimated tax payment deadlines?

Missing the estimated tax payment deadlines can lead to underpayment penalties, which can accumulate at a rate of 0.5% per month on unpaid taxes, potentially reaching up to 25%.

Why is making estimated tax payments important for self-employed individuals?

For self-employed individuals, making estimated tax payments helps manage tax obligations throughout the year, preventing surprises during tax season and reducing the risk of underpayment penalties.

What is a recommended strategy for making estimated tax payments?

Financial experts suggest making estimated tax payments in smaller, more frequent contributions rather than larger quarterly payments, as this approach can make budgeting easier and help avoid underpayment penalties.

How can I accurately determine my estimated tax payments?

It is important to keep accurate records and use reliable tax software or seek professional help to efficiently figure out projected tax responsibilities and stay compliant with IRS guidelines.