Introduction

Building a solid relationship with tax and business consultants is key to navigating the tricky waters of financial management. By embracing some straightforward practices - like keeping communication clear, defining roles, and using technology effectively - businesses can really boost their collaboration with consultants. This often leads to better outcomes. But let’s be real: many organizations find it tough to keep the conversation flowing and set the right expectations, which can put a damper on their consulting relationships.

So, what can you do to dodge these common pitfalls and ensure a successful partnership with tax professionals? Let’s dive into some strategies that can help!

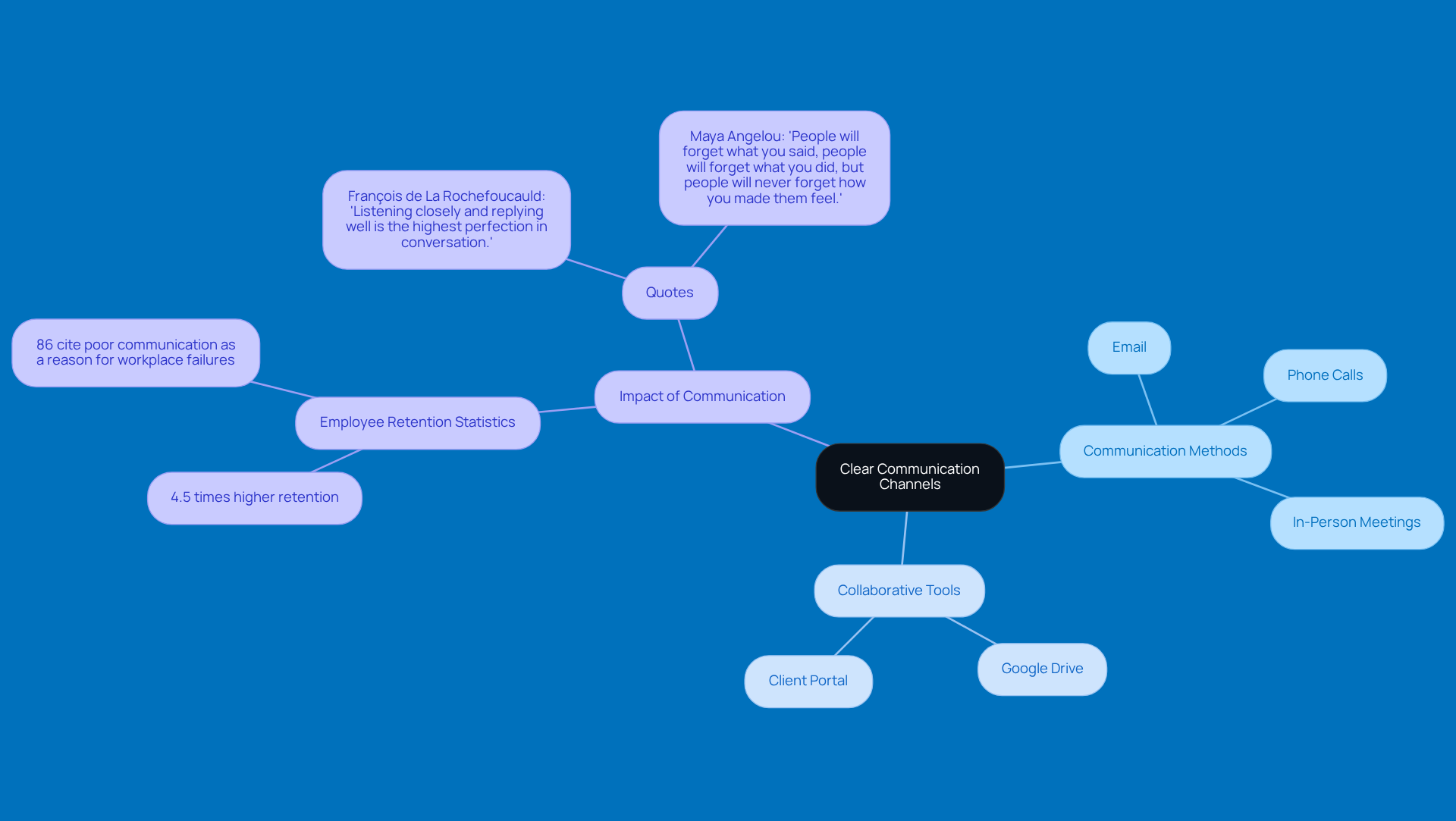

Establish Clear Communication Channels

To build a great relationship with your tax advisor at Steinke and Company, it’s super important to set up clear ways to communicate right from the start. So, let’s talk about how you prefer to connect - whether it’s through email, phone calls, or good old-fashioned in-person meetings. And don’t forget to set some expectations for how quickly you’d like to hear back!

Using collaborative tools can really help keep everyone in the loop. For instance, a shared Google Drive folder lets both you and your consultant access important documents and updates in real-time. This way, you can cut down on any chances of miscommunication. Plus, regular check-ins are key to making sure you’re both on the same page with ongoing tasks and deadlines.

Did you know that organizations with effective messaging strategies enjoy 4.5 times higher employee retention? That really highlights how valuable clear communication is in building successful consulting relationships. On the flip side, 86% of employees say that poor communication is a major reason for workplace failures, which just goes to show how crucial effective dialogue is. As François de La Rochefoucauld wisely said, 'Listening closely and replying well is the highest perfection in conversation.'

At Steinke and Company, we also have integrated platforms like our client portal that can really boost internal communications and tackle common challenges, making collaboration even smoother. So, let’s get started on this journey together!

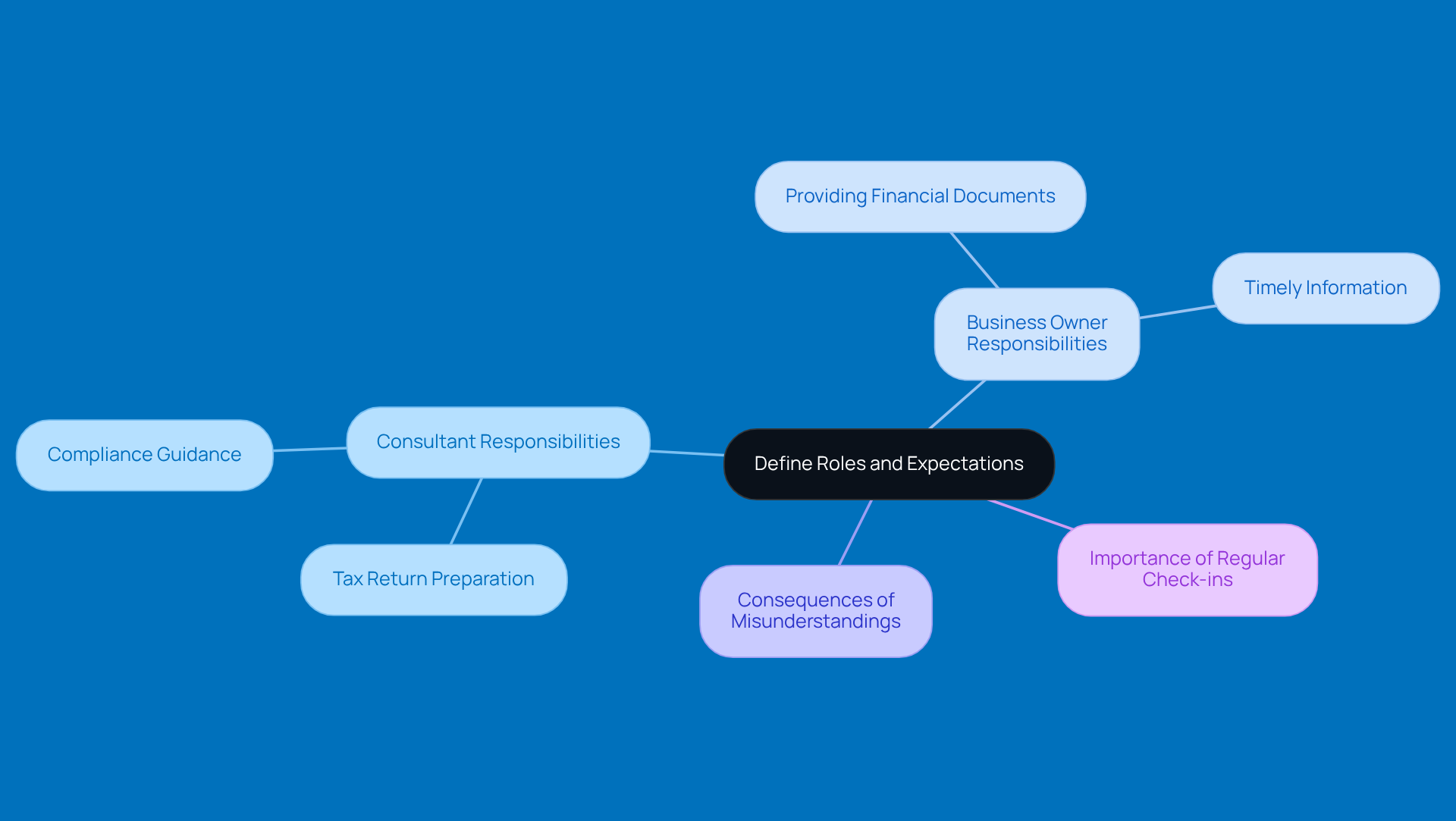

Define Roles and Expectations

Defining the roles and expectations for both the tax and business consultants and the business owner right from the start is key to a successful partnership. You can do this with a formal agreement or just a simple outline of responsibilities. For instance, the advisor typically handles tax return preparation and compliance guidance, while the business owner is responsible for providing essential financial documents and timely information. By setting these roles early on, you can avoid misunderstandings and keep both parties accountable.

Did you know that misunderstandings in client-consultant relationships can lead to major inefficiencies? Over 70% of clients report feeling dissatisfied because expectations weren’t clear. That’s why it’s so important to revisit these roles regularly, especially as business dynamics or advice from tax and business consultants change. This proactive approach not only fosters a collaborative atmosphere but also boosts the overall efficiency of the consulting relationship, leading to better economic outcomes. So, how often do you check in on your roles and responsibilities?

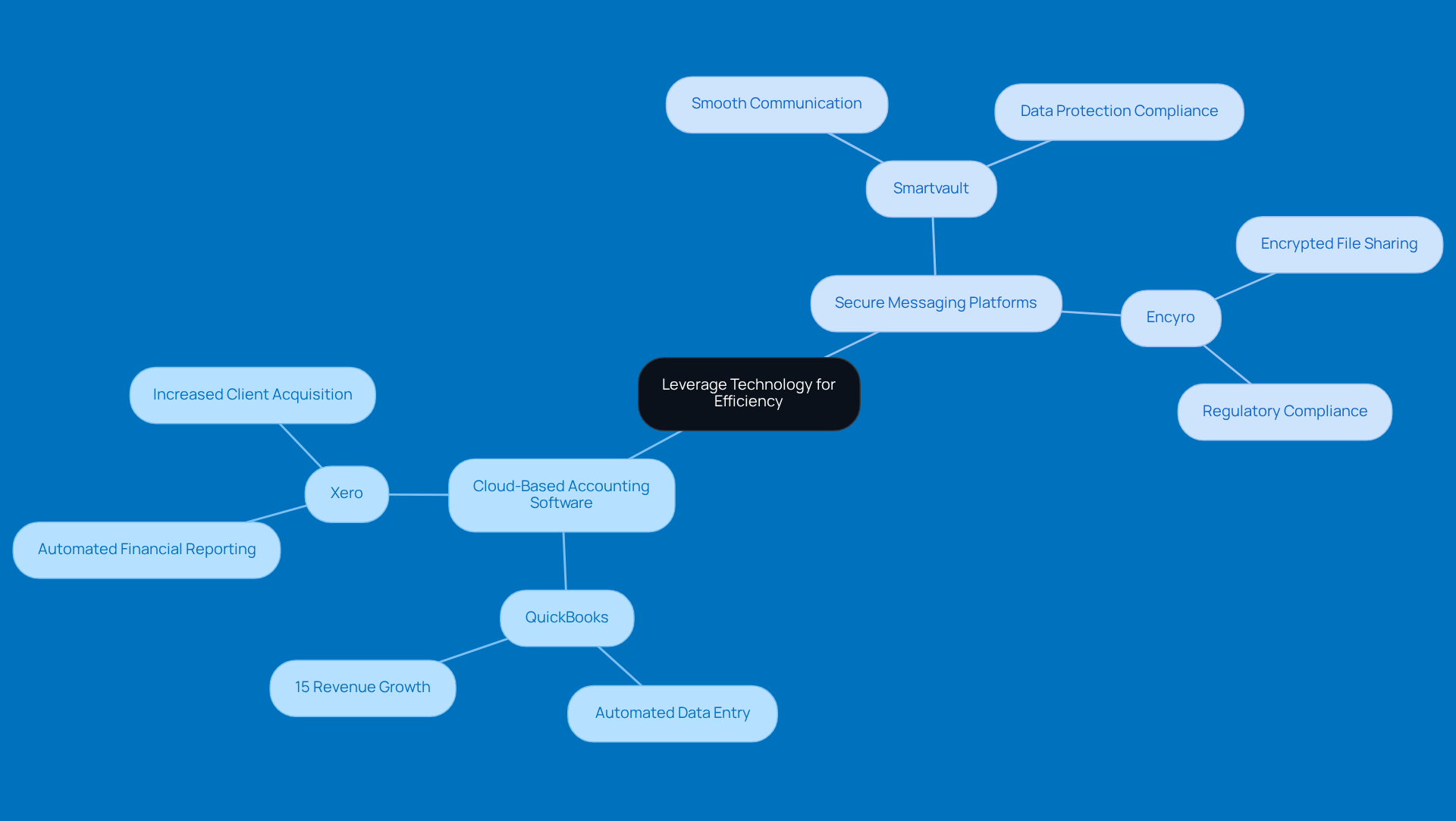

Leverage Technology for Efficiency

Let’s talk about how you can use technology to make your interactions with tax consultants a breeze. Tools like cloud-based accounting software - think QuickBooks or Xero - can really help. They automate data entry and financial reporting, which means you spend less time on those tedious manual tasks. Did you know that companies using cloud accounting see a whopping 15% year-over-year revenue growth? Plus, they’re adding five times the clients compared to those who aren’t using these tools. That’s a serious competitive edge!

Now, let’s not forget about secure messaging platforms for sharing sensitive info. Services like encrypted email or secure file-sharing options such as Smartvault and Encyro can really come in handy. These tools not only make communication smoother but also help you stay compliant with data protection regulations, like the GLBA Safeguards Rule, which is all about keeping customer information safe.

Before you jump into new tech solutions, take a moment to understand your current technology stack. This way, you can approach things more strategically. By embracing technology, both advisors and business owners can boost their productivity and focus on making those big decisions that really matter. So, why not give it a shot? It could transform how you manage your business!

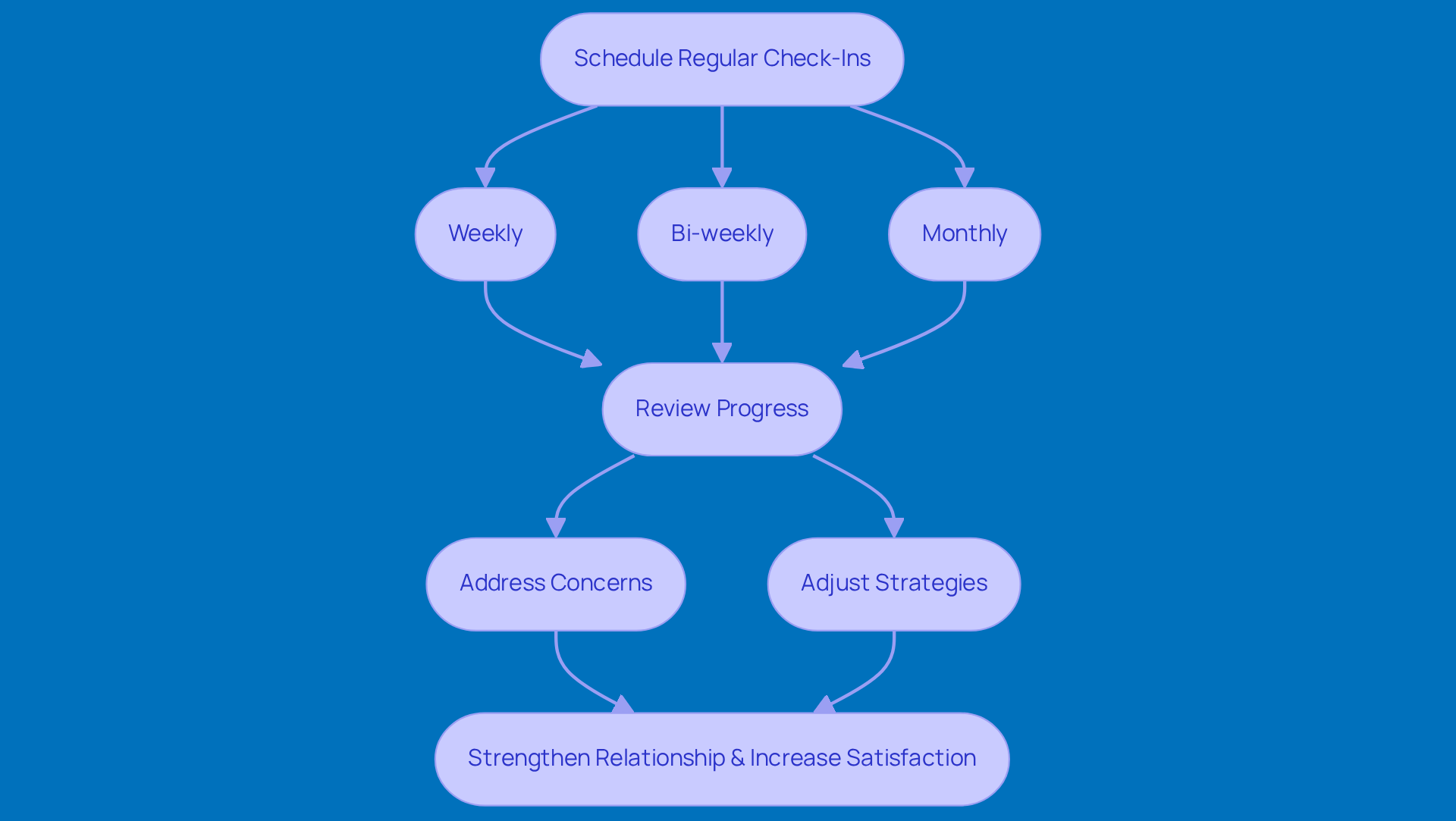

Schedule Regular Check-Ins and Feedback Sessions

Setting up a regular schedule for check-ins and feedback sessions with your tax consultant is super important for managing your taxes effectively. Depending on how complicated your tax situation is, you might want to meet:

- Weekly

- Bi-weekly

- Monthly

These sessions are a great chance to review how things are going, tackle any concerns, and tweak your strategies if needed.

For instance, if new tax regulations pop up, having a timely check-in means you can reassess your compliance strategy right away. Plus, keeping the conversation open during these meetings creates a collaborative vibe where both you and your consultant can share insights and feedback. This not only boosts your outcomes but also strengthens your working relationship. Clients who regularly engage in feedback sessions often report much higher satisfaction rates.

Did you know that proactive monetary planning tied to consistent communication can lead to a 15% increase in client retention rates at CPA firms? By making these interactions a priority, you’re ensuring that your tax strategies stay in sync with your ever-changing financial landscape. So, why not schedule that next check-in today?

Conclusion

Building a successful partnership with tax and business consultants really comes down to a few key practices that make communication smooth, clarify roles, and smartly use technology. When businesses focus on these areas, they can boost collaboration, simplify processes, and ultimately see better results in managing their finances.

So, what are some of these strategies? First off, setting up clear communication channels is a must. It’s also important to define roles and expectations right from the start. Don’t forget to leverage technology to make things more efficient, and make it a point to schedule regular check-ins. These practices not only help avoid misunderstandings but also strengthen the bond between business owners and their consultants. And let’s not underestimate the power of proactive communication and feedback - they play a huge role in keeping clients happy and coming back for more.

If you’re looking to get the most out of your consulting relationships, embracing these best practices is essential. By taking the initiative to implement these strategies, you’ll be better equipped to handle the complexities of tax management while creating a collaborative environment that drives success. So, why wait? It’s time to shake things up and transform how you work with your consultants for a partnership that’s not just efficient, but truly productive!

Frequently Asked Questions

Why is it important to establish clear communication channels with a tax advisor?

Establishing clear communication channels is vital for building a strong relationship with your tax advisor, ensuring that both parties understand preferences for communication methods and expectations for response times.

What methods of communication can be used with a tax advisor at Steinke and Company?

You can communicate with your tax advisor through email, phone calls, or in-person meetings, depending on your preference.

How can collaborative tools enhance communication with a tax advisor?

Collaborative tools, such as a shared Google Drive folder, allow both you and your consultant to access important documents and updates in real-time, reducing the chances of miscommunication.

What role do regular check-ins play in the communication process?

Regular check-ins are essential for ensuring that both you and your tax advisor are on the same page regarding ongoing tasks and deadlines.

What impact does effective communication have on employee retention in organizations?

Organizations with effective messaging strategies enjoy 4.5 times higher employee retention, highlighting the importance of clear communication in successful consulting relationships.

What percentage of employees believe poor communication leads to workplace failures?

86% of employees say that poor communication is a major reason for workplace failures, emphasizing the need for effective dialogue.

What tools does Steinke and Company offer to improve communication?

Steinke and Company offers integrated platforms like a client portal that enhances internal communications and addresses common challenges, making collaboration smoother.