Introduction

Navigating the tricky world of tax regulations can feel overwhelming for small business owners, especially those in rural areas where resources might be a bit scarce. That’s where tax-saving pros, like CPAs and enrolled agents, come into play. They’re not just about cutting down tax bills; they also help with compliance and smart financial planning. But here’s the kicker: finding the right expert who can customize their services to fit your business's unique needs can be a challenge.

So, what’s the best way to team up with these professionals to really tap into their expertise and boost your financial success? Let’s dive into some friendly tips that can make this collaboration a breeze!

Understand the Role of Tax Saving Professionals

Tax saving professionals, such as CPAs, enrolled agents, and tax advisors, are absolutely essential for small businesses trying to navigate the tricky world of tax regulations. They don’t just help cut down on tax bills; they also make sure everything’s above board legally, which is super important for keeping your business running smoothly. These pros offer a range of services, from tax prep and planning to tailored advice that tackles the unique challenges small businesses face, especially in rural areas.

Take small business owners, for example. They often feel the squeeze from changing market conditions and inflation. That’s where tax advisors come in - they can really boost financial outcomes. These advisors help spot opportunities in the tax code that might slip under the radar, allowing businesses to fine-tune their tax strategies. This proactive approach can lead to significant long-term savings and better cash flow management.

But it’s not just about compliance; CPAs and enrolled agents are like strategic partners in financial planning. They help set up key performance indicators (KPIs) and dashboards, giving owners a real-time look at their financial health. This kind of data-driven decision-making not only eases the stress of tax season but also lets owners focus on growth and sustainability.

In rural communities, where small businesses often serve as the economic backbone, the impact of tax advisors is even more pronounced. Their guidance helps these businesses stay strong and compliant, ultimately boosting the economic vitality of their communities. By leveraging the knowledge of tax saving professionals, small business owners can confidently navigate the complexities of tax strategy, leading to better financial stability and success.

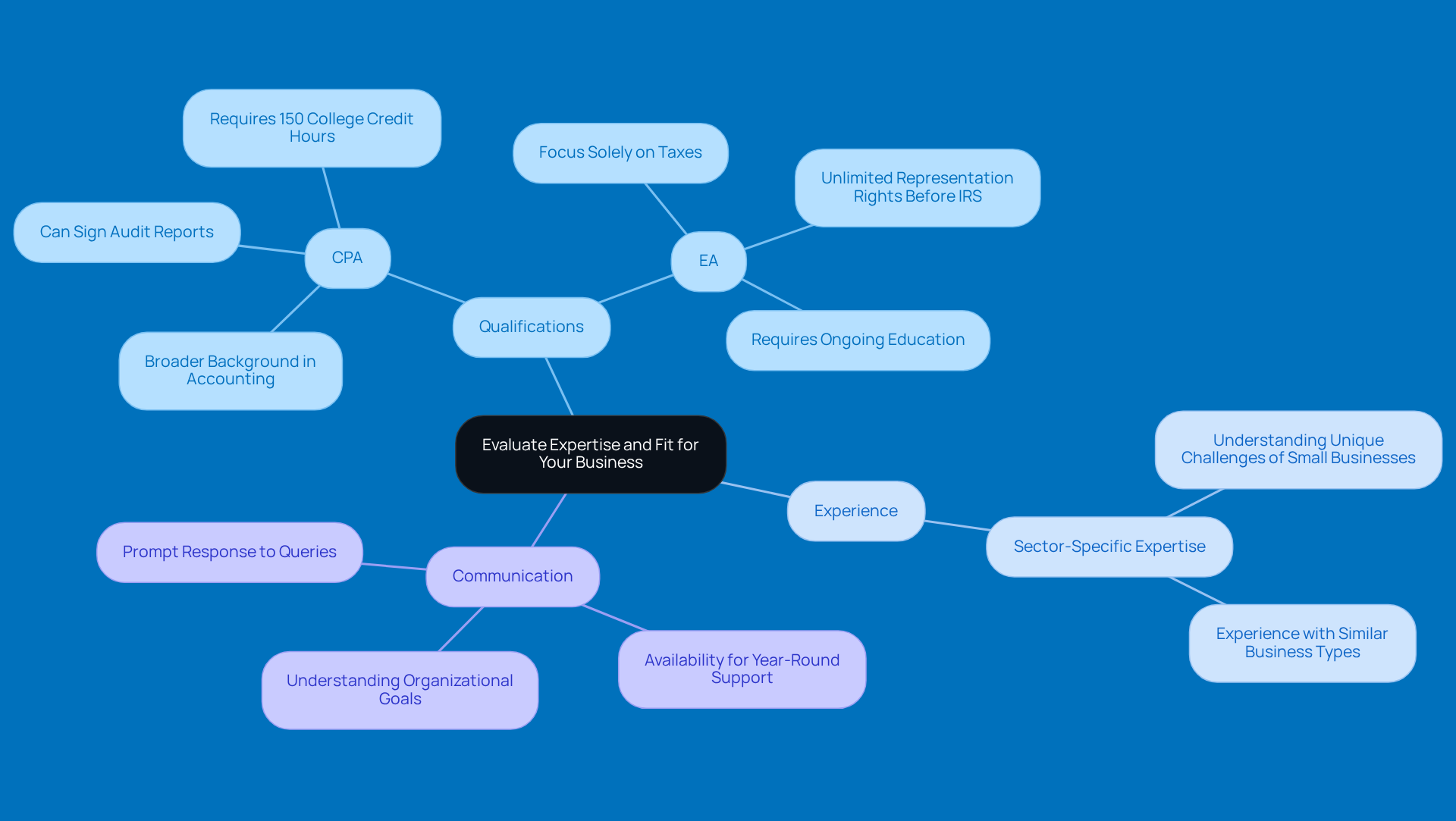

Evaluate Expertise and Fit for Your Business

Are you considering tax saving professionals? It’s all about doing your homework on their qualifications, experience, and how well they know the industry. Look for credentials like CPA or enrolled agent (EA) status - these show they’re serious about tax expertise. CPAs have a broader background in accounting and finance, making them great for tackling complex tax situations. On the other hand, EAs are all about taxes and can represent clients before the IRS without limits. Both can provide valuable insights tailored to the unique challenges faced by small businesses in rural areas.

Have you asked about their experience with companies like yours? Knowing their expertise in your specific sector can really boost the effectiveness of their tax planning strategies. For example, CPAs often excel at spotting deductions and credits that can be especially beneficial for small agency owners, helping you stay compliant while maximizing your savings.

And let’s not forget about communication! A good candidate won’t just have the technical know-how; they’ll also understand your organizational goals. As industry experts say, tax saving professionals will help you navigate the complexities of tax compliance and planning, guiding you through the unique pressures of running a rural business. So, make it a priority to find a tax expert who can offer personalized guidance and support throughout the year.

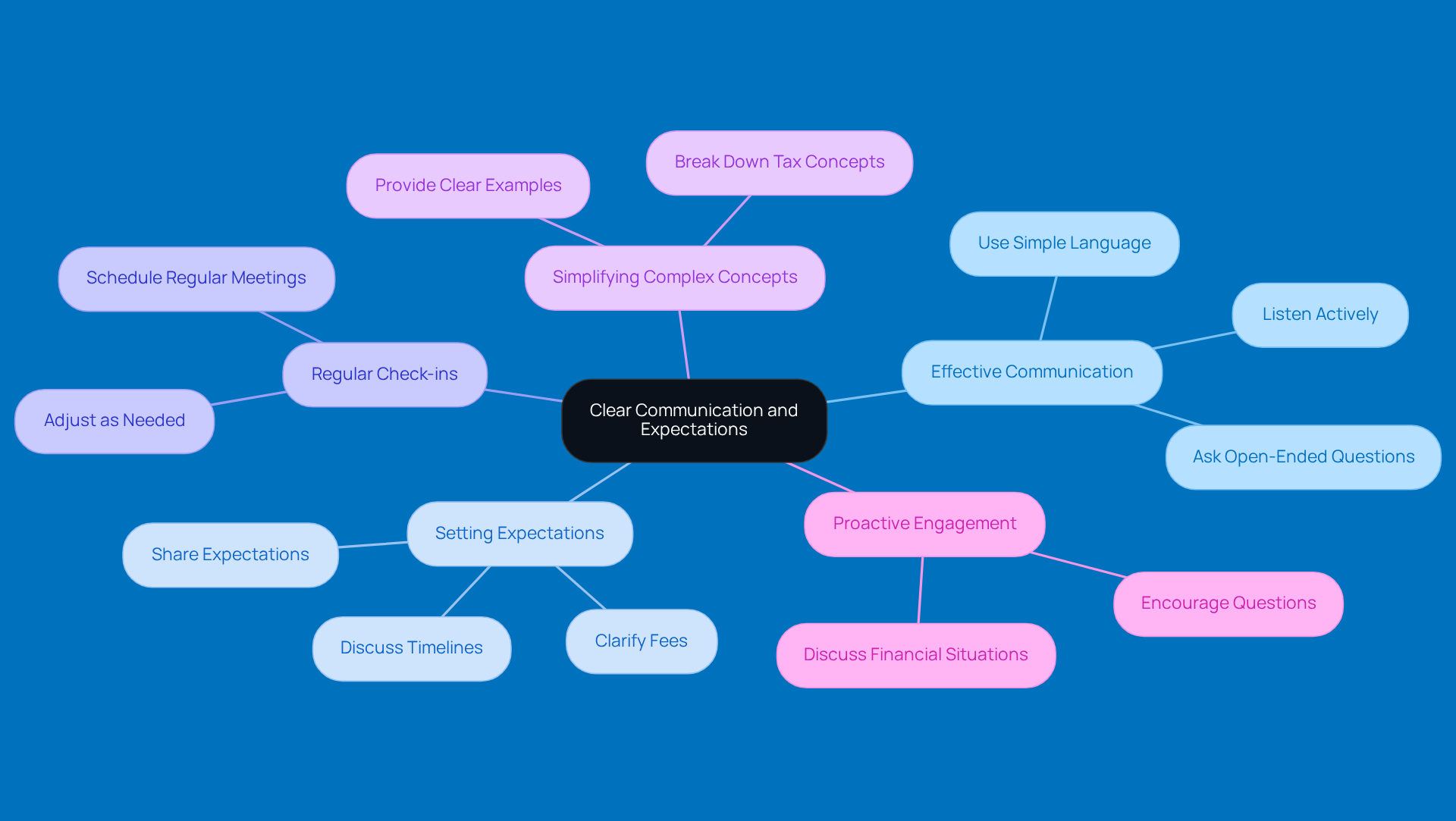

Establish Clear Communication and Expectations

Effective communication is key to building a great partnership with your tax saving professionals. Right from the start, it’s important to share your expectations about what services you need, timelines, and fees. Setting these parameters not only clears up roles but also lays the groundwork for a collaborative relationship. Regular check-ins are a must; they help ensure that you and your tax advisor stay on the same page and can adjust as things change.

Encourage your tax advisor to break down those complex tax concepts into simple, understandable terms. This not only makes the tax process less daunting but also empowers you to make informed decisions. And don’t be shy about asking questions! This kind of proactive engagement builds trust and collaboration, which are crucial for achieving the best outcomes with tax saving professionals.

For example, in rural areas, successful relationships between clients and tax advisors often rely on open communication. Clients who actively discuss their financial situations and tax strategies usually see better results. By setting clear expectations and keeping the conversation going, you can tackle the complexities of tax planning with confidence and clarity.

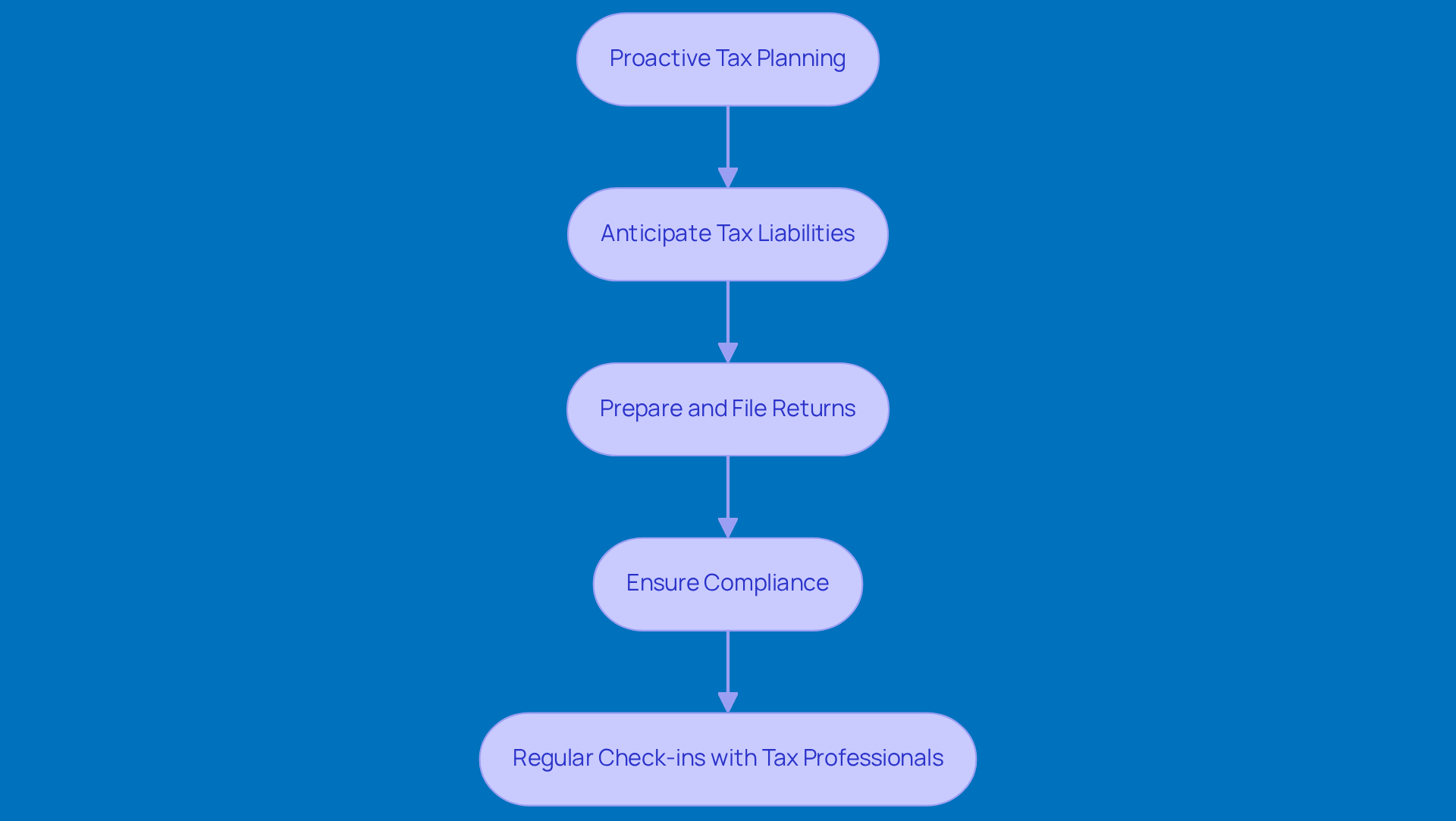

Implement Proactive Tax Planning and Regular Reviews

Proactive tax planning is all about anticipating those tax liabilities and making smart decisions throughout the year-rather than just scrambling when tax season rolls around. Here at Steinke and Company, we make sure your tax season is smooth, accurate, and stress-free. We handle everything from preparing and filing your corporate and personal returns to ensuring compliance and minimizing any surprises.

Regular check-ins with your tax saving professionals are essential! They help you assess your financial situation, chat about potential deductions, and tweak your tax strategy as needed. This ongoing conversation not only helps tax saving professionals spot opportunities for tax savings but also keeps you compliant with any changing regulations. By staying proactive, you can reduce risks and boost your business's financial resilience. So, why wait? Let’s get started on making your tax planning as easy as pie!

Conclusion

Engaging with tax-saving pros is super important for small businesses looking to fine-tune their financial strategies and stay on top of ever-changing tax rules. By getting to know what these experts do and tapping into their know-how, business owners can tackle the tricky world of tax planning with confidence and clarity.

Throughout this article, we’ve highlighted some key practices. First off, it’s essential to evaluate the qualifications and fit of your tax professionals. Next, establishing clear communication and expectations is a must. And let’s not forget about implementing proactive tax planning strategies! These practices not only boost the effectiveness of your partnership but also empower you to make informed decisions that can lead to significant long-term savings and better financial health.

Ultimately, working with tax-saving professionals isn’t just a seasonal chore; it’s an ongoing partnership that can really drive your business success. By prioritizing communication, setting clear expectations, and engaging in regular reviews, you can ensure that you’re not just compliant but also ready for growth and resilience in the face of changing market conditions. Embracing these best practices can truly change the way you approach your financial planning and tax strategies, paving the way for a more stable and prosperous future. So, why not take the plunge and start this journey today?

Frequently Asked Questions

What is the role of tax saving professionals for small businesses?

Tax saving professionals, such as CPAs, enrolled agents, and tax advisors, help small businesses navigate tax regulations, reduce tax bills, and ensure legal compliance, which is crucial for smooth business operations.

What services do tax saving professionals offer?

They offer a range of services including tax preparation, tax planning, and tailored advice to address the unique challenges faced by small businesses, particularly in rural areas.

How can tax advisors help small businesses improve their financial outcomes?

Tax advisors can identify opportunities in the tax code that businesses might overlook, allowing them to optimize their tax strategies, which can lead to significant long-term savings and improved cash flow management.

In what ways do CPAs and enrolled agents contribute to financial planning?

They act as strategic partners by helping set up key performance indicators (KPIs) and dashboards, providing real-time insights into financial health, which aids in data-driven decision-making.

Why is the role of tax advisors particularly important in rural communities?

In rural areas, small businesses are often the economic backbone, and tax advisors help these businesses remain compliant and financially stable, ultimately enhancing the economic vitality of their communities.

How do tax saving professionals assist in managing stress during tax season?

By providing guidance and strategic planning, tax saving professionals help ease the stress associated with tax season, allowing business owners to focus on growth and sustainability.