Introduction

If you're a small business owner, you know how crucial it is to have an effective electronic tax organizer. It can really help you streamline your tax prep process. By following some best practices - like setting up key components and using technology - you can boost your efficiency and cut down on the stress that tax season often brings. But here's the big question: how do you make sure your organizer not only fits your current needs but also keeps up with the ever-changing tax laws and your clients' situations? Let’s dive into some strategies that can lead to a more organized and successful tax experience!

Establish Essential Components for Your Organizer

Creating an effective electronic tax tool? Let’s break it down into some essential components that’ll make tax prep a breeze for everyone involved. Here’s what you should include:

-

Customer Information: First things first, make sure your organizer captures all the necessary details. We’re talking names, addresses, Social Security numbers, and contact info. This foundational data is super important for accurate tax filing.

-

Income Categories: Next up, clearly define sections for different types of income. Think wages, self-employment income, rental income, and investment income. This way, you can accurately report earnings and spot potential deductions.

-

Deduction Lists: Don’t forget to include comprehensive lists of common deductions that are relevant to small businesses. Business expenses, home office deductions, vehicle expenses - you name it! This will help your customers maximize their deductions and lower their tax bills.

-

Checklist of Materials: It’s also a good idea to provide a list of items individuals need to gather. W-2s, 1099s, receipts, and bank statements should all be on that list. This ensures that your customers are well-prepared and reduces the chances of missing important documents.

-

Important Dates: Lastly, highlight key tax deadlines and reminders for your customers to submit their info. A proactive approach helps clients stay organized and avoid those last-minute scrambles.

By putting these essential components in place, small business owners can create a solid electronic tax organizer that simplifies the tax preparation process and boosts compliance. So, what are you waiting for? Let’s get started!

Implement Systematic Document Categorization

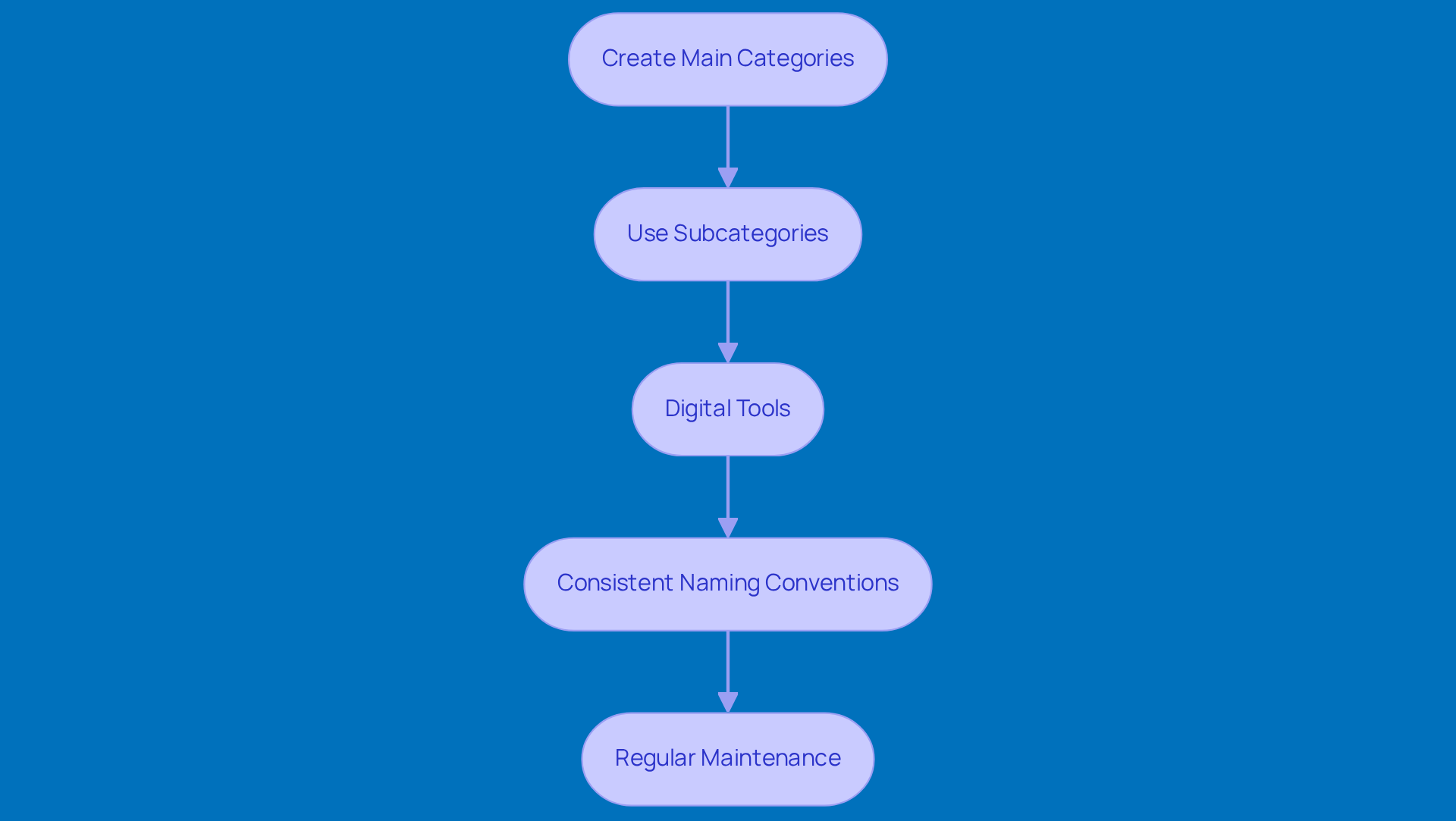

Do you want to make your electronic tax organizer function more efficiently? Let’s chat about how you can streamline your materials with some friendly tips from Steinke and Company’s tax pros. Here’s how to get started:

-

Create Main Categories: Kick things off by setting up broad categories like Income, Expenses, Deductions, and Tax Forms. This high-level organization makes it a breeze to find files when tax season rolls around, helping you stay compliant and dodge any surprises.

-

Use Subcategories: Now, let’s get a bit more specific. Under each main category, think about creating subcategories for different types of files. For instance, under Expenses, you could have Office Supplies, Travel Expenses, and Utilities. This extra detail helps you track and report accurately, which is super important for your financial and tax planning with an electronic tax organizer.

-

Digital Tools: Don’t forget about the power of digital tools! There are plenty of software options out there, including those from Steinke and Company, that let you easily categorize and tag your files. This way, you can upload and organize everything without breaking a sweat, making tax season a lot smoother.

-

Consistent Naming Conventions: Here’s a little tip: use a consistent naming convention for your files. For example, include the date and type of file in the name (like "2025-01-15_W2_JohnDoe.pdf"). This simple practice makes searching and retrieving files a whole lot easier, enhancing your tax prep experience.

-

Regular Maintenance: Lastly, set aside some time to regularly review and update your categories. As your business grows, your documentation needs will change too. Keeping your system fresh ensures you stay efficient and supports your overall success.

By putting these categorization strategies into action, small business owners can save a ton of time searching for documents and improve their tax preparation experience. And who doesn’t want better financial outcomes? So, why not give it a try?

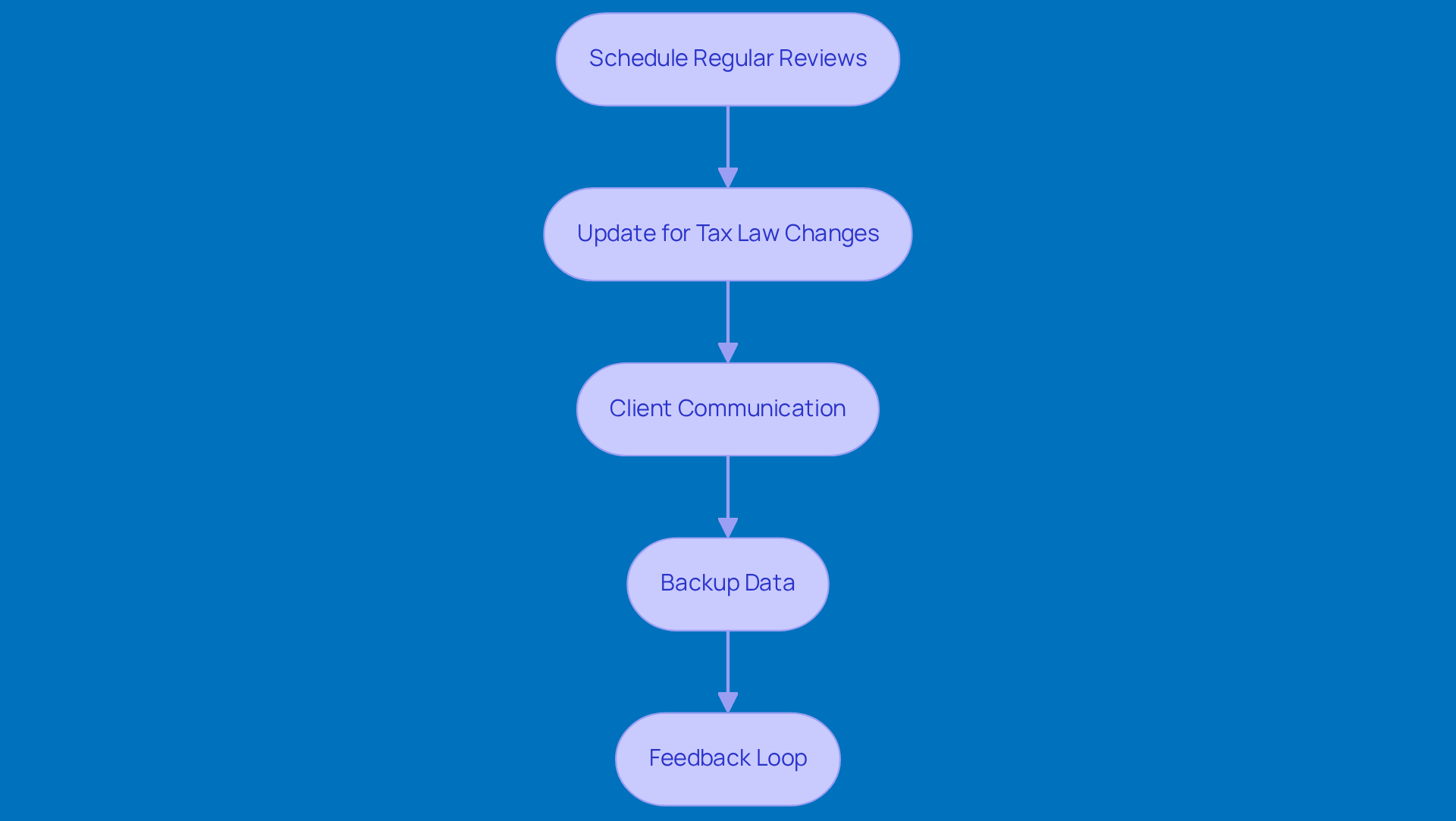

Conduct Regular Updates and Reviews

To get the most out of your electronic tax organizer, it’s super important to keep things fresh with regular updates and reviews. Here are some friendly tips to help you out:

-

Schedule Regular Reviews: How about setting aside a specific time each month or quarter to check in on your tax planner? This little routine can help you spot any missing documents or outdated info that needs your attention.

-

Update for Tax Law Changes: Tax laws can change, and you don’t want to be caught off guard! Make it a habit to review your planner regularly to include any new deductions, credits, or compliance requirements. Staying on top of this means you’ll be compliant and ready to save.

-

Client Communication: Keep the lines of communication open with your clients about any changes in their financial situations - like new income streams or big expenses. This ongoing chat helps ensure that your planner stays accurate and reflects their current financial state.

-

Backup Data: Don’t forget to back up your electronic device regularly! Using cloud storage solutions that offer automatic backups can keep your data safe and easily accessible.

-

Feedback Loop: Set up a way for clients to share their thoughts on how user-friendly the planner is. Their feedback can be a goldmine for improving the structure and content, making it even more effective for future tax seasons.

By sticking to these practices, small business owners can keep their electronic tax organizer accurate and efficient, making tax prep a breeze!

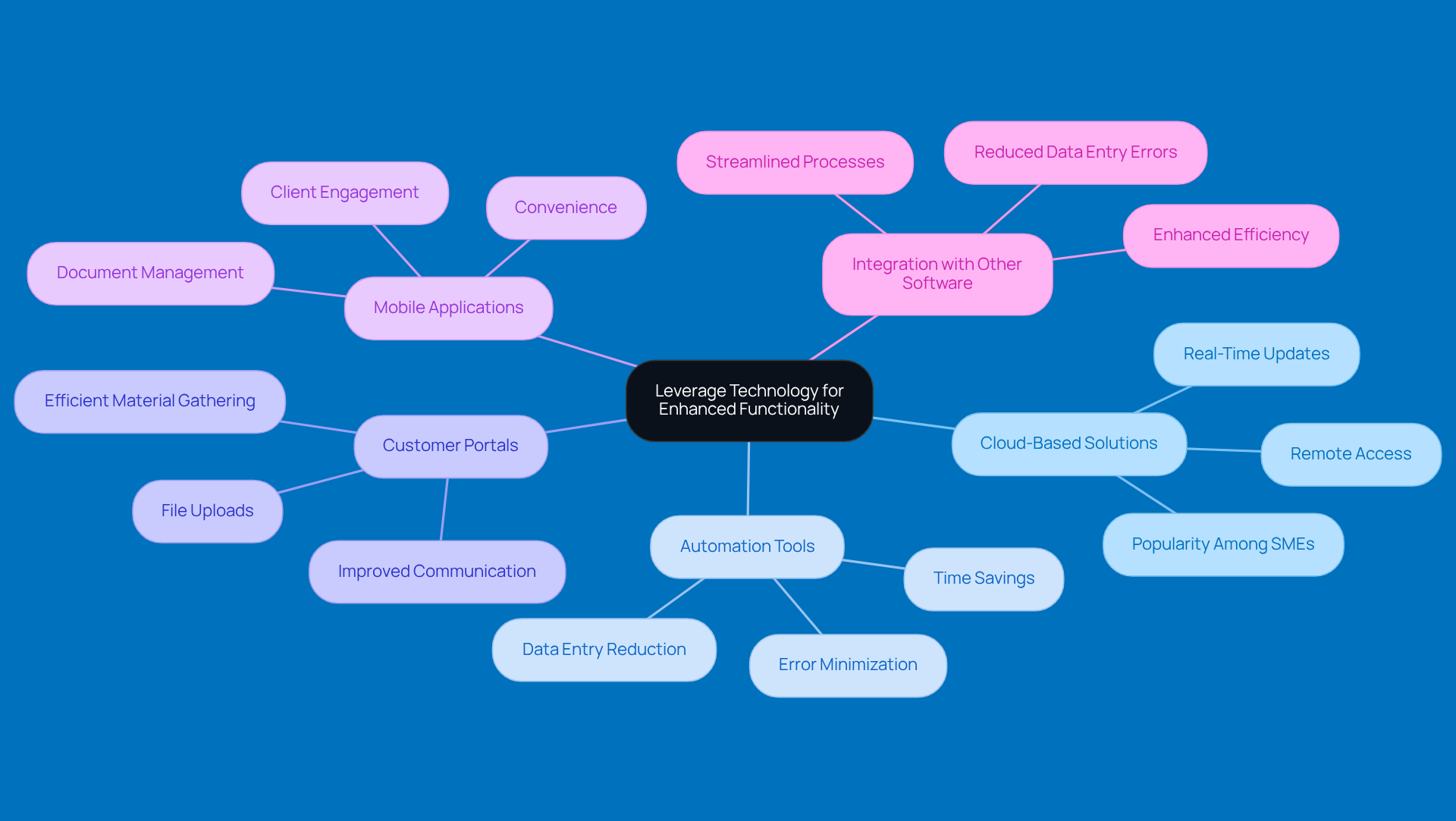

Leverage Technology for Enhanced Functionality

To make the most of your electronic tax organizer, let’s tap into technology to boost its functionality. Here are some friendly strategies to consider:

-

Cloud-Based Solutions: Why not go for cloud-based tax software? It allows for real-time updates and remote access, which is super handy for small business owners who need to check their planner while on the move. Plus, the cloud accounting software market is on the rise, showing just how popular it’s becoming among small and medium enterprises.

-

Automation Tools: Think about using automation tools to make data entry and file collection a breeze. Some software can automatically pull in financial data from your bank accounts or accounting systems, cutting down on manual input. This not only saves you time but also helps reduce errors, making your tax prep more accurate.

-

Customer Portals: Have you considered customer portals? They let users upload files straight to their organizer, which makes communication smoother and ensures you gather all the necessary materials efficiently. It’s a great way to keep things flowing during tax season.

-

Mobile Applications: Don’t forget about mobile apps! They let users manage their tax documents right from their smartphones. This convenience can really boost client engagement and satisfaction, helping them stay organized and in the loop.

-

Integration with Other Software: Lastly, make sure your electronic tax tool plays nicely with other software you use, like accounting or payroll solutions. This integration cuts down on data entry errors and enhances efficiency, leading to a more streamlined tax prep process.

By embracing these tech advancements, small business owners can develop a more functional and user-friendly electronic tax organizer. It’s all about making tax preparation a smoother experience!

Conclusion

Creating an effective electronic tax organizer is key to making tax prep a breeze and staying compliant. By honing in on the essential components we’ve discussed, small business owners can craft a tool that not only gathers crucial info but also makes the whole tax filing experience a lot smoother. Think about it: with systematic document categorization, regular updates, and a bit of tech magic, you can keep your tax process organized and efficient.

We’ve highlighted some best practices, like setting up essential components such as:

- Customer info

- Income categories

- Deduction lists

It’s all about keeping your documents organized - think main and subcategories - and making sure to review everything regularly to stay on top of those ever-changing tax laws. Plus, embracing tech - like cloud solutions and automation tools - can really amp up the functionality and user-friendliness of your tax organizer.

In the end, adopting these practices doesn’t just simplify tax prep; it can lead to better financial outcomes for your small business. By focusing on organization, communication, and tech integration, you can turn your electronic tax organizer into a valuable asset that supports your financial success. So, why not take these steps today? A smoother tax season is just around the corner, and implementing these strategies will make your tax preparation experience not just efficient, but effective too!

Frequently Asked Questions

What are the essential components for creating an effective electronic tax organizer?

The essential components include capturing customer information, defining income categories, providing deduction lists, including a checklist of materials, and highlighting important dates.

What customer information should be included in the organizer?

The organizer should capture names, addresses, Social Security numbers, and contact information to ensure accurate tax filing.

Why is it important to define income categories in the organizer?

Defining income categories, such as wages, self-employment income, rental income, and investment income, allows for accurate reporting of earnings and helps identify potential deductions.

What types of deductions should be included in the organizer?

The organizer should include comprehensive lists of common deductions relevant to small businesses, such as business expenses, home office deductions, and vehicle expenses.

What materials should individuals gather for tax preparation?

Individuals should gather items such as W-2s, 1099s, receipts, and bank statements to ensure they are well-prepared for tax filing.

Why is it important to highlight key tax deadlines in the organizer?

Highlighting key tax deadlines and reminders helps clients stay organized and avoid last-minute scrambles, ensuring timely submission of their information.