Introduction

Navigating the world of business taxes can feel pretty overwhelming for small agencies, right? With regulations changing and financial landscapes shifting, it’s no wonder many feel lost. But here’s the good news: getting a handle on effective tax planning services can really pay off. Think about it - better cash flow and fewer compliance headaches are just the beginning!

So, what can small businesses do to not just survive but actually thrive in this tricky environment? It’s all about seizing opportunities while dodging potential pitfalls. Let’s dive into some strategies that can help you make the most of your situation!

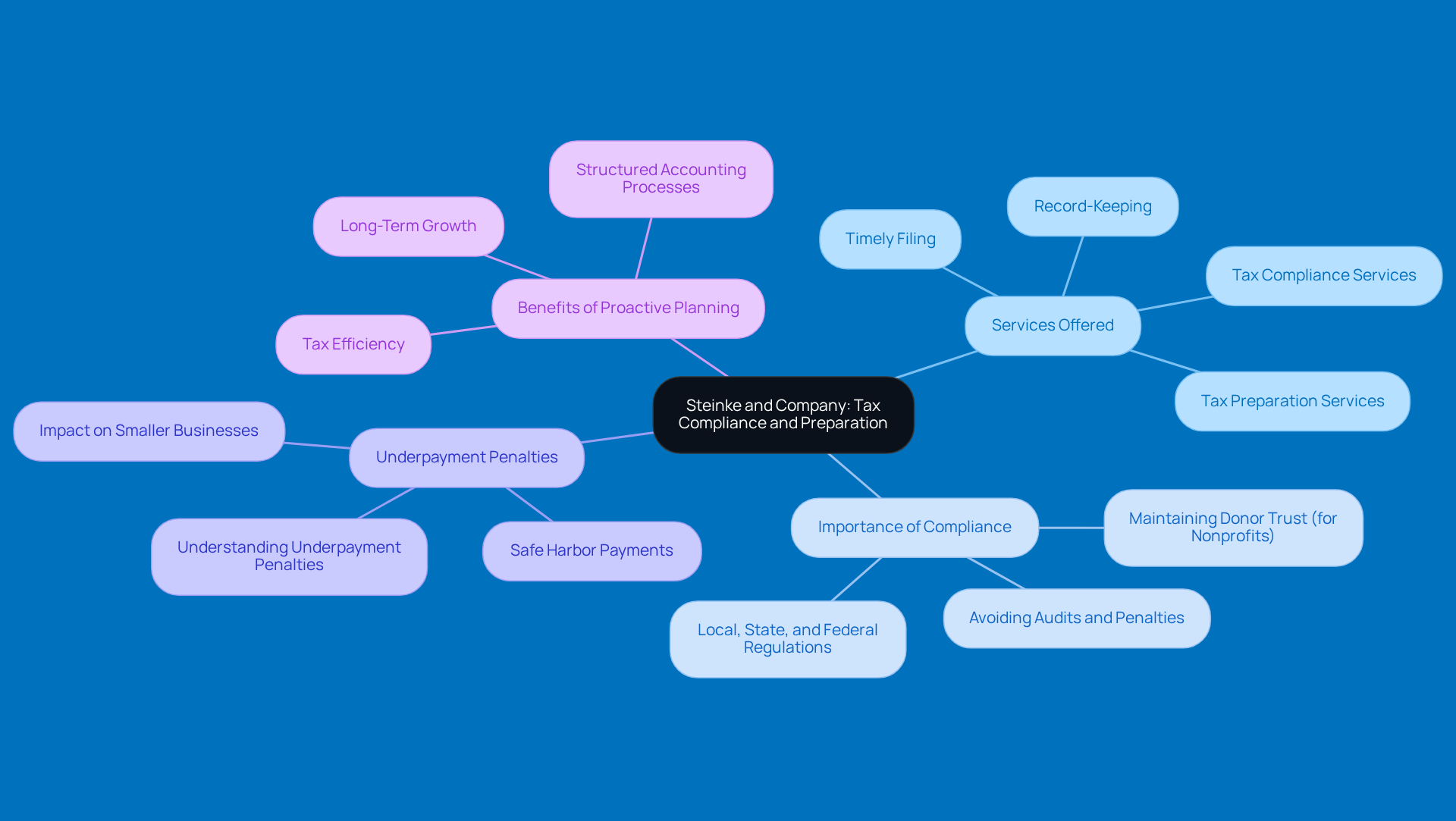

Steinke and Company: Comprehensive Tax Compliance and Preparation

Steinke and Company offers a wide range of tax compliance and preparation services designed just for smaller organizations. This means you get careful record-keeping, timely filing, and a commitment to following local, state, and federal regulations. By setting up solid accounting systems and sticking to close processes, business owners can really cut down on the chances of audits and penalties. This way, they can focus on what they do best - running their business! Companies that have strong accounting practices often see better tax outcomes, which highlights the importance of proactive tax planning.

Understanding underpayment penalties is super important for agency owners. The IRS hits you with these penalties when taxpayers don’t pay enough of their tax liability through withholding or estimated tax payments during the year. But don’t worry - proactive tax planning can help you dodge these costly penalties. For example, safe harbor payments let taxpayers prepay a minimum amount of their tax obligation, which protects them from underpayment penalties, no matter what their actual tax liability is for the year. This is especially helpful for smaller businesses that might have income that goes up and down.

Our approach blends advanced technology with a personal touch, making sure clients not only stay compliant but also feel at ease. Nonprofits have to deal with tricky compliance requirements that go beyond just the 990 forms. They need to track and report restricted funds properly to keep donor trust and avoid financial penalties. Similarly, private equity-backed companies can really benefit from structured accounting processes that boost compliance readiness and tax efficiency.

As the tax landscape shifts - especially with changes from the One Big Beautiful Bill Act - smaller organizations need to make tax preparation a priority to navigate these complexities. This act has big implications for tax planning, so it’s crucial for independent business owners to stay in the loop. Working with experts who get the unique challenges of small-town life and seasonal work can be a game changer. In the end, the perks of thorough tax preparation go beyond just compliance; they foster long-term growth and stability for businesses, helping them thrive in their communities.

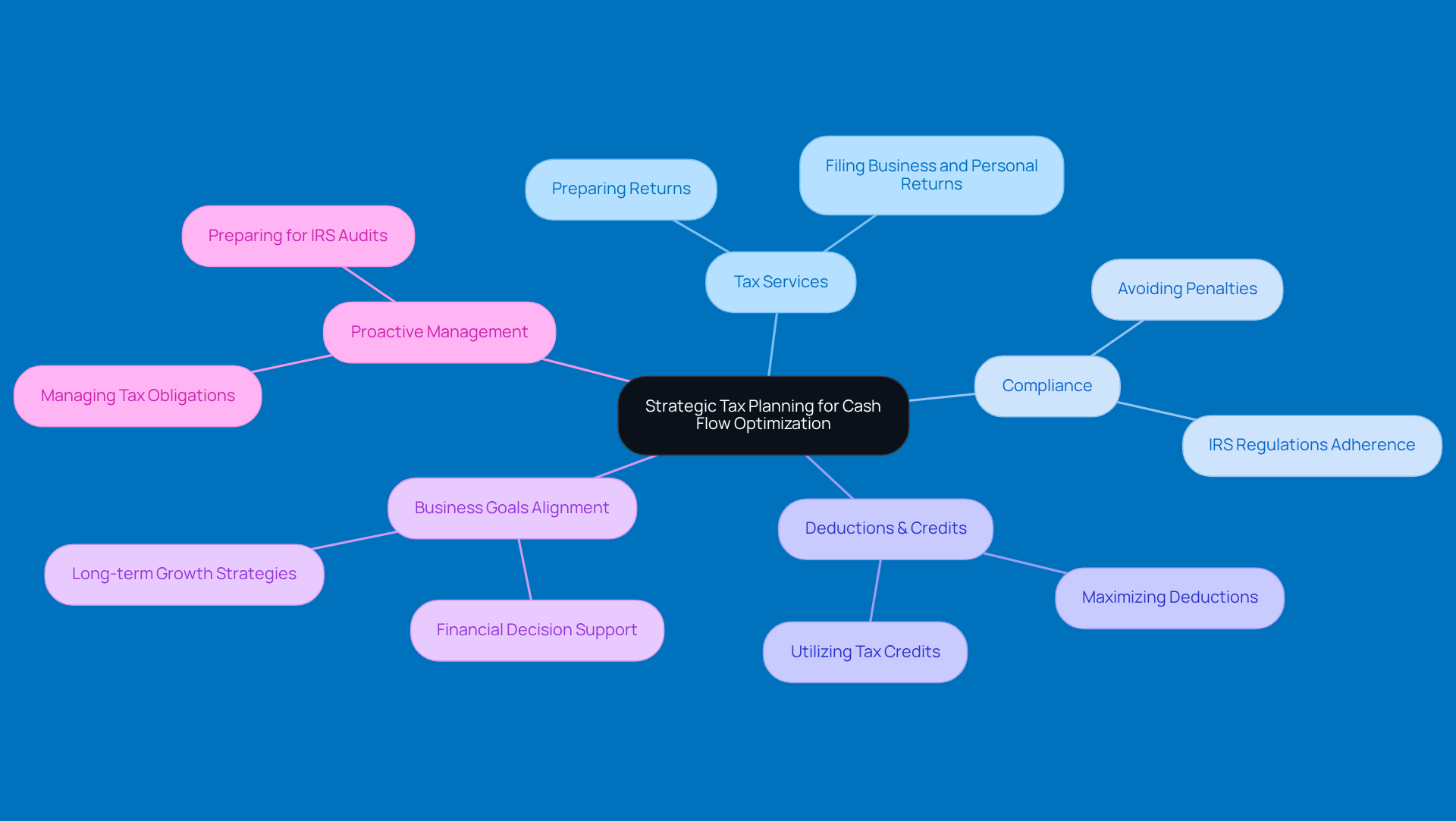

Strategic Tax Planning for Cash Flow Optimization

Strategic business tax planning services are super important for small organizations looking to thrive. At Steinke and Company, we dive into your current and future income to spot tax-saving opportunities that can really boost your cash flow. We handle everything from preparing and filing your business and personal returns to making the most of deductions, credits, and deferrals.

Our expert team is here to keep you compliant with IRS regulations, so you can avoid those last-minute surprises and stress during tax season. We believe it’s crucial to align your tax strategies with your business goals through business tax planning services, ensuring that every financial decision you make supports your long-term growth and stability.

And hey, if you ever find yourself facing an IRS audit or worrying about underpayment penalties, we’ve got your back! We assist independent business owners like you by offering business tax planning services to manage tax obligations proactively, so you can focus on what you do best.

Monthly Accounting and Financial Oversight for Compliance

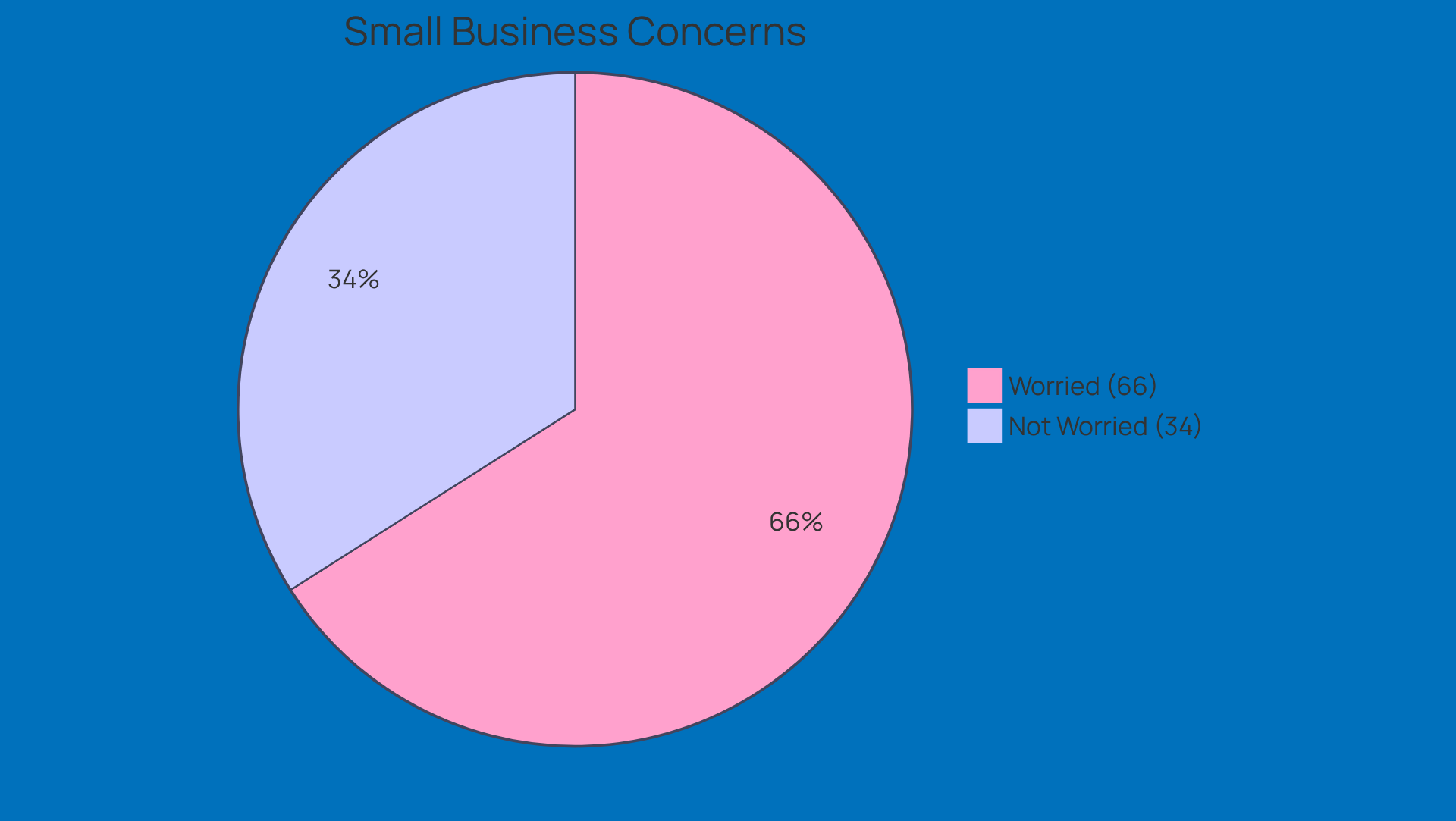

At Steinke and Company, we get it - keeping your accounting in check is crucial for small agencies. Our monthly accounting services help you stay compliant and keep your records up to date. Think about it: regular financial oversight isn’t just a box to check; it’s your safety net. It helps you spot discrepancies early and ensures that everything aligns with the rules.

Plus, this proactive approach gives you a clear picture of your financial health, empowering you to make smart decisions. Did you know that 66% of small businesses are worried about recent banking issues? That really shows how important solid financial oversight is in today’s complex economic landscape.

By embracing effective oversight practices, small organizations can not only minimize risks but also sharpen their financial strategies. This way, you’re not just surviving; you’re thriving in a constantly changing market. So, why not take that step towards resilience today?

Business Coaching and Advisory for Growth Strategies

At Steinke and Company, we’re all about helping small businesses craft growth strategies that really hit home. We know every firm faces its own unique challenges, so we blend financial insights with strategic planning to give you personalized guidance. This way, your business goals align perfectly with your financial capabilities, which is key for sustainable growth.

But that’s not all! Our proactive business tax planning services take things a step further. We meet with you 1-3 times a year to go over your tax return or current books. Together, we’ll spot missed opportunities and lay out a clear plan using business tax planning services to lighten your tax load while boosting your business. It’s a holistic approach that builds resilience and adaptability in today’s fast-changing market.

As we look ahead to 2026, local businesses need to tackle complexities head-on. Prioritizing structured decision-making and operational readiness is crucial for long-term success. And let’s not forget about intentional contracting - it can pave the way for predictable revenue and stronger relationships with buyers. This is exactly what small agencies need to thrive!

Conclusion

When it comes to effective tax planning services for small agencies, it’s clear that tailored strategies can really boost financial stability and growth. By focusing on comprehensive tax compliance, strategic planning, monthly oversight, and even business coaching, small businesses can tackle the tricky tax landscape while keeping their eyes on what they do best.

So, what’s the takeaway here? Proactive tax planning isn’t just about avoiding those pesky underpayment penalties; it’s also a smart way to optimize cash flow through savvy deductions and credits. Plus, regular financial oversight helps ensure compliance and gives business owners the confidence to make informed decisions. And let’s not forget the value of personalized coaching, which aligns financial strategies with long-term goals, helping businesses stay resilient in a fast-changing market.

In the end, investing in these essential tax planning services goes beyond mere compliance; it’s a vital step toward sustainable growth and success for small agencies. By embracing these practices, business owners can set themselves up to thrive in their communities, turning challenges into real opportunities for advancement. So, why not take that step today?

Frequently Asked Questions

What services does Steinke and Company offer?

Steinke and Company provides a wide range of tax compliance and preparation services specifically designed for smaller organizations, including careful record-keeping, timely filing, and adherence to local, state, and federal regulations.

How can strong accounting practices benefit businesses?

Strong accounting practices can lead to better tax outcomes, reduce the chances of audits and penalties, and allow business owners to focus on running their business effectively.

What are underpayment penalties and how can they be avoided?

Underpayment penalties are imposed by the IRS when taxpayers do not pay enough of their tax liability through withholding or estimated tax payments. These penalties can be avoided through proactive tax planning, such as making safe harbor payments to prepay a minimum amount of tax obligations.

What special considerations do nonprofits face regarding tax compliance?

Nonprofits must navigate complex compliance requirements beyond just filing 990 forms, including the proper tracking and reporting of restricted funds to maintain donor trust and avoid financial penalties.

How can private equity-backed companies improve their tax compliance?

Private equity-backed companies can benefit from structured accounting processes that enhance compliance readiness and tax efficiency.

Why is tax preparation important for smaller organizations?

Tax preparation is crucial for smaller organizations to navigate the complexities of the changing tax landscape, especially with new legislation like the One Big Beautiful Bill Act, which has significant implications for tax planning.

How does Steinke and Company ensure client comfort while maintaining compliance?

Steinke and Company combines advanced technology with a personal touch to ensure that clients remain compliant while also feeling at ease with the tax preparation process.

What are the long-term benefits of thorough tax preparation?

Thorough tax preparation fosters long-term growth and stability for businesses, helping them thrive in their communities beyond just ensuring compliance.