Introduction

Tax planning might not be the first thing that comes to mind when you think about running a small business, but it’s super important - especially when resources are tight. By managing tax obligations smartly, you can actually find some pretty significant savings that can boost your financial health. But with tax laws changing all the time and so many strategies out there, how do you make sure you’re making the best choices? In this article, we’ll explore four essential tax planning strategies that not only help you save money but also set you up for sustainable growth and success.

Understand the Importance of Tax Planning for Businesses

Tax planning is super important for small businesses, especially in rural areas where resources can be tight. It’s all about taking a good look at your finances to make sure you’re following tax laws while also snagging every deduction and credit you can. When done right, tax planning can really lighten your tax load, boost your cash flow, and help you forecast your finances better.

Did you know that small businesses that engage in tax planning throughout the year can save a ton? Many report cutting their overall tax bills by as much as 20%! By getting to know the ins and outs of tax regulations, you can make smarter choices about spending and investing, which is key for long-term growth and stability.

Plus, proactive tax planning means fewer surprises when tax season rolls around. It lets you focus on what you do best - running your business - without the stress of unexpected tax bills. So, it’s clear that tax planning strategies for business are a vital part of building a sustainable business. Why not start thinking about your tax strategy today?

Implement Key Tax Strategies to Maximize Savings

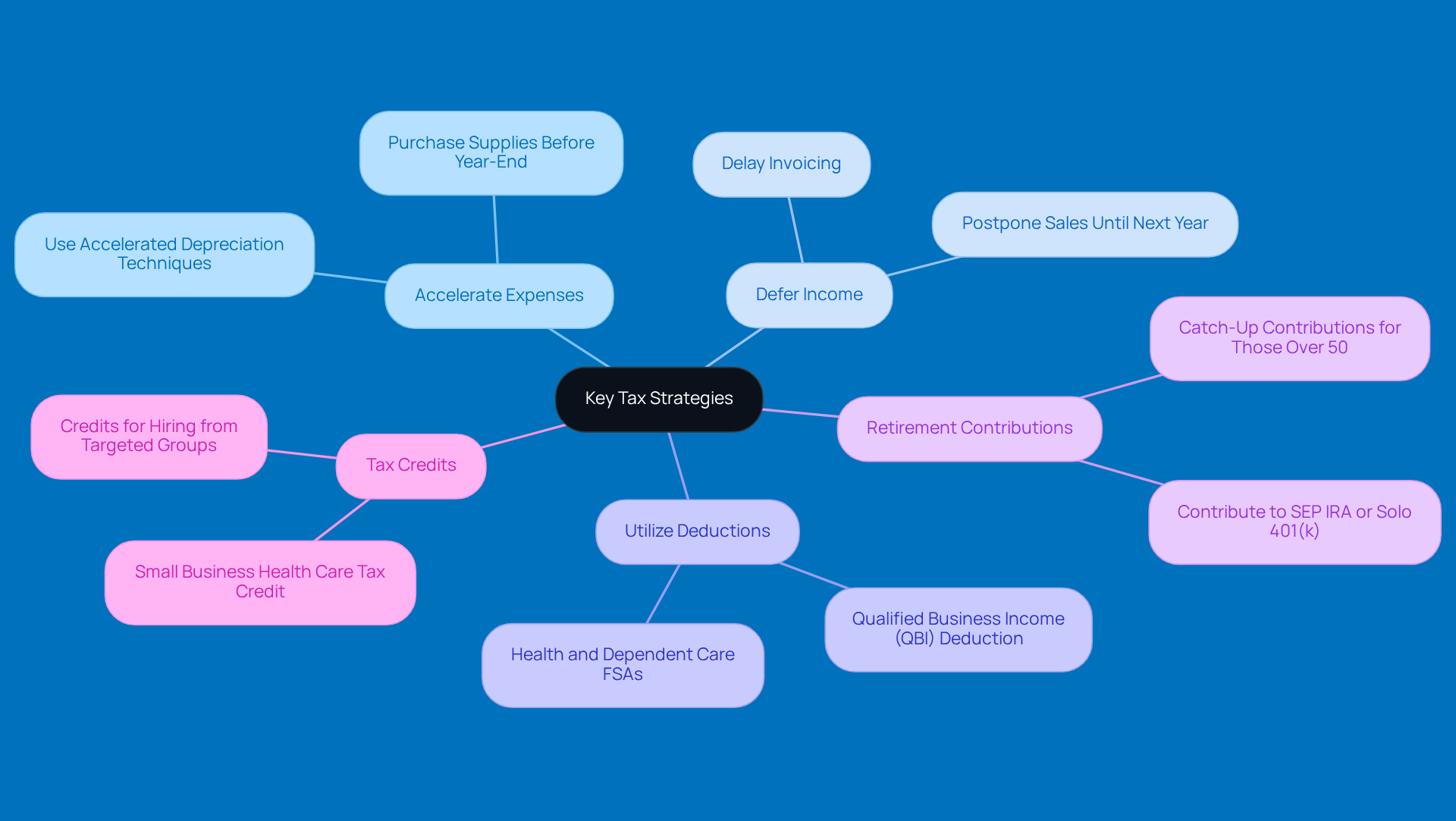

If you're a small business owner looking to save on taxes, there are some smart strategies you might want to consider:

-

Accelerate Expenses: Think about grabbing those necessary supplies or equipment before the tax year wraps up. By doing this, you can deduct those costs right away, which helps lower your taxable income. For instance, using accelerated depreciation techniques on qualifying assets can really boost your deductions and improve your cash flow.

-

Defer Income: Have you thought about pushing some income to the next tax year? This can be a great move, especially if you expect to land in a lower tax bracket. You can delay invoicing or hold off on sales until after the year ends, which can really change your overall tax bill.

-

Utilize Deductions: Don’t forget to take advantage of deductions like the Qualified Business Income (QBI) deduction. If you qualify, you could deduct up to 20% of your qualified income. This deduction is here to stay and can lead to some serious tax savings for small business owners.

-

Retirement Contributions: Contributing to retirement plans is a win-win. Not only does it help secure your future, but it also gives you immediate tax benefits. Plans like a SEP IRA or Solo 401(k) can really cut down your taxable income, and if you're over 50, those catch-up contributions can boost your savings even more.

-

Tax Credits: Have you explored the tax credits available to you? Credits for hiring employees from targeted groups or investing in renewable energy can directly lower your tax bill and improve your cash flow. For example, small businesses might qualify for the Small Business Health Care Tax Credit, which helps reduce premium costs and supports employee well-being.

By implementing these tax planning strategies for business, you can navigate the tax planning maze with ease and enhance your financial results. So, why not give them a try?

Utilize Tools and Resources for Effective Tax Management

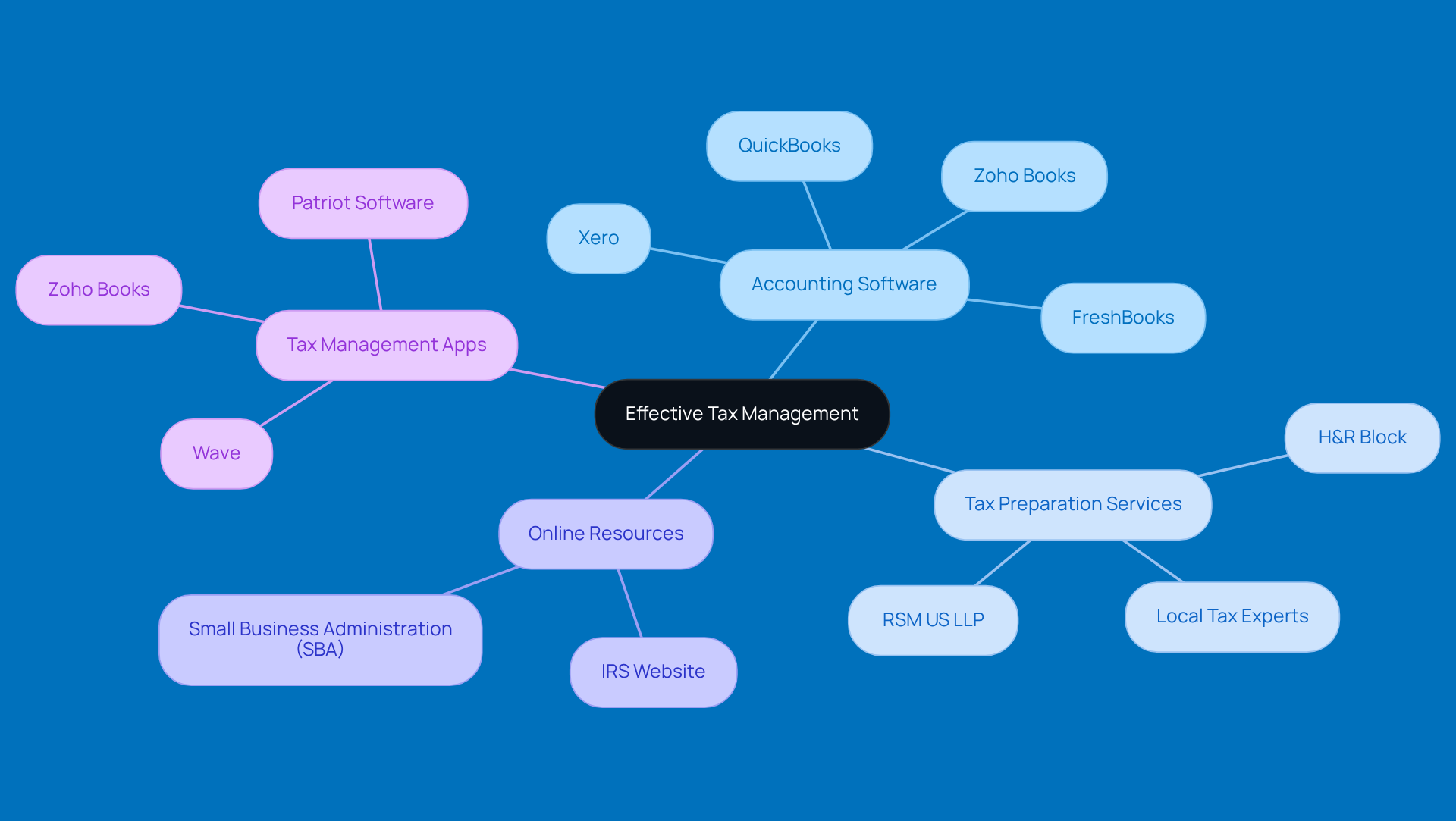

Effective tax management can really get a boost when you utilize tax planning strategies for business along with some handy tools and resources.

-

Accounting Software: Think about investing in solid accounting software like QuickBooks or Xero. These tools can automate a lot of the tax prep work, like tracking expenses and generating reports. This not only cuts down on mistakes but also saves you valuable time, letting you focus on what you do best-running your business.

-

Tax Preparation Services: Have you considered bringing in a tax expert or firm that specializes in helping small businesses? Their know-how can help you navigate the tricky waters of tax laws while implementing tax planning strategies for business to ensure you snag every deduction and credit available. For instance, local businesses like Sarah's bakery have successfully implemented tax planning strategies for business, significantly reducing their taxable income and freeing up cash for growth.

-

Online Resources: Don’t forget about the wealth of information available online! The IRS website is a treasure trove of tax regulations, forms, and deadlines. Plus, platforms like the Small Business Administration (SBA) offer great advice specifically for entrepreneurs, helping you stay informed and compliant.

-

Tax Management Apps: Have you checked out mobile apps designed for tax management? They can really simplify things! These apps help you track expenses, manage receipts, and remind you of important tax deadlines, keeping you organized all year round. Tools like Zoho Books and Wave are user-friendly and cater to the needs of small businesses, making tax prep a breeze.

Review and Adjust Tax Strategies Regularly for Continued Success

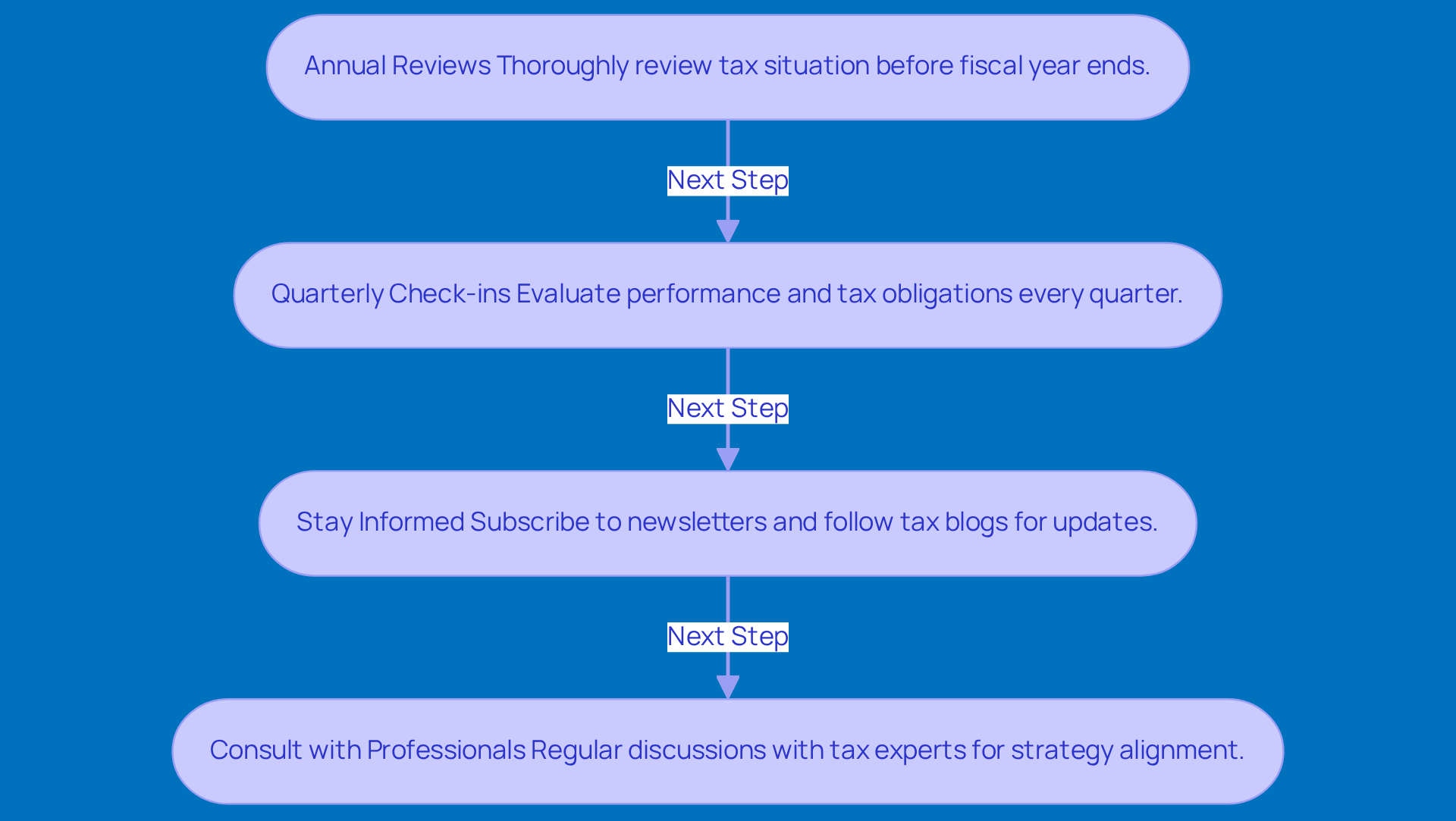

Tax laws and regulations are always changing, which means it’s super important for small business owners to regularly check in on their tax strategies. Here are some friendly tips to keep in mind:

-

Annual Reviews: Make it a habit to do a thorough annual review of your tax situation before the fiscal year wraps up. This proactive step helps you spot any legislative changes that might impact your business and lets you tweak your strategies as needed.

-

Quarterly Check-ins: How about setting up quarterly financial check-ins? These little evaluations can help you keep tabs on your performance and tax obligations. Staying on top of things means you can make timely adjustments throughout the year.

-

Stay Informed: It’s key to stay in the loop about any changes in tax legislation that could affect your business. Consider subscribing to newsletters from trusted tax advisory firms or following relevant blogs. This way, you’ll be updated on new deductions, credits, and compliance requirements.

-

Consult with Professionals: Don’t underestimate the value of regular chats with tax professionals. They can ensure your strategies are in line with current laws and best practices. Plus, their expertise can help you uncover potential tax-saving opportunities and navigate those tricky regulations with ease.

Conclusion

Tax planning is super important for small businesses, and it can really make a difference in their financial health and sustainability. By getting ahead with proactive tax strategies, business owners can not only stay on the right side of tax laws but also maximize deductions, improve cash flow, and boost their profitability. Seriously, the importance of tax planning is huge! It’s like a roadmap that helps navigate the tricky world of tax obligations while paving the way for long-term growth.

In this article, we’ve highlighted some key strategies like:

- Accelerating expenses

- Deferring income

- Utilizing deductions

- Contributing to retirement plans

Each of these strategies comes with its own perks that can lead to some pretty significant tax savings. Plus, using tools like accounting software and tax management apps, along with chatting with tax professionals, can really simplify the tax prep process and keep business owners in the loop about their options.

In the ever-changing world of tax regulations, it’s crucial to regularly review and tweak those tax strategies for ongoing success. Staying updated on tax law changes and actively seeking professional advice can reveal new opportunities for savings and compliance. By making effective tax planning a priority, small business owners can not only lighten their tax load but also set themselves up for a stable and prosperous future. Embracing these practices today can truly lead to a brighter tomorrow!

Frequently Asked Questions

Why is tax planning important for small businesses?

Tax planning is crucial for small businesses, especially in rural areas, as it helps ensure compliance with tax laws while maximizing deductions and credits. This can lighten the tax burden, improve cash flow, and enhance financial forecasting.

How much can small businesses save through tax planning?

Small businesses that engage in tax planning throughout the year can save significantly, with many reporting reductions in their overall tax bills by as much as 20%.

What are the benefits of understanding tax regulations?

Understanding tax regulations allows businesses to make informed decisions about spending and investing, which is essential for long-term growth and stability.

How does proactive tax planning affect tax season?

Proactive tax planning reduces surprises during tax season, allowing business owners to focus on running their business without the stress of unexpected tax bills.

What should businesses do to start their tax strategy?

Businesses should begin thinking about their tax strategy today to build a sustainable business and take advantage of tax planning benefits.