Introduction

Navigating the maze of taxes can feel pretty overwhelming for small business owners, right? With regulations constantly changing and new opportunities popping up, it’s no wonder many feel lost. But here’s the thing: effective tax planning isn’t just about ticking boxes for compliance; it’s a crucial strategy for boosting your financial health and sustainability.

What if I told you there are some essential strategies that could lead to significant savings and make your operations smoother? In this article, we’re diving into four key tax planning strategies that can help small businesses like yours optimize tax obligations while maximizing benefits. Let’s ensure you not only survive but thrive in this increasingly complex financial landscape!

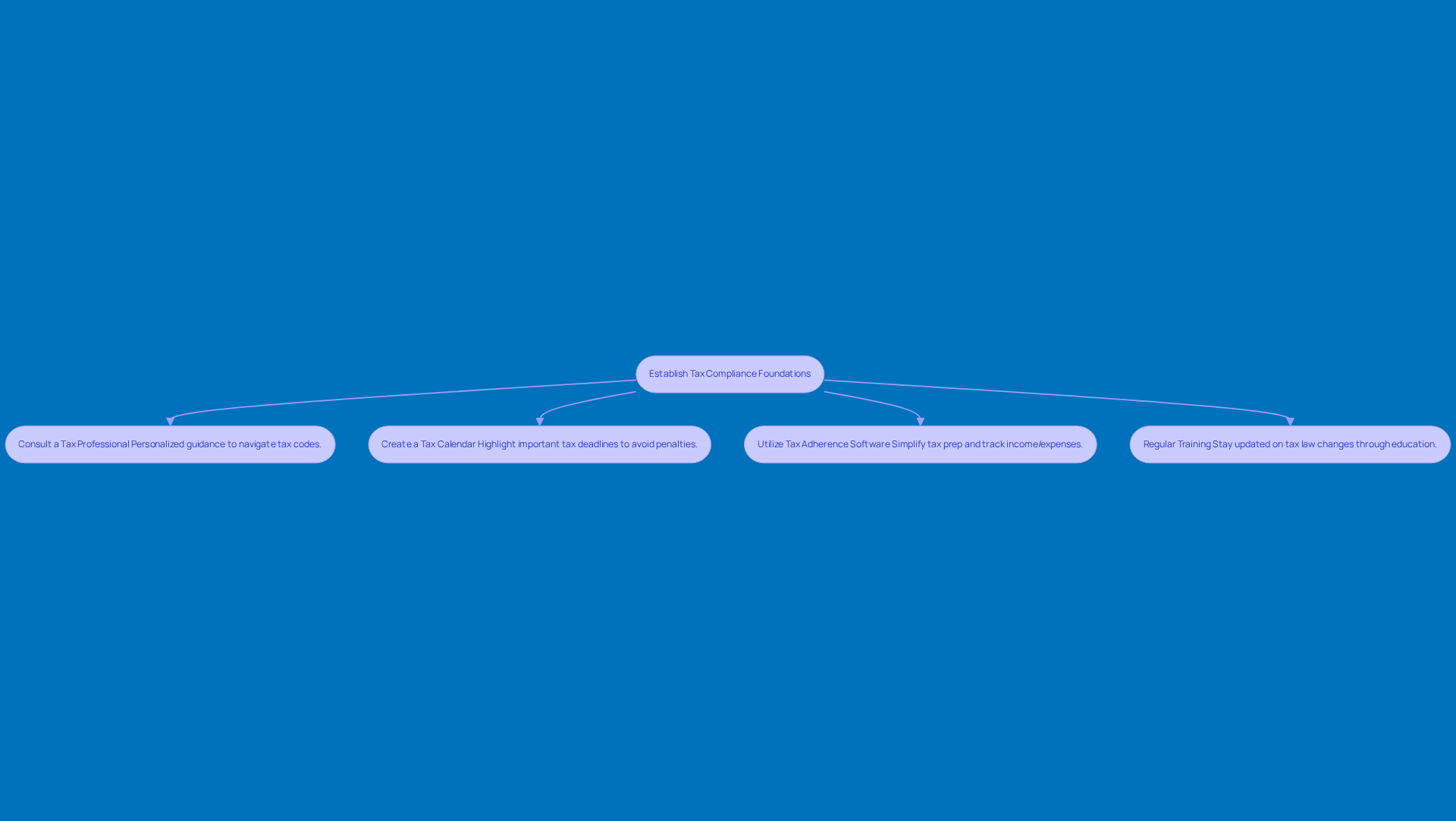

Establish Tax Compliance and Preparation Foundations

To build a solid tax compliance foundation, small business owners need to get a grip on their specific tax responsibilities, which cover federal, state, and local taxes. This means getting familiar with the different types of taxes that apply to their business structure, like income tax, payroll tax, and sales tax.

-

Consult a Tax Professional: Teaming up with a CPA or tax advisor can really make a difference. They offer personalized guidance that fits your business's unique situation. This partnership is key because tax advisors can help you navigate the tricky tax code and spot optimization opportunities that might slip through the cracks without expert help.

-

Create a Tax Calendar: Putting together a detailed calendar that highlights important tax deadlines is a smart move. It helps ensure you file and pay on time, which can save you from those pesky penalties and interest charges that can weigh heavily on small businesses, especially when finances are tight.

-

Utilize Tax Adherence Software: Using tax adherence software can seriously boost your efficiency by simplifying the tax prep process. These tools are great for keeping a close eye on your income and expenses, which is crucial for staying compliant and maximizing deductions. And as the IRS updates reporting thresholds, like the increase in the 1099-K reporting threshold to $20,000 starting in 2026, you’ll want to make sure your systems are up to date.

-

Regular Training: Keeping up with tax law changes through workshops or online courses is super important. Ongoing education helps entrepreneurs adapt to the ever-changing tax landscape, like the permanent Qualified Business Income (QBI) deduction and the return of bonus depreciation, which allows for a 100% write-off of eligible property through 2029.

By putting these strategies into action, small business owners can lay down a strong foundation for tax compliance. This not only leads to better financial outcomes but also reduces stress when tax season rolls around.

Develop Tailored Tax Planning Strategies for Small Businesses

Creating customized tax planning for companies involves taking a good look at your unique financial situation to uncover potential tax savings. Let’s dive into four essential strategies that can really make a difference:

-

Evaluate Your Business Structure: Have you thought about whether your current business structure-like an LLC, S-Corp, or something else-is the most tax-efficient for you? The structure you choose can greatly affect your tax planning for companies. For example, S-Corps often offer some nice perks when it comes to self-employment taxes compared to sole proprietorships. That’s where Steinke and Company comes in, helping you navigate these complexities to keep you compliant and avoid any surprises.

-

Timing Your Revenue: It’s all about timing! Effective tax planning for companies involves planning when you earn and spend to optimize your tax liabilities. For instance, if you can hold off on earning some income until next year, you might lower your tax bill for the current year-especially if you think you’ll be in a lower tax bracket down the line. This is particularly relevant for owners of pass-through entities, who can push taxable earnings into 2026 if they expect to stay in the same or a lower tax bracket.

-

Maximize Your Deductions: Don’t leave money on the table! Make sure you’re identifying and claiming all eligible deductions, like work-related expenses, home office deductions, and vehicle costs. Many small businesses can benefit from a variety of deductions that can significantly reduce taxable income, boosting your cash flow. Steinke and Company is here to ensure you’re aware of all potential deductions as part of your tax planning for companies to maximize your savings.

-

Contribute to Retirement Plans: Encouraging contributions to retirement plans is a win-win. Not only do they benefit your employees, but they also come with some serious tax advantages for your business. Understanding the tax implications of retirement earnings is crucial; for instance, options like SEP-IRAs allow self-employed folks to contribute up to 20% of their net self-employment income, maximizing tax savings while planning for the future.

By applying these strategies with a little help from Steinke and Company, small business owners can tackle the complexities of tax planning for companies more effectively, ensuring they keep more of their hard-earned income.

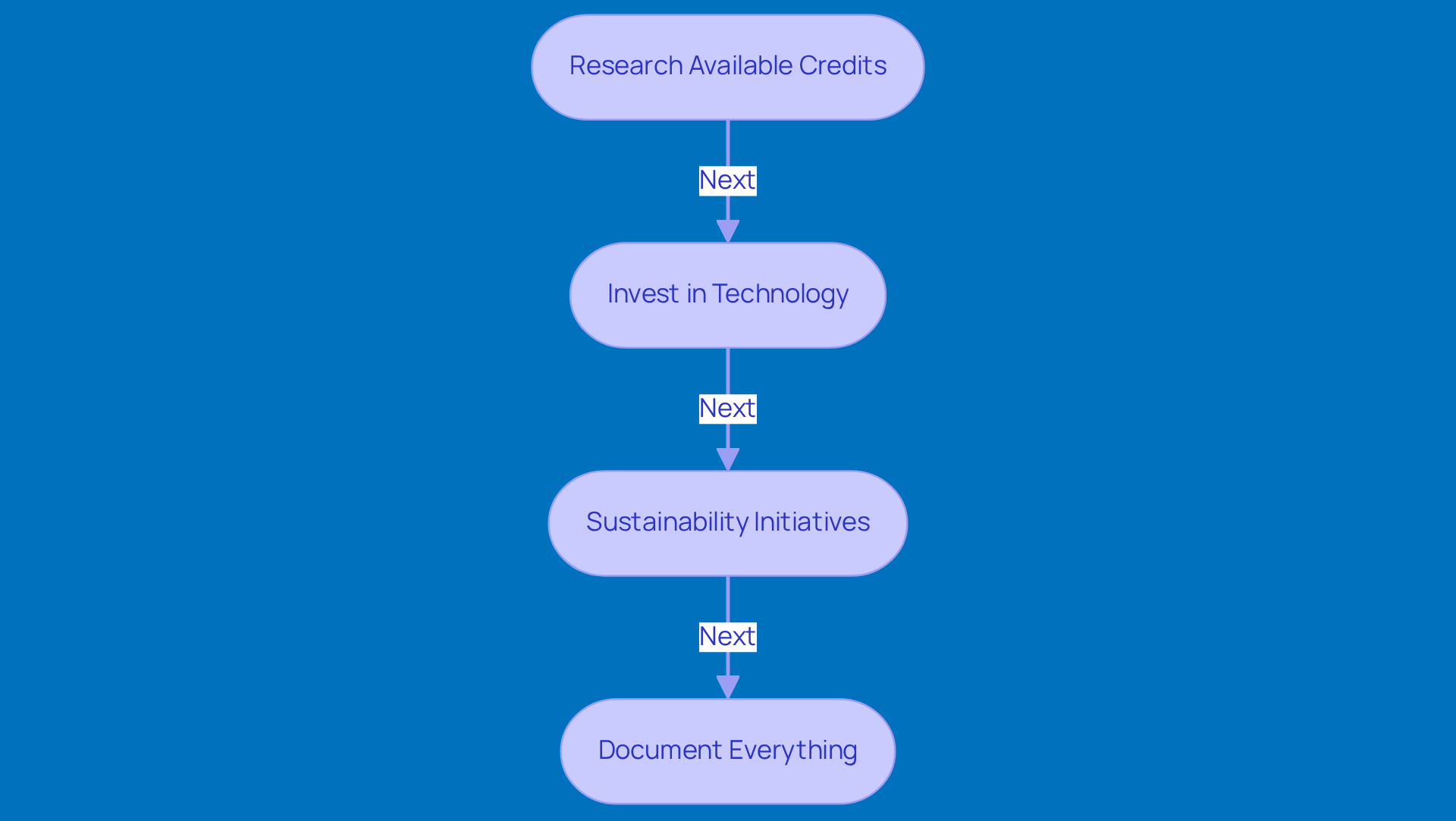

Leverage Tax Incentives and Credits for Financial Advantage

Small businesses, listen up! It’s time to dive into the world of tax planning for companies, including incentives and credits that can really boost your financial health and operational efficiency. Let’s break it down:

-

Research Available Credits: First things first, get to know the federal and state tax credits out there. Have you heard of the Work Opportunity Tax Credit (WOTC)? It’s available until December 31, 2025, and it can save you a pretty penny if you hire eligible workers, especially veterans. Believe it or not, fewer than 30% of small businesses that qualify for the R&D Tax Credit actually take advantage of it. So, doing your homework on these credits is a must!

-

Invest in Technology: Thinking about upgrading your tech? Certain investments, like new equipment or software, might just qualify for tax credits. For instance, in 2025, you can write off up to $2.5 million of qualifying property under the Section 179 deduction. That’s a great way to boost your operational efficiency and save on taxes at the same time!

-

Sustainability Initiatives: Are you into green practices? There are credits for businesses that go eco-friendly! Take the Plug-In Electric Drive Vehicle Credit, for example. It offers up to $7,500 for businesses buying new electric vehicles. Not only does this help the planet, but it also gives you some financial relief.

-

Document Everything: Don’t forget to keep your paperwork in check! Proper documentation is key when claiming credits and incentives. Staying organized can help you avoid audits and ensure compliance. Plus, with the IRS ramping up scrutiny on R&D claims starting in 2025, being prepared with detailed information is more important than ever.

By strategically utilizing tax planning for companies to access these tax incentives, small businesses can lighten their tax load and invest in growth and sustainability. So, what are you waiting for? Start exploring these opportunities today!

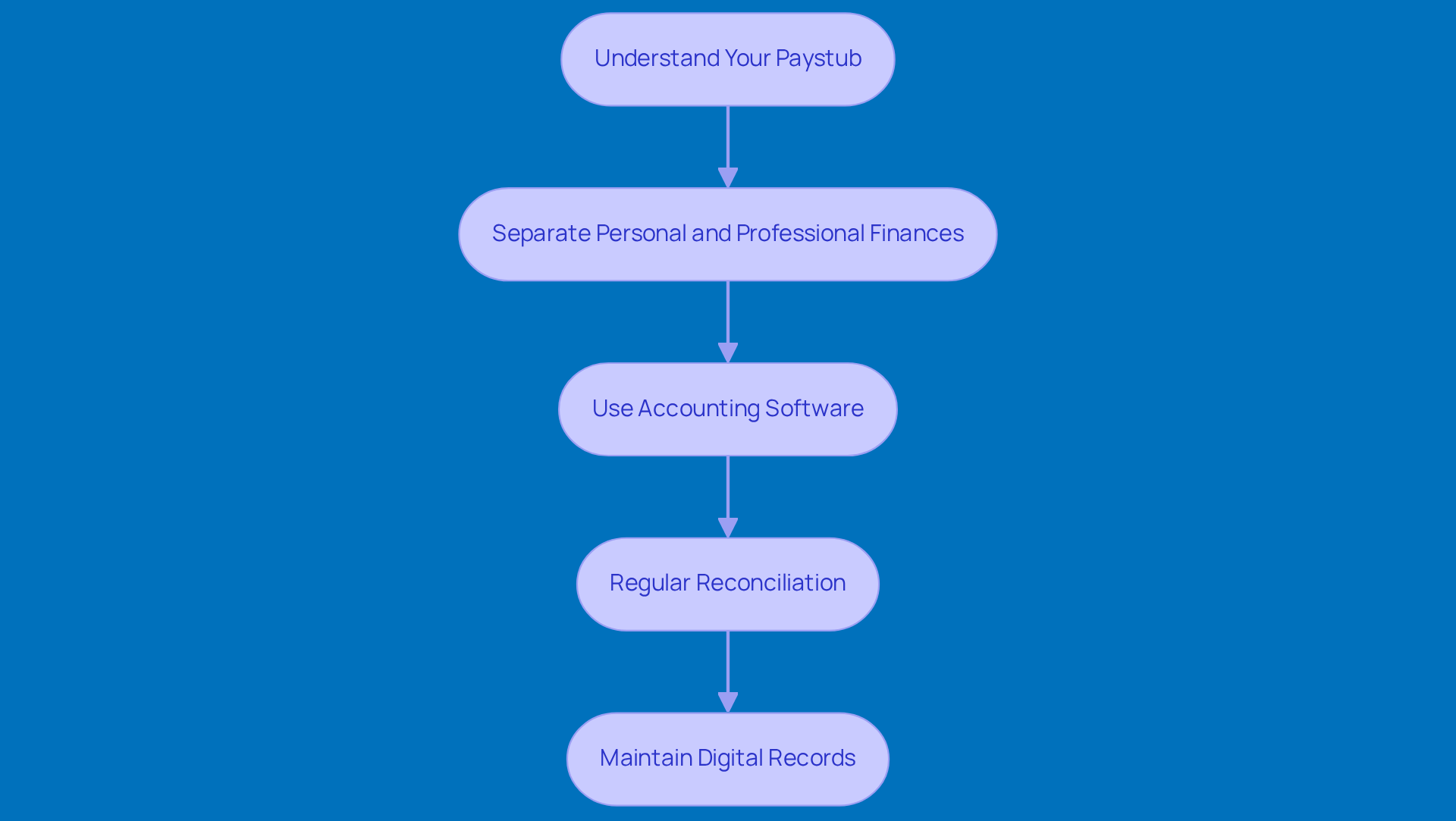

Implement Detailed Record-Keeping for Tax Optimization

Keeping track of your finances is super important for small businesses, particularly in the context of tax planning for companies. One of the first things you should do is get to know your paystub. It’s all about understanding your earnings and those pesky deductions that affect your take-home pay. Here are some friendly tips to help you boost your record-keeping:

-

Separate Personal and Professional Finances: Consider opening dedicated business bank accounts and credit cards. This little step can make tracking your income and expenses a breeze, which is key for effective tax planning for companies.

-

Use Accounting Software: Why not invest in some accounting software? It can automate your record-keeping and give you real-time insights into your finances. This way, you’ll have a clear picture of your income and expenses, which will simplify tax planning for companies and make tax season a lot less stressful.

-

Regular Reconciliation: Make it a habit to reconcile your accounts monthly. This helps catch any discrepancies early on and keeps your financial records accurate. Plus, it’s a great way to spot any potential issues with tax planning for companies regarding withholdings or deductions before they become a headache.

-

Maintain Digital Records: Embrace the cloud! Storing your receipts and documents online can help reduce clutter and make everything easy to access when tax time rolls around. Keeping digital copies of your paystubs and tax documents can really streamline your record-keeping process.

By implementing these strategies, you’ll not only enhance your financial stability but also ensure effective tax planning for companies to remain compliant with tax regulations. And who doesn’t want that? Better business growth and smoother operations are just around the corner!

Conclusion

When it comes to small businesses, effective tax planning strategies are a game changer. They not only help optimize financial health but also ensure you’re on the right side of tax regulations. By getting a grip on four key strategies - building a solid foundation for tax compliance, crafting personalized tax planning approaches, tapping into available tax incentives and credits, and keeping detailed records - you can confidently navigate the often tricky tax landscape.

Let’s talk about some key insights. First off, consulting with tax professionals is a must. Have you thought about creating a tax calendar? It can really help keep things organized. Plus, using tax adherence software can streamline your compliance efforts. And don’t forget to evaluate your business structure, time your revenue wisely, maximize deductions, and contribute to retirement plans. These steps can seriously boost your tax efficiency. Also, exploring tax credits and keeping meticulous records not only protects you from audits but also supports sustainable growth.

In the end, adopting these proactive tax planning strategies can take a load off your shoulders during tax season. It empowers you to keep more of your hard-earned money and invest in future growth. As tax laws change, staying informed and adaptable is key. So, why not take charge of your tax strategies today? Make sure you’re ready to seize every opportunity for financial advantage in 2025 and beyond!

Frequently Asked Questions

What are the key components of establishing tax compliance for small businesses?

Small business owners need to understand their specific tax responsibilities, which include federal, state, and local taxes, as well as familiarize themselves with different types of taxes applicable to their business structure, such as income tax, payroll tax, and sales tax.

Why should small business owners consult a tax professional?

Consulting a CPA or tax advisor provides personalized guidance tailored to the business's unique situation. Tax professionals can help navigate complex tax codes and identify optimization opportunities that may be overlooked without expert assistance.

How can creating a tax calendar benefit small business owners?

A tax calendar helps business owners keep track of important tax deadlines, ensuring timely filing and payment. This can prevent penalties and interest charges, which can be particularly burdensome for small businesses.

What role does tax adherence software play in tax preparation?

Tax adherence software enhances efficiency by simplifying the tax preparation process. It helps business owners monitor their income and expenses, ensuring compliance and maximizing deductions, especially as IRS reporting thresholds change.

Why is regular training important for small business owners regarding tax laws?

Ongoing education through workshops or online courses is vital for staying updated on tax law changes. This helps entrepreneurs adapt to the evolving tax landscape, including updates like the Qualified Business Income (QBI) deduction and changes to bonus depreciation.

What are the overall benefits of implementing these tax compliance strategies?

By adopting these strategies, small business owners can build a strong foundation for tax compliance, leading to improved financial outcomes and reduced stress during tax season.