Introduction

Navigating the financial landscape as a travel nurse can be quite the adventure! It’s rewarding, sure, but it can also get a bit tricky, especially when it comes to understanding your tax obligations. You might not realize it, but there’s a real chance to save big on taxes through some savvy deductions. This means you have a unique opportunity to keep more of your hard-earned cash in your pocket.

But let’s be honest - figuring out how to establish a tax home, manage multi-state filings, and leverage reciprocity agreements can feel overwhelming. Sound familiar? Don’t worry, you’re not alone! So, how can you effectively navigate these challenges and ensure you’re maximizing your earnings? Let’s dive in and explore!

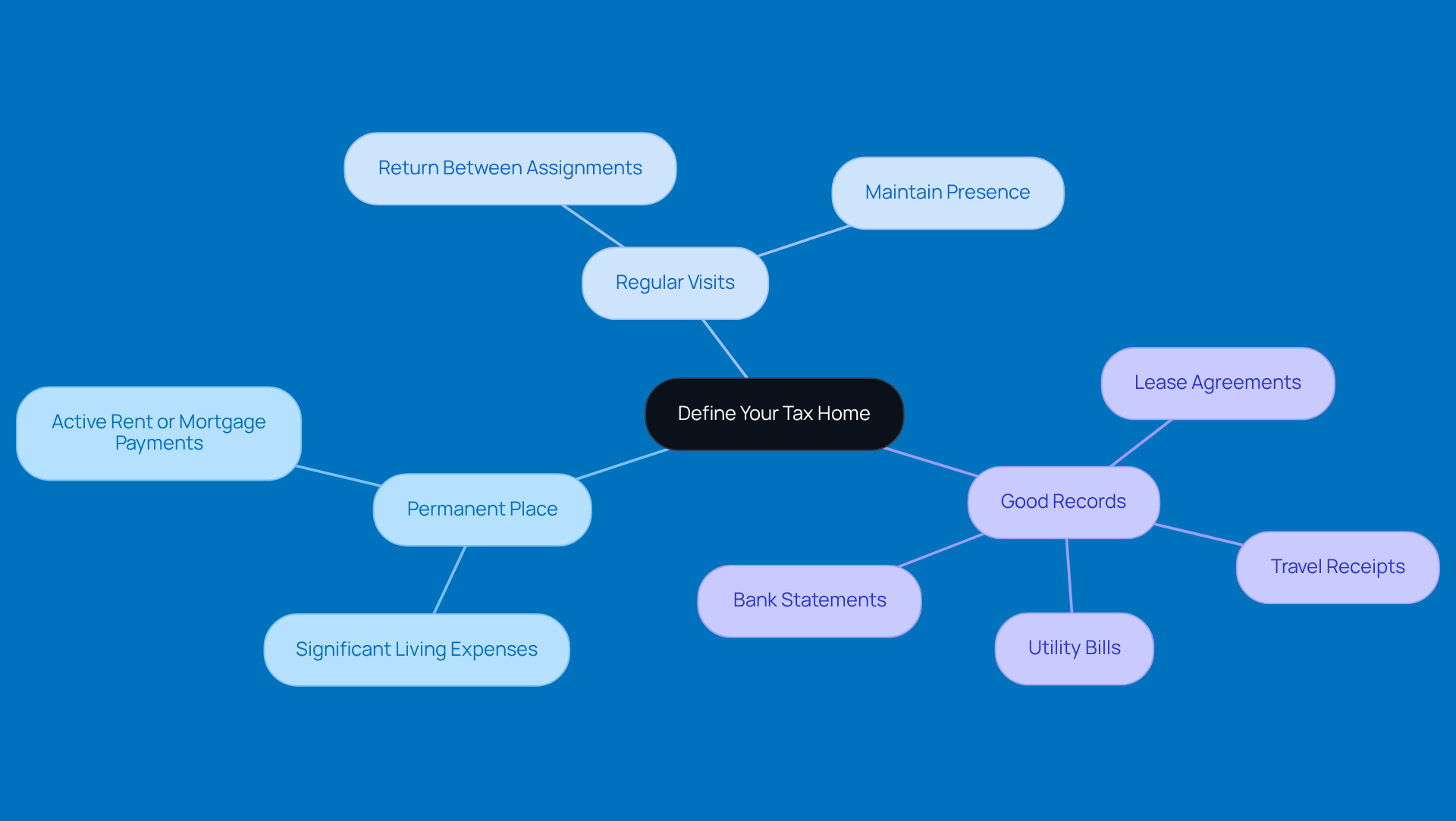

Define Your Tax Home to Maximize Deductions

A tax residence is basically the main area or city where your primary business or work is located, no matter where you actually live. For travel healthcare pros, establishing a legit tax residence is super important to qualify for tax deductions for travel nurses on expenses like accommodation and meals. So, how do you keep a tax home? Here are a few tips:

- Make sure you have a permanent place where you rack up significant living expenses.

- Head back to this place regularly between your assignments.

- Keep good records, like lease agreements and utility bills, to show your connection to this spot.

By adhering to these guidelines, travel healthcare professionals can take advantage of tax deductions for travel nurses and save a pretty penny on taxes each year. Individuals with a valid tax residence can take advantage of tax deductions for travel nurses, which enables some to report taking home 20-30% more than those who are considered itinerant workers. This smart strategy not only boosts your deductions but also keeps you in line with IRS rules, helping you avoid any nasty audits.

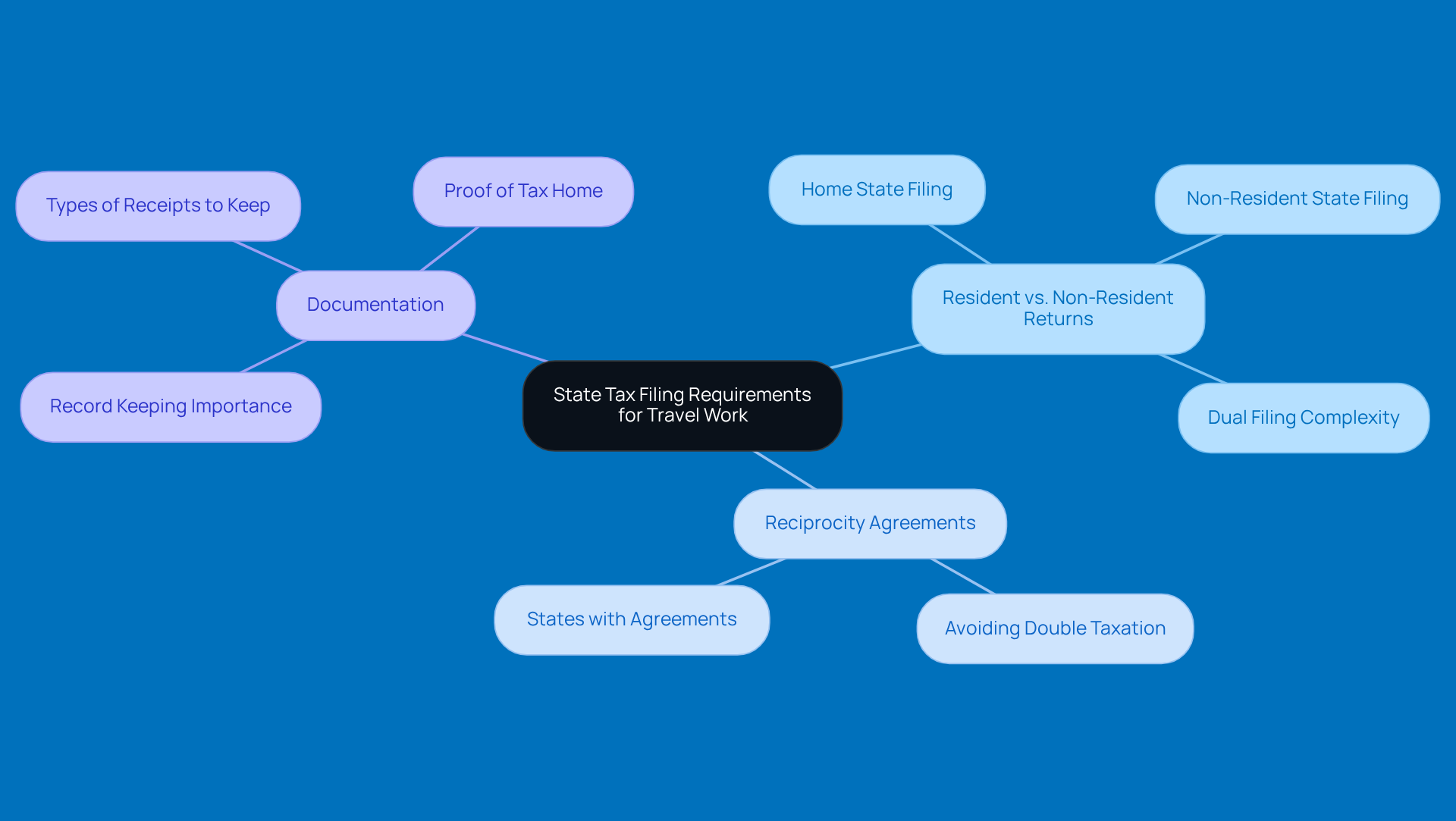

Understand State Tax Filing Requirements for Travel Work

Travel nurses often find themselves hopping from one region to another, which means they need to file tax returns in each place where they earn income. Let’s break down some key points to keep in mind:

- Resident vs. Non-Resident Returns: Generally, you’ll file a resident return in your home state and non-resident returns in the states where you’ve worked. This dual filing can get a bit tricky, especially if you’ve had assignments in multiple locations.

- Reciprocity Agreements: Some areas have agreements in place to prevent double taxation. This means you won’t have to pay taxes in both your home state and the state where you worked. Getting to know these agreements can really simplify your tax situation.

- Documentation: It’s super important to keep detailed records of your assignments, like dates and locations. This helps you report your income accurately and stay on the right side of local tax laws. Plus, having good documentation supports any deductions you might want to claim.

Understanding these requirements is crucial for traveling healthcare professionals. It helps you avoid costly mistakes and ensures you’re following tax regulations. As tax pros often say, staying organized and knowing your filing obligations can lead to some serious savings and peace of mind. So, keep those records tidy and stay informed!

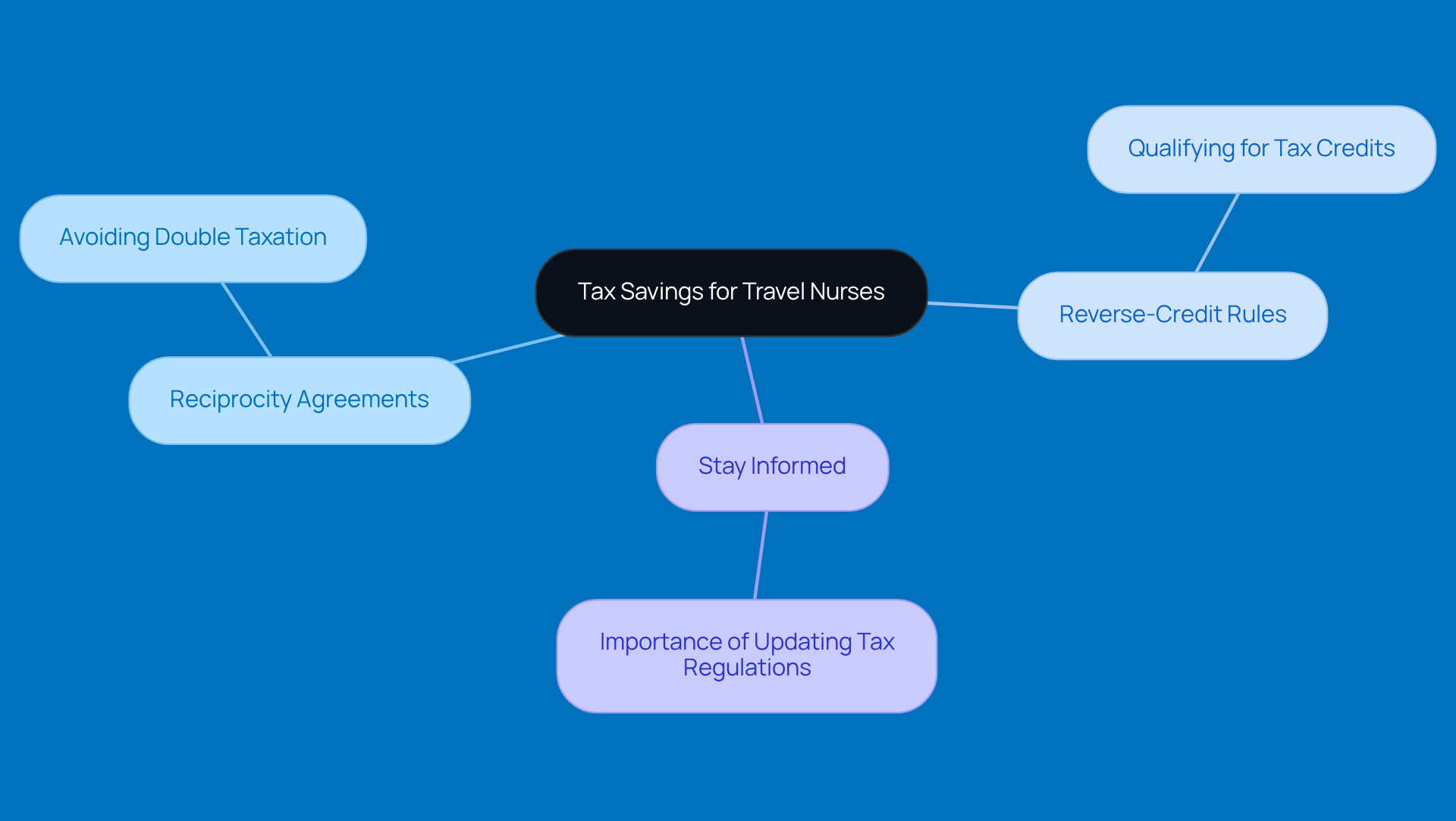

Leverage Reciprocity and Reverse-Credit Rules for Savings

Reciprocity agreements between regions can greatly affect the tax deductions for travel nurses and change the game regarding your tax responsibilities. Let’s break it down:

-

Reciprocity Agreements: If you’re working in a state that has a reciprocity agreement with your home state, you might only need to pay taxes there. This means you can avoid the headache of double taxation - who wouldn’t want that?

-

Reverse-Credit Rules: Did you know that if you pay taxes in a region where you’ve worked, you could qualify for a credit on your residential tax return? This can help lower your overall tax bill, which is always a win in my book.

-

Stay Informed: Tax regulations aren’t set in stone; they can change. So, it’s super important to keep yourself updated on the regions you work in and their tax agreements with your home base.

By using these rules to your advantage, you can maximize your tax savings through tax deductions for travel nurses and keep more of that hard-earned income in your pocket!

Plan for Higher Tax Rates in Your Home State

Hey there, travel pros! It’s important to remember that your home state might have higher tax rates compared to where you’re working. To keep those financial surprises at bay, here are some handy strategies:

- Budget for Higher Rates: If your home state has those elevated tax rates, make sure to factor that into your financial planning. This way, you won’t be caught off guard when tax season rolls around.

- Track Your Income: Keep a close eye on your earnings from each assignment. Not only does this help you report your income accurately, but it also makes calculating your overall tax liability a breeze.

- Consult a Tax Professional: Let’s face it - multi-state taxation can be a bit of a maze. Teaming up with a tax pro who understands the ins and outs of travel nursing can really help you grasp your obligations and effectively manage tax deductions for travel nurses.

By putting these strategies into action, you’ll be well on your way to being financially prepared and compliant with tax regulations. Plus, you’ll maximize those savings as a travel nurse!

Conclusion

Understanding tax deductions is super important for travel nurses who want to make the most of their finances. By figuring out what a tax home is, navigating state tax rules, taking advantage of reciprocity agreements, and being ready for possibly higher tax rates back home, travel healthcare pros can really boost their savings. These strategies not only help optimize deductions but also keep you compliant with tax regulations, leading to better financial security.

Throughout this article, we’ve highlighted some key insights, like the need to:

- Maintain a legitimate tax residence

- Grasp the ins and outs of state tax filings

- Use available tax credits to dodge double taxation

Keeping detailed records and staying updated on changing tax laws can help travel nurses manage their tax responsibilities and steer clear of costly errors. Plus, having a tax professional in your corner can be a game-changer, offering personalized advice to maximize your savings.

In the end, the importance of these tax strategies is huge. As travel nurses work in different locations, being proactive about tax planning can lead to more take-home pay and a sense of peace. Embracing these practices empowers travel healthcare professionals to focus on their essential work while keeping more of their hard-earned income.

Frequently Asked Questions

What is a tax home?

A tax home is the main area or city where your primary business or work is located, regardless of where you actually live.

Why is establishing a tax home important for travel healthcare professionals?

Establishing a legitimate tax home is crucial for travel healthcare professionals to qualify for tax deductions on expenses such as accommodation and meals.

What are some tips for maintaining a tax home?

To maintain a tax home, ensure you have a permanent place with significant living expenses, return to this place regularly between assignments, and keep good records like lease agreements and utility bills to demonstrate your connection to that location.

How do tax deductions for travel nurses benefit individuals?

Individuals with a valid tax residence can take advantage of tax deductions, potentially allowing them to report taking home 20-30% more than those considered itinerant workers.

What is the significance of adhering to IRS rules regarding tax homes?

Following IRS rules helps travel healthcare professionals maximize their deductions while avoiding audits.