Introduction

Navigating the ins and outs of income tax management can feel pretty overwhelming for small businesses, right? With regulations constantly changing and the financial landscape shifting, it’s no wonder many business owners feel stressed. But what if I told you there’s a way to turn tax season from a headache into a chance for growth and better cash flow? In this article, we’ll explore four essential solutions that can help you take charge of your tax management, setting you up for a brighter, more prosperous future.

Ensure Tax Compliance and Accurate Preparation

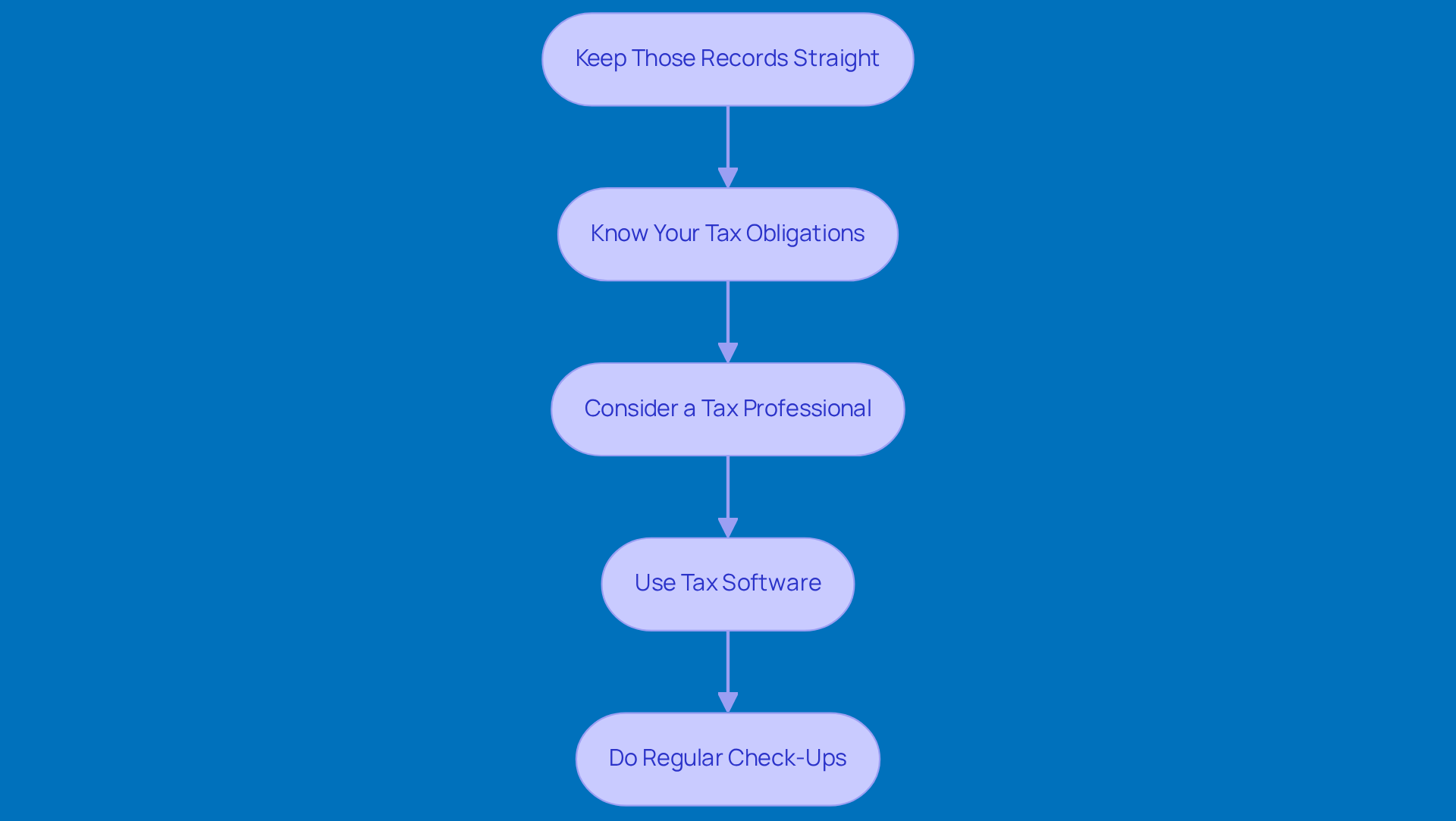

To keep your small business on the right side of tax compliance and make preparation a breeze, here are some friendly tips to consider:

-

Keep Those Records Straight: It’s super important to maintain detailed records of all your income, expenses, and financial transactions. Think receipts, invoices, and bank statements. When your records are accurate, tax prep becomes a lot easier, and you can be sure you’re capturing all those deductions, which helps cut down on mistakes.

-

Know Your Tax Obligations: Getting familiar with federal, state, and local tax requirements is key. You’ll want to know which forms to file, when deadlines are, and how payment schedules work. Don’t hesitate to tap into resources from the IRS and your local tax authorities - they’re there to help you stay informed and compliant.

-

Consider a Tax Professional: Bringing a CPA or tax advisor on board who knows the ins and outs of tax compliance for small businesses can be a game changer. Their expertise can help you navigate the tricky regulations and spot potential deductions you might miss, ultimately boosting your bottom line.

-

Use Tax Software: Investing in reliable tax prep software can really streamline your filing process and cut down on errors. There are plenty of options designed specifically for small businesses, complete with features like automated calculations and deadline reminders to keep you on track.

-

Do Regular Check-Ups: Scheduling regular reviews of your financial records and tax filings is a smart move to ensure everything’s accurate and compliant. This proactive approach helps you catch any discrepancies early, which can save you from headaches down the line with tax authorities and promotes a culture of financial diligence.

So, what do you think? Have you tried any of these strategies? Let’s keep the conversation going!

Implement Strategic Tax Planning for Cash Flow Optimization

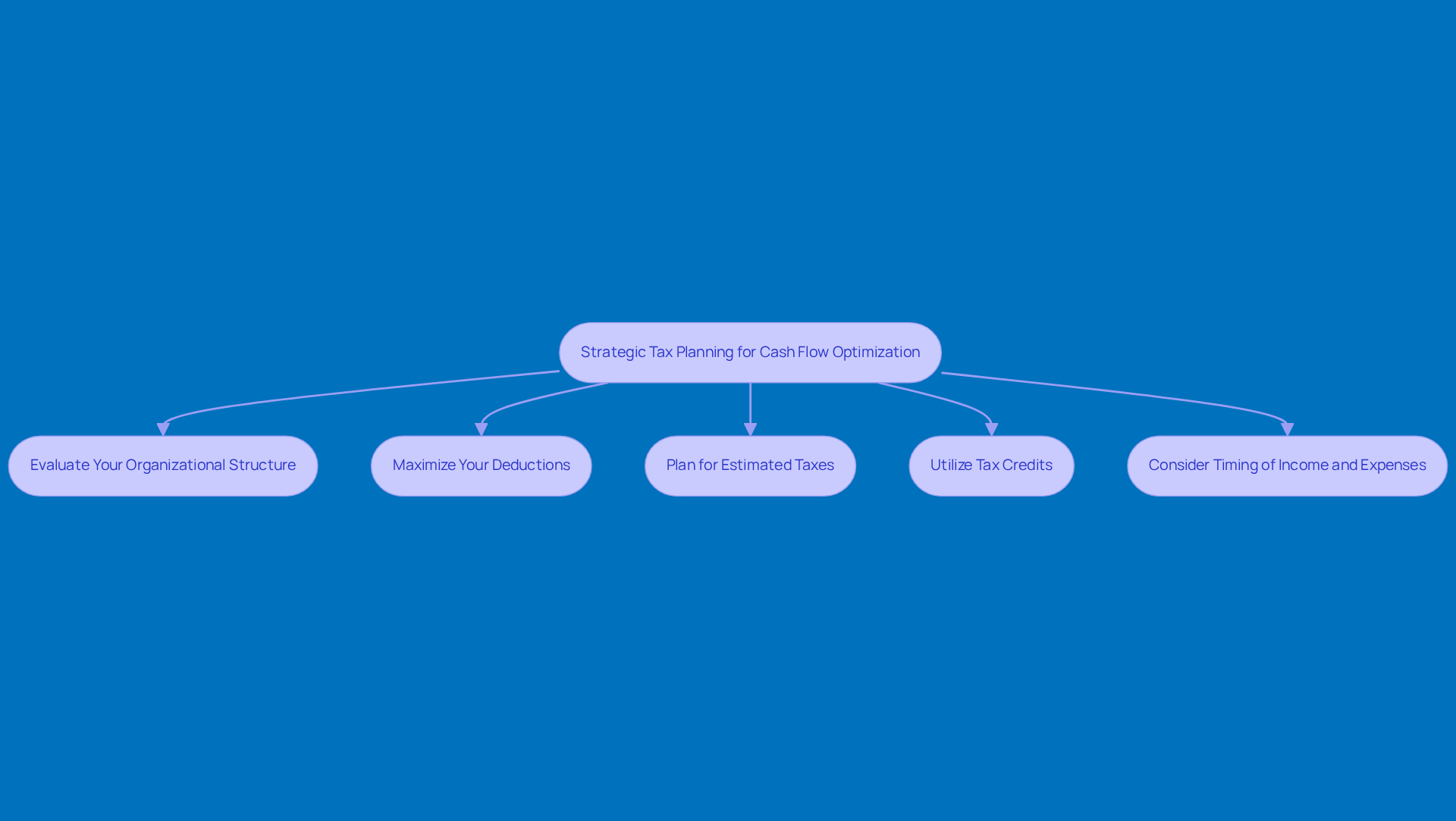

If you’re a small business looking to optimize your cash flow through strategic tax planning, here are some friendly tips to consider:

-

Evaluate Your Organizational Structure: Have you thought about whether your current setup-like an LLC, S-Corp, or C-Corp-is the best for maximizing tax efficiency? Each structure has its own solutions income tax implications, and selecting the right one can result in significant savings.

-

Maximize Your Deductions: Make sure you’re on top of all the deductions you can claim, from professional expenses to home office deductions and asset depreciation. Staying updated on tax law changes can help you take advantage of every deduction available, which can significantly affect your solutions income tax.

-

Plan for Estimated Taxes: If you think you’ll owe more than $1,000 in taxes, it’s a good idea to make quarterly estimated tax payments. This proactive approach can help you avoid penalties and maintain steady cash flow throughout the year, especially when it comes to solutions income tax, making budgeting a breeze. Just remember, the IRS wants you to pay at least 90% of your current year’s tax liability or 100% of last year’s tax to dodge any fees. And heads up-the interest rate for underpayments has been 8% per year, compounded daily, since October 1, 2023, and will stay that way at least through June 30, 2024.

-

Utilize Tax Credits: Don’t forget to check out any tax credits your business might qualify for, like those for hiring from certain demographics or investing in renewable energy. Tax credits can directly reduce your solutions income tax bill, providing a nice boost to your bottom line.

-

Consider Timing of Income and Expenses: Timing can be everything! Think about when you recognize income and when you incur expenses. For example, deferring income to next year or bringing expenses into the current year can help lower your taxable income.

By putting these strategies into action, small businesses can really improve their solutions income tax management, which will lead to better cash flow and financial health in 2026. Plus, if you need a hand navigating these complexities, Steinke and Company is here to help with expert tax preparation and planning services!

Utilize Technology and Systems for Efficient Tax Management

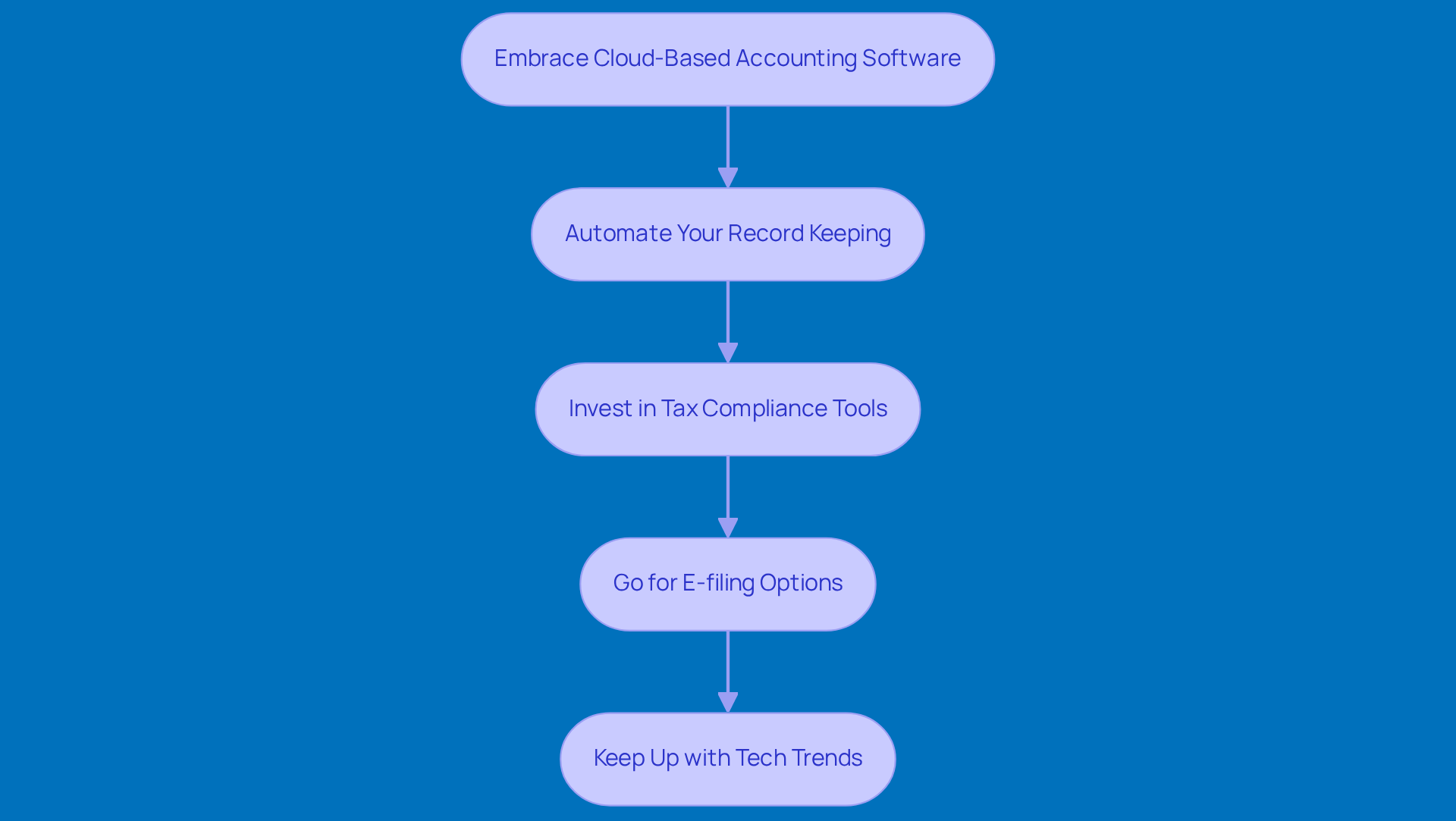

If you're a small business owner looking to boost your tax management game and steer clear of those pesky underpayment penalties, here are some friendly strategies to consider:

-

Embrace Cloud-Based Accounting Software: Think about using cloud-based accounting solutions that let you track your financial transactions in real-time. These platforms often play nice with tax software, making tax prep and filing a breeze. Plus, accurate tracking means you’re more likely to meet your estimated tax payment responsibilities, which is key to avoiding those underpayment penalties.

-

Automate Your Record Keeping: Why not let technology do some of the heavy lifting? Use systems that automate the collection and organization of your financial documents. For example, apps that scan receipts and categorize expenses can save you tons of time and reduce mistakes. Many small businesses report freeing up to 360 hours a year through automation! That’s time you can spend on more strategic tasks, ensuring you make timely payments and stay compliant with IRS requirements.

-

Invest in Tax Compliance Tools: Consider getting tax compliance software that helps you manage filings, deadlines, and payments. These handy tools can send you alerts for upcoming deadlines and make sure all your forms are filled out correctly, cutting down on the risk of penalties. Did you know that over 70% of employees say automation tools speed up their workflow? Staying compliant with IRS regulations is crucial to avoid those costly underpayment penalties.

-

Go for E-filing Options: Why stick to traditional paper filing when you can e-file your tax returns? It’s usually faster and more secure. E-filing not only speeds up the process but also helps you get your refunds quicker, which is a big plus for managing cash flow-especially as we all adjust to the changes in COVID-19 tax benefits.

-

Keep Up with Tech Trends: Make it a habit to check out new technologies in tax management, like AI and machine learning. These innovations can really boost your accuracy and efficiency in tax prep and compliance, helping you adapt to the ever-changing regulatory landscape. As tax management evolves, embracing these technologies will be key to staying compliant and improving your business's financial health.

So, what do you think? Are you ready to take your tax management to the next level?

Engage in Continuous Financial Oversight and Coaching

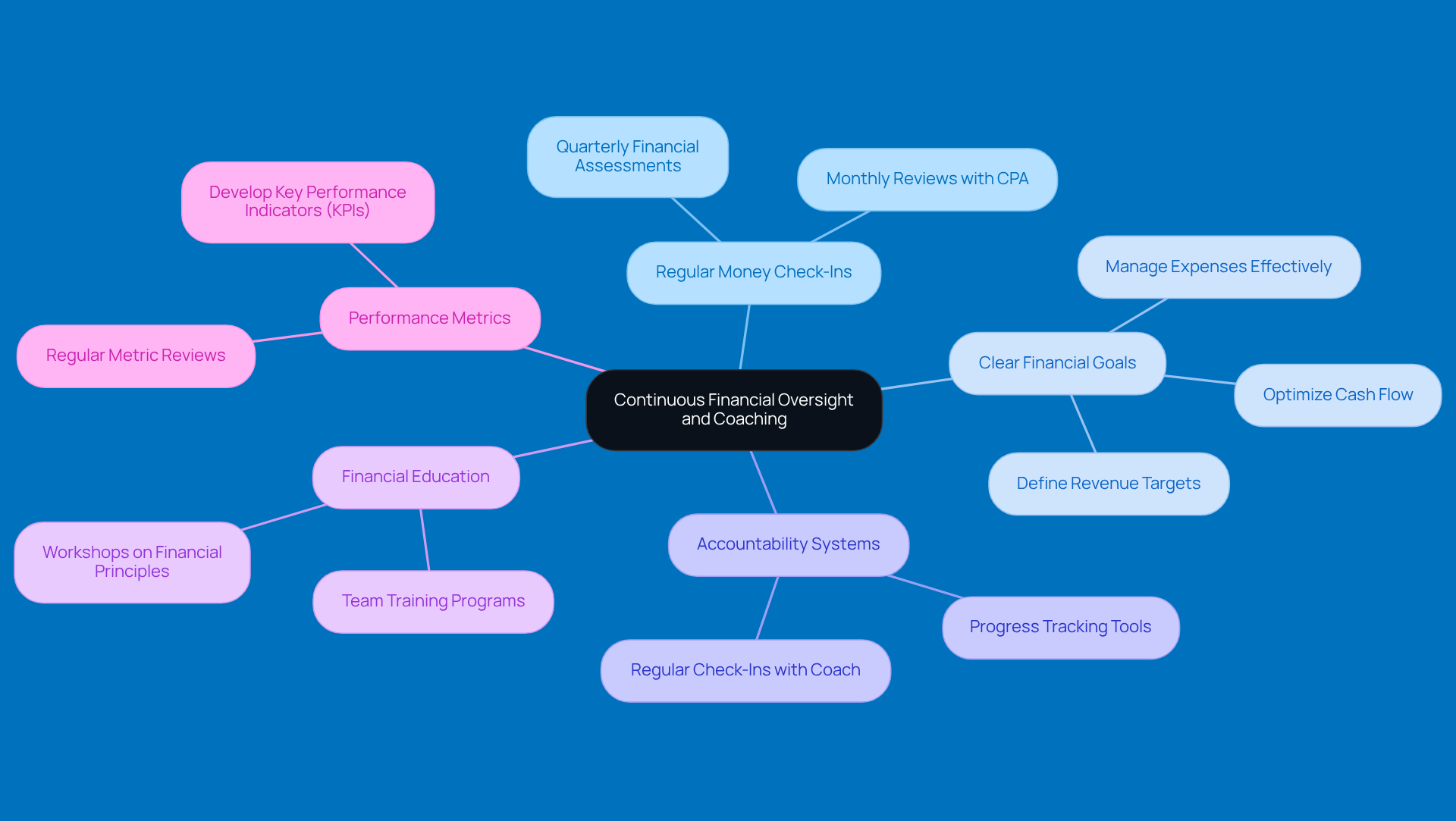

To keep your financial game strong, small businesses can really benefit from these strategies:

-

Schedule Regular Money Check-Ins: How about setting up monthly or quarterly reviews with a CPA or advisor? This way, you can evaluate how you’re doing against your goals and spot areas that might need a little extra love.

-

Set Clear Financial Goals: Team up with a coach to nail down some clear financial objectives. Think about what you want to achieve - whether it’s hitting revenue targets, managing expenses better, or optimizing cash flow. Having a plan makes all the difference!

-

Create Accountability Systems: It’s super helpful to have systems in place that keep track of your progress toward those financial goals. Regular check-ins with a coach or advisor can help you stay focused and motivated. Plus, it’s nice to have someone in your corner!

-

Invest in Financial Education: Don’t forget to educate yourself and your team! A solid grasp of financial principles can empower everyone to make better decisions and foster a culture of fiscal responsibility in your organization.

-

Use Performance Metrics: Developing key performance indicators (KPIs) is a smart move for monitoring your financial health. By regularly reviewing these metrics, you can make informed decisions and adjust your strategies as needed.

So, what do you think? Are you ready to take your financial oversight to the next level?

Conclusion

When it comes to managing income tax, small businesses really need to get it right. It’s not just about compliance; it’s about boosting your financial health too! By keeping accurate records, knowing your tax obligations, and using the right tech, you can make your tax processes smoother and cut down on any potential liabilities.

Throughout this article, we’ve highlighted some key strategies. Engaging a tax professional, using tax software, and doing regular financial check-ups are all super important. These practices not only help you stay compliant but also empower you to maximize deductions and make the most of tax credits. Plus, embracing cloud-based accounting and automating your record-keeping can save you time and reduce errors - who wouldn’t want that?

So, what’s the takeaway? A proactive approach to income tax management is essential for small businesses that want to thrive in today’s competitive landscape. By focusing on tax compliance and strategic planning, you can create a culture of financial diligence. This way, you’ll be making informed decisions that support your long-term success. Taking action now can lead to better cash flow and a stronger financial future, so let’s embrace these best practices together!

Frequently Asked Questions

What is the importance of maintaining detailed records for tax compliance?

Maintaining detailed records of all income, expenses, and financial transactions is crucial as it makes tax preparation easier and ensures that all deductions are captured, reducing the likelihood of mistakes.

What should I know about my tax obligations?

It's important to familiarize yourself with federal, state, and local tax requirements, including the forms to file, deadlines, and payment schedules. Resources from the IRS and local tax authorities can help you stay informed and compliant.

How can a tax professional assist my small business?

A CPA or tax advisor can provide valuable expertise in navigating tax compliance for small businesses, helping you identify potential deductions and ensuring adherence to regulations, which can ultimately enhance your financial outcomes.

What role does tax software play in tax preparation?

Investing in reliable tax preparation software can streamline the filing process, reduce errors, and offer features like automated calculations and deadline reminders, making it easier for small businesses to manage their taxes.

Why is it beneficial to conduct regular check-ups on financial records and tax filings?

Regular reviews of financial records and tax filings help ensure accuracy and compliance, allowing you to catch discrepancies early and maintain a culture of financial diligence, which can prevent issues with tax authorities.