Introduction

Navigating the ins and outs of tax deductions can feel pretty overwhelming, right? Especially when you’re trying to figure out if your rental properties qualify for the Qualified Business Income (QBI) deduction. This tax benefit can lead to some serious savings, but only if you meet the specific eligibility criteria set by the IRS.

As property owners, you might be wondering whether to claim your rental income as QBI. It’s a bit of a puzzle, isn’t it? You’ve got to wrap your head around the requirements and gather the right documentation to back up your claims. So, what steps do you need to take to stay compliant and make the most of those potential benefits? Let’s dive in!

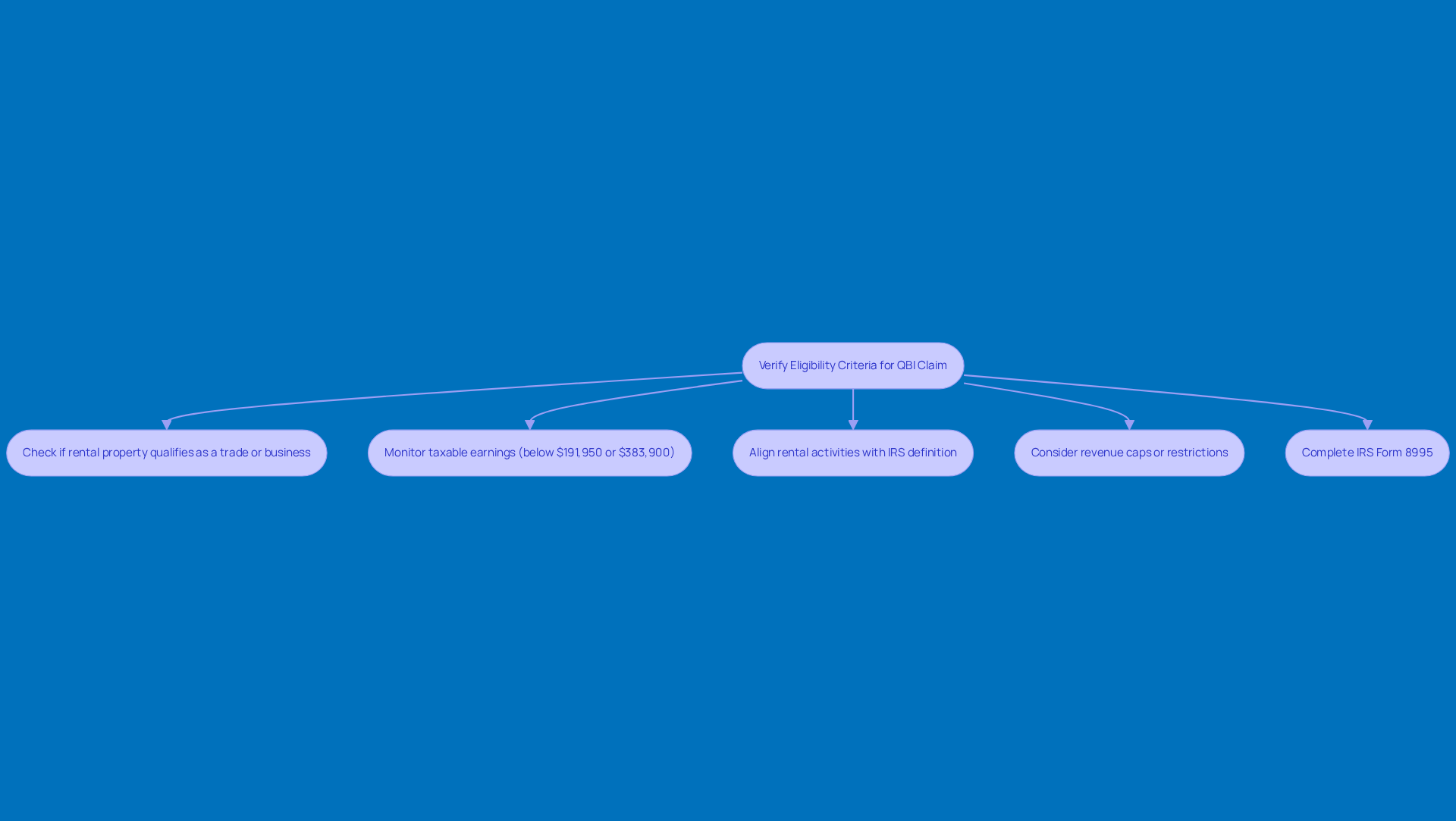

Verify Eligibility Criteria for QBI Claim

-

First things first, you should ask yourself, should I claim rental property as QBI, and make sure your leased property qualifies as a trade or business according to IRS guidelines. This usually means you need to be actively managing it, not just sitting back and collecting rent, which raises the question: should I claim rental property as QBI?

-

Keep an eye on your taxable earnings, too! For 2026, you’ll want to stay below $191,950 if you’re filing individually, or $383,900 for joint filers. Going over these limits could mean a reduction or even a loss of your QBI benefit. And just a heads-up, these thresholds are adjusted for inflation.

-

Next, check whether your rental activities align with the IRS definition of a rental real estate enterprise and consider if I should claim rental property as QBI. This means you’ll need to keep separate records and clock in at least 250 hours of qualifying rental services each year, especially if your enterprise has been around for less than four years.

-

Don’t forget about any revenue caps or restrictions that might impact your eligibility for the QBI benefit, especially if you’re on the higher end of the earning spectrum.

-

Finally, grab IRS Form 8995 to see if you qualify and to accurately figure out your QBI deduction. Make sure to jot down all your relevant earnings and expenses to back up your claim!

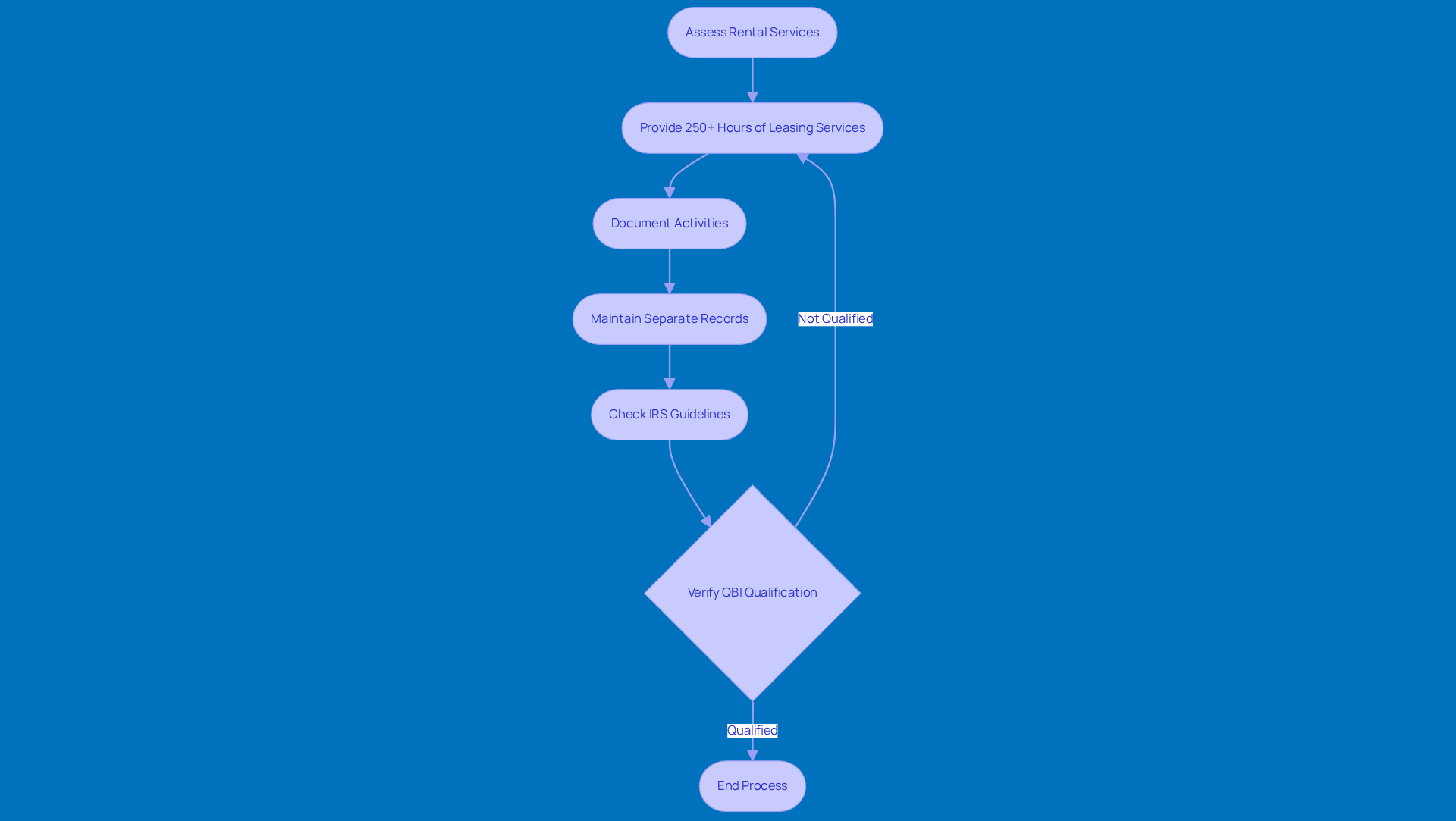

Assess Rental Services and Safe Harbor Compliance

Hey there! Just a quick reminder: make sure you’re providing at least 250 hours of leasing services each year. This can cover a range of activities like:

- Advertising

- Negotiating leases

- Managing properties

- Handling maintenance tasks

It’s super important to keep separate books and records for each leasing property. This way, you can accurately track your income and expenses, which is essential for backing up your claims for the QBI deduction when considering if I should claim rental property as QBI.

When you’re leasing, aim for continuity and regularity. You want your activities to feel like a business operation, not just something you do on a whim.

Don’t forget to document all the leasing services you perform! Keep track of specific dates, hours spent, and detailed descriptions of what you did. This meticulous record-keeping is crucial for meeting IRS requirements.

Lastly, take a moment to check out the IRS guidelines on safe harbor provisions. It’s a good idea to ensure you’re compliant and verify your qualification for the QBI benefit by asking, should I claim rental property as QBI, especially with the updated regulations coming in 2026.

So, are you ready to dive into your leasing activities with confidence?

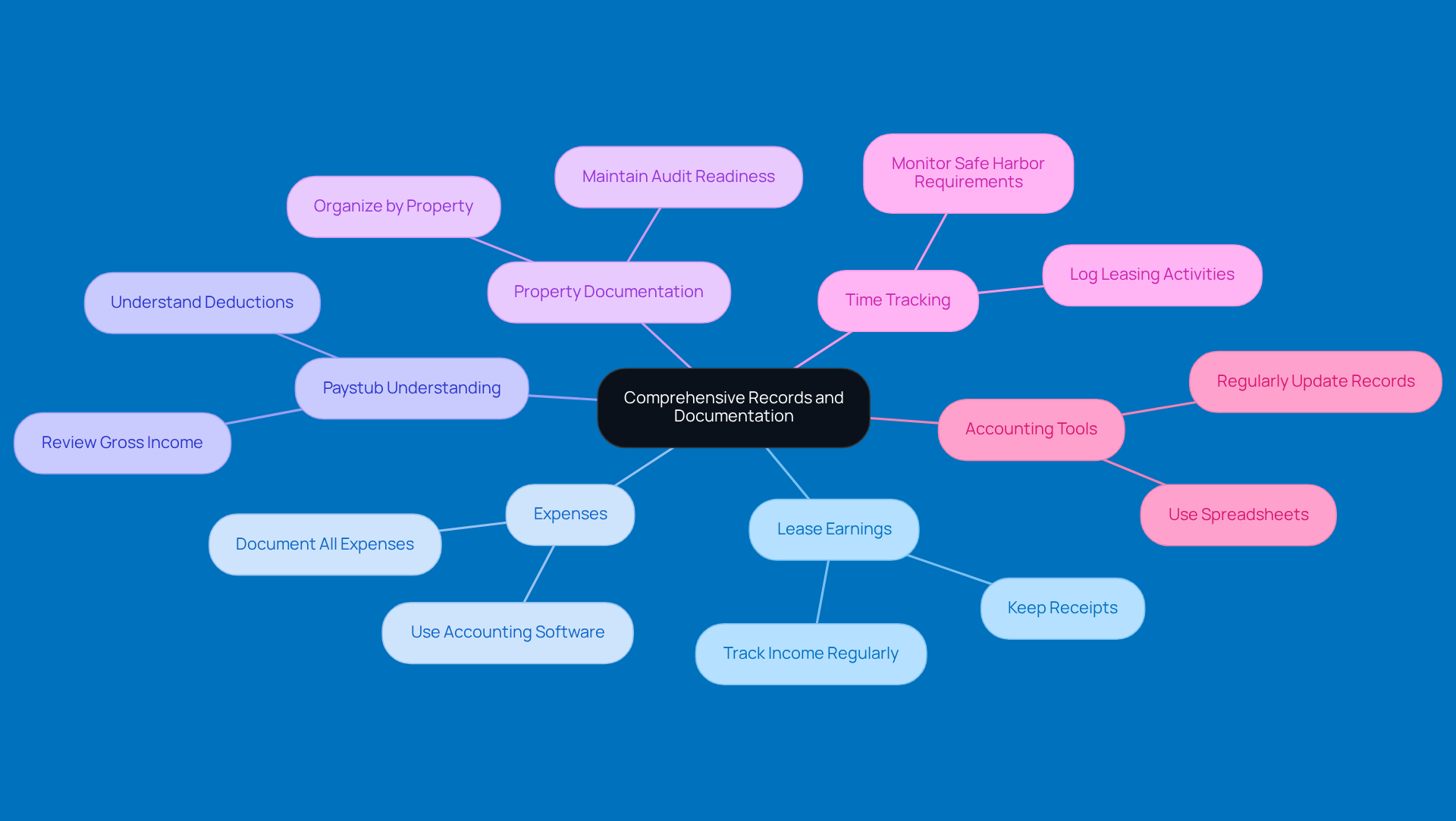

Maintain Comprehensive Records and Documentation

Keeping track of your lease earnings and expenses is super important! Make sure you have all those receipts and invoices handy for when you need to take a closer look. And hey, understanding your paystub is key - it shows your gross income and deductions, which can really shape your financial picture.

When it comes to your leased properties, try to organize the documentation for each one separately. This makes it way easier to access what you need and helps with audits down the line. Plus, don’t forget to keep an eye on the hours you spend on leasing activities. This is crucial for meeting those safe harbor requirements under IRS guidelines.

Using accounting software or even a simple spreadsheet can really help you keep accurate records of your income and expenses. It’s all about enhancing your financial oversight! And remember, regularly reviewing and updating your documentation is a must. You want to make sure everything aligns with your current activities and meets the latest IRS compliance standards, especially as we gear up for the 2026 tax year.

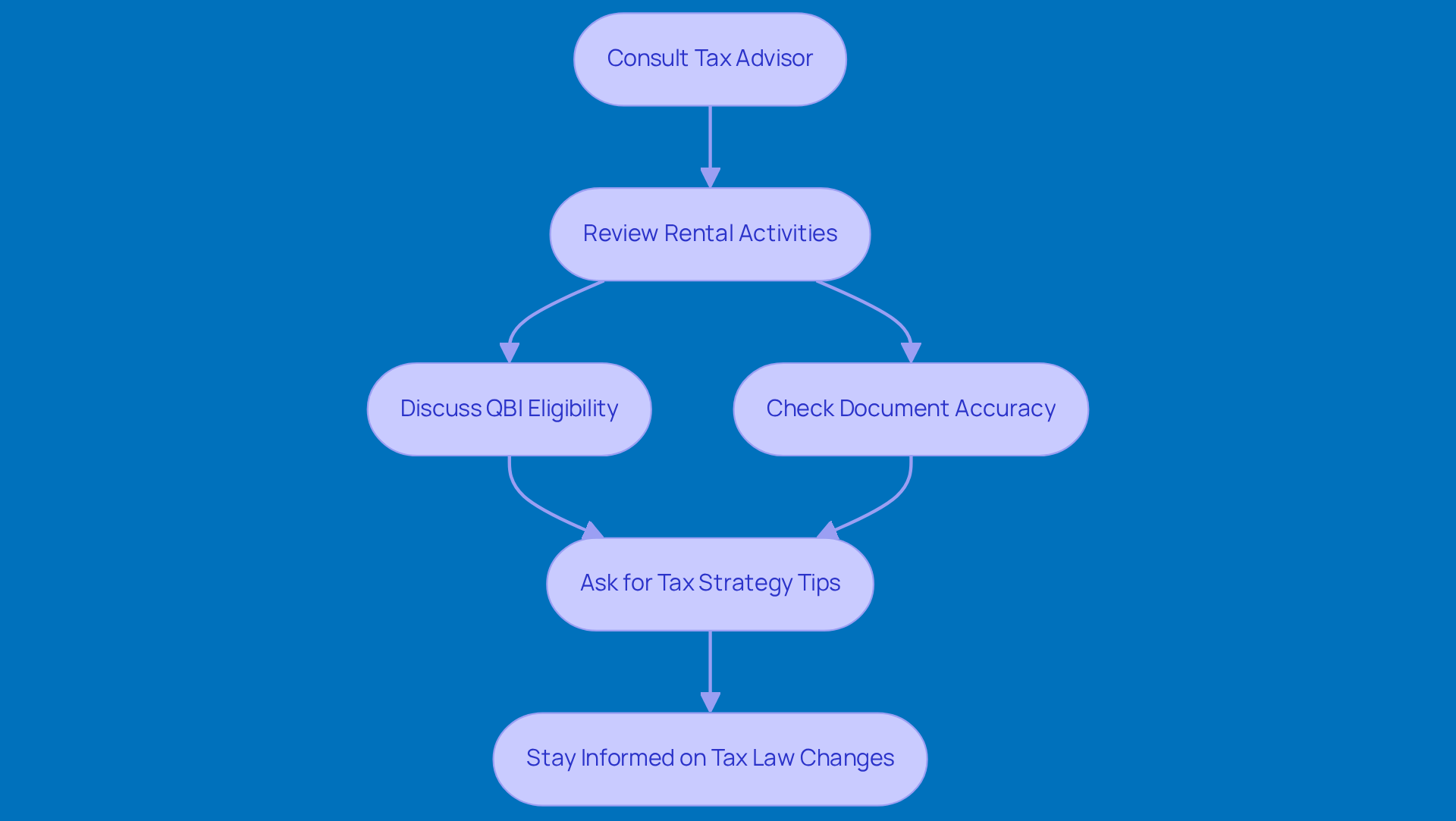

Consult a Tax Advisor for Expert Guidance

If you’re running a small business, chatting with a tax advisor who knows the ins and outs of tax compliance is super important. You’ll want to dive into your rental activities and determine if you should consider the question of should I claim rental property as QBI to qualify for the Qualified Business Income (QBI) reduction. Trust me, understanding this can save you from those pesky underpayment penalties that the IRS loves to dish out.

Take some time to go over your documents and records with your advisor. It’s all about making sure everything’s complete and accurate - this can really help you dodge some costly penalties down the line. Plus, don’t hesitate to ask for tips on how to tweak your tax strategy for better savings. Have you heard about safe harbor payments? They can be a lifesaver, protecting you from those underpayment penalties.

And hey, keep your ear to the ground for any changes in tax laws that might impact your eligibility for the QBI deduction. Staying informed is key to your long-term success and compliance!

Conclusion

Deciding whether to claim your rental property as Qualified Business Income (QBI) is a big deal for property owners. By getting a grip on the eligibility criteria and the steps needed to qualify, you can make choices that might lead to some serious tax benefits. It’s super important to actively manage your rental properties, keep thorough records, and chat with a tax advisor to help you navigate the ins and outs of the QBI deduction.

Here are some key takeaways from this checklist:

- Make sure you verify the eligibility criteria for QBI claims.

- Assess your rental services to ensure you’re in line with IRS guidelines.

- Don’t forget to maintain meticulous documentation.

- Engage in at least 250 hours of qualifying rental services.

- Keep separate records for each property.

- Regularly review your financial documentation.

- Consult with a savvy tax advisor to boost your understanding and compliance.

In the end, figuring out if your rental property qualifies for QBI isn’t just about saving on taxes; it’s about taking a proactive approach to managing your property and planning your finances. By staying informed and organized, you can optimize your tax strategies and secure your financial future. So, take a moment to assess your eligibility and reach out to experts - it can lead to greater peace of mind and financial success in the ever-changing world of rental property management!

Frequently Asked Questions

What is the first step to determine if I can claim rental property as Qualified Business Income (QBI)?

The first step is to verify if your leased property qualifies as a trade or business according to IRS guidelines, which typically requires you to actively manage the property rather than just collecting rent.

What are the income thresholds for claiming QBI in 2026?

For 2026, the income thresholds are $191,950 for individuals and $383,900 for joint filers. Exceeding these limits could lead to a reduction or loss of your QBI benefit.

How do I know if my rental activities qualify as a rental real estate enterprise?

Your rental activities must align with the IRS definition of a rental real estate enterprise, which includes keeping separate records and providing at least 250 hours of qualifying rental services each year, particularly if your enterprise has been established for less than four years.

Are there any revenue caps or restrictions that could affect my eligibility for the QBI benefit?

Yes, there may be revenue caps or restrictions that could impact your eligibility for the QBI benefit, especially if you are earning at the higher end of the income spectrum.

What form do I need to use to check my eligibility for QBI and calculate my deduction?

You will need to use IRS Form 8995 to determine your eligibility for QBI and to accurately calculate your QBI deduction. Make sure to record all relevant earnings and expenses to support your claim.