Overview

So, you’re thinking about launching an accounting firm for small businesses? That’s awesome! Let’s break down the four key steps you’ll want to focus on to make your venture a success.

-

Defining your business structure and services is crucial. You’ll want to choose a structure that offers you legal protection—think LLC or corporation. It’s all about keeping your personal assets safe while you help your clients thrive. Plus, figuring out what services you’ll offer right from the start sets the stage for everything else.

-

Establishing compliance and operational procedures is a must. You don’t want to run into any regulatory hiccups down the line, right? Make sure you’re adhering to all the necessary requirements. This step is all about laying a solid foundation for your firm.

-

Developing client acquisition and marketing strategies is essential. Who are you trying to reach? Targeting the right market is key. Use technology to your advantage—social media, email campaigns, you name it! It’s a great way to connect with potential clients and show them what you can do.

-

Implementing financial oversight and strategic planning will keep your firm on track. Regularly reviewing your finances and planning for the future is essential for long-term success. Remember, it’s a competitive landscape out there, and you want to stay ahead of the game.

In a nutshell, careful planning and execution are your best friends in this journey. So, are you ready to take the plunge? Let’s get started!

Introduction

Starting an accounting firm can be quite the adventure for aspiring entrepreneurs, especially these days when small businesses are on the lookout for specialized financial help. In this article, we’ll walk through a simple four-step process that not only makes launching your accounting practice easier but also boosts your chances for long-term success. But let’s be real—navigating the maze of business structures, compliance rules, and client acquisition strategies can feel overwhelming. So, how do you make sure you’re making the right choices that lead to sustainable growth and profitability? Let’s dive in!

Define Your Business Structure and Services

Choosing the right organizational structure for your accounting practice is super important. It impacts everything from liability to taxes and how flexible your operations can be. Many small entrepreneurs lean towards sole proprietorships because they’re simple and don’t require much admin work. But here’s the catch: they also put your personal assets at risk if your business runs into legal trouble.

On the flip side, setting up a Limited Liability Company (LLC) can be a game changer. It protects your personal assets from business debts and claims, which is a huge relief. Plus, LLCs offer flexibility when it comes to taxes. You can choose to be taxed as a sole proprietorship, partnership, or corporation, which can really help with financial planning as your business grows. For example, many small businesses in the accounting firm sector start as sole proprietorships and then transition to LLCs as they grow, benefiting from the added credibility and legal protections that come with it.

Now, let’s talk taxes. The structure you pick has serious tax implications. Sole proprietorships pass profits and losses straight to your personal tax return. This can simplify things, but it might also mean higher personal tax rates as your income rises. On the other hand, LLCs can provide better tax treatment, especially if you’re earning more. They allow for pass-through taxation and even give you the option to be taxed as an S Corporation, which could lower your overall tax bill.

It’s also crucial to understand different accounting methods—cash, accrual, and hybrid—when you’re deciding on your structure. Each method affects how you track income and expenses, which can have a big impact on your financial management and tax responsibilities.

At Steinke and Company, we really emphasize the importance of tailored tax planning and advisory services for an accounting firm small business. Our consultations can help you spot missed opportunities and create strategies to lighten your tax load while promoting growth. Just a heads up: LLCs come with ongoing compliance requirements, like filing annual reports, which can add to your admin duties. Plus, changing your organizational structure down the line can get tricky and might have tax consequences, so it’s wise to think things through from the start. Understanding these differences is key to making smart choices for your accounting practice. As you plan your business, think about how your structure will influence not just your tax obligations but also your ability to attract clients and secure funding. The right choice can really boost your company’s resilience and growth potential in a competitive market.

Establish Compliance and Operational Procedures

-

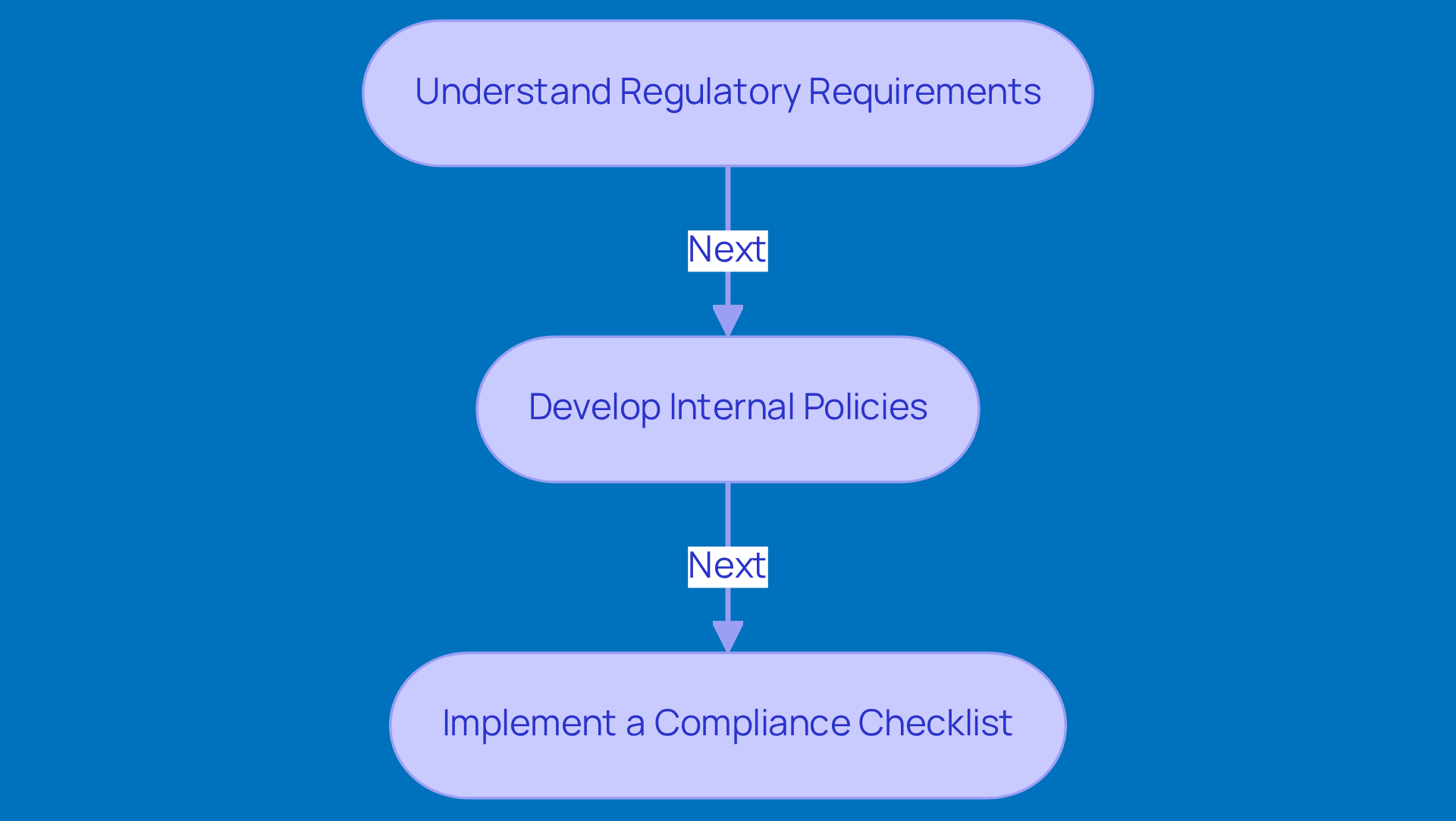

Understand Regulatory Requirements: Hey there! If you’re in the accounting firm small business, it’s super important to get a handle on all those federal, state, and local regulations that impact your operations. We’re talking about licensing, tax obligations, and those pesky compliance mandates from the IRS. With the accounting market expected to hit a whopping $735.94 billion by 2025, staying on top of these rules isn’t just smart—it’s essential for keeping your edge and dodging those costly penalties. Steinke and Company, an accounting firm for small businesses, really emphasizes the importance of proactive tax planning, assisting businesses in not only complying but also avoiding those last-minute surprises when tax season arrives.

-

Develop Internal Policies: Now, let’s chat about internal policies. Setting up solid policies is key for laying out how things run, keeping privacy intact, and ensuring your data security is top-notch. These policies should match up with industry standards and legal requirements, especially with the rise in cyber threats that accountants are facing these days. Think strong security measures like encryption and multi-factor authentication—these are must-haves to protect sensitive financial data and comply with regulations like the Gramm-Leach-Bliley Act (GLBA), GDPR, and CCPA. In a world where 66% of accountants feel the competition is heating up, having robust internal policies can really set you apart. Steinke and Company, an accounting firm small business, is here to help you build those frameworks to keep your customer info safe and sound.

-

Implement a Compliance Checklist: Let’s not forget about the power of a compliance checklist! This handy tool can help you regularly check in on how well your firm is sticking to regulations. Your checklist should cover the essentials—filing deadlines, documentation needs, and ongoing training for your team on compliance issues. Did you know that 52% of compliance experts say a lack of partner data is a big risk? Keeping thorough documentation and training can really help tackle compliance challenges and boost your operational efficiency. Plus, organizations that use compliance tools often see faster sales cycles—66% of users report quicker deal closures! That’s a win-win. Steinke and Company offers tailored tax planning and advisory services to help small businesses and accounting firm small business navigate these complexities while fostering growth.

Develop Client Acquisition and Marketing Strategies

-

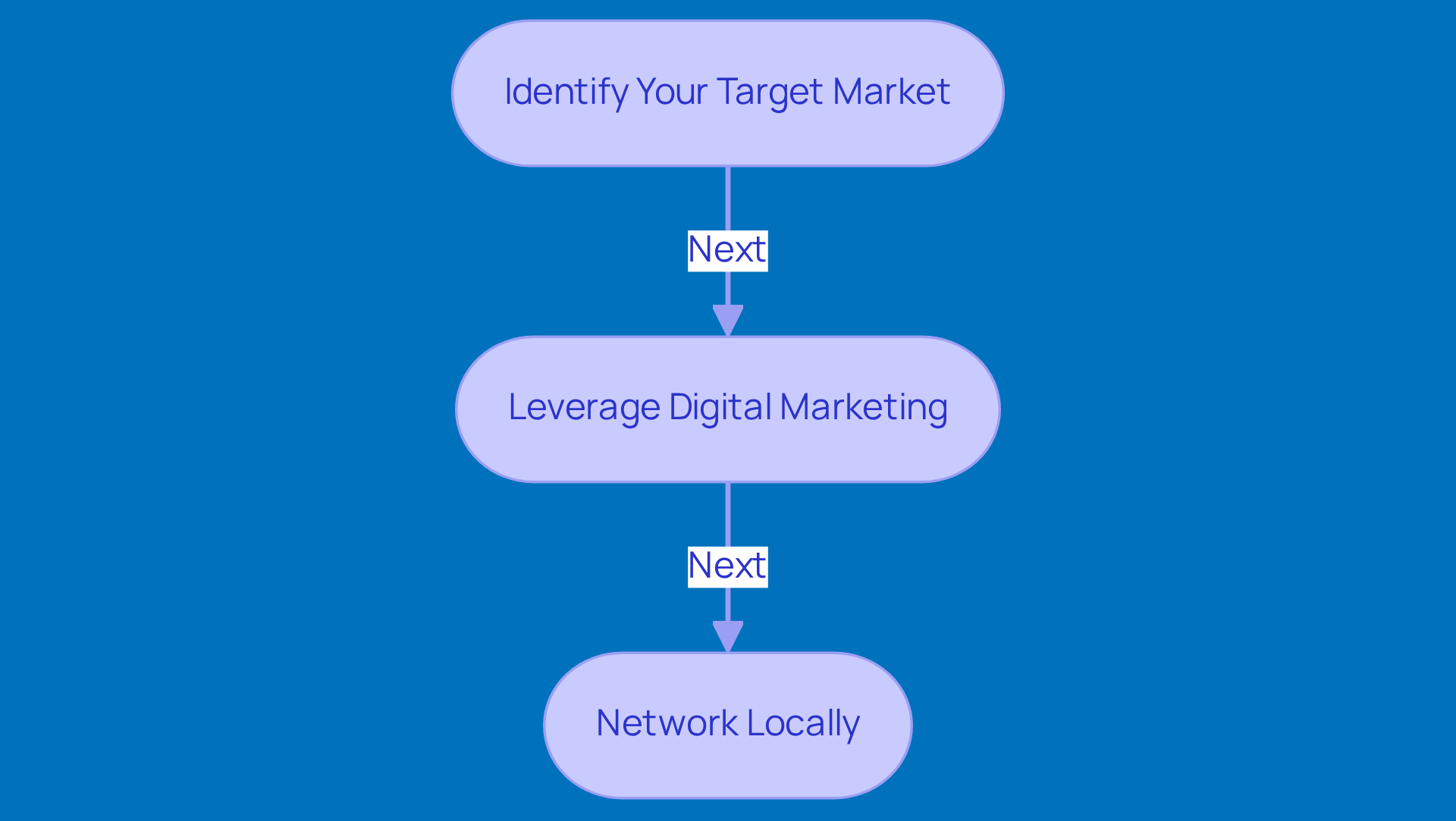

Identify Your Target Market: So, let’s start by figuring out who your ideal customer really is. Think about things like their industry, the size of their business, and what specific needs they have. When you truly understand your target market, you can tailor your marketing strategies to hit home, making sure your messaging resonates with those potential customers.

-

Leverage Digital Marketing: Now, let’s talk about the magic of digital marketing! Use online platforms like social media, email marketing, and a professional website to connect with your audience. Share content that not only shows off your expertise but also builds trust within your community. Personalized email campaigns and engaging social media posts can really boost customer engagement and help nurture those leads.

-

Network Locally: Don’t underestimate the power of local networking! Get involved in local business events, join community organizations, and team up with other professionals to build relationships and generate referrals. In smaller communities, word-of-mouth is still a powerhouse, so those personal connections can be a game-changer for attracting customers. By positioning yourself as a trusted advisor in your network, you can really expand your reach and influence.

Implement Financial Oversight and Strategic Planning

-

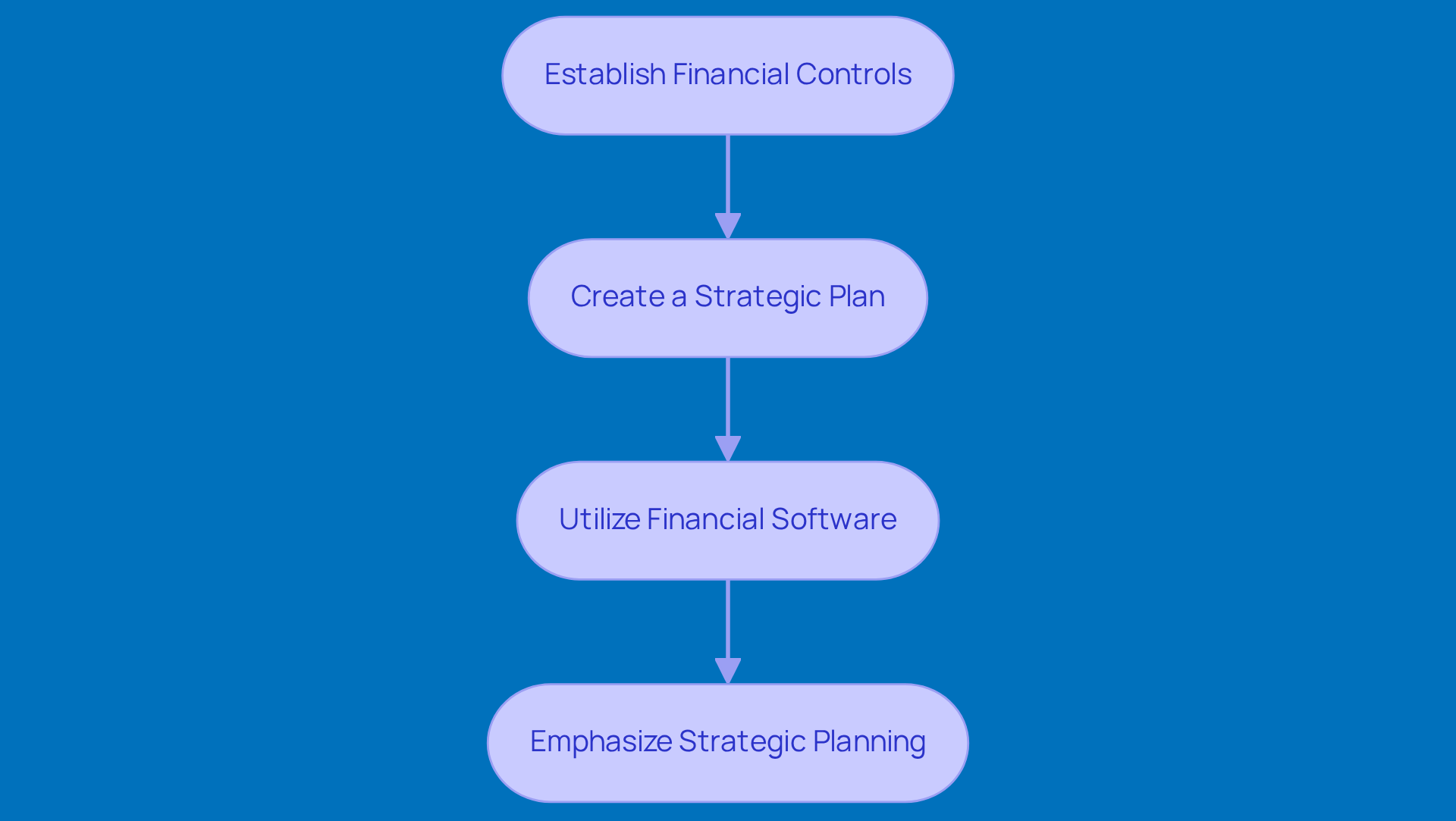

Establish Financial Controls: Let’s talk about financial controls! Implementing solid financial controls is key to keeping an eye on your income and expenses. This way, you can ensure your financial reporting is spot on. Regular reconciliations and audits? Absolutely essential! They help you spot any discrepancies and build trust with your clients, reinforcing accountability along the way.

-

Create a Strategic Plan: Now, how about crafting a strategic plan? It’s all about laying out your company’s goals and the steps you need to take to reach them. Think of it as a living document that you revisit regularly to keep up with market changes. You know, successful accounting firms small business often find that having a clear strategic plan helps them tackle challenges and seize opportunities more effectively.

-

Utilize Financial Software: Investing in advanced accounting software can really streamline your financial management. Imagine having real-time insights into your company’s performance at your fingertips! This tech not only boosts efficiency and accuracy but also supports your budgeting and forecasting efforts. Companies using cloud accounting solutions have seen some impressive results, like improved customer engagement and even up to 15 percent year-over-year revenue growth. Pretty cool, right?

-

Emphasize the Importance of Strategic Planning: Let’s not forget about the importance of strategic planning! It’s not just a nice-to-have; it’s a must, especially for accounting practices in rural areas where resources might be tight. By proactively addressing potential risks and aligning your services with what clients really need, you can boost your resilience and adaptability. Industry experts agree—a well-crafted strategic plan can be your roadmap to sustainable growth and profitability, helping you stay competitive in a fast-changing landscape.

Conclusion

Starting a successful accounting firm for small businesses is all about taking a well-rounded approach. First up, you’ve got to nail down the right business structure and services. Choosing between a sole proprietorship and an LLC isn’t just a formality; it can really shape your liability, taxes, and even how flexible and scalable your firm can be. By getting a grip on these basics, you’re setting yourself up for long-term success in a competitive market.

Now, let’s talk about compliance and operational procedures. These are key to navigating the tricky regulatory waters out there. Having solid internal policies and a handy compliance checklist can really boost your operational efficiency and keep your clients’ sensitive info safe. Plus, don’t forget about client acquisition and marketing strategies! Whether it’s digital marketing or good old-fashioned local networking, these tactics are essential for bringing in and keeping clients in the accounting world.

But here’s the thing: launching an accounting firm isn’t just about the nitty-gritty technical stuff. It’s about creating a sustainable practice that adapts to the changing needs of small businesses. By focusing on strategic planning and financial oversight, you can map out a path for growth and flexibility. Embracing these practices will not only help you hit your immediate goals but also ensure your firm thrives in an ever-evolving economic landscape. So, are you ready to take the plunge and build something great?

Frequently Asked Questions

Why is choosing the right organizational structure important for an accounting practice?

The right organizational structure impacts liability, taxes, and the flexibility of operations, which are crucial for the success and sustainability of the business.

What are the advantages of a sole proprietorship?

Sole proprietorships are simple to set up and require minimal administrative work. However, they put personal assets at risk if the business faces legal issues.

How does a Limited Liability Company (LLC) benefit an accounting practice?

An LLC protects personal assets from business debts and claims, offers flexibility in tax treatment, and can enhance credibility as the business grows.

What are the tax implications of choosing a sole proprietorship versus an LLC?

Sole proprietorships pass profits and losses directly to the owner's personal tax return, which can lead to higher personal tax rates. LLCs can provide better tax treatment, including pass-through taxation and the option to be taxed as an S Corporation, potentially lowering the overall tax bill.

What accounting methods should be considered when deciding on a business structure?

It's important to understand cash, accrual, and hybrid accounting methods, as each affects how income and expenses are tracked, influencing financial management and tax responsibilities.

What ongoing compliance requirements come with an LLC?

LLCs have ongoing compliance duties, such as filing annual reports, which can increase administrative responsibilities.

Why is tailored tax planning important for an accounting firm?

Tailored tax planning and advisory services can help identify missed opportunities and create strategies to reduce tax burdens while promoting business growth.

What should be considered when planning the business structure of an accounting practice?

Consider how the chosen structure will influence tax obligations, client attraction, and funding opportunities, as these factors can significantly affect the company's resilience and growth potential.