Introduction

Effective bookkeeping is the backbone of a successful winery, but let’s be honest - many vineyard owners feel swamped by the ins and outs of financial management. In this article, we’ll explore five essential best practices that can turn winery bookkeeping from a daunting chore into a smooth process. This not only boosts profitability but also keeps you compliant with regulations.

Now, you might be wondering: what happens when the usual methods just don’t cut it in this fast-paced industry? Well, it’s time to discover how embracing innovative strategies can protect your winery’s financial health and set you up for sustainable growth in a competitive market. So, let’s dive in!

Ensure Accurate Inventory Tracking

If you want to keep a close eye on your stock, it’s crucial for vineyards to set up a solid stock management system. This means doing regular physical counts and making sure they match up with your documented data. Using software solutions tailored for wineries, like InnoVint, can really help streamline this process, giving you real-time updates on stock levels. Here are some best practices to consider:

- Regular Audits: Aim to conduct physical inventory counts at least quarterly. This way, you can verify that your recorded inventory levels are accurate and tackle any discrepancies right away.

- Standardized Valuation Methods: Stick to consistent techniques for assessing stock, like FIFO (First In, First Out) or weighted average cost. This ensures transparency in your reporting.

- Digital Tools: Embrace technology! Using tools like barcode scanning or RFID systems can automate stock tracking and cut down on human error.

As Ashley Kniffin wisely points out, "Maintaining up-to-date stock records guarantees you are aware of the accurate stock available, prevents inadvertent overselling of an item, and facilitates improved predictions and planning to make knowledgeable economic choices." By keeping your inventory records precise, you can manage production schedules better, reduce waste, and boost profitability. So, why not take a moment to review your stock management practices? It could make a world of difference!

![]()

Segment Revenue Streams Effectively

Wineries can really boost their financial performance by smartly segmenting their revenue streams. Let’s break down how to do this in a few simple steps:

-

Identifying Key Segments: Start by looking at your revenue through different lenses-think product lines like red, white, and sparkling wines, and sales channels such as direct-to-consumer, wholesale, and online platforms. This detailed approach gives you a clearer picture of which segments are truly driving your profits.

-

Analyzing Profit Margins: It’s crucial to regularly check the profit margins for each segment. For instance, if you find that your average cost of goods sold over the last three months was $50,000, that insight can really help you fine-tune your pricing strategies. This kind of analysis not only highlights the high-performing areas that are boosting your bottom line but also points out segments that might need a little strategic tweaking to enhance profitability.

-

Tailored Marketing Strategies: Next up, craft targeted marketing campaigns for each segment based on what the performance data tells you. By aligning your marketing efforts with the strengths of each product line and sales channel, you can allocate your resources more effectively and really maximize your return on investment. As Pedro Noyola wisely puts it, "It's important to analyze the gross margin of each sales channel separately, rather than comparing them."

Understanding revenue segmentation is key for vineyards looking to make smart choices about product development, pricing strategies, and marketing initiatives. This ultimately leads to better profitability and sustainable growth. Plus, managing shipping costs effectively-like the case study on low shipping expense recovery-can have a big impact on your overall profitability. So, what are you waiting for? Let’s get started on optimizing those revenue streams!

Maintain Compliance and Tax Awareness

Wineries really need to keep compliance and tax awareness at the forefront to dodge those pesky penalties and keep things running smoothly. Here are some key practices to consider:

- Regular Training: It’s super important to provide ongoing training for your staff about compliance requirements. This includes understanding federal and state regulations related to alcohol production and sales. Keeping everyone in the loop can make a big difference!

- Documentation: Make sure to keep thorough records of all transactions, including winery bookkeeping for sales, purchases, and inventory changes. This not only supports your compliance efforts but also makes audits a whole lot easier.

- Consultation with Experts: Don’t hesitate to reach out to tax professionals who specialize in the beverage industry. They can help you stay updated on any changes in tax laws and compliance requirements.

By fostering a culture of compliance, you can really mitigate risks and focus on what matters most-growing your business!

Manage Cash Flow and Forecast Financial Needs

Managing cash flow can feel like a juggling act, but wineries can make it easier with a few smart strategies:

-

Cash Flow Forecasting: Start by creating a detailed cash flow forecast that outlines your expected income and expenses for the coming months. This proactive approach helps you anticipate financial needs and make informed decisions, boosting your operational stability. Did you know that predictive cash forecasting can enhance accuracy by 20% compared to traditional static models? That means better liquidity management for your vineyard!

-

Monitor Receivables: Keep a close eye on your accounts receivable to ensure you’re collecting payments on time. Efficient management of receivables is crucial for maintaining liquidity. In fact, 80% of businesses that use data-driven cash forecasts spot potential cash shortages earlier, allowing them to tackle issues before they escalate.

-

Expense Management: Regularly review your expenses to find areas where you can cut costs without compromising quality. By optimizing your spending, you can enhance your financial health and allocate resources more effectively.

By actively managing cash flow through winery bookkeeping and these strategies, wineries can secure the funds they need for smooth operations and future growth. So, why not give these tips a try and position your winery for success in today’s competitive market?

Oversee Fixed Asset Management

Wineries really need to get on board with some solid practices for managing their fixed resources. It’s all about boosting operational efficiency and making financial reporting a breeze.

-

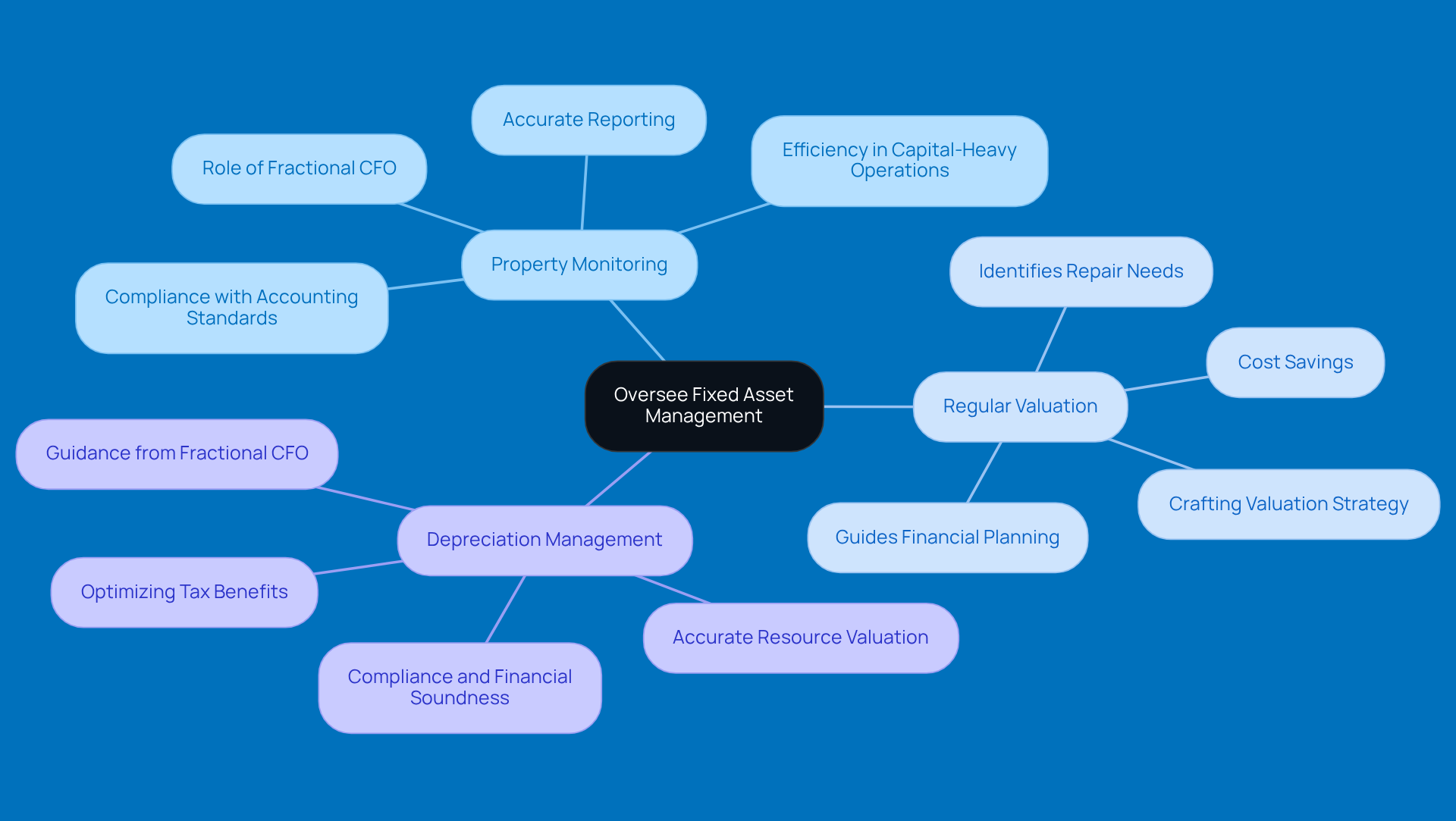

Property Monitoring: First off, let’s talk about property monitoring. Setting up a solid system to keep tabs on your fixed properties-like land, buildings, and equipment-is key. This not only helps with accurate reporting but also keeps you in line with accounting standards, which is super important given the regulatory hurdles wineries face. Plus, efficient resource monitoring can really help with the complexities of capital-heavy operations. And hey, bringing in a fractional CFO can make this process smoother and more cost-effective.

-

Regular Valuation: Next up, regular valuations. It’s a good idea to periodically evaluate your fixed properties to see what they’re worth. This practice can guide your financial planning and help you make smart decisions about investments and how to use your resources. Regular check-ins can also point out when repairs or upgrades are needed, keeping everything in tip-top shape. A fractional CFO can help you craft a valuation strategy that aligns with your financial goals, ultimately saving you some bucks in the long run.

-

Depreciation Management: Now, let’s dive into depreciation management. Understanding and using the right depreciation techniques can really help you optimize tax benefits while accurately reflecting resource values on your accounts. Effective depreciation management is a smart tax strategy that can lower your taxable income, giving you more room to reinvest in your operations. Keeping an eye on when resources are used is crucial for accurate depreciation calculations, ensuring you stay compliant and financially sound. A fractional CFO can guide you in selecting the best depreciation methods tailored to your specific situation, enhancing your cost-effectiveness.

By effectively managing winery bookkeeping with the help of a fractional CFO, wineries can boost their financial health, streamline operations, and stay compliant with all those pesky regulations. So, why not take that step today?

Conclusion

When it comes to running a winery, effective bookkeeping practices are key to achieving financial success and keeping things running smoothly. By honing in on accurate inventory tracking, breaking down revenue streams, staying compliant, managing cash flow, and keeping an eye on fixed assets, wineries can build a solid financial foundation that supports growth and sustainability.

So, what are some key strategies? Well, think about using technology for inventory management, diving into profit margins across different revenue segments, and making sure you’re compliant with tax regulations. Plus, managing cash flow proactively through forecasting and keeping tabs on expenses can really boost a winery's financial health. And let’s not forget the importance of regular training and expert consultations - they can really help wineries navigate the tricky waters of financial management.

In the end, adopting these best practices doesn’t just streamline operations; it also sets wineries up to thrive in a competitive market. By taking action now, wineries can be ready for whatever challenges and opportunities come their way, paving the path for ongoing success in the ever-changing world of the wine industry. So, why wait? Let’s get started on this journey together!

Frequently Asked Questions

Why is accurate inventory tracking important for vineyards?

Accurate inventory tracking is crucial for vineyards as it ensures awareness of stock levels, prevents overselling, and facilitates better predictions and planning for economic decisions.

What are some best practices for inventory tracking in vineyards?

Best practices include conducting regular audits (at least quarterly), using standardized valuation methods like FIFO or weighted average cost, and adopting digital tools such as barcode scanning or RFID systems to automate stock tracking.

How can vineyards segment their revenue streams effectively?

Vineyards can segment their revenue streams by identifying key segments such as product lines (red, white, sparkling wines) and sales channels (direct-to-consumer, wholesale, online), which helps in understanding which segments drive profits.

Why is it important to analyze profit margins for each revenue segment?

Analyzing profit margins for each segment helps vineyards fine-tune pricing strategies, identify high-performing areas, and recognize segments that may need adjustments to enhance profitability.

How can tailored marketing strategies benefit vineyards?

Tailored marketing strategies allow vineyards to craft targeted campaigns based on performance data, aligning marketing efforts with the strengths of each product line and sales channel to maximize return on investment.

What role does managing shipping costs play in a vineyard's profitability?

Effectively managing shipping costs can significantly impact overall profitability, making it an important consideration when optimizing revenue streams.