Introduction

Navigating the world of tax compliance can feel like a maze for small business owners, especially when it comes to those tricky W-2 Box 12 codes. These little guys are super important - they help determine your tax liabilities and keep you in good standing with the IRS. But let’s be honest, many entrepreneurs might not fully understand what these codes mean, which can lead to some costly mistakes or missed chances for tax savings.

So, how can you, as a small business owner, tackle these complexities? It’s all about maximizing your benefits while steering clear of those pitfalls. Let’s dive in and make sense of it all together!

Steinke and Company: Your Partner for W-2 Box 12 Code Compliance

Navigating the ins and outs of tax compliance can be a real headache for small businesses in rural America. At Steinke and Company, we’re all about making compliance with the 12d code on W-2 a breeze. We help you report everything accurately to the IRS, so you can breathe easy knowing you’re on the right side of the law. Plus, our tailored strategies not only help you cut down on tax obligations but also let you focus on running your business smoothly.

Now, let’s talk about underpayment penalties. These pesky fees can sneak up on you if you don’t pay enough of your tax liability throughout the year. But don’t worry! By detailing your W-2 info correctly and making those estimated tax payments on time, you can dodge those unnecessary penalties. Strategies like the de minimis exception and safe harbor payments can really save you from financial stress.

As tax expert Mitchell J. Thompson puts it, "Minimizing tax liabilities and maximizing deductions and credits are essential components of effective tax planning." With our know-how, you can tackle your tax responsibilities confidently and get back to what you do best. So, why not reach out and see how we can help you today?

Understanding the Key W-2 Box 12 Codes and Their Meanings

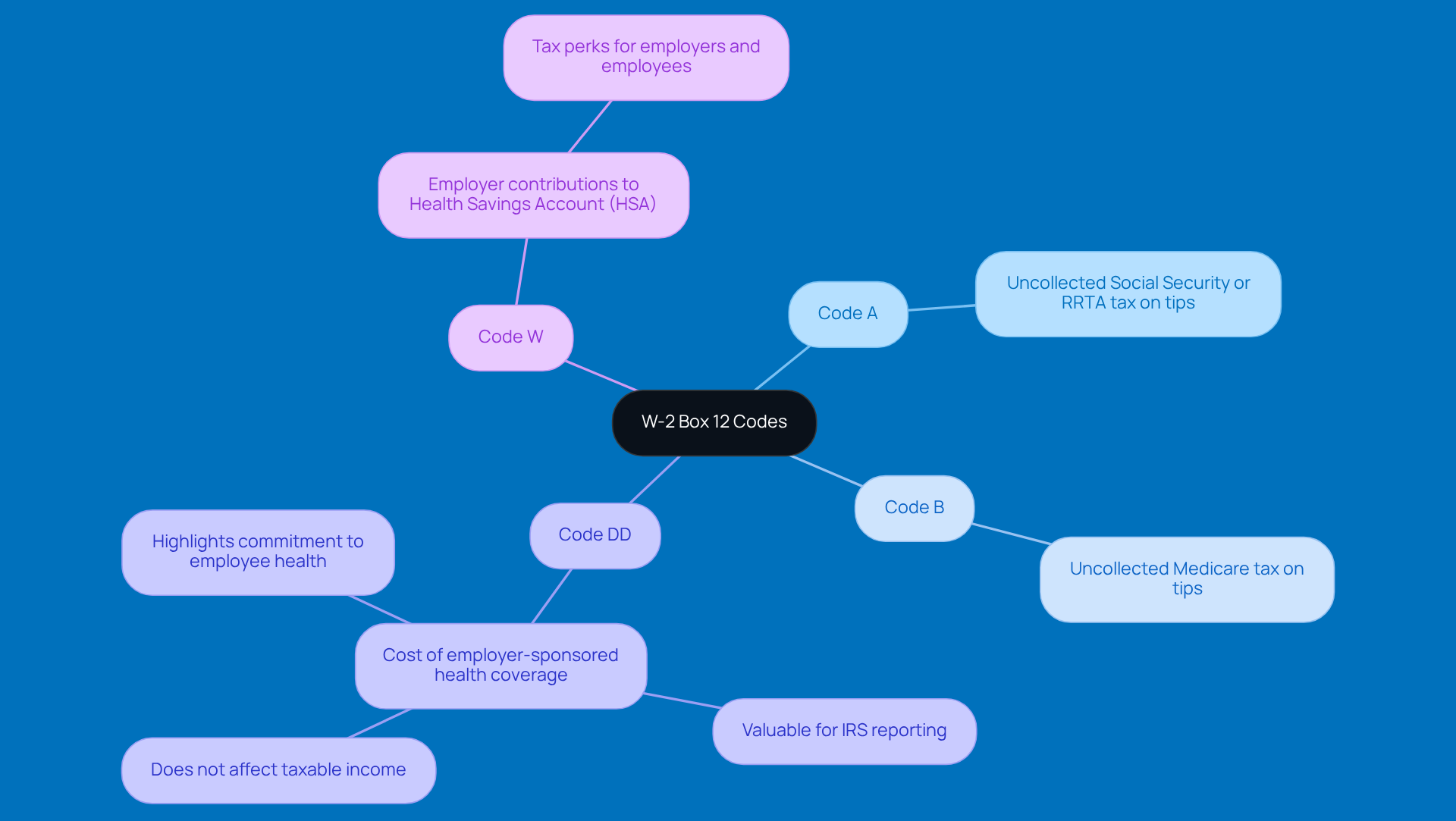

W-2 Box 12, which includes the 12d code on W-2, is a key player when it comes to reporting various forms of compensation and benefits. It includes specific codes that can really impact tax documentation for small businesses. Let’s break down some of these important codes:

- Code A: This one’s for uncollected Social Security or RRTA tax on tips. It helps employers report any taxes that weren’t withheld on employee tips.

- Code B: Similar to Code A, this code covers uncollected Medicare tax on tips, ensuring that tax obligations are reported accurately.

- Code DD: This code shows the cost of employer-sponsored health coverage. It’s valuable information for the IRS but doesn’t affect taxable income. For small businesses, this is a big deal as it highlights their commitment to employee health benefits.

- Code W: This one refers to employer contributions to a Health Savings Account (HSA), which can provide tax perks for both employers and employees.

Understanding these codes is super important for small business owners. They give the IRS a clear picture of compensation and benefits, which ultimately affects tax responsibilities. If these regulations are misunderstood, it could lead to some headaches with the IRS. That’s why it’s a good idea for entrepreneurs to chat with tax experts to ensure everything’s documented correctly. For example, a small business that effectively uses Code DD can showcase its investment in employee health, which might just boost its reputation and help attract top talent.

Tax specialists emphasize that getting the details in Box 12, including the 12d code on W-2, right is crucial for maximizing tax savings and staying compliant. By using these codes properly, small businesses can navigate the complexities of tax reporting more smoothly, leading to better financial outcomes. So, why not take a closer look at your W-2s and see how you can make the most of these codes?

How W-2 Box 12 Codes Affect Your Taxable Income

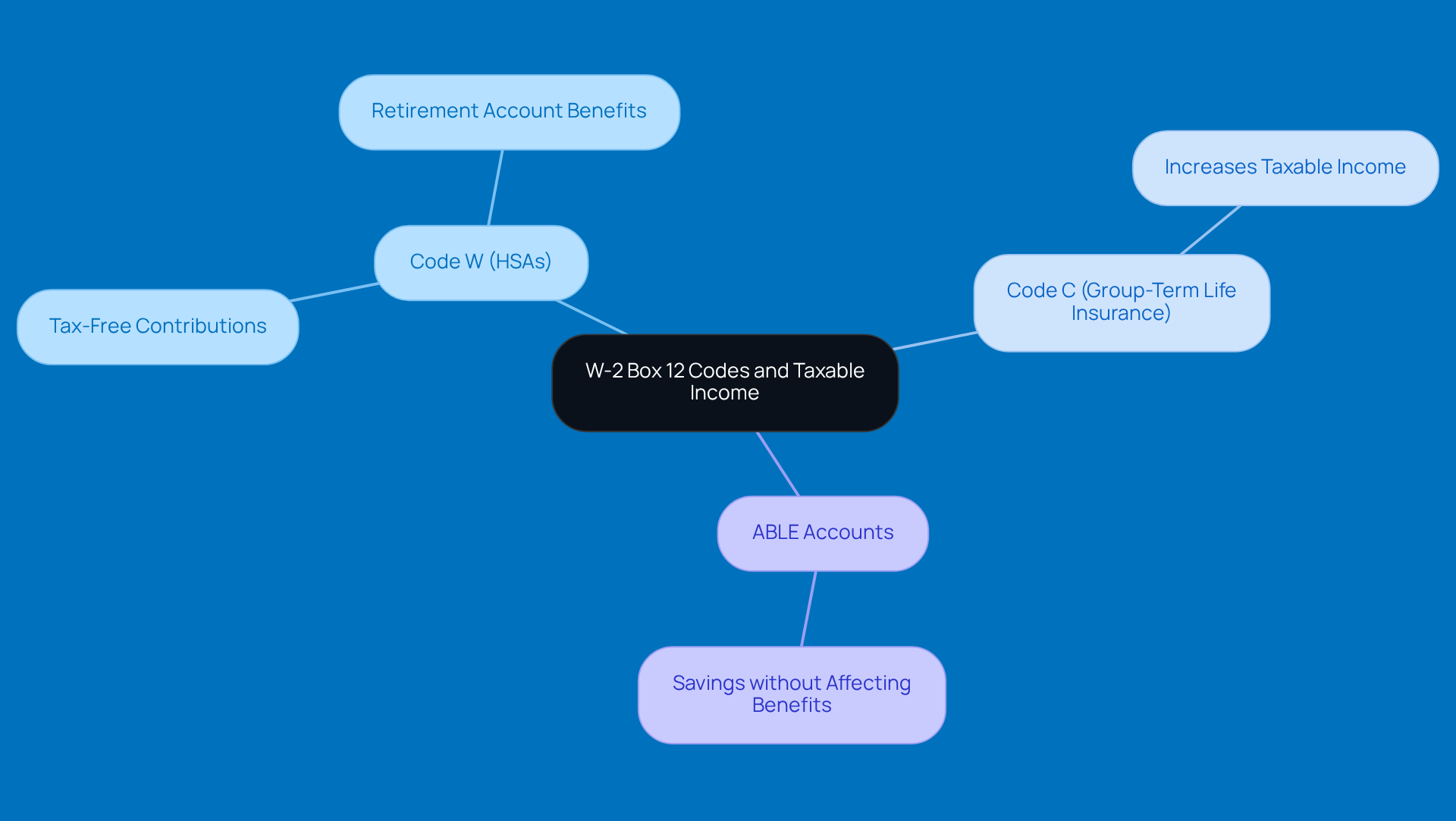

The information provided in the 12d code on w2 can significantly impact your taxable income. For example, if you see contributions under Code W for Health Savings Accounts (HSAs), those are tax-free! That means they can help lower your taxable income. HSAs are great because they not only let you save for medical expenses but can also act like a retirement account, letting your funds grow tax-free until you need them.

On the flip side, if you spot amounts under Code C for group-term life insurance over $50,000, that could bump up your taxable income. So, it’s super important to take a close look at the regulations regarding the 12d code on w2. They can lead to some serious tax savings or, on the other hand, unexpected liabilities, depending on how they’re reported.

And let’s not forget about ABLE accounts! These are fantastic for individuals with disabilities, allowing them to save without messing with their Medicaid or Supplemental Security Income. It’s all about enhancing financial planning strategies, right? So, take a moment to review these options - they could make a big difference!

Practical Tips for Accurate Filing of W-2 Box 12 Codes

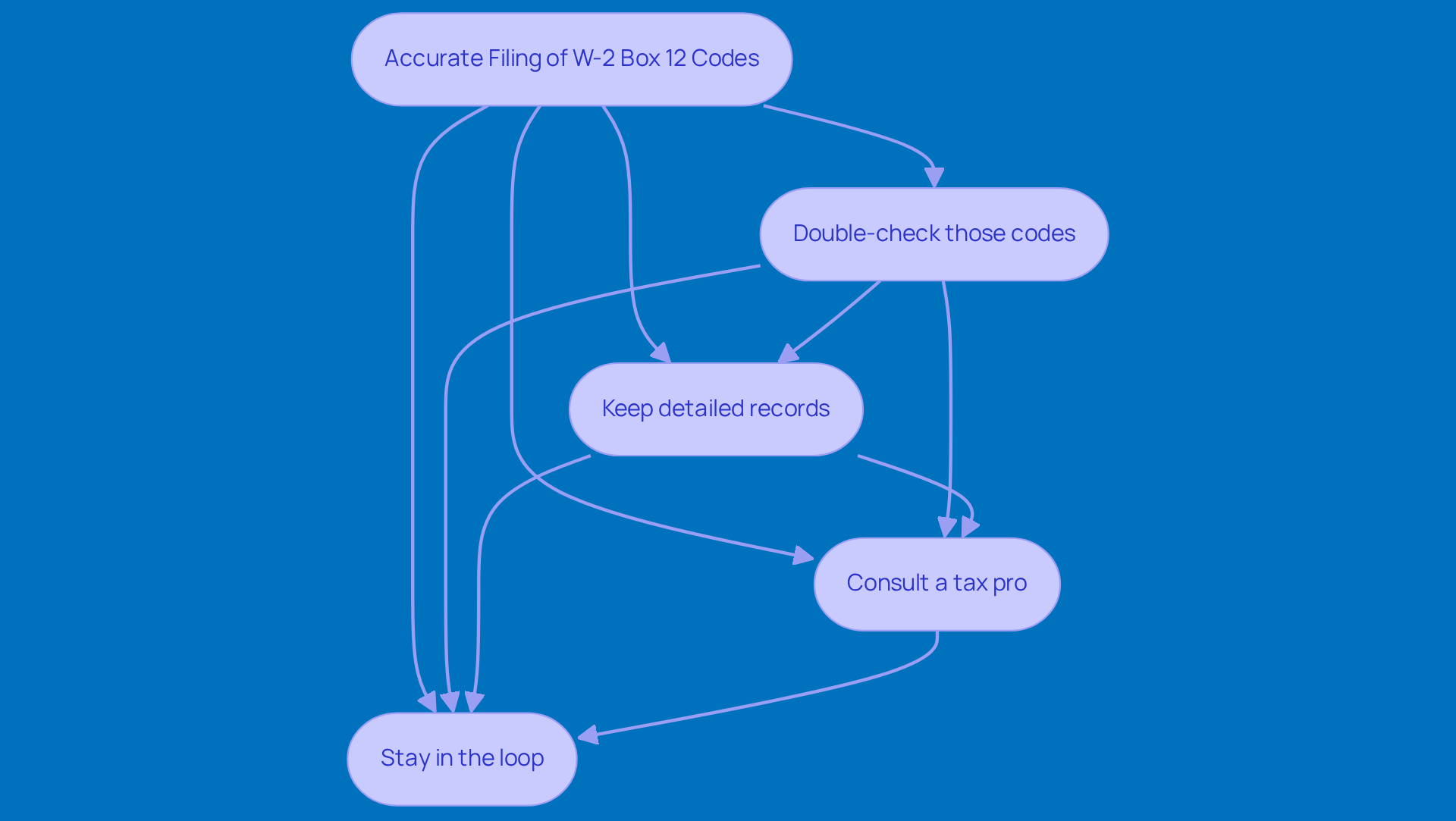

To make sure you're filing W-2 Box 12 codes accurately, here are some essential tips you won't want to miss:

- Double-check those codes: Always take a moment to verify that you’re using the right codes for each type of compensation or benefit. Misreporting can lead to some serious headaches with the IRS, like audits and penalties. Nobody wants that!

- Keep detailed records: It’s super helpful to maintain thorough records of all the compensation and benefits you provide to your employees throughout the year. This not only helps with precise documentation but also acts as a safety net during audits. Trust me, it pays off!

- Consult a tax pro: If you’re feeling unsure about any codes or what they mean, don’t hesitate to reach out to a tax professional. Their expertise can save you from costly mistakes and help you stay compliant with the latest regulations.

- Stay in the loop: Tax regulations can change every year, so it’s important to keep yourself updated on any changes to the 12d code on w2 and W-2 reporting requirements. Staying vigilant can help you avoid errors that might pop up from outdated info.

By following these best practices, you can boost your compliance and significantly lower the risk of errors in your tax filings. This way, you’ll keep things running smoothly for your business!

Conclusion

Navigating the complexities of W-2 Box 12 codes is super important for small businesses looking to file their taxes accurately and stay compliant. When you understand what these codes mean - especially the 12d code - you can report compensation and benefits correctly. This not only helps you avoid penalties but also boosts your financial outcomes.

Let’s break it down a bit. Codes like A, B, DD, and W do more than just affect your tax obligations; they also show how much you care about your employees’ welfare. By using these codes wisely, small businesses can cut down on tax liabilities and make the most of potential deductions. Plus, some practical tips - like double-checking codes, keeping detailed records, and chatting with tax professionals - can really help streamline the filing process and keep you compliant.

So, here’s the takeaway: the importance of W-2 Box 12 codes is huge! They’re essential tools for tax reporting that can greatly impact your business’s financial health. By embracing best practices for compliance and staying updated on regulatory changes, you can not only reduce risks but also empower your small business to thrive. Taking proactive steps today can lead to a smoother tax filing experience down the road. What steps are you planning to take to make tax season easier?

Frequently Asked Questions

What services does Steinke and Company provide?

Steinke and Company helps small businesses in rural America with compliance regarding the 12d code on W-2 forms, ensuring accurate reporting to the IRS.

How does Steinke and Company assist with tax compliance?

They offer tailored strategies that not only help reduce tax obligations but also allow business owners to focus on running their operations smoothly.

What are underpayment penalties and how can they be avoided?

Underpayment penalties are fees incurred when insufficient tax liability is paid throughout the year. They can be avoided by accurately detailing W-2 information and making estimated tax payments on time.

What strategies can help prevent underpayment penalties?

Strategies such as the de minimis exception and safe harbor payments can help businesses avoid unnecessary underpayment penalties.

What is the importance of effective tax planning according to tax expert Mitchell J. Thompson?

Effective tax planning involves minimizing tax liabilities and maximizing deductions and credits, which are essential for managing tax responsibilities effectively.