Introduction

Creating a solid tax preparation business plan isn’t just a box to check off; it’s like your roadmap to success. By setting clear goals, getting a grip on market trends, and laying out your operational game plan, you can really set yourself up to thrive in a competitive world.

But with so many moving parts, how do you make sure your business plan is both thorough and flexible enough to keep up with the ever-evolving tax landscape? This guide will walk you through the essential steps and key elements you need to craft a strong tax preparation business plan that paves the way for growth and sustainability.

Define Your Tax Preparation Business Plan

Start by clearly outlining your goals in your tax preparation business plan. This foundational step is super important for guiding your decisions and strategies as you set up your business. Let’s break it down:

-

Vision Statement: What are your long-term dreams? A well-crafted vision statement serves as an inspiring tagline, motivating both your team and customers while laying out a clear path for growth.

-

Mission Statement: What’s the core purpose of your business? What unique value do you bring to your customers? A strong mission statement helps clarify your identity and shows your commitment to serving your target market, which can boost employee engagement and act as a marketing asset.

-

Objectives: Set specific, measurable goals for your first year. Think about targets like the number of clients you want to serve or revenue milestones. Having measurable goals gives you a clear roadmap for success and lets you track your progress, making it easier to adjust as needed.

Involve your staff in crafting your vision and mission statements. This not only enhances buy-in but also aligns everyone within your firm. And don’t forget to revisit these statements during significant changes to keep them relevant and effective.

Also, consider adding proactive tax planning services, like those offered by Steinke and Company. They provide regular meetings throughout the year to review tax returns and strategic planning sessions tailored to your needs. This approach helps spot overlooked opportunities and offers customized strategies for growth and efficiency. By weaving expert advisory services into your strategy, you can boost financial clarity and help your clients achieve their goals.

By thoughtfully developing your vision and mission statements and setting measurable goals, you’re building a solid foundation for your tax preparation business plan, ensuring that it aligns with your core values and aspirations.

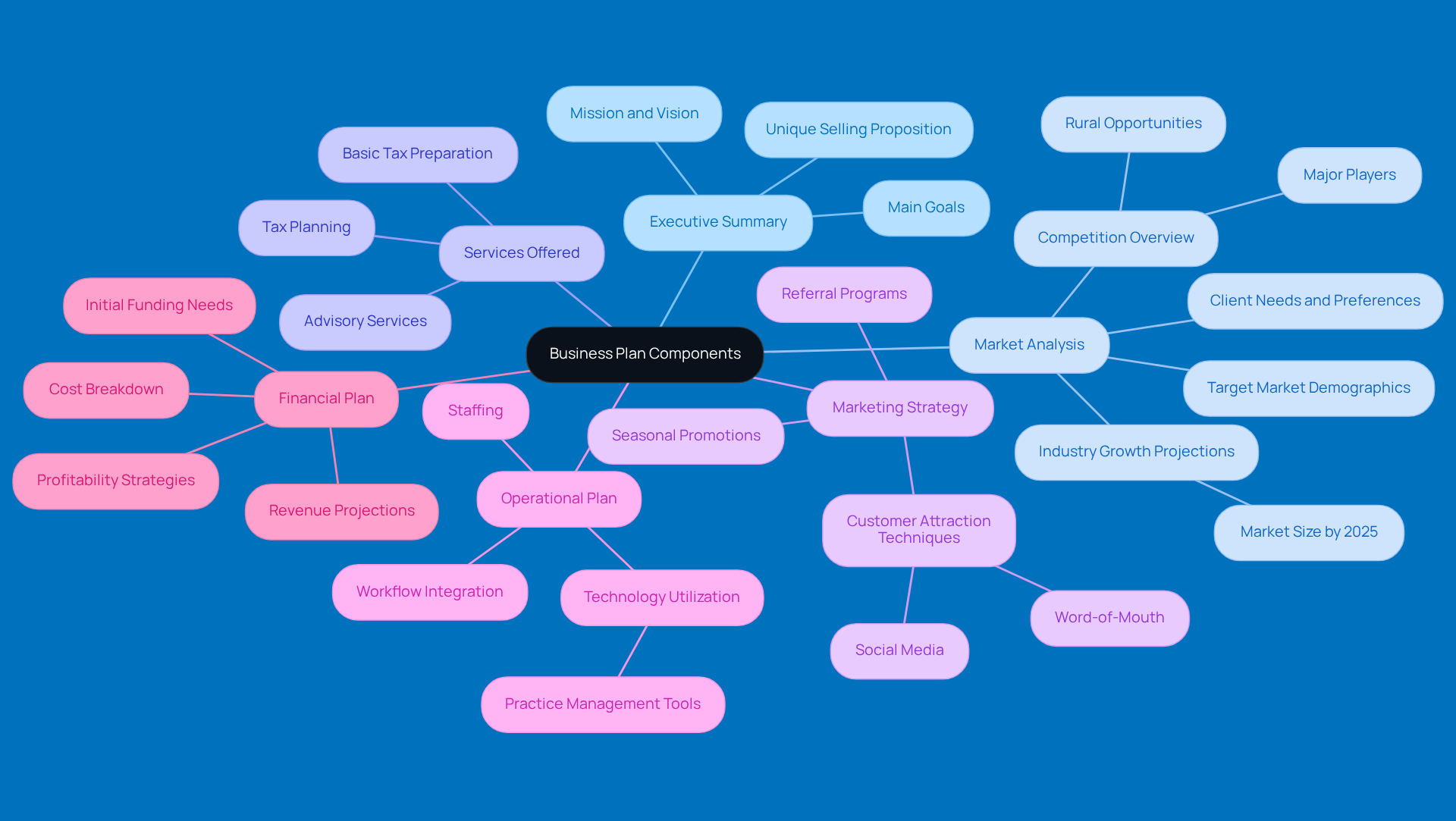

Outline Key Components of Your Business Plan

Are you in the process of creating a solid tax preparation business plan for your firm? Let’s break it down into some key components that’ll set you up for success:

-

Executive Summary: Think of this as your business’s elevator pitch. It’s a brief overview that captures your mission, vision, and main goals. You want to convey what makes your firm stand out in the tax filing world.

-

Market Analysis: Dive into your target market! Get to know the demographics, needs, and preferences of your potential clients. Don’t forget to check out the competition, especially in rural areas where traditional firms might miss out on opportunities. Fun fact: the Tax Preparation Services industry is expected to grow significantly, with a market size hitting $14.5 billion by 2025. That’s a clear sign that there’s a strong demand for personalized services!

-

Services Offered: What services will you provide? Be specific! Whether it’s basic tax prep, tax planning, or advisory services, make sure to highlight how your offerings meet the unique needs of small businesses and individuals in your community. It’s all about aligning with what your local market wants.

-

Marketing Strategy: How will you attract and keep customers? Think modern marketing techniques-social media, word-of-mouth, you name it! Consider setting up referral programs and seasonal promotions to create a buzz and get people talking about your services.

-

Operational Plan: Let’s talk about the nitty-gritty of your daily operations. Outline your staffing, workflow, and how you’ll integrate technology. Using practice management tools can really streamline things and boost client service. There are plenty of case studies out there showing how this can enhance efficiency during tax season.

-

Financial Plan: Finally, let’s get into the numbers. Present your initial funding needs and revenue projections. Break down expected costs, pricing models, and how you plan to achieve profitability. Knowing your financial metrics is key to navigating the ups and downs of the industry and ensuring you grow sustainably.

Each of these elements deserves a good look to build a strong foundation for your tax preparation business plan. With the right approach, you’ll be well-positioned to thrive in a competitive market!

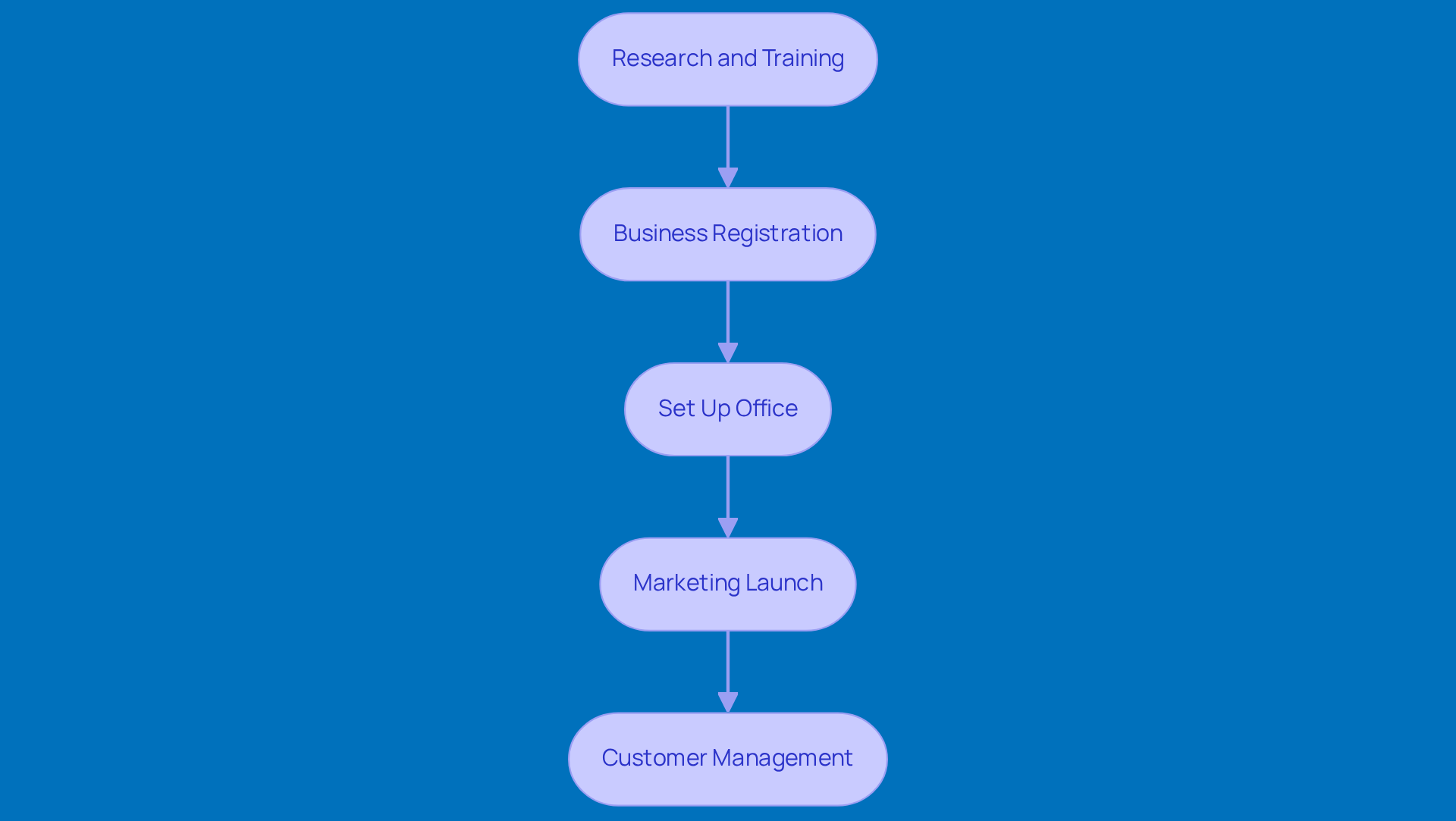

Develop a Step-by-Step Action Plan

Are you creating a solid action plan for your tax preparation business plan? Let’s break it down into some friendly steps:

-

Research and Training: First things first, you’ll want to figure out what certifications you need for tax preparers in 2025. Think about becoming an Enrolled Agent or snagging a CPA license. And don’t forget, engaging in training programs is super important! Ongoing education keeps you in the loop with tax laws and compliance requirements.

-

Business Registration: Next up, make sure you tick off all the legal boxes to register your business. This includes getting any licenses and permits that your state or locality requires. It’s all about starting off on the right foot!

-

Set Up Office: Now, let’s talk about where you’ll work. Choose a spot that makes sense for you, whether it’s a cozy home office or a bustling storefront. You’ll need to invest in some essential equipment and software, and just a heads up, setup costs can range from a few hundred to several thousand dollars, depending on how complex your operations are.

-

Marketing Launch: Time to get the word out! Develop a marketing plan that mixes both budget-friendly and premium strategies. A good rule of thumb is to allocate about 8-16% of your projected sales revenue to marketing efforts. This way, you can effectively reach those potential customers.

-

Customer Management: Finally, set up a customer management system that keeps everything organized. You want to make sure customer info and appointments are easy to manage. Using software solutions can really streamline your workflows and enhance client interactions, making onboarding and ongoing communication a breeze.

Remember, each step of the tax preparation business plan should come with a timeline and assigned responsibilities. This way, you’ll keep accountability high and ensure you’re making progress. Ready to get started?

Establish Financial Projections and Funding Sources

If you're looking to set up solid financial projections for your tax preparation business, here are some friendly steps to get you started:

- Estimate Startup Costs: First things first, let’s figure out those initial expenses. Think about what you’ll need for office setup, software, and marketing. It’s super important to understand these costs - did you know that 20% of small businesses without accounting software struggle to make it through their first year? Yikes!

- Revenue Projections: Next up, let’s talk about how much money you expect to bring in. Do some market research and come up with competitive pricing strategies. The tax filing services market is on the rise, projected to grow from $32.94 billion in 2024 to $34.9 billion in 2025. That’s a pretty good sign for newcomers!

- Funding Sources: Now, where’s the money going to come from? You might want to look into personal savings, loans, or even attracting some investors. A mix of traditional loans and creative financing options often works well for developing a tax preparation business plan.

- Break-even Analysis: Finally, it’s time for a break-even analysis. This will help you figure out when your business will start making a profit. By comparing your fixed and variable costs with your projected revenues, you can set some realistic financial goals.

These financial insights will help you make smart decisions and catch the eye of potential investors, setting your tax preparation business plan up for success!

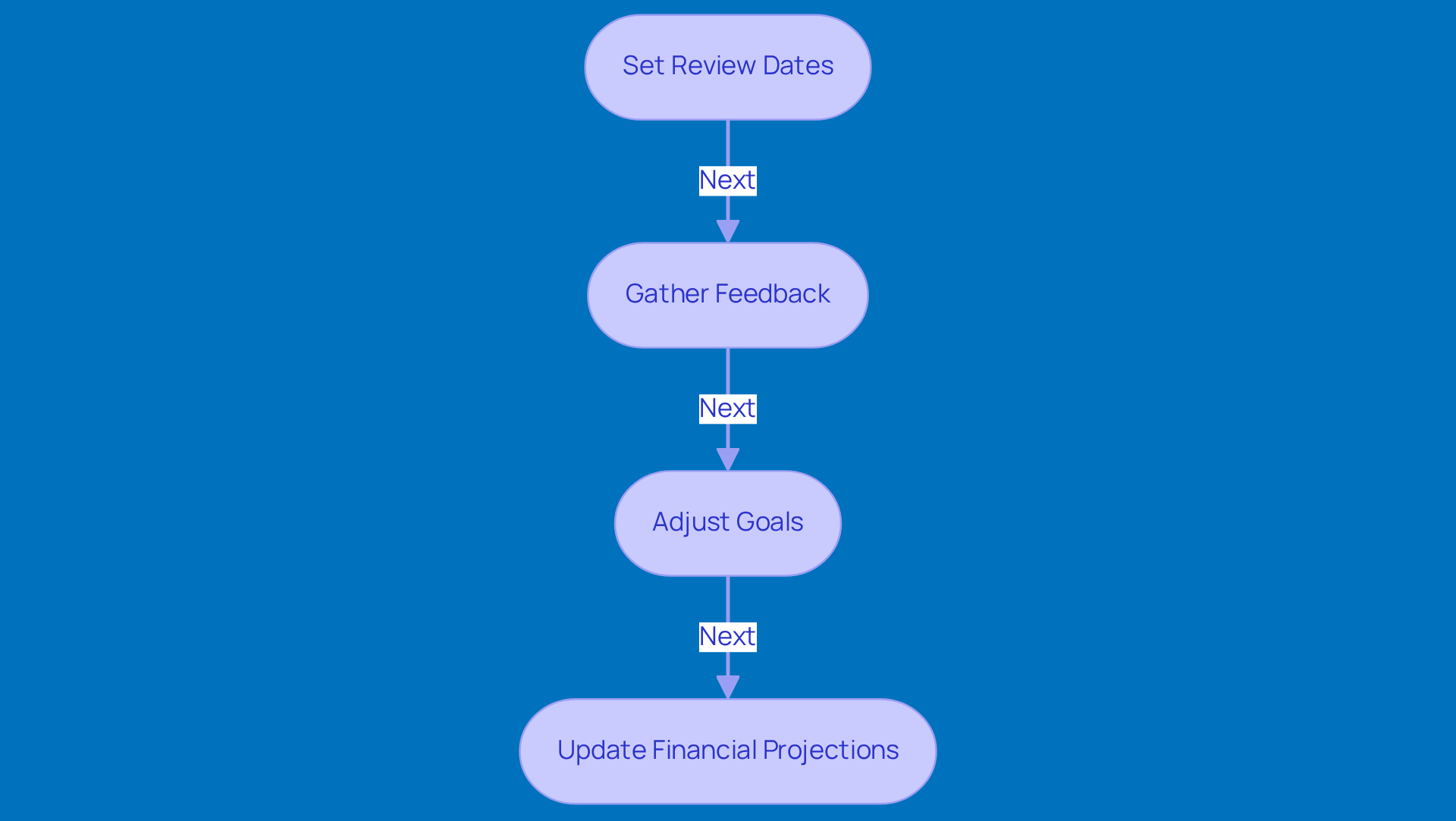

Review and Adapt Your Business Plan Regularly

To effectively review and adapt your business plan, here are some friendly tips:

- Set Review Dates: How about scheduling regular check-ins, like quarterly? This way, you can assess how your business is doing against your plan. It’s a structured approach that lets you make timely adjustments based on real-time data.

- Gather Feedback: Don’t forget to ask for input from your customers and stakeholders! Actively seeking their thoughts can help you pinpoint areas for improvement. Using feedback tools like surveys or direct interviews can give you valuable insights into customer satisfaction and service effectiveness. You know, companies that really listen to their customers often see improved loyalty and retention. In fact, did you know that 14% of small businesses fail because they overlook their customers? That really highlights how important this practice is!

- Adjust Goals: Be ready to tweak your objectives based on performance data and market changes. Flexibility in goal-setting is key, especially in the fast-paced world of a tax preparation business plan, where regulations and customer demands can shift quickly.

- Update Financial Projections: It’s time to revise your financial forecasts to reflect what’s actually happening and any new opportunities that pop up. Accurate financial planning is super important! Companies with solid plans are 30% more likely to grow compared to those that don’t have one. Plus, 90% of failed startups blame poor or no planning, which really shows the risks of neglecting this part.

This ongoing process will help ensure that your tax preparation business plan keeps your business competitive and aligned with your vision. Ultimately, it leads to better performance and happier customers. And remember, integrating customer feedback can strengthen client relationships, just like we saw in that case study about building customer loyalty through custom solutions!

Conclusion

Creating a solid tax preparation business plan is a key step in building a successful firm in today’s competitive market. By laying out clear vision and mission statements, setting measurable goals, and outlining the essential components, you can craft a strong framework that guides your strategies and decisions. This foundational approach not only keeps your business aligned with its core values but also paves the way for sustainable growth and success.

Throughout this article, we’ve highlighted some important elements like:

- Conducting a thorough market analysis

- Developing a comprehensive marketing strategy

- Establishing sound financial projections

Each of these pieces plays a vital role in making sure your business is ready to meet the needs of your target audience while staying adaptable to market changes. And let’s not forget the importance of regularly reviewing and adjusting your business plan; being responsive to feedback and shifting conditions is crucial for long-term success.

In the end, creating a tax preparation business plan isn’t just a one-off task - it’s an ongoing commitment to excellence. By following the steps we’ve discussed and staying flexible, you can enhance your service offerings and build stronger relationships with your clients. So, why not take action today? Developing and refining your plan can lead to a brighter future in the ever-changing world of tax services!

Frequently Asked Questions

What is the first step in creating a tax preparation business plan?

The first step is to clearly outline your goals, including a vision statement, mission statement, and specific objectives.

What is a vision statement and why is it important?

A vision statement outlines your long-term dreams and serves as an inspiring tagline that motivates your team and customers while providing a clear path for growth.

What should a mission statement include?

A mission statement should clarify the core purpose of your business and the unique value you bring to your customers, which helps define your identity and commitment to your target market.

How can I set objectives for my tax preparation business?

Set specific, measurable goals for your first year, such as the number of clients you want to serve or revenue milestones, to create a clear roadmap for success.

How can involving staff in developing vision and mission statements benefit my business?

Involving staff enhances buy-in and aligns everyone within the firm, ensuring that the vision and mission reflect collective goals.

What are some key components to include in a tax preparation business plan?

Key components include an executive summary, market analysis, services offered, marketing strategy, operational plan, and financial plan.

What is the purpose of an executive summary in a business plan?

The executive summary serves as a brief overview that captures your mission, vision, and main goals, acting as an elevator pitch for your business.

Why is market analysis important in a tax preparation business plan?

Market analysis helps you understand the demographics, needs, and preferences of your potential clients and assess competition, which is crucial for tailoring your services.

What types of services should I consider offering in my tax preparation business?

Consider offering a range of services such as basic tax preparation, tax planning, and advisory services tailored to meet the unique needs of small businesses and individuals.

How can I effectively market my tax preparation services?

Use modern marketing techniques such as social media, word-of-mouth, referral programs, and seasonal promotions to attract and retain customers.

What should be included in the operational plan of a business plan?

The operational plan should outline staffing, workflow, and technology integration, including the use of practice management tools to enhance efficiency.

What key financial metrics should I consider in my financial plan?

Present your initial funding needs, revenue projections, expected costs, pricing models, and strategies for achieving profitability to ensure sustainable growth.