Overview

So, you're thinking about launching a tax preparation business? That's fantastic! Let’s break it down into five essential steps that'll set you up for success.

- First off, you’ll want to identify your qualifications—what makes you the go-to person for tax prep?

- Next, don’t forget to register your business; it’s a crucial step that keeps everything above board.

- Now, let’s talk tools. Implementing effective tools can really streamline your process, making your life a whole lot easier.

- And what about client acquisition strategies? Developing these is key to attracting clients and keeping them coming back.

- Finally, establishing continuous learning practices will ensure you stay sharp and ready for whatever comes your way.

Remember, each of these steps highlights the importance of compliance, stellar customer service, and operational efficiency. A well-rounded approach is critical in this competitive industry, and trust me, it’ll make a difference in attracting and retaining clients. So, are you ready to dive in and make your mark in the tax prep world?

Introduction

Starting a tax preparation business can be a truly rewarding adventure, especially with the growing demand for skilled professionals in the field. If you've got the right qualifications, tools, and strategies, you can carve out a successful niche in this competitive landscape.

But let’s be real—the journey comes with its own set of challenges. Navigating regulations, ensuring compliance, and attracting clients can feel like a daunting task.

So, what steps can you take to not just start a business, but also thrive in the ever-changing world of tax preparation?

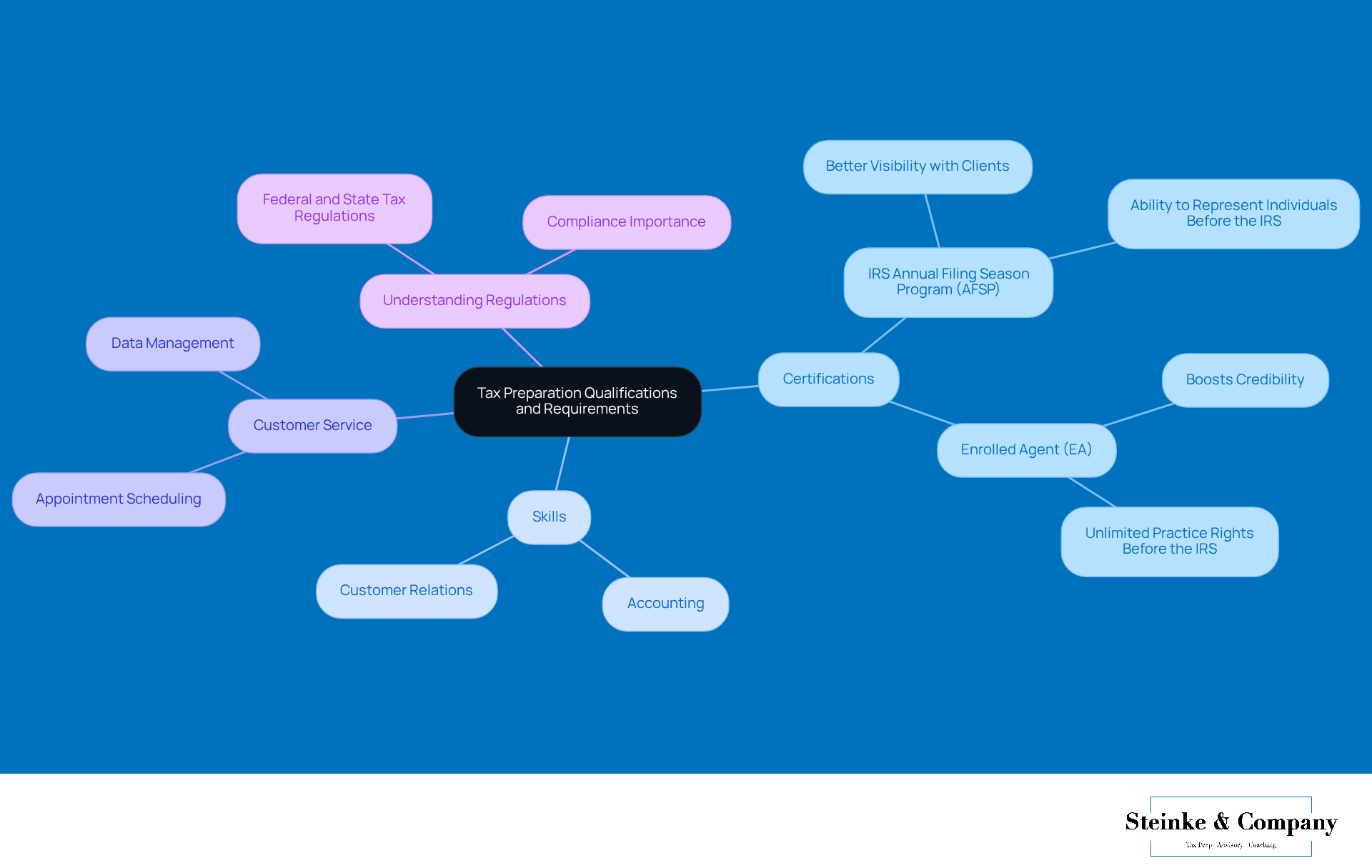

Identify Your Qualifications and Requirements

Before you dive into your tax preparation journey, let’s take a moment to evaluate your qualifications and think about snagging some relevant certifications. The IRS Annual Filing Season Program (AFSP) is a great starting point, offering some solid perks like better visibility with clients and the ability to represent individuals before the IRS. Plus, becoming an Enrolled Agent (EA) can really boost your credibility since EAs are recognized as tax pros with unlimited practice rights before the IRS. As of 2025, there are over 50,000 EAs in the U.S., showing just how much demand there is for skilled tax professionals.

Getting familiar with federal and state tax regulations is super important because compliance is key to successful tax prep. Understanding the specific needs of your target audience—be it private practice doctors or small business owners—will help you tailor your services effectively.

And let’s not forget about the importance of strong skills in accounting and customer relations. Managing client interactions and ensuring accurate tax submissions is crucial. Focusing on customer support can really enhance satisfaction and loyalty, which are vital for long-term success in the tax preparation business. Our customer engagement policies, like organized appointment scheduling and secure data management through a customer portal, show our commitment to privacy and quality. In fact, case studies have shown that companies that prioritize customer service see a big boost in loyalty and referrals.

For instance, one firm shared, "At first, we believed we might be too small of an enterprise for Systems Engineering, but we soon discovered that wasn’t true. They treated us as though we were their only client throughout the whole process, and we were up and running within three weeks." This really underscores how crucial customer service is to your business strategy.

If you have any questions about scheduling an appointment or onboarding, feel free to check out our FAQs for more info!

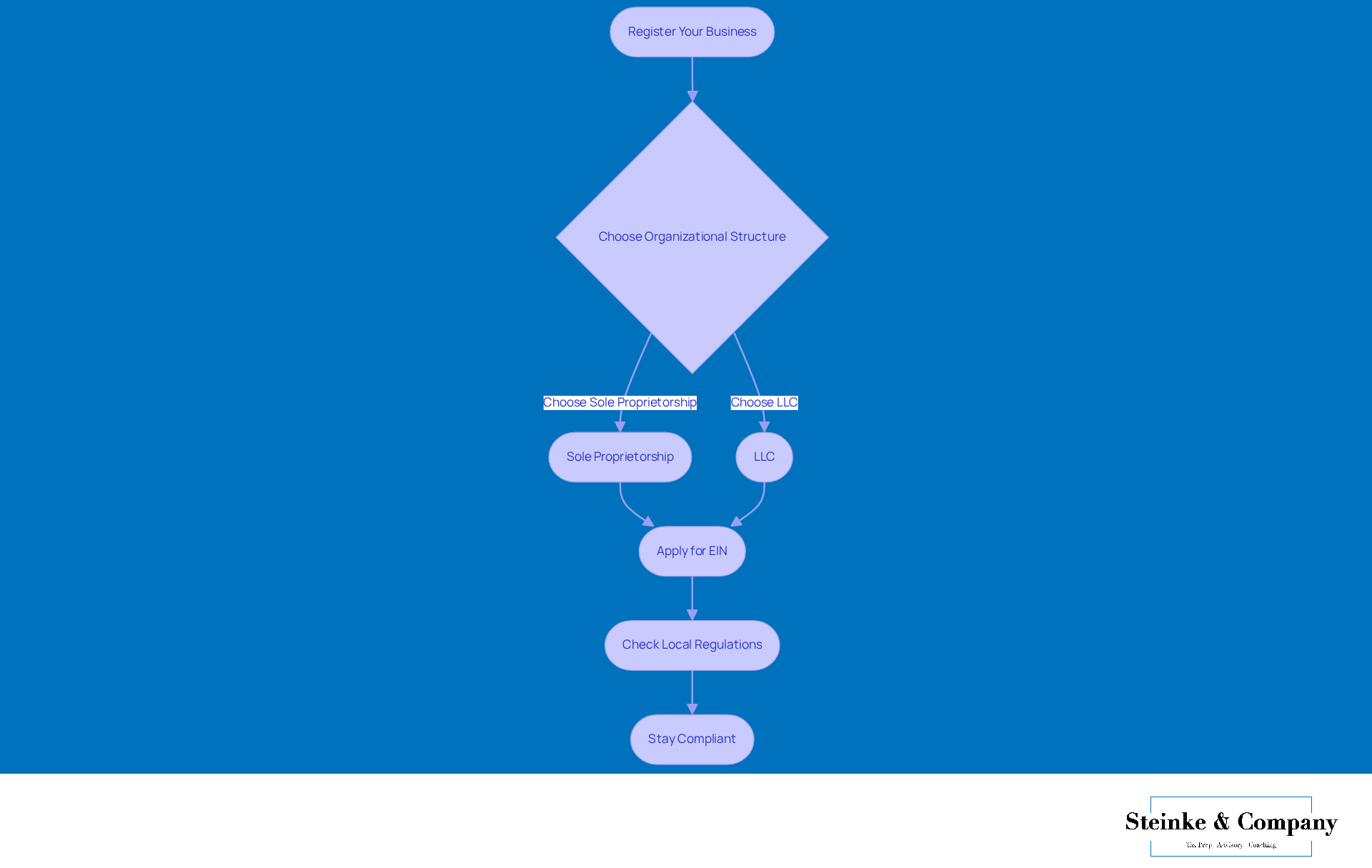

Register Your Business and Obtain Necessary Licenses

If you're looking to run your own tax preparation business, the first step is to get registered with the right state authorities. It’s super important to choose the right organizational structure—like a sole proprietorship or a Limited Liability Company (LLC)—as this can really impact your success and tax efficiency. Did you know that many tax preparers prefer LLCs over sole proprietorships? That’s mainly because LLCs provide added liability protection and some potential tax perks.

Once you’re registered, you’ll need to apply for an Employer Identification Number (EIN) from the IRS. And don’t forget to check your local regulations to see if you need a specific tax preparer license or any other permits. Staying compliant with all state and federal requirements is crucial to avoid any penalties and to keep your business running smoothly.

So, are you ready to take the plunge into the world of the tax preparation business?

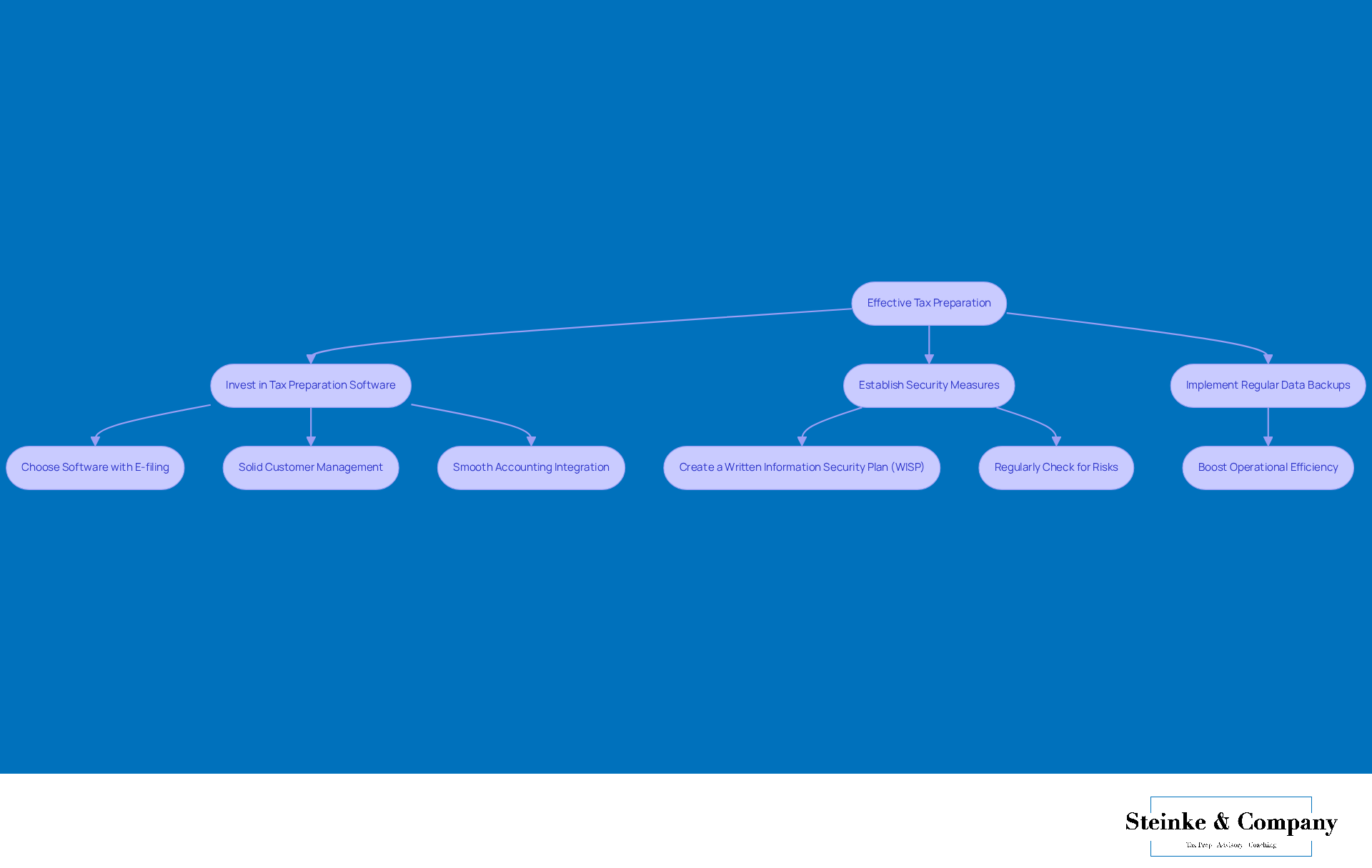

Implement Effective Tax Preparation Tools and Systems

Investing in reliable tax preparation software is super important for your business’s success. Make sure to look for features like e-filing capabilities, solid customer management systems, and smooth integration with your accounting software. Some of the top choices out there include:

- Intuit ProConnect

- Drake Tax

- H&R Block Tax Software

Each of these has its own unique features that can really cater to different business needs.

But it’s not just about the software! Setting up a secure system to store customer documents and sensitive info is key to following data protection regulations, like those outlined in the Gramm-Leach-Bliley Act (GLBA). This means you’ll want to create a Written Information Security Plan (WISP) to keep user data safe and regularly check for risks to make sure your security measures are doing their job.

And let’s not forget about regular data backups! They’re crucial for preventing loss and keeping your customers’ trust intact. By putting these tools and systems in place, you can boost your operational efficiency and provide a secure, trustworthy solution that meets your customers’ expectations.

Develop Strategies for Client Acquisition and Retention

To really draw in customers, it’s all about crafting a solid marketing strategy that mixes both online and offline methods. Think about using social media platforms to connect with potential clients, building a professional website that showcases what you offer, and exploring local advertising options to boost your visibility. Don't forget about networking with professionals like accountants and financial advisors—these connections can lead to some valuable referrals!

Once you’ve got those customers, make outstanding support your top priority to encourage loyalty. Regular follow-ups and personalized communication can really strengthen those relationships. And hey, why not consider offering value-added services like tax planning consultations in your tax preparation business? These strategies not only enhance customer loyalty but also help boost your retention rate. In the tax preparation business, firms that focus on holistic advisory support often see a 5-10% higher retention compared to those that only stick to compliance. So, what’s stopping you from making these changes today?

Establish Continuous Learning and Compliance Practices

To really thrive in today’s changing tax preparation business world, it’s super important to keep learning. Think about joining workshops, webinars, and industry conferences. Getting involved with professional organizations like the National Association of Tax Professionals (NATP) can open up a treasure trove of resources and networking opportunities. Plus, staying on top of IRS updates and changes in tax laws is crucial for keeping things compliant and adjusting to new regulations.

Don’t forget to set up strong internal compliance measures! Regular audits of your procedures and customer files can help maintain high standards and minimize potential liabilities. And hey, let’s talk about data security—this is a big deal! Prioritizing practices that protect customer information is essential, especially with regulations like the Gramm-Leach-Bliley Act (GLBA) in play. This means:

- Encrypting sensitive data

- Using multi-factor authentication

- Having a clear breach notification protocol in place

Interestingly, a lot of professionals in the tax preparation business actively attend industry conferences, which really shows how valuable it is to stay connected and informed in this profession. Remember, overlooking data security isn’t just a minor slip-up; it can lead to serious financial consequences, including lawsuits and a loss of client trust. So, let’s keep our practices sharp and our clients’ info safe!

Conclusion

Starting a tax preparation business? It’s all about having a strategic approach that covers a few essential bases. By getting a grip on the qualifications you need, registering your business the right way, using effective tools, crafting client acquisition strategies, and committing to continuous learning, you can set yourself up for success.

Let’s break it down: you’ll want to obtain the necessary certifications, pick the right business structure, and tap into technology to boost your operational efficiency. Don’t forget, great customer service and building strong relationships are key to keeping clients coming back. Plus, staying updated with the ever-changing tax laws and regulations through ongoing education is a must.

In the end, launching a successful tax preparation business isn’t just about crunching numbers; it’s about building a trustworthy brand that puts client satisfaction first and adapts to industry shifts. By following these steps and staying committed to excellence, you can thrive in a competitive market and create a reputable practice that stands the test of time. So, are you ready to take the plunge?

Frequently Asked Questions

What qualifications and certifications should I consider before starting tax preparation?

Before starting tax preparation, consider obtaining certifications like the IRS Annual Filing Season Program (AFSP) for better visibility with clients and the ability to represent individuals before the IRS. Becoming an Enrolled Agent (EA) can also boost your credibility, as EAs are recognized tax professionals with unlimited practice rights before the IRS.

Why is it important to understand federal and state tax regulations?

Understanding federal and state tax regulations is crucial for compliance, which is key to successful tax preparation. Familiarity with these regulations helps ensure accurate tax submissions and adherence to legal requirements.

How can I tailor my tax preparation services to my target audience?

Tailoring your services effectively requires understanding the specific needs of your target audience, whether they are private practice doctors or small business owners. This knowledge allows you to provide more relevant and effective tax preparation services.

What skills are important for successful tax preparation?

Important skills for successful tax preparation include strong accounting abilities and customer relations skills. Managing client interactions and ensuring accurate submissions are crucial for building satisfaction and loyalty.

How does customer service impact a tax preparation business?

Prioritizing customer service can enhance client satisfaction and loyalty, which are vital for long-term success. Companies that focus on customer engagement often see boosts in loyalty and referrals.

What is the first step in starting my own tax preparation business?

The first step is to register your business with the appropriate state authorities, selecting the right organizational structure, such as a sole proprietorship or Limited Liability Company (LLC).

Why might choosing an LLC be beneficial for tax preparers?

Many tax preparers prefer LLCs over sole proprietorships because LLCs provide added liability protection and potential tax advantages, which can enhance overall business efficiency.

What do I need to do after registering my business?

After registering your business, you need to apply for an Employer Identification Number (EIN) from the IRS and check local regulations for any specific tax preparer licenses or permits required.

How can I ensure compliance with state and federal requirements?

Staying informed about and adhering to all state and federal regulations is crucial to avoid penalties and ensure smooth operation of your tax preparation business.