Introduction

Understanding the ins and outs of business interest expense deductions can really change the game for small and midsize enterprises looking to fine-tune their tax strategies. These deductions have the potential to significantly lower taxable income, offering some much-needed relief as tax regulations keep evolving. But let’s be honest - navigating the eligibility criteria and documentation requirements can feel like a maze. Many business owners might find themselves asking: are they truly making the most of these benefits?

This guide is here to walk you through the essential steps to ensure your business not only qualifies for these deductions but also uses them effectively in today’s ever-changing financial landscape. So, let’s dive in and make sure you’re getting the most bang for your buck!

Define Business Interest Expense Deduction

When it comes to cutting expenses, businesses can take advantage of the business interest expense deduction for costs tied to loans used for their day-to-day operations. According to IRS guidelines, this includes interest on loans for buying inventory, equipment, or other business-related expenses, which can be eligible for a business interest expense deduction. Understanding the business interest expense deduction is crucial for small businesses as it can significantly help lower taxable income, resulting in less tax to pay overall.

Now, the rules and eligibility for claiming the business interest expense deduction are governed by Section 163(j) of the Internal Revenue Code. Here’s a key point: companies that have average total earnings below $31 million over the past three years might not have to worry about the new limits on deductions for borrowing costs. Plus, if you’re in certain sectors, floor plan financing charges are exempt from these expense limits, which is a nice perk.

And there’s more! Recent updates from the One Big Beautiful Bill Act (OBBBA) allow businesses to add back depreciation, amortization, and depletion when figuring out adjusted taxable income. This could really boost tax savings! As CPA Ted Ibinger points out, these updates are especially helpful for businesses with hefty expenses, so it’s a great time for owners to rethink their financing strategies.

So, what do you think? Are you ready to dive into your financial strategies and see how these changes can work for you?

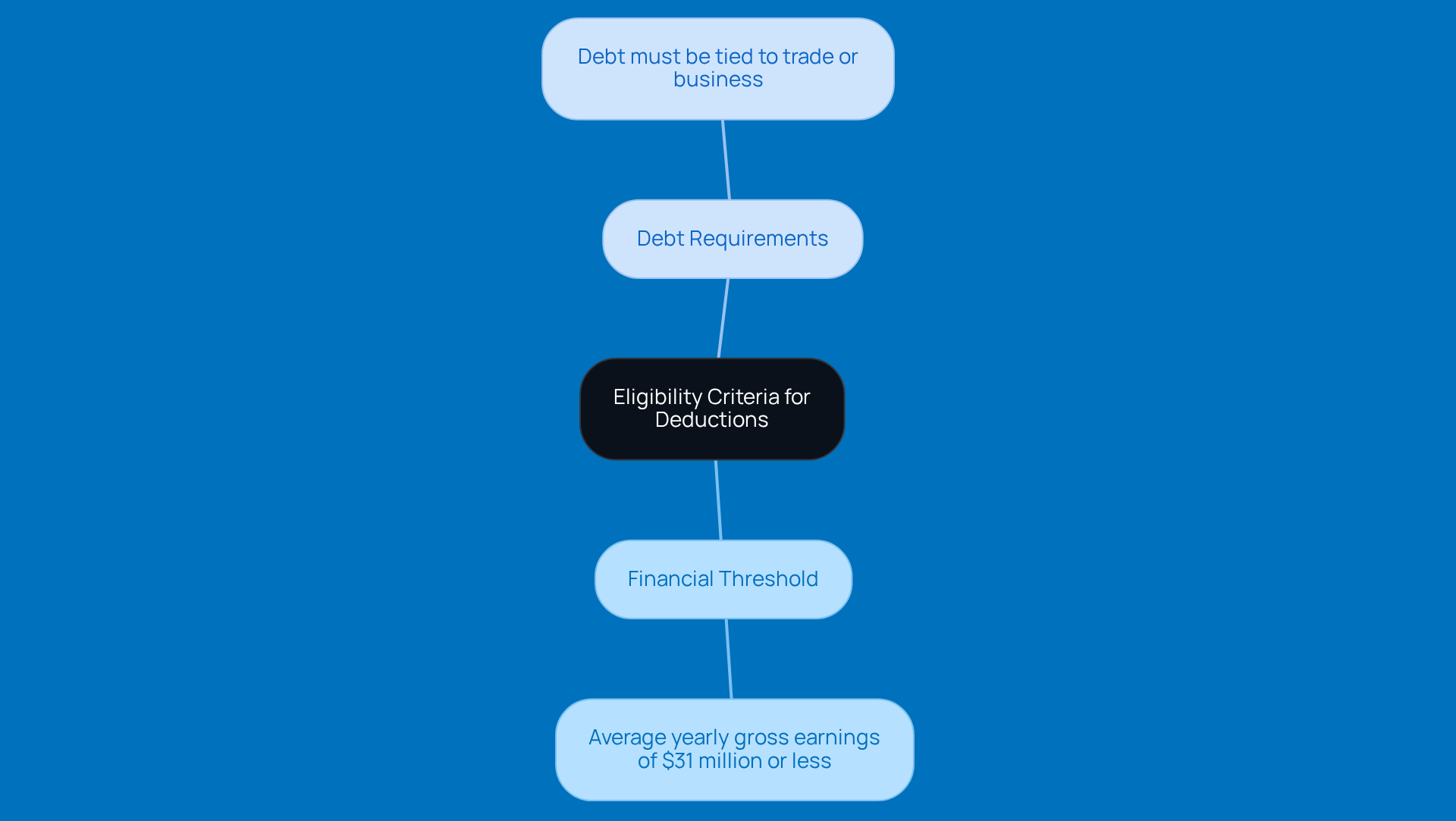

Identify Eligibility Criteria for Deductions

If you want to qualify for the business interest expense deduction, there are a few criteria your business needs to meet. Generally, if your company has average yearly gross earnings of $31 million or less over the past three years, you’re in luck! This means about 98% of U.S. companies can benefit from this exemption, allowing many small and midsize firms to enjoy this relief without running into restrictions.

But there’s a catch: the charge must be paid or accrued on legitimate debt that’s directly tied to your trade or business to be eligible for the business interest expense deduction. So, it’s super important to take a good look at your company’s financials to make sure you’re eligible before diving into the reduction process. Trust me, the business interest expense deduction can really impact your tax strategy and overall financial health!

Have you thought about how this could change things for your business? It’s worth considering!

Collect Required Documentation and Records

If you want to ensure that you can benefit from the business interest expense deduction, keeping detailed records is key. This means having all your loan agreements, payment schedules, and bank statements handy, especially those that show the business interest expense deduction related to the interest you've paid. Plus, it’s super important to document how you’ve used any borrowed funds to support the business interest expense deduction. Organizing these records not only makes tax time easier but also gives you solid proof if the IRS comes knocking.

You know, a lot of folks trip up on documentation - like not keeping track of how they used their funds - which can lead to denied claims and even penalties. But don’t worry! By setting up a solid record-keeping system, you can dodge these issues and stay on the right side of tax regulations. And hey, using cloud-based accounting software can really boost your ability to track and manage your financial records. It cuts down on mistakes and helps you file your taxes on time.

At Steinke and Company, we offer personalized tax compliance and preparation services to help you navigate these requirements smoothly. Remember, good record-keeping isn’t just about following the rules; it also helps you make smart financial decisions and fine-tune your tax strategy. So, how’s your record-keeping game? Let's make it better together!

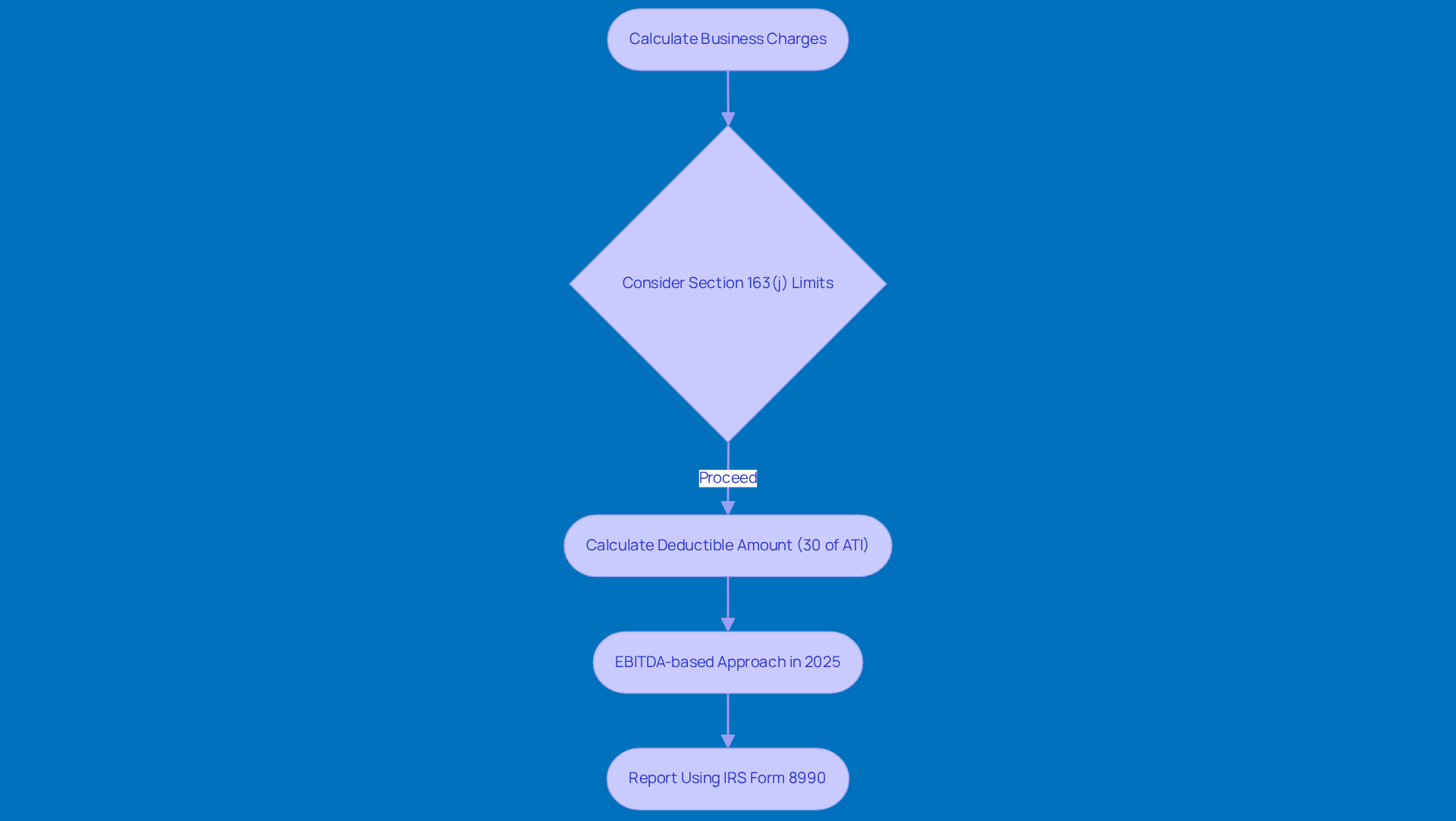

Calculate Deductible Interest Expense

Do you want to determine your deductible business interest expense deduction? Let’s break it down together! First, you’ll want to calculate all the business charges you’ve paid during the tax year. Then, you’ll need to consider the limits set by Section 163(j). This section lets you write off up to 30% of your adjusted taxable income (ATI). So, if your ATI is $100,000, you can take advantage of a business interest expense deduction amounting to $30,000 in interest expenses.

Now, here’s something to keep in mind: starting in 2025, the way we calculate ATI is going to change to an EBITDA-based approach. This could mean a bigger base for your deductions, which is definitely something to look forward to!

When it comes time to report your calculations and make sure you’re following these limits, don’t forget about IRS Form 8990. This handy form will help you navigate the ins and outs of the allowance limits and keep your records in tip-top shape. So, are you ready to tackle those deductions?

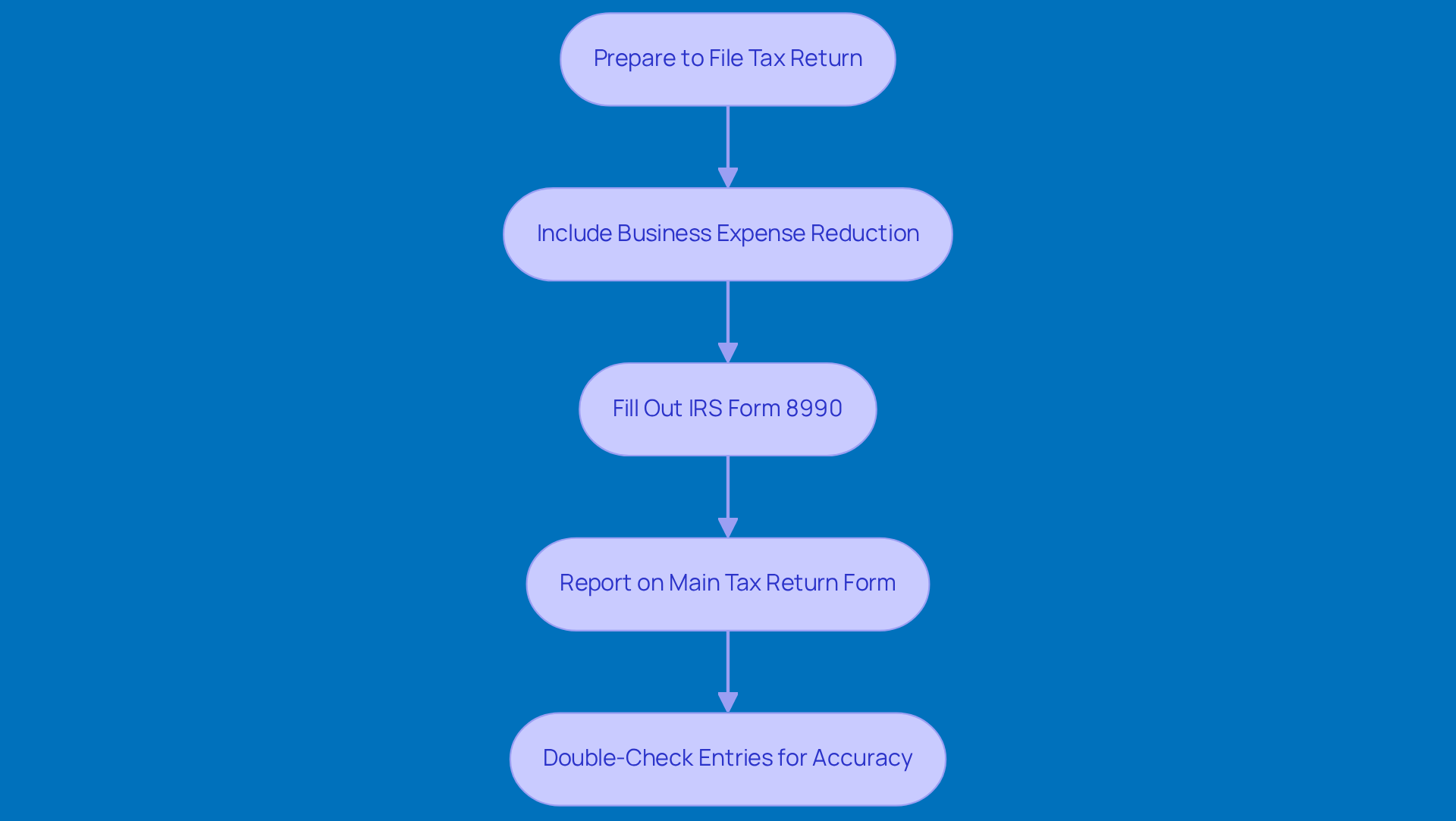

File Your Tax Return with the Deduction

When you're getting ready to submit your tax return, don’t forget to include the expense reduction related to your business on the right forms. For most folks, that means filling out IRS Form 8990, which covers those interest expense limitations. And remember, you’ll also need to report that deduction on your main tax return form - like Form 1040 if you’re a sole proprietor, Form 1065 for partnerships, or Form 1120 for corporations.

It’s super important to double-check all your entries for accuracy. You definitely want to steer clear of any potential issues with the IRS! Plus, understanding your paystub withholdings is key, and keeping your tax records straight is essential. Accurate records not only help you verify your deductions but also protect you from underpayment penalties that can pop up if you don’t meet your tax obligations throughout the year.

With all the recent changes in tax benefits following the end of COVID-19 relief measures, small business owners really need to stay on top of their tax planning. It’s all about optimizing compliance and avoiding those unexpected fees. So, how are you planning to tackle your taxes this year?

Conclusion

Wrapping up, maximizing your business interest expense deduction is a smart move for anyone looking to boost their financial health and cut down on tax bills. By getting a handle on the eligibility criteria, keeping solid records, calculating those deductible expenses accurately, and filing the right tax forms, you can really make the most of this deduction.

Throughout this article, we’ve highlighted some key points, like:

- The importance of knowing the IRS guidelines

- The recent tweaks from the One Big Beautiful Bill Act

- Why meticulous record-keeping is a must

Each step, from figuring out if you’re eligible to filing your tax returns, is crucial for making sure you can take advantage of these deductions without any compliance headaches.

So, as you think about these strategies, it’s super important to take a proactive look at your financial practices and get ready for changes on the horizon, like the shift to an EBITDA-based approach in 2025. By taking the time to understand and implement these steps, you’re not just optimizing your tax strategies; you’re also setting yourself up for long-term success in a changing financial landscape. Embracing these practices today can lead to some serious savings and a healthier bottom line tomorrow!

Frequently Asked Questions

What is the business interest expense deduction?

The business interest expense deduction allows businesses to deduct costs tied to loans used for day-to-day operations, including interest on loans for buying inventory, equipment, or other business-related expenses, thereby lowering taxable income and reducing overall tax liability.

What governs the rules and eligibility for claiming the business interest expense deduction?

The rules and eligibility for claiming the business interest expense deduction are governed by Section 163(j) of the Internal Revenue Code.

Who can benefit from the business interest expense deduction?

Businesses with average total earnings below $31 million over the past three years may benefit from the deduction without facing new limits on borrowing costs, which applies to about 98% of U.S. companies.

Are there any exceptions to the deduction limits?

Yes, floor plan financing charges are exempt from the expense limits for certain sectors, allowing those businesses to benefit from the deduction without restrictions.

What recent updates have been made regarding the business interest expense deduction?

Recent updates from the One Big Beautiful Bill Act (OBBBA) allow businesses to add back depreciation, amortization, and depletion when calculating adjusted taxable income, potentially increasing tax savings.

What conditions must be met for a business to qualify for the deduction?

To qualify for the business interest expense deduction, the interest charge must be paid or accrued on legitimate debt directly tied to the trade or business. It is important for businesses to review their financials to ensure eligibility.

How can the business interest expense deduction impact a company's financial strategy?

The business interest expense deduction can significantly impact a company's tax strategy and overall financial health by reducing taxable income and resulting in lower taxes owed.