Introduction

Tax season can feel pretty overwhelming for small agency owners, especially in rural areas where resources might be a bit scarce. But here’s a thought: outsourcing your tax preparation could be a game changer! Not only does it help streamline your operations, but it also boosts compliance and financial efficiency. By teaming up with experts like Steinke and Company, you can tackle the tricky world of tax regulations without breaking a sweat.

Now, you might be wondering, what happens when the pressure of looming tax deadlines meets the need for flexibility in your operations? Well, that’s exactly what we’re diving into here! This article will explore the fantastic benefits of tax outsourcing and how it can completely change the way small businesses handle their financial responsibilities. So, let’s get started!

Steinke and Company: Customized Tax Outsourcing Solutions for Rural Businesses

Steinke and Company truly excels in providing tailored tax outsourcing solutions specifically designed for rural businesses. They understand the local economy and the unique challenges that small agency owners face. Their services not only help ensure compliance but also boost operational efficiency. By blending modern technology with traditional values, organizations looking to thrive in a competitive landscape find tax outsourcing to be a smart move.

The significance of tax outsourcing on the efficiency of rural enterprises is quite notable. Companies that embrace these services often find their operations running smoother, letting them focus on what they do best while keeping their tax filings timely and accurate. For example, businesses that use outsourced tax preparation often report better filing consistency and document accuracy, which helps avoid delays caused by internal overload.

So, what does effective tax outsourcing look like for small business operators? It starts with creating organized workflows and bringing in certified experts who can navigate the complexities of tax regulations. This proactive approach not only lowers audit risks but also boosts compliance transparency, which is key to maintaining trust within the community.

The numerous perks of tax outsourcing for small agency owners are significant. It gives them access to expert advice without the burden of keeping an internal team, making it cost-effective and flexible during busy filing times. Plus, outsourcing adds a layer of consistency and predictability to tax season operations, which is especially helpful for businesses that see seasonal ups and downs.

In rural America, where resources can be tight, investing in tax outsourcing stands out as a smart choice for long-term financial health. By teaming up with experienced providers, small businesses can stay ahead of regulatory changes and optimize their tax positions effectively. This not only meets immediate compliance needs but also supports sustainable growth over time.

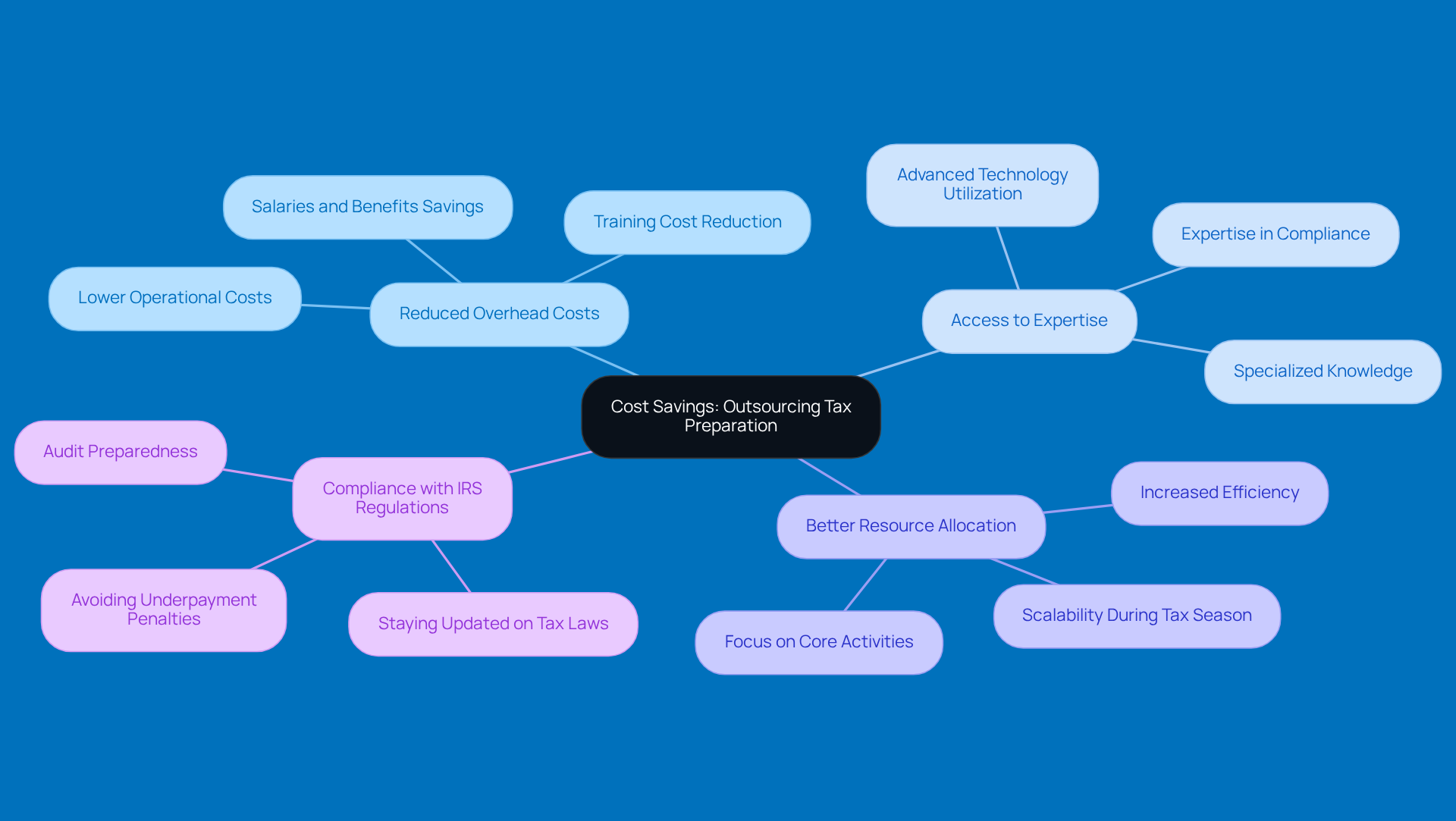

Cost Savings: Reduce Overhead by Outsourcing Tax Preparation

Small business owners can save a chunk of change by utilizing tax outsourcing for their tax preparation. By adopting tax outsourcing instead of relying on in-house staff dedicated to tax compliance, companies can cut down on overhead costs like salaries, benefits, and training. Plus, when you consider tax outsourcing, you often gain access to bulk pricing and specialized know-how, which can really boost your financial efficiency. This means management can allocate resources better, focusing on growth and the core activities that matter most.

And here’s the kicker: by tapping into the expertise of contracted tax pros, business leaders can navigate the tricky waters of underpayment penalties. This helps ensure they’re sticking to IRS regulations and dodging those costly fines. It’s a smart move that not only improves tax outsourcing compliance but also prepares organizations for better financial management. So, if you’re a small to mid-sized company, this could be a game-changer for you!

Access to Expertise: Ensure Compliance with Professional Tax Outsourcing

Outsourcing tax prep through tax outsourcing can be a game changer for small agency owners. It gives you access to specialized expertise that’s super important for keeping up with all those ever-changing tax laws and regulations. Take professional tax outsourcing firms like Steinke and Company, for instance. They’ve got seasoned experts who are always in the loop about the latest changes, which means your tax returns are prepared accurately and you won’t miss out on potential deductions and credits.

This strategic advantage not only helps companies cut down on tax liabilities but also reduces the risk of costly mistakes and penalties that come with non-compliance. For example, did you know that the estate tax exclusion amount is set to drop by half for Tax Season 2025? Having informed experts on your side can really help small businesses navigate these changes smoothly.

Companies that use tax outsourcing for their preparation services often report big improvements in filing consistency and document accuracy. By tapping into this expertise, business leaders can focus on what they do best while knowing their tax responsibilities are handled with care. Plus, if the IRS comes knocking for an audit, having a professional tax preparer can make a world of difference. They can help small business owners understand their rights and guide them through the audit process, which really takes the stress out of the situation.

Steinke and Company emphasizes the importance of being prepared and knowledgeable. Check out our FAQs about IRS audits for more tips to help you during tax season!

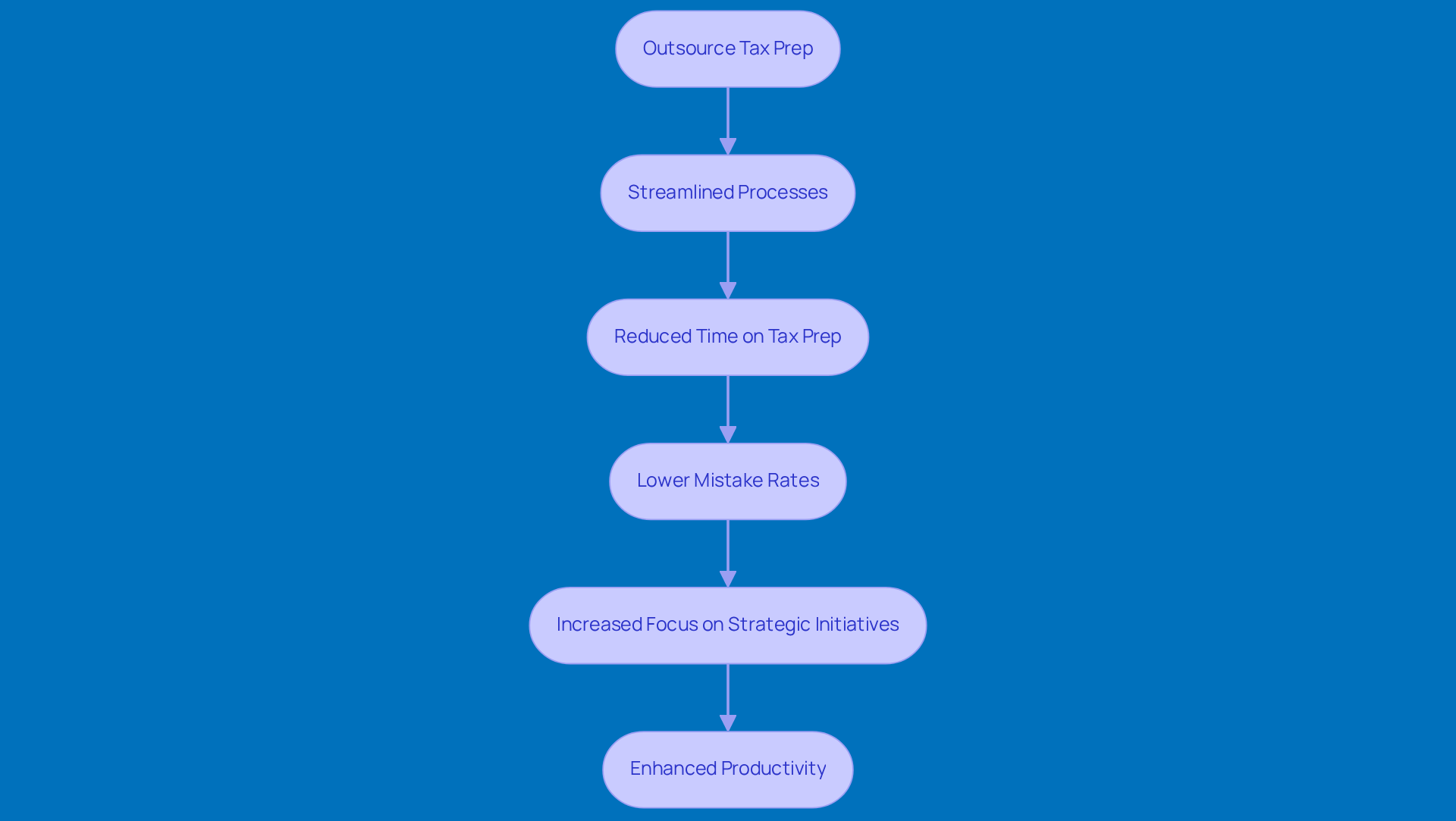

Increased Efficiency: Streamline Tax Processes with Outsourcing

Outsourcing tax prep through tax outsourcing can really boost how efficiently small businesses run. When you hand off tax tasks to specialized firms, you can streamline your processes, cutting down the time spent on tax prep and lowering the chances of making mistakes. This not only speeds up filing but also frees up business leaders to focus on strategic initiatives and customer service, which ultimately ramps up productivity.

For instance, companies that engage in tax outsourcing often see noticeable improvements in consistency and compliance, especially during those hectic filing periods. Plus, outsourcing takes the pressure off internal teams, letting them concentrate on high-priority tasks instead of getting bogged down in repetitive manual reviews. So, business leaders can navigate the complexities of tax regulations with more flexibility, ensuring timely and accurate submissions while boosting their operational capabilities.

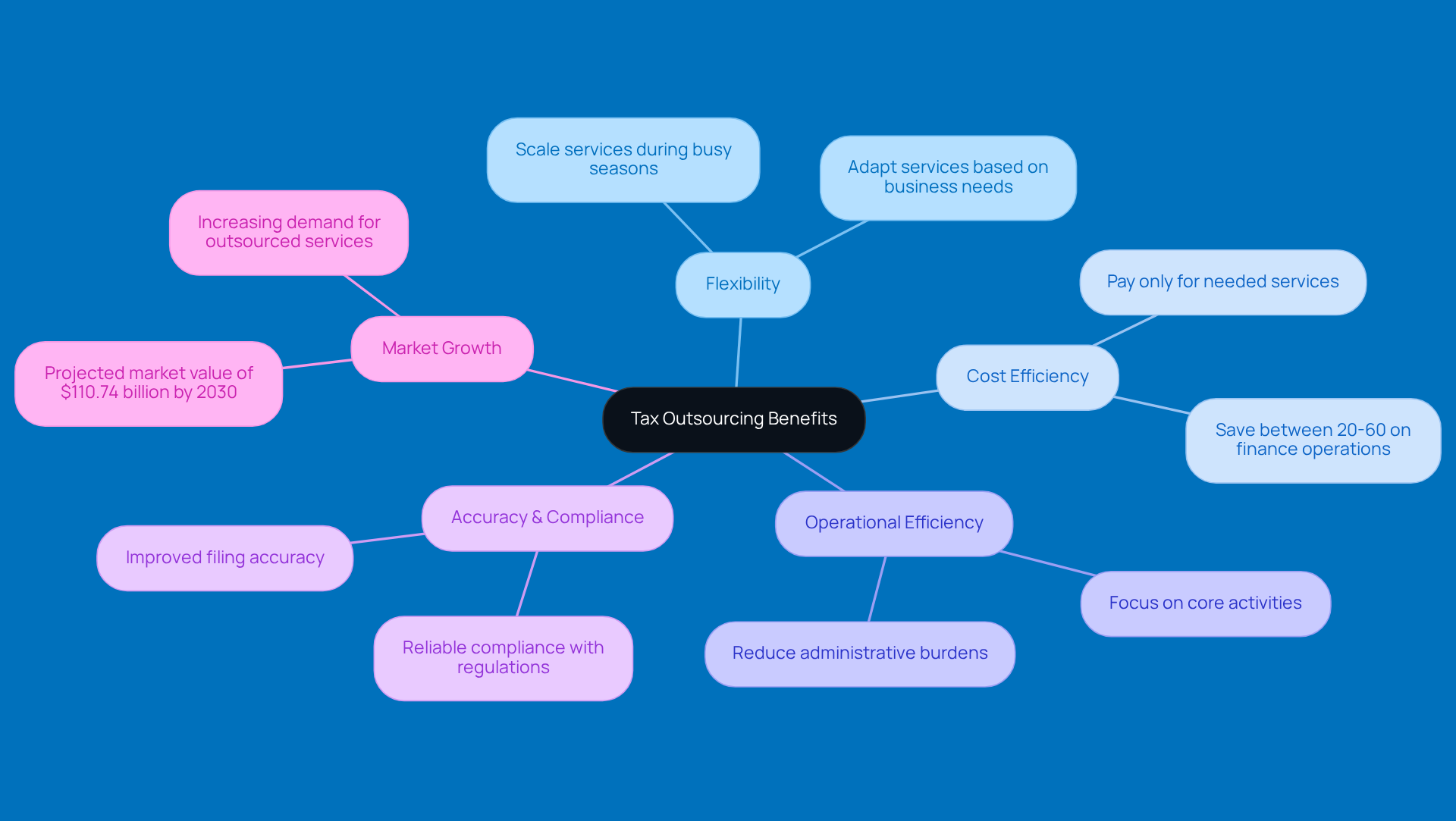

Flexibility: Scale Tax Services According to Business Needs

Tax outsourcing allows small agency owners the flexibility they need to scale their tax functions based on what’s happening in their business. Think about it: during those busy tax seasons, companies can rely on tax outsourcing to ramp up their services and handle the extra workload. Then, when things quiet down, they can dial it back, so clients only pay for what they actually need. This kind of adaptability not only helps avoid the financial strain of keeping a full-time in-house tax team but also boosts operational efficiency.

In fact, many companies that utilize tax outsourcing services see a big jump in filing accuracy and compliance, especially during those high-volume reporting times. And with the market for tax outsourcing projected to hit $110.74 billion by 2030, it’s clear that small businesses are starting to recognize the strategic benefits of tax outsourcing services. By tapping into external expertise, business leaders can focus on what really matters, streamline their processes, and keep their cool during tax season.

So, if you’re a small agency owner, have you thought about how outsourcing could lighten your load? It might just be the key to making tax season a little less stressful!

Enhanced Focus: Concentrate on Core Business Functions While Outsourcing Taxes

Outsourcing tax prep? It’s a game changer for small firm leaders! By utilizing tax outsourcing and handing over tax compliance to seasoned pros, agency owners can shift their focus back to what really matters - like strategic planning, boosting customer engagement, and driving those operational improvements. This shift doesn’t just ramp up productivity; it also creates a space where innovation and growth can thrive.

Take a look at companies that have jumped on the tax outsourcing bandwagon. They’re seeing some impressive boosts in efficiency, which means they can tackle the tricky world of tax regulations without all the stress. And guess what? Statistics show that businesses using tax outsourcing enjoy better accuracy in their filings and a lighter operational load. This all leads to a more agile and responsive business model.

So, what does this mean for you? It means you can focus on what truly counts: delivering value to your clients and expanding your market presence. Isn’t that what we’re all aiming for?

Risk Management: Mitigate Compliance Risks Through Tax Outsourcing

Tax outsourcing can really help small agency owners avoid compliance headaches. When you team up with tax pros like Steinke and Company, you can rest easy knowing your tax filings are spot-on and in line with the latest rules. This smart move cuts down the chances of audits, penalties, and all those pesky legal troubles that come from messing up your taxes.

Plus, Steinke and Company is all about planning, so you won’t find yourself in a last-minute scramble when deadlines roll around. That’s key for keeping your tax season stress-free! And let’s not forget, these outsourcing firms are always on top of the latest tax law changes, giving your business that extra layer of protection as you navigate the tricky compliance waters.

Now, if the IRS comes knocking, knowing your rights and having your records organized can really take the edge off and make the whole process smoother. With the right guidance, small agency owners can tackle these challenges with confidence. So, why not consider tax outsourcing for your tax prep? It could be the best decision you make this tax season!

Conclusion

Tax outsourcing is really a game-changer for small agency owners, especially in rural areas where resources can be tight. By tapping into outside expertise, businesses can tackle the tricky world of tax regulations more smoothly, all while staying compliant and running efficiently. This smart move not only takes the stress out of tax prep but also lets agency owners focus on what they do best, boosting productivity and growth potential.

Let’s talk about some of the key perks of tax outsourcing. We’re looking at big cost savings, access to specialized know-how, and a nice bump in efficiency, not to mention better risk management. Small businesses that jump on the tax outsourcing bandwagon can look forward to smoother processes, fewer compliance headaches, and the flexibility to tailor services to fit their unique needs. All these factors come together to create a more agile and resilient business model, which is crucial for thriving in today’s competitive scene.

So, when it comes to outsourcing tax functions, think of it as an investment in your long-term success. Partnering with seasoned providers like Steinke and Company can help small agency owners fine-tune their tax positions, reduce risks, and keep up with the ever-changing regulations. Embracing tax outsourcing not only eases the operational burden but also sets businesses up for sustainable growth, allowing them to zero in on what really matters: delivering value to clients and expanding their market presence.

Frequently Asked Questions

What services does Steinke and Company provide for rural businesses?

Steinke and Company offers customized tax outsourcing solutions specifically designed for rural businesses, focusing on compliance and operational efficiency.

How does tax outsourcing benefit rural enterprises?

Tax outsourcing helps rural enterprises run smoother operations, allowing them to focus on their core activities while ensuring timely and accurate tax filings.

What are the key components of effective tax outsourcing for small businesses?

Effective tax outsourcing involves creating organized workflows and employing certified experts who can navigate complex tax regulations, reducing audit risks and enhancing compliance transparency.

What advantages do small agency owners gain from tax outsourcing?

Small agency owners benefit from expert advice without the need for an internal team, making it cost-effective and flexible during busy filing periods, while also adding consistency to tax season operations.

Why is tax outsourcing a smart choice for rural businesses?

In rural America, where resources may be limited, tax outsourcing helps businesses stay ahead of regulatory changes and optimize their tax positions, supporting long-term financial health and sustainable growth.

How can small business owners save money through tax outsourcing?

By outsourcing tax preparation, small business owners can reduce overhead costs associated with in-house staff, such as salaries and training, and gain access to bulk pricing and specialized expertise.

What potential issues can tax outsourcing help businesses avoid?

Tax outsourcing can help businesses navigate underpayment penalties, ensuring compliance with IRS regulations and avoiding costly fines, which improves overall financial management.